-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: NFPs Await

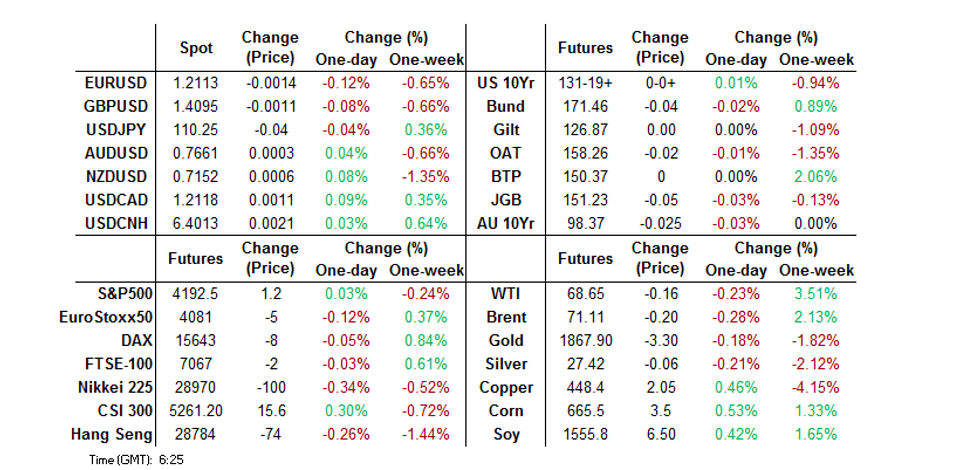

- Markets coil ahead of NFPs, DXY a touch higher, Tsys little changed, equities mixed.

- Gold hits air pocket lower before recovering to trade little changed.

- NFP expectations wide, questions surrounding correlation with ADPs continue to do the rounds.

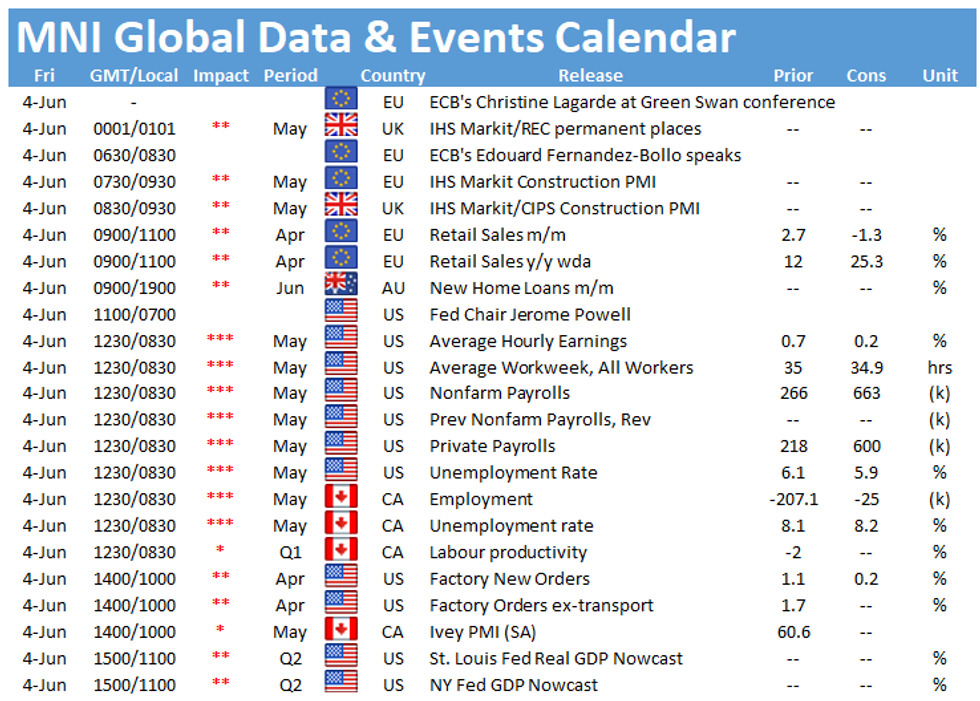

BOND SUMMARY: Westpac's RBA Watcher Steals The Headlines

T-Notes held to a 0-02 range overnight, sitting at the lower end of Thursday's range, last unch. at 131-19, on volume of ~62K. Cash Tsys sit unchanged to 0.5bp cheaper across the curve, with little in the way of tier 1 headlines crossing in Asia. Focus is squarely on Friday's NFP print, which comes in the wake of Thursday's strong U.S. labour market data, although many continued to question the link between the ADP employment print and headline NFP reading. Factory orders and final durable goods data will complement the NFP release on Friday. Elsewhere, Fed Chair Powell takes part in a BIS panel covering climate matters, with the Fed set to go into pre-meeting blackout at the end of today.

- JGB futures drifted lower during the morning session, with participants looking to Thursday's cheapening in U.S. Tsys & the proximity to next Tuesday's 30-Year JGB supply. The contract last prints 7 ticks below settlement levels, with the major cash JGB benchmarks running little changed to ~1.0bp cheaper on the day (10s and 20s were the flat prints). The latest round of domestic household spending data was firmer than expected, but there has been little in the way of notable headline flow to trade off. On the fiscal front, reports suggested that the Japanese government will say the country must "aim to" achieve its fiscal target bearing, with the country's fiscal state in dire straits, based on a draft of a fiscal blueprint obtained by local media outlets. The draft apparently noted that the country must lay the foundations for fiscal restoration before baby boomers reach 75. Monday's local docket is sparse.

- Aussie bonds cheapened a little, aided by Westpac's Bill Evans tweaking his RBA call. Evans suggested that "the RBA Board is likely to decide that there will be no extension of the YCT to the November 2024 bond at the July Board meeting because such action would imply no tightening till 2025." He did stress that "Westpac disagrees with that interpretation but cannot dispute the resulting decision." He previously expected the YCT to be extended to ACGB November 2024 and was perhaps the last remaining major voice in that camp. On the broader bond buying scheme Evans suggested that "the QE program has now matured to allow the Board more flexibility going forward. We expect the Governor to announce an open-ended A$5 billion per week purchase program to be reviewed later in 2021 to be introduced following the completion of QE2. Given the confidence the RBA has in the QE program and Australia's low relative use of QE we continue to expect that the ultimate level of additional purchases will reach A$150 billion which we have advocated for some time." ANZ also pointed to the chances of the implementation of a "flexible" QE scheme. The move in futures was fairly limited all in, with contracts now off lows, YM -2.5 and XM -3.0. 3s cheapened by ~4.5bp in cash ACGB trade, providing the weak point on the curve. EFPs widened a touch, but sit comfortably away from their recent highs. Elsewhere, the AOFM weekly issuance looks thin, while today's ACGB Nov '25 auction printed 0.76bp through prevailing mids at the time of supply, with the cover ratio printing at a comfortable ~3.5x.

FOREX: Rangey In Pre-NFP Lull

Limited movement with narrow ranges ahead of US NFP later today. AUD/USD and NZD/USD both hovered around neutral.

- In Australia notes from Westpac and NAB garnered some attention with Westpac predicting the RBA will change to a flexible QE regime and NAB forecasting the RBA will not roll its YCC forwards to Nov 2024.

- In New Zealand data earlier showed construction work done rose 3.7% in Q1 against estimates of 3.0%.

- JPY stronger, USD/JPY down 8 pips while EUR/JPY down 22 pips. Data earlier showed household spending rose 13.0% Y/Y in April, above estimates of 8.7%.

- Offshore yuan is slightly weaker, USD/CNH rising above 6.40 and breaking yesterday's high.There were reports in the China Securities Journal that analysts say expectations of yuan appreciation have abated, noting yuan is under pressure from seasonal FX demand from overseas-listed Chinese companies for dividend payments.

FOREX OPTIONS: Expiries for Jun04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E669mln), $1.2150(E603mln), $1.2185-1.2200(E1.2bln-EUR puts)

- USD/JPY: Y107.90-00($800mln), Y109.90-00($796mln)

- EUR/GBP: Gbp0.8550(E680mln)

- AUD/USD: $0.7730-50(A$1.4bln), $0.7780-0.7800(A$1.1bln-AUD puts)

- USD/CNY: Cny6.39($1.2bln), Cny6.40($1.0bln-USD puts), Cny6.41($630mln), Cny6.45($1.0bln-USD puts)

ASIA FX: Subdued; Elevated Inflation Boosts PHP

Narrow ranges seen in a subdued session ahead of US NFP.

- CNH: Offshore yuan is slightly weaker, USD/CNH rising above 6.40 and breaking yesterday's high. There were reports in the China Securities Journal that analysts say expectations of yuan appreciation have abated, noting yuan is under pressure from seasonal FX demand from overseas-listed Chinese companies for dividend payments.

- SGD: Singapore dollar flat, hugging a 15 pip range all session amid a lack of catalysts.

- TWD: Taiwan dollar is flat, having reversed losses at the open. Markets assess reports that the CBC ae to increase SME support by TWD 100bn and the approval of a TWD 260bn COVID-19 relief bill.

- KRW: Won is weaker, South Korea' reported 695 daily new coronavirus cases on Friday, above 600 for the third day. The won is on track for its first weekly decline in 3 weeks.

- MYR: Ringgit is lower, coronavirus cases remain elevated which has accelerate outflows from Malaysian stocks.

- IDR: Rupiah is weaker, BI Deputy Gov said yesterday that the BI will ensure monpol remains accommodative in order to boost the recovery.

- PHP: Peso is stronger, data earlier showed CPI rose in-line with estimates at 4.5%, core CPI rose 3.3%. Following the release BSP Governor Diokno said the bank expects CPI to ease to within target range by the second half of 2021.

- THB: Baht declined, data showed CPI fell faster than expected at -0.93% M/M, the Y/Y figure came in at 2.44% against estimates of 3.3%.

ASIA RATES: South Korea Will Not Increase Issuance To Fund Budget

- SOUTH KOREA: Futures higher after South Korean Finance Minister Hong crossed the wires saying the MOF would review allocating a second extra budget but added that South Korea won't need to issue deficit bonds for the extra budget with the budget expected to be funded by tax revenue.

- CHINA: Repo rates rose as the PBOC refrained from injecting liquidity again despite reports earlier this week of additional liquidity in June, futures lower giving back early gains. US President Biden signed an order yesterday which amends a ban on US investment In Chinese companies, extending a Trump era policy. The ban names 59 firms involved with China's military including Huawei and major telecoms companies.

- INDONESIA: Yields higher across the curve, BI Deputy Gov said yesterday that the BI will ensure monpol remains accommodative in order to boost the recovery. The Deputy Gov added BI will persist in bond purchases in order to maintain an impact on inflation, the bank has purchased IDR 117.1tn so far in 2021, compared to IDR 473.5tn total in 2020.

EQUITIES: A Little More Mixed As We Move Towards The Close

Another mixed day in Asia-Pac equity markets after a negative lead from the US as strong data fueled concerns stimulus will be withdrawn. Markets in Japan are lower, data earlier showed household spending rose 13.0% Y/Y in April, above estimates of 8.7%. Markets in mainland China are outperforming, even after US President Biden signed an order yesterday which amends a ban on US investment In Chinese companies with military links, extending a Trump era policy. Markets in Taiwan and South Korea are lower, weighed down by tech stocks after the Nasdaq lagged its peers on Thursday. US futures are little changed, markets await NFP data later in the session.

GOLD: Back To Unchanged After Hitting Air Pocket In Asia

Spot has recovered to trade at nearly unchanged levels ($1,867/oz) after hitting a bit of an air pocket during Asia-Pac hours, as it broke through Thursday's low and then technical support in the form of the May 20 low, bottoming out at $1,856/oz. Gold has struggled over the last 24 hours, with the broader U.S. dollar pushing higher over that horizon, while U.S. real yields also ticked higher. This dynamic came about on the back of stronger than expected U.S. labour market data (initial jobless claims and ADP employment) ahead of today's NFP print. Some have questioned the link between the ADP & NFP releases, but the latter will no doubt shape broader price action on Friday.

OIL: Crude Futures Lower, But On Track For Second Weekly Gain

Oil is lower in Asia-Pac trade on Friday. WTI & Brent sit $0.10 below settlement levels. Crude futures are under pressure from a stronger dollar but still on track for a second straight weekly gain as robust performance earlier in the week took the benchmarks to the highest since 2018. Prices are supported by a draw in headline DOE crude stocks, inventories fell 5.08m bbls, double the expected draw, downstream figures were less bullish.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.