-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Matters Dominate In Japan, Wider Macro Matters Assessed

EXECUTIVE SUMMARY

- FED'S BRAINARD, TREASURY'S ADEYEMO IN RUNNING TO BE BIDEN'S ECONOMIC CZAR, SOURCES SAY (RTRS)

- BOJ POLICYMAKERS DIVIDED ON WAGE, INFLATION OUTLOOK, JAN MEETING SUMMARY SHOWS (RTRS)

- JAPAN'S TOP FX DIPLOMAT WARNS SHARP CURRENCY MOVES WON'T BE TOLERATED (RTRS)

- CHINA’S XI WANTS TO DEEPEN COOPERATION WITH AUSTRALIA (XINHUA)

- BANK OF CANADA'S MACKLEM SAYS HE IS 'NOT EVEN THINKING' OF CUTTING RATES (RTRS)

- LAWMAKERS SEEK SCRUTINY OF FARMLAND PURCHASES BY CHINESE, OTHER FOREIGN BUYERS (WSJ)

- GLOBAL 2023 ECONOMIC VIEW DOWNGRADED, AT ODDS WITH MARKET OPTIMISM (RTRS POLL)

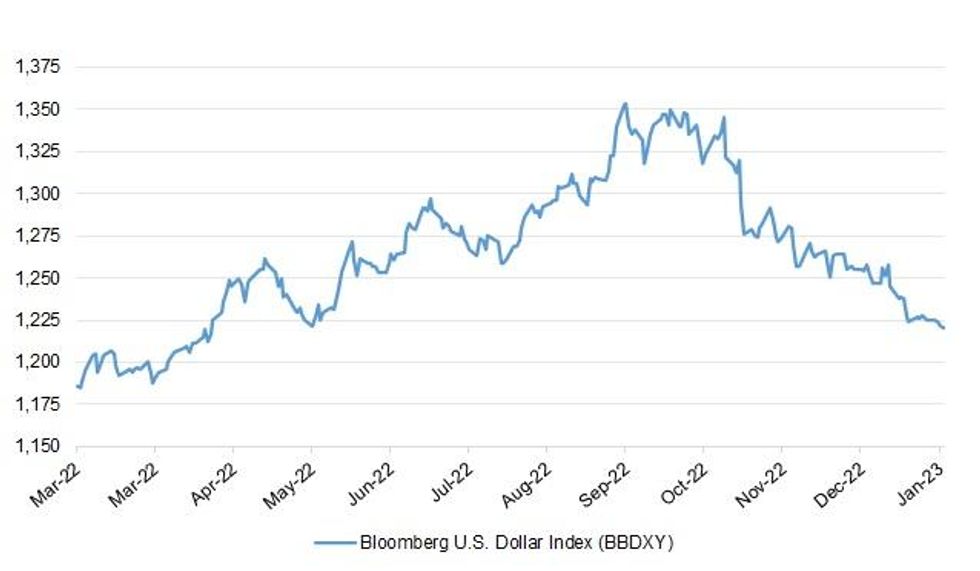

Fig. 1: Bloomberg U.S. Dollar Index (BBDXY)

Source: MNI - Market News/Bloomberg

UK

FISCAL/POLITICS: Liz Truss is expected to join Conservative party calls for tax cuts ahead of Jeremy Hunt’s March Budget, despite new forecasts warning of slower growth and lower tax revenues than expected. (FT)

ECONOMY: Business confidence in Britain has sunk to its lowest level since the global financial crisis, according to a survey of accountants, amid persistently high inflation and fears that the country is already in a recession. (BBG)

ECONOMY: Confidence among small business owners fell again in the final months of 2022, sliding to levels not seen since Britain went into lockdown for the second time two years ago. (The Times)

ECONOMY: Britain's annual car production fell to the lowest in more than six decades, crippled by a global semiconductor shortage and COVID curbs in China, while the number of electric vehicles made in the UK rose, according to the Society of Motor Manufacturers and Traders (SMMT). (RTRS)

EUROPE

SWEDEN: The drop in Swedish housing prices continued for a ninth straight month in December, with signs of stabilization in Stockholm home values not yet enough to lift the gloom in the biggest Nordic economy’s residential property market. (BBG)

U.S.

POLICY: Federal Reserve Vice Chair Lael Brainard is a contender for the White House's top economic policy position, joining a list that includes Deputy Treasury Secretary Wally Adeyemo and Commerce Secretary Gina Raimondo, two people familiar with the process said on Wednesday. (RTRS)

POLITICS: Facebook will allow former President Donald Trump to return to its platform, the company announced, two years after his suspension was enacted following the 2021 insurrection at the U.S. Capitol. (CNBC)

EQUITIES: Tesla Inc's aggressive price cuts have ignited demand for its electric vehicles, Chief Executive Elon Musk said on Wednesday, playing down concerns that a weak economy would throttle buyers' interest. (RTRS)

EQUITIES: The US Federal Trade Commission filed its lawsuit to block Microsoft Corp.’s $69 billion takeover of gaming company Activision Blizzard Inc. in December partly to get ahead of its European counterparts and dissuade them from accepting a settlement allowing the deal, according to people familiar with the investigations. (BBG)

OTHER

GLOBAL TRADE: Dutch and U.S. officials will meet in Washington on Friday to discuss potential new controls on exporting semiconductor manufacturing gear to China, with a deal possible by the end of the month, according to two sources familiar with the matter. (RTRS)

GLOBAL TRADE: Brazilian President Luiz Inacio Lula da Silva said on Wednesday that he favored an agreement between Mercosur and China in a plan to modernize and open the South American trade bloc to other regions. (RTRS)

U.S./CHINA: A bipartisan group of lawmakers is renewing a push to intensify oversight of foreign purchases of U.S. farmland, citing concerns over recent acquisitions by Chinese buyers. (WSJ)

U.S./CHINA: The growing clamor in Congress to completely ban the popular social media platform TikTok in the US raises pressure on the Biden administration, which is in the late stages of reviewing the security risks of the app. (BBG)

BOJ: With less than three months until Haruhiko Kuroda steps down as governor of the Bank of Japan, none of the top candidates to replace the country’s longest-serving central bank chief seem to want the job. (FT)

BOJ: Bank of Japan policymakers were divided on prospects for achieving their 2% inflation target with some warning that it could take time for wages to rise sustainably, a summary of opinions from their latest meeting showed on Thursday. (RTRS)

BOJ: Clients of Japan’s biggest bank are bracing for the central bank to finally abandon its ultra-easy monetary policy, which could happen by the end of September, according to the head of Mitsubishi UFJ Financial Group Inc.’s global markets business. (BBG)

JAPAN: Sharp one-sided currency moves cannot be tolerated, Japan's top finance diplomat Masato Kanda told Reuters, reaffirming Tokyo's determination to intervene in the foreign exchange market to curb any speculative or significant yen moves. (RTRS)

JGBS: The Bank of Japan is facing a fresh headache in the dysfunctional local bond market — it has become so illiquid that some securities are being kicked out of an important global index. (BBG)

JGBS: The Bank of Japan is facing a fresh headache in the dysfunctional local bond market — it has become so illiquid that some securities are being kicked out of an important global index. (BBG)

AUSTRALIA/CHINA: President Xi Jinping attaches “great importance” to the developments of relations between China and Australia, he says in a message to Australian Governor-General David Hurley on Australian Day, Xinhua News Agency reports. (BBG)

NEW ZEALAND: A decision will be made in “a few weeks” on the minimum wage adjustment, Prime Minister Chris Hipkins said in Auckland on Thursday. (Stuff NZ)

SOUTH KOREA: South Korea's government promised strong support for exporters after the country posted on Thursday its first economic contraction in 2/1-2 years, due mainly to a crash in exports, and faced a possibility it was in recession. (RTRS)

BOC: Bank of Canada Governor Tiff Macklem on Wednesday said he was focused on whether interest rates would need to go higher and is not even considering cutting them as part of the fight against inflation. (RTRS)

MEXICO: Mexico's central bank should consider decoupling from the U.S. Federal Reserve's monetary policy, deputy governor Omar Mejia said in a Bloomberg Linea story published on Wednesday, calling for discussion of the issue at the bank's next policy meeting. (RTRS)

TURKEY: Turkey's central bank said on Thursday it will provide 2% forex conversion support to companies that bring forex into the country from abroad and sell it to the central bank and pledge not to buy forex for a period determined by the bank. (RTRS

RUSSIA: President Joe Biden announced on Wednesday that the U.S. is sending 31 advanced M1 Abrams tanks to Ukraine, casting it as a broader effort from European allies that demonstrates they are still united against Russia's invasion. (RTRS)

RUSSIA: Japan, as this year's G7 chair, expects Russia's invasion of Ukraine to dominate talks this year among the world's major advanced economies, its top finance diplomat, Masato Kanda, told Reuters. (RTRS)

RUSSIA: It will “take some time” for the tanks to be delivered to Ukraine, a senior Biden administration official said Wednesday. “We are talking months as opposed to weeks,” said the official, who spoke on the condition of anonymity, ground rules set by the administration. (CNBC)

RUSSIA: Canada is considering contributing four Leopard 2 tanks to Ukraine, senior sources told CBC News — but no decision has been made. (CBC)

RUSSIA: Banks should be on alert for Russian oligarchs attempting to circumvent U.S. sanctions by investing in commercial real estate, a U.S. Treasury Department watchdog said. (WSJ)

PERU: A group of Peruvian leftist lawmakers submitted a “vacancy motion” to seek the impeachment of President Dina Boluarte, the first since she took office in December after the impeachment of former President Pedro Castillo, La Republica reported. (BBG)

CHILE: Decreasing levels of local uncertainty are helping the peso strengthen versus the dollar, Finance minister Mario Marcel said on Wednesday. (BBG)

CHILE: The labor committee at Chile’s lower house gave its initial approval to the government-backed pension reform bill, according to a statement from the finance ministry. (BBG)

MACRO: Global economic growth is forecast to barely clear 2% this year, according to a Reuters poll of economists who said the greater risk was a further downgrade to their view, at odds with widespread optimism in markets since the start of the year. Falling energy prices, a slowdown in inflation in most economies from multi-decade highs, an unexpectedly resilient euro zone economy and China's economic reopening have led traders to speculate the downturn will be more mild. (RTRS)

METALS: Copper production in Chile, the world's largest producer of the red metal, will grow at a slower rate this decade than previously hoped, a government report seen by Reuters showed, with peak output later and lower than estimated a year ago. (RTRS)

OVERNIGHT DATA

JAPAN DEC SERVICES PPI +1.5% Y/Y; MEDIAN +1.6%; NOV +1.7%

JAPAN DEC, F MACHINE TOOL ORDERS +0.9% Y/Y; PRELIM +1.0%; NOV -7.7%

SOUTH KOREA Q4, A GDP -0.4% Q/Q; MEDIAN -0.4%; Q3 +0.3%

SOUTH KOREA Q4, A GDP +1.4% Y/Y; MEDIAN +1.3%; Q3 +3.1%

SOUTH KOREA 2022 GDP +2.6%; MEDIAN +2.5%; 2021 +4.0%

SOUTH KOREA JAN CONSUMER CONFIDENCE 90.7; DEC 90.2

MARKETS

US TSYS: Little Changed In Muted Asian Session

TYH3 deals at 115-07+, +0-03, operating in a narrow 0-03 range on limited volume of ~30k.

- Cash Tsys sit little changed across the major benchmarks.

- Gyrations in JGBs set the tone through the Asian session, however with liquidity impaired due to Chinese and Australian holidays, there was little follow through in Tsys.

- Macro headline flow was also scarce.

- The space looked through 40-year JGB supply which passed smoothly.

- There is a thin docket in Europe today. Further out we have a slew of data from the U.S. including Q4 GDP, new home sales and initial jobless claims. We also have the latest 7-Year Tsy supply.

JGBS: Mostly Firmer, BoJ Side Effects Continue To Ripple Through

JGB futures sit +9 ahead of the bell, after backing away from their post-auction Tokyo peak. The contract hasn’t threatened the boundaries of its recent range.

- There was smooth takedown of the latest round of 40-Year JGB supply, which saw the high yield print below wider expectations, while the cover ratio nudged higher ticking above the 6-auction average. This allowed the super-long end to outperform, with benchmark JGB yields operating 1.5bp cheaper to 3.0bp richer, as 10s provide the only cheaper point on the curve.

- Liquidity issues caused by the BoJ’s notable holdings and continued/upsized purchases are starting to have an even more far-reaching impact on JGBs, with JGBs maturing in Mar ’24 & Mar ’32 being removed from the FTSE Russell WGBI, with the Jun ’32 & Sep ’32 JGBs set to follow suit soon.

- There was a Nikkei article which outlined the well-trodden view of the Japanese life insurer and pension fund community after last year’s cash repatriation and given elevated FX hedging costs.

- Elsewhere, we had services PPI data (a modest downside outcome) and the previously covered summary of opinions from the most recent monetary policy decision (no surprises) crossed.

- Looking ahead, Tokyo CPI data headlines tomorrow’s local docket.

NZGBS: Richening Creeps In Wake Of Well-Received Supply

NZGBs added to yesterday’s richening, running 3-5bp firmer across the curve, with yesterday’s bull steepening move extending.

- Today’s local docket was headlined by the weekly NZGB auctions, covering NZGB-27, -33 & -51. Cover ratios of 1.4-4.8x were observed across the 3 lines, with the Apr-27 line seeing the strongest cover. The smooth to strong reception of the supply allowed NZGBs to richen after a muted start.

- Swap rates were 5-6bp lower, leaving swap spreads flat to wider. 2-Year swaps hit a fresh YtD low, pulling further below 5.00%.

- The major RBNZ dated OIS staging posts moved back to yesterday’s post-CPI lows, with just under 60bp of tightening priced for next month’s meeting, alongside pricing of a terminal OCR of ~5.30%.

- Local headline flow has seen the YtD budget deficit print a touch narrower than expected, but that didn’t move the needle for the space.

- Elsewhere, comments from new PM Hipkins stressed that labour shortages are the top issue facing businesses at present, not ruling out further moves in immigration policy.

- The observance of a national holiday in Australia limited regional liquidity on Thursday, while the ongoing LNY holiday in China continues to remove a macro focal point from the broader Asia-Pac region.

- Looking ahead, the monthly ANZ business survey headlines the domestic docket ahead of the weekend.

- A reminder that Auckland is closed for a regional holiday on Monday, which will limit liquidity in NZ markets.

EQUITIES: Hang Seng Pushes Higher After LNY Break

Hong Kong returned from the LNY break observed in the city, reacting to the interim bid in U.S. tech stocks and positive signs re: Chinese consumer spending during the holiday period. That allowed the Hang Seng to add the best part of 2% as of typing.

- Elsewhere, the Nikkei 225 was very limited, posting modest losses ahead of the close.

- Meanwhile, holidays in mainland China, Australia and India sapped a notable amount of liquidity from the region.

- E-minis were flat to 0.4% higher, with the NASDAQ 100 leading the way as the tech benchmark ticked higher in lieu of Tesla’s quarterly earnings.

GOLD: Tight Range As Gold Registers Fresh Cycle Highs

Gold consolidated recent gains in what was still holiday-thinned Asia-Pac dealing, managing to register a fresh cycle high in the process, while operating in a narrow range, last dealing little changed, just below the $1,950/oz mark.

- This came as the broader USD also held to a narrow range, just above its recent cycle base, while U.S. Tsy yields were little changed.

- Known ETF holdings of the yellow metal have ticked away from their cycle lows in recent days but remain well shy of their ’22 hig, which in itself is shy of the ’20 all-time peak.

- Technically, trend conditions in gold remain bullish. The fresh cycle highs confirm an extension of the uptrend and maintains the price sequence of higher highs and higher lows. Moving average studies remain in a bull mode position - reflecting the uptrend. The focus is on $1963.0 next, a Fibonacci retracement. Conversely, support to watch lies at the 20-day EMA. Short-term pullbacks are considered corrective.

OIL: Coiling In Asia, Key Themes Assessed

WTI & Brent are essentially unchanged as we move towards London hours, with both holding tight ranges during the Asia-Pac session amid diminished liquidity owing to the ongoing LNY holiday in China and a national holiday in Australia.

- That seemed to leave traders time to focus on the well-documented discussion points observed in the early weeks of ’23, namely the Chinese demand question and the Fed outlook, along with its feedthrough into the value of the USD.

- Technically, key short-term resistance for WTI is located at $82.66, the Jan 18 high. Clearance of this hurdle would reinstate the recent bullish theme and expose $83.14, the Dec 1 high and $85.33, a Fibonacci retracement. On the downside, the support to watch lies at $78.45, the Jan 19 low. A break of this level would signal a potential reversal.

FOREX: Tight G-10 Ranges, USD Little Changed

There has been little in the way of meaningful moves in the Asian session. JPY and the Antipodeans are marginally outperforming, and the DXY is little changed.

- Japan Dec PPI Services crossed the wires early in the session, the headline figure was a touch below estimates, however this is unlikely to move the needle for the BoJ.

- BoJ's summary of opinions from the January monetary policy meeting was also on the wires. The comments reiterated themes observed previously, noting the need for continued easing as well as time to assess the impact of December's surprise YCC tweak.

- JPY was stronger in early trade, however USD/JPY found support ahead of ¥129.00 before paring losses to sit ~0.2% softer.

- AUD/USD firmed through the session, risk appetite grew after a bid in HK Equities, meeting resistance at yesterday's high. China's Xi wants to deepen cooperation with Australia reported Xinhua.

- NZD/USD was range bound, dealing in a narrow $0.6470/90 range, also benefiting from the bid in the Hang Seng to recover off early lows.

- EUR/USD is marginally softer than NY closing levels.

- Lunar NY Holiday impacted liquidity in Asia-Pac hours, with China still out, while the observance of a national holiday in Australia sapped further liquidity from the timezone.

- There is a thin calendar in Europe today. Further out we have a slew of U.S. data including Q4 GDP, new home sales and initial jobless claims.

FX OPTIONS: Expiries for Jan26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E727mln), $1.2230-50(E625mln), $1.2300(E514mln)

- USD/JPY: Y105.00($510mln)

- AUD/USD: $0.7700-15(A$873mln-AUD puts)

- USD/CNY: Cny6.4600($500mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/01/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/01/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/01/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/01/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 26/01/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 26/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 26/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/01/2023 | 1330/0830 | ** |  | US | durable goods new orders |

| 26/01/2023 | 1330/0830 | *** |  | US | GDP (adv) |

| 26/01/2023 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/01/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 26/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 26/01/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 26/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/01/2023 | 2350/0850 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.