-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Not Over Yet

EXECUTIVE SUMMARY

- BIDEN SAYS BANKING CRISIS 'NOT OVER YET' (RTRS)

- US OFFICIALS SIGNAL NEW RULES FOR BANKS AFTER SVB, SIGNATURE FAILURES (BBG)

- BIDEN PUSHES FOR REPUBLICAN PROPOSAL IN U.S. DEBT-CEILING STANDOFF (RTRS)

- DOMBROVSKIS: EU BANKING SECTOR STABLE, CAN WITHSTAND SHOCKS (RTRS)

- UK TREASURY OFFICIAL SEES NO IMMEDIATE CONCERNS ON UBS-CREDIT SUISSE DEAL (RTRS)

- TOP BIDEN AIDE SPEAKS WITH CHINESE COUNTERPART AS TENSIONS FLARE (BBG)

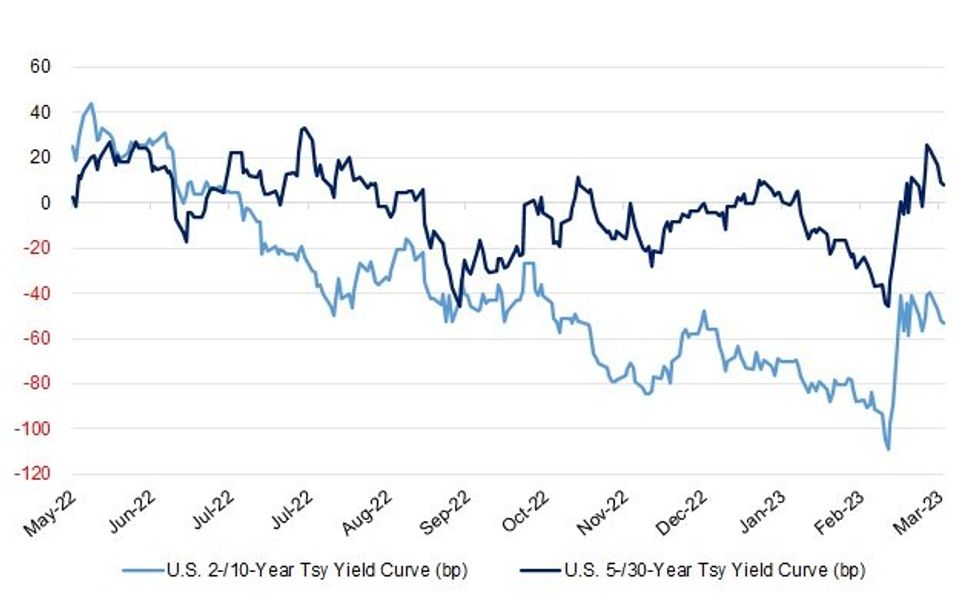

Fig. 1: U.S. 2-/10- & 5-/30-Year Tsy Yield Curves

Source: MNI - Market News/Bloomberg

UK

FISCAL/POLITICS/ECONOMY: Jeremy Hunt, UK chancellor, is to pump more money into the NHS to fund a new pay deal for health workers, but hopes of a deal to end strikes by teachers have descended into acrimony. (FT)

BANKS: Britain's No. 2 Treasury official said on Tuesday that he does not have any immediate concerns about the execution of Switzerland's Credit Suisse rescue by UBS but will monitor the deal closely, reiterating that UK banks are "very resilient." (RTRS)

EUROPE

GERMANY: Germany's ruling coalition government on Tuesday presented the results of 30-hour marathon negotiations aimed at resolving a spat that has threatened to delay major policy initiatives in Europe's top economy. Finance Minister Christian Lindner said while discussions had been intense the outcome was "good", adding there would be no major impact on the government budget as a result of the decisions taken. (RTRS)

FRANCE: One of France’s most prominent union leaders said he had been invited by Prime Minister Elisabeth Borne to meet early next week to discuss the government’s pension reform plan that triggered a 10th day of nationwide protests Tuesday. (BBG)

FRANCE: Philippe Aghion, a French economist who’s advised Emmanuel Macron on his economic program, is joining a growing chorus calling for the president to hit the pause button on his pension reform in the face of rising anger on the streets. (BBG)

FRANCE: The escalation of violence in cities across France is spreading alarm through President Emmanuel Macron’s coalition, with some leading supporters fretting that the situation is spinning out of control. (BBG)

ITALY: Italy’s cabinet approved a new energy relief package worth €4.9 billion ($5.3 billion) that extends support to low income families but ends fiscal relief for most other households. (BBG)

ITALY: Italy likely won’t complete some of the projects needed to unlock European Union recovery funds by their 2026 deadline, EU affairs minister Raffaele Fitto said on Tuesday. (BBG)

ITALY: Italy’s controversial plan to put €55mn of EU money towards renovating a football stadium in Florence has been challenged by the European Commission, highlighting Rome’s struggle to find suitable projects for the bloc’s pandemic recovery fund. (FT)

BANKS: The European Union's banking sector is stable and prepared to withstand shocks, European Commission's Vice President Valdis Dombrovskis told a seminar organised by Generali. "The banking sector is stable and it's well prepared to withstand potential shocks," Dombrovskis he said. (RTRS)

U.S.

FED/BANKS: Federal Reserve Vice Chair for Supervision Michael Barr Tuesday said he anticipates the need to strengthen rules for banks over USD100 billion. (MNI)

FED/BANKS: The Federal Reserve is monitoring the risks that higher interest rates pose to the balance sheets of banks after losses on a large portfolio of Treasuries helped precipitate the collapse of Silicon Valley Bank, the Fed’s vice chair of supervision Michael Barr told Congress Tuesday. (MNI)

BANKS: U.S. President Joe Biden said on Tuesday he has done what is possible to address the banking crisis with available authorities but that it is "not over yet." (RTRS)

BANKS: Top US financial officials on Tuesday outlined what’s likely to be the biggest regulatory overhaul of the banking sector in years, in an initiative aimed at addressing underlying issues that contributed to the collapse of Silicon Valley Bank and other US regional lenders. (BBG)

BANKS: A Fox reporter tweeted the following on Tuesday: “Someone close to @firstrepublic says the bank -- as of NOW -- is NOT for sale for a variety of reasons. Plus just 4 of its 270 brokers have resigned. @FoxBusiness confirmed others are seeking employment but may stay as the situation sorts itself out.” (MNI)

FED/FISCAL: Council of Economic Advisers and Invest in American Cabinet Chief Economist, Heather Boushey, discusses the debt ceiling and when President Biden and Speaker McCarthy will meet again. She also talks about the timeline to find the next Fed Vice Chair as inflation rises up to six percent and The Fed continues to rise interest rates. (BBG)

FISCAL: Democratic U.S. President Joe Biden on Tuesday called on House Speaker Kevin McCarthy to outline this week the spending cuts Republicans want in exchange for votes to raise the government's debt ceiling. (RTRS)

POLITICS: A federal judge ordered former Vice President Mike Pence to comply with a grand jury subpoena issued as part of a special counsel investigation of ex-President Donald Trump’s efforts to overturn his 2020 election loss, NBC News reported Tuesday. (CNBC)

EQUITIES: Micron Technology Inc., the largest US maker of memory chips, gave a better forecast for the current quarter than some analysts had feared, sparking hope that the worst of a brutal industry slump may be over. (BBG)

OTHER

GLOBAL TRADE: The European Union patent body will oversee a new process to set fair royalties on patents for technologies widely used in products like cellphones, according to a draft EU regulation that seeks to reduce litigation over royalty disputes. (RTRS)

U.S./CHINA: White House National Security Advisor Jake Sullivan spoke with China’s top diplomat Wang Yi on Friday, people familiar with the matter said, with relations between the world’s two largest economies severely strained. (BBG)

U.S./CHINA/TAIWAN: China urged the U.S. on Wednesday not to allow Taiwan President Tsai Ing-wen to transit through the United States and said any such move is "essentially a provocation". (RTRS)

U.S./CHINA/TAIWAN: The United States sees no reason for China to overreact to planned transits of the United States this week and next month by Taiwan's president, senior U.S. officials said, calling them consistent with long-standing practice and the U.S. one-China policy that recognizes Beijing diplomatically, not Taipei. (RTRS)

U.S./CHINA/TAIWAN: External pressure will not stop our determination to go out into the world, Taiwan President Tsai Ing-wen said on Wednesday before leaving for the United States and Central America. (RTRS)

BOJ: Bank of Japan (BOJ) Deputy Governor Shinichi Uchida said on Wednesday the central bank will make a comprehensive assessment of various data, including developments in trend inflation, in guiding monetary policy. (RTRS)

BOJ: It is important to maintain ultra-loose monetary policy in order to support Japan's economy and lay the groundwork for companies to hike wages, Ryozo Himino, deputy governor of the Bank of Japan (BOJ), said on Wednesday. (RTRS)

BOJ: Japanese Finance Minister Shunichi Suzuki said on Wednesday it was important for the central bank to communicate with markets to offer some predictability on the policy outlook. (RTRS)

JAPAN: The Japanese government is considering lowering the rates on mortgages provided by the Japan Housing Finance Agency for childrearing households, Nikkei reports without attribution. (BBG)

RBA: Inflation remains high but is declining from its peak, leaving a finely balanced interest rate call for the Reserve Bank of Australia board next Tuesday. The odds of an interest rate increase are probably around a 50-50 coin toss for the nine-member RBA board, who will be tempted to hit pause at the current 3.6 per cent cash rate. (AFR)

RBNZ: The Reserve Bank wants feedback on proposed new guidance for the financial sector to manage climate-related risks. Deputy governor Christian Hawkesby said the recent upper North Island flooding and then Cyclone Gabrielle highlighted how climate change was already affecting the country. (NBR)

SOUTH KOREA: South Korean President Yoon Suk Yeol said on Wednesday the government needs to draw up measures to boost domestic consumption, such as those to attract more foreign tourists. He made the remarks at a scheduled meeting on the economy. (RTRS)

SOUTH KOREA: The slump in South Korea’s property market may lead to defaults on project-financing loans, but policymakers have put in place measures to cope following an unexpected credit crunch last year, according to the nation’s financial watchdog chief. (BBG)

SOUTH KOREA: South Korean authorities will consider lifting a short-selling ban as early as this year if conditions are met, the nation’s financial watchdog chief said, acknowledging that the restriction is impeding foreign investors from buying local stocks. (BBG)

NORTH KOREA: The United States has seen no willingness by North Korea to accept a U.S. offer to hold talks on its nuclear weapons program but the offer still stands, White House national security spokesperson John Kirby told reporters on Tuesday. (RTRS)

ASIA: The Asian Development Bank said on Wednesday that it expects developed markets to grow slowly this year with a rate of less than 1%, while markets in Asia, particularly China, will emerge as a major driver for global growth. The bank's vice president, Ahmed Said, made the remarks at the Boao Forum in southern China's Hainan province. (RTRS)

CANADA: Canada broke its last fiscal anchor of a steady decline in debt to GDP with a budget that boosts spending into a mild recession. That ratio climbs to 43.5% from 42.4% in the fiscal year starting April 1, according to a budget presented to Parliament Tuesday by Finance Minister Chrystia Freeland. The deficit for fiscal 2023-24 climbs to CAD40.1 billion versus an estimate last fall of CAD30.6 billion, while nominal GDP growth that’s the best measure of the tax base slumps to 0.9% this year from 11% in 202. (MNI)

CANADA: Canada’s continued deficit spending growth has broken the government’s last fiscal anchor and means more painful future choices around cutbacks or tax increases, former senior government advisor official Robert Asselin told MNI. (MNI)

BOC: Canada’s budget met its goal of making sure new spending is modest enough to prevent the Bank of Canada from raising interest rates again to control inflation, former senior finance department official Mostafa Askari told MNI. (MNI)

BRAZIL: Brazil's Finance Minister Fernando Haddad said on Tuesday that the highly anticipated fiscal framework of the new government will be announced this week, following a concluding meeting on the matter with Chief of Staff Rui Costa on Wednesday. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskyy warned Tuesday that unless his nation wins a drawn-out battle in a key eastern city, Russia could begin building international support for a deal that could require Ukraine to make unacceptable compromises. He also invited the leader of China, long aligned with Russia, to visit. (AP)

RUSSIA: Russia's Strategic Missile Forces began planned exercises involving the Yars mobile nuclear intercontinental ballistic missile systems, Russia's defence ministry said on Wednesday. "In total, more than 3,000 military personnel and about 300 pieces of equipment are involved in the exercises," the defence ministry said in a statement on the Telegram messaging app. (RTRS)

RUSSIA: The United States has not seen any indications that Vladimir Putin is getting closer to using tactical nuclear weapons in his war on Ukraine, just days after the Russian leader said he was moving such weapons into Belarus. (RTRS)

RUSSIA: The U.S. would be willing to share some nuclear force data with Moscow if Russia were to come into compliance with the New START nuclear arms treaty, White House spokesman John Kirby said on Tuesday. (RTRS)

RUSSIA: Russia's Finance Ministry said on Tuesday that it transferred 7.8 billion roubles ($102 million) to the National Settlement Depository to make coupon payments on its sovereign 2035 Eurobonds in roubles. Russia has been servicing its foreign debt in roubles as Western sanctions make payments in dollars and euros impossible. (RTRS)

INDIA: The Reserve Bank of India will raise its main interest rate by 25 basis points on April 6 and then pause for the rest of the year, according to a Reuters poll of economists who said the central bank would still maintain its tightening stance. (RTRS)

ISRAEL: President Biden told reporters on Tuesday that the Israeli government can’t "continue down this road" with its judicial overhaul plan and stressed he is not going to invite Israeli Prime Minister Netanyahu to the White House “in the near term." (Axios)

BANKS: The G20's Financial Stability Board said on Tuesday its members would review the lessons from recent actions by authorities in Switzerland, the United States and elsewhere to rescue ailing banks. (RTRS)

OIL: The U.S. could start buying back crude oil for the Strategic Petroleum Reserve late this year after President Joe Biden last year directed the largest ever sale from the stockpile, Energy Secretary Jennifer Granholm said. (RTRS)

OIL: Prices for Russian Urals oil cargoes loading in April in Indian and Chinese ports have improved against comparable Brent benchmark, but have remained below the West's $60 price cap due to lower Brent prices, three market sources told Reuters. (RTRS)

OIL: The US is pushing Iraq and Turkey to restart exports of crude oil and to resolve a dispute with Kurdish authorities that led to the disruption, which has driven up global prices. (BBG)

CHINA

PBOC: The People’s Bank of China’s relending programs have incentivized banks to allocate more loans toward green projects, Governor Yi Gang said. (BBG)

CREDIT: China’s March credit growth is expected to extend the strong momentum of the first two months of the year, according to the Securities Daily citing multiple analysts. (BBG)

ECONOMY: The Global Times tweeted the following on Wednesday: “42% surveyed CEOs in Chinese mainland confident about economic growth in the following year, far more optimistic than their global peers, among which pessimists rose to 73%. Geopolitical conflict becomes top concern for Chinese firms in the short term: PwC CEO Survey.” (MNI)

ECONOMY: China's potential growth rate is the potential growth rate of the whole world,an official from China's state planner said on Wednesday. Zhao Chenxin, Deputy Director General of China's National Development and Reform Commission, told the Boao Forum in southern China's Hainan province that economic globalisation has suffered some setbacks and twists, but has generally continued to move forward. (RTRS)

ECONOMY: The upgrade of traditional industries using AI and digitalisation – as well as structural transformation – could potentially drive future economic growth, according to Xu Hongcai, deputy director of the Economic Policy Committee of the China Policy Science Research Association. (MNI)

ECONOMY: China’s USD250 billion outbound tourism industry is set to fully recover by 2024 as air fares drop and Covid requirements are eased for Chinese travellers, former State Council adviser Henry Wang told MNI. (MNI)

PROPERTY: Relaxed house purchase restrictions in Xiamen could lead to further liberalisation of the market nationwide, according to Li Naichao, president of the Beijing Chamber of Commerce for the Residential Real Estate Industry. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY133 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY200 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY133 billion after offsetting the maturity of CNY67 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1549% at 09:28 am local time from the close of 1.9933% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday, the same as the close on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8771 WEDS VS 6.8749 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8771 on Wednesday, compared with 6.8749 set on Tuesday.

OVERNIGHT DATA

AUSTRALIA FEB CPI +6.8%; MEDIAN +7.2%; JAN +7.4%

SOUTH KOREA MAR CONSUMER CONFIDENCE 92.0; FEB 90.2

MARKETS

US TSYS: Marginally Richer In Asia

TYM3 deals at 114-20, 0-00+, with a 0-07+ range observed on volume of ~91k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- A bid in JGBs spilled over into the wider space facilitating a recovery off session lows seeing tsys marginally richen. There was no outright fundamental driver for the move.

- Earlier in the session, Tsys were pressured as e-minis moved higher. There was a strong lead from Micron which gave a better forecast for the current quarter than expected, and a 14% rise in Alibaba yesterday in NY, on news of an overhaul that will see the company split into six business units. TU and TY both dealt below Tuesdays low.

- A TU(3,036 lots)/UXY(1,250 lots) block flattener was the highlight flow wise

- There is a thin calendar in Europe today, further out Pending Home Sales provides the main point of interest in an otherwise thin data calendar. Fed VC Barr appears before the House Financial Services Committee. We also have the latest 7 Year supply.

JGBS: Long End Leads The Bid As Curve Flattens

A flow-centric move in JGB futures was seen in early Tokyo afternoon trade, with a pull higher accelerating on a break of the morning high in the contract. We haven’t got much in the way of an outright fundamental explainer for the move, outside of average to low offer/cover ratios at today’s BoJ Rinban operations (covering 3- to 25-Year JGBs).

- JGB futures now sit +17 as we head into the last hour of trade, pulling back from best levels, continuing to operate comfortably within the recently observed range.

- Wider cash JGBs see 2-10bp of richening as the curve flattens, with the firm pricing at yesterday’s 40-Year JGB auction and Dai-Ichi Life’s intentions to repatriate funds into super-long JGBs (noted on Tuesday) likely legacy drivers in the super-long end. The wider curve has reversed the steepening impetus that was observed into yesterday’s 40-Year supply.

- Swap rates are 0.5-3bp lower across the curve, with swap spreads running wider as a result.

- Outgoing BoJ Governor Kuroda failed to move the needle when it came to his latest round of parliamentary comments.

- Meanwhile, newly installed BoJ Deputy Governor Uchida pointed to some degree of willingness to keep the market guessing when it came to future policy moves (similar to Governor-in-waiting Ueda), while stressing the importance of BoJ communication channels.

- Elsewhere, new Deputy Governor Himino pointed to the need to maintain ultra-loose policy settings to support the economy.

- 2-Year JGB supply and the weekly international security flow data headline Thursday’s light local docket.

AUSSIE BONDS: Off Extremes After CPI Data Miss

ACGBs sit slightly cheaper to slightly richer ahead of the bell (YM -1.0 & XM +0.5) but off season extremes. The market scaled back gains sparked by a weaker-than-expected CPI Monthly print for February (6.8% Y/Y versus 7.2% expected) in line with an initial weakening in U.S. Tsys in Asia-Pac trade. U.S. Tsys did however reverse course later in the season, assisting ACGBs to lift off their post-CPI cheaps.

- 3-year and 10-year cash benchmarks are flat.

- The AU-US 10-year yield differential is -6bp at -26bp.

- Swap rates are 1-2bp lower and EFPs slightly tighter.

- Bills strip pricing is -1 to -3bp led by the reds.

- The local calendar is light until Private Sector Credit (Feb) data on Friday.

- The market focus however is already likely tuned into the RBA rates decision next Tuesday given today’s data was the last of the releases flagged by RBA Governor Lowe as key inputs to decision in April.

- Based on market pricing, today’s CPI result, coupled with yesterday’s retail spending outcome, should be enough to offset the resilient business survey and strong jobs data and deliver a pause from the RBA. April meeting pricing attaches an 8% chance of a 25bp hike.

AUSSIE BONDS: ACGB May-34 Auction Results

The Australian Office of Financial Management (AOFM) sells A$800mn of the 3.75% 21 May 2034 Bond, issue #TB167:

- Average Yield: 3.3864% (prev. 3.4741%)

- High Yield: 3.3900% (prev. 3.4775%)

- Bid/Cover: 3.7812x (prev. 3.1000x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 38.8% (prev. 62.6%)

- Bidders 52 (prev. 52), successful 16 (prev. 18 ), allocated in full 11 (prev. 11)

NZGBS: At Cheaps With Curve Flatter

NZGBs closed at session cheaps with yields 6-11bp higher and the 2/10 curve 5bp flatter. An e-mini-induced cheapening in U.S Tsys in Asia-Pac trade supported the move higher in NZGB yields. Cash 10-year benchmark slightly outperformed U.S. Tsys with the NZ/US yield differential narrowing 1bp to +57bp. The 10-year yield differential has traded in a 40-85bp range since mid-December.

- Swaps closed 3-11bp softer, implying a tighter long-end swap spread, with the 2s10s curve 8bp flatter.

- RBNZ dated OIS closed with pricing 1-10bp softer across meetings with November leading. Terminal rate expectations rose to 5.23% with 25bp of tightening priced for April.

- After a week-long hiatus, the local calendar sees the release tomorrow of ANZ Business Confidence (Mar) and Building Consents (Feb). The market will be focused on the pricing and cost components of the survey given that the February result continued to point to inflationary pressures. Building consents should confirm a trend softening due to a tightening in financial conditions. The data is likely to be cyclone impacted.

- With the global calendar relatively light until Friday when Euro Area CPI (Mar) and US PCE deflator (Feb) are released, the markets will be closely watching to see if global yields remain pressured by improving risk sentiment.

EQUITIES: Little Spill Over From Alibaba Surge

Much of the focus today has been on firmer HK and China related tech shares, following the Alibaba re-organization news. The spill over to the rest of the region has been fairly limited though. US equity futures are firmer, with Micron's positive earnings guidance post the Tuesday close, helping at the margins (Eminis and Nasdaq futures are +0.40/+0.50% higher at this stage).

- The HSI sits close to 2% higher, but we are down from early session highs. We were 3% higher in early trade. The HS Tech index has followed a similar trajectory, last up around 2.70%.

- Alibaba is around 13% higher, as the company plans to split up into 6 groups, which could result in fresh IPOs.

- The HS China Enterprise index is around 2.1% higher. Mainland China stocks aren't showing a hugely positive trend, with the CSI 300 up around 0.25%, while the Shanghai Composite index is down slightly at this stage. Northbound stock connect flows are firmer though, +2.84bn yuan for the session so far.

- The Topix has seen some positive spill over from the Alibaba bounce, +0.75% at this stage. The Taiex is a touch higher (+0.15%), while the Kospi is around flat.

- SEA stocks are mostly positive, although gains are under 1% at this stage.

GOLD: Pulls Back Amid Firmer USD/Yields

Gold has moved off recent highs, the precious metal last near $1966.00, versus opening levels around $1973.50. We are off around 0.40% so far in the session, which is in line with the firmer USD trend against the majors.

- In terms of levels, Tuesday highs were around the $1975 region, while gains above $2000 haven't been sustained in recent weeks. On the downside, recent lows come in between $1940/$1950 from Monday/Tuesday of this week. The 20-day EMA is further back at $1928.50.

- Outside of USD drivers/firmer US yields, gold ETF holdings continue to track higher. Now back to early Feb levels. This comes despite lower risk aversion in other asset classes, particularly the equity space.

OIL: Holding Recent Gains

Brent crude is tracking higher in the first part of trade for Wednesday. We were last near $78.80/bbl, around +0.20% above closing levels from the NY session. Some resistance is evident above $79/bbl from a near term standpoint. Still, Brent is around 5% firmer for the week, although most of the gains came from Monday's session. We are now back above the 20-day EMA (just under $78.50/bbl). The 50-day EMA sits higher (near $81/bbl), while the 100-day is higher still (near $84/bbl). WTI is just above $73.50/bbl.

- For Brent, moves above the 100-day EMA have generally been selling points over recent months, so we may have to see a definitive break above this level, before the medium-term outlook turns more positive.

- Outside of the more positive risk backdrop, amid generally positive equity trends, supply side issues remain front and center. Focus is likely to rest with oil inventory data out in the US later today, which follows other data released on Tuesday, which showed a sharp drop in reported inventory levels.

FOREX: Yen Pressured In Asia

The Yen is the weakest performer in the G-10 space on Wednesday.

- JPY has played some catch up with rising US Yields. USD/JPY prints at ¥131.60/70 ~0.6% firmer, resistance was seen at ¥131.76 high from Mar 27. If bulls break through ¥131.76, ¥133.00 high from Mar 22 is the next target.

- AUD is also pressured, the Feb CPI print in Australia was weaker than expectations. AUD/USD prints at $0.6695/0.6700, ~0.2% softer on the day. Downside support doesn't come in until $0.6625 low 24 March. AUD/NZD is also softer, and deals a touch below $1.07 handle.

- The firmer equity backdrop has helped NZD outperform today. NZD/USD is ~0.1% firmer.

- Elsewhere in G-10 the greenback is benefiting from the bid in USD/JPY which has spilled over into the wider G-10 space. EUR and GBP are both down ~0.1%.

- BBDXY is up ~0.2%, Hang Seng is up ~1.9% and E-minis are ~0.4% firmer.

- There is a thin calendar in Europe today, further out US Pending Home Sales provides the main point of interest in an otherwise thin data calendar.

FX OPTIONS: Expiries for Mar29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0680-85(E1.0bln), $1.0780-00($2.5bln), $1.0850(E549mln), $1.1000-20(E1.3bln)

- USD/JPY: Y128.00-10($585mln), Y130.75($630mln), Y131.60-80($1.0bln)

- AUD/USD: $0.6650(A$681mln), $0.6800(A$566mln)

- USD/CNY: Cny6.8000($1.2bln), Cny6.9100($1.7bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/03/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/03/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 29/03/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/03/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/03/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/03/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/03/2023 | 0930/1030 |  | UK | Bank of England FPC Report/minutes | |

| 29/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/03/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 29/03/2023 | 1400/1000 |  | US | US House Financial Services Hearing | |

| 29/03/2023 | 1400/1000 |  | US | Treasury Secretary Janet Yellen | |

| 29/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 29/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 29/03/2023 | 1630/1230 |  | CA | BOC Deputy Gravelle speech "The market liquidity measures we took during COVID" | |

| 29/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 29/03/2023 | 1850/1950 |  | UK | BOE Mann Panellist at NABE | |

| 29/03/2023 | 2045/2245 |  | EU | ECB Schnabel Panels NABE Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.