-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NZ Domestic Price Pressures Sticky, Prolonged RBNZ Hold

EXECUTIVE SUMMARY

- RECENT DATA HAVE NOT GIVEN FED CONFIDENCE - POWELL - MNI BRIEF

- ECB RATE CUTS MUST CONTINUE INTO ‘25-ECB’s VILLEROY - MNI BRIEF

- LAGARDE SAYS GERMANY MAY HAVE TURNED CORNER AFTER MAJOR SHOCKS - BBG

- US TO SANCTION IRANIAN DRONE PROGRAM AFTER ATTACK ON ISRAEL - BBG

- JAPAN MARCH EXPORTS HIT 4Th STRAIGHT RISE - MNI BRIEF

- NZ Q1 INFLATION RISES 4%, HIGHER THAN RBNZ FORECAST - MNI BRIEF

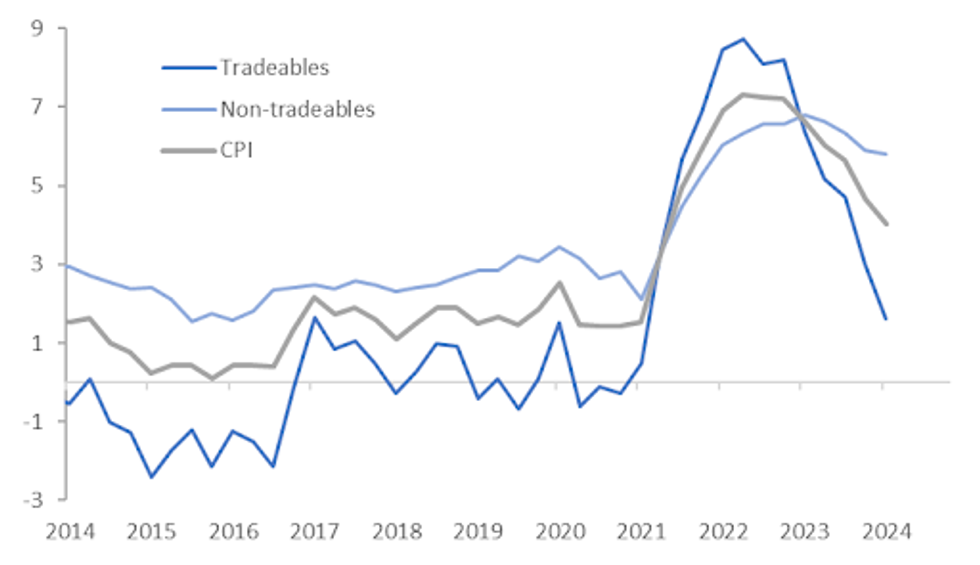

Fig. 1: NZ CPI Y/Y - Non-Tradables Sticky

Source: MNI - Market News/Bloomberg

U.K.

BOE (BBG): Bank of England Governor Andrew Bailey hinted that the UK might be able to lower interest rates before the US, saying inflation dynamics in the two economies are diverging. Bailey said on Tuesday that there is more “demand-led inflation pressure” in the US than seen in the UK after markets were spooked by surprisingly strong price data in America last week. He said there is “strong evidence” of UK price pressures retreating.

POLITICS (BBG): UK Chancellor of the Exchequer Jeremy Hunt said the prospect of interest rate cuts later this year would lift the mood of voters, hinting that Prime Minister Rishi Sunak won’t call a general election until the fall.

EUROPE

ECB (MNI BRIEF): The ECB will follow its expected rate cut in June with further cuts through 2024 and more into 2025, Bank of France Governor Francois Villeroy said Tuesday.

GERMANY (CNBC): European Central Bank President Christine Lagarde said the German economy may be starting to recover after being rocked by a series of shocks in recent years. “It looks as if Germany might have turned the corner,” Lagarde said in an interview with CNBC in Washington Tuesday. “Industrial production numbers have ramped up, and much higher than what we had expected. So I think we need to see how that consolidates.”

POLITICS (BBC): Brussels police were ordered to shut down a conference for right-wing politicians, including Brexiteer Nigel Farage and Hungary's Prime Minister Viktor Orban, on Tuesday. People were stopped from entering the National Conservatism Conference a few hours after it began, organisers said - although it continued for those inside. The local Socialist Party mayor said he issued the order to ensure public security.

U.S.

FED (MNI BRIEF): Federal Reserve Chair Jerome Powell Tuesday dialed back expectations on rate cuts, noting that firm inflation last quarter has introduced new uncertainty over when the Fed will be able to lower interest rates this year.

US/IRAN (BBG): Congressional leaders are discussing how to push ahead with legislation that would place sanctions on importers of Iranian oil, with the issue gaining momentum after the nation’s direct attack on Israel, Senator Ben Cardin said Tuesday.

CHINA/US (RTRS): China and the United States should explore ways for a pragmatic and cooperative relationship between their militaries, and "gradually accumulate mutual trust", the Chinese defence minister was cited as saying by the ministry on Wednesday.

OTHER

IRAN (BBG): The US will impose new sanctions on Iran targeting the country’s missile and drone program following its weekend attack on Israel that threatened to push the Middle East into a wider conflict. White House National Security Advisor Jake Sullivan said Tuesday that sanctions would be unveiled “in the coming days” and added the US is coordinating with Group of Seven nations and other partners on a “comprehensive response.”

ISRAEL (RTRS): A third meeting of Israel's war cabinet set for Tuesday to decide on a response to Iran's first-ever direct attack was put off until Wednesday, as Western allies eyed swift new sanctions against Tehran to help dissuade Israel from a major escalation.

CANADA (MNI): Canada's Finance Minister Chrystia Freeland stuck to fiscal "anchors" in a budget with a deficit just under her goal of CAD40 billion and a plan to lower it to less than 1% of GDP, while using much of an economic windfall to boost spending and raising taxes on the rich.

CANADA (MNI INTERVIEW): Canada's budget leans towards bigger spending rather than fiscal restraint that would help firms over the longer term, and the government may go further astray next year before an election, the head of one of the country's largest business groups told MNI.

JAPAN (MNI BRIEF): Japan's exports posted their fourth straight y/y rise in March thanks to solid exports of automobiles and ships, data released by the Ministry of Finance showed on Wednesday.

SOUTH KOREA/JAPAN (BBG): Finance Ministers of South Korea and Japan shared “serious concerns” on the recent weakening of their currencies and mentioned they could take “appropriate steps” to counter drastic FX market volatility, according to a statement from the Korean ministry.

NEW ZEALAND (MNI BRIEF): Headline New Zealand inflation rose in line with expectation over Q1, printing at 4.0% y/y, or 0.6% q/q, down from Q4 2023’s 4.7%, according to data published today by Stats NZ.

JAPAN (MNI BRIEF): Japan's exports posted their fourth straight y/y rise in March thanks to solid exports of automobiles and ships, data released by the Ministry of Finance showed on Wednesday.

CHINA

ECONOMY (21ST CENTRUY BUSINESS HERALD): Authorities should increase policy intensity to address weak demand and stabilise the housing market, following the deceleration in March macroeconomic data, 21st Century Business Herald reported citing analysts.

HOUSING (CAIXIN): March's typical housing boom failed to materialise this year as home prices and sales continued to fall across the country, Caixin reported. The sales prices of new and established homes in 70 large cities fell by 0.3% and 0.5% m/m in March, National Bureau of Statistics data showed.

EQUITIES (CSRC): China’s top securities regulator said the new delisting rules will not impact the market in the short term as it has made arrangements about a transition period, Guo Ruiming, director of the Listed Company Supervision Department of the China Securities Regulatory Commission said in a statement on its website.

BONDS (SHANGHAI SECURITIES NEWS): Many of China’s mutual fund companies have set purchase limits on their products focused on short to mid-term bonds as demand for such instruments has been surging following recent cuts in the country’s interest rates, according to a report by the Shanghai Securities News.

TRADE (RTRS): Wu Huazhan's Chinese television factory used to impose minimum orders to manage production efficiently. Times are now so bleak, it will take any order. Foshan Top Winning Import & Export's profit margin has dropped to a wafer-thin 0.5% from 2% some 3-4 years ago, according to Wu, a co-owner of the Guangdong-based factory and one of the many exporters fretting about business prospects at China's biggest trade fair in the southern city of Guangzhou.

CHINA MARKETS

MNI: PBOC Conducts CNY2 Bln Via OMO Weds; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the maturity of CNY2 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8124% at 10:16 am local time from the close of 1.8155% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Tuesday. the same as the close on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1025 on Wednesday, compared with 7.1028 set on Tuesday. The fixing was estimated at 7.2419 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND INFLATION SLOWS TO 4% Y/Y, EST. 4.0%; PRIOR 4.7%

NZ 1Q CONSUMER PRICES RISE 0.6% Q/Q; EST. +0.6%; PRIOR +0.5%

NZ 1Q NON-TRADABLE PRICES RISE 1.6% Q/Q; PRIOR +1.1%

NZ 1Q TRADABLE PRICES FALL 0.7% Q/Q; PRIOR -0.2%

NZ RBNZ 1Q SECTORAL FACTOR MODEL INFLATION INDEX RISES 4.3% Y/Y; PRIOR 4.7%

NZ MARCH GOVT. BONDS HELD BY FOREIGNERS RISE TO 62.9%; PRIOR 62.6%

JAPAN MARCH EXPORTS RISE 7.3% Y/Y; EST. 7.0%; PRIOR 7.8%

JAPAN MARCH IMPORTS -4.9% Y/Y; EST. -5.1%; PRIOR +0.5%

JAPAN MARCH TRADE BALANCE 366.5B YEN; EST. 345.5B YEN; PRIOR -377.8B YEN

AUSTRALIA MARCH WESTPAC LEADING INDEX FALLS 0.05% M/M; PRIOR +0.06%

MARKETS

US TSYS: Treasury Futures Little Changed After Earlier Testing Support

- Jun'24 10Y futures have remained in tight ranges throughout the day testing initial support at 107-16, before making highs of 107-21+, we now trade - 01+ from NY closing levels at 107-20.

- Cash Treasury curve has erased earlier moves with yields mostly unchanged for the day, the 2Y yield -0.6bp at 4.981%, 10Y -0.6bps to 4.661%, while the 2y10y is back to unchanged at -31.149.

- Bond volatility has spiked with the Move Index up 38.45% MTD to 119.59.

- Looking ahead: Beige Book, TIC Flows and more Fed speakers later in the evening: Cleveland Fed Mester on a Federal Reserve update (Q&A) at 1730ET, Fed Gov Bowman IIF Global Outlook Forum (no text, Q&A) at 1915ET.

JGBS: Mostly Cheaper, 1Y Supply Tomorrow, National CPI On Friday

JGB futures are weaker but sit in the middle of today’s range, -17 compared to the settlement levels, after reversing weakness seen in early rounds of the Tokyo afternoon session. Early afternoon weakness was consistent with the results of today’s BoJ Rinban operations, which saw flat to positive spreads and higher cover ratios for the longer-dated buckets.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Trade Balance data.

- Cash US tsys are dealing slightly richer in today’s Asia-Pac session after yesterday’s cheapening following Fed Chair Powell’s "lack of further progress on inflation" comment.

- Cash JGBs are mostly cheaper across the curve, with yields flat (5-year) to 1.6bps (40-year) higher. The benchmark 10-year yield is 1.2bp higher at 0.883%, after setting a fresh YTD high of 0.885% today.

- Given the recent global trend of inflation prints coming in hotter than expected, the stakes are likely higher for this Friday’s Japan National CPI release.

- The swaps curve has twist-steepened, with rates 2bps lower to 1bp higher. Swap spreads are tighter.

- Tomorrow, the local calendar sees weekly International Investment Flow, Tertiary Industry Index, Tokyo Condominiums for Sale and Machine Tool Orders data alongside 1-year supply. The MoF will also conduct an Enhanced-Liquidity Auction for 15.5-39-year OTR JGBS.

AUSSIE BONDS: Cheaper, Narrow Ranges, Employment Report Tomorrow

ACGBs (YM -4.0 & XM -4.0) are holding cheaper after dealing in relatively narrow ranges in the Sydney session. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Westpac Leading Index.

- Cash US tsys are dealing little changed in today’s Asia-Pac session after yesterday’s cheapening following Fed Chair Powell’s "lack of further progress on inflation" comment.

- Cash ACGBs are 4bps cheaper, with the AU-US 10-year yield differential at -29bps.

- Swap rates are 4-5bps higher.

- The bills strip has bear-steepened, with pricing -1 to -7.

- RBA-dated OIS pricing is 3-6bps firmer for 2025 meetings. A cumulative 13bps of easing is priced by year-end.

- Tomorrow, the local calendar will see the Employment Report for March. There will be a lot of focus and uncertainty around this release after the outsized 116.8k rise in new jobs in February due to the timing of new starts around holidays. There could be payback for the outsized March outcome, which was the highest since the pandemic-affected November 2021.

- Bloomberg consensus expects a moderate 10k rise with the unemployment rate returning to its November/December level of 3.9%.

- Tomorrow’s local calendar also sees NAB Business Confidence for Q1.

NZGBS: Yields Sharply Higher After Q1 CPI Signals Sticky Domestic Inflation

NZGBs closed just off the worst levels of the session, with yields 6-7bps higher. The key event of today’s session was the release of Q1 CPI.

- While Q1 CPI printed in line with consensus at 0.6% q/q and 4.0% y/y, the continued stickiness of domestically driven non-tradeables inflation is likely to keep rates on hold for some time, especially as we’ve seen most of the disinflationary impact from tradeables.

- The 10-year NZGB slightly underperformed its $-bloc counterparts, with the NZ-US and NZ-AU yield differentials 2bps and 1bp wider on the day.

- Nevertheless, NZ-US 10-year yield differential at +26bps sits near its tightest level since mid-2021. Before the recent narrowing, this differential had oscillated between +30 and +80bps since late 2022.

- Swap rates closed 3bps higher than pre-CPI levels and 5bps higher on the day.

- RBNZ dated OIS pricing closed is 3-9bps firmer after the data across meetings, with late-24/early-25 leading. A cumulative 30bps of easing is priced by year-end versus 38bps before the data.

- Tomorrow, the local calendar is empty apart from the NZ Treasury’s planned sale of NZ$275mn of the 4.5% May-30 bond, NZ$175mn of the 2.0% May-32 bond, NZ$50mn of the 2.75% May-51 bond and NZ$30mn of the 3% Sep-30 Inflation-Linked bond.

FOREX: NZD Up Post Sticky CPI, USD Weaker Elsewhere

The USD sits marginally off recent highs, last around 1265.25, off nearly 0.10% versus end NY levels from Tuesday. An NZD/USD bounce has been the standout today, up nearly 0.50%, post stronger than expected Q1 CPI details.

- The Kiwi is higher versus all G10 currencies, with the expectation that the RBNZ is unlikely to lower its OCR anytime soon. NZGBs are 6-8bps higher today, with most of the move coming post NZ CPI.

- NZD/USD was last near 0.5900, earlier highs were at 0.5908. Apr 15 highs at 0.5950 will be viewed as upside resistance. Support seen at 0.5864, Nov 11 lows.

- AUD/USD has been dragged higher, last near 0.6415, close to 0.20% firmer. Outside of spill over from NZD gains, we have seen a better China equity tone (amid assurances from the regulator), while US equity futures are also higher, up over 0.20%.

- The AUD/NZD cross is lower, last near 1.0860, close to recent lows. The AU-NZ 2y swap has edged lower down 1.5bps to -94.50bps.

- USD/JPY has traded very a tight range, last near 154.60/65, down slightly. US yields are close to unchanged. Earlier we had solid Japan export growth for March, but it was in line with expectations. The South Korean and Japan FinMins also discussed the respective weakness of their two exchange rates.

- Later the Fed’s Mester speaks and the Beige Book is published. The ECB’s Lagarde, Schnabel and Cipollone and BoE’s Bailey appear. In terms of data, March UK CPI/PPI and euro area CPI are released.

ASIA PAC EQUITIES: Equities Mixed, Powell's Hawkish Comments And FX Moves The Focus

As Asian markets break for lunch, regional equities trade mixed. Japanese equities the worst performers, while Taiwan equities perform the best up about 1.5%. Local currencies have been the main focus in the region today, with the yen front and center as investors watch closely for any intervention from the BoJ, while comments from Fed Chair Jerome Powell indicated that policymakers will wait longer then expected before cutting interest rate due to a string of unexpectedly high inflation reports. Earlier New Zealand CPI was the main economics data point in the region and was in line with expectations at 4%, this is the lowest figure in almost three years, although still comfortably above the RBNZ target range of 1-3%.

- Japanese stocks initially opened slightly higher, but quickly turned negative as investors weigh the implications of Jerome Powell's remarks on the Federal Reserve's future interest rate adjustments and watch for any risk of currency intervention. The yen has remained stable at trading around 154.60 throughout the session after experiencing a sudden and brief rally overnight. While a weakening yen, currently at a three-decade low, could benefit exporters, there is mounting unease about the speed of its decline and the currency's volatility. Equities have recovered somewhat from earlier moves lower with he Topix now down 0.40% after being down as much as 1.30%, while the Nikkei fares slightly better down 0.12%.

- South Korea’s Kospi is lower today down 0.15%, local yields are higher with the KTB 10Y above 3.60% for the first time since mid-December, while the KRW is off lows now trading at 1,389.70. Foreign investors has sold 160b won of equities today, while retail investors have purchased 246b won.

- Taiwan equities are higher today largely tracking mainland China's markets higher with the Taiex now up 1.50% at 20,187 and now testing the 20-day EMA. The index is still 3.30% off recent highs after failing to break the 20,800 last week. Foreign investors have sold $1.3B of equities on Tuesday, the largest amount since Jan 17th the second highest for the past year, for a total outflow of $2.8b of outflows over the past 4 trading days.

- Australian equities are unchanged today, gains in Financials are being offset by loses in Mining and Health Care names. Earlier Westpac Leading Index fell to -0.05% in March from 0.08% in Feb. The ASX200 is off 3.60% from recent highs and hovers just above support at 7,600.

- Elsewhere in SEA, New Zealand Equities are 0.60% higher after CPI data fell to 4%, the weakest reading in almost three years. Thailand's SET Index is down 2.06% as the market returns from holidays, the Indonesian JCI is up 0.21%, Philippines PSEi is up 1%, Singapore equities are up 0.50%, while Malaysian equities are down 0.15%

ASIA EQUITIES: China & HK Equities Higher, Small-Caps Up On CSRS Clarification

Hong Kong and China equity markets are mostly higher today. On Tuesday the CSI2000 was down 7.16% after a report from the CSRC, however they since clarified and said the latest delisting rules would target “zombie” listed companies but not small-cap stocks in the index, the tighter delisting rules also won’t have an impact on the market in the short term. The index has rebounded the majority of Tuesday sell-off to be up 5.50% today, although is still down around over 8% the past week, versus the CSI300 which is unchanged over the same time. Elsewhere, China's banks may become a focus today after Fitch revises down outlooks.

- Hong Kong equities are mixed today, the HSTech Index is down 0.20%, the Mainland Property Index is unchanged, while the HSI is down 0.07%. In China, the CSI300 is up 0.70%, while the focus has been on smaller-cap and growth indices with the CSI1000 up 3.28% and the ChiNext is 1.34% higher.

- China Northbound saw 2.8b of inflows on Tuesday, with the 5-day average at -0.83billion, while the 20-day average sits at 0.21billion yuan.

- In the property space, Chinese developers, saw their shares rise in Hong Kong afternoon trading, possibly due to reports suggesting the establishment of a national real estate platform to acquire unfinished properties for affordable housing. CIFI Holdings closed 4.5% higher, while Sunac China rose 4.4% and Sino-Ocean closed 4% higher. The positive sentiment followed news that CIFI had received government financing support for 15 projects, with 68 projects included in the "white-list." However, concerns about falling home prices persisted, with Bloomberg's gauge of Chinese developers' stocks narrowing losses to 2.4%.

- On Tuesday, Chinese President Xi Jinping defended his country's export practices during talks with German Chancellor Olaf Scholz, highlighting the positive impact of China's clean technology exports on global inflation and climate change efforts. Despite Western pressure to address overcapacity and unfair trade practices, Xi emphasized the importance of objective market perspectives and warned against protectionism, while Scholz pressed for better market access and fair competition conditions for German firms during his visit to China.

- Looking ahead, Hong Kong has Unemployment data due on Thursday, while China's 1 & 5 yr LPR on Monday is the next focus

OIL: Crude Lower As Fed Easing Seems Delayed But Watching Geopolitics

Oil prices have trended lower throughout the APAC session as there were no new developments in either the Middle East or Russia on Tuesday while US crude stocks rose sharply and Fed cuts are likely to be delayed. The market remains wary though of anything in the geopolitical space. The USD index is down 0.1%.

- WTI is down 0.7% to $84.77/bbl, close to the intraday low of $84.71. Brent is 0.6% lower at $89.49 having breached $90 early in the session. It is just off its low of $89.44.

- The Middle East remains firmly within the market’s radar after Israel said it would respond to Iran’s drone/missile attack but when it feels the time is right. Iran replied that it would promptly retaliate.

- In the options market, calls are trading at their widest premium over puts since the Hamas attack on Israel in October and 3mn barrels have been bought betting that prices reach $250 by June, according to Bloomberg.

- Bloomberg reported that US crude stocks rose 4.09mn barrels last week, according to people familiar with the API data. But there were inventory drawdowns of refined products, gasoline -2.5mn and distillate -427k. The official EIA data is out later today.

- Later the Fed’s Mester speaks and the Beige Book is published. The ECB’s Lagarde, Schnabel and Cipollone and BoE’s Bailey appear. In terms of data, March UK CPI/PPI and euro area CPI are released.

GOLD: Advance Takes A Breather

Gold is little changed in the Asia-Pac session, after closing unchanged at $2382.89 on Tuesday.

- Bullion proved resilient in the face of Fed Chair Powell’s "lack of further progress on inflation" comment, which pressured US Treasuries.

- The DXY was also firmer on Powell's comments amid expectations the ECB, the BoC, and possibly the BoE could cut before the Fed. USD-JPY also edged up on expectations the BoJ will remain accommodative.

- The yellow metal is up around 15% YTD, with the advance partially driven by haven demand as geopolitical tensions in the Middle East and Ukraine continue to percolate.

- According to MNI’s technicals team, attention remains on $2452.5, a Fibonacci projection. Initial firm support is at $2276.1, the 20-day EMA.

- After outperforming on Monday, silver fell 2% yesterday to ~$28/oz, leaving the metal around 5% off its recent 3-year high.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/04/2024 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 17/04/2024 | 0600/0700 | *** |  | UK | Producer Prices |

| 17/04/2024 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/04/2024 | 0900/1100 |  | EU | ECB's Cipollone in Italian Banking Meeting | |

| 17/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/04/2024 | 1205/1305 |  | UK | BoE's Greene on IIF Panel | |

| 17/04/2024 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/04/2024 | 1300/1500 |  | EU | ECB's Cipollone at IIF Global Outlook Forum | |

| 17/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 17/04/2024 | 1545/1745 |  | EU | ECB's Schnabel Speaks At IRFMP | |

| 17/04/2024 | 1600/1700 |  | UK | BoE's Bailey In IIF Fireside Chat | |

| 17/04/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/04/2024 | 1800/1400 |  | US | Fed Beige Book | |

| 17/04/2024 | 1800/1900 |  | UK | BoE's Haskel At Kings College London Panel | |

| 17/04/2024 | 2000/1600 | ** |  | US | TICS |

| 17/04/2024 | 2130/1730 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.