-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: ECB Views Continue To Draw Lines Into May Meeting

EXECUTIVE SUMMARY

- FED LENDING TO BANKS STILL HIGH, BUT EASES IN LATEST WEEK (RTRS)

- ECB’S HOLZMANN: 50BP RATE HIKE ‘COULD BE IN THE BALLPARK’ AT ITS NEXT MEETING (CNBC)

- ECB’S WUNSCH: ECB NEEDS MORE RATE HIKES AND FASTER BALANCE SHEET CUTS (RTRS)

- ECB’S KAZAKS: RISK OF NOT DOING ENOUGH TO TACKLE INFLATION IS HIGHER THAN DOING TOO MUCH (CNBC)

- ECB’S VASLE: HALF-POINT HIKE POSSIBLE IF DATA WARRANT IT (BBG)

- ECB’S SCICLUNA: ‘STILL SOME WAY TO GO’ ON INTEREST RATE HIKES, POLICYMAKER SAYS (CNBC)

- SLOVAKIA’S CENTRAL BANK BOSS REJECTS CALL TO RESIGN AFTER BRIBERY RULING (FT)

- CHINA’S MEGABANKS PLAN FUNDING SPREE TO PLUG CAPITAL SHORTFALL (BBG)

- FED’S POWELL, PBOC’S YI HOLD FIRST ONE-ON-ONE TALK SINCE 2020 (BBG)

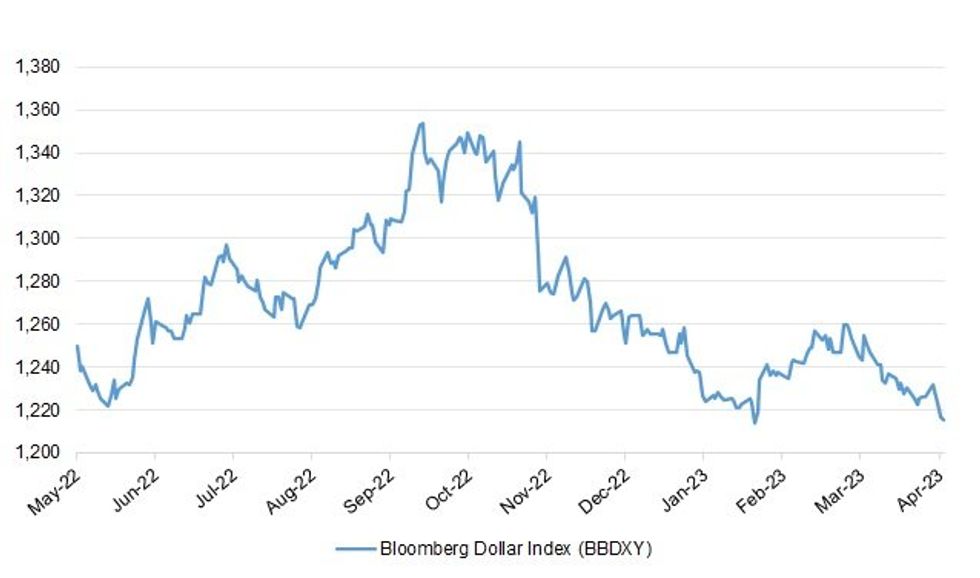

Fig. 1: Bloomberg Dollar Index (BBDXY)

Source: MNI - Market News/Bloomberg

UK

ECONOMY: British finance minister Jeremy Hunt said on Thursday there was no room for complacency in tackling low growth and high inflation after data showed the economy stagnated in February, hurt by strikes among public workers. (RTRS)

BANKS: Britain’s chancellor said on Thursday that his government needed to look at raising the level of protection for bank customers given the speed at which deposits fled Silicon Valley Bank last month. (FT)

PENSIONS: The UK government is considering proposals to pool private sector defined contribution pension plans in a bid to unlock investment in British industry, Chancellor of the Exchequer Jeremy Hunt said. (BBG)

BREXIT: The UK and the European Union will agree a Memorandum of Understanding on financial services cooperation in the coming weeks and months, but it will be years if ever before the City of London gains access to EU financial markets and the current exception made for clearing is unlikely to be extended when it expires, EU sources told MNI. (MNI)

EUROPE

ECB: The euro zone is not heading for a recession as growth is likely to accelerate after a weak first quarter, European Central Bank policymaker Joachim Nagel said on Thursday. (RTRS)

ECB: Robert Holzmann, ECB policymaker and governor of the Austrian National Bank, told CNBC that if the economic outlook changes, the central bank will change its approach to interest rates. (CNBC)

ECB: The European Central Bank should speed up the reduction of its balance sheet and could stop reinvesting cash from debt maturing in its largest bond buying scheme to complement further interest rate hikes, Belgian policymaker Pierre Wunsch said. (RTRS)

ECB: Receding concerns over the health of the financial system mean a half-point increase in interest rates is possible when the European Central Bank meets next month, according to Governing Council member Bostjan Vasle. (BBG)

ECB: Martins Kazaks, governor of the central Bank of Latvia and ECB policymaker, shares his views on the fight against inflation and says more interest hikes will be necessary. (CNBC)

ECB: Edward Scicluna, governor of the Central Bank of Malta, discusses the outlook for European Central Bank interest rate hikes, indicating that further increases are likely. (CNBC)

ECB: Slovakia’s central bank governor has rebuffed a call by the country’s leadership for him to resign after a judge fined him in a bribery case. (FT)

FRANCE: French Finance Minister Bruno Le Maire said on Thursday that he was determined to return France to "sound public finances" as the COVID-19 pandemic and subsequent high inflation fade. (RTRS)

FRANCE: French protests against President Emmanuel Macron’s pension reform saw a sharp drop in mobilization on Thursday before a ruling on the law’s constitutionality. (BBG)

SPAIN: Now that power prices are falling, Spanish consumers should soon also be seeing such a move in everyday costs, according to Economy Minister Nadia Calvino. (BBG)

RATINGS: Potential rating reviews of note slated for after hours on Friday include:

- Fitch on Croatia (current rating: BBB+; Outlook Stable) & Portugal (current rating: BBB+; Outlook Stable)

- Moody’s on the European Union (current rating: Aaa; Outlook Stable)

- S&P on the Czech Republic (current rating: AA-; Outlook Stable)

- DBRS Morningstar on Malta (current rating: A (high), Stable Trend)

U.S.

FED: Federal Reserve lending to banks eased further in the latest week, signaling that while the absolute levels of emergency credit remain high, financial sector strains which started a month ago are continuing to ease. (RTRS)

FISCAL: House Speaker Kevin McCarthy is preparing to unveil next week a plan that would suspend the nation’s debt ceiling for a year in return for spending concessions, according to people familiar with the talks. (BBG)

PROPERTY: Shadow lenders are circling commercial real estate, a large asset class that traditional banks and the bond market are increasingly backing away from, potentially forcing borrowers to start paying up for deals. (BBG)

EQUITIES: Boeing on Thursday warned it will likely have to reduce deliveries of its 737 Max airplane because of a problem with a part made by supplier Spirit AeroSystems. Boeing said the problem was not an “immediate safety of flight issue and the in-service fleet can continue operating safely.” (CNBC)

OTHER

GLOBAL TRADE: Taiwan's leading tech companies suffered the biggest drop in revenue in at least a decade last month, according to Nikkei data, signaling a looming downturn in demand for chips and other electronics that could have a far-reaching effect across the globe. Nineteen Taiwanese tech manufacturers that supply such top players as Apple, Microsoft and others generated a combined 1.07 trillion New Taiwan dollars ($35.3 billion) in March, down 18.5% on the year and the largest drop since 2013. (Nikkei)

GLOBAL TRADE/GEOPOLITICS: International Monetary Fund Managing Director Kristalina Georgieva on Thursday warned policymakers against the danger of a new Cold War as they ramp up efforts to secure their industrial supply chains amid geopolitical tensions between major powers. (RTRS)

U.S./CHINA: The People’s Bank of China’s Governor Yi Gang met with US Federal Reserve Chair Jerome Powell in Washington this week for their first one-on-one talk since 2020. (BBG)

CHINA/TAIWAN: Taiwan is working with friendly nations on how to respond to a possible economic blockade by China, a scenario that appears more likely than a direct military attack on the island, according to a senior Taiwanese diplomat. (BBG)

GEOPOLITICS: The FBI arrested a 21-year-old Air National Guardsman in connection with the leak of highly classified documents including maps, intelligence updates and the assessment of Russia’s war in Ukraine. (BBG)

GEOPOLITICS: Japanese Finance Minister Shunichi Suzuki says he wants China to participate in Sri Lanka debt restructuring negotiations after creditors formally launched talks earlier in the day. (BBG)

BOJ: The Bank of Japan will not take further policy action until the U.S. Federal Reserve releases its report on the failure of Silicon Valley Bank (SVB) expected by May 1, MNI understands. (MNI)

BOJ: Some Bank of Japan officials have challenged the Bank's view that the y/y core consumer price index (CPI) will fall below 2% toward the middle of the fiscal year, noting strong wage growth and ongoing cost pass-through could delay the reversion or soften its fall more than expected, MNI understands. (MNI)

AUSTRALIA: Australia’s outdated tax system is buckling under spending pressure, prompting the Labor government to explore options to boost revenue to pay for programs including a vast defense build up and health care weeks before budget day. (BBG)

NEW ZEALAND: New Zealand Finance Minister Grant Robertson anticipates a price tag of as much as NZ$10 billion ($6.3 billion) for cyclone relief that he said will be distributed over many years as the country rebuilds by tapping unspent emergency funds and consolidating its fiscal policy. He spoke to Kathleen Hays from the IMF Spring Meeting in Washington. (BBG)

BOK: Bank of Korea Governor Rhee Chang-yong warned that the central bank’s war on inflation isn’t over despite signs of cooling prices, saying it remains uncertain whether the current policy is tight enough. (BBG)

NORTH KOREA: North Korea's state media said on Friday that the country tested a new solid-fuel intercontinental ballistic missile (ICBM) on Thursday. North Korea fired what appeared to be a new model ballistic missile on Thursday, South Korea said, triggering a scare in northern Japan where residents were told to take cover, though there turned out to be no danger. (RTRS)

SINGAPORE: Singapore’s central bank kept its monetary policy settings unchanged after five straight tightening moves since October 2021, pointing to rising global growth risks and ebbing inflation. (BBG)

MEXICO: Mexico’s central bank board members are weighing their path forward as dissipating price pressures allow them to consider the end of a record tightening cycle. (BBG)

MEXICO: Mexican Deputy Finance Minister Gabriel Yorio said on Thursday that the government will not need to issue debt to finance its $6 billion deal to buy 13 power plants from Spanish energy company Iberdrola. (RTRS)

MEXICO: Banco Bilbao Vizcaya Argentaria, Banco Santander SA and Bank of America Corp. are lining up to finance Mexico’s deal to purchase power plants from Spain’s Iberdrola for $6 billion, according to people familiar with the talks. (BBG)

BRAZIL: Lower house is on Finance Minister Fernando Haddad’s side and there is, so far, no sign of any difficulty for the government, Speaker Arthur Lira said during interview with GloboNews. (BBG)

BRAZIL: Brazil’s development bank BNDES intends to set aside as much as 30% of its disbursements to finance local companies in the areas of innovation, sustainability and energy transition, as part of a plan to support the industrial sector with affordable interest rates. (BBG)

RUSSIA: The European Union will launch an 11th wave of sanctions on Russia and seek to crack down on efforts to evade economic penalties introduced in the wake of its full-scale invasion of Ukraine, a top EU official told CNBC Thursday. (CNBC)

RUSSIA: Senior officials from the United States, Europe and Britain met on Thursday with financial institutions to brief them on efforts by Russia to evade Western sanctions imposed over its invasion of Ukraine, a senior U.S. Treasury official told reporters. (RTRS)

RUSSIA: Switzerland has made it clear that it does not want to be seen as a haven for the evasion of sanctions on Russia, and is working with the U.S. and other partners on such issues, a senior U.S. Treasury official said on Thursday. (RTRS)

RUSSIA: Russia could consider the possibility of a prisoner exchange for jailed Wall Street Journal reporter Evan Gershkovich only after a Russian court renders a verdict on an espionage allegation against the 31-year-old American, according to a senior Russian official. (WSJ)

COLOMBIA: Recent peso rally will help contain inflationary pressures, Colombian Central Bank Governor says Thursday, in interview with Bloomberg TV. (BBG)

CHILE/METALS: Chile is willing to discuss lowering the tax burden for mining companies in a royalty bill before Congress, the top copper-producing nation’s finance minister said in an interview. (BBG)

PERU: Peru's central bank kept unchanged its benchmark interest rate at 7.75% on Thursday for the third consecutive time, as the monetary authority in the Andean nation faces the highest inflation in a quarter century. (RTRS)

WORLD BANK: World Bank President David Malpass on Thursday said progress on sovereign debt issues would be measured by actual restructuring deals being agreed for Ghana, Ethiopia and Zambia, and said there was still no agreement on his longstanding call for a standstill in debt service payments for countries seeking help. (RTRS)

OIL: Angola expects its oil production to temporarily increase next year on the back of recent private investments in the sector, but output will remain below 1.5 million barrels per day, its finance minister told Reuters on Thursday. (RTRS)

OIL: North Sea oil traders snapped up the most benchmark cargoes in over two years, the latest exhibit that a global rush for crude may be building momentum following surprise OPEC+ production cuts. (BBG)

CHINA

PBOC: China is expected to achieve around 5% economic growth this year as the property market improves, according to People’s Bank of China Governor Yi Gang. (BBG)

FISCAL: China should raise the level of social security to promote the economy, according to a Yicai editorial. (MNI)

FISCAL: China is likely to maintain a high volume of special government bond issuance in 2Q to stabilize the economy, Securities Times reported, citing analysts. (BBG)

POLICY: Beijing wants to cultivate "unicorn firms" that support the high-quality upgrading of the economy, according to Li Qiang, China’s Premier. (MNI)

PROPERTY: Chinese property developers’ total financing via non-bank channels was 91.8b yuan ($13.37b) in March, more than double the level of February, Shanghai Securities News reported, citing data from China Index Academy. (BBG)

FTZS/BANKS: The Hainan Free Trade Zone (FTZ) wants foreign banks to participate in its development and will pursue favourable financial policies to attract the institutions, according to Xing Wei, vice chairman of the China Banking Association. (MNI)

BANKS: China’s megabanks are planning at least 40 billion yuan ($5.8 billion) of bond sales, kicking off a major funding push to comply with global capital requirements by early 2025. (BBG)

EQUITIES: China Evergrande New Energy Vehicle Group Ltd.’s billionaire founder vowed to overtake Tesla Inc. as the world’s biggest maker of electric cars within three to five years back in early 2019. Four years later, the company’s stock has gone from boom to bust and it’s struggling to survive. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY2 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY15 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY2 billion after offsetting the maturity of CNY17 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0137% at 09:51 am local time from the close of 1.9935% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 50 on Thursday, compared with the close of 41 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8606 FRI VS 6.8658 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8606 on Friday, compared with 6.8658 set on Thursday.

OVERNIGHT DATA

NEW ZEALAND MAR BNZ-BUSINESSNZ MANUFACTURING PMI 48.1; FEB 51.7

New Zealand’s manufacturing sector experienced a decline in activity during March, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for March was 48.1 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 3.6 points down from February, and well below the longterm average activity rate of 53.0. BusinessNZ’s Director, Advocacy Catherine Beard said that the numbers behind the main March result showed the manufacturing sector facing some stiff headwinds ahead. (BusinessNZ)

NEW ZEALAND FEB NET MIGRATION +11,655; JAN +6,445

SOUTH KOREA FEB L MONEY SUPPLY +0.4% M/M; JAN +0.3%

SOUTH KOREA FEB M2 MONEY SUPPLY +0.3% M/M; JAN -0.1%

MARKETS

US TSYS: Curve Marginally Flattens In Muted Asian Session

TYM3 deals at 115-18, +0-03+, with a 0-04 range on volume of ~65k.

- Cash tsys sit flat to 1.5bps richer across the major benchmarks, the curve is a touch flatter.

- There was a muted start to dealing with cash tsys little changed in early dealing, ranges were narrow with little follow through on moves.

- Tsys marginally richened as USD was marginally pressured as an offer in USD/CNH led the greenback lower.

- Little meaningful macro headline flow crossed through the session.

- FOMC dated OIS price ~18bp hike into the May meeting with a terminal rate of 5%. There are ~65bps of cuts priced for 2023.

- In Europe today we have the final print of French CPI and ECB-speak from Lagarde and Panetta. Further out we have US Retail Sales, Business Inventories, Industrial Production and UofMich Consumer Sentiment. Fedspeak from Chicago Fed President Goolsbee and Fed Governor Waller will cross.

JGBS: Hovering Around Unchanged Into The Weekend

The JGB space hasn’t really managed to generate anything in the way of a meaningful move away from early Tokyo levels, with futures -2 as we move towards the close, while cash JGBs operate within 1bp of yesterday’s closing levels.

- An uptick in swap rates, resulting in swap spread widening and swap curve steepening, will have applied some light pressure to JGBs.

- Headline flow from Finance Minister Suzuki & BoJ Governor Ueda didn’t move the needle, failing to introduce fresh, tangible information.

- BoJ Rinban operations (covering 1- to 10- & 25+-Year JGBs) also did little for JGBs.

- In the corporate bond space, Berkshire Hathaway priced ~Y165bn of bonds in a 5-part deal, after Warren Buffett pointed to increased investment in Japanese trading houses in recent days.

- Market chatter has turned towards the investment intention outlines for the domestic life insurer and pension fund community, with the potential for a meaningful BoJ policy pivot, in addition to the volatility observed in wider financial markets alongside the well-documented, elevated FX-hedging costs that Japanese investors currently face, generating even deeper than normal interest in the capital deployment plans of this sizable investor cohort (the semi-annual outlines will likely filter out over the next couple of weeks or so).

- Looking ahead to next week, national CPI data and 20-Year JGB supply provide the highlights of the local docket.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y5.12515tn 3-Month Bills:

- Average Yield -0.1816% (prev. -0.1875%)

- Average Price 100.0488 (prev. 100.0509)

- High Yield: -0.1675% (prev. -0.1860%)

- Low Price 100.0450 (prev. 100.0505)

- % Allotted At High Yield: 93.4287% (prev. 90.7936%)

- Bid/Cover: 3.296x (prev. 3.759x)

AUSSIE BONDS: Holding Cheaper & Steeper, ACGB Dec-34 Syndication Slated For Next Week

Aussie bond futures operated in relatively close proximity to their respective overnight lows for most of Friday’s Sydney session, with a shallow look through the overnight base in YM futures failing to generate a meaningful extension. The former sits -2.0, while the latter is -4.5. Wider cash ACGB trade sees 2.5-5.5bp of cheapening, with the overnight/early Sydney bear steepening impulse remaining in play.

- There hasn’t been much in the way of meaningful local news flow to shape price action, which left participants pondering and adjusting to price action in wider markets for most of the day.

- The AOFM’s announcement re: its intent to issue the new ACGB Dec-34 via syndication next week applied some brief pressure to XM futures, although the overnight/early Sydney lows in the contract held, before it bounced back towards pre-syndication announcement levels. A quick reminder that the AOFM had previously outlined its intention to introduce ACGB Dec-34 in the current quarter.

- Bills sit flat to 3bp cheaper through the reds, off lows, with a modest steepening bias.

- RBA-dated OIS is little changed on the day, with the terminal rate pricing hovering at ~3.65%, and just under 15bp of cuts priced by year-end (vs. the current terminal cash rate pricing).

- Looking ahead, the minutes from the most recent RBA meeting, CBA household spending data and flash Judo Bank PMI prints headline locally next week.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- A new 21 December 2034 Treasury Bond is planned to be issued via syndication in the week beginning 17 April 2023 (subject to market conditions). The Joint Lead Managers for the issue will be announced after they are advised of their selection and before close of business today.

- On Thursday 20 April it plans to sell A$1.0bn of the 23 June 2023 Note & A$500mn of the 25 August 2023 Note.

NZGBS: Curve A Touch Steeper On The Day

NZGBs held steeper on the day, with little in the way of net movement outside of the early catch up to Thursday’s moves in U.S. Tsys, leaving NZGB benchmarks 2-5bp cheaper at the bell. Swap rates generally mimicked those moves, leaving swap spreads little changed.

- Locally, Finance Minister Robertson outlined ~NZ$9-10bn rebuild costs for Cyclone Gabrielle, although he pointed to that being spread over “many years”, also telling BBG that he wanted to minimise the amount of borrowing deployed when it comes to funding the spending. Finally, Robertson conceded that it is possible that NZ is already in a technical resilience, but pointed to various areas of economic resilience that he hoped would result in a shallow and short-lived recession (in the case that scenario is realised).

- When it comes to RBNZ pricing, RBNZ-dated OIS continues to show 20bp of tightening for the Bank’s next meeting, while terminal OCR pricing continues to hover just below 5.50%.

- Locally, manufacturing PMI data moved back into contractionary territory after a two-month hiatus, although survey sponsor BNZ noted that "disappointing as New Zealand’s March PMI was, it wasn’t especially negative in longer-term context. Neither was it much out of line with manufacturing readings across the world of late.”

- Looking ahead, Q1 CPI data dominates next week’s local docket.

EQUITIES: APac Equities Bid, E-Minis Little Changed To A Touch Softer Ahead Of Bank Earnings

The positive lead from Wall St. and the continuation of the recent USD softening generally supported Asia-Pac equities into the weekend, with the major benchmarks running 0.3-1.2% firmer.

- The Nikkei 225 outperformed, aided by quarterly earnings from Fast Retailing, which were accompanied by an upgrade in the company’s full-year operating profit guidance.

- There hasn’t been much in the way of meaningful news flow catalysts since the NY-Asia handover, but we note that northbound net flows seen in the HK-China Stock Connect schemes are running at the highest level since March 17. This comes after Chinese President Xi called on foreign investors to deepen their presence in Chinese markets as the country improves its business operating environment (on Thursday).

- E-minis were incrementally lower vs. settlement, holding to a tight range, with focus on large cap financial earnings later today (J.P.Morgan, Wells Fargo, Citi & BlackRock), which come in the wake of the well documented banking tumult seen in March. There wasn’t much impact from Boeing warning that it will likely have to reduce deliveries of its 737 Max plane owing to part issues, although the company noted that the problems caused are not an “immediate safety of flight issue and the in-service fleet can continue operating safely.”

GOLD: Gold Holds Just Below Cycle Highs, Supported By Weaker USD In Asia

The softer USD narrative in Asia-Pac hours supported bullion, pushing spot back towards Thursday’s cycle highs, last dealing +$5/oz at ~$2,045/oz. A breach of yesterday’s cycle high ($2,048.7/oz) would expose the March ’22 highs, which protect the all-time high from ’20. The Fed pivot narrative continues to dominate when it comes to support for bullion, with the softer USD fuelling the bid in gold, although our weighted U.S. real yield monitor has ticked away from its multi-month trough in recent days. When it comes to flows, known ETF holdings of gold now sit at the highest level observed since late January, after bouncing from cycle lows registered around the time of the well-documented U.S. banking tumult observed in March.

OIL: On Track For A Fourth Straight Weekly Gain

Oil looked to a softer USD for some light support in Asia-Pac hours, with WTI & Brent crude futures adding ~$0.35 apiece after Thursday’s downtick (in the wake of the notable rally from cycle lows observed in recent weeks). In the background, signs of tighter market conditions continue to underpin crude, leaving the major benchmarks on course for a fourth consecutive weekly gain, with news outlets pointing to more than ample demand in physical crude markets across both Europe & Asia. Both Brent & WTI remain in bullish patterns from a technical perspective, with the Jan 23 highs in both providing the major points of nearby technical resistance.

FOREX: USD Moderately Pressured In Asia

The greenback is moderately pressured in Asia today, BBDXY is down ~0.2% last printing at 1214 a touch above year to date lows (1210.29)

- Kiwi is firmer, NZD/USD has consolidated Thursday's gains and sits a touch above the $0.63 handle. There was little reaction to the fall in March BusinessNZ Manufacturing PMI. The measure fell to 48.1 with February's print revised lower to 51.7.

- Yen is also firmer, USD/JPY is ~0.2% softer. The pair last prints at ¥132.35/45. Technically yesterday's price action added to the evidence that the latest recovery was corrective in nature. Bears now target a break of low from Apr 10 (¥131.83) which open ¥130.64 the low from Apr 5 and key support.

- AUD/USD is little changed from yesterday's closing levels. The pair has observed a narrow range with little follow through. Resistance was seen ahead of yesterday's high.

- Elsewhere in G-10 EUR/USD is through yesterday's high printing its highest level of 2023. Resistance was seen at $1.1076 the high from Apr 1 2022.

- Cross asset wise; regional equities firmer benefitting from the strong lead from Wall St. US Treasury Yields are little changed across the curve.

- In Europe today we have the final print of French CPI and ECB speak from Lagarde and Panetta. Further out we have US Retail Sales, Business Inventories, Industrial Production and UofMich Consumer Sentiment.

FX OPTIONS: Expiries for Apr14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0890-00(E2.2bln), $1.0950(E1.1bln), $1.1000(E1.8bln), $1.1050(E630mln)

- USD/JPY: Y130.00($1.2bln), Y132.00($910mln), Y133.00($661mln), Y134.00($602mln)

- NZD/USD: $0.6400(N$1.1bln)

- USD/CAD: C$1.3440-45($1.7bln)

- USD/CNY: Cny6.8000($503mln), Cny6.9000($914mln), Cny6.9050($514mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/04/2023 | 0600/0800 | *** |  | SE | Inflation report |

| 14/04/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 14/04/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 14/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank Spring Meetings | |

| 14/04/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2023 | 1245/0845 |  | US | Fed Governor Christopher Waller | |

| 14/04/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/04/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 14/04/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2023 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2023 | 1600/1700 |  | UK | BOE Tenreyro Panellist at the IMF Meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.