-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI EUROPEAN OPEN: NZD & Local Rates Plunge Post RBNZ

EXECUTIVE SUMMARY

- LITTLE GLOBAL DEFLATIONARY THREAT FROM CHINA - IMF - MNI INTERVIEW

- FED GOV BOWMAN STILL WILLING TO HIKE IF NEEDED - MNI BRIEF

- TRUMP, BIDEN WIN MICHIGAN PRIMARIES BUT DEMOCRATS MOUNT GAZA PROTEST VOTE - RTRS

- ECB INFLATION SCEPTICS HOLD UPPER HAND - SCICLUNA - MNI INTERVIEW

- BOJ NEEDS TO CONDUCT RATE HIKE WITHOUT DRAMA, TOP ACADEMIC SAYS - BBG

- AUSSIE MONTHLY CPI FALLS TO 3.4% Y/Y - MNI BRIEF

- RBNZ LOWERS PEAK OCR CALL, ADJUSTS CPI FORECAST - MNI BRIEF

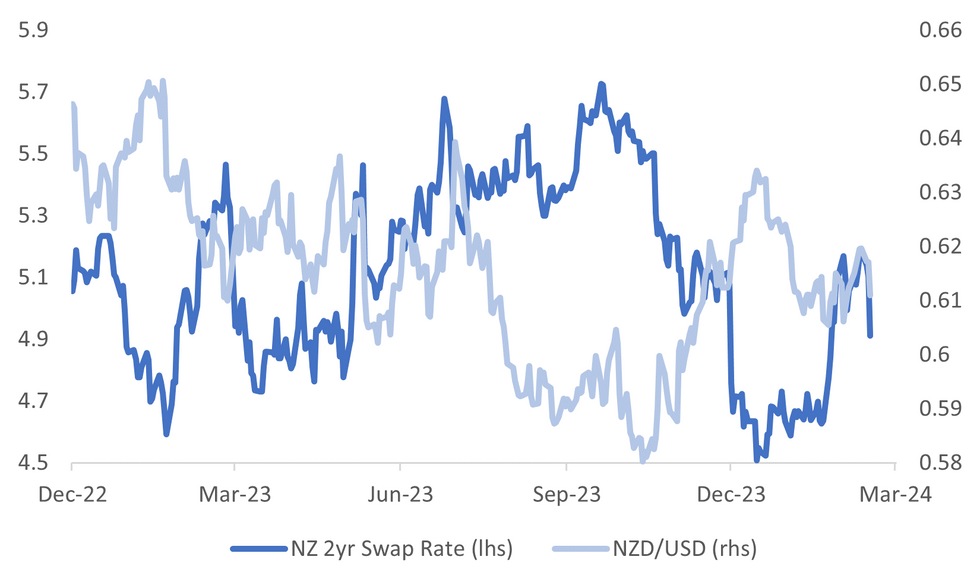

Fig. 1: NZD/USD Versus NZ 2yr Swap

Source: MNI - Market News/Bloomberg

U.K.

BOE (MNI BRIEF): Bank of England Deputy Governor Dave Ramsden said on Tuesday restrictive monetary policy has eased labour markets but offered no fresh steer on the timing of the cycle’s first rate cut.

BOE (BBG): The Bank of England may sell all the UK government bonds bought under quantitative easing to better prepare for a future crisis, a move that would put it at odds with the US Federal Reserve. BOE Deputy Governor Dave Ramsden, who oversees financial markets, said officials may continue running down the QE portfolio, which peaked at £895 billion, even after hitting the “preferred minimum range of reserves.”

EUROPE

ECB (MNI INTERVIEW): A majority of the European Central Bank’s Governing Council remains sceptical that inflation has been shown to come down quickly enough to justify easing policy yet, Central Bank of Malta Governor Edward Scicluna told MNI, though he played down reports the ECB could wait until June before lowering rates and called instead for a cut to be considered by as soon as next month.

NATO (BBC): Several Nato countries, including the US, Germany and the UK, have ruled out deploying ground troops to Ukraine, after French President Emmanuel Macron said "nothing should be excluded".

FRANCE/GERMANY (POLITICO): As Ukraine runs short on ammunition, the German and French leaders are at odds over military aid.

CORPORATE (BBG): Swisscom AG is in advanced talks to acquire Vodafone Group Plc’s Italian business after fending off competition from billionaire Xavier Niel, according to people familiar with the matter.

FRANCE (BBG): Qatar will invest 10 billion euros ($10.9 billion) in French startups and funds as the two countries deepen an already close bilateral relationship.

RUSSIA (ECONOMIST): A slew of data released on Wednesday will probably show that Russia’s economy is expanding rapidly. The unemployment rate is hovering around 3%, an all-time low. Wages are growing strongly, even after taking into account high inflation.

U.S.

FED (MNI BRIEF): Federal Reserve Governor Michelle Bowman reiterated her openness Tuesday to raising interest rates again if progress on inflation stalls or reverses, though she judges that current policy is restrictive and will bring inflation back to 2% over time.

INFLATION (MNI BRIEF): U.S. Treasury Secretary Janet Yellen said Tuesday she expects inflation to keep falling even as the economy remains strong. "Inflation is already coming down in a great deal and I believe is going to came down more, of course there’re risks but for me the outlook is for more of the same," she said at an event sponsored by the American Chamber of Commerce during G20 meetings in Sao Paulo, though she conceded some inflation risks remain.

POLITICS (RTRS): U.S. President Joe Biden easily won the Democratic presidential primary in Michigan on Tuesday, but a protest vote by Democrats angry over his support for Israel’s war against Hamas in Gaza exceeded organizers' expectations.

FISCAL (BBG): Congressional leaders expressed confidence they could avoid a partial government shutdown after meeting at the White House with President Joe Biden, as time runs out to reach a deal.

APPLE (RTRS): Apple (AAPL.O), opens new tab has canceled work on its electric car, a source familiar with the matter told Reuters on Tuesday, a decade after the iPhone maker kicked off the project.

OTHER

MIDEAST (RTRS): Yemen's Houthis said on Tuesday they could only reconsider their missile and drone attacks on international shipping in the Red Sea once Israel ends its "aggression" in the Gaza Strip. Asked if they would halt the attacks if a ceasefire deal is reached, Houthi spokesman Mohammed Abdulsalam told Reuters the situation would be reassessed if the siege of Gaza ended and humanitarian aid was free to enter.

JAPAN (BBG): The Bank of Japan should nimbly end its negative interest rate policy with minimum fuss, according to an economics professor and former adviser to an economic panel for the prime minister.

AUSTRALIA (MNI BRIEF): Australia’s monthly CPI indicator printed at 3.4% y/y in January, flat over December and 20 basis points lower than the market estimate, data released by the Australian Bureau of Statistics showed. CPI excluding volatile items grew at 4.1% y/y, 10bp lower than the prior month, while trimmed mean rose by 3.8%, down form December’s 4%.

NEW ZEALAND (MNI BRIEF): The Reserve Bank of New Zealand monetary policy committee (MPC) unanimously voted to hold the official cash rate at 5.5% today, its fifth consecutive pause, while the updated Monetary Policy Statement adjusted the pace it expects inflation to fall and lowered its peak rate prediction.

SOUTH KOREA (BBG): South Korea and US will conduct the annual Freedom Shield exercise on March 4-14, South’s Joint Chiefs of Staff says in a statement.

SOUTH KOREA (RTRS): CEO Mark Zuckerberg arrived in South Korea late on Tuesday, where he is expected to hold talks on artificial intelligence and have meetings with President Yoon Suk Yeol and the heads of some of the country's tech powerhouses.

HONG KONG (RTRS): Hong Kong's financial secretary on Wednesday announced major measures to bolster the city's flagging property market by scrapping most stamp duties on transactions, with the city economy expected to grow a modest 2.5%-3.5% this year.

CHINA

GLOBAL INFLATION (MNI INTERVIEW): Fears that China will export deflation to the world are overblown, with the country’s inflation likely to move out of negative territory as domestic demand picks up and the drag from commodity prices wanes, the International Monetary Fund’s deputy mission chief for China told MNI.

MONETARY POLICY (ECONOMIC DAILY): China should step up its use of precise, flexible and innovative monetary policies that can support the nation’s economic transformation and high-quality development, the Economic Daily says in a commentary.

GROWTH (ECONOMIC DAILY): Authorities should make good use of monetary and financial regulatory tools as well as market force to help drive quality growth of the economy, according to a commentary published in the Economic Daily.

HOUSING (HOUSING MINISTRY): Local governments are required to formulate annual housing development plans for 2024 and 2025 which should scientifically arrange land supply based on housing demand to prevent high volatility, according to a statement on the website of the Ministry of Housing and Urban-Rural Development.

SOE REFORM (SECURITIES DAILY): Authorities should implement SOE reforms which optimise the layout of state capital and bring large positive externalities such as AI, according to Wang Hongzhi, deputy director of the State-owned Assets Commission.

CHINA MARKETS

MNI: PBOC Injects Net CNY275 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY324 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net injection of CNY275 billion reverse repos after offsetting CNY49 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:28 am local time from the close of 1.9287% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 42 on Tuesday, compared with the close of 46 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1075 on Wednesday, compared with 7.1057 set on Tuesday. The fixing was estimated at 7.2004 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JAN. CONSUMER PRICES RISE 3.4% Y/Y; EST. +3.6%; PRIOR 3.4%

AUSTRALIA 4Q TOTAL CONSTRUCTION RISES 0.7% Q/Q; EST. +0.6%; PRIOR +1.4%

NEW ZEALAND JANUARY FILLED JOBS RISE 0.6% M/M; PRIOR 0.0%

MARKETS

US TSYS: Treasuries Steady, Remain Rangebound Ahead of GDP & PCE Data Later

TYH4 is currently trading at 109-21, up + 04 from New York closing levels

Treasury futures have crept higher over the day, although we remain well within Tuesday ranges while yields are 0-2bps lower across the curve.

- Mar'24 10Y futures remain in a tight range in Asia trading 109-23 high vs 109-17+ low, we trade just off the highs at 109-21. Initial supports holds at 109-17, (50.0% of the Oct - Dec bull cycle). A clear break of this retracement would strengthen the bearish condition and signal scope for an extension towards 108-19+, the 61.8% Fibonacci level. On the upside, initial firm resistance is seen at 110-24+, the 50-day EMA.

- Yield 0-2bps lower today with the 2Y yield is -1bp lower at 4.674%, the 10Y yield is -1.2bps lower at 4.291%, while the 2y10y is +0.049 at -39.362.

- Earlier, House Speaker Mike Johnson offered to delay Funding Deadlines (Punchbowl)

- Looking ahead, Wednesday data calendar includes GDP, PCE, Wholesale/Retail Inv, Fed Speak.

JGBS: Futures Holding Weaker, Heavy Local Calendar Tomorrow

JGB futures remain weaker, -7 compared to settlement levels, after dealing in a relatively narrow range in today’s Tokyo session.

- There hasn’t been much in the way of domestic drivers to flag, with Leading & Coincident Indices due later today.

- (Bloomberg) “I would expect the BoJ to end the negative rate in April, but cannot deny the possibility of that to happen in March,” says Inadome, a senior strategist at Sumitomo Mitsui Trust Asset Management. (See link)

- Today’s BoJ Rinban operations showed positive spreads, but lower offer cover ratios across the 5-10-, 10-25- and 25-year+ buckets. On balance, the results are consistent with the mildly weaker open to the Tokyo afternoon session.

- Cash US tsys are dealing flat to 1bp richer in today's Asia-Pac session, with newsflow light.

- The cash JGB curve has bear-steepened, with yields flat to 3bps higher. The benchmark 10-year yield is 0.5bps higher at 0.698% versus the Nov-Dec rally low of 0.555% and the February high of 0.770%.

- The swaps curve has also bear-steepened, with rates flat to 3bps higher. Swap spreads are tighter out to the 30-year.

- Tomorrow, the local calendar sees Retail Sales, International Investment Flows, Industrial Production and Housing Starts data. The MoF also plans to sell Y2.9bn of 2-year JGBs.

AUSSIE BONDS: Cheaper On The Day But Slightly Richer After CPI Monthly Miss, Retail Sales Tomorrow

ACGBs (YM -1.0 & XM -3.5) have strengthened slightly since the release of CPI Monthly data.

- January CPI inflation printed below expectations holding steady at 3.4% y/y, with ex-volatile items & holiday travel dipping 0.1pp to 4.1% and the trimmed mean 0.2pp to 3.8%.

- The first month of the quarter doesn’t include updates for the services component.

- RBA Governor Bullock noted recently that the help from falling goods inflation is probably behind us. January goods inflation was only 0.1pp lower at 3.1% y/y and non-tradeables 0.1pp higher at 0.9%.

- Cash ACGBs are flat to 3bps cheaper on the day, with the AU-US 10-year yield differential 2bps higher at -13bps.

- Swap rates are flat to 2bps higher on the day, with the 3s10s curve steeper.

- The bills strip is little changed, with pricing flat to -1.

- RBA-dated OIS pricing is little changed across meetings on the day. A cumulative 37bps of easing is priced by year-end.

- Tomorrow, the local calendar sees Retail Sales and Private Sector Credit for January and Private Capital Expenditure for Q4.

- TCorp issued A$600mn of its 1.75% 20 March 2034, 4.75% 20 February 2035 and 4.25% 20 February 2036 Benchmark bonds via Yieldbroker tender.

NZGBS: Sharp Rally After RBNZ Signals It Is Happy With Where Rates Are

NZGBs closed sharply richer, with benchmark yields 9-16bps lower and the 2/10 curve steeper, after the RBNZ left the OCR at 5.50%, as widely expected.

- The main change from the RBNZ was the more neutral tone to the meeting assessment with November’s more hawkish elements removed. The tone suggested that the RBNZ is happy with where rates are for now and is not looking to change them in either direction, but policy will need to stay restrictive to return inflation to target.

- Swap rates are 8-16bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is 5-21bps softer across meetings. A cumulative 52bps of easing is priced by year-end from an expected OCR peak of 5.54%.

- Before the decision, the market had attached a 29% chance of a 25bp hike at today’s meeting, with an anticipated terminal OCR of 5.65% (reflecting a 61% probability of a 25bp hike) by the May meeting.

- Tomorrow, the local calendar will see ANZ Business Confidence, along with RBNZ Governor Orr’s appearance in front of a Parliament Select Committee on MPS.

- Tomorrow, the NZ Treasury plans to sell NZ$300mn of the 0.25% May-28 bond, NZ$150mn of the 3.5% Apr-33 bond and NZ$50mn of the 1.75% May-41 bond.

FOREX: NZD Slumps Post RBNZ, USD Mostly Firmer Elsewhere

The main theme today has been NZD weakness, post the RBNZ's dovish hold (at least relative to expectations). NZD/USD fell to a low of 0.6103 in recent dealings, after tracking at 0.6175/80 in pre RBNZ dealings. We were last near 0.6110/15, around 1% weaker for the session.

- The main change from the RBNZ was the more neutral tone to the meeting assessment with November’s more hawkish elements removed. The tone suggested that the RBNZ is happy with where rates are for now. RBNZ dated OIS pricing closed 5-21bps softer across meetings. Pre RBNZ the market had attached a 29% chance of a 25bp hike at today’s meeting.

- For NZD/USD a clean break sub 0.6100 could see mid Feb lows near 0.6050 targeted.

- AUD/USD has been dragged lower by the NZD move and generally softer regional equity tone. AUDUSD is down 0.35% to 0.6520, close to session lows. Initial support is at 0.6496. AUDUSD fell briefly on the lower-than-expected January CPI outcome which came in unchanged at 3.4% y/y. But then fell sharply following the RBNZ decision. With kiwi underperforming, AUDNZD is 0.6% higher at 1.0665, slightly off session highs (1.0687).

- There are steadier trends elsewhere, albeit with the USD firmer. The BBDXY is up close to 0.1%, last near 1242.75. USD/JPY was sub 150.40 earlier, but we now track back at 150.60

- Looking ahead, Fed’s Bostic, Collins, Williams and BoE’s Mann speak. US Q4 GDP revisions are released as well as January inventories and trade balance. The European Commission February survey also prints.

ASIA EQUITIES: HK & China Equities Turn Lower, Country Garden Issued Wind-up

Hong Kong and China equities have opened mixed today, but have turned lower as the day has progressed. Hong Kong Budget and GDP were released earlier, with a focus on the property sector, while Macau gaming operator Galaxy Entertain missed their earnings forecast

- Equities markets are mixed, tech were up as much at 1.20% earlier only to have traded lower over the day to now be flat. Property again under-preforms on the back of Country Gardens Wind-up notice, with the mainland property index down 1.73%, while the HSI is down 0.20%. In China, indices have turned lower throughout the day early gains in growth stock have been completely reverse with the CSI100 up as much as 1.50% earlier to now trade 1.40% on the day, while the CSI300 trade down 0.10%

- China Northbound flows were +12.24b yuan on Monday, the forth highest daily inflow since July 2023, the other three have occurred in the past month.

- Major companies with earnings due out today include Baidu Inc and Sun Hung Kai Property. Baidu will be closely watched as earnings are expected to have grown by the slowest rate in a year, while investments in AI may also be a drag on results. Galaxy Entertainment the Macau Casino and Hotel company missed their earnings forecast earlier, although occupancy rates in their hotels remained near 100%.

- Earlier Chinese Property developer Country Garden was issued with a wind-up notice in a Hong Kong court with the first hearing expected to take place on May 17th, this follows from yesterday when China Vanke Co was reported to be in talks for a debt restructure.

- Hong Kong's GDP and Budget were released earlier with GDP coming in at 4.30% YoY inline with expectations, while QoQ was 0.4% vs 0.5% expected. The focused for the budget was on the easing of property curbs after house prices had fallen to the lowest in seven years, measures to curb housing demand have been cancelled with immediate effect. Other parts of the budget have been focused on improving tourism and hosting events with an additional HK$1.1B in funding, while there is also a focus on attracting foreign investment inflows.

- Looking ahead to Thursday, HK has Budget Balance and Money Supply data due, while the China calendar remains empty.

ASIA PAC EQUITIES: Equities Mostly Lower, SK Exception as Zuckerberg To Meet Samsung

Regional Asian Equities are mostly lower today, with South Korea the exception as it was announced Zuckerberg will visit Seoul to discusses AI with Samsung. Elsewhere investors have been looking to book in profit ahead of a busy few days for US data, and recent rallies in Asia equities leaving the BBG APAC Index down 0.32%.

- Japan equities are off lows from earlier to trade mixed, banks are weighing on the index today after yesterday pushing higher on the back of 2y JGBs hit their highest levels since 2011, the Topix Bank index is down 0.40%. Earlier Bank of Japan Executive Director Seiichi Shimizu says there hasn’t yet been enough certainty that the bank’s stable inflation goal will be achieved, and that the Bank will consider adjusting it's monetary easing once the price goal is in sight. Currently the Topix is flat, while the Nikkei 225 trades 0.20% lower.

- South Korean equities are higher today, after news broke that Mark Zuckerberg will visit Seoul to discuss AI technology with Samsung. The "Korea Discount" is nearing yearly lows again after recent policy announcements underwhelmed the market, while foreign equity inflows also continue to slow with the 5-day average is now at $40m, while the 20-day sits at $286m

- Taiwan Equities have followed wider markets lower today, the Philadelphia semiconductor index closed 0.20% lower on Tuesday which hasn't helped. Equity flows were negative on Tuesday and continue to slow, although still in positive territory on a rolling average as the 5-day average is now at $132m while the 20-day sits at $331m, currently the Taiex is 0.50% lower.

- Australian equities are closed flat today, after weakness in Financials and materials sectors outweighed gains in tech, energy and real estate. Earlier Australia had construction work done data out coming in just above expectations at 0.7% vs 0.6%, while CPI came in below expectations at 3.4% vs 3.6%,

- Elsewhere in SEA, NZ equities higher after the RBNZ kept rates on hold, up 0.60%, Indonesia recorded a fourth day of foreign equity outflows, although their equity is up 0.36% today, while Singapore & Malaysia equities are 0.30-0.50% lower.

OIL: Crude Falls On US Stock Build, EIA Data Out Later

Crude gave up some of Tuesday’s gains early in APAC trading driven by another large US crude stock build but has recovered somewhat as geopolitical developments and the extension of OPEC cuts continue to put the market on edge. WTI is down 0.4% to $78.56/bbl, close to the intraday high, and Brent is -0.4% to $82.36/bbl. The USD is up 0.1%.

- Bloomberg reported a crude inventory build of 8.428mn barrels, according to people familiar with the API data, after +7.2mn the previous week. But product stocks continued to rundown with gasoline -3.3mn and distillate -500k. Refinery outages have resulted in crude builds and product drawdowns. Official EIA data is out later and includes refining capacity utilisation.

- The UK Navy reported a rocket exploded 3-5NM from a vessel but it is safe and will continue to its next port. The US has hit 230 targets to date in Yemen to contain attacks on Red Sea shipping. The Iran-backed Houthis have said they will only reconsider striking vessels once Israel ceases its “aggression” in Gaza. So, it seems that problems for shipping in the area are likely to continue.

- Later the Fed’s Bostic, Collins, Williams and BoE’s Mann speak. US Q4 GDP revisions are released as well as January inventories and trade balance. The European Commission February survey also prints.

GOLD: Steady Ahead Of US PCE On Thursday

Gold is steady in the Asia-Pac session, after closing little changed at $2030.48 on Tuesday.

- There has been very little movement in precious metals over the past 24 hours in line with the narrow ranges for the USD index as market participants await US PCE inflation on Thursday. The core PCE price index is expected to show a rise.

- For a market that still has an aggressive easing cycle priced despite the recent paring of easing expectations, participants will be particularly wary of any upside surprise from the PCE data.

- The Federal Reserve has specified that bringing inflation back toward its 2% target is necessary before it will start to cut borrowing costs.

- The swap market assigns around a 50% chance of a June rate cut, with little likelihood of any move before then. Lower rates are typically positive for bullion, which doesn’t offer any interest.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2024 | 0700/0800 | ** |  | SE | PPI |

| 28/02/2024 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 28/02/2024 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/02/2024 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/02/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 28/02/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/02/2024 | 1100/1200 |  | EU | ECB's Lagarde and Cipollone in G20 and CB Governors meeting | |

| 28/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/02/2024 | 1330/0830 | * |  | CA | Current account |

| 28/02/2024 | 1330/0830 | * |  | CA | Payroll employment |

| 28/02/2024 | 1330/0830 | *** |  | US | GDP |

| 28/02/2024 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 28/02/2024 | 1530/1530 |  | UK | BOE's Mann at FT future forum event 'The economic outlook..' | |

| 28/02/2024 | 1700/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/02/2024 | 1715/1215 |  | US | Boston Fed's Susan Collins | |

| 28/02/2024 | 1745/1245 |  | US | New York Fed's John Williams | |

| 29/02/2024 | 2350/0850 | * |  | JP | Retail sales (p) |

| 29/02/2024 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.