-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Inside Range Ahead Key Inflation Data

MNI BRIEF: EU Calls Feb 3 Summit To Brainstorm Defence

MNI EUROPEAN OPEN: Japan Real Wages Rise For Second Straight Month

EXECUTIVE SUMMARY

- GROWTH SOFTER, INFLATION MODERATE - FED BEIGE BOOK - MNI BRIEF

- FED’S DALY SAYS RATE CUTS NEEDED TO KEEP LABOR MARKET HEALTHY - RTRS

- BOJ TO WATCH MARKETS VIGILANTLY - TAKATA - MNI BRIEF

- JAPAN JULY REAL WAGES POST 2ND STRAIGHT RISE - MNI BRIEF

- RBA WILL HIKE IF NEEDED - GOV BULLOCK - MNI BRIEF

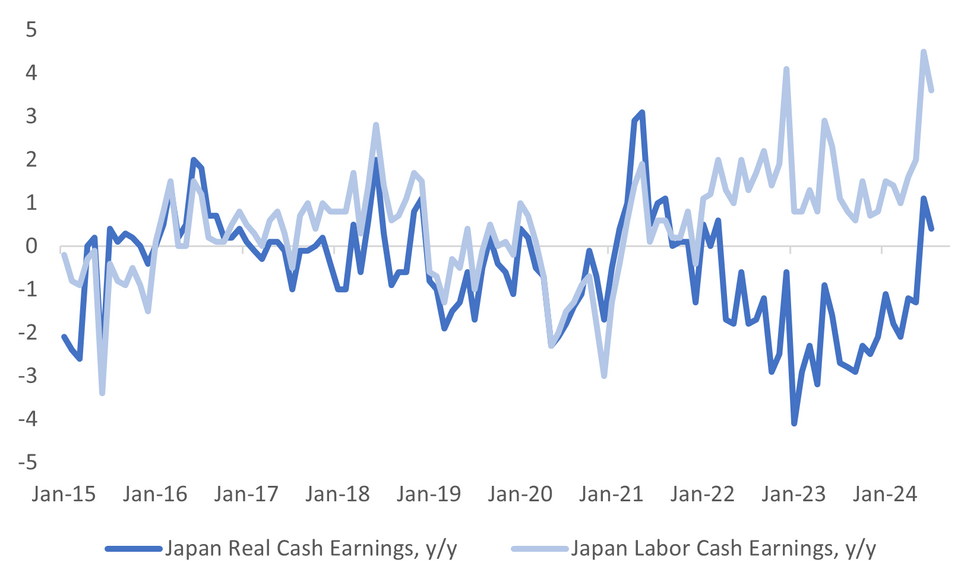

Fig. 1: Japan Wage Trends Y/Y

Source: MNI - Market News/Bloomberg

UK

POLITICS (BBC): “Former cabinet minister Priti Patel has been knocked out of the Conservative leadership contest in the first round of voting by Tory MPs. The former immigration minister Robert Jenrick topped the poll of MPs with 28 votes followed by Kemi Badenoch on 22 votes.”

EU

ECB (MNI): Bank Of Spain Chief Escriva Seen As Consensual, Dovish

FRANCE (FRANCE24): “President Emmanuel Macron remained undecided on Wednesday on the choice of his new prime minister, with Conservative Xavier Bertrand and the former Socialist prime minister Bernard Cazeneuve both seen as frontrunners. Analysts speculated on Wednesday that Michel Barnier, a right-winger and the EU’s former negotiator on Brexit, could also take on the role of premier, adding to the uncertainty.”

UKRAINE (POLITICO): “As Moscow’s forces advance in Ukraine’s east and Kyiv lobbies Western allies to use their missiles on Russian territory, top opposition figures accused Zelenskyy of increasingly staffing government posts with a coterie of close allies and loyalists in a bid to consolidate power around his office.”

FINANCE (EURONEWS): “Green securitisations could boost environmental lending by hundreds of billions of euros per year, France’s central bank governor said.”

US

FED (RTRS): “ The Federal Reserve needs to cut interest rates to keep the labor market healthy, but it is now down to incoming economic data to determine by how much, San Francisco Fed President Mary Daly said on Wednesday. "As inflation falls, we've got a real rate of interest that's rising into a slowing economy; that's a basic recipe for over-tightening," Daly told Reuters in an interview.”

FED (MNI BRIEF): A growing number of Federal Reserve districts reported stalled or slowing economic activity, while business contacts indicated they expect inflation to stay at current levels or decline further in the near term, the Fed's Beige Book said Wednesday.

CORPORATE (BBG): “US President Joe Biden is preparing to block Nippon Steel Corp.’s $14.1 billion takeover of United States Steel Corp., according to people familiar with the matter.”

CORPORATE (BBG): “Nvidia Corp., responding to a Bloomberg News report about the US Department of Justice sending out subpoenas as part of an antitrust probe, said it has been in contact with the government agency but hasn’t been subpoenaed.”

ELECTION (AP): “The Biden administration seized Kremlin-run websites and charged two Russian state media employees in its most sweeping effort yet to push back against what it says are Russian attempts to spread disinformation ahead of the November presidential election.”

OTHER

JAPAN (MNI BRIEF): Inflation-adjusted real wages, a barometer of households' purchasing power, stayed in positive territory in July for the second straight month, up 0.4% vs. 1.1% in June, 1% higher than market expectations, preliminary data released by the Ministry of Health, Labour and Welfare on Thursday showed.

JAPAN (MNI BRIEF): Bank of Japan board member Hajime Takata said on Thursday that the BOJ will raise the policy interest rate further if prices move in line with forecasts and solid capital investment and pass-through of cost increases are confirmed.

AUSTRALIA (MNI BRIEF): Reserve Bank of Australia Governor Michele Bullock has stressed the board could still hike rates should inflation not continue to moderate.

CANADA (MNI BRIEF): Canadian Liberal Prime Minister Justin Trudeau lost an agreement Wednesday with an opposition party to pass confidence votes like budgets, though NDP Leader Jagmeet Singh declined to say he will quickly seek to force an early election.

CANADA (MNI BOC WATCH): The Bank of Canada lowered interest rates for a third consecutive meeting on Wednesday and again signaled further moves can be justified given a broad inflation slowdown that officials see as creating a growing risk that prices fade too much.

CHINA

MORTGAGES (SHANGHAI SECURITIES NEWS): “Outstanding mortgages in six major state-owned banks reached CNY25.5 trillion by end-Q2, a net decline of CNY325.5 billion since the start of the year, as homeowners continued with early repayments, Shanghai Securities News reported, citing banks’ semi-annual reports.”

INFLATION (SECURITIES DAILY): “China’s CPI has likely accelerated in August due to bad weather and stable domestic demand, experts interviewed by the Securities Daily said. Minsheng Bank Chief Economist Wen Bin expects CPI to reach 0.7% y/y in August, as pork prices rose from mid-May due to farmers’ second fattening their herds and rainy weather disrupting pig transportation.”

STEEL (IRON & STEEL ASSOCIATION): “China’s steel industry should abandon its traditional model based on scale production as the sector no longer exhibits cyclical increases in demand, according to Luo Tiejun, vice president of the Iron and Steel Association.”

EQUITIES (BBG): “JPMorgan Chase & Co. abandoned its buy recommendation for Chinese stocks, citing heightened volatility around the upcoming US elections in addition to growth headwinds and tepid policy support.”

CHINA MARKETS

MNI: PBOC Net Drains CNY87.6 Bln via OMO Thursday

The People's Bank of China (PBOC) conducted CNY63.3 billion via 7-day reverse repos, with the rate unchanged at 1.70%. The operation led to a net drain of CNY87.6 billion after offsetting maturities of CNY150.9 billion, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6535% at 09:36 am local time from the close of 1.7095% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Wednesday, compared with the close of 48 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0989 on Thursday, compared with 7.1148 set on Wednesday. The fixing was estimated at 7.1023 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JULY TRADE SURPLUS A$6.009B; EST. +A$5.00B; PRIOR A$5.425B

AUSTRALIA JULY EXPORTS +0.7% M/M; PRIOR +1.4%

AUSTRALIA JULY IMPORTS -0.8% M/M; PRIOR +0.4%

NEW ZEALAND CORELOGIC HOME VALUES AUG. -0.5% M/M; PRIOR -1.0%

JAPAN JULY LABOR CASH EARNINGS +3.6% Y/Y; EST. +2.9%; PRIOR +4.5%

JAPAN JULY REAL CASH EARNINGS +0.4% Y/Y; EST. -0.6%; PRIOR +1.1%

JAPAN JULY CASH WAGES FROM SAME SAMPLE +4.8% Y/Y; EST. +3.2%; PRIOR +5.1%

JAPAN JULY SAME BASE REGULAR FULL-TIME PAY +3.0% Y/Y; EST. +2.8%; PRIOR +2.7%

SOUTH KOREA Q2 GDP -0.2% Q/Q,; EST. -0.2%; SAME AS PREVIOUS ESTIMATE

SOUTH KOREA Q2 GDP +2.3% Y/Y, EST. +2.3%; SAME AS PREVIOUS ESTIMATE

MARKETS

US TSYS: Tsys Little Changed Ahead Of Further Employment Data

- It has been a slow session for US tsys today, futures are off session highs and now trade little changed for the day. TUZ4 is trading at 104-02¾ vs 104-04 highs, while TYZ4 is 114-18 vs 114-22+ highs.

- The cash tsys curve has retraced some of the overnight bull-steepening move, yields are about 1bps higher. The 2yr is +0.8bps at 3.762%, with the 10yr also +0.8bps at 3.763%, the 2s10s is -0.069 at -0.345 after overnight un-inverting and hitting highs of 0.464.

- Earlier, the Fed's Daly stated that the Fed will need cut interest rates to maintain a healthy labor market, but the size of the cut will depend on incoming economic data. She emphasized the importance of avoiding overly tight policy, which could further slow the labor market, a scenario she finds undesirable. Daly expects the labor market to remain stable and continue expanding but is uncertain about the extent of the necessary rate cut.

- Fed funds was pricing in a 50/50 chance of the 50bps cut at the September meeting, before softening a touch into the close overnight. Projected rate cut pricing through year end vs Tuesday close levels: Sep'24 cumulative -36bp (-34.4bp), Nov'24 cumulative -72.6bp (-67.6bp), Dec'24 -110.3bp (-102.4bp).

- Later today we have Challenger Job Cuts, ADP private payrolls, nonfarm productivity, and weekly jobless claims. Additionally we get ISM Services (including its Employment component), and final August PMIs.

JGBS: Bull-Flattener After BoJ Takata & 30Y Supply

JGB futures are richer but well off the session high, +10 compared to settlement levels

- Outside of the previously outlined stronger-than-expected cash earnings data, the market has had a speech by BoJ board member Takata and 30-year supply to digest.

- (MNI) BoJ Takata said that the BoJ will raise the policy interest rate further if prices move in line with forecasts and solid capital investment and pass-through of cost increases are confirmed.

- However, Takata downplayed an imminent rate hike, saying the BoJ must monitor evolving market and economic conditions. “Developments of overseas economies following the rate hikes are the risk factor and the BoJ needs to monitor evolving conditions with high vigilance,” Takata told business leaders in Kanazawa City.

- Cash US tsys are ~1bp cheaper across benchmarks in today’s Asia-Pac session after yesterday’s solid post-data rally.

- The cash JGB curve has bull-flattened, with yields flat to 3bps lower after today’s 30-year supply. The 30-year supply was adequately absorbed, with the low price aligning with dealer expectations. The cover ratio remained steady, and the auction tail lengthened only slightly.

- Swap rates are little changed across the curve.

- Tomorrow, the local calendar will see Household Spending and Coincident & Leading Indices data alongside BoJ Rinban Operations covering 5-25-year+ JGBs.

AUSSIE BONDS: Richer But Off Bests After RBA Governor’s Speech

ACGBs (YM +3.0 & XM +2.0) are stronger but near Sydney session lows after RBA Governor Bullock’s Anika Lunch speech.

- Outside of the previously outlined merchandise trade surplus, RBA Governor Bullock stuck to her view that it is “premature to be thinking about rate cuts” despite Treasurer Chalmers saying that current rates were “smashing the economy”, which she didn’t comment on.

- Her tone was unchanged from the August 6 meeting and press conference that underlying inflation is moderating slower than the Board expected and its priority remains to bring it down while preserving job gains, as it hurts everyone and disproportionately those on low incomes.

- Cash US tsys are ~1bp cheaper across benchmarks in today’s Asia-Pac session after yesterday’s solid post-data rally.

- Cash ACGBs are 2-3bps richer, with the AU-US 10-year yield differential at +16bps.

- Swap rates are 3bps lower.

- The bills strip is still holding a bull-flattener, with pricing flat to +4.

- RBA-dated OIS pricing is little changed across meetings. A cumulative 19bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Home Loans and Foreign Reserves data.

NZGBS: Richer But Mid-Range

NZGBs closed mid-range, with benchmark yields 3-6bps lower and the 2/10 curve steeper.

- The key data today was CoreLogic house values. NZ’s housing market began to recover in H2 '23 with a pickup in transactions and prices, but it has been deteriorating again over 2024 as affordability remains stretched and sentiment soft. Residential building consents are on the RBNZ’s list of higher frequency indicators, and they remain weak, weighing on overall growth. A further deterioration in residential property could drive larger-than-expected monetary easing.

- Unlike Australia, increased demand from immigration doesn’t appear to have sustainably boosted house prices. Like Australia though, it has put pressure on rents with NZ Q2 CPI rents +4.8% y/y, the highest rate since the series began in 2000.

- Today’s weekly supply saw adequate demand, with cover ratios ranging from 1.86x (may-34) to 2.61x (May-30) across the lines.

- Cash US tsys are ~1bp cheaper across benchmarks in today’s Asia-Pac session after yesterday’s solid post-data rally.

- Swap rates closed 3-7bps lower.

- RBNZ dated OIS pricing closed 2-7bps softer, led by mid-2025 meetings. A cumulative 77bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Q2 Volume of All Buildings data.

FOREX: USD/JPY Can't Sustain Post Wages Dip, Central Bank Speak In Focus

At this stage, G10 FX changes are very limited versus end Wednesday levels in the US. The USD BBDXY index is unchanged, just under 1233.00 at the time of writing.

- USD/JPY dipped as far as 143.19 in the first part of trade, as we saw much stronger than expected July wages data. The second positive y/y gain for real earnings bodes well for the consumption outlook. This dip was fresh lows back to August 5, but the pair quickly recovered ground. We were last 143.70, little changed for the session.

- BoJ board member Takata stated further rate hikes could occur if data outcomes align with the central banks forecasts. Takata also stated that the fallout from the early August moves needs to be assessed. This hints at no policy changes in the near term. The next BoJ meeting is on the 20th of September.

- Both AUD and NZD are steady. The A$ is near 0.6720. We heard from RBA Governor Bullock, but not a lot was learned about the monetary policy outlook compared to earlier comments. Fresh lows in iron ore haven't impact AUD sentiment.

- NZD/USD was soft in early trade, but from lows sub 0.6180 we have rebounded back to 0.620, little changed for the session.

- In the cross asset space, US equity futures have weakened this afternoon, although losses are currently in the 0.10-0.20% range. These shifts didn't impact FX sentiment though. US yields have ticked higher, but gains are not much beyond 1bps at this stage. US Fed San Francisco head Daly stated in an interview with Reuters that rates will come down, but upcoming data outcomes will determine the magnitude of the move.

- Looking ahead, euro area July retail sales and German factory orders are due. In the US, August Challenger job cuts and ADP employment, services/composite PMI/ISM, jobless claims and Q2 final productivity/ULC are all due.

ASIA STOCKS: APAC Equities Off Earlier Highs As Tech Stocks Slip

Asian stocks trimmed earlier gains, and US futures dipped as with Nasdaq futures leading the way as Asian tech stocks ticked lower while traders await more jobs data due later today. The MSCI Asia Pacific Index erased most of its 0.8% rise, with Japan's Nikkei 225 down over 1% while benchmarks in China, Hong Kong and South Korea have also turned lower, Australian & New Zealand tech stocks are higher following Blackstone announcing they are buying Airtrunk in a A$26b deal. Markets remain cautious, particularly due to concerns about AI hype, with Nvidia facing its largest two-day decline since October 2022. JPMorgan downgraded Chinese stocks, citing weak policy support and potential volatility ahead of the US election. Traders are closely watching the US jobs report, which could influence the Fed’s rate cuts later this month.

- China & Hong Kong: CSI300 +0.10%, Banks are the worst performing with CSI 300 Bank Index -0.40%, while Property is the best with the CSI 300 Real Estate Index +1.70%. The HSI is -0.45%, HS Mainland Banks -1.18%, HSTech is -0.40% while HSProp is +1.65%.

- South Korea: Samsung is -0.30%, Sk Hynix is 2.33% after being up over 4% earlier, this follows a 8% drop on Wednesday. The KOSPI is -0.43% while the KOSDAQ is -1.53%.

- Taiwan: TSMC is +1.30%, Hon Hai is -1.90% while the Taiex is -1.10%

- Australia & New Zealand: ASX 200 is 0.16%, with Financials contributing the most to gains, while Tech stocks also trade higher. The NZX 50 is +0.67%.

- In Asia EM, the Thai SET is the top performer up 2%, with most other markets trade little changed.

OIL: Crude Holding Onto Losses, EIA US Stock Data Out Later

Crude has held onto this week’s losses with only a small increase during today’s APAC trading. It has lost the gains made over the last 12 months. WTI is up 0.4% to $69.45/bbl off the intraday high of $69.69, while Brent is 0.3% higher at $72.95/bbl after rising to $72.85. The USD index is little changed.

- There have been comments from some OPEC delegates that the start of output cut reductions is likely to be delayed but this news has been unable to support prices. Markets are likely to want to hear a definite decision from the group before beginning to recover, especially given concerns re the demand outlook.

- Bloomberg reported that US crude inventories fell 7.4mn barrels last week, according to people familiar with the API data. Gasoline stocks fell 300k and distillate 400k. The official EIA data is out later today but has been showing steady crude drawdowns since the start of July.

- Later there are US August Challenger job cuts and ADP employment, services/composite PMI/ISM, jobless claims and Q2 final productivity/ULC, as well as euro area July retail sales and German factory orders. The ECB’s Tuominen speaks. Friday’s US payrolls data are a focus for crude markets as they await Fed easing to support demand.

GOLD: Steady Despite Speculation Of A 50bp Cut In September

Gold is broadly unchanged at $2,496/oz over the past 24 hours.

- This occurred despite a sizeable rally in US Treasuries, as soft US job openings data rekindled speculation of a 50bp Fed cut two weeks from now.

- With Friday's crucial nonfarm payrolls report intensifying the focus on labour market indicators, the July JOLTS report saw job openings fall to 7.673m (cons 8.10m) in July after a downwardly revised 7.91m (initial 8.184m) in June.

- Adding to the dovish tone was a BoC rate cut (as expected) and a Fed Beige Book that highlighted softer economic activity alongside moderating inflation and employment.

- For the first time since mid-August, the US STIR market briefly showed around 50/50 implied probability of a 50bp cut in September - with 112bps of total cuts this year - though those extremes faded by a couple of basis points (last 36bps, i.e. 44% prob of 50bp Sept cut, and 110bps respectively).

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, the trend in gold remains bullish with a focus on $2,536.4 next, a Fibonacci projection. Initial support to watch lies at $2,485.4, the 20-day EMA, which has been pierced.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/09/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 05/09/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/09/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 05/09/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 05/09/2024 | 0830/0930 |  | UK | BOE DMP Data | |

| 05/09/2024 | 0900/1100 | ** |  | EU | Retail Sales |

| 05/09/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/09/2024 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/09/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 05/09/2024 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 05/09/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/09/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 05/09/2024 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 05/09/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 05/09/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.