-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese GDP Beats, U.S. Holiday Saps Liquidity

EXECUTIVE SUMMARY

- TRUMP SLAMS HUAWEI, HALTING SHIPMENTS FROM INTEL & OTHERS (RTRS SOURCES)

- LASCHET ELECTED LEADER OF MERKEL'S CDU PARTY (BBC)

- BOJ TO MULL WIDENING LONG-TERM YIELD BAND, JIJI SAYS (BBG)

- BIDEN PLANS IMMEDIATE EXECUTIVE ACTIONS TO ROLL BACK TRUMP ERA (CNBC)

- CHINA GDP BEATS EXP.

- YELLEN TO MAKE CLEAR U.S. DOESN'T SEEK WEAK DOLLAR (WSJ SOURCES)

- SOME WORRY EVIDENT RE: ELDERLY DEATHS IN NORWAY AFTER TAKING PFIZER COVID VACCINE

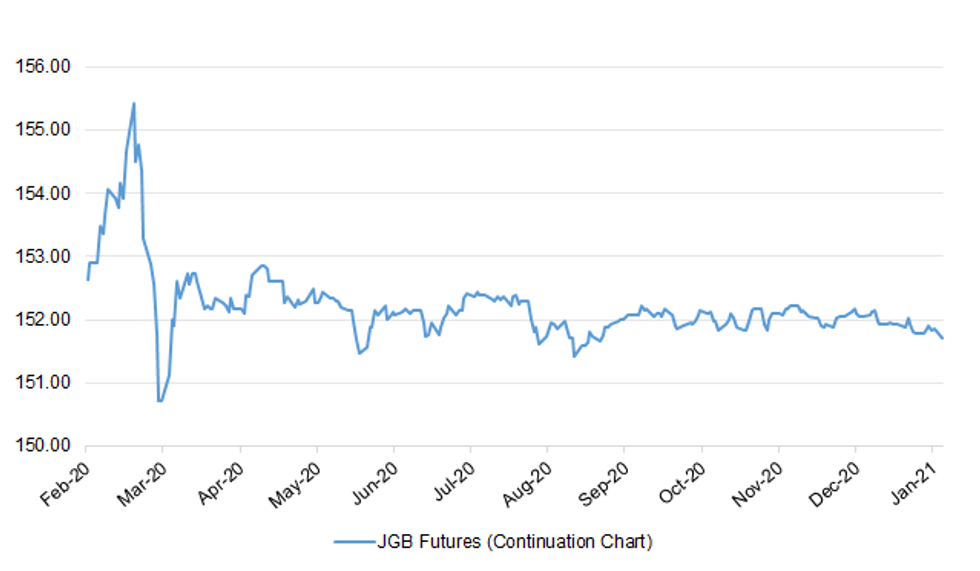

Fig. 1: JGB Futures (Continuation Chart)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The U.K. reported another 38,598 cases on Sunday, the fewest since Dec. 27. Reporting is often lower on weekends, however. Fatalities, at 671, were also below the average of 1,100 over the previous seven days. Hospitalizations continued to rise with 37,475 patients as of Jan. 14. (BBG)

CORONAVIRUS: The number of people in hospital with Covid-19 has 'well exceeded' that of the first peak last April, according to the latest government data. Professor Chris Whitty told a Downing Street press conference on Friday that the amount of people in hospital with the virus is higher than ever. The Chief Medical officer warned that deaths contributed to by Covid-19 will continue rise into next week. "I'm afraid in the next week we do anticipate the number of people in the NHS and the number of deaths will continue to rise as the effects of what everyone has done continue to feed through," he said. Prof Whitty said the peak of people entering hospital will be in the next week to 10 days for most places across the UK. He said he 'hoped' that the peak of infections had already happened in the south-east, east, and London where there was a surge in the variant. (Manchester Evening News)

CORONAVIRUS: Covid-19 restrictions will not start to ease until March, and only if Britain's vaccination programme stays on track, foreign secretary Dominic Raab said on Sunday. Mr Raab told Sky News the government wanted to end the national lockdown as soon as possible. "By early spring, hopefully by March, we'll be in a position to make those decisions," he said. "I think it's right to say we won't do it all in one big bang. As we phase out the national lockdown, I think we'll end up phasing through a tiered approach." (FT)

CORONAVIRUS: Removing Covid restrictions before March would be a disaster in the battle against coronavirus and would risk putting the NHS under enormous pressure if lifted prematurely, a leading epidemiologist has said. Prof John Edmunds, a member of the Scientific Advisory Group for Emergencies, said Boris Johnson would be very unwise to ease lockdown curbs before the majority of the public has received vaccinations. (Guardian)

CORONAVIRUS: Every adult in Britain will be vaccinated by the end of June, senior Government figures hope, as they grow increasingly optimistic they will be able to accelerate the rollout. (Telegraph)

CORONAVIRUS: Mass testing of entire regions is being considered by ministers to help get the country out of lockdown, it has emerged. (Telegraph)

CORONAVIRUS: The UK is to close all travel corridors from Monday morning to "protect against the risk of as yet unidentified new strains" of Covid, the PM has said. Anyone flying into the country from overseas will have to show proof of a negative Covid test before setting off. It comes as a ban on travellers from South America and Portugal came into force on Friday over concerns about a new variant identified in Brazil. Boris Johnson said the new rules would be in place until at least 15 February. (BBC)

CORONAVIRUS: Ministers have ordered plans to be drawn up for a fresh crackdown at Britain's borders to stop new variants of the coronavirus undermining the vaccination effort. Officials have been told to prepare for the creation of quarantine hotels for those arriving in Britain and to use GPS and facial-recognition technology to check that people are staying in isolation. (Sunday Times)

CORONAVIRUS: The U.K. government is considering all possible measures to fight the potential spread of new variants of coronavirus, Foreign Secretary Dominic Raab said. Speaking to Sky News on Sunday, Raab said border checks would be strengthened and refused to rule out setting up quarantine hotels for those arriving in Britain. (BBG)

BREXIT: Brussels' refusal to grant UK financial services access to the single market will force Britain to diverge from EU rules after Brexit, industry sources have warned. (Telegraph)

BREXIT: A Scottish fishing lobby group that once hailed Brexit as an opportunity slammed U.K. Prime Minister Boris Johnson's trade accord with the European Union, labeling it a "desperately poor deal" for fishermen. (BBG)

BREXIT: Boris Johnson will hold talks with business leaders today about cutting red tape as ministers draw up plans to turn Britain into the "Singapore of Europe" now that it has left the European Union. The prime minister will speak to 30 senior leaders about topics such as "regulatory freedoms" and reforming EU rules. Rishi Sunak, the chancellor, has been charged by Mr Johnson with leading a cross-Whitehall committee which will require departments to closely examine which regulations can be reformed. (The Times)

FISCAL: Rishi Sunak is drawing up plans to increase corporation tax in his March budget to help to balance the books as concern mounts that Britain's debt is unsustainable. The chancellor is considering partially reversing cuts made by George Osborne when he was chancellor, under which corporation tax has fallen from 28 per cent to 19 per cent. (The Times)

FISCAL: Following talks with Boris Johnson over the past week, the chancellor is expected to use the budget on March 3 to announce an extension of government support, including the furlough and business loan schemes. Contrary to some reports, he is also considering an extension to stamp duty cuts and an increase in benefits. But senior government sources say that, if the coronavirus vaccination programme remains on track, the chancellor will also begin to plug the yawning deficit in the public finances. (Sunday Times)

FISCAL: Rishi Sunak, the Chancellor, is under pressure to slash taxes to promote the Government's "levelling up" agenda and prolong the stamp duty holiday to help homebuyers who risk an extra tax bill in April. Council tax should be a key target for reform, according to the think tank Onward in research for the Levelling Up Taskforce, which counts 65 "red wall" MPs among its backers. (Telegraph)

FISCAL: The £20 weekly uplift in Universal Credit could still be extended beyond March under plans favoured by work and pensions ministers, The Daily Telegraph understands. (Telegraph)

FISCAL: Rishi Sunak has drawn up plans to give nearly six million people a one-off £500 benefit payment in an attempt to stave off a revolt over universal credit. (The Times)

FISCAL: A financial support scheme for airports in England will open this month, the government says, as the aviation sector faces new Covid travel curbs. Aviation minister Robert Courts said the move was a response to the closure of all UK air corridors from Monday. The aim was to provide grants by the end of this financial year, he said. (BBC)

FISCAL: Eurostar is on track for a financial collapse that risks cutting off a vital link to the Continent as the pandemic subsides, business leaders and MPs have warned the Chancellor. Rishi Sunak is also this weekend facing public calls to bail out the Channel Tunnel operator after repeatedly rejecting private appeals for taxpayer support. Eurostar has been left fighting for survival after travel restrictions triggered a 95pc plunge in passengers since March 2020. It has pared operations to just two services-a-day as it scrambles to preserve cash. (Telegraph)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed the UK at AA-; Outlook Negative

EUROPE

ECB: The European Central Bank is threatening to impose additional capital requirements on banks that continue to ignore requests to rein in risk in the booming leveraged loan market. Policymakers are increasingly frustrated by the lack of action to tighten risk controls in the market at some European lenders, which they fear could lead to repayment problems if interest rates rise. If industry practices do not change, the EU regulator "won't hesitate to impose capital add-ons" through its annual Supervisory Review and Evaluation Process process, said a person familiar with internal discussions. (FT)

CORONAVIRUS: EU governments struggling with the slow rollout of coronavirus vaccines hit out at plans by Pfizer to delay supplies to Europe from next week. Germany expressed regret and six Nordic and Baltic states noted their "severe concern about the sustainability and credibility of the vaccination process" following the decision. (FT)

CORONAVIRUS: The European Investment Bank wants to give financial support to regional Covid-19 vaccine makers for the expansion of their production capacities, EIB President Werner Hoyer said in an interview with Welt. (BBG)

FRANCE: France reported 16,642 new cases on Sunday, the lowest daily increase in six days and less than the previous seven-day rolling average of infections of 18,148. Total cases are now 2.91 million. Deaths linked to the virus rose by 141 in the past 24 hours, to 70,283, according to data from health authorities. Separately, the health ministry said 422,127 people have been vaccinated since Dec. 26, with those over the age of 75 eligible for inoculation starting Monday. (BBG)

FRANCE: France is "very reluctant" to back any move by the European Union to create vaccination passports that would allow people who have been inoculated against Covid-19 to travel, Clement Beaune, junior minister for European Affairs, told France Info radio on Sunday. "It's premature" to discuss using a document of this type to allow travel within Europe, at least until the vaccine is widely available, he said. (BBG)

GERMANY: Centrist Armin Laschet has been elected leader of Germany's Christian Democrats (CDU), the party of Chancellor Angela Merkel. Mr Laschet, premier of North Rhine-Westphalia state, defeated two rivals in the party's virtual conference. He is now in a good position in the race to succeed Mrs Merkel when she steps down as German chancellor in September, after 16 years in office. But he faces a changed political landscape following the Covid pandemic. (BBC)

GERMANY: The German chancellery wants to impose a nationwide night-time curfew to try to contain the spread of the coronavirus, Business Insider reported, citing unidentified people with knowledge of the decision. The country's states have in principle agreed to a curfew, the people said, as they prepare for consultations scheduled for Jan. 19 on new pandemic measures, Business Insider said. They haven't yet decided the hours of the curfew, which may only be implemented if certain infection levels are exceeded. Tighter face-mask requirements are also being considered, according to the report. (BBG)

ITALY: Italian Prime Minister Giuseppe Conte risks emerging weakened from a parliamentary showdown this week even if he can muster enough votes to hold on to power. Conte faces a confidence vote in the lower house on Monday, which he's likely to win, but may face a similar vote in the Senate on Tuesday, where he has less room for maneuver after former ally Matteo Renzi withdrew his backing. Conte needs about a dozen more votes in the Senate to restore an outright majority in the 321-strong upper chamber after the defection of Renzi's group. (BBG)

ITALY: Italy reported 12,545 new cases Sunday, down from 16,310 a day earlier. The number of hospitalized patients fell for a fifth day, reaching 25,260, the lowest since Nov. 4. Patients in intensive-care units are also at the lowest since early November. The country reported 377 deaths linked to Covid-19, down from 475 on Saturday. Italy has reached 1,123,021 vaccination doses and started second shots Sunday. (BBG)

ITALY: U.S. drugs firm Pfizer has told Italy it will cut its deliveries of vaccine shots against the novel coronavirus by 29% starting from Monday, the country's COVID-19 special commissioner Domenico Arcuri said. Arcuri said Pfizer had informed Rome it was not able to foresee for how long it would be curtailing its supplies compared to what had been planned and by how much. (RTRS)

ITALY: Italy's government expects debt to rise more than expected this year, as it gets ready to boost fiscal stimulus to support its battered economy. The Treasury, led by Finance Minister Roberto Gualtieri, expects Italy's debt to rise to 158.5% of output in 2021, up from 155.6%, while the country's budget deficit would be 8.8%. The new forecasts, first reported by Corriere della Sera, reflect the struggle of the eurozone's third-biggest economy amid a resurgent coronavirus outbreak and a deepening political crisis. (BBG)

ITALY: Banca Monte dei Paschi di Siena SpA expects to get 2 billion euros ($2.4 billion) to shore up its balance sheet this year and forecast a return to profitability in 2022, part of a five-year plan the troubled Italian lender plans to submit to the country's regulator. The bank expects to report a loss of 562 million euros for this year and post net income of 41 million euros next year, rising to 559 million euros in 2025. More than 1,500 jobs will be eliminated, the bank said late Friday. (BBG)

IRELAND: Ireland expects coronavirus hospitalizations to peak "in the next week or two," Health Minister Stephen Donnelly told state broadcaster RTE Radio, even as the nation ramps up its vaccination program. (BBG)

AUSTRIA: Austria will extend its COVID-19 lockdown, with the goal to start easing restrictions from Feb. 8, the government said on Sunday. The catering sector and tourism will not be able to reopen in February, it added. (RTRS)

SWEDEN: Sweden's Prime Minister Stefan Lofven has said he can't rule out further restrictions under a temporary new law to combat the spread of the coronavirus pandemic. "But I hope we won't need to use it," he said during an interview on state broadcaster SVT on Sunday evening. The law, which runs from January until September, gives Lofven's government the right to shutter businesses and fine citizens that fail to comply with tougher restrictions. (BBG)

NORWAY: The Norwegian government is introducing mandatory testing at the border from Monday, it said in a statement on its website. Anyone who has been in area that requires a period of quarantine must be tested at the border crossing point if they wish to enter Norway. Previously there was a 24-hour window to have the test completed. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- DBRS Morningstar confirmed Slovenia at A (high), Stable Trend

U.S.

FED: Inflation could be rising but there isn't much risk of it getting out of control, said Minneapolis Federal Reserve President Neel Kashkari on Friday. "I believe we can get back to 2% inflation," Kashkari said during a town hall meeting with the Minnesota Hospital Association. "And if inflation goes a little bit above 2% that's absolutely fine," he added. (MarketWatch)

FED: President-elect Joe Biden's proposed stimulus plan is the right medicine for an economy likely to see substandard growth in the first half of 2021, Boston Federal Reserve President Eric Rosengren said Friday. As the first central bank official called to publicly speak on the Biden plan, he said he was comfortable with the aggressive fiscal action despite a nearly $2 trillion price tag that will take an already debt-laden federal government deeper into the red. (CNBC)

FED: MNI EXCLUSIVE: Fed Prepared to Stick With Vague QE Guidance

- The Federal Reserve's vague guidance on tapering asset purchases risks creating unwanted spikes in borrowing costs, but policy makers may be too far apart to refine it further, former officials told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: A top economic adviser to President-elect Joe Biden warned the U.S. economy is "spiraling downward" and called for swift action to address vulnerabilities that the global pandemic has drawn into focus.Brian Deese, who will serve as director of Biden's National Economic Council, said Sunday that the incoming administration's $1.9 trillion spending plan would generate "the kind of robust recovery we need." (BBG)

FISCAL: A FOX reporter tweeted the following on Friday: "Wall Street Dem sources say they believe @JoeBiden will be forced to scale back spending plans and increases minimum wage increases because of divided government and opposition from moderate Dems for grandiose spending." (MNI)

FISCAL: Sen. Pat Toomey (Pa.), a top Republican on the Senate Banking Committee, blasted the $1.9 trillion relief package unveiled by President-elect Joe Biden on Thursday as "a colossal waste and economically harmful." (The Hill)

FISCAL: The IRS announced it would begin accepting 2020 tax returns on Feb. 12, a delay from the usual late-January start of tax season. The agency said it needed more time to prepare its systems after the Covid relief act went into effect in late 2020. (CNBC)

POLITICS: President-elect Joe Biden's top health officials are confident the United States will have enough coronavirus vaccine doses to meet the incoming administration's goal of inoculating 100 million people in 100 days despite a slower-than-expected rollout of the life-saving drugs. "That is what the president elect has promised. It will be a hefty lift, but we have enough to do that," Dr. Rochelle Walensky, Biden's pick to lead the Centers for Disease Control and Prevention, told CBS' "Face the Nation" on Sunday. (CNBC)

CORONAVIRUS: US states reported more than 180,000 new coronavirus cases on Sunday, down from the previous day but ahead of a public holiday and presidential inauguration that could see pandemic data delayed. The 43 states for which the Covid Tracking Project collated data tallied more than 186,000 new infections and 2,044 deaths. Washington state reported system issues and did not provide data. (FT)

CORONAVIRUS: National Institute of Allergy and Infectious Diseases Director Anthony Fauci on Sunday said President-elect Joe Biden's plan to administer 100 million COVID-19 vaccines in 100 days is "absolutely a doable thing." (Axios)

CORONAVIRUS: The highly contagious variant of the coronavirus first seen in the United Kingdom will become the dominant strain in the United States within about two months, its rapid spread heightening the urgency of getting people vaccinated, the Centers for Disease Control and Prevention predicted Friday in its most sobering warning yet about mutations in the virus. (Washington Post)

CORONAVIRUS: Operation Warp Speed leaders waited more than two months to approve a plan to distribute and administer Covid-19 vaccines proposed by U.S. health officials, administration officials said, leaving states with little time to implement a mass-vaccination campaign amid a coronavirus surge. (WSJ)

CORONAVIRUS: Several Democratic governors are criticizing the Trump administration for apparently misleading public health officials about holding a stockpile of Covid-19 vaccines in reserve. Health and Human Services Secretary Alex Azar said on Tuesday that the government would begin releasing doses of vaccine that were being held in "physical reserve" to ensure enough supply for second doses. (CNBC)

CORONAVIRUS: Uncertainty over how many doses the U.S. government had tucked away and calls to speed up vaccinations have confused and angered officials trying to determine how quickly they can dispense the potentially life-saving shots amid surging infections and deaths from Covid-19. (BBG)

CORONAVIRUS: President-elect Joe Biden plans to use FEMA and the National Guard to build coronavirus vaccine clinics across the United States, according to new details of his Covid-19 vaccination plan released by his transition team on Friday. (CNBC)

CORONAVIRUS: New York City Mayor Bill de Blasio said the city will run out of vaccines by next week due to supply shortages. "I'm telling you at this rate, there will not be any doses available in New York by next week," de Blasio said in an interview with WNYC. "If we don't get a serious supply, we're going to have to freeze the appointment system. That would be insane after all the progress we've made." (BBG)

CORONAVIRUS: New York will get 50,000 fewer doses next week from the federal government than it did the week before, despite increasing the number of people eligible for the vaccine this week, Governor Andrew Cuomo said in a briefing on Friday. (BBG)

CORONAVIRUS: New Jersey is receiving less than a fourth of the Covid-19 vaccines doses that it could be administering each week, according to state Health Commissioner Judith Persichilli. (BBG)

CORONAVIRUS: Illinois eased restrictions on three regions following a sustained drop in Covid-19 hospitalizations and cases on Friday but most regions including Chicago still need to see more declines before mitigation measures are relaxed and activities such as indoor dining are allowed again, Governor J.B. Pritzker told reporters. (BBG)

POLITICS: President-elect Joe Biden plans to take immediate action to turn the page on the Trump era after his inauguration speech this week, chief of staff Ron Klain said Sunday after laying out Biden's plan for his first days in office. Biden is planning a 10-day blitz of executive action on what his administration is calling the "four crises" facing the country — Covid-19, the economic downturn, racial injustice and climate change. "He's going to come back to the White House after giving that speech at the Capitol and take some immediate actions to start to move this country forward," Klain told CNN's "State of the Union" on Sunday. (CNBC)

POLITICS: House Speaker Nancy Pelosi is expected to send the House's impeachment article to the Senate next week, according to a source familiar with her thinking, which will kickstart the beginning of the trial, though Pelosi would not say publicly Friday when she will do so. (CNN)

POLITICS: Incoming White House Chief of Staff Ron Klain said Friday that he's hoping for a quick impeachment trial for President Trump in the U.S. Senate. "Hopefully, the trial will not be a lengthy trial," Mr. Klain said at a Washington Post event. Mr. Klain said he's hopeful that the Senate will be able to tackle impeachment while also shepherding President-elect Joseph R. Biden's early agenda through Congress. (Washington Times)

POLITICS: U.S. defense officials say they are worried about an insider attack or other threat from service members involved in securing President-elect Joe Biden's inauguration, prompting the FBI to vet all of the 25,000 National Guard troops coming into Washington for the event. (Associated Press)

POLITICS: President Trump is heading into his final days in office with the lowest approval ratings of his term, according to a set of new polls. The polls indicate Trump has seen diminished support, even from his own party, in the wake of the deadly riot at the U.S. Capitol, with a majority of Americans favoring efforts in Congress to bar him from holding elected office again. (Axios)

POLITICS: President Donald Trump retains overwhelming support from Republican voters in the final days of his term, an NBC News poll conducted after a mob of his supporters stormed the U.S. Capitol shows. Nearly nine in 10 Republicans approve of Trump's job performance, according to the survey, a figure virtually unchanged from just ahead of the November contest. Eighty-nine percent of Republicans said they approved of Trump before the election, compared to 87% in the most recent poll. (CNBC)

POLITICS: As President Trump prepares to leave office in days, a lucrative market for pardons is coming to a head, with some of his allies collecting fees from wealthy felons or their associates to push the White House for clemency, according to documents and interviews with more than three dozen lobbyists and lawyers. (New York Times)

EQUITIES: Apple is closing more than 20 retail stores across Texas, Georgia and North Carolina after Covid-19 cases continued to spike in those states. The technology giant is also temporarily closing its stores in the Washington, D.C., area ahead of the Presidential inauguration next week. (BBG)

U.S.: A reminder that the U.S. will observe the Martin Luther King Holiday on Monday, the relevant holiday notices/exchange schedules can be found below:

- CME: https://www.cmegroup.com/tools-information/holiday...

- ICE: https://www.theice.com/publicdocs/futures_us/excha...

- NASDAQ: https://www.nasdaq.com/nasdaq-2020-holiday-hours-t...

- NYSE: https://www.nyse.com/markets/hours-calendars

- SIFMA: https://www.sifma.org/resources/general/holiday-sc...

OTHER

U.S./CHINA: The Trump administration notified several Huawei suppliers, including chipmaker Intel, that it is revoking certain licenses to sell to the Chinese company and intends to reject dozens of other applications to supply the telecommunications firm, people familiar with the matter told Reuters. The action against Huawei Technologies - likely the last against the company under Republican President Donald Trump's administration - is the latest in a long-running effort to weaken the world's largest telecommunications equipment maker, which it says is a threat to U.S. national security and foreign policy interests. (RTRS)

U.S./CHINA: China hopes to reopen dialogue, build mutual trust and rational relations with the U.S., wrote Wang Yi, China's Minister of Foreign Affairs, in the Communist Party magazine QiuShi published on Saturday. Beijing hops to peacefully co-exist with the U.S. despite the differences in social systems, Wang wrote. (MNI)

U.S./CHINA: The incoming Biden administration should abolish any diplomatic offences from the last days of the current Trump administration, rather than legitimizing them, the Global Times said in an editorial on Sunday. China and the U.S. are at risk of sliding into a war should the new administration carry out sanctions on Chinese companies and in particular disregard the norms of engaging with Taiwan, the newspaper said. (MNI)

U.S./CHINA: After being placed on a US blacklist, Chinese aviation firm Skyrizon has vowed that it would firmly protect its legitimate rights and interests with "legal weapon," saying that it opposes all unreasonable suppression of Chinese firms. (Global Times)

U.S./CHINA/HONG KONG: The Trump administration has imposed sanctions on Chinese officials in response to the crackdown on the pro-democracy movement in Hong Kong, which continued last week with the arrest of politicians and activists. The state department sanctions target two Chinese Communist party officials involved in setting Hong Kong policy, in addition to a pro-Beijing legislator in the territory and three Hong Kong security officials in the police force. (FT)

U.S./CHINA/TAIWAN: Intel plans to add outsourcing orders in Taiwan with at least 10% increase this year, Taipei-based Economic Daily News reports, citing unidentified people in supply chain. TSMC is expected to get all of Intel's CPU outsourcing orders; Intel to increase Atom chip related orders by 30% and add some Xeon chip orders to TSMC. (BBG)

U.S./EU: French Foreign Minister Jean-Yves Le Drian is calling for a moratorium on trade tariffs between the European Union and the U.S. to allow time for the "poisonous" issue to be resolved with the incoming Biden administration. (BBG)

GEOPOLITICS: Brussels is set to warn that global markets are too reliant on the dollar as it seeks ways of curbing Europe's vulnerability to US sanctions and other financial risks, in a challenge to the currency's supremacy just days before Joe Biden's inauguration as president. A draft European Commission policy paper seen by the Financial Times reveals the depth of EU frustration after four years of the administration of Donald Trump, whose policies underscored the dominance of the US and its currency in the global financial system. (FT)

GEOPOLITICS: The United States has told India it is unlikely to get a waiver on its planned acquisition of Russian S-400 air defence systems, raising the risk of sanctions similar to those imposed on Turkey for buying that equipment, people aware of the matter said. (RTRS)

CORONAVIRUS: Australian authorities are seeking urgent clarification from their Norwegian counterparts in the wake of disturbing reports that 30 elderly people died shortly after receiving their first shot of the Pfizer vaccine. Norwegian medical experts have stated they could not rule out a possible link between the side effects of nausea and fever and the subsequent deaths of the patients in question. (BBG)

CORONAVIRUS: The number of deaths worldwide attributed to coronavirus surpassed 2m on Friday, following a surge in cases across multiple continents. (FT)

CORONAVIRUS: The World Health Organization said Friday that coronavirus vaccines aren't "silver bullets" and relying solely on them to fight the pandemic has hurt nations. (CNBC)

CORONAVIRUS: The World Health Organization Emergency Committee on Covid-19 is recommending that countries don't require proof of vaccination from incoming travelers, as the impact of inoculations in reducing transmission is yet unknown. Nations should instead implement coordinated, evidence-based measures for safe travel. (BBG)

CORONAVIRUS: The U.S. "has reason to believe" some Wuhan Institute of Virology researchers became sick in autumn 2019, before the first identified case of the outbreak, "with symptoms consistent with both COVID-19 and common seasonal illnesses", State Dept says in fact sheet. Until China "allows a full and thorough accounting of what happened in Wuhan, it is only a matter of time until China births another pandemic and inflicts it on the Chinese people, and the world," Sec. of State Mike Pompeo says in emailed statement. (BBG)

HONG KONG: Hong Kong is likely to delay the distribution of mainland Chinese producer Sinovac's Covid-19 vaccine because of a lack of trial data, raising transparency concerns over a shot Beijing wants to sell internationally. Any doubts over CoronaVac risks heightening political tension in Hong Kong over the government's free vaccine plan. (FT)

BOJ: The Bank of Japan will consider a proposal to allow wider fluctuations around its long-term yield target, Jiji reported Saturday, without attribution. The central bank is likely to stick to its existing target for a long-term yield of around zero percent, while in practice allowing fluctuations wider than the current range of 0.2 of a percentage point either side of zero, Jiji said. (BBG)

JAPAN: The Japanese government said Sunday it remains committed to holding the rescheduled Tokyo Olympics and Paralympics this summer, reacting to an international media storm sparked by comments from one of its senior ministers. (Nikkei

RBNZ: RBNZ advised Monday that some statistical releases have been put on hold due to implications from the illegal breach of a file transfer system." (BBG)

SOUTH KOREA: President Moon Jae-in said the country may reach herd immunity by November at the latest, as inoculations may begin in late February or early March. He said it's clear the third virus wave has reached its peak. The country reported 389 new cases on Monday, the lowest number since Nov. 29. (BBG)

SOUTH KOREA: South Korea on Saturday extended its current social distancing level for two weeks while easing business restrictions on cafes, gyms and other indoor facilities. (Yonhap)

SOUTH KOREA: South Korea's first homegrown coronavirus treatment candidate from Celltrion Inc. is expected to be used to treat patients starting early February, Prime Minister Chung Sye-kyun said Monday. "We expect the drug to be used from early next month in antivirus activities in the field if the review process goes smoothly," Chung said during an interagency meeting on the COVID-19 response held at the government complex in Seoul. (Korea Times)

SOUTH KOREA: South Korean President Moon Jae-in says government will announce "extraordinary" home supply measures before Lunar New Year holiday, which will far exceed market expectation. (BBG)

SOUTH KOREA: South Korea's ruling Democratic Party has launched a task force aimed at putting the country's tech sector under pressure to share profit in a bid to reduce pandemic-induced economic inequalities. (Nikkei)

CANADA: Canada's daily coronavirus cases could more than double by the end of this month on current trends, according to the country's top doctor. (FT)

CANADA: MNI POLICY: Canada FM Must Use All Fiscal Firepower Needed

- Canadian Prime Minister Justin Trudeau on Friday told his finance deputy to spend as much as needed in the near term to sustain the economy through the pandemic, and avoid permanent new spending while refocusing on curbing climate change and income inequality - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BOC: MNI POLICY: BOC May Taper QE in April, Exit Mid-22- Survey

- The Bank of Canada will scale back QE again as soon as April and wind up the program by mid-2022, an MNI survey found, potentially well ahead of other major central banks in finding the exit - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

MEXICO: The U.S. Department of Justice criticized Mexico's decision to publish information the agency says was given in confidence, and questioned whether the countries should continue to share documents. In a statement, a department spokesperson said the DOJ was "deeply disappointed" in Mexico's decision to close an investigation into former Defense Minister General Salvador Cienfuegos, who was arrested in 2020 on charges of working with drug traffickers. (BBG)

BRAZIL: Brazil granted approval for the emergency use of AstraZeneca Plc and Sinovac Biotech Ltd vaccines against Covid-19, allowing the country to kick-start deploying shots as the virus roars back in Latin America's largest economy. (BBG)

BRAZIL: Brazil researchers are warning that a new coronavirus strain spotted just days ago could be aggravating an outbreak in Manaus, the largest city in the Amazon rainforest. (BBG)

BRAZIL: Brazil's President Jair Bolsonaro said on Friday that a plane would be sent to India to pick up COVID-19 vaccines in two or three days at most, after the government had announced the flight would leave on Friday. Bolsonaro said that there was little he could do about the pandemic in Brazil as a second wave of the new coronavirus tears through the country and that he "should be at the beach." (RTRS)

RUSSIA: Putin critic Alexei Navalny has been detained after flying back to Moscow from Germany, five months after he was nearly killed by a nerve agent attack. The activist, 44, was led away by police at passport control at Sheremetyevo airport. Thousands had gathered at a different Moscow airport to greet his flight from Berlin, but the plane was diverted. (BBC)

RUSSIA: Russia's third indigenous Covid-19 vaccine is expected to be rolled out in March, state media reported on Sunday. The vaccine is being developed by the Chumakov Federal Scientific Centre for Research and Development of Immune and Biological Products in Moscow. (FT)

RUSSIA/RATINGS: Sovereign rating reviews of note from Friday include:

- S&P affirmed Russia at BBB-; Outlook Stable

SOUTH AFRICA: South Africa's National Treasury is considering raising taxes as one of several possible mechanisms to fund the vaccination drive against Covid-19, Business Day reported. (BBG)

SOUTH AFRICA: South Africa's debt-laden power utility Eskom Holdings SOC Ltd. is extending power cuts to Monday after delays in restarting some key generation units. The state-owned company said it will continue with the planned power outages, cutting 2,000 megawatts from the grid on Monday. Eskom resumed rolling blackouts last Thursday and planned to ration electricity for four straight days after its newest facility, Kusile, lost some generation capacity. (BBG)

IRAN: The United States on Friday imposed sanctions on companies in Iran, China and the United Arab Emirates for doing business with the Islamic Republic of Iran Shipping Lines and on three Iranian entities over conventional arms proliferation. They are the latest in a series of measures aimed at stepping up pressure on Tehran in the waning days of President Donald Trump's administration, which ends on Wednesday. (Nikkei)

IRAN: Only weeks after the U.S. election, and three days after an Iranian nuclear scientist was assassinated, Iranian authorities convicted an American businessman on spying charges, a family friend told NBC News. (NBC)

IRAN: Iran's Revolutionary Guards on Saturday fired long-range ballistic missiles into the Indian Ocean on the second day of a military exercise, state media reported. The drill, which comes in the waning days of high tensions with U.S. President Donald Trump's administration, was conducted in the country's central desert region. (RTRS)

MIDDLE EAST: Two B-52H "Stratofortress" bombers flew over the Middle East on Sunday, U.S. Central Command said in an emailed statement. Flyover was the second of the year and the fifth in "last few months," according to statement. (BBG)

OIL: U.S. president-elect Joe Biden has indicated plans to cancel the Keystone XL pipeline permit via executive action on his first day in office, sources confirmed to CBC News on Sunday. A purported briefing note from the Biden transition team mentioning the plan was widely circulated over the weekend after being shared by the incoming president's team with U.S. stakeholders. The words "Rescind Keystone XL pipeline permit" appear on a list of executive actions supposedly scheduled for Day 1 of Biden's presidency. (CBC)

OIL: The Keystone oil pipeline's developer plans to announce a series of overhauls—including a pledge to use only renewable energy—in a bid to win President-elect Joe Biden's support for the controversial project. (WSJ)

OIL: Canada's ambassador to the United States said she would continue to promote a project that she said fit with both countries' environmental plans. "There is no better partner for the U.S. on climate action than Canada as we work together for green transition," Ambassador Kirsten Hillman said in a statement. (RTRS)

OIL: Iraq's oil minister affirmed Iraq's commitment to the OPEC+ reduction decision and the compensation of its overproduction share, he said in a statement on Saturday. The minister added that Iraq has no intention to negotiate with OPEC+ members regarding its oil production share or compensation of overproduction. (RTRS)

OIL: Iraqi Oil Minister Ihsan Abdul Jabbar expects oil prices to reach around $60 in the second quarter of 2021, he said in an interview with Iraq's Sharqiya TV on Friday. (RTRS)

OIL: Libya's oil output has dropped by about 200,000 barrels a day after the closure of a leaking pipeline, underscoring how difficult it is for the country to maintain its production following almost a decade of civil war. (BBG)

FOREX: The yuan replaced the US dollar as the most used currency in transactions between Hong Kong and Macau and the nine mainland Chinese cities that together make up the Greater Bay Area development zone, a local branch of the country's central bank said. Transactions worth 17.2 trillion yuan (US$2.65 trillion) were cleared in the zone last year, the Guangzhou branch of the People's Bank of China (PBOC) said on Thursday. (SCMP)

CHINA

CORONAVIRUS: China reported 109 new Covid-19 local cases across Beijing and three provinces as stubborn outbreaks in the north-east of the country widened. (FT)

PBOC: The PBOC is expected to refrain from major policy changes such as cutting RRRs or monetary tightening before the Mid-February Chinese New Year and instead maintain liquidity through OMO/MLF operations, the China Securities Journal wrote in an editorial. The central bank has had a long period to use normal tools, and recent MLFs proved that there is ample liquidity and funding, the editorial said. Uncertainties from recent local virus outbreaks, the coming tax payment period and higher cash demand during the holidays will prevent the PBOC from tightening, the Journal said. (MNI)

YUAN: Chinese enterprises should step up their exchange rate risk management capacity, should be wary of market sentiment and adapt to higher yuan volatilities, the official People's Daily said in an editorial. Companies could consider hedging through FX derivatives or use the yuan as a settlement currency in cross-border transactions, wrote the newspaper. Financial institutions should increase hedging tools and reduce costs, the Daily said. (MNI)

MARKETS: China's capital market should raise the proportion of direct financing and promote the sound development of a multi-level market, said one of China's state planners on Saturday stressing the need to improve the financial regulation system to steer clear of systemic risks. (Global Times)

OVERNIGHT DATA

CHINA Q4 GDP +6.5% Y/Y; MEDIAN +6.2%; Q3 +4.9%

CHINA Q4 GDP YTD +2.3% Y/Y; MEDIAN +2.1%; Q3 +0.7%

CHINA Q4 GDP +2.6% Q/Q; MEDIAN +2.7%; Q3 +3.0%

CHINA DEC INDUSTRIAL OUTPUT +7.3% Y/Y; MEDIAN +6.9%; NOV +7.0%

CHINA DEC INDUSTRIAL OUTPUT YTD +2.8% Y/Y; MEDIAN +2.7%; NOV +2.3%

CHINA DEC RETAIL SALES +4.6% Y/Y; MEDIAN +5.5%; NOV +5.0%

CHINA DEC RETAIL SALES YTD -3.9% Y/Y; MEDIAN -3.9%; NOV -4.8%

CHINA DEC PROPERTY INVESTMENT YTD +7.0% Y/Y; MEDIAN +7.2%; NOV +6.8%

CHINA DEC FIXED ASSETS EX RURAL YTD +2.9% Y/Y; MEDIAN +3.2%; NOV +2.6%

CHINA DEC UNEMPLOYMENT 5.2%; MEDIAN 5.2%; NOV 5.2%

MNI DATA IMPACT: China's Economy Recovers; GDP +2.3% Y/Y

- The Chinese economy, impacted heavily by the COVID-19 pandemic, registered 2.3% y/y growth in 2020, with Q4 GDP improving to 6.5% y/y as both industrial output and fixed-asset investment peaked, according to data released by the National Bureau of Statistics on Monday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN NOV, F INDUSTRIAL OUTPUT -3.9% Y/Y; FLASH -3.4%

JAPAN NOV, F INDUSTRIAL OUTPUT -0.5% M/M; FLASH 0.0%

JAPAN NOV CAPACITY UTILISATION -2.9% M/M; OCT +6.0%

UK JAN RIGHTMOVE HOUSE PRICES +3.3% Y/Y; DEC +6.6%

UK JAN RIGHTMOVE HOUSE PRICES -0.9% M/M; DEC -0.6%

CHINA MARKETS

PBOC NET DRAINS CNY3BN VIA OMOS MON

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged on Monday. This resulted in a net drain of CNY3 billion given the maturity of CNY5 billion of reverse repos today, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:28 am local time from 2.0109% at Friday's close.

- The CFETS-NEX money-market sentiment index closed at 39 on Friday vs 36 on Thursday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4845 MON VS 6.4633

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4845 on Monday. This compares with the 6.4633 set on Wednesday.

MARKETS

SNAPSHOT: Broad Mix Of Weekend News, But U.S. Holiday Saps Liquidity In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 297.36 points at 28221.56

- ASX 200 down 52.432 points at 6663

- Shanghai Comp. up 24.947 points at 3591.325

- JGB 10-Yr future down 15 ticks at 151.70, yield up 0.8bp at 0.051%

- Aussie 10-Yr future up 1.5 ticks at 98.92, yield down 1.7bp at 1.066%

- U.S. 10-Yr future up 0-03 at 136-30+, cash Tsys are closed

- WTI crude down $0.38 at $51.99, Gold up $0.44 at $1828.73

- USD/JPY down 12 pips at 103.73

- TRUMP SLAMS HUAWEI, HALTING SHIPMENTS FROM INTEL & OTHERS (RTRS SOURCES)

- LASCHET ELECTED LEADER OF MERKEL'S CDU PARTY (BBC)

- BOJ TO MULL WIDENING LONG-TERM YIELD BAND, JIJI SAYS (BBG)

- BIDEN PLANS IMMEDIATE EXECUTIVE ACTIONS TO ROLL BACK TRUMP ERA (CNBC)

- CHINA GDP BEATS EXP.

- YELLEN TO MAKE CLEAR U.S. DOESN'T SEEK WEAK DOLLAR (WSJ SOURCES)

BOND SUMMARY: Mixed Performance, JGBS Lag On BoJ Story, Light Bid Elsewhere

Weakness in JGB futures probably helped T-Notes off of early Asia highs after the latter had a look through its Friday highs early on, before a modest bid came back in, although the range for T-Notes was limited to 0-03. Contract last +0-03+ at 136-31, with volume running at a sedate ~45K owing to the U.S. holiday, which means that cash Tsys will be closed until Tuesday's Asia-Pac session. Eurodollar futures unchanged to +0.5 through the reds, with activity in the space calming after some buying activity in early Asia-Pac hours.

- A JiJi source report pointing to the BoJ considering a suggestion re: the widening of the band that it allows 10-Year JGB yields to operate in is all that has mattered for JGBs, with futures last -16, although the contract is now 13 ticks off the early Tokyo lows. As we mentioned earlier, it was an unattributed report, with no indication re: the timing of any potential announcement, although most have chosen to focus on the BoJ's monetary policy review, set to be released in March, as a potential landing strip for any such move.

- It was quite a narrow session for the Aussie bond space, which leaves YM +1.0 and XM +1.5 at typing, with the latter sticking to the range established in early Sydney dealing and little attention paid to the latest round of Chinese macro data. Long end outperformance has been at the fore in cash trade, with the curve bull flattening, while swaps have lagged ACGBs from 5-Years to further out, resulting in some swap spread widening.

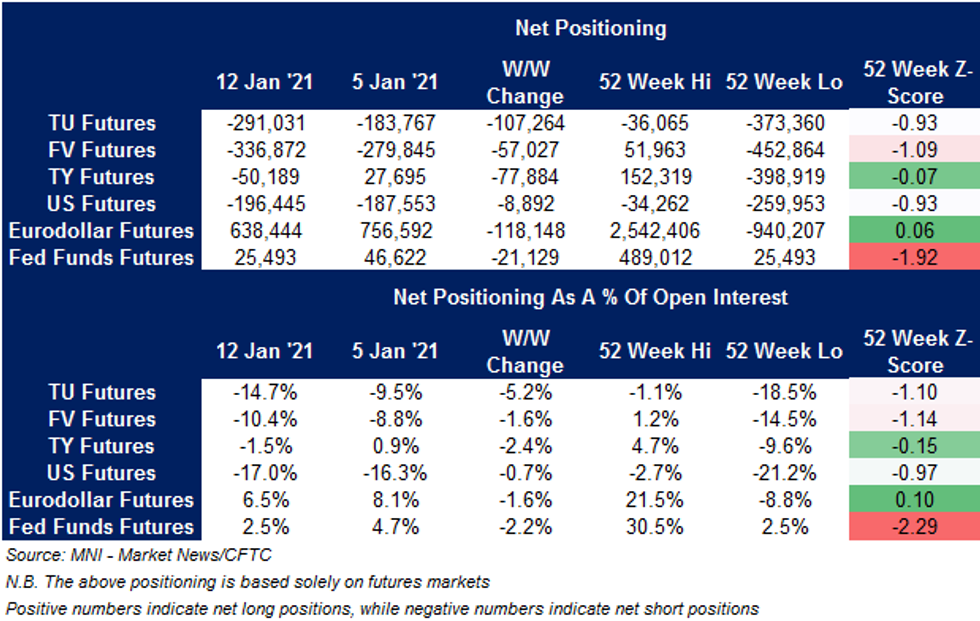

US TSYS: CFTC CoT Points To Larger Net Short Exposure

The latest CFTC CoT report saw an extension of net short exposure in TU, FV and US futures, while net exposure to TY futures moved into net short territory for the first time since early November, hitting the shortest levels seen since June in the process.

EQUITIES: Risk Off And Thin Volumes

Asian equity indices and European/US futures have declined to kick off the week in Asia, under some pressure as broad risk off sentiment prevails, volumes are thin with US markets away for Martin Luther King Jr. day.

- Tensions between the Trump administration and China continue to keep pressure on equity markets. The latest spat has seen Trump pledge to restrict licences to several Huawei suppliers which impacted shares in South Korea and Taiwan as markets assessed the impact on chip component makers.

- Indices in China and Hong Kong have bucked the trend, gaining slightly after positive GDP and Industrial Production data from the region.

GOLD: Dip In Early Asia Unwound

Spot gold saw a sharp move lower in early Asia-Pac trade, with little in the way of headline flow behind the price action. This left most to point to thinner liquidity conditions around Monday's U.S. holiday as a major component of the move, exacerbating downward pressure on a technical break below the recent lows. This train of thought was given further credence by the subsequent recovery, with spot last dealing little changed, just shy of $1,830/oz, after printing as low as $1,804.7/oz early on. A move through today's early low would open the way to round number support at $1,800/oz, with any sustained breach there set to shift bearish focus to the Dec 1 low, located at $1,775.9/oz. To the upside, bulls need to reclaim the 50-EMA before looking higher.

OIL: Extends Friday's Losses

Oil is lower to kick off the week, holding declines seen on Friday. WTI last trades down $0.39 at $51.97, brent down $0.46 at $54.64.The declines come amid general risk off sentiment with most equity indices in the region negative and global futures also under some pressure.

- A stronger US dollar is also a headwind for oil, the greenback has seen upside after reports in the WSJ that Yellen will not pursue a weak US dollar policy.

- Extra pressure comes from Friday's Baker Hughes US Rig Count data which showed oil rigs rose to 363 from 360, the eighth consecutive week of gains for the metric.

- Oil did come off session lows of $51.76 after strong GDP and Industrial Production data from China.

- Elsewhere, oil output from Libya has fallen around 200k BPD after the closure leaking pipelines for maintenance. Total oil output is now around 1m BPD as Waha Oil carries out maintenance across the pipeline linking the Samah and Dahra fields to the Es Sider crude oil terminal. The maintenance works are scheduled to start today, for an estimated two weeks, according to state-controlled parent company NOC, which hopes to reduce that to a seven to 10-day period.

- There were headlines earlier in the session the US President elect Biden will cancel presidential permission for the Keystone XL pipeline as one of his first acts in office.

FOREX: Yellen To Defend Market-Based FX Rate, Biden Could Withdraw Keystone Pipeline Permit

Participants shied away from riskier currencies in a slow start to the week caused by a market holiday in the U.S., with markets awaiting the this week's congressional testimony from Janet Yellen, the inauguration of Joe Biden as the new U.S. President and a number of central bank decisions. The WSJ circulated a piece noting that Yellen is expected "to affirm the U.S.'s commitment to market-determined exchange rates when she testifies on Capitol Hill Tuesday, and she will make clear the U.S. doesn't seek a weaker dollar for competitive advantage." The article lent support to the greenback, allowing it to outperform all of its G10 peers save for the yen, which gained on the back of broader sense of caution.

- CAD landed at the bottom of the G10 pile after a CBC News report suggested that Joe Biden would rescind presidential permission for the Keystone XL pipeline as soon as on his first day in office. USD/CAD rose past Friday's high.

- The Antipodeans struggled alongside CAD & NOK as crude oil traded on a softer footing. AUD/NZD seems poised to snap its seven-week winning streak.

- Chinese data dump provoked little in the way of immediate reaction in the yuan. China's economy grew 2.3% in 2020, coming in better than expected. Monthly economic activity data saw a beat in industrial output counterbalanced by a miss in retail sales.

- GBP was weaker at the start to the week as the UK closed its travel corridors with other countries, while Foreign Sec Raab refused to rule out the prospect of forcing inbound travellers to quarantine in dedicated hotels upon arrival.

- EUR was happy to look past the election of the new CDU leader over the weekend & continued political uncertainty in Italy.

- Final Italian CPI, Canadian housing starts and comments from BoE Gov Bailey & Riksbank's Jansson take focus from here.

FOREX OPTIONS: Expiries for Jan18 NY cut 1000ET(Source DTCC)

- EUR/USD: $1.2080(E522mln-EUR puts), $1.2100-05(E627mln-EUR puts)

- USD/JPY: Y103.50-60($551mln), Y104.15-25($549mln)

- EUR/GBP: Gbp0.8840-50(E780mln-EUR puts)

- AUD/USD: $0.7345(A$836mln-AUD calls)

ASIA FX: Greenback Strength Inspires EM Weakness

EM FX: EM Asia currencies suffered amid risk off sentiment and some upside in the greenback. The US dollar caught a bid following WSJ reports suggesting that Yellen is expected "to affirm the U.S.'s commitment to market-determined exchange rates when she testifies on Capitol Hill Tuesday, and she will make clear the U.S. doesn't seek a weaker dollar for competitive advantage."

- The yuan saw limited reaction to stronger GDP and Industrial Production data. The PBOC fixed USD/CNY at 6.4845, around 212 pips higher than the previous fix on USD strength. USD/CNH moved higher through the session, last up 101 pips at 6.4949.

- USD/IDR operates +45 at 14,065 after rising in tandem with most of the other USD/Asia crosses.

- USD/THB firmed up at the re-open, as greenback appreciation drove a move higher in USD/Asia. The baht also under some pressure from headlined on Friday where the BoT warn that it may need to revise its 2021 GDP estimate lower, as the latest Covid-19 outbreak weighs on economic recovery. Last trades up 88 pips at 30.115.

- USD/SGD trades 28 pips higher at 1.3325 having reclaimed the 1.33 level. Weakness in SGD limited by strong exports data in the session.

- In South Korea the won is the worst performer in Asia, impacted by the latest Trump pledge to restrict licences to several Huawei suppliers which impacted sentiment South Korea as markets assessed the impact on chip component makers. USD/KRW last up 6.25 at 1105.50.

- USD/MYR is around 115 pips higher on the session at 4.0470, PM Muhyiddin announced that he will form a Covid-19 advisory group, which will help the gov't draft policies to contain the virus.

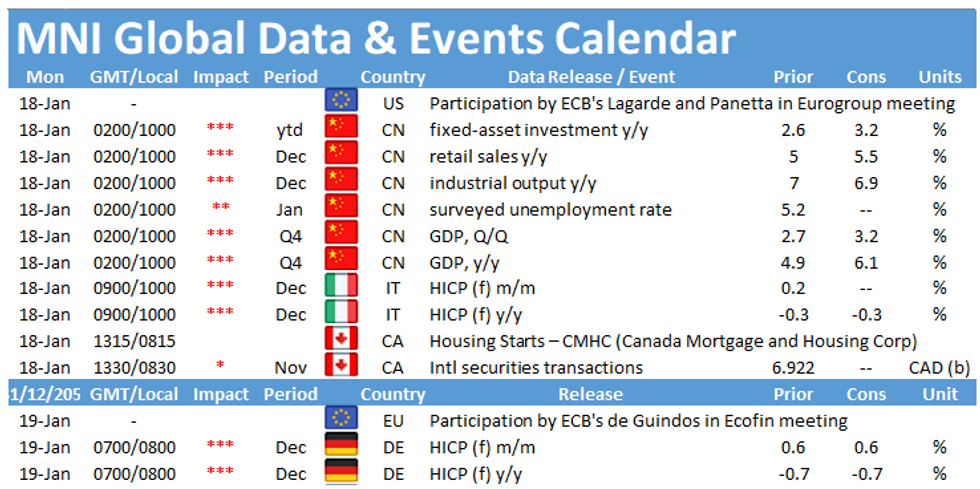

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.