-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: CNY Gets More Airtime

EXECUTIVE SUMMARY

- EX-PBOC OFFICIAL: RAPID YUAN GAINS WON'T LAST (XINHUA)

- CHINA'S BANKING REGULATOR WARNS OF GLOBAL ASSET BUBBLE RISKS (BBG)

- EX-CHINA SAFE OFFICIAL DOWNPLAYS YUAN RISE IMPACT ON STOCKS (CSJ)

- CHINA OFFICIAL PMIS VIRTUALLY INLINE WITH EXPECTATIONS

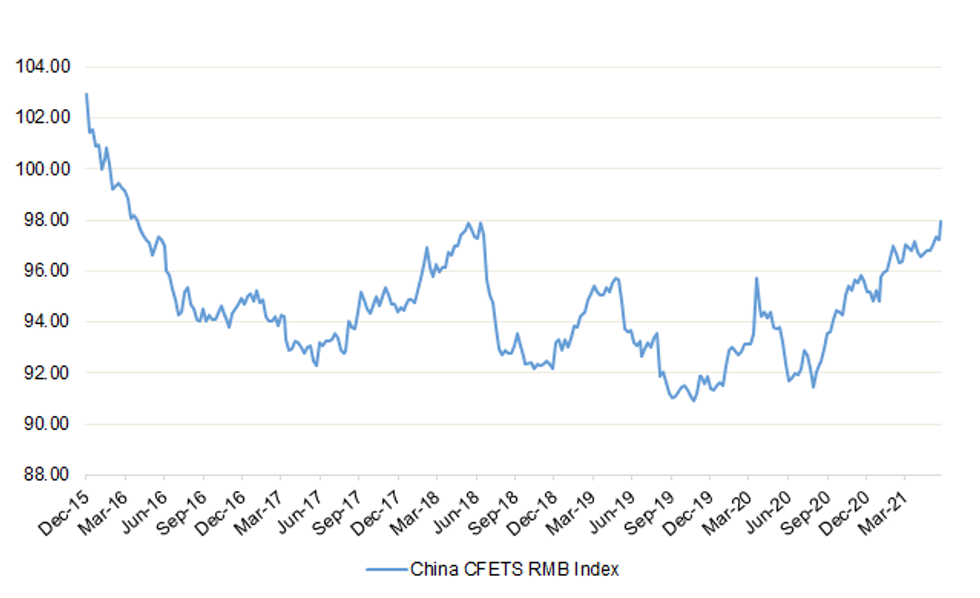

Fig. 1: China CFETS RMB Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The government is aiming to offer everyone aged over 50 their second coronavirus vaccination by June 21 as it battles to prevent the lifting of lockdown restrictions being derailed. With three weeks to go until the next stage of easing, Nadhim Zahawi, the vaccines minister, set a new objective: that everyone in the government's top nine priority groups will have been protected by then with both doses. He said that it was a "race between the vaccine and the virus" as scientific advisers and public health experts warned of the risk of lifting all coronavirus restrictions while cases of the Indian variant were surging. (The Times)

CORONAVIRUS: Ministers on Friday insisted England can still exit the final stage of lockdown on June 21 in spite of a rise in Covid-19 cases, as the spectre of coronavirus overwhelming the country's hospitals receded. Kwasi Kwarteng, business secretary, said there was nothing in current data to suggest final lockdown restrictions could not be lifted on June 21 as planned, adding: "I don't think we will move the date." (FT)

CORONAVIRUS: Facemasks and work from home guidance could remain in place after June 21 under government plans to "prioritise" the end of social distancing if the Indian variant continues to surge, The Times has been told. Ministers are increasingly concerned that the variant's spread could undermine plans to lift all restrictions next month. They are discussing contingency plans that could mean only a partial end to the lockdown. The Treasury is prioritising the end of the "one metre plus" distancing rule and the "rule of six" indoors, which is viewed as crucial to supporting hospitality and retail and helping the economy to recover. Ministers also want to end rules that limit mass gatherings so that festivals, concerts and sporting events can go ahead. (The Times)

CORONAVIRUS: Medical advisers will next month insist that Boris Johnson makes a political decision on whether to vaccinate children and will not offer a firm recommendation, The Telegraph understands. In a break from previous practice, the joint committee on vaccination and immunisation (JCVI) is expected to set out "options and consequences" rather than taking a stance on the controversial issue. (Telegraph)

CORONAVIRUS: The government appears to have abandoned its "data not dates" principle, an expert advising its coronavirus response has warned, adding that its reluctance to delay unlocking was leading to "contradictory" messaging. Prof Stephen Reicher, a psychologist on the Scientific Pandemic Insights Group on Behaviours, joined scientists warning against the final lifting of restrictions on 21 June as cases passed 4,000 for the first time since late March on Friday. (Guardian)

CORONAVIRUS: Plans to make Covid-19 passports a legal requirement for large events are set to be dropped, The Telegraph understands. (Telegraph)

CORONAVIRUS: Employers allowing working from home expect more than half their staff to work remotely for at least part of the week over the next year. Two thirds of companies are offering remote work to their teams, according to research, although the British Chambers of Commerce cautioned that many were concerned about the impact on the morale and wellbeing of staff. On average, respondents to the business lobby group's latest survey expected 53 per cent of their workforces to be working at least some of their hours remotely over the coming 12 months. More than 70 per cent of companies said that at least one of their employees would be doing so. (The Times)

BREXIT: Edwin Poots, the new leader of Northern Ireland's largest political party, on Sunday accused the EU of treating the region as a political "plaything", as tensions continued between the UK and Brussels over the implementation of post-Brexit trading rules. Poots, who became leader of the Democratic Unionist party on Thursday, argued that while in the past the European Commission had put its "heart and soul" into maintaining peace within the region, the "current batch" of commissioners showed little regard for the peace process in Northern Ireland. (FT)

BREXIT: Britain's relations with the EU risk growing increasingly fractious as frustrations mount over the UK's refusal to fully implement its post-Brexit obligations in Northern Ireland, a top Brussels official has warned. Maros Sefcovic, the EU's point person on relations with the UK, said he wants the two sides to agree a joint "road map" in early June that would provide a clear timetable for resolving problems linked to the roll out of new trading arrangements for the region. While the EU is showing "creativity and pragmatism" in discussions, the same cannot be said of the UK, the bloc's Brexit commissioner told the Financial Times, revealing he had warned his British counterpart David Frost of rising impatience from EU member States. (FT)

BREXIT: Australia and the U.K. continue to negotiate plans for a free-trade agreement, Trade Minister Dan Tehan said on the Australian Broadcasting Corp.'s Insiders program. Tehan said he had lengthy discussions with U.K. Trade Secretary Liz Truss on Friday and expects to be speaking with her again on Tuesday. Beef and lamb are subjects under consideration, as well as issues surrounding mobility, investment and services. (BBG)

INFLATION: Britain's biggest builder's merchant has warned customers of "considerable" cost increases to a wide range of raw materials in a move that will fuel fears of an inflationary price spiral as the economy pulls out of its Covid-19-induced recession. Travis Perkins has told customers to prepare for a 15 per cent rise in the price of bagged cement, 10 per cent in chipboard and 5 per cent in paint from Tuesday. It told customers that while it was trying to keep cost increases to a minimum, "the market is facing considerable cost and availability challenges on a number of key commodity items at the moment". (Sunday Times)

BOE: The Bank of England has hired head-hunters to help with the appointment of a new chief economist amid talk that it is looking overseas for a high-profile recruit. A source said that the executive search firm taken on by the Bank had "international reach" and specialised in "diverse" hires. Britain's central bank, which has never before used head-hunters to line up a chief economist, is under pressure to increase female and ethnic minority representation in senior positions. The role of chief economist is one of the most senior appointments that the Bank can make itself and is the only one that it can make to its nine-strong rate-setting monetary policy committee. The governor, the deputy governors and the four external rate-setters are all appointed by the Treasury. Interviews for the role are scheduled to begin this week, with Silvana Tenreyro, an external member of the MPC, said to be in the frame. (The Times)

POLITICS: The latest YouGov/Times voting intention figures see the Conservative Party loose three points. They now have 43% of the vote, while Labour gain a point to 29% (+1). Elsewhere, the Liberal Democrats are on 8% (n/c), the Greens 8% (n/c) and Reform UK have 3% of the vote (+1). (YouGov)

POLITICS: The Conservatives have seen a dip in their lead since the local elections and Boris Johnson's personal ratings have also fallen, according to the latest Opinium poll for the Observer. The Tory lead fell to 6 points from 13 points in the week after the local elections took place. The Conservatives were on 42%, down 2 points, with Labour on 36% of the vote, up 5 points. The poll was conducted after the explosive appearance before a Commons select committee last week by Dominic Cummings, the prime minister's former senior adviser, who attacked the government's Covid response. However, pollsters at Opinium suggested that the fall in the Tory lead may not last as the underlying popularity of the government's vaccine rollout remained strong. The vaccine rollout appears to have driven the resurgence in the government's popularity. (Observer)

POLITICS: According to the Survation poll for the Daily Mail, the Conservatives have a ten-point lead over Labour. Asked who would make the best Prime Minister, Mr Johnson beats Labour leader Sir Keir Starmer by the huge margin of 16 percentage points. (Daily Mail)

POLITICS: Boris Johnson's Conservatives are giving him the benefit of the doubt after his former chief adviser declared he was unfit to lead the country out of the pandemic. But ministers fear the British premier will face a bigger battle with his party if the coronavirus variant first detected in India derails his plan to lift restrictions next month. (BBG)

EUROPE

GERMANY: Germany's Green party declined for a second consecutive week and Chancellor Angela Merkel's conservative bloc clawed back support, four months before the country goes to the polls. Support for the Greens fell to 22% while Merkel's Christian Democratic-led bloc rose 1 percentage point to 25% in the weekly Insa poll for Bild am Sonntag. It was the second 1-point decline in a row for the Greens, whose support has soared to all-time highs in the race to succeed Merkel. (BBG)

FRANCE: France is ready to start reducing financial support to businesses and workers hit by coronavirus restrictions as its vaccination program offers a route out of the crisis, Labor Minister Elisabeth Borne said on Sunday. The government has spent more than 40 billion euros ($48.8 billion) in 2020 and 2021 to protect employment, benefiting 2.7 million people on furloughs last month, up from 2.4 million in March, Borne told France Inter radio. (BBG)

ITALY: Italian Prime Minister Mario Draghi's cabinet backed a plan to reduce bureaucratic obstacles, a key commitment he made to unlock the first tranche of 24 billion euros ($29 billion) in European Union recovery funds. The decree approved late Friday seeks to facilitate public-works projects and streamline tender procedures, easing a long-standing impediment to governments seeking to spur growth. The green light for the plan comes amid rising support for policies adopted by the former European Central Bank head since he took office in February. According to an Ipsos poll published in Corriere della Sera on Saturday, 66% of Italians are in favor of Draghi's agenda, up from 58% at the end of April. (BBG)

SPAIN: Spain will reopen its ports to international cruise ships starting June 7, the government announced, citing an easing of the pandemic and increasing vaccinations. The country, which relies heavily on tourism, banned ships from docking at its ports June 2020. (BBG)

NETHERLANDS: The Netherlands is speeding up its reopening plan as cases and hospital admissions continue to fall. Museums, theaters and cinemas can reopen from June 5, four days earlier than planned, Prime Minister Mark Rutte said during a press briefing in the Hague on Friday. The Dutch government announced on Thursday it plans to spend an additional six billion euros on aid for companies impacted by the pandemic, bringing the total amount earmarked for businesses to 80 billion euros. (BBG)

IRELAND: Ireland will continue easing virus restrictions next month, Prime Minister Micheal Martin said. Hotels can reopen from June 2 as scheduled while outdoor dining can resume on June 7. Cinemas and theaters will reopen and as many as 200 people will be able to attend outdoor events. Ireland will adopt use of the EU digital travel certificate from July 19 and "broadly" follow EU rules for travel from Great Britain and the U.S., effectively allowing international travel to resume. (BBG)

SNB: The Swiss National Bank's monetary policy is appropriate given there's no great risk of spiraling inflation, its President Thomas Jordan said in an interview with Schweiz am Wochenende. "We think the risk of inflation is moderate in Switzerland," he told the newspaper in an interview published on Saturday. "The strong currency acts as a damper on inflation, the franc is still highly valued." The SNB is using a deposit rate of -0.75% coupled with a pledge to conduct foreign exchange interventions to keep the franc in check and stave off deflationary pressures. The Swiss economy slumped the most in decades last year, though data suggest momentum is now building. Switzerland's KOF economic barometer suggests prospects are "very positive," so long as the virus can be tamed. Even the improved growth outlook doesn't warrant a change to policy, Jordan said. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- DBRS Morningstar confirmed Poland at A, Stable Trend

U.S.

FED: The Trimmed Mean PCE inflation rate over the 12 months ending in April was 1.8 percent. According to the BEA, the overall PCE inflation rate was 3.6 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 3.1 percent on a 12-month basis. (Dallas Fed)

FISCAL: MNI: Biden Floats $6T '22 Budget; Relies on Low Interest Rates

- President Joe Biden on Friday released his first full budget aimed at spending USD6 trillion in fiscal year 2022 before rising to USD8.2 trillion in 2031, relying on low interest rates from the Federal Reserve. The president's plans to invest in infrastructure, education, health care and more would push federal spending to its highest sustained levels since World War II. The spending growth would be driven by Biden's two-part agenda to upgrade the nation's infrastructure and substantially expand the social safety net, contained in his American Jobs Plan and American Families Plan, along with other planned increases in non-defense discretionary spending - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Transportation Secretary Pete Buttigieg said Sunday that Senate Democrats and Republicans must establish a clear direction on infrastructure negotiations when Congress returns to Washington after the Memorial Day break, signaling that the White House is losing patience with bipartisan talks. "By the time that they return, which is June 7 just a week from tomorrow, we need a clear direction," Buttigieg said during an interview on CNN's "State of the Union." "The President keeps saying, 'inaction is not an option' and time is not unlimited here. The American people expect us to do something." (CNBC)

FISCAL: Senate Democrats plan to forge ahead with crafting a massive infrastructure package next month — regardless of whether Republicans get on board — as they push to pass a bill this summer. Senators will be out of Washington next week for the Memorial Day holiday. When lawmakers return, Democrats aim to write an infrastructure plan that touches on everything from transportation to broadband, utilities and job training. "As the President continues to discuss infrastructure legislation with Senate Republicans, the committees will hold hearings and continue their work on the Build Back Better agenda — with or without the support of Republican Senators," Senate Majority Leader Chuck Schumer, D-N.Y., wrote in a letter to Democrats on Friday. "We must pass comprehensive jobs and infrastructure legislation this summer." (CNBC)

FISCAL: Congress has the opportunity to replenish the Restaurant Revitalization Fund to ensure "small businesses get the relief they need," Democratic Representative Jerrold Nadler and over 100 other bipartisan members of Congress say in letter to House Speaker Nancy Pelosi and Republican Leader Kevin McCarthy. "This program is in extremely high-demand and at current funding levels the SBA will not be able to assist a large portion of the applicants," lawmakers say in letter. (BBG)

CORONAVIRUS: The U.S. recorded almost 22,000 new cases Friday, with weekly infections falling by more than half since the end of April, according to data compiled by Johns Hopkins University and Bloomberg. Infections are at the lowest level since last June. This week, half of all Americans 18 years and older had been fully vaccinated, though the pace of inoculation continues to slow. (BBG)

POLITICS: Senate Republicans on Friday blocked a bill that would create an independent commission to investigate the Jan. 6 insurrection at the U.S. Capitol, as Democrats and the GOP diverge over how best to probe the attack on the legislature and prevent another assault on the democratic process. In a 54-35 vote, the measure failed to hit the threshold needed to overcome a filibuster as nearly all GOP senators opposed it. Six Republicans voted to advance the proposal: Bill Cassidy of Louisiana, Susan Collins of Maine, Lisa Murkowski of Alaska, Rob Portman of Ohio, Mitt Romney of Utah and Ben Sasse of Nebraska. All of those senators but Portman voted in February to find former President Donald Trump guilty of inciting an insurrection. (CNBC)

OTHER

U.S./CHINA: U.S. Senate Majority Leader Chuck Schumer said on Friday the Senate would resume consideration of a sweeping package of legislation intended to boost the country's ability to compete with Chinese technology on June 8. The Senate had sought to pass the $250 billion measure on Thursday but the legislation was delayed by Republicans who said Schumer and his fellow Democrats had not allowed enough time to consider amendments. (RTRS)

U.S./CHINA: The Biden administration is unlikely to remove tariffs on Chinese goods in the short term, but China and the United States might find a middle ground by increasing tariff exclusions as a way to reduce tensions, a Chinese think-tank said. (RTRS)

U.S./CHINA: The U.S. government blocked imports of seafood Friday from the entire fleet of a Chinese company that authorities say forced crew members to work in slave-like conditions that led to the deaths of several Indonesian fishermen last year.Customs and Border Protection said it will place an immediate hold on any imports linked to the more than 30 vessels operated by Dalian Ocean Fishing, under a U.S. law that bars goods suspected to have been produced with forced labor. (CNBC)

U.S./CHINA: The world needs the cooperation of the Chinese government to trace the origins of Covid-19 and prevent future pandemic threats, two leading U.S. disease experts said Sunday. Information to support the theory that the SARS-CoV-2 virus may have escaped from a lab in Wuhan, China, has increased, said Scott Gottlieb, a commissioner of the Food and Drug Administration in the Trump administration who now sits on the board of Pfizer Inc. (BBG)

GLOBAL TRADE: British finance minister Rishi Sunak said there was a deal to be done with the United States on tax but big tech firms would have to pay their fair share in return for British backing for Washington's corporation tax proposals. (RTRS)

GLOBAL TRADE: A bureau under China's state-owned assets supervisor on Sunday released a recommendation list of 178 technology innovations of centrally administrated state-owned enterprises (SOEs), highlighting breakthroughs in such sectors as semiconductors, server operating systems, core electronic components, key materials and advanced manufacturing. Most of the items are vulnerable "bottleneck" industries at the forefront of a full-blown technology battle between the world's two largest economies, and they embody part of China's ongoing efforts to achieve technology independence, where these SOEs are expected to play a bigger role going forward. SOEs could explore areas that private companies have avoided, while playing a leading and bridging role in integrating the resources of research institutes, private firms and capital, to obtain maximum results in cutting-edge technology breakthroughs amid the US' relentless crackdown, analysts said. (Global Times)

GLOBAL TRADE: China News tweeted the following on Sunday: "China's logistics industry has basically returned to pre-pandemic level thanks to steady growth continuing in April. The value of China's social logistics reached about 15.25 trillion U.S. dollars in the first four months of 2021, up 20 percent year on year, said authorities." (MNI)

GLOBAL TRADE/CORONAVIRUS: Vietnam is bracing for disruptions its tech manufacturing sector, the country's economic engine and a vital cog in global supply chains, after authorities detected a new variant of COVID-19 with characteristics of both Indian and U.K. strains. (Nikkei)

G7: U.S. Treasury Secretary Janet Yellen told G7 finance ministers and central bank governors on Friday it was important to provide further fiscal support "to promote a robust and lasting recovery in the wake of the pandemic," the Treasury said in a statement. Yellen, during a virtual meeting of the finance leaders from wealthy democracies, emphasized U.S. commitment to solving global problems multilaterally, including cooperating on tackling climate change and environmental issues. "She expressed her support for ongoing work on digital payments issues, including exploration of potential central bank digital currency policy considerations," the Treasury said. (RTRS)

GEOPOLITICS: The Biden administration announced it would re-impose sanctions against nine Belarusian state-owned enterprises and is developing additional penalties to target officials in the administration of President Alexander Lukashenko over the forced landing of a Ryanair Holdings Plc jetliner and the arrest of a dissident journalist. (BBG)

GEOPOLITICS: Russia has agreed to release $500m in credit to Belarus and look to increase the number of flights between the two countries as the Kremlin doubled down on its support for Alexander Lukashenko after his forced landing of a passenger flight that has sparked western condemnation. Russian president Vladimir Putin hosted Lukashenko in Sochi on Saturday, treating his guest to a yacht trip on the Black Sea a day after the two men held talks for more than five hours. The two-day summit has underscored Moscow's position as the embattled autocrat's closest and most reliable foreign ally and took place as the US joined the EU in imposing sanctions against Minsk. (FT)

GEOPOLITICS: The chief editor of a popular Internet news site in one of Belarus' largest cities was detained and his residence searched amid a crackdown on independent journalists and opponents of authoritarian President Alexander Lukashenko. Police said Sunday they were investigating Hrodna.life editor Aliaksei Shota on suspicion of extremism. The publication focuses on Belarus' fifth-largest city Grodno. (AP)

CORONAVIRUS: A top World Health Organization official said Friday that investigations into the origins of Covid-19 are being "poisoned by politics." U.S. President Joe Biden announced Wednesday that he's ordered intelligence agencies to conduct "a report on their most up-to-date analysis of the origins of Covid-19, including whether it emerged from human contact with an infected animal or from a laboratory accident." (CNBC)

CORONAVIRUS: The World Health Organization is finalizing its assessment of China's Sinovac shot after it asked for further clarifications on the data provided, according to Mariangela Simao, WHO assistant director-general for drug access, vaccines and pharmaceuticals. The expert group will meet June 1 for a decision, Simao said. (BBG)

JAPAN: The approval rating of Prime Minister Yoshihide Suga's government fell 7 percentage points from April to 40% in a new Nikkei/TV Tokyo survey as public ire over the pandemic response flared anew under the extended state of emergency. (Nikkei)

JAPAN: The Japanese government is considering requiring spectators of the Tokyo Olympics either tested or vaccinated, the Yomiuri newspaper reported, citing officials who weren't identified. The government's draft plan calls for spectators to present a proof of negative Covid test results taken within a week of the game they're viewing, and those who present certification of vaccination would be exempt from that requirement. (BBG)

JAPAN: The head of the International Paralympic Committee said he's satisfied with the precautions being taken to protect athletes at the Tokyo Games, as concerns mount over whether the event can be held safely during the pandemic. "We would not be organizing the games if we believed they could cause a big spread of the virus," Andrew Parsons, chief of the group, said in an interview. "I'm confident with the level of protection." (BBG)

AUSTRALIA: Australia's Victoria state recorded six new local Covid-19 infections Monday in addition to the five reported earlier, taking active cases to at least 54. "I want to be very clear with everyone, this outbreak may well get worse before it gets better," Acting State Premier James Merlino told reporters in Melbourne. "In the past 24 hours we identified many more points of concern." The nation's second-most populous state has been under stay-at-home orders since May 27 and will remain so until at least June 3, when officials will assess if the latest outbreak is under control. (BBG)

AUSTRALIA/NEW ZEALAND/CHINA: Ahead of Australian Prime Minister Scott Morrison's arrival in New Zealand, the Government has confirmed that it will become a party to a trade dispute between Australia and China on barley tariffs. The Australian Government took the case to the World Trade Organisation after China whacked an 80 per cent tariff on imported Australian barley which Australian Trade Minister Dan Tehan has said "effectively stopped Australia's barley trade with China". New Zealand is joining the dispute as a third party, which means that it is supporting Australia as a matter of principle over fair trade rules, wishing to uphold the international "rules-based trading system". New Zealand was not asked to join, but has chosen to do so. "We participate as a third party in disputes between other WTO members when we want to influence the interpretation and application of WTO agreements on matters that are also of direct interest to us," according to the Ministry of Foreign Affairs website. (Stuff NZ)

RBNZ: The Reserve Bank of New Zealand (RBNZ) would prefer to have monetary stimulus in place for a longer period of time than take it away too quickly, a senior official said on Monday. New Zealand's central bank held interest rates last week, but hinted at a hike as early as September next year, becoming one of the first advanced economies to signal a move away from the stimulatory settings adopted during the COVID-19 pandemic. RBNZ Assistant Governor Christian Hawkesby said the implications of COVID-19 were not yet over so a similar amount of monetary stimulus was still needed as was required back in February. "Our messages around having stimulus in place for a considerable period of time, being patient and our least regret is keeping stimulus in place for too long rather than taking it away too quickly, all of those messages stay in place," Hawkesby said in an interview. Hawkesby said the official cash rate (OCR) projections RBNZ released last week were conditional on a number of underlying assumptions that need to fall in place to allow the bank to remove some stimulus at the back end of next year. (RTRS)

NORTH KOREA: North Korea on Monday slammed the U.S. lifting of "missile guidelines" on South Korea as a "stark reminder" of Washington's hostile approach to Pyongyang, saying the move is meant to spark an arms race on the Korean Peninsula and other neighboring countries. (Yonhap)

CANADA: Pointing to new federal modelling data, Tam said the Public Health Agency of Canada (PHAC) expects the third wave to continue to decline "as long as we maintain current measures and don't increase in-person contact rates across the community." While there are fresh reasons for optimism, Tam cautioned provinces against re-opening too quickly — especially indoor spaces. "While this forecast is very encouraging, it reaffirms that now is not the time to relax our measures. If measures are relaxed, increasing the number of community-wide in-persons contacts, resurgence is likely," she said. (CBC)

CANADA: To avoid wasting doses, Health Canada has extended the expiration date on some of its supply of AstraZeneca Plc vaccine from six months to seven months, according to a spokesperson for Ontario's health ministry. That follows a decision by Ontario to allow some residents to get their second vaccination after 10 weeks to avoid wasting 50,000 doses set to expire on Monday. On Friday, the country's most populous province said most residents will receive their second AstraZeneca dose after 12 weeks while the interval for second doses of the Pfizer and Moderna vaccines could be as short as 28 days depending on supply. (BBG)

BRAZIL: Brazilians staged protests against President Jair Bolsonaro's handling of the COVID-19 pandemic in at least 16 cities across the country on Saturday, carrying signs such as "Out with Bolsonaro" and "Impeachment now." (RTRS)

BRAZIL: Brazil's government is reviewing exceptional and temporary restrictions on the entry of foreigners into the country to curb the spread of Covid-19 and its new variants. A decision, based on technical guidance provided by local health regulator Anvisa, will be published in an extra edition of the official gazette this Friday. (BBG)

RUSSIA: President Joe Biden said the U.S. will stand up for human rights and pledged to raise the matter during his meeting with Russian President Vladimir Putin next month. "I'll be meeting with President Putin in a couple of weeks in Geneva, making it clear that we will not, we will not stand by and let him abuse those rights," Biden said Sunday during remarks in Delaware ahead of the Memorial Day holiday. The leaders are set to meet on June 15-16 at a fraught time in relations after cyberattacks the U.S. has blamed on Russia or Russia-based hackers, as well as Putin's support for Belarus, which forced down a Ryanair flight on May 23 to arrest a journalist. (BBG)

SOUTH AFRICA: Eskom has fired its chief procurement officer, Solly Tshitangano, with immediate effect. Tshitangano was suspended in February following allegations of poor performance. On Friday evening, Eskom issued a statement saying that it had received a report from the chairman of Tshitangano's disciplinary hearing who recommended that he be dismissed. (Fin 24)

SOUTH AFRICA: South African President Cyril Ramaphosa extended a night-time curfew and reduced the permissible size of public gatherings to contain the spread of the coronavirus after a surge in infections. The curfew will run from 11 p.m. to 4 a.m., one hour longer than before, as the country moves to virus alert-level two, from level one. A maximum of 100 people will be allowed at indoor gatherings and 250 at outdoor events. A widely anticipated tightening of curbs on alcohol sales didn't materialize. (BBG)

SOUTH AFRICA: South African President Cyril Ramaphosa reiterated calls for vaccines to be distributed more equitably. "It is truly absurd, almost obscene, that western governments must now incentivise some of their reluctant citizens to be vaccinated whilst those of us in the developing world are literally dying for vaccines," Ramaphosa said in an address Saturday at the Northern Cape Province conference. "We are simply asking for a waiver of the vaccine patents, whilst the pandemic is raging." (BBG)

SOUTH AFRICA: Eskom Holdings SOC Ltd. asked the public to limit power use on Sunday as it struggles to keep South Africa's ailing electrical infrastructure running. In a statement, the state-owned utility said the power grid was under severe strain answering the demands of winter and managing breakdowns. It said it might need to turn off power supplies at short notice. Station failures have taken out 14,746 megawatts from the system, while 3,330 megawatts are unavailable due to unplanned maintenance, according to the utility. Eskom said it's "working tirelessly" to return more generators to service and replace older ones. (BBG)

IRAN: The U.S. national security community is monitoring two Iranian naval vessels whose ultimate destination may be Venezuela, according to three people familiar with the situation, in what would be a provocative move at a tense moment in U.S.-Iran relations. An Iranian frigate and the Makran, a former oil tanker that was converted to a floating forward staging base, have been heading south along the east coast of Africa, said the people, who spoke on condition of anonymity to discuss a sensitive subject. (POLITICO)

IRAN: A French national arrested in Iran a year ago during a tourist trip has been referred for trial on charges of espionage and propaganda against the state, his lawyer said in a tweet. (BBG)

ISRAEL: Israel's opposition parties have banded together to try to form a minority government that could unseat the country's longest-serving prime minister, Benjamin Netanyahu, and head off the country's fifth election in two years. The self-styled "change government" must now present its plans to President Reuven Rivlin. If he approves the proposal the 120-seat Knesset must vote on it, a process that will take at least a week to arrange. "Four elections have already damaged the state — the political crisis in Israel is unprecedented in the world," Naftali Bennett, who leads rightwing, pro-settlements party Yamina, said in a primetime address on Sunday night. "I am going to work with all my strength to form a government with my friend Yair Lapid," he added, referring to the leader of the centrist Yesh Atid. (FT)

ISRAEL: Egypt and Israel held high-level talks in both countries Sunday to shore up a fragile truce between Israel and the Hamas militant group and rebuild the Gaza Strip after a punishing 11-day war that left parts of the seaside enclave in ruins. (AP)

MARKETS: Recent interest rate hikes by emerging economies could lead to a bursting of global financial asset bubbles, according to a senior official with China's banking regulator. Unprecedented pandemic easing measures by developed countries have enlarged such bubbles, Liang Tao, vice chairman of China Banking and Insurance Regulatory Commission, said at the International Finance Forum in Beijing on Saturday. Developed countries are sticking with ultra-low rates even as emerging economies raised their borrowing costs, potentially resulting in the re-pricing of global assets, he said. (BBG)

COPPER: A strike by a union of remote operations workers at BHP's Escondida and Spence copper mines in Chile entered its second day on Friday, as the company uses replacement workers to ensure continued production, a union leader told Reuters. The 200-member union runs BHP's Integrated Operations Center, which remotely manages pits and cathode and concentrator plants from Santiago. (RTRS)

OIL: Saudi Arabia, the world's largest oil exporter, on Sunday said it is committed to meet India's requirements of petroleum products, an affirmation that came in the wake of the country pitching for easing global output cuts to rein in surging oil prices. In an interview to PTI, Saudi ambassador Dr Saud bin Mohammed Al Sati also said that Saudi Arabia made investments worth USD 2.81 billion in India in 2020 and is looking at a greater momentum in bilateral economic ties in areas like petroleum, renewable energy, IT and artificial intelligence. (PTI)

OIL: Iran started its first transfer of crude oil via its strategic Goreh-Jask pipeline, allowing the country to bypass the Strait of Hormuz, the state-run Islamic Republic News Agency reported. The oil passed through the pipeline's second pump house and reached a facility near the port of Jask, IRNA said, without giving any details on the size or volume of the transfer. (BBG)

OIL: National Iranian Oil Co. will sign three agreements with local firms on Monday to study the giant Azadegan oil field that it shares with Iraq, according to a statement on NIOC's website. If the preliminary agreements lead to finalized contracts, they will increase oil production capacity at the Azadegan field, the statement said without giving figures. (BBG)

OIL: A group of GOP senators led by Sen. Thom Tillis, R-N.C., sent a letter to President Biden on Friday expressing opposition to his energy policies. The letter notes that within Biden's first 100 days in office, he halted construction of the Keystone XL pipeline and lifted sanctions on Russia's Nord Stream 2 pipeline. Senators also mentioned gasoline shortages Americans up and down the East Coast faced as a result of a significant cyberattack on the Colonial Pipeline earlier this month, comparing them to the shortages that resulted from the Arab Oil Embargo of the early 1970s. They also mentioned the 41% increase in gasoline prices since Biden took office. (Fox)

OIL: Colonial Pipeline, the largest fuel pipeline in the United States, on Friday said it had resolved a temporary network disruption, just weeks after a ransomware attack crippled fuel delivery for several days in the southeast region. Colonial earlier on Friday experienced a network issue, the company said, but restored service to its network. The issue was not associated with malware, the company said. The company had earlier said shippers were having problems entering and updating nominations for deliveries. The "system functionality has returned to normal," the company said. The reason for the network issues was not immediately clear. (RTRS)

CHINA

YUAN: A rapid appreciation of the yuan against the U.S. dollar probably won't last, according to a former Chinese central bank official, calling the trade "overbought." The rise in the yuan suggests short-term speculation, Sheng Songcheng, former director of the central bank's statistics and analysis department, said in an interview with the official Xinhua News Agency. China should prevent huge short-term inflows, which could push up the exchange rate of the Chinese currency, hurt competitiveness of exporters and affect independent operations of China's financial market and monetary policy, Sheng said. Separately, the People's Bank of China-backed Financial News said in an editorial Sunday that the yuan may depreciate in future due to factors such as potential tightening by the U.S. Federal Reserve if inflation keeps beating expectations. (BBG)

YUAN: The Chinese yuan may weaken against the dollar should the Federal Reserve tightens monetary policy to control inflation, or if the U.S. economy rebounds sharply, the PBOC-run Financial News said in a commentary. The Fed's withdrawal from easing may deflate asset bubbles, cause a sharp adjustment in U.S. asset prices, and trigger risk aversion in the global markets, it said. In turn, funds may flow back to the U.S. and lift the dollar index, the newspaper said. China's exports may also weaken as overseas supply capacity increases, further pressuring the yuan, the newspaper said. Yuan rose above 6.36 against the dollar last week, the highest in more than three years. (MNI)

YUAN: The Chinese yuan will remain strong in the short term after rising above 6.4 against the U.S. dollar, but room for further appreciation may be limited and it may weaken slightly in the second half as domestic growth momentum slows, according to a report by CICC. The current account surplus may narrow in the following months as Chinese exporters face declining profits amid rising raw material prices, FX exchange and freight costs while overseas production capacity gradually recovers, the report said. Capital inflow will also fluctuate as China-U.S. rate spreads are unlikely to widen further, the report said. (MNI)

YUAN/EQUITIES: The appreciation of yuan is not necessarily a bullish factor for Chinese A-shares, Guan Tao, former official of the State Administration of Foreign Exchange, said in an interview with China Securities Journal. The link between stock performance and yuan moves is not stable as Chinese exporters are under pressure from the currency's appreciation, Guan said. Yuan's appreciation couldn't offset surge in commodities prices, according to Guan, who is currently global chief economist of BOC International China. (BBG)

PBOC: The PBOC may increase liquidity injection through daily reverse repos in June if market rates rise as local government special bond issuances peak and rising PPI fuel tightening expectation, the Securities Daily reported citing Wang Qing, chief analyst at Golden Credit Rating. New special bonds could reach up to CNY800 billion in June, compared to CNY351.9 billion in May, the daily cited Wang as saying. The PBOC has continued to inject a small amount of CNY10 billion daily via 7-day reverse repos since May, seeking to guide the market rates around the current policy rates of 2.2% the newspaper said. (MNI)

MARKETS: China will tighten its crackdown on violations in the country's capital market, an official with the country's securities watchdog said Saturday. These violations include fraudulent issuances, financial fraud, and market manipulation in the name of market value management, said Li Chao, vice chairman of the China Securities Regulatory Commission. The commission will hasten the optimization of securities and law-enforcement systems and mechanisms, together with other relevant parties, Li said. (Xinhua)

CORONAVIRUS: The southern China city of Guangzhou imposed stay-at-home orders for residents of several streets to contain a Covid-19 outbreak. (BBG)

CORONAVIRUS: COVID-19 flare-ups at Yantian Port area in Shenzhen, South China's Guangdong Province have pushed the major port to slow its operations by suspending the acceptance of heavy export containers for several days. As of press time, 13 asymptomatic carriers were found in Shenzhen. According to a local official statement issued on Friday, the Yantian district in Shenzhen urged all citizens to be tested for COVID-19. In addition to Yantian, Guangzhou and Foshan in the province also reported new COVID-19 cases, causing disruptions to not just port operations but also cargo transport. While the cases in Guangzhou and Foshan were related to a dim sum restaurant, the cases in Yantian were related to a foreign ship in the port area. As a result of the new COVID-19 cases, the Yantian Port said it would stop accepting heavy containers waiting for export starting from Tuesday. According to new requirements, the port would only accept heavy export containers with an estimated time of arrival within three days, and this condition will last until June 6. (Global Times)

POLICY: China should take a gradual approach pulling back financing to high-emission industries in order to avoid credit risks, state bank chiefs said Saturday. Financial institutions need to support coal and steel companies to upgrade their technology to reduce emissions, even as they stop financing any further expansion of capacity, said Zhou Xuedong, executive vice president at China Development Bank, at a panel during the International Finance Forum in Beijing. "These [high-emission] industries have significant outstanding credit, and an exit of financing that's too fast could lead to the deterioration of bank assets," said Zhou. "This is a gradual process." China has pledged to become carbon neutral by 2060, which would require a drastic shift from fossil fuel to renewable energy. This has raised the question of how the financial sector can contribute to this goal without risking financial stability. (BBG)

POLICY: MNI BRIEF: China Should Tighten Links With OBOR Nations: Off'l

- China should diversify its investment destinations by strengthening ties with countries under the One Belt One Road initiative, a People's Bank of China official said at the Qvjiang Forum, adding that such a move would help counter unbalanced global development due to the Covid-19 pandemic - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CREDIT: Shanghai Electric falls in Shanghai and Hong Kong after the company warned of a "major risk" from a potential writeoff that could cost it 8.3 billion yuan in profits. Shares down as much 21% in Hong Kong, most since 2015, and among worst on the Hang Seng Composite Index, down the 10% limit in Shanghai worst on the CSI 300. Write off due to failure by subsidiary to pay account receivables could lead to losses of 526 million yuan while failure to repay loans may result in losses of as much as 7.8 billion yuan, according to a filing made to the Shanghai exchange on Sunday. It didn't give a timeline for the losses. Listed firm has a 40% stake in the telecommunications subsidiary. Board members and management will take all possible measures to reduce the impact of the writeoff. (BBG)

OVERNIGHT DATA

CHINA MAY OFFICIAL MANUFACTURING PMI 51.0; MEDIAN 51.1; APR 51.1

CHINA MAY OFFICIAL NON-MANUFACTURING PMI 55.2; MEDIAN 55.1; APR 54.9

CHINA MAY OFFICIAL COMPOSITE PMI 54.2; APR 53.8

MNI {AU} AUSSIE BONDS: Recent trade in YMM1 sees ~5.8K given at 99.780: China May PMI Edges Down To 51.0; Services Up

- China's Purchasing Managers' Index (PMI) edged down to 51.0 in May from April's 51.1, staying above the breakeven 50.0 level for the 15th straight month as manufacturing activity accelerated although demand slowed, according to data from the National Bureau of Statistics on Monday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN APRIL, P INDUSTRIAL OUTPUT +2.5% M/M; MEDIAN +3.9%; MAR +1.7%

JAPAN APRIL, P INDUSTRIAL OUTPUT +15.4% Y/Y; MEDIAN +16.9%; MAR +3.4%

MNI DATA BRIEF: Japan April Factory Output Rises 2.5% But To Fall In May

- Japan's industrial production posted the second monthly straight rise in April but production is expected to fall in May, increasing concerns over weaker production caused by the shortage of semiconductors in the second quarter - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN APRIL RETAIL SALES -4.5% M/M; MEDIAN -1.7%; MAR +1.2%

JAPAN APRIL RETAIL SALES +12.0% Y/Y; MEDIAN +15.2%; MAR +5.2%

JAPAN APRIL DEP'T & SUPERMARKET SALES +15.5% Y/Y; MEDIAN +15.5%; MAR +2.9%

AUSTRALIA APR PRIVATE SECTOR CREDIT +0.2 % M/M; MEDIAN +0.4%; MAR +0.4%

AUSTRALIA APR PRIVATE SECTOR CREDIT +1.3 % Y/Y; MEDIAN +1.4%; MAR +1.0%

AUSTRALIA MAY MELBOURNE INSTITUTE INFLATION +3.3% Y/Y; APR +2.3%

AUSTRALIA MAY MELBOURNE INSTITUTE INFLATION -0.2% M/M; APR +0.4%

NEW ZEALAND MAY, F ANZ BUSINESS CONFIDENCE INDEX +1.8; PRELIM +7.0; APR -2.0

NEW ZEALAND MAY, F ANZ BUSINESS ACTIVITY OUTLOOK INDEX +27.1; PRELIM +32.3; APR +22.2

Compared to the preliminary May results, activity indicators were lower. The bulk of the later-month responses arrived promptly in response to the reminder email that arrived in inboxes the morning of the Budget. The details of the Budget were not known at that time, but it's possible that uncertainty may have affected the numbers. The June preliminary read will capture responses starting tomorrow. Inflationary pressures are certainly not receding but inflation expectations remain close to the RBNZ's target range midpoint of 2%. Retailers' pricing intentions lifted a point to 66%, while the manufacturing (72%), construction (80%) and services (49%) sectors all hit or remained at record highs in data that goes back to 1993. Expected costs are in the 90s for manufacturing, construction and agriculture, and not far off it for retail (88%). The aggregate is being held down by the services sector, where 'only' a net 72% of firms expect higher costs. (ANZ)

SOUTH KOREA APR INDUSTRIAL OUTPUT -1.6% M/M; MEDIAN +0.4%; MAR -0.9%

SOUTH KOREA APR INDUSTRIAL OUTPUT +12.4% Y/Y; MEDIAN +11.5%; MAR +4.4%

SOUTH KOREA APR CYCLICAL LEADING INDEX +0.4PT M/M; MAR +0.3PT

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information. The operation aims to keep liquidity reasonable and ample, the PBOC said on its website. The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:26 am local time from the close of 2.3086% on Friday. The CFETS-NEX money-market sentiment index closed at 45 on Friday vs 37 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3682 MON VS 6.3858 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3682 on Monday, compared with the 6.3858 set on Friday, marking the strongest fixing since May 17, 2018.

CHINA CFETS YUAN INDEX UP 0.78% IN WEEK MAY 28

The CFETS Weekly RMB Index was 97.95 last Friday, May 28, compared with 97.19 in the week as of May 21. The gauge, which compares the yuan to a basket of currencies from China's 24 major trading partners, is up 3.28% from 94.84 on Dec. 31, 2020.

MARKETS

SNAPSHOT: CNY Gets More Airtime

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 311.9 points at 28841.31

- ASX 200 down 8.906 points at 7170.5

- Shanghai Comp. down 7.173 points at 3593.611

- JGB 10-Yr future up 4 ticks at 151.47, JGB 10-Yr yield down 0.3bp at 0.08%

- Aussie 10-Yr future -0.5 ticks at 98.365, Aussie 10-Yr yield up 0.3bp at 1.692%

- U.S. 10-Yr future down -0-05 at 131-25, Cash Tsys are closed

- WTI crude up $0.45 at $66.77, Gold up $3.76 at $1907.16/oz

- USD/JPY down 19 pips at y109.67

- EX-PBOC OFFICIAL: RAPID YUAN GAINS WON'T LAST (XINHUA)

- CHINA'S BANKING REGULATOR WARNS OF GLOBAL ASSET BUBBLE RISKS (BBG)

- EX-CHINA SAFE OFFICIAL DOWNPLAYS YUAN RISE IMPACT ON STOCKS (CSJ)

- CHINA OFFICIAL PMIS VIRTUALLY INLINE WITH EXPECTATIONS

BOND SUMMARY: Core FI Markets Stick To Tight Ranges In Asia

T-Notes stuck to the confines of a 0-02+ range in Asia, last -0-05 at 131-25, with the movement in the Chinese yuan garnering the most attention early this week after Chinese state owned media and a mixture of former & current policymakers flagged risks to those betting on a continued appreciation in the CNY vs. the USD. Broader headline flow and market moves remain limited as the U.S. and the UK observe holidays on Monday, with the former resulting in the closure of the cash Tsy market.

- JGB futures ticked away from overnight highs during the Tokyo morning, given the moves in T-Notes during late NY/early Asia dealing, but still sit 4 ticks above Friday's settlement levels. The major benchmarks across the cash curve generally sit within 0.5bp of Friday's closing levels, trading firmer in the main. On the data front, domestic prelim. industrial production and retail sales missed expectations, but there has been little else to note outside of some limited activity in the JPY corporate issuance space. 2-Year JGB supply passed smoothly enough, with the low price meeting broader dealer expectations (proxied by the BBG dealer poll), although the internals were mixed, with the cover ratio softening a touch as the tail narrowed.

- Yields are little changed across the Aussie curve, with slightly softer than expected domestic private credit data and in-line with broader exp. official Chinese PMI readings doing little for the space. The front end of the curve remains underpinned, with lifts in the white IR contracts headlining the session thus far. YM unch., XM -0.5, with Bills running unchanged to -2 through the reds.

EQUITIES: Data Misses Hit Sentiment

A broadly negative day for equity markets in the Asia-Pac region with liquidity thinner than usual due to market holidays in the US and UK. Markets in Japan are lower, industrial production and retail sales data both missed estimates. Markets in mainland China are under pressure, the CSI 300 down around 0.4%, NBS PMI data showed the pace of growth in the manufacturing industry dipped slightly in May. In Taiwan the Taiex posted solid gains though, TWD rose to the strongest since April 1997. In the US futures are marginally higher, markets look ahead to data this week including PMI, ISM and NFP.

OIL: Crude Futures Edge Higher As USD Slips

Oil edged higher in Asia-Pac trade on Monday; WTI is up $0.35 from settlement levels at $66.67/bbl while Brent is up $0.28 at $69.00/bbl. Prices initially dipped lower but managed to reverse the early losses as the greenback lost some ground. Markets now look ahead to the OPEC+ meeting this week, with other focus on the talks between world powers and Iran in Vienna.

GOLD: Atop $1,900/oz Again

The DXY initially ticked higher in Asia-Pac hours before giving back those modest gains to operate towards the bottom end of Friday's range, albeit comfortably above the lows that were witnessed in early trade last week. That, coupled with Friday's pullback from highs in the DXY and slight richening of U.S. Tsys, has allowed spot to consolidate above $1,900/oz, with bulls looking to force a break of $1,910/oz at present. Technical resistance resides at the nearby May 26 high of $1,912.8/oz, followed by the Jan 8 high at $1,917.6/oz, with the market's assumption surrounding the level of transitory inflationary impulse, coupled with the U.S. yield & DXY backdrop front & centre.

FOREX: Early Moves Reversed As USD Slips

Initial gains in the greenback were reversed as the session wore on, as a result AUD and NZD both head into the European open in positive territory, while JPY has firmed.

- AUD/USD up 13 pips, Victoria state reported 5 new COVID-19 cases, gains were supported by higher iron ore prices. Data showed private sector credit rose 1.3% Y/Y against estimates of a 1.4% rise.

- NZD/USD is up around 6 pips, ANZ activity outlook fell to 27.1 in May, while business confidence fell to 1.8.

- USD/JPY is down 19 pips, domestic prelim. industrial production and retail sales both missed expectations.

- Offshore yuan is in positive territory, reversing losses of around 120 pips earlier in the session. May manufacturing PMI missed estimates at 51.0, which was slower than April's expansion, while non-manufacturing PMI rose to 55.2, the PBOC also fixed USD/CNH 26 pips above sell side estimates, indicating a preference for a weaker yuan after several commentary pieces expressing the same over the weekend.

- SNB's Joran gave an interview to a Swiss newspaper over the weekend, he noted that CHF remains highly valued but noted this worked to dampen inflation. USD/CHF is down 10 pips.

FOREX OPTIONS: Expiries for May31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100-17(E764mln), $1.2145-55(E756mln)

- USD/CAD: C$1.2400($1.1bln-USD puts)

CNY: Continued Minimal Deviations Between Mid-Point Fixing & Expectations

The PBoC USD/CNY mid-point fixing continues to show a minor bias towards a weaker yuan when compared to broader market expectations, although the deviation between the two is limited, as shown in the chart below i.e. the PBoC hasn't shown much in the way of outright, overt pushback against the recent strengthening, at least from a fixing perspective. A quick reminder that the CFETS RMB index moved to the highest level witnessed since '16 last week.

Fig. 1: USD/CNY vs. Differential Between USD/CNY Mid-Point Fixing & BBG Survey Estimate

Source: MNI - Market News/Bloomberg

- As we flagged earlier, the weekend saw current & former policymakers and state-owned media highlight issues which could push back against the continued swift appreciation of the CNY, with the authorities keen to maintain the message that the CNY will operate in a 2-way environment around "basically stable" levels.

- If USD/CNY does continue its move lower then technical support at the following levels may come into play:

- CNY6.3554 - Low May 17 2018

- CNY6.3292 - Low May 11 2018 & key support

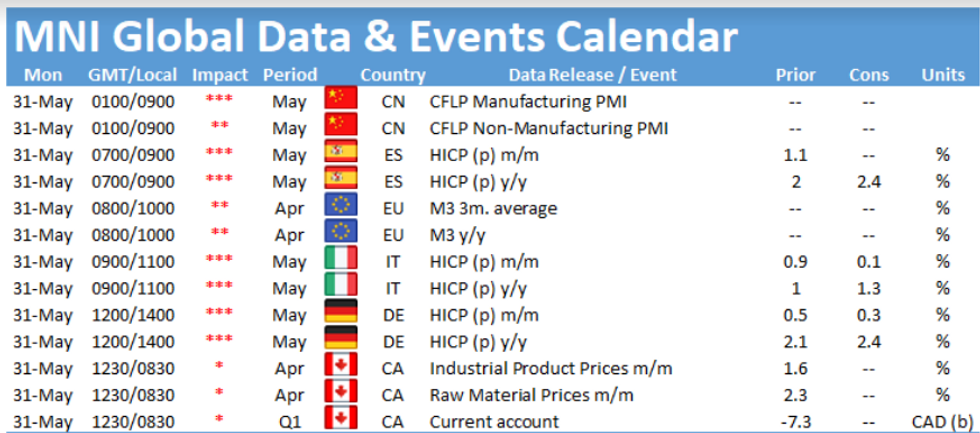

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.