-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: BoE Due

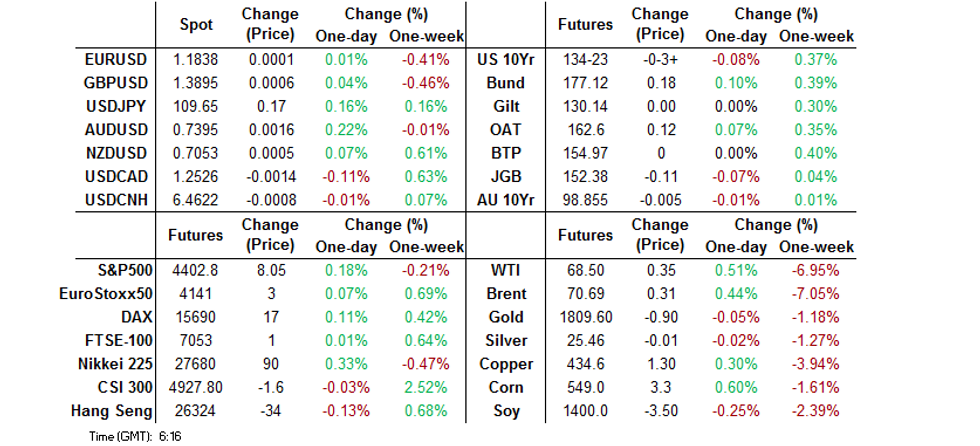

- Most of the discussion during Asia-Pac hours centred on Wednesday's comments from Fed Vice Chair Clarida, with broader headline flow muted.

- Core markets were rather limited, with an eye on the proximity to Friday's NFP print.

- Today's BoE MPC meeting has the potential to be a key event for the market. Voting dynamics surrounding the Bank's asset purchase facility will be eyed. However, the sequencing review will potentially be much more significant. The MNI Markets team thinks the most likely change to the sequencing guidance will be to remove the Bank Rate threshold altogether, and leave maximum flexibility to the MPC.

BOND SUMMARY: Activity Peaks At Cash Tsy Re-open As Asia Reacts To Clarida

Most of the Asia-Pac session's meaningful price action came around the cash Tsy re-open, and looked to be a result of the Asia-Pac region's reaction to Wednesday's comments from Fed Vice Chair Clarida on tapering/rate hikes and, to a lesser degree, the strong ISM services print out of the U.S. The contract last prints -0-04 at 134-22+, 0-01 off worst levels, on volume of ~80K. Cash Tsys sit 0.5-1.5bp cheaper as 5s lead the weakness. San Francisco Fed President Daly ('21 voter) reiterated her view re: the potential for tapering later this year/in early '22. A 7.0K screen seller of EDU3 provided the highlight on the flow side. Elsewhere, a 5.0K screen buyer of the FVU1 123.75 puts was seen. Pre-NY focus will fall on the latest BoE decision, where the vote split surrounding the Bank's asset purchase facility and any comments on the sequencing review re: normalisation will be eyed. NY hours will be headlined by comments from Fed Governor Waller and Minneapolis Fed President Kashkari ('23 voter). We will also get the latest round of weekly jobless claims data.

- The broader weakness in global core FI markets has weighed on JGB futures during Tokyo trade, with the contract last printing 10 ticks lower on the day. The cash curve has seen some twist steepening, with 10s back to the 0.01% marker in yield terms. The shorter end of the cash curve trades ~1.5bp richer, while 40s run ~1.0bp cheaper. The combination of the global core FI impulse, a softer JPY and a modest uptick for domestic equities has negated any risk-off flows surrounding the longer end of the curve. There has been a lack of notable domestic news flow, outside of confirmation of the previously outlined story re: the expansion of the quasi state of emergency to cover a further 8 prefectures. Wage data headlines the local docket on Friday.

- Over in Australia, YM & XM both sit -0.5 at typing, with the modest overnight twist flattening unwound. Local COVID matters dominated headline flow as NSW recorded a new daily record for COVID cases (262), with the Hunter & Upper Hunter areas set to enter a 1-week lockdown from 17:00 local time. The release of the RBA's SoMP, RBA Governor Lowe's semi-annual testimony in front of the House of Representatives Standing Committee on Economics, A$700mn of ACGB 0.25% 21 November 2025 supply and the release of the AOFM's weekly issuance slate headline locally on Friday.

JAPAN: Generally Reserved Net International Security Flows Witnessed Last Week

As is the norm, the bond flows provided the highlights in the latest round of weekly international security flow data.

- Japanese investors reverted back to net purchases of foreign bonds, albeit at rather limited levels. 2 of the 3 latest weeks have seen net purchases and have effectively negated the net selling witnessed in the middle of those 3 weeks, in net rolling terms.

- Foreign investors registered net purchases of Japanese bonds for the 4th time in 5 weeks, even with 10-Year JGB yields tending towards 0 (perhaps another sign that x-ccy basis swaps were once again deployed), reverting from the net sales seen in the previous week. Once again, the weekly net level witnessed wasn't particularly large.

- Overall Japanese outflows weren't too far from neutral last week, while investors bought a net ~Y550bn of Japanese assets based on this dataset.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 225.6 | -1087.4 | -1297.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -190.6 | 134.4 | -274.3 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 547.8 | -227.8 | 3248.8 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 3.2 | -58.5 | -382.8 |

FOREX: Yen Falters On Firmer E-Minis, Gotobi Day Flows

The yen went offered into the Tokyo fix and continued to underperform G10 peers thereafter. Gotobi day flows were the usual local suspect, but it is worth noting that Japan moved to extend quasi-emergency measures to eight more prefectures after reporting another record increase in daily Covid-19 cases. USD/JPY moved past yesterday's high, as U.S. e-minis and Japanese equity benchmarks edged higher in relatively muted Asia-Pac trade.

- Fed's Daly said inflation readings don't suggest that the Fed should change course and she expects later this year or early next year to be the appropriate time to taper. The DXY ground higher, building on gains registered after yesterday's round of hawkish comments from Fed Vice Chair Clarida.

- G10 high betas drew support from a generally firmer commodity complex and better risk appetite. The AUD outperformed even as iron ore retreated amid recent signs that China could tighten output curbs at steel mills.

- Spot USD/CNH remained rangebound, with an in-line PBOC fix giving it no clear directionality.

- The main risk even today is the Bank of England MPC meeting, with German factory orders and U.S. weekly jobless claims also due. Fed's Waller and Kashkari are set to speak.

FOREX OPTIONS: Expiries for Aug05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E1.2bln), $1.1825-30(E1bln), $1.1850-60(E3.4bln), $1.1885-00(E1.5bln), $1.1905-25(E958mln), $1.2000(E602mln)

- USD/JPY: Y109.00-05($878mln), Y109.15-30($1.3bln), Y109.35-50($1.4bln), Y110.00($584mln)

- AUD/USD: $0.7480-90(A$532mln)

- USD/CAD: C$1.2470($658mln), $C1.2525($721mln), C$1.2550($1.1bln)

ASIA FX: IDR Snaps Winning Streak, TWD Rally Rolls On

- CNH: Offshore yuan is flat and keeping to a tight range with an in-line PBOC fix giving it no clear directionality.

- SGD: Singapore dollar is flat, on the coronavirus front there were 92 new cases on Wednesday, holding below the key 100 figure for a second day.

- TWD: Taiwan dollar is higher for the fourth day, the focus of the session today is CPI, the headline Y/Y figure is expected at 1.81% in July from 1.89% in June which was the highest since 2013.

- KRW: Won is slightly stronger, on the coronavirus front there were 1,776 new cases on Thursday, above 1,700 for the second day. Social distancing rules will be reviewed on Friday.

- MYR: Ringgit is flat, all eyes on Malaysia's political turmoil and Covid-19 situation. A tug of war between PM Muhyiddin and UMNO Pres Zahid stole the limelight yesterday, with the two seen at odds as to whether Muhyiddin government still has the backing of majority of lawmakers.

- IDR: Rupiah is weaker for the first day in six, data showed GDP rose 3.31% in Q2 against estimates of 2.69% Q/Q.

- PHP: Peso declines. BSP Gov Diokno reiterated his familiar position, noting that CPI is expected to ease back to within the target range by the year-end. The central bank said yesterday that "further adjustments on the RRR remain on the table".

- THB: Baht hovers around neutral, The Bank of Thailand on Wednesday voted 4 to 2 to leave benchmark policy rate unchanged at the record low of 0.5%, with one MPC member absent, data showed CPI rose 0.45% Y/Y missing estimates of a 0.88% increase.

ASIA RATES: PBOC Drains Liquidity After Month End Injection

- INDIA: Yields holding steady in early trade. Bonds are likely to tread water today ahead of the RBI rate announcement tomorrow. The RBI are expected to keep policy settings unchanged at the August meeting amid concerns over growth and a potential third Covid wave. All 21 economists surveyed by Bloomberg expect the MPC to leave the benchmark repurchase rate unchanged. While the RBI is widely expected to announce another tranche of its so-called government securities acquisition program, bond traders will be watching for any cues on return to policy normalisation especially with inflation running above the RBI's target band.

- SOUTH KOREA: Futures are mixed in South Korea with the 10-Year contract coming under pressure and the 3-Year contract higher. On the coronavirus front there were 1,776 new cases on Thursday, above 1,700 for the second day. Health authorities are expected to extend the current distancing rules, which have been in place since mid-July for another two weeks, at a meeting on Friday. There were reports in Yonhap that South Korea could fully vaccinate 70% of its population by late October. There were also reports that BoK's Koh, the dissenter at the last meeting and known as one of the most hawkish members, has been named as the head of the FSC in South Korea.

- CHINA: The PBOC drained a net CNY 20bn at its OMO operations after the injections last week mature. Repo rates are steady, the overnight repo rate is up 1.3bps at 1.7013% while the 7-day repo rate is up 3.6bps at 1.8563%. Futures are higher, bouncing after a two day losing streak, 10-Year contract up 9 ticks at 110.365, equity markets are hovering around neutral while the yuan is flat in a session with few catalysts.

- INDONESIA: Yields higher across the curve, bonds coming of the back of a five day winning streak. data showed GDP rose 3.31% in Q2 against estimates of 2.69% Q/Q. Indonesia's death toll from Covid-19 has eclipsed 100,000 on Wednesday, as the country reported 1,747 new fatalities. More than a third of all deaths occurred in July, as rapid spread of new infections put a strain on the healthcare system and caused oxygen shortages. Worth flagging that FinMin Indrawati urged commercial lenders to help stimulate economic recovery by playing their part and boosting loan disbursement. Indrawati warned that "it will be very difficult for the economy to recover until the financial sector resumes lending growth".

EQUITIES: China Markets Steady

Equity moves were muted in the Asia-Pac session on Thursday, mulling over a mostly negative lead from the US and hawkish comments from Fed speakers. Markets in Japan were higher, the Nikkei 225 up around 0.4%; Japan extended its Covid-19 quasi-emergency measures to 8 prefectures after recording more than 14,000 new infections for the first time on Wednesday. In China bourses are slightly lower, but have recovered the bulk of opening losses. Liquor stocks came under pressure after a piece from the Ministry of Science and Technology warning drinking alcohol could lead to cancer. Other markets in the region swung between minor gains and minor losses. In the US futures are a little higher, participants will already have one eye on the US NFP figure on Friday after a number of Fed speakers this week.

GOLD: Back To Where We Started

After Wednesday's 2-way fluctuations (rallying on much softer than expected U.S. ADP employment data, before turning negative on a record rate of expansion for the headline ISM services survey and comments from Fed Vice Chair Clarida that we have documented elsewhere) bullion managed to settle back into familiar territory, sticking to the $1,810/oz level in Asia-Pac hours.

- The well-defined technical overlay remains intact, with initial support located at the July 23 low ($1,790.0/z) and initial resistance located at the July 15 high/bull trigger ($1,834.1/oz).

- Friday's U.S. NFP print presents the next major round of event risk.

OIL: Crude Futures Bounce From Closing Lows

Crude futures are slightly higher in Asia-Pac trade on Thursday, picking up from closing lows on Wednesday. Major benchmarks are down almost 8% from the start of the week. WTI & Brent print ~$0.30 above settlement levels. The fall yesterday came as US DoE inventories unexpectedly rose and a hawkish set of comments from Fed officials. The latest declines have benchmarks through support levels, WTI now has support at $65.01/64.60 the low from Jul 20 / 76.4% of the May 21 - Jul 6 rally, Brent has support at $66.91/43 the July 20 low and the bear trigger. Sentiment in China has been broadly neutral today, stock markets treading water after losing ground earlier this week. In terms of demand concerns remain that the delta variant will affect the outlook, CNPC warned earlier of a 5% decline in short term oil demand.

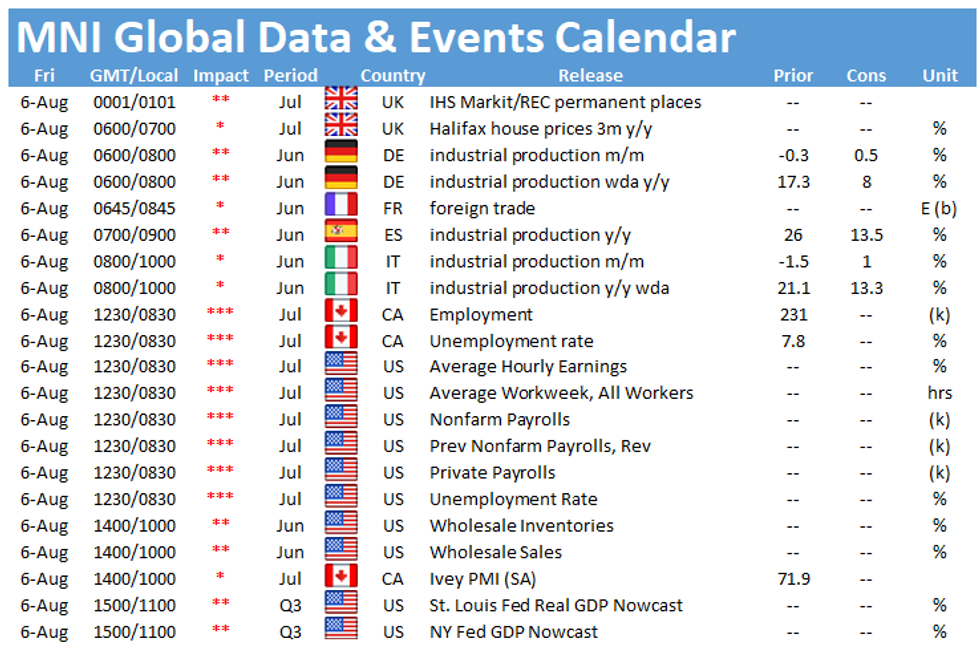

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.