MNI EUROPEAN OPEN: Markets Steady Ahead OF FOMC

EXECUTIVE SUMMARY

- GEOPOLITICAL TENSIONS RISE AFTER EXPLOSIONS IN LEBANON - BBC

- JAPAN’S Q3 TANKAN EXPECTED TO BE LITTLE CHANGED -MNI

- AUKUS LOOKING TO EXPAND COOPERATION WITH OTHERS - BBG

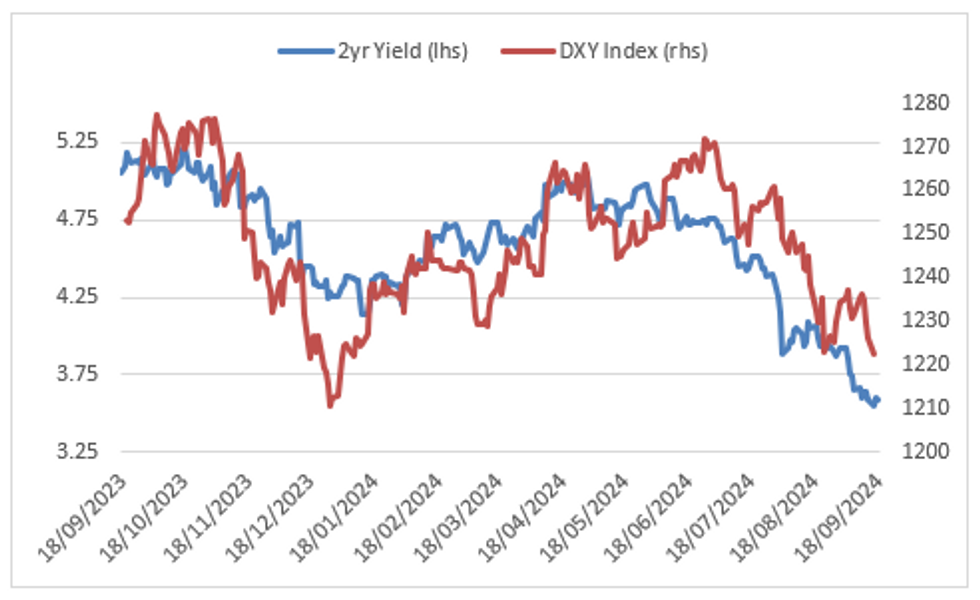

Fig. 1: US 2yr Yield vs DXY Index

Source: MNI - Market News/Bloomberg

UK

BOE (MNI WATCH): “The Bank of England looks set to keep Bank Rate on hold at 5.0% and to announce either a modest increase in or no change to the pace of its reduction of gilt holdings built up through quantitative easing at its meeting on Thursday.”

EU

ECB (MNI BRIEF): “Rises in taxes as well as cuts in spending will be needed to find the €20bn France needs every year for the next five years until France's budget deficit gets to the 3% of GDP EU limit, Bank of France Governor Francois Villeroy said.”

NORGESBANK (MNI PREVIEW): “The Norges Bank is unanimously expected to leave the policy rate on hold at 4.50% at its September meeting. This meeting comes with an updated MPR and set of projections.”

HUNGARY (MNI INTERVIEW): “Hungary will stick to plans to reduce the budget deficit despite an additional “peace budget” for 2025 to stimulate flagging growth, National Economy Minister Marton Nagy told MNI.”

HUNGARY (MNI INTERVIEW): “Gyorgy Matolcsy’s successor as governor of the National Bank of Hungary will bring fresh thinking and a more harmonious relationship with government while retaining its independence, National Economy Minister Marton Nagy told MNI.”

US

POLITICS (BBG): “Former President Donald Trump said Indian Prime Minister Narendra Modi plans to meet with him next week — the latest visit from a foreign leader or official as nations grapple with the possibility of the Republican returning to power after November’s election.”

ENERGY (BBG): “Chevron Corp. Chief Executive Officer Mike Wirth called on the administration to reverse the pause, labeling the policy as a failure that “elevates politics over progress.” The permitting halt, which went into effect earlier this year, will raise energy costs, threaten supplies for America’s European allies and increase emissions by slowing the transition from coal to gas, Wirth said in a speech at the GasTech conference in Houston Tuesday.

AUKUS (BBG): “Australia, the US and UK are moving closer to expanding advanced technology cooperation with other Indo-Pacific nations under the Aukus security accord, as they seek a strategic edge in competition with China.”

OTHER

MIDDLE EAST (BBC): “Nine people, including a child, have been killed after handheld pagers used by members of the armed group Hezbollah to communicate exploded across Lebanon, the country’s health minister says. The group blamed Israel for what it called “this criminal aggression” and vowed that it would get “just retribution”. The Israeli military declined to comment.”

JAPAN (MNI): “The Bank of Japan's September Tankan survey will show the benchmark business sentiment has changed little over the quarter, while capital investment plans among small and larger firms remains solid, according to private economists.”

JAPAN (MNI): “Japan’s exports rose 5.6% y/y in August for the ninth straight rise but slowed from July's 10.2% gain as automobile shipments fell 9.9% following the prior month's 4.4% growth, data released by the Ministry of Finance showed on Wednesday.”

AUSTRALIA (AFR/BBG): “The Reserve Bank is growing more confident that it can create a new digital version of the Australian dollar to save banks and other participants in financial markets billions each year by streamlining the settlement of transactions.”

NZ (BBG): “New Zealand consumer confidence rebounded in the three months through September, according to the Westpac McDermott Miller index.”

KOREA (BBG): “North Korea fired multiple short-range ballistic missiles Wednesday, displaying military hardware it has been suspected of sending to Russia in a test that came soon after it dispatched its foreign minister to Moscow.”

CANADA (MNI INTERVIEW): “Canadian PM Justin Trudeau has scope to break a cap on deficits while bargaining with opposition leaders to survive confidence votes, or push for his minority Liberal government to make a political comeback by tackling voter priorities like housing, former adviser Tyler Meredith told MNI.”

CANADA (BBG): “The Bank of Canada’s No. 2 official said policymakers want to see more progress on core inflation, even with yearly headline price pressures back to target.”

SARB (MNI PREVIEW): “The South African Reserve Bank (SARB) is expected to fire the starting pistol on its monetary easing cycle, trimming the repo rate by 25bp and bringing it to 8.00%.”

CBRT (MNI PREVIEW): “The CBRT is expected to keep its one-week repo rate unchanged at 50% and maintain a hawkish tilt to its communication. Among sell-side, analysts remain divided over the timing of the first rate cut.”

CHINA

PBOC (CHINA SECURITIES JOURNAL): The People’s Bank of China is expected to cut the reserve requirement ratio within the year, given the continuous contraction in manufacturing PMI, prices and real-estate sector, China Securities Journal reported, citing analysts.

ECONOMY (SECURITIES DAILY): Chief economists expect authorities to make stronger efforts in Q4 to meet the annual growth target of about 5%, Securities Daily has reported.

ECONOMY (21ST CENTURY BUSINESS HERALD): China’s Ministry of Transport recorded the cross-regional flow of 215.9 million people during the first day of the Mid-Autumn Festival, up 10.6% m/m, and 37.9% and 13.3% over the same period in 2023 and 2019, 21st Century Business Herald reported.

ECONOMY (MNI): “Beijing municipality consumption increased 3.3% y/y between January and August, unchanged from the first seven months of the year, the capital’s data department said on Wednesday.”

PROPERTY (MNI): “Beijing house buyers bought 6.5 million square meters of newly built commercial housing between January and August, down 5.1% y/y, and declining further from the 4.1% drop seen during the first seven months of the year, data from the capital’s statistics department showed on Wednesday.”

CHINA MARKETS

MNI: CHINA PBOC CONDUCTS CNY568.2 BLN VIA 7-DAY REVERSE REPOS WEDS

- PBOC issued CNY568.2bn via reverse repo at 1.7% during this mornings operations. Today's maturities CNY487.5bn, while the one year medium loan facility had maturities of CNY591bn.

- Total net withdrawal of CNY510.3bn, with the Central Bank advising that it will inject one-year liquidity to domestic lenders on Sept. 25, marking a third delay amid a broad overhaul of its policy toolkit.

MARKET DATA

NEW ZEALAND Q2 CURRENT ACCOUNT DEFICIT NZ$4.826B; EST. -NZ$3.943B; PRIOR –NZ$3.825B

NEW ZEALAND Q2 CURRENT ACCOUNT DEFICIT 6.7% OF GDP YTD; EST. 6.5%; PRIOR 6.7%

NEW ZEALAND Q3 WESTPAC CONSUMER CONFIDENCE 90.8; PRIOR 82.2

AUSTRALIA AUG. WESTPAC LEADING INDEX -0.05% M/M; PRIOR -0.03%

JAPAN AUG. TRADE DEFICIT Y695.29B; EST. -Y1,432B YEN; PRIOR –Y628.7B

JAPAN AUG. EXPORTS +5.6% Y/Y; EST. +10.6%; PRIOR +10.2%

JAPAN AUG. IMPORTS +2.3% Y/Y; EST. +15.0%; PRIOR +16.6%

JAPAN AUG. ADJUSTED TRADE DEFICIT Y595.85B; EST. -Y963.0B; PRIOR –Y677.3B

JAPAN JULY CORE MACHINE ORDERS +8.7% Y/Y; EST. +2.5%; PRIOR -1.7%

JAPAN JULY CORE MACHINE ORDERS -0.1% M/M; EST. +0.5%; PRIOR +2.1%

MARKETS / UP TODAY (TIMES GMT/LOCAL)

US TSYS: Tsys Futures Little Changed, Curve Steeper As 2yr Trades At 3.592%

- It has been a very slow session, ranges have been tight while volume as well below recent averages. The short-end has performed slightly better with TU -00+ at 104-11⅛ up from earlier lows of 104-10⅜, while TY is - 00+ at 115-11+.

- The bullish theme remains with TY contract holding on to its latest gains. The push higher mid last week has resulted in a print above key resistance and the bull trigger at 115-19, the Aug 5 high. The move higher confirms a resumption of the uptrend and paves the way for a climb towards the 116.00 handle. Moving average studies remain in a bull-mode position, highlighting a clear medium-term uptrend. Firm support is seen at 114-23+, the 20-day EMA.

- Cash tsys are trading about 0.5-1.5bps lower, the 2yr continues to outperform head of tonight's FOMC meeting trading 1.3bps at 3.592% vs cycle lows of 3.523%.

- Investors are increasingly betting on a larger-than-expected half-point interest rate cut at this week’s Federal Reserve meeting, with activity in October fed funds futures reaching record levels since the contract's inception in 1988. Odds of a 50bps cut have increased recently with commentary from ex-Fed Pres Dudley following articles from WSJ & FT which leaned slightly dovish.

- Projected rate hikes through year end gain slightly vs. late Tuesday levels (*): Sep'24 cumulative -42.3bp (-41.5bp), Nov'24 cumulative -78.2bp (-78.0bp), Dec'24 -117.0bp (-116.5bp).

- Focus will turn to FOMC announcement includes the Summary of Economic projections later today.

AUSSIE BONDS: Cheaper, Mid-Range, Awaiting FOMC & AUS Jobs

ACGBs (YM -3.0 & XM -2.0) are weaker with current dealings in the middle of today’s Sydney session ranges.

- Outside of the previously outlined Westpac leading Index, there hasn't been much by way of domestic drivers to flag.

- Cash US tsys are ~1bp richer in today’s Asia-Pac session after yesterday’s modest sell-off. Yesterday’s session reflected position squaring ahead of today’s FOMC policy announcement. The markets still project closer to a 50bp cut than a 25bp move from the Fed.

- Cash ACGBs are 2bps cheaper with the AU-US 10-year yield differential at +21bps.

- Swap rates are 2bps higher.

- The bills strip has bear-steepened, with pricing -2 to -5.

- RBA-dated OIS pricing is flat to 2bps firmer across 2025 meetings. A cumulative 20bps of easing is priced by year-end.

- Tomorrow, the local calendar will see August labour market data. Bloomberg

consensus expects 26k new jobs, around half of the 3-month average, with

unemployment remaining at 4.2%. - Employment prints have been on the upside in recent months but have still come in below growth in the labour force driving up unemployment. The participation rate is expected to stay at its new high of 67.1%.

BONDS: NZGBS: Cheaper, Narrow Ranges, Q2 GDP Tomorrow

In today’s local session, NZGBs closed 4bps cheaper after dealing in narrow ranges.

- Outside of the previously outlined Consumer Sentiment and Current Account Balance, which had limited impacts, there wasn't much by way of domestic drivers to flag.

- Q2 GDP prints tomorrow with both Bloomberg consensus and NZ Treasury expecting a 0.4% q/q decline resulting in the economy contracting 0.6% y/y. It rose 0.2% q/q and 0.3% y/y in Q1.

- The RBNZ’s August forecast was slightly weaker at -0.5% q/q with Q3 also negative. Treasury noted this week that there were few signs of recovery in Q3. Thus, we expect the RBNZ to cut rates by 25bp at its October and November meetings.

- All 15 analysts on Bloomberg expect the economy to contract with the range of forecasts between -0.1% and -0.4% q/q. The annual growth rate is projected to be between +0.2% and -0.7%.

- Swap rates closed 3bps higher.

- RBNZ dated OIS pricing closed 1-4bps firmer across meetings. A cumulative 82bps of easing is priced by year-end.

- Tomorrow, the NZ Treasury plans to sell NZ$250mn of the 1.50% May-31 bond, NZ$200mn of the 4.25% May-34 bond and NZ$50mn of the 2.75% Apr-37 bond.

GOLD: Weaker Ahead Of Today’s FOMC Decision

Gold is 0.2% higher in today’s Asia-Pac session, after closing 0.5% lower at $2569.50 on Tuesday following stronger-than-expected US IP and retail sales data.

- However, US retail sales and industrial production data delivered few clues for today’s FOMC outcome. Retail Sales headline beat with a slight upward revision to prior data (0.1% M/M (vs -0.2%, 1.1% prior rev up 0.1pp). Meanwhile, IP was much stronger than expected in August at 0.8% M/M (cons 0.2) but there was a downward revision.

- US Treasuries finished weaker across benchmarks after US yields briefly fell to one-week lows early in the NY session. The session for US Treasuries reflected position squaring ahead of today’s FOMC policy announcement. The markets still project closer to a 50bp cut than a 25bp move from the Fed. Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, a bullish structure in gold remains intact, with the focus on $2,600.Firm support lies at $2,520.7, the 20-day EMA.

JGBS: Yield Swings Muted Ahead Of FOMC & BoJ Decisions

JGB futures are stronger, +5 compared to the settlement levels.

- Outside of the previously outlined trade balance and machine orders data, there hasn't been much by way of domestic drivers to flag.

- The market’s attention is on Friday’s BoJ MPM decision, where the board is expected to keep the policy rate unchanged at 0.25%. The upside risk to prices, driven by high import costs—previously a key concern for policymakers in July— has eased due to the yen’s recent appreciation.

- Before that, the FOMC will announce its policy decision later today, with markets leaning more toward a 50bp rate cut than a 25bp move from the Fed.

- Cash US tsys are ~1bp richer in today’s Asia-Pac session after yesterday’s modest sell-off. Yesterday’s session reflected position squaring ahead of today’s FOMC policy announcement.

- The cash JGB curve has twist-flattened, pivoting at the 2-year, with yield swings bounded by +/- 1.5bps. The benchmark 10-year yield is 0.3bp lower at 0.826% versus the recent low of 0.74%.

- Swap rates are 1-2bps lower out to the 30-year and 4bps higher beyond. Swap spreads are mixed.

- Tomorrow, the local calendar will see Tokyo Condominiums for Sale data alongside an Enhanced Liquidity Auction covering OTR 5-15.5-year JGBs.

LNG: Upcoming Winter Gas Needs In Focus

European and Asian natural gas prices rose on Tuesday as the market focused on the upcoming winter despite elevated storage levels and also took advantage of Monday’s fall in prices. European LNG rose 4.4% to EUR 35.58 but it is not back to Friday’s close and is still down over 10% in September to date. Concerns about disruptions to Russian gas flows through Ukraine during winter persist.

- UBS estimates that European gas prices could rise to around EUR 50 if there is a cold winter and unplanned disruptions to supplies, according to Bloomberg. Fighting in Kursk around a gas transit point and the year-end expiry of the agreement to allow Russian gas to flow through Ukraine are key risks to European supply, as well as unplanned Norwegian outages.

- US natural gas fell 2.6% to $2.31 but is still 8.7% higher in September. Prices rose to a high of $2.44 due to a fire on a pipeline in Texas and then fell on some profit taking. The eastern US is now forecast to have cooler weather over the coming 2 weeks.

- North Asian prices rose 2.9% but are still down 5.2% this month. But price rises may ease as China’s storage facilities fill up and Malaysia’s LNG exports rebound after an outage. Japanese cooling demand has increased again though.

- Chevron announced that it will shut down between a half and one train at its Australian Gorgon LNG facility in June 2025.

OIL: Crude Moderately Lower Ahead Of FOMC & EIA Inventory Data

After rising this week, oil prices are moderately softer ahead of the Fed decision later today. Geopolitical developments in the Middle East are also being watched closely following explosions in Lebanon, which Hezbollah is blaming Israel for. WTI is down 0.5% to $70.84/bbl after reaching a low of $70.78, while Brent is down 0.5% to $73.35 after falling to $73.27. The USD index is down 0.1%.

- Bloomberg reported that US crude inventories rose 1.96mn barrels last week, according to people familiar with the API data, which has weighed on prices today. Gasoline and distillate rose 2.3mn barrels each. The official EIA data is out today.

- Later the FOMC decision is announced and the revised dot plot released. Bloomberg consensus is forecasting a 25bp cut (see MNI Fed analyst outlook and MNI Fed Preview). There is significant speculation that the first move will be 50bp with the market pricing in 1.5 25bp moves. An outsized 50bp would likely drive crude higher on optimism re the US demand outlook.

- There are also US August housing starts/permits, final euro area August CPI and UK August CPI/PPI. The ECB’s McCaul and Buch speak.

ASIA STOCKS: Asian Equities Trade In Tight Ranges Ahead Of FOMC

Asian stocks traded in a narrow range as investors awaited the Fed's rate decision, with the market now favoring a 50bps cut slightly. The MSCI Asia Pacific Index rose in early morning trading led higher by Japanese exports as the yen fell, however as the day progressed the yen and recovered with exporters paring gains, while Asia tech stocks trade slightly lower. China markets have returned from their break and trade mixed, with gains in consumer discretionary & Utilities offset by losses in Consumer Staples & Tech stocks. Hong Kong & South Korea are out for public holidays today.

- Chinese chip-related stocks surged following the nation's announcement of a breakthrough in developing homegrown semiconductor-making equipment, signaling progress in overcoming US sanctions. Companies like Changchun UP Optotech and Sai Micro Electronics saw significant gains.

- Japanese equities are trading in tight ranges, the Nikkei 225 is unchanged, while the TOPIX trade 0.30% as the yen recovers from Tuesday's sell-off.

- Taiwan's Taiex is trading 0.70% lower, after TSMC fell 0.75% while Hon Hai is down 3.60%. Taiwan's central bank meets tomorrow, where they are expected to keep rates on hold.

- Australia's ASX 200 is trading down 0.15% with Metals & Mining and Health care stocks weighing on the market. New Zealand's NZX 50 is down 0.45% after A2 milk fell over 2%.

- Eyes are all on the Fed tonight, there has been a surge in activity in October fed funds futures with the bulk of new bets targeting an 50bps cut.

FOREX: Yen Outperforming, US$ Slightly Weaker Ahead Of Fed

The US dollar is slightly weaker today ahead of the FOMC decision later with the BBDXY index down 0.1% with most G10 currencies stronger against the greenback. The yen is outperforming and making up some of Tuesday’s losses as the Fed is widely expected to cut rates, while the BoJ’s next move is likely to be a hike, even if it isn’t this Friday.

- USDJPY is down 0.7% to 141.37 with key support at 139.58. It reached a low of 141.23 earlier.

- After reaching a high of 0.6773 earlier, AUDUSD has given up those gains to be down 0.1% on the day at 0.6751, as softer commodity prices, especially iron ore, and mixed regional equities weigh. AUDJPY is down 0.8% to 95.42, close to the intraday low.

- NZDUSD is up 0.2% to 0.6196 but off the intraday high of 0.6207. AUDNZD is 0.2% lower at 1.0898 where 1.09 seems to be providing some support.

- European currencies are little changed with EURUSD at 1.1122 and GBPUSD 1.3159 but USDCHF is down 0.2% to 0.8453.

- Bloomberg consensus is forecasting a 25bp FOMC cut (see MNI Fed analyst outlook and MNI Fed Preview). There is significant speculation that the first move will be 50bp with the market pricing in 1.5 25bp moves.

- There are also US August housing starts/permits, final euro area August CPI and UK August CPI/PPI. The ECB’s McCaul and Buch speak.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 18/09/2024 | 0600/0700 | *** |  GB GB | Consumer inflation report |

| 18/09/2024 | 0600/0700 | *** |  GB GB | Producer Prices |

| 18/09/2024 | 0600/0800 | ** |  SE SE | Unemployment |

| 18/09/2024 | 0900/1100 | *** |  EU EU | HICP (f) |

| 18/09/2024 | 0900/1100 | ** |  EU EU | Construction Production |

| 18/09/2024 | 1100/0700 | ** |  US US | MBA Weekly Applications Index |

| 18/09/2024 | 1230/0830 | * |  CA CA | International Canadian Transaction in Securities |

| 18/09/2024 | 1230/0830 | *** |  US US | Housing Starts |

| 18/09/2024 | 1300/1500 |  EU EU | MNI Connect Video Conference on Euro Area Macro Projections | |

| 18/09/2024 | 1430/1030 | ** |  US US | DOE Weekly Crude Oil Stocks |

| 18/09/2024 | 1730/1330 |  CA CA | BOC Minutes (Summary of Deliberations) | |

| 18/09/2024 | 1800/1400 | *** |  US US | Fed Rate Decision / FOMC Statement |

| 18/09/2024 | 2000/1600 | ** |  US US | TICS |