-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Erdogan Ramps Up Pressure For Rate Cuts

EXECUTIVE SUMMARY

- YELLEN & LIU HE CONDUCT CALL, COMMUNICATION TO CONTINUE

- FED'S BRAINARD: MBS QE SUCCESSFULLY PROVIDING SUPPORT (MNI)

- JOHNSON FACES GROWING PRESSURE FROM TORY MPS TO AVOID A DELAY TO UNLOCKING (TELEGRAPH)

- MELBOURNE LOCKDOWN EXTENDED

- ERDOGAN TIMELINE FOR RATE CUTS PUSHES TURKISH LIRA TO RECORD LOW (BBG)

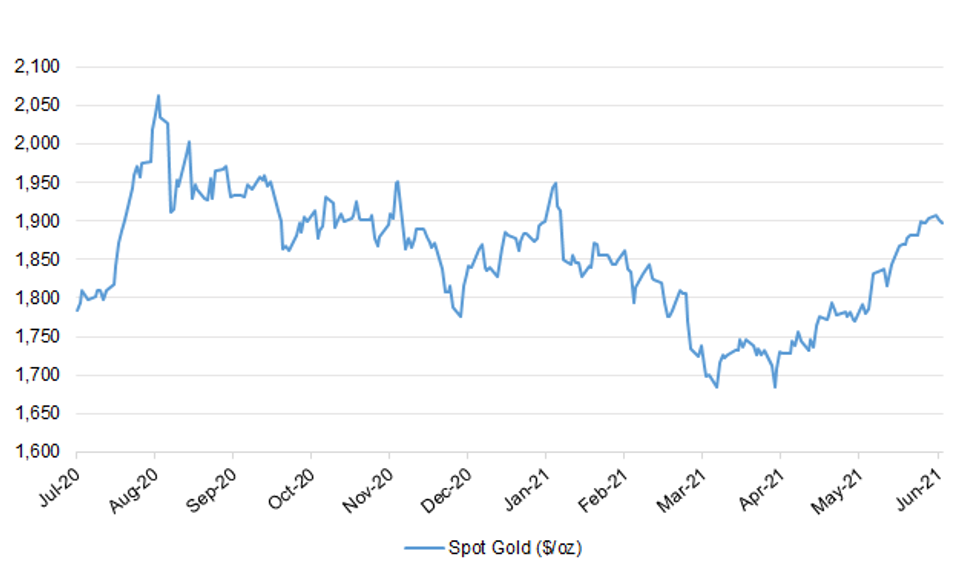

Fig. 1: Spot Gold ($/oz)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson faces growing pressure from Tory MPs to push ahead with unlocking on June 21, as scientists remain split on whether they believe it should be delayed. Senior Conservatives warned that unless the data on the Delta variant of coronavirus - the renamed strain previously known as the Indian strain - worsened significantly, it would be hard to justify postponing the final step in the roadmap out of restrictions. (Telegraph)

CORONAVIRUS: The vast majority of Scotland's central belt will remain in Level 2 restrictions as Nicola Sturgeon delayed the easing of COVID measures for many parts of the country. The first minister said there would be a "slight slowing down" in the lifting of lockdown rules for much of Scotland amid the spread of the Indian variant of coronavirus. (Sky)

BREXIT: Opposition among UK farmers is growing towards a trade deal close to being concluded with Australia. They say there are no meaningful safeguards in place to stop farmers being undercut by cheap imports. However, some, including farmers in Australia, believe it's an opportunity for positive change. (BBC)

BREXIT: Post-Brexit trade deals must prioritise high-quality British jobs, the Government has been warned by business groups, consumer rights bodies and unions. (Telegraph)

BOE: Bank of England deputy Sir Jon Cunliffe told the BBC it was important people did not overstretch themselves in terms of mortgage borrowing. Talking to the BBC, Sir Jon Cunliffe said the way people had learned to work differently during the pandemic may also be changing their preferences for where they want to live. He said the Bank's main concern was rising personal debt. "We learned from experience that if households are carrying high levels of debt, and you then hit a bump, the recession is much worse. We learned that 10 years ago after the financial crisis," he said. (BBC)

BOE: MNI: UK Lawmakers Ask Govt For Details Of BOE Indemnity Deal

- UK lawmakers have asked the government to reveal the terms of the agreement detailing how it would indemnify the Bank of England for any losses made on its quantitative easing programme, and to clear up uncertainty which a legal expert told MNI left a "floating derivative" on the Treasury's balance sheet - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: Boris Johnson has ordered swift progress on parliamentary approval of legislation allowing him to set the date of the next general election, increasing Labour fears that he could make a dash to the polls as early as 2023. Jacob Rees-Mogg, leader of the House of Commons, has told the prime minister he expects the legislation to "breeze through" parliament and to gain royal assent early next year. Sir Keir Starmer, Labour leader, has put his party on standby for Johnson to "cut and run" and to hold an early election if the Conservatives maintain a strong lead in opinion polls. (FT)

EUROPE

GERMANY: The German economy, Europe's largest, should grow by between 3.4% and 3.7% this year, Economy Minister Peter Altmaier said on Tuesday, offering a more upbeat outlook than when the government raised its forecast at the end of April. "Overall, the German economy will have regained its pre-pandemic strength by the end of this year. That is a reason for optimism," Altmaier told foreign reporters. "We expect the German economy to grow somewhere between 3.4 and 3.7 percent this year. If things go very well, maybe a tenth or two more. And we expect it to grow by 4% next year," he added. (RTRS)

SWITZERLAND/RATINGS: Failure to update the bilateral relationship between Switzerland (AAA/Stable) and the EU (AAA/Stable) will lead to the gradual erosion of existing accords and lower Swiss economic growth over time than would otherwise have been the case, Fitch Ratings says. However, Switzerland's wealthy, flexible, competitive economy should be fairly resilient and the government's ample fiscal space remains an important shock absorber. (Fitch)

U.S.

FED: MNI BRIEF: Fed MBS QE Successfully Providing Support-Brainard

- Federal Reserve Board Governor Lael Brainard said Tuesday the Fed's monthly purchases of mortgage-backed securities have been successful at providing broad support to households and businesses, seemingly dismissing the need to consider adjusting purchases as other officials have recently suggested - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Plosser Says Fed Policy Echoes The 60s and 70s

- Federal Reserve policy and the U.S. political backdrop offer eerie reminders of the period before and during the Great Inflation of the 1970s, former Philadelphia Fed President Charles Plosser told MNI. "Today Fed policy sounds a lot like it did in the 60s and 70s -- all we have to do is keep monetary policy easy and accept a little inflation and we'll march down the road to lower unemployment," Plosser said in an interview. "For them to argue the outcome will be different -- well prove it to me, show me the evidence" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: US Hiring May Quicken as Benefits End-ISM Chief

- U.S. manufacturing employment should accelerate as jobless benefits start winding down later this month across nearly half the country, easing supply kinks that have sent prices surging, Institute for Supply Management manufacturing chair Tim Fiore told MNI Tuesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: US Labor Shortage to Help Long-Term Unemployed

- A shortage of U.S. workers some say is hampering the labor market's recovery may end up benefitting the nation's more than 4 million long-term unemployed as applicants with longer gaps in their work histories receive a second look from eager employers, former Bureau of Labor Statistics Commissioner Katharine Abraham told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

OTHER

MNI BRIEF: China Vice Premier Liu Speaks to Yellen on Economy

- China's Vice Premier Liu He held a video call with U.S. Treasury Secretary Janet Yellen on Wednesday, Xinhua News Agency reported. The two officials conducted "extensive exchanges" on the macroeconomic situation and cooperation in multilateral and bilateral areas with equality and mutual respect, and they frankly shared views on issues of mutual concern, Xinhua said. Both expressed willingness to continue communication, Xinhua said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

U.S./CHINA: The U.S. Commerce Department is failing to do its part to protect national security and keep sensitive technology out of the hands of China's military, according to a U.S. congressional advisory report seen by Reuters. (RTRS)

U.S./CHINA: U.S. lawmakers urge NBA to end endorsement of Chinese apparel firms. (BBG)

GLOBAL TRADE: Member nations of a Pacific regional trade deal agreed Wednesday to allow the U.K. to begin the process to join, Japan's economy minister said. (BBG)

CORONAVIRUS: Global economic and health leaders called on the world's wealthier nations to provide $50 billion in funding to accelerate Covid-19 vaccine distribution across the planet and help end the pandemic. The heads of the International Monetary Fund, World Bank, World Health Organization and World Trade Organization said Tuesday that nations need to act before the virus has a chance to spread throughout unvaccinated countries and evolve into more dangerous new variants. (CNBC)

CORONAVIRUS: The U.S. National Institutes of Health announced Tuesday it has started an early stage clinical trial looking at what happens when an adult who is fully vaccinated with one type of Covid-19 vaccine, like Pfizer's, is boosted with a different shot about three to four months later. The trial will include about 150 adults who have received one of the three Covid vaccine regimens currently available under the Food and Drug Administration's emergency use authorization: Johnson & Johnson's, Moderna's or Pfizer's. (CNBC)

CORONAVIRUS: Secretary of State Antony Blinken said Tuesday that the United States would soon distribute millions of doses of coronavirus vaccines around the world, including in Latin America, which is struggling to obtain them for its citizens amid rising hospitalization rates. But the question on the minds of many — which countries will receive doses first and how quickly will they be delivered — remained unanswered as Blinken began his first official visit to the region. "Sometime in the next week to two weeks we will be announcing the process by which we will distribute those vaccines," Blinken said at a news conference in San Jose with Costa Rican President Carlos Alvarado Quesada. President Biden promised to provide 80 million doses to other countries by the end of June. But his administration has not provided further details amid a global competition for vaccines that has left many developing countries far behind the industrialized West. (Washington Post)

BOJ: MNI BRIEF: BOJ's Adachi Warns Of Early Policy Unwinding

- Bank of Japan board member Seiji Adachi has warned that unwinding the central banks' easy policy at a premature stage would undermine an economic recovery and trigger a new crisis - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ/LIBOR: Financial institutions in Japan must accelerate efforts to prepare for the transition away from Libor, according to the Bank of Japan's point man on the expiry of the benchmark that affects financial contracts worth trillions of dollars. "We're no longer at a stage to wonder whether it's doable or not. We're at the stage where we have to get it done," said Akira Otani, the head of BOJ's financial markets department, in an interview with Bloomberg. (BBG)

AUSTRALIA: Melbourne will remain in lockdown for a further seven days, with only small changes to current restrictions, in response to the latest outbreak and fears over transmission via "fleeting contact". Health authorities said it is possible changes will be made to restrictions in regional Victoria if there are no cases or spread of exposure sites over the next 24 hours. (The Age)

RBA: The pandemic is unlikely to leave lasting economic scars, according to the Reserve Bank, but the significant increase in household savings over the past year raises the risk of sharply increased consumption that could cause a surge in inflation. The current downturn was unlike previous contractions, the Reserve Bank of Australia's (RBA) head of economic analysis Bradley Jones told a resources industry conference in Canberra. This was due in part to the "unusual size" of the government policy response, which has put household and business balance sheets "in better shape than before the pandemic", he said. "The increase in household income during the pandemic is unprecedented as far as past downturns go, and policy has also supported business balance sheets through a difficult period," he said. (AFR)

RBNZ: RBNZ comments in notes for a speech by Head of Financial Markets Vanessa Rayner, on website. Balance sheet tools are expected to be a part of the 'conventional tool set' in the future. "Based on our actions taken over the past year alone, our balance sheet will remain large for a long time." "The LSAP program may be unwound and the size of the balance sheet may be lower than it is today. However, any decision to reduce the size of the balance sheet by not reinvesting maturing assets will depend on the level of monetary policy stimulus required in the future and will be decided by the MPC, guided by staff advice." (BBG)

RBNZ: Strong global demand for New Zealand primary products is ensuring the economy remains resilient during the Covid-19 pandemic and is helping offset tourism losses, Reserve Bank governor Adrian Orr says. (Stuff NZ)

NEW ZEALAND: Auckland house prices rose 2 per cent last month, pushing the price record out to $1.07 million. Barfoot & Thompson today released its May sales data, saying the market "shows no hint that restrictions imposed in March have had an impact on prices or sales numbers". The agency was referring to anti-investor moves, removing what Finance Minister Grant Robertson termed tax "loopholes" - interest deductibility on mortgages for investment properties - as well as doubling the brightline test's time period from five to 10 years. "May's trading was excellent, with the median price increasing, the average price being in line with the record price set in April and sales numbers being their highest in the month of May for four years," the agency said. (NZ Herald)

SOUTH KOREA: the finance ministry said it expects inflation to moderate in June as base effects becomes less favorable. To ease the burden from higher commodity prices, Finance Minister Hong said the government will increase egg imports from 40 million to at least 50 million, ramp up rice supplies, and offer loans to companies to help with commodity purchases. (BBG)

CANADA: Alberta reached a turning point in its COVID-19 vaccine rollout on Tuesday, announcing that everyone who has currently received a first dose will be able to begin booking second shots between now and the end of June, Premier Jason Kenney announced. (CBC)

MEXICO: President Andres Manuel Lopez Obrador's ruling coalition is close to retaining its lower house super-majority in Mexican midterm elections, according to Parametria's last pre-election poll, in what would be a stronger result than some are expecting. The president's Morena party will hold 48% of the lower house of Congress with 239 seats, slightly short of its current 253, Parametria said in a survey shared with Bloomberg News. Lopez Obrador's coalition will take 315 seats when combined with its allied Green Party and Worker's Party, just below the 334 required for the super-majority, according to the poll. The June 6 midterms, which usually see the ruling party lose seats, present the biggest challenge yet to Lopez Obrador's self-declared "fourth transformation" of Mexican society. (BBG)

TURKEY: The lira fell to fresh record lows against the U.S. dollar after Turkey's President Recep Tayyip Erdogan renewed calls for lower interest rates, making a vague reference to summer months as a target date. "I spoke with our central bank governor today. It's an imperative that we lower interest rates. For that, we will reach July and August thereabouts so that rates can begin to fall," the Turkish leader said in an interview with state broadcaster TRT late Tuesday. (BBG)

BRAZIL: Commitment to the health of Brazilians and to future generations is being maintained, Economy Minister Paulo Guedes told journalists in Brasilia. Government supports Brazil's administrative reform. Economy seems to be starting to rebound. "Brazil will surprise for the third year in a row," said the minister. Government expects construction sector to maintain investments, he said. Eletrobras should be privatized, minister said. (BBG)

RUSSIA: Brazil's JBS SA told the U.S. government that a ransomware attack on the company that disrupted meat production in North America and Australia originated from a criminal organization likely based in Russia, the White House said on Tuesday. JBS, the world's largest meatpacker, said on Tuesday night it had made "significant progress in resolving the cyberattack." The "vast majority" of the company's beef, pork, poultry and prepared foods plants will be operational on Wednesday, according to a statement, easing concerns over rising food prices. (RTRS)

SOUTH AFRICA: Embattled power utility Eskom announced on Tuesday that it would implement stage 2 load-shedding from 10am Wednesday to 10pm on Friday. Embattled power utility Eskom announced on Tuesday that it would implement stage 2 load-shedding from 10am Wednesday to 10pm on Friday. (Times)

IRAN: World powers and Iran are unlikely to reach a final agreement in the current round of talks to revive their 2015 nuclear deal, Iranian officials said, cooling speculation that U.S. sanctions on Tehran's key oil exports might soon be lifted. Diplomats had hoped to fully restore the landmark deal before Iran's June 18 presidential elections, after which the presidency of Hassan Rouhani will wind down. He's widely expected to be succeeded by a hardliner who will be more hostile to the U.S. and the nuclear deal. But on Tuesday, Ali Rabiei, spokesman for Iran's government, said that negotiators now expect to finalize a deal in August, when Rouhani's tenure ends. He said there were "no obstacles" in the way of negotiators in Vienna, who are in their eighth week of talks. (BBG)

ISRAEL: Israel will ask the U.S. for $1 billion in additional emergency military aid this week, Sen. Lindsey Graham (R-S.C.) told "Fox and Friends" on Tuesday and Israeli officials confirmed. (Axios)

METALS: Vale, the world's second-largest iron ore producer and a major nickel and copper miner, said it hasn't been impacted yet by a water emergency in Brazil. "Vale is monitoring the situation and there is no impact on its operations so far," the Rio de Janeiro-based company said in emailed response. (BBG)

OIL: The "surplus" of global oil inventories decreased from 260 million barrels to 34 million barrels, and the level of inventories is expected to return to five-year average in June, Russian Deputy Prime Minister Alexander Novak said on Tuesday. "We have been observing a balance of supply and demand in the market for several months, primarily due to the agreement that has been in force for a year. (Sputnik)

OIL: Kuwait oil minister Mohammad Abdulatif al-Fares confirmed on Tuesday that Kuwait is fully committed to all OPEC decisions and said oil markets will be able to absorb the gradual output increase decided by OPEC+ that started last May, the state news agency (KUNA) said, citing a ministry statement. OPEC+ oil producers agreed on Tuesday to stick to the existing pace of gradually easing supply curbs through July, as they sought to balance expectations of a recovery in demand against a possible increase in Iranian supply. (RTRS)

OIL: The Biden administration has given Chevron and four other US oil service companies until Dec.1 to wind down operations in Venezuela. The June 1 action by the Treasury Department extends a previous six-month waiver that was set to expire June 3. (Platts)

OIL: President Joe Biden's administration will suspend leases for oil and gas in the Arctic National Wildlife Refuge pending a review of their environmental impacts, the U.S. Interior Department said on Tuesday. The action reverses one of former President Donald Trump's signature efforts to expand fossil fuel and mineral development in the United States. (RTRS)

CHINA

YUAN: The Chinese yuan may fluctuate in a wider range against the U.S. dollar, while any one-way movement cannot be sustained, the China Securities Journal reported citing analysts. Yuan may face depreciation pressure in Q3 if the Federal Reserve tightens its ultra-loose monetary policy as expected, which may drive up U.S. bond yields and lift the dollar index, the newspaper said citing Guo Lei, chief economist of GF Securities. The yuan has begun to weaken against the dollar yesterday after the PBOC raised FX reserve requirement ratio to slow appreciation, with the onshore yuan down 220 points to report 6.3827 as of 6:38 pm local time. (MNI)

YUAN: China must ensure that the yuan's appreciation shouldn't deviate from its economic fundamentals and that the currency won't move in one way that may damage the economy, wrote Guan Tao, chief economist of Bank of China International and a former forex regulatory official in a blog post by Tencent News. Recently, the large-scale capital inflow has fueled the excessive appreciation of the yuan and affected economic and financial stability, and a possible reversal of capital flow may follow if the Chinese economy enters a slowdown, said Guan, noting that the country should balance economic development and security. The volatile appreciation of the yuan has lasted for a year with both the central parity rate and closing price of the yuan rising about 12%, Guan added. (MNI)

OVERNIGHT DATA

JAPAN MAY MONETARY BASE Y651.0TN; APR Y655.5TN

JAPAN MAY MONETARY BASE +22.4% Y/Y; APR +24.3%

AUSTRALIA Q1 GDP +1.8% Q/Q; MEDIAN +1.5%; Q4 +3.2%

AUSTRALIA Q1 GDP +1.1% Y/Y; MEDIAN +0.6%; Q4 -1.0%

NEW ZEALAND Q1 TERMS OF TRADE INDEX +0.1% Q/Q; MEDIAN -0.3%; Q4 +1.5%

SOUTH KOREA MAY CPI +2.6% Y/Y; MEDIAN +2.6%; APR +2.3%

SOUTH KOREA MAY CORE CPI +1.5% Y/Y; MEDIAN +1.3%; APR +1.4%

SOUTH KOREA MAY CPI +0.1% M/M; MEDIAN +0.1%; APR +0.2%

UK MAY BRC SHOP PRICE INDEX -0.6% Y/Y; APR -1.3% Y/Y

UK MAY BRC SHOP PRICE INDEX +0.2% M/M; APR -0.3% M/M

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information. The operation aims to keep liquidity reasonable and ample, the PBOC said on its website. The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.1977% at 09:26 am local time from the close of 2.2064% on Tuesday. The CFETS-NEX money-market sentiment index closed at 40 on Tuesday vs 45 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3773 WEDS VS 6.3572 TUES

The PBOC started setting daily central parity rates on Jan 4, 2007. On July 21, 2005, China switched to a managed-float formula against a basket of currencies, weakening the yuan's peg to the dollar.

MARKETS

SNAPSHOT: Erdogan Ramps Up Pressure For Rate Cuts

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 122.71 points at 28936.36

- ASX 200 up 65.232 points at 7208.2

- Shanghai Comp. down 23.474 points at 3601.24

- JGB 10-Yr future down 1 ticks at 151.47, yield down 0.3bp at 0.08%

- Aussie 10-Yr future down 1.5 ticks at 98.355, yield up 1.3bp at 1.705%

- U.S. 10-Yr future down -0-01 at 131-24, yield up 0.51bp at 1.6113%

- WTI crude up $0.15 at $67.86, Gold down $4.07 at $1896.27

- USD/JPY up 16 pips at Y109.64

- YELLEN & LIU HE CONDUCT CALL, COMMUNICATION TO CONTINUE

- FED'S BRAINARD: MBS QE SUCCESSFULLY PROVIDING SUPPORT (MNI)

- JOHNSON FACES GROWING PRESSURE FROM TORY MPS TO AVOID A DELAY TO UNLOCKING (TELEGRAPH)

- MELBOURNE LOCKDOWN EXTENDED

- ERDOGAN TIMELINE FOR RATE CUTS PUSHES TURKISH LIRA TO RECORD LOW (BBG)

BOND SUMMARY: Pretty Steady

T-Notes were happy to hold within the upper half of yesterday's range in Asia-Pac dealing, last -0-01 at 131-24+, with cash Tsys trading little changed to ~1.0bp cheaper, 20s leading the cheapening. There has been nothing in the way of notable headline or market flow for Tsys, with participants taking a bit of a breather after Tuesday's recovery from session lows.

- Another narrow session leaves JGB futures 1 tick below yesterday's settlement level, while cash JGBs run little changed to ~0.5bp cheaper across the curve. There has been little in the way of top tier news flow, with BoJ's Adachi reiterating his dovish leaning and the latest round of BoJ Rinban operations experiencing mixed offer/cover ratios when compared to the previous operations for each bucket:

- In Sydney YM -1.0, XM -1.0. Both contracts have recovered from worst levels of the day after the latter had a brief look below early Sydney/overnight lows on the back of stronger than consensus Q1 GDP readings for Australia, although the sell-side had largely adjusted to the view that risks were skewed to the upside re: the release in the wake of the partials prints, limiting the follow through and stickiness of the move. Both the Q/Q & Y/Y readings were within the range of estimates provided in the BBG survey. The 7-day extension of the COVID-related lockdown covering the Melbourne area (although the regional Victoria area may not see its restrictions extended) was also noted, but had no lasting impact on the space. Elsewhere, Bills trade unchanged to 1 tick lower through the reds, with a post-fix bout of buying activity noted in IRM1 after 3-Month BBSW fixed at the lowest level witnessed since late March.

GOLD: Resistance Holds

Little to really pen for gold over the last 24 hours, after failure at technical resistance and a recovery from intraday lows in the DXY allowed spot to trade just below $1,900/oz, where it currently resides. For more on the recent movement in gold, including a technical overview and coverage of fundamental drivers, please refer to our recent analysis piece.

OIL: Creeps Up From Highest Close Since 2018

Oil is higher in Asia-Pac trade on Wednesday, approaching Tuesday's highs after giving back some gains into the close. WTI is up $0.24 from settlement levels at $67.96/bbl while Brent is up $0.24 at $70.49/bbl. Yesterday's close was the highest since 2018 as markets priced in a more protracted period of negotiations that could stall Iran's re-entry to international oil markets Saudi Arabia's energy minister also helped engender bullish sentiment saying there were clear signs of improvement in the demand picture as the OPEC+ group confirmed a supply increase in July. As a note API figures are delayed to the US holiday on Monday and so will be published later today.

FOREX: AUD Gives Back After Lockdown Extended

AUD/USD gained after Q1 GDP data printed 0.3ppts above estimates at 1.8% Q/Q, but came off best levels after the lockdown in Melbourne was extended by 7 days though the wider Victoria area was spared. The pair last up 6 pips.

- NZD/USD up around 5 pips. RBNZ head of financial markets Rayner said that the balance sheet will remain large for a long time, and that new monpol tools will likely remain mainstream for as long as global rates remain near record lows. There was also an interview with RBNZ Gov Orr doing rounds, he said strong global demand for New Zealand primary products is ensuring the economy remains resilient during the Covid-19 pandemic and is helping offset tourism losses. Data earlier showed New Zealand terms of trade rose 0.1% Q/Q against estimates of a 0.3% decline.

- JPY lost some ground, USD/JPY up 15 pips heading into the European session. BoJ's Adachi gave a speech and was positive on the economy while reiterating his dovish leanings saying the BoJ needed to maintain its ultra-loose policy.

- The yuan moved in a narrow range, USD/CNH last down 13 pips. The PBOC fixed USD/CNY 4 pips below sell side estimates, the first fix indicating a preference for a stronger yuan in four days. US Tsy Sec Yellen held an introductory virtual meeting with the Vice Premier Liu He and said talks were constructive.

- GBP/USD is higher as sterling gains. Comments from Japan economy minister Nishimura indicated the process of getting the UK to join as a member of the TPP in underway.

- TRY collapsed to a record low against the greenback after President Erdogan called on the central bank to cut rates in a bid to reduce inflation.

FOREX OPTIONS: Expiries for Jun02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-05(E800mln), $1.2400-10(E550mln)

- USD/JPY: Y111.25($500mln)

- AUD/USD: $0.7710-15(E667mln), $0.7740-50(A$1.2bln-AUD puts)

- AUD/JPY: Y83.15(A$943mln-AUD puts)

- NZD/USD: $0.7200-20(N$1.5bln-NZD puts)

- USD/CNY: Cny6.38($760mln), Cny6.40($926mln)

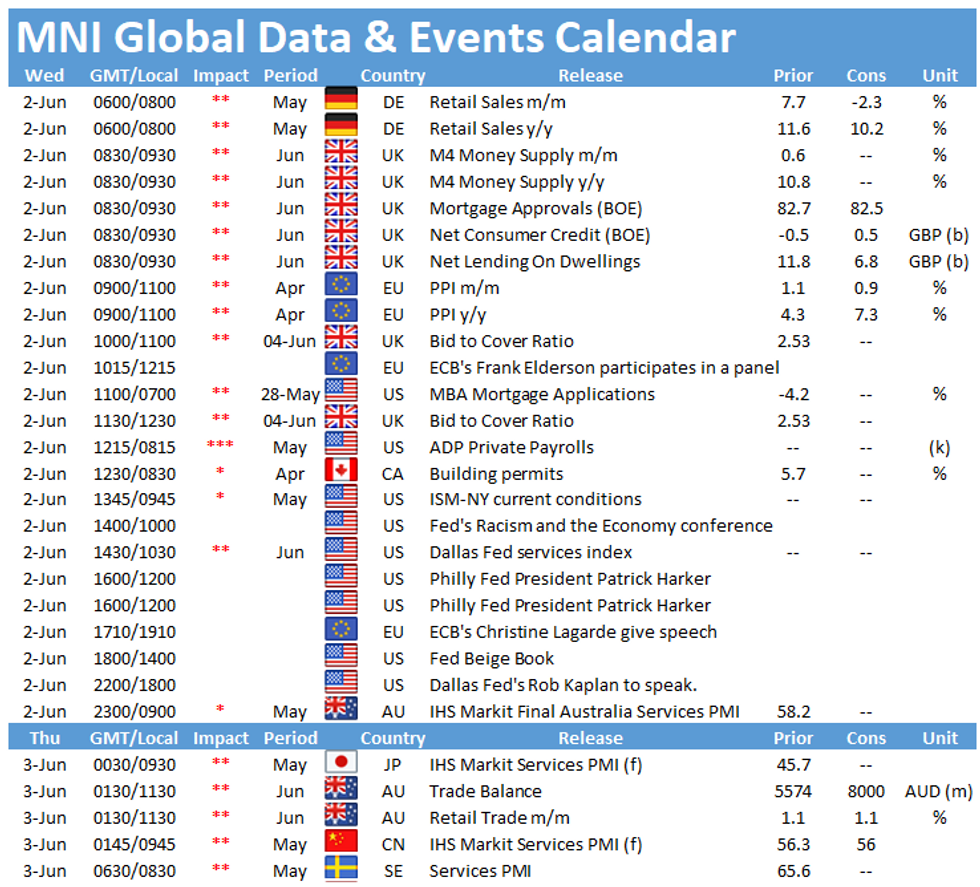

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.