-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Themes To mull Ahead Of The Weekend

EXECUTIVE SUMMARY

- FED'S BALANCE SHEET JUMPS USD94B TO USD8.7T (MNI)

- YELLEN SAYS TREASURY IS READY TO TAKE ‘ADDITIONAL ACTIONS IF WARRANTED’ TO STABILIZE BANKS (CNBC)

- U.S. MONEY MARKET FUNDS GOT $238 BILLION OF NEW CASH IN JUST 2 WEEKS (BBG)

- ECB'S CENTENO: INFLATION WAS AND STILL IS TOO HIGH (BBG)

- BOE’S MANN: CENTRAL BANKS MAY FACE TOUGHER TASK REINING IN PRICE RISES (RTRS)

- OIL RESERVE REFILL IS ‘DIFFICULT’ THIS YEAR, US ENERGY CHIEF SAYS (BBG)

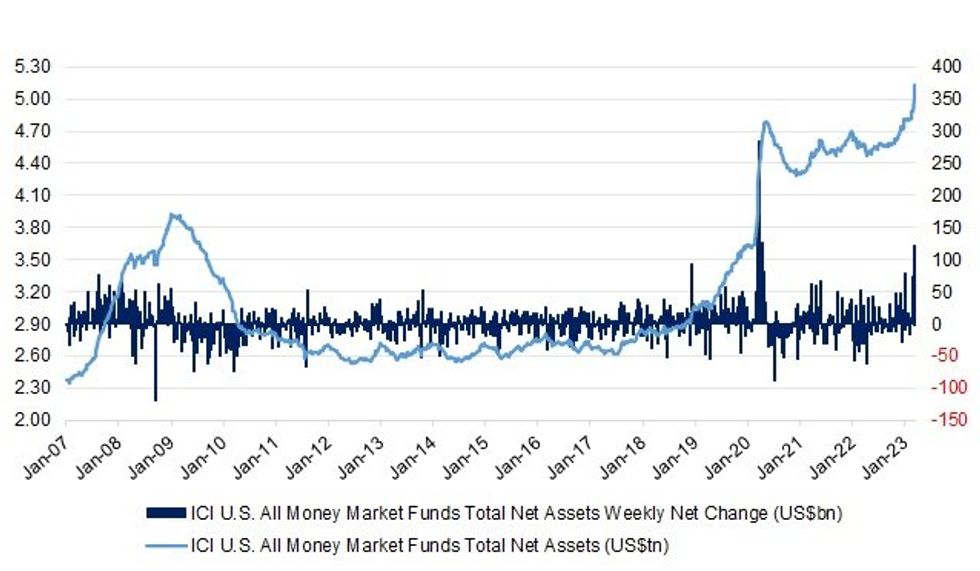

Fig. 1: ICI U.S. All Money Market Funds Total Net Assets

Source: MNI - Market News/Bloomberg

UK

BOE: Central banks may face a hard task in limiting the impact of factors such as currency volatility which can lead to businesses raising prices in an inflationary way, Bank of England policymaker Catherine Mann said on Thursday. (RTRS)

FISCAL: Jeremy Hunt believes tax cuts this year remain unlikely because they could make it harder to control inflation after the Bank of England voted to raise interest rates again. The Chancellor privately warned that the persistence of high prices will make it harder for him to offer tax cuts or public spending increases in future. Another minister told i that Rishi Sunak “needs rates to come down” in the next year in order to convince voters that the economy is going in the right direction. (The i)

EUROPE

ECB: Mario Centeno of Portugal also warned that a careful approach to tightening is required. “The risk of overreacting is palpable, is present, and we should keep it in mind,” he said in Lisbon. (BBG)

ECB: Eurozone financial conditions are tightening following the collapse of Silicon Valley Bank and the forced takeover of Credit Suisse by UBS, a former member of the European Central Bank’s executive board told MNI, adding that the ECB still has work to do to tame inflation but that the peak in rates is now likely to be lower. (MNI)

FISCAL: Hungary said it’s near an agreement with the European Union that would bring it a step closer toward accessing almost €28 billion ($30.5 billion) in funds frozen over concerns about the rule of law and fundamental rights. (BBG)

BANKS: The Swiss authorities and UBS Group AG are racing to close the takeover of Credit Suisse Group AG within as little as a month, according to two sources with knowledge of the plans, to try to retain the lender's clients and employees. (RTRS)

BANKS: UBS Group AG wealth boss Iqbal Khan told Credit Suisse Group AG staff in Asia that retention packages could come as soon as next week, according to people familiar with the matter, as the bank seeks to prevent an exodus of top talent. (BBG)

BANKS/BONDS: The Credit Roundtable, a lobby group of some of the biggest fixed income asset managers from the United States and Canada, has decided not to take legal action against Credit Suisse AG a person familiar with the matter told Reuters on Thursday. (RTRS)

BANKS/BONDS: The Swiss authorities’ full write-down of Credit Suisse Group AG (CS) Additional Tier 1 (AT1) notes, while not imposing full losses on its equity, is not regarded by Fitch Ratings as a global crisis management template for troubled banks. (Fitch)

RATINGS: Sovereign rating reviews of note slated for after hours on Friday include:

- Fitch on Malta (current rating: A+; Outlook Stable)

- Moody’s on Estonia (current rating: A1; Outlook Stable) & Poland (current rating: A2; Outlook Stable)

- S&P on Germany (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Finland (current rating: AA (high), Stable Trend) & France (current rating: AA (high), Stable Trend)

U.S.

FED: The Federal Reserve's balance sheet jumped USD94.5 billion on the week to Wednesday as the central bank's discount window lending receded from last week's record high, according to data released Thursday. (MNI)

BANKS: Treasury Secretary Janet Yellen said Thursday that the federal emergency actions to back up Silicon Valley Bank and Signature Bank customers could be deployed again in the future if necessary. (CNBC)

BANKS: Citizens Financial Group Inc is working on a bid to acquire the private banking business of failed Silicon Valley Bank, two people familiar with the matter said on Thursday. (RTRS)

MONEY MARKETS: The amount of money parked at money-market funds climbed to a fresh record in the week through March 22 as bankin concerns continued to rock global markets. (BBG)

INFLATION: U.S. Treasury Secretary Janet Yellen said on Thursday that supply chain pressures and shipping costs were coming down and were eventually likely to bring down inflation. (RTRS)

FISCAL: House Republicans are finalizing a formal list of spending cuts they’ll demand from President Joe Biden in exchange for their support for raising the US debt ceiling, Budget Committee Chair Jodey Arrington told reporters. (BBG)

POLITICS: President Joe Biden’s approval rating dipped in a new poll released Thursday, approaching an all-time low for that survey as Americans give the Democrat poor marks on how he has handled the economy. Only 38% of respondents said they approve of the job Biden is doing, versus 61% who said they disapprove, according to the Associated Press-NORC Center for Public Affairs Research poll. The president’s approval in March fell from 45% in February and 41% in January, according to the survey. (CNBC)

OTHER

GLOBAL TRADE: Democratic and Republican senators questioned President Joe Biden’s trade chief on efforts to negotiate agreements on critical minerals with the European Union and Japan, demanding greater transparency and congressional approval. (BBG)

U.S./CHINA: A US Navy destroyer conducted a freedom of navigation operation in the South China Sea on March 24 local time, according to a statement from the US 7th Fleet. (BBG)

U.S./CHINA: TikTok Chief Executive Shou Chew’s appearance in Congress on Thursday did little to calm the bipartisan fury directed at the viral video-sharing service. If anything, his more than four hours of testimony gave critics more fuel to insist the app be banned in the US. (BBG)

U.S./CHINA: U.S. corporate due diligence firm Mintz Group's Beijing office was raided by authorities and five Chinese staff were detained, a source with the company told Reuters on Thursday. (RTRS)

NATO: Sweden, meanwhile, has been left puzzled by the separation of its application from Finland’s. While Turkey has made its objections known, it’s unclear why Hungary continues to drag its heels. “I didn’t get an actual explanation, only the message that they have no intention of delaying any country’s accession,” Prime Minister Ulf Kristersson said after talking to his Hungarian counterpart, Viktor Orban, at an EU summit in Brussels. “I don’t see any reason for delay, but we are aware that every country makes it’s own decisions.” (BBG)

JAPAN: Japanese firms see inflation and the chance of worldwide recession as the primary risks they face in fiscal 2023, a Reuters monthly poll showed. (RTRS)

AUSTRALIA: Prime Minister Anthony Albanese’s center-left Labor party is on the cusp of holding power in every mainland state and territory for just the second time in the party’s 120-year history. Yet such dominance may prove a poisoned chalice. Polls suggest a state election on Saturday in New South Wales, Australia’s most populous state that includes Sydney, could end 12 years of center-right rule. That would mean all of the nation’s six states and two territories bar one — the island state of Tasmania — would be under Labor rule. (BBG)

NEW ZEALAND: New Zealand’s economy may have contracted in the first three months of 2023 as a result of Cyclone Gabrielle and other severe weather events, according to a report from the Economics Division of the Ministry of Foreign Affairs and Trade. (BBG)

NORTH KOREA: The Japanese government is making final preparations to extend sanctions on North Korea by 2 years, TV Asahi reports, citing an unidentified official. (BBG)

NORTH KOREA: North Korean state news agency KCNA said on Friday it tested a new nuclear underwater attack drone under leader Kim Jong Un's guidance this week, as a U.S. amphibious assault ship arrived in South Korea for joint drills. (RTRS)

BRAZIL: The Brazilian stock market deepened losses on Thursday after the country's central bank decision to maintain a hawkish stance triggered further criticism from leftist President Luiz Inacio Lula da Silva. (RTRS)

RUSSIA/BANKS: Credit Suisse Group AG and UBS Group AG are among the banks under scrutiny in a US Justice Department probe into whether financial professionals helped Russian oligarchs evade sanctions, according to people familiar with the matter. (BBG)

RUSSIA/BANKS: The European Central Bank is pressing Austria's Raiffeisen Bank International to unwind its highly profitable business in Russia, five people with knowledge of the matter told Reuters. (RTRS)

SOUTH AFRICA: Blackouts have reduced the potential size of South Africa’s economy by almost a fifth since they started being imposed around 2008, according to an energy specialist at Africa’s biggest fund manager. (BBG)

COLOMBIA/IMF: Colombia's economy is currently undergoing a transition toward a more sustainable growth path, the International Monetary Fund said Thursday, highlighting tightened macroeconomic policies, slowing global growth and higher borrowing costs. (RTRS)

IRAN: Treasury Secretary Janet Yellen said on Thursday the United States was looking at ways to strengthen its sanctions against Iran, but acknowledged the sanctions had not resulted in the behavioral or policy changes Washington desires from Tehran. (RTRS)

ISRAEL: Israeli Prime Minister Benjamin Netanyahu summoned his defence chief on Thursday after reports the minister wanted to halt the government's judicial overhaul plans, as cracks opened in the ruling coalition over the bitterly disputed project. (RTRS)

FOREX: U.S. Treasury Secretary Janet Yellen said on Thursday she remained confident the U.S. dollar was going to remain the global reserve currency even as she remarked that Russia and China may want to develop an alternative to it, which she described as difficult to achieve. (RTRS)

METALS: The London Metal Exchange (LME) said on Thursday that no further “irregularities” have been found in LME-warranted nickel stocks following a 100% inspection of all bagged nickel warrants in LME-licensed warehouses. The 146-year-old exchange is on track to resume the Asian hours nickel trading on March 27 “given its confidence in the situation following the inspection,” it added. (RTRS)

OIL: US Energy Secretary Jennifer Granholm said it will be “difficult” this year to refill government oil reserves, even as crude prices hovered within the agency’s target buy-back range. (BBG)

OIL: A change is on the horizon for oil demand, with India set to eclipse China as the most important driver of global growth — and potentially the last, as the world shifts to a greener future. (BBG)

CHINA

PBOC: The People’s Bank of China needs to carefully weigh additional cuts to the reserve requirement ratio to ensure Chinese lenders have adequate buffers against any possible liquidity risk, sharpening regulators’ focus on banks’ liquidity management and investments, policy advisers and economists said. (MNI)

INFLATION/ECONOMY: The price war among automakers in China has fueled worries that the pressures on profitability could spread to their suppliers, the Securities Times reported, citing unidentified companies. (BBG)

ECONOMY: The National Development and Reform Commission (NDRC) has launched a High Quality Development and Common Prosperity Demonstration Zone, in Zhejiang province, according to 21st Century Herald. (MNI)

EQUITIES: Chinese insurance companies are likely to increase their equity investments as the domestic stock market recovers and the pressure for them to hunt for higher returns builds up following rises in liabilities costs, according to a front-page commentary in the Securities Daily. (BBG)

TRUSTS: The China Banking and Insurance Regulatory Commission (CBIRC) released its final version of reforms for the trust industry that will see firms in the sector classified into separate categories, each with distinct rules, according to the 21st Century Herald. (MNI)

PROPERTY/BONDS: Evergrande Real Estate Group Co Ltd, a unit of China Evergrande Group, said it failed to pay interest on 4 billion yuan ($586.6 million) bonds due by March 23. (RTRS)

CHINA MARKETS

PBOC NET DRAINS CNY173 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY7 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY173 billion after offsetting the maturity of CNY180 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8963% at 09:23 am local time from the close of 1.9178% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Thursday, compare with the close of 42 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8374 FRI VS 6.8709 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8374 on Friday, compared with 6.8709 set on Thursday.

OVERNIGHT DATA

JAPAN FEB CPI +3.3% Y/Y; MEDIAN +3.3%; JAN +4.3%

JAPAN FEB CPI EXCL. FRESH FOOD +3.1% Y/Y; MEDIAN +3.1%; JAN +4.2%

JAPAN FEB CPI EXCL. FRESH FOOD & ENERGY +3.5% Y/Y; MEDIAN +3.4%; JAN +3.2%

JAPAN MAR, P JIBUN BANK MANUFACTURING PMI 48.6; FEB 47.7

JAPAN MAR, P JIBUN BANK SERVICES PMI 54.2; FEB 54.0

JAPAN MAR, P JIBUN BANK COMPOSITE PMI 51.9; FEB 51.1

Activity at Japanese private sector firms increased for the third consecutive month, according to March flash PMI data. Central to the upturn was a solid improvement at Japanese service providers. (IHS Markit)

AUSTRALIA MAR, P JUDO BANK MANUFACTURING PMI 48.7; FEB 50.5

AUSTRALIA MAR, P JUDO BANK SERVICES PMI 48.2; FEB 50.7

AUSTRALIA MAR, P JUDO BANK COMPOSITE PMI 48.1; FEB 50.6

The Flash PMI results for March confirm that the economic slowdown that commenced in 2022 is continuing into 2023. The composite output and new orders indexes fell in March to be at the lowest levels since the Delta lockdowns in 2021. The March results are consistent with a soft landing for the Australian economy in 2023 and 2024 as the economy responds to higher interest rates. (Judo Bank)

UK MAR GFK CONSUMER CONFIDENCE -36; MEDIAN -36; FEB -38

MARKETS

US TSYS: Richer In Asia, TYM3 Bid Capped At Thursdays Highs

TYM3 deals at 116-05+, +0-06, with a 0-18 range observed on volume of ~134k.

- Cash tsys sit 4-5bps richer across the major benchmarks, the belly is leading the bid.

- The short end of the treasury curve was cheaper in early dealing as Asia-Pac participants digested remarks late in yesterday's NY session by Tsy Sec Yellen, she softened her language on deposit insurance pledging additional actions if warranted.

- Despite the absence of a headline driver tsys firmed off session lows. The bid extended as e-minis retreated from best levels and the USD firmed alongside the Yen.

- The bid was capped as TYM3 failed to break Thursday's NY session high (116-08) and 2s failed to break 3.75% as yields moved lower.

- Despite marginally paring gains tsys have held richer as we approach the European session.

- Preliminary PMIs from France, Germany and EU headline in Europe. Further out we have Durable Goods Orders and US flash IHS Markit Manufacturing Index and S&P Global Services Index. Fedspeak from St Louis Fed President Bullard will also cross.

JGBS: Contained End To The Week, Twist Steepening Evident

JGB futures operated in a contained range in the grander scheme of things, failing to challenge the extremities witnessed in the overnight session during Tokyo dealing. Gyrations in U.S. Tsys were in the driving seat for the most part, outside of the early super-core CPI-related blip lower, while weakness in the longer end of the JGB curve became more pronounced, before fading.

- JGB futures are +10 into the close, while cash JGBs are 3.5bp richer to 2bp cheaper, with 40s the only benchmark softening on the day.

- The swap space has been more non-committal, operating within -/+0.5bp of yesterday’s closing levels at typing.

- In terms of the details, national CPI data saw the headline and excluding fresh food measures experience Y/Y moderations that were in line with expectations, owing to government subsidies surrounding energy. Meanwhile, the excluding fresh food and energy metric saw a larger than expected uptick, topping expectations by 0.1ppt to print a fresh cycle high at +3.5% Y/Y (incoming BoJ Governor Ueda had previously pointed to peak inflation being in the rear view).

- Services PPI data headlines Monday’s domestic docket.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y5.12518tn 3-Month Bills:

- Average Yield -0.2292% (prev. -0.2437%)

- Average Price 100.0616 (prev. 100.0655)

- High Yield: -0.2214% (prev. -0.2214%)

- Low Price 100.0595 (prev. 100.0595)

- % Allotted At High Yield: 72.2628% (prev. 23.3379%)

- Bid/Cover: 2.833x (prev. 3.288x)

AUSSIE BONDS: At Bests Ahead Of Key Local Data Releases

ACGBs closed just shy of bests (YM +7.0 & XM +7.5) after U.S Tsys re-visited but failed to breach NY highs in Asia-Pac trade. Cash ACGBs richened 6-7bp with the 3/10 curve 1bp flatter and the AU-US 10-year yield differential -1bp at -16bp.

- Swaps closed 5-6bp stronger with the 3s10s 1bp flatter and EFPs 1-2bp wider.

- Bills strip flattened with pricing +1 to +10.

- A subdued session for RBA dated OIS with pricing 1-6bp softer across meetings with 30bp of easing priced by year-end. April meeting pricing was at +2bp.

- The AOFM released its weekly Issuance schedule with a planned sale of A$150mn of 0.75% Nov-27 indexed bond (Tue), A$800mn of 3.75% May-34 bond (Wed) and A$500mn of 0.25% Nov-25 bond (Fri).

- After a light few days, the calendar heats up again next week with the scheduled release of February Retail Sales (Tue) and Monthly CPI (Wed). These two releases were highlighted in the RBA Minutes as important inputs to the April policy decision.

- Until then, the market’s attention will be on U.S. Tsys and global STIR as it continues to process the dovishly perceived hike by the Fed this week.

AUSSIE BONDS: ACGB Apr-26 Auction Results

The Australian Office of Financial Management (AOFM) sells A$500mn of the 4.25% 21 April 2026 Bond, issue #TB142:

- Average Yield: 2.8595% (prev. 3.4550%)

- High Yield: 2.8625% (prev. 3.4600%)

- Bid/Cover: 4.9700x (prev. 4.2200x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 50.0% (prev. 6.6%)

- Bidders 35 (prev. 35), successful 5 (prev. 11), allocated in full 3 (prev. 6)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 28 March it plans to sell A$150mn of the 0.75% 21 November 2027 Indexed Bond.

- On Wednesday 29 March it plans to sell A$800mn of the 3.75% 21 May 2034 Bond.

- On Thursday 30 March it plans to sell A$1.0bn of the 9 June 2023 Note, A$1.0bn of the 7 July 2023 Note & A$500mn of the 8 September 2023 Note.

- On Friday 31 March it plans to sell A$500mn of the 0.25% 21 November 2025 Bond.

NZGBS: Closes At Bests

NZGBs close at session bests after richening with U.S. Tsys but then failing to weaken with them after they bounce off NY highs. The 2-year and 10-year cash benchmarks closed respectively 8bp and 4bp stronger with the 2/10 curve 4bp steeper. NZ/US & NZ/AU cash 10-year yield differentials closed respectively +1bp at +72bp and +2bp at +88bp.

- Swaps closed 6-7bp richer, implying a flatter swap spread box, with the 2s10s curve 1bp flatter.

- RBNZ dated OIS pricing closed 2-10bp softer for meetings beyond April with terminal rate expectations at 5.14%. April meeting pricing continued to hold in its recent 20-25bp of tightening range at 23bp.

- The NZ calendar is light until late next week with the first major release being ANZ Business Confidence and Building consents on Thursday.

- A more interesting data week for Australia with the scheduled release of February retail sales (Tue) and monthly CPI (Wed). These two releases were highlighted in the RBA Minutes as important inputs to the April policy decision.

- With the global calendar light today, the global roll-out of flash PMIs as the highlight, the market attention will be on U.S. Tsys as it continues to process the dovishly perceived hike by the Fed this week.

EQUITIES: Asia-Pac Equities Struggle Even With Hang Seng Tech Bid, E-Minis Nudge Higher

Broader risk assets struggled in early Asia-Pac trade, without much of a headline driver evident.

- A bid in Hong Kong tech names then seemed to stabilise wider risk sentiment, allowing e-minis to trade back in the green.

- The bid in Hong Kong tech names was aided by after hours news from Thursday, which saw Beijing release its regular round of computer game approvals, which will have supported related names. Also of note, Meituan, the food delivery company, will report Q4 earnings later today.

- The Hang Seng Tech Index is off best levels, but still prints more than 1% firmer on the day.

- Broader financials generally struggled after a heavy session for U.S. bank names on Thursday, with the well-documented worry re: the space still reverberating.

- The major regional equity benchmarks all trade lower, albeit by less than 1%, while the 3 major e-mini contracts are 0.1% better off into London hours.

GOLD: Thursday’s Gains Consolidated In Asia

Bullion has consolidated Thursday’s gains during the final Asia-Pac session of the week, last dealing little changed, just above the $1,990/oz mark. Spot once again failed to consolidate above $2,000/oz on Thursday, after drawing support from shifts in market pricing which pointed to deeper Fed cuts through late ‘23/early ’24. Still, gold managed to register the highest daily close since March of last year.

- Technically, trend conditions in gold remain bullish. The breach of former resistance at the Feb 2 high confirmed a resumption of the bull trend that started in late September ‘22. The recent forays above $2,000/oz open the way to $2,034.0/oz (a Fibonacci projection), which represents the next meaningful area of technical resistance.

- Known ETF holdings of gold continue to tick away from cycle lows, with the well-documented worry re: the global banking sector and associated repricing in the outlook for interest rates across the major global central banks in the driving seat there.

- Looking ahead, U.S. durable goods orders and flash S&P global PMIs present the headline data points ahead of the weekend, while comments from St. Louis Fed President Bullard are also due.

OIL: Recovering From Early Asia Lows To Trade Little Changed

WTI and Brent initially extended on Thursday’s weakness with risk assets on the defensive in early Asia-Pac trade, before stabilising as e-minis recovered and the Hang Seng Tech Index firmed, leaving the global oil benchmarks $0.10 or so below their respective settlement levels into London hours. Still, WTI & Brent remain on track to snap a two-week streak of weekly net losses.

- To recap, crude tracked broader risk sentiment for the most part on Thursday, before legging lower late in the day as US Energy Secretary Granholm noted that it will be somewhat “difficult” to refill the SPR during ’23, even with crude prices operating within the already disclosed target purchase band. This also fed into early Asia-Pac price action.

FOREX: Yen Firmer In Asia, NZD Pressured

USD/JPY sits a touch off session lows. The pair is ~0.5% lower and the yen is the strongest performer in the G-10 space at the margins. US Treasury yields have ticked lower, boosting demand for the JPY.

- USD/JPY prints at ¥130.15/25, the next downside target is ¥129.75 76.4% retracement of the Jan 16 to Mar 8 rally. On the wires this morning Japan's February National CPI crossed. Headline (3.3%) and Core (3.1%) figures were in line with expectations. Core-core measure was a touch above expectations at 3.5%.

- Kiwi is the weakest performer in the G-10 space today thus far. NZD/USD prints at $0.6235/40 ~0.2% softer. ANZ downgraded their milk price forecast to $8.25/kg. The NZ Ministry said the economy may have shrunk in Q1 due to Cyclone Gabrielle.

- AUD/USD is little changed from yesterday's closing levels, the pair was pressured in early dealing as e-minis came off best levels and sparking a risk off move seeing the USD and Yen firm alongside US Treasuries. Support was seen at $0.6660 and AUD/USD pared losses.

- Cross asset wise, US Treasury Yields are ~4bps lower across the curve. E-minis are up ~0.1% and Hang Seng is marginally softer. BBDXY is flat.

- Preliminary Services and Manufacturing PMIs from France, Germany and EU headline in Europe. UK Retail Sales and flash Services and Manufacturing PMI will also print. Further out we have Durable Goods Orders and US flash IHS Markit Manufacturing Index and S&P Global Services Index.

FX OPTIONS: Expiries for Mar24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600-05(E1.7bln), $1.0675-80(E627mln), $1.0700-10(E1.4bln), $1.0800(E1.6bln), $1.0850(E539mln), $1.0875(E509mln), $1.0890-10(E656mln)

- USD/JPY: Y130.00($830mln), Y131.00($592mln), Y132.95-00($1.3bln), Y133.75($749mln)

- EUR/GBP: Gbp0.8900(E635mln)

- AUD/USD: $0.6700(A$669mln)

- USD/CAD: C$1.3600-05($606mln), C$1.3620-30($1.1bln)

- USD/CNY: Cny7.3635($1.4bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/03/2023 | 0700/0800 | ** |  | SE | PPI |

| 24/03/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 24/03/2023 | 0730/0730 |  | UK | DMO to Publish Apr-Jun Gilt Op Calendar | |

| 24/03/2023 | 0800/0900 | ** |  | ES | PPI |

| 24/03/2023 | 0800/0900 | *** |  | ES | GDP (f) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/03/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/03/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/03/2023 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/03/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 24/03/2023 | 1500/1500 |  | UK | BOE Mann Panellist at Global Independence Center Conference Ukraine | |

| 24/03/2023 | 1630/1630 |  | UK | BOE Announces Q2 Active Gilt Sales Schedule |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.