-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN OPEN: JGB 10yr Yield Sub 200-Day Moving Average

EXECUTIVE SUMMARY

- TRUMP DISQUALIFIED FROM 2024 BALLOT IN COLORADO, COURT SAYS - BBG

- FED’S GOOLSBEE SAYS MARKET IS GETTING A LITTLE AHEAD OF ITSELF - FOX NEWS

- FRANCE AND GERMANY SEE EU DEAL ON FISCAL RULES ON WEDNESDAY - BBG

- JAPAN NOV EXPORTS FALL, FIRST IN THREE MONTHS - MNI BRIEF

- PRODUCTIVITY, WAGES KEEP PRESSURE ON RBA - EX OFFICIALS - MNI

- CHINA'S DEC LOAN PRIME RATE UNCHANGED - MNI BRIEF

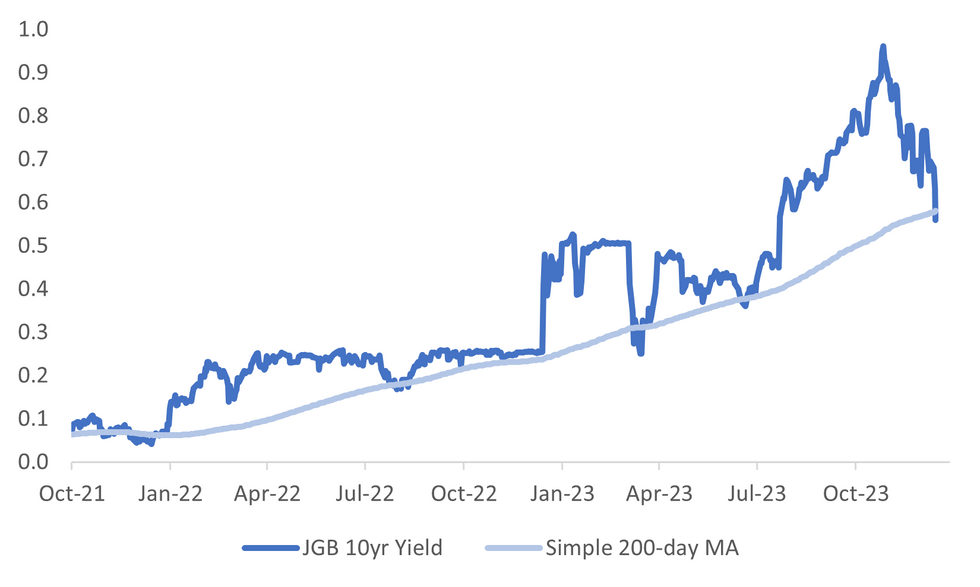

Fig. 1: JGB 10yr Yield

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): UK Prime Minister Rishi Sunak’s governing Conservative Party faces the prospect of a testing special election next year after a sitting former Tory lawmaker’s constituents voted to oust him following a suspension for bullying.

MARKETS (BBG): The UK’s finance regulator set out its latest plans to simplify its listings regime and revive interest in London’s stock markets. The Financial Conduct Authority confirmed on Tuesday it will replace the standard and premium listings rules with one set of “streamlined eligibility and ongoing requirements,” in keeping with proposals announced in May.

EUROPE

FISCAL (BBG): The finance ministers of the European Union’s two biggest economies said they are confident they will reach a deal on new fiscal rules with their counterparts from the bloc at a virtual meeting on Wednesday.

SPAIN (BBG): The Spanish government plans to buy a stake in Telefonica SA worth as much as $2.2 billion, a bid to safeguard one of the nation’s most strategic assets as Saudi Arabia builds up its own position in the company.

U.S.

POLITICS (BBG): Donald Trump was barred from the presidential primary ballot in Colorado, as that state’s highest court became the first to say he had forfeited his right to run for re-election by inciting the Jan. 6 attack on the US Capitol. Colorado’s Supreme Court issued the ruling Tuesday, but paused its effect to allow time for Trump to appeal to the US Supreme Court. Trump’s campaign said he would appeal. He has until Jan. 4, under the state court’s ruling.

MIDEAST (BBG): The US and its allies are considering possible military strikes against Houthi rebels in Yemen, in a recognition that a newly announced maritime task force meant to protect commercial ships in the Red Sea may not be enough to eliminate the threat to the vital waterway.

FED (MNI INTERVIEW): Federal Reserve officials are likely to begin cutting interest rates around the middle of next year to ensure monetary policy does not tighten as inflation falls, though market bets on March cuts are overdone, former St. Louis Fed President James Bullard told MNI.

FED (FOX NEWS/BBG): Federal Reserve Bank of Chicago President Austan Goolsbee said the market may be getting ahead of itself when it comes to rate cuts, adding that such easing will only be justified if inflation continues to cool toward the central bank’s target.

FED (BBG): Federal Reserve Bank of Atlanta President Raphael Bostic said he doesn’t expect there will be urgency to lower rates next year, emphasizing that the US central bank must be resolute and patient as officials assess their next policy move.

CORPORATE (DJ): We've said this over and over again over the last few quarters: We're focused on the things that we can control,' CEO says. Shares of FedEx Corp. dropped in after-hours trading Tuesday after the package-delivery giant trimmed its full-year sales forecast, amid continued concerns about subdued shipping demand through the peak holiday season.

US/CHINA (RTRS): The United States has added 13 companies in China to a list of entities receiving U.S. exports that officials have been unable to inspect, according to a government notice posted on Tuesday. Companies are placed on the "Unverified List" when U.S. export control officers cannot complete on-site visits to determine whether they can be trusted to receive U.S.-origin technology and other goods. U.S. inspections of Chinese companies require the approval of China's commerce ministry.

OTHER

JAPAN (MNI BRIEF): Japan's exports posted their first y/y drop in November due to slowing exports of automobiles, down 0.2% in November vs +1.6% in October, data released by the Ministry of Finance showed on Wednesday.

AUSTRALIA (MNI): Persistent wage growth and sluggish productivity remain a risk to the Reserve Bank of Australia’s hopes of trying to pull inflation back to its 2-3% target band in a timely manner, potentially staying its hand on rate cuts in 2024 despite a slowing economy, former officials and advisors told MNI.

NEW ZEALAND (BBG): New Zealand’s new government has a “single-minded” focus on slowing inflation so that interest rates can begin to fall, Prime Minister Christopher Luxon said in an interview during his first official visit abroad since taking office.

NEW ZEALAND (BBG): New Zealand’s government is pledging to cut spending and return the budget to surplus even as economic growth slows and it faces the extra cost of paying for tax cuts from the middle of next year.

NEW ZEALAND (BBG): New Zealand’s central bank was surprised by data last week showing the economy shrank, but has no opinion yet on what it means for the interest rate outlook, according to Governor Adrian Orr.

ISRAEL (BBG): Israeli President Isaac Herzog told ambassadors from around the world the country is prepared to agree to a second humanitarian pause in fighting in exchange for the return of more hostages held by Hamas.

CHINA

RATES (MNI BRIEF): China's Loan Prime Rate remained unchanged on Wednesday according to a People's Bank of China statement, in line with market expectation following the PBOC's decision to keep a key policy rate steady on Dec 15.

POLICY (SECURITIES TIMES): China is likely to ramp up both fiscal and monetary policy support for the economy next year, a Securities Times report cited experts as saying.

MARKETS (SHANGHAI SECURITIES): The number of companies seeking pre-IPO guidance has surged in December, with many of them planning to list on the Beijing stock exchange, according to a Shanghai Securities News report.

CHINA/EU (BBG): When the European Union launched a probe into Chinese support for electric vehicles, the bloc’s carmakers braced for painful retaliation from the increasingly assertive superpower.

CHINA MARKETS

MNI: PBOC Injects Net CNY20 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY134 billion via 7-day reverse repo and CNY151 billion via 14-day on Wednesday, with the rates unchanged at 1.80% and 1.95%, respectively. The reverse repo operation has led to a net injection of CNY20 billion reverse repos after offsetting CNY265 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8225% at 09:32 am local time from the close of 1.7660% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 48 on Tuesday, compared with the close of 50 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.0966 Wednesday vs 7.0982 on Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0966 on Wednesday, compared with 7.0982 set on Tuesday. The fixing was estimated at 7.1314 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND DEC ANZ CONSUMER CONFIDENCE INDEX 93.1; PRIOR 91.9

NEW ZEALAND DEC ANZ CONSUMER CONFIDENCE M/M 1.3%; PRIOR 4.3%

AUSTRALIA NOV WESTPAC LEADING INDEX M/M 0.07%; PRIOR -0.04%

JAPAN NOV TRADE BALANCE -¥776.9BN; MEDIAN -¥1000.1BN; PRIOR -¥661.0BN

JAPAN NOV TRADE BALANCE ADJUSTED -¥408.9BN; MEDIAN -¥768.9BN; PRIOR -¥501.3BN

JAPAN NOV EXPORTS Y/Y -0.2%; MEDIAN 1.4%; PRIOR 1.6%

JAPAN NOV IMPORTS Y/Y -11.9%; MEDIAN -8.6%; PRIOR -12.5%

CHINA DEC 5-YEAR LPR 4.20%; MEDIAN 4.20%; PRIOR 4.20%

CHIAN DEC 1-YEAR LPR 3.45%; MEDIAN 3.45%; PRIOR 3.45%

MARKETS

US TSYS: Marginally Richer, Narrow Ranges In Asia

TYH4 deals at 112-16, +0-02, a range of 0-05 has been observed on volume of ~44k.

- Cash tsys sit ~2bps richer across the major benchmarks.

- Tsys have firmed in Asia today operating in narrow ranges for the most part. The space trimmed its losses seen in yesterday's NY session, participants perhaps used the opportunity to close short positions/add fresh longs.

- Chicago Fed President Goolsbee noted this morning that the market may be getting ahead of itself when it comes to rate cuts, adding that such easing will only be justified if inflation continues to cool toward the central bank’s target (BBG).

- CPI data from the UK provides the highlight in Europe today, further out we have Nov Home Sales and Consumer Confidence. We also have Fedspeak from Atlanta Fed President Bostic and Chicago Fed President Goolsbee due.

JGBS: Futures Pushing Higher, 10yr Yield Sub 200-day MA

JGB futures sit sub session highs, but have maintained a positive bias through the session. We were last 146.93, +.74 for JBH4. Highs came in at 147.10, while earlier dips sub 146.80 drew support. Volumes have been over 34.5k.

- Some mild support has been evident from firmer US Tsy futures, with TYH4 last at 112-16+, +02.

- The 10yr cash JGB yield sits near 0.56% in latest dealings, sub its simple 200-day MA (0.574%). We are down 7bps for the session in yield terms. We are off by a similar amount in yield terms for the 7yr, and 20-40yr tenors.

- 10yr swap rates sit near 0.77%, off by around 2.5bps.

- The data calendar had Nov trade figures and condominium sales, which haven't shifted sentiment.

- Tomorrow, we have weekly offshore investment flows, but the main focus will be on Friday's Nov National CPI print.

AUSSIE BONDS: Richer On Wednesday

ACGB's have ticked higher on Wednesday, improving risk sentiment and a post-BOJ bid in JGBs which spilled over to the wider space have added support.

- Futures are marginally firmer however XM and YM remain well within recent ranges.

- November Westpac Leading Index printed at 0.07%, the prior read was -0.03%.

- Domestic newsflow was limited today with no news of note crossing.

- The next data of note is Friday's November Private Sector Credit, a reminder that there are no RBA speakers scheduled for this week.

NZGBs: Curve Flattens On Wednesday

NZGBs have finished dealing 1bp cheaper to 5bps richer across the major benchmarks, the curve has twist flattened pivoting on 5s.

- An uptick in US Tsys has provided a level of support to the belly and long end of the curve today.

- Rising Oil prices and an uptick in ANZ Consumer Confidence perhaps weighed on the short end which underperformed today.

- The New Zealand Government pledged to cut spending and return the budget to surplus in 2024 despite a slowdown in economic growth, in its half-year economic and fiscal outlook.

- A reminder that the local docket is empty for the remainder of the week.

FOREX: Muted Asian Session Across G-10

It has been a muted Asian session across G-10 FX on Wednesday, ranges have been narrow for the most part with little follow through on moves. Cross asset wise; US Tsy Yields are a touch lower as is BBDXY.

- The Yen has continued to trim some of yesterday's post BOJ losses however USD/JPY remains well within recent ranges. The pair sits ~0.2% lower today last printing at ¥143.50/55 as the downtick in US Tsy Yields adds a level of support for the Yen. Resistance is at ¥145.26 76.4% retracement of the Dec 11 - 14 sell-off. Support comes in at ¥142.25 Dec 19 low.

- AUD/USD is ~0.1% firmer and is testing Tuesday's session highs. The uptrend in AUDUSD remains intact, bulls target break of resistance at the $0.6800 handle and $0.6821, the Jul 27 high.

- Kiwi is also a touch firmer, NZD/USD has broken Tuesday's high and has continued to tick higher albeit in a narrow range. Bulls focus on the $0.63 handle.

- There are no other moves of note in the space.

- UK CPI provides the highlight of today's European session.

EQUITIES: Asia Pac Markets Higher, But China Underperforms

Asia Pac markets are tracking higher following a positive lead from US/EU markets in Tuesday trade. The main exception is China bourses, which are weaker into lunchtime break. US futures are modestly higher in the first part of Wednesday trade, but overall moves have been modest. Eminis sit near 4822, while Nasdaq futures are near 17037.

- At break, the CSI 300 is off just over 0.5%, putting the index (3316.5) close to recent cyclical lows. We saw LPRs held steady as expected, while developer China South City avoided a dollar bond default (SCMP).

- Still, flows into an ETF which tracks EM stocks (ex China) has surged in recent months (see this BBG link). Investors may still be reluctant to move into China markets given growth and policy stimulus uncertainties.

- Hong Kong markets have performed better. The HSI is up 1% at the break. A leadership restructure at Alibaba has improved sentiment in the company and aided broader sentiment.

- Japan markets are in positive territory, but away from best levels. Toyota has trimmed gains after it suspended shipments from subsidiary Daihatsu, after safety testing issues (see this BBG link).

- The Kospi has broken higher, up nearly 1.7%, buoyed by generally positive tech sentiment/soft landing optimism. The Taiex is lagging up 0.30% at this stage.

- In SEA, markets are tracking higher, but gains are under 1%.

OIL: Largely Holding Week To Date Gains

Brent crude has drifted a touch lower in the first part of Wednesday trade, but overall ranges have been tight. We last sat near $79.10/bbl, a touch below recent highs ($79.65-70/bbl). This follows cumulative gains of nearly 3.50% through Mon-Tues trade this week. WTI was last near $73.45/bbl, having followed a similar trajectory to Brent for the session.

- Reuters headlines crossed earlier, stating that US crude oil and fuel inventories reportedly rose last week according to sources. This comes ahead of the EIA data later today in the US.

- It would also fit with various time spreads, which continue to show a reasonable supply backdrop for Brent and WTI into the first part of 2024.

- The Red Sea situation remains the other focus point. The US and allies are reportedly considering military strikes on Houthi militants based in Yemen. The Houthis warned the US they will be legitimate targets if they interfere in its ongoing operations against Israel-linked vessels.

- A new OPEC+ meeting is possible in the near future for the group to discuss the market situation but currently there is no need for new decisions, Russia Dep. PM Novak said, cited by Interfax.

GOLD: Holding Close To Recent Highs

Gold has largely tracked sideways through the first part of Wednesday trade. We last sat near $2040.5, little changed versus end Tuesday levels. We did see a brief dip to sub $2037, but this was supported. Early gains above $2041 also couldn't be sustained.

- A fairly contained session for gold matches with other macro variables. The BBDXY USD index is steady near 1223, while US Tsy Futures have shown a modestly firmer bias. US equity futures sit a touch higher.

- The broader technical backdrop for gold still looks positive. Recent resistance has been evident on moves into the $2045-2050 range. A break above this level could see $2054 targeted, which is a 50% retracement of the earlier Dec pull back.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/12/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/12/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 20/12/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 20/12/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 20/12/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 20/12/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 20/12/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 20/12/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/12/2023 | 1330/0830 | * |  | US | Current Account Balance |

| 20/12/2023 | 1400/1500 |  | EU | ECB Lane Speech On Euro Area Outlook | |

| 20/12/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/12/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 20/12/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/12/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 20/12/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/12/2023 | 1830/1330 |  | CA | BOC minutes from last rate meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.