-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Day Is Here, It’s All In The Signal

EXECUTIVE SUMMARY

- ECB STILL HAS A LONG WAY TO GO ON RATES, TWO POLICYMAKERS SAY (BBG)

- NORTH KOREA FIRES 10 MISSILES, SOUTH KOREA SAYS (CNN)

- CHINA PBOC GOVERNOR PLEDGES TO KEEP YUAN STABLE (DJ)

- CHINA REGULATOR SAYS IT’S CONCERNED ABOUT PROPERTY SECTOR (BBG)

- CHINA LOCKS DOWN AREA WHERE FOXCONN IPHONE PLANT IS LOCATED (BBG)

- BRAZIL’S BOLSONARO VOWS TO FOLLOW CONSTITUTION, ORDERS TRANSITION TO LULA (BBG)

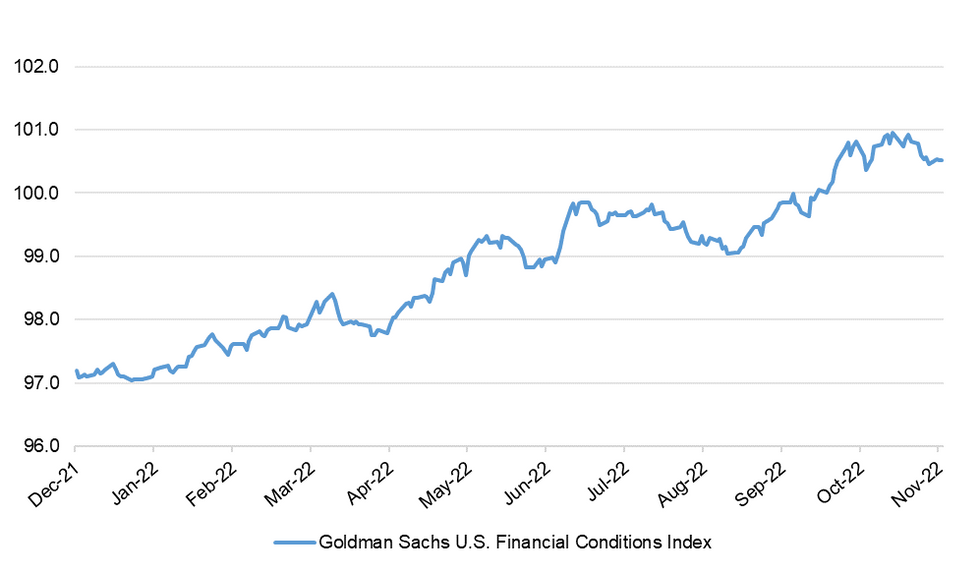

Fig. 1: Goldman Sachs U.S. Financial Conditions Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Full backing for 75 basis point rise. The Times MPC explains what it thinks the Bank of England should do about increasing interest rates. (The Times)

FISCAL: Trade Secretary Kemi Badenoch questioned the accuracy of economic forecasts produced by the UK’s independent fiscal watchdog, weeks before the government is due to announce a package of tax rises and spending cuts meant to reassure markets about the state of the country’s finances. (BBG)

BREXIT: Ministers have held off setting a date for fresh elections in Northern Ireland in an attempt to buy time for a breakthrough in negotiations with Brussels over the Brexit deal. (The Times)

ENERGY: The government has “war gamed” emergency plans to cope with energy blackouts lasting up to seven days in the event of a national power outage amid growing fears over security of supply this winter. (Guardian)

EUROPE

ECB: The European Central Bank will have to continue raising borrowing costs to fight record inflation, according to two of its top policymakers. (BBG)

GERMANY: The German government plans to collect windfall profits from electricity companies despite legal uncertainties about the proposal, according to a government paper seen by Bloomberg. (BBG)

GERMANY: Germany, racing to end its reliance on Russian gas, plans to introduce new regulation that will make it possible to expropriate property to link offshore liquid natural gas terminals to the grid, Handeslblatt reported. (RTRS)

DENMARK: Danes on Tuesday handed the Social Democratic Party a mandate to form a new government in a general election seen as a vote of confidence in Prime Minister Mette Frederiksen's handling of the pandemic and her leadership to overcome yet another crisis. (RTRS)

BANKS: The Qatar Investment Authority plans to increase its stake in Credit Suisse by investing in a share sale alongside the Saudi National Bank, according to people with knowledge of the talks. (FT)

U.S.

ECONOMY: U.S. manufacturing is on the path to a mild contraction after activity grew at the slowest pace in more than two years in October, Institute for Supply Management chair Timothy Fiore told MNI Tuesday, adding that he sees scope for prices to continue to fall further. (MNI)

POLITICS: President Joe Biden's approval rating edged higher with just a week to go before U.S. midterm elections when his Democratic Party is expected to lose control of the House of Representatives, a Reuters/Ipsos opinion poll completed on Tuesday found. (RTRS)

EQUITIES/ECONOMY: Amazon.com Inc. is freezing staffing levels in its profitable advertising business, according to a person familiar with the matter, showing that the world’s largest e-commerce company is taking more drastic measures to align expenses with slowing sales. (BBG)

OTHER

GLOBAL TRADE: The corridor for exporting grain from Ukrainian ports needs a long-term means to defend it reliably and the world must provide a firm response to any Russian attempt to disrupt it, President Volodymyr Zelenskiy said on Tuesday. (RTRS)

GLOBAL TRADE: Turkish Defence Minister Hulusi Akar said on Tuesday that he believed a U.N. brokered grains deal that Russia had suspended over the weekend would continue, after two phone calls in as many days with his Russian counterpart. (RTRS)

GLOBAL TRADE: Beijing will accelerate efforts to join the Trans-Pacific trade bloc and a regional digital agreement, as China’s new leadership team seeks to deliver on its ambitious plans to increase high-quality exports, said a former adviser to China's State Council. (MNI)

U.S./CHINA: The Council on Foreign Investment in the U.S. (CFIUS) should take action to ban TikTok, Brendan Carr, one of five commissioners at the Federal Communications Commission, told Axios in an interview. (Axios)

U.S./CHINA/TAIWAN: Brendan Carr, one of five commissioners at the U.S. Federal Communications Commission, has arrived in Taiwan to attend meetings with Taiwanese government counterparts, Axios has learned. (Axios)

JAPAN: Japanese Finance Minister Shunichi Suzuki on Wednesday showed a broader concern about the yen’s weakness, saying the slower pace of the yen’s depreciation, not just sharp movements, isn’t desirable for the Japanese economy. (MarketWatch)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Wednesday a tweak to the central bank's yield curve control (YCC) policy could become a future option, but dismissed not now. (RTRS)

BOJ: Japan’s central bank should swap its exchange-traded fund holdings for perpetual bonds to ensure that an eventual exit from stimulus doesn’t upend equities, according to one of Prime Minister Fumio Kishida’s advisers. (BBG)

RBNZ: Reserve Bank of New Zealand Deputy Governor Christian Hawkesby comments on 3q labor market data at press conference Wednesday in Wellington. The big picture really was that, both the unemployment number, the wages numbers, they all came in broadly consistently with our most recent projections. (BBG)

RBNZ: The Reserve Bank of New Zealand said on Wednesday the country's financial system is as a whole resilient but global financial stress will test this. (RTRS)

SOUTH KOREA: Both the finance ministry and the central bank played down the accelerated pace of prices growth in separate statements and affirmed their previous projections that inflation would stay elevated for some time. (RTRS)

SOUTH KOREA: A South Korean insurer took the unusual step of delaying buying back perpetual bonds, in the first such case for the nation’s issuers since 2009 that adds to signs of a crisis in the local credit market. (BBG)

NORTH KOREA: North Korea fired at least 10 missiles of various types from its east and west coasts on Wednesday, South Korea’s Ministry of National Defense said. (CNN)

HONG KONG: John Lee says ‘the worst is behind us,’ urges banks to ‘get in front’ of the queue for business as Hong Kong kicks off financial summit. (SCMP)

BOC: The Bank of Canada needs to hike interest rates further to fight stubbornly high inflation, Governor Tiff Macklem said on Tuesday, reiterating that "we are getting closer, but we are not there yet." (RTRS)

BOC: The Bank of Canada and the Department of Finance announced the resumption of the Canadian government cash management bond buyback program. (BBG)

BRAZIL: Brazilian President Jair Bolsonaro vowed to respect the constitution and while stopping short of formally conceding, authorized the government to start the political transition after his loss to Luiz Inacio Lula da Silva. (BBG)

BRAZIL: Brazil oil regulator known as ANP suspended the weekly fuel stock requirement for distributors in order to avoid shortages, according to a statement. (BBG)

SOUTH AFRICA: Four more public service unions were issued with strike certificates yesterday after marathon talks failed to break the wage deadlock at the public service co-ordinating bargaining council (PSCBC), bringing the country a step closer to debilitating strike action that could cripple government services. (Business Day)

SOUTH AFRICA: Eskom says it will continue with stage two rolling blackouts from 4pm Tuesday until 5am Wednesday, after which it will implement stage one. Stage one will last until 4pm, when stage two will kick in again. Eskom says this pattern will continue until Friday. (SABC)

MIDDLE EAST: The United States is concerned about threats from Iran against Saudi Arabia and will not hesitate to respond if necessary, a White House spokesperson said on Tuesday. (RTRS)

ISRAEL: Former Israeli Prime Minister Benjamin Netanyahu appeared well placed to return to power as exit polls following Tuesday's election showed his right-wing bloc heading for a narrow majority lifted by a strong showing from his far-right allies. (RTRS)

OIL: OPEC’s crude production held steady last month after the group pledged a symbolic cutback to stabilize market sentiment. (BBG)

CHINA

YUAN: China will aim to keep the yuan's exchange rate stable at a reasonable and balanced level and for the economy's potential growth rate to be in a reasonable range, said People's Bank of China Gov. Yi Gang. (Dow Jones)

CREDIT: China’s new yuan loans and aggregate finance may see a seasonal decline in October after banks accelerated lending at the end of Q3 to meet regulatory requirement, thereby satisfying some of October's demand, the Securities Daily reported citing Wang Qing, chief analyst at Golden Credit Rating. (MNI)

PBOC/LIQUIDITY: The People’s Bank of China’s Pledged Supplemental Lending (PSL) facility increased a net CNY154.3 billion in October, accelerating from September’s CNY108.2 billion, the 21st Century Business Herald reported. (MNI)

MARKETS: A Chinese securities official said opening markets is good for China. Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said China will continue to welcome foreign institutions and also hope that more international companies will list in Hong Kong. (CNA)

PROPERTY: China’s Banking and Insurance Regulatory Commission said that the country’s property sector is an area of concern, although risks are manageable. (BBG)

PROPERTY: Several private property developers including Longfor and Country Garden are promoting their second round of bond issuance with credit enhancement by China Bond Insurance Co Ltd, sending a positive signal about the stability of bond financing channels for private developers, the Securities Times reported. (MNI)

CORONAVIRUS: China has locked down the Zhengzhou Airport Economy Zone where Foxconn’s iPhone plant is located to cut Covid spread, according to a WeChat statement by the local authorities. (BBG)

CORONAVIRUS: Chinese electric vehicle (EV) maker Nio said on Wednesday it has suspended production due to COVID-19 curbs, as rising cases across the country cause more disruptions to business activity. (RTRS)

CHINA MARKETS

PBOC NET DRAINS CNY262 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY18 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY262 billion after offsetting the maturity of CNY280 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7982% at 9:48 am local time from the close of 1.7373% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Tuesday vs 68 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 7.2197 WEDS VS 7.2081 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2197 on Wednesday, compared with 7.2081 set on Tuesday.

OVERNIGHT DATA

JAPAN OCT MONETARY BASE -6.9% Y/Y; SEP -3.3%

JAPAN OCT MONETARY BASE OUTSTANDING Y620.9TN; SEP Y618.1TN

AUSTRALIA SEP BUILDING APPROVALS -5.8% M/M; MEDIAN -10.0%; AUG +23.1%

AUSTRALIA SEP HOME-LOAN VALUES -8.2% M/M; MEDIAN -3.0%; AUG -3.4%

AUSTRALIA SEP OWNER-OCCUPIED HOME LOAN VALUES -9.3% M/M; MEDIAN -2.5%; AUG -2.7%

AUSTRALIA SEP INVESTOR LOAN VALUES -6.0% M/M; MEDIAN -3.0%; AUG -4.8%

NEW ZEALAND Q3 EMPLOYMENT CHANGE +1.3% Q/Q; MEDIAN +0.5%; Q2 0.0%

NEW ZEALAND Q3 EMPLOYMENT CHANGE +1.2% Y/Y; MEDIAN +0.3%; Q2 +1.%

NEW ZEALAND Q3 UNEMPLOYMENT RATE 3.3%; MEDIAN 3.2%; Q2 3.3%

NEW ZEALAND Q3 PARTICIPATION RATE 71.7%; MEDIAN +71.7%; Q2 +70.9%

NEW ZEALAND Q3 NON-GOV’T ORDINARY TIME WAGES +1.1% Q/Q; MEDIAN +1.1%; Q2 +1.3%

NEW ZEALAND Q3 NON-GOV’T WAGES INCLUDING OVERTIME +1.2% Q/Q; MEDIAN +1.2%; Q2 +1.3%

NEW ZEALAND Q3 AVERAGE HOURLY EARNINGS +2.6% Q/Q; MEDIAN +1.7%; Q2 +2.3%

NEW ZEALAND OCT CORELOGIC HOUSE PRICES -0.6% Y/Y; SEP +2.8%

SOUTH KOREA OCT CPI +5.7% Y/Y; MEDIAN +5.7%; SEP +5.6%

SOUTH KOREA OCT CPI +0.3% M/M; MEDIAN +0.4%; SEP +0.3%

SOUTH KOREA OCT CORE CPI +4.8% Y/Y; MEDIAN +4.5%; SEP +4.5%

UK OCT BRC SHOP PRICE INDEX +6.6% Y/Y; SEP +5.7%

MARKETS

SNAPSHOT: Fed Day Is Here, It’s All In The Signal

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 24.49 points at 27654.43

- ASX 200 up 9.843 points at 6986.7

- Shanghai Comp. up 34.769 points at 3003.076

- JGB 10-Yr future down 12 ticks at 148.74, yield down 0.6bp at 0.251%

- Aussie 10-Yr future down 4.0 ticks at 96.185, yield up 4.2bp at 3.805%

- U.S. 10-Yr future unch. at 110-18+ yield up 1.07bp at 4.0526%

- WTI crude up $1.25 at $89.62, Gold up $3.16 at $1651.14

- USD/JPY down 70 pips at Y147.57

- ECB STILL HAS A LONG WAY TO GO ON RATES, TWO POLICYMAKERS SAY (BBG)

- NORTH KOREA FIRES 10 MISSILES, SOUTH KOREA SAYS (CNN)

- CHINA PBOC GOVERNOR PLEDGES TO KEEP YUAN STABLE (DJ)

- CHINA REGULATOR SAYS IT’S CONCERNED ABOUT PROPERTY SECTOR (BBG)

- CHINA LOCKS DOWN AREA WHERE FOXCONN IPHONE PLANT IS LOCATED (BBG)

- BRAZIL’S BOLSONARO VOWS TO FOLLOW CONSTITUTION, ORDERS TRANSITION TO LULA (BBG)

US TSYS: Twist Steepening Pre-FOMC

The cash Tsy curve has twist steepened in Asia Pac hours, with the region seemingly keen to fade Tuesday’s twist flattening impulse, aided by block blow in FV (+5K & +5.75K) & TY futures (-2K).

- An early uptick came alongside a weaker USD and the latest batch of North Korean missile launches.

- The bid then moderated/unwound, dependent on the point of the curve that is being examined, with weakness in Antipodean rates and the longer end of the JGB curve introducing a cross-market element to price action.

- Cash Tsys run 3bp richer to 2bp cheaper, twist steepening (as mentioned above) with a pivot around 10s. TYZ2 has stuck to a fairly limited 0-09 range, last dealing a between its base and midpoint, +0-01 at 110-19, on solid volume of ~!00K.

- Participants are zeroed in on risk events due during Wednesday’s NY session, which will be dominated by the latest FOMC decision (see our preview of that event here: https://roar-assets-auto.rbl.ms/documents/19964/FedPrevNovember2022UPDATEWANALYSTS.pdf ) and quarterly Tsy refunding announcement (see our preview of that event here: https://roar-assets-auto.rbl.ms/documents/20001/MNI_US_DeepDive_Issuance_Nov2022.pdf )

JGBS: Steeper With Lack Of Demand Evident In Longer End

Cash JGBs run flat to ~5bp cheaper, with the super-long end struggling despite the presence of BoJ Rinban operations in the 25+-Year zone and even after the U.S. Tsy curve twist flattened on Tuesday.

- Participants may have been exhibiting increased caution ahead of the impending FOMC decision, as yesterday’s cheapening in super long paper extended, with wider FI market flows also eyed.

- Futures were -8 at the bell, with the contract’s overnight low giving way as wider core global FI markets cheapened as Asia-Pac dealing wore on, before the contract corrected from Tokyo lows into the bell.

- Local headline flow saw Finance Minister Suzuki sound a little more worried re: the impact of a weaker JPY, while BoJ Governor Kuroda reiterated the need for the BoJ to persist with its current monetary policy settings, although he did concede that YCC settings may need to be altered at some point down the line.

- BoJ Rinban operations covering 1- to 5- & 25+-Year JGBs had no real impact on the space, with relatively vanilla offer/cover ratios unearthed in the details.

- Looking ahead, Thursday’s local docket will see the latest batch of weekly international securities flow data cross.

AUSSIE BONDS: Weaker On Wednesday

Aussie bonds were seemingly driven by cross-market flows on Wednesday, with an early U.S. Tsy-inspired bid giving way as trans-Tasman impetus from a softer NZGB complex post-NZ labour market data applied pressure, before a second round of cheapening was seen as U.S. Tsys came back from highs.

- Some desks pointed to set up ahead of next week’s ACGB May-34 syndication as a source of pressure, but it is hard to be sure on that front, especially as the curve flattened on the day.

- YM finished -9.0, with XM -4.5.

- Local data was mixed vs. consensus exp., with a lack of meaningful market impetus derived from the housing finance and building approvals prints.

- EFPs were wider all day, but pulled back from extremes, with the 3-/10-Year box steepening a touch.

- Bills were 2-14bp cheaper through the reds at the bell, bear steepening.

- Looking ahead Thursday’s local docket will see final services and composite PMI data from S&P Global, as well the monthly trade balance reading. Elsewhere, RBA’s Kearns, who is Head of the Bank’s Domestic Markets divison, will participate on a panel discussing the topic of “Wholesale Market Conditions and Resilience.”

AUSSIE BONDS: ACGB Nov-28 Auction Results

The Australian Office of Financial Management (AOFM) A$800mn of the 2.75% 21 November 2028 Bond, issue #TB152:

- Average Yield: 3.4932% (prev. 3.7893%)

- High Yield: 3.5000% (prev. 3.7925%)

- Bid/Cover: 3.1313x (prev. 2.7429x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 60.0% (prev. 44.3%)

- Bidders 43 (prev. 41), successful 25 (prev. 15), allocated in full 19 (prev. 9)

NZGBS: NZGB Post Data Weakness Extends

NZGBS continued to cheapen in the wake of the release of the domestic labour market report, with the major benchmarks ultimately going out 12-14bp cheaper as the curve bear steepened.

- Swap rates lagged the move in yields resulting in some tightening of swap spreads.

- A reminder that the domestic data saw firmer than expected employment growth and average hour earnings, although the unemployment rate held steady as participation jumped.

- Elsewhere, RBNZ Deputy Governor Hawkesby flagged that the data was in line with the Bank’s own expectations, while highlighting the need to slow demand against the backdrop of a “very hot” labour market.

- RBNZ dated OIS firmed at the margins post data, with ~71bp of tightening now priced for this month’s meeting, while a terminal OCR of ~5.25% is now priced.

- Looking ahead, Thursday’s domestic docket will be headlined by the latest round of NZGB supply (’28, ’33 & ’51 paper will be auctioned).

EQUITIES: Hong Kong & China Lead The Way, Even After China Plays Down Re-opening Rumours

The major Asia-Pac equity indices were little changed to firmer on Wednesday, with Hong Kong & Chinese equities leading the charge, building on Tuesday’s gains, even after the Chinese government played down any knowledge of the formation of a COVID re-opening committee late on Tuesday (with rumours surrounding that matter deemed the major driver of Tuesday’s move higher).

- News of fresh overt and stealth COVID-related restrictions surrounding some Chinese cities also failed to dent sentiment.

- The Hang Seng was subjected to shortened trading hours owing to adverse weather conditions in Hong Kong, closing 2.6% higher, while the CSI last prints ~1.4% better off.

- Elsewhere, the Nikkei 225 was limited by a firmer JPY, closing around unchanged levels, with the latest North Korea missile launch also doing little to aided sentiment in Japan.

- U.S. equity index futures lodged marginal gains, with the 3 major e-mini contracts last 0.1-0.3% higher, likely benefitting from the uptick in Hong Kong & Chinese equities.

OIL: Prices Supported Ahead Of Fed Meeting

Oil prices posted solid gains during the day with both WTI and Brent up over a percent to around $89.60/bbl and $95.75 respectively on a softer USD ahead of the Fed and hopes that China will reopen.

- US EIA inventory data is published tonight and is expected to show a 200k drawdown of crude after 2.588m build last week (Dow Jones) pointing to further tightness in the market. Gasoline stocks are expected to shrink by 900k. The API reported a 6.5mn crude drawdown and -2.6mn for gasoline in the latest week.

- The US and Saudi Arabia are concerned that Iran may be about to attack not only Saudi Arabia but also Erbil in Iraq, according to Dow Jones.

- Brent contracts continue to signal market tightness.

- The Fed meeting later will be important for gauging the outlook for oil demand. It is expected to raise rates 75bp again.

GOLD: Consolidating Tuesday’s Gain Pre-FOMC

Gold has benefitted from the pull lower in our weighted U.S. real yield monitor over the past 24 or so hours, with some intraday volatility in the USD providing les clarity in terms of direction for bullion. This leaves spot gold at $1,650/oz, with Asia-Pac trade limited by the impending U.S. Federal Reserve monetary policy decision.

- The November FOMC meeting is mainly about the message the Fed wants to send about its plans for December. A 4th consecutive 75bp hike is assured this time. A step-down to a 50bp hike at the following meeting looks like the path of least resistance for now - the question is, how strongly does the FOMC seek to express that view.

- In a close call, we expect only limited changes to the Statement - but anticipate that Chair Powell will signal that the Committee is currently eyeing either 50bp or 75bp in December, with the decision to be data-dependent. If there are substantive changes to the Statement, the risks are almost certainly that they lean dovish, with either an overt nod to slowing the pace of increases, or a reference to the impact of cumulative hikes on the economy.

FOREX: Greenback Heads Into FOMC Meeting On Back Foot, Yen Gains Despite Risk-On Tone

The greenback traded on the back foot amid positive risk tone and pre-FOMC positioning. The BBXY index shed 2 figs through the session, with short-end U.S. Tsy yields easing off in a steepening move. E-mini futures crept higher, trimming Tuesday's losses, underpinning positive market sentiment.

- The yen bucked the risk-on trend which sent other safe havens (USD and CHF) losing altitude. Spot USD/JPY fell 1.20 fig. top-to-bottom, before trimming losses to last trade at Y147.58. U.S./Japan 2-Year spread tightened 3.8bp & 10-Year differential stayed little changed, which may have aided the downswing in USD/JPY.

- Bloomberg cited trader sources attributing sharp yen purchases to the BoJ minutes, which showed that several board members made reference to FX markets at the September meeting. The minutes underscored the central bank's intention to maintain dovish bias, but Governor Kuroda told lawmakers that Japan is no longer in deflation since the launch of the current easing programme.

- High-beta currencies traded on a firmer footing, outperformed only by the yen. The kiwi paced gains in the space, after New Zealand's Q3 employment and wage data smashed expectations, driving a marginal uptick in RBNZ rate-hike pricing.

- Offshore yuan garnered some strength, while holding yesterday's range, amid broader dollar weakness. The PBOC set its USD/CNY reference rate at a new cyclical high and 643 pips below sell-side estimate, while Governor Yi reiterated his pledge to keep the yuan stable.

- When it comes to scheduled events, Wednesday is all about the Fed's monetary policy decision, with policymakers expected to raise interest rates by 75bp.

- Outside of the much awaited Fed Chair Powell's presser, we will hear comments from ECB's Makhlouf, Villeroy & Nagel.

- U.S. ADP employment change, German jobless rate and manufacturing PMI readings from several European economies will take focus on the data front.

FX OPTIONS: Expiries for Nov02 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.1bln), $0.9725(E702mln), $0.9800(E1.3bln), $0.9820-25(E702mln), $0.9850-70(E1.1bln), $0.9900(E862mln), $1.0000(E2.4bln)

- USD/JPY: Y150.00($1.0bln)

- GBP/USD: $1.2000-22(Gbp1.3bln)

- EUR/JPY: Y141.10(E738mln)

- AUD/USD: $0.6720(A$1.2bln)

- NZD/USD: $0.6175(N$713mln)

- USD/CNY: Cny7.2500($715mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/11/2022 | 0700/0800 | ** |  | DE | Trade Balance |

| 02/11/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 02/11/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/11/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/11/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 02/11/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/11/2022 | 1515/1115 |  | CA | BOC director Ron Morrow speaks on payments supervision | |

| 02/11/2022 | 1800/1400 | *** |  | US | FOMC Statement |

| 03/11/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.