-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NZD & Local Yields Surge Post Hawkish RBNZ Hold

EXECUTIVE SUMMARY

- FED's GOOLSBEE: KEEPING RATES HIGH FOR TOO LONG IS A CONCERN - BBG

- CHINA SHOULD BUOY GROWTH TO WOO HESITANT FDI - ADVISORS - MNI

- HOUSE PREPARES TO DROP CHINA INVESTMENT CURBS FROM DEFENSE BILL - BBG

- RBNZ HOLDS AT 5.5%, ADJUSTS PEAK OCR, CPI CALLS - MNI BRIEF

- AUSSIE MONTHLY CPI FALLS TO 4.9% - MNI BRIEF

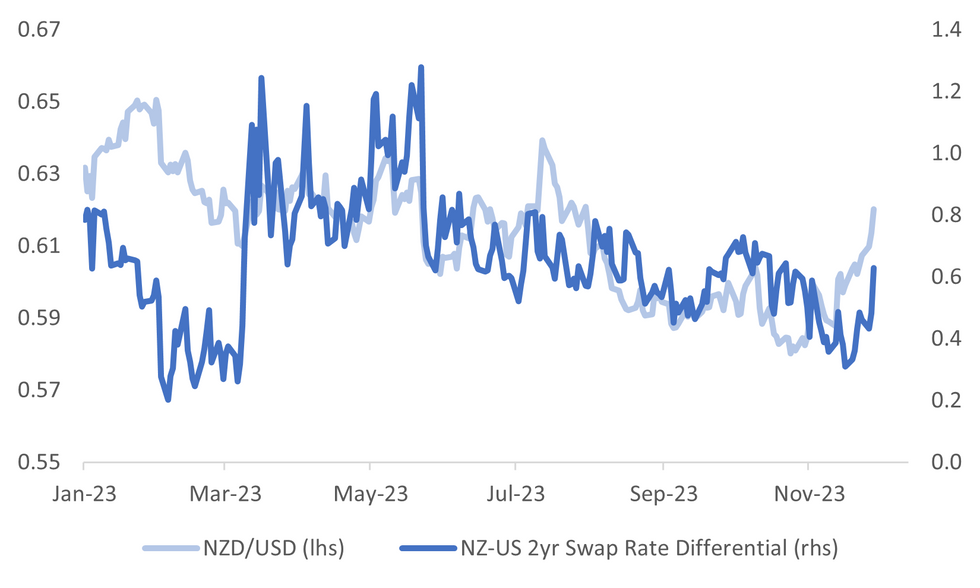

Fig. 1: NZD/USD Versus NZ-US 2yr Swap Rate Differential

Source: MNI - Market News/Bloomberg

U.K.

ENERGY (BBG): The number of UK households in fuel poverty will continue to worsen, touching 6.5 million from January, because of a planned energy price increase and the scaling back of government support.

POLITICS (BBC): Government talks with the Democratic Unionist Party (DUP) on restoring Stormont are in the "final, final stages", the Northern Ireland secretary has said.

EUROPE

ECB (RTRS): The European Central Bank may need to take on a bigger role in supervising shadow banks as they are now bigger than conventional lenders and may be sitting on elevated risk, the outgoing head of the ECB's supervision arm told European newspapers.

EU/UK (BBG): The European Commission has come up with three options for how to deal with painful tariffs on electric cars traded with the UK, including one to delay them by as many as three years, according to people familiar with the matter.

FISCAL (MNI): The European Union’s rotating presidency is working on a new landing zone proposal for a reformed fiscal rules regime for the bloc following a messy meeting on Monday night of sherpas charged with preparing the ground for a political compromise ahead of a crunch Dec 8 meeting of finance ministers, officials told MNI.

ITALY (BBG): The European Commission has approved Italy’s fourth payout from the EU’s Recovery Fund, bringing its proceeds so far to more than half of the total €194 billion ($213 billion) allotted.

FRANCE (ECONOMIST): During the past month, unprecedentedly, a French cabinet minister has remained in office while facing charges in court. Eric Dupond-Moretti, the justice minister, is accused of using his office to settle old scores with magistrates and prosecutors. On Wednesday a special tribunal will reach a verdict.

U.S.

FED (BBG): Federal Reserve Bank of Chicago President Austan Goolsbee says he’s closely watching what happens with housing inflation, which has come down some but still has a way to go. High rates for a long time could be of some “concern,” Goolsbee says.

FED (BBG): Billionaire investor Bill Ackman is betting the Federal Reserve will begin cutting interest rates sooner than markets are predicting.

FED (MNI BRIEF): No directors of Federal Reserve Banks voted to raise the discount rate ahead of the November FOMC meeting where the primary credit rate was set at the existing level of 5.5%, according to minutes from the discussions.

FED (MNI BRIEF): Federal Reserve Governor Chris Waller on Tuesday said continued disinflation over several months could require the central bank to lower the fed funds rate to keep real rates constant.

US/CHINA (BBG): Congressional negotiators on Tuesday were poised to abandon plans to use the annual defense policy bill to tighten controls on US investment in Chinese technology, according to people familiar with the discussions.

OTHER

ISRAEL/HAMAS (BBG): Hamas has turned over 12 more hostages — 10 Israelis and two Thai citizens — to the Red Cross, according to the Israeli prime minister’s office, despite earlier competing claims of violations of the deal that brought their war to a temporary pause.

JAPAN (BBG): Bank of Japan Board Member Seiji Adachi stressed the need to stick with monetary easing, in what appeared to be an attempt to cool market speculation over an early policy normalization move.

NEW ZEALAND (MNI BRIEF): The Reserve Bank of New Zealand Monetary Policy Committee held the Official Cash Rate at 5.5% on Wednesday and slightly adjusted the pace it expects inflation to fall, while increasing its outlook for the OCR’s peak.

NEW ZEALAND (RTRS): New Zealand's new government will introduce legislation to reform the Reserve Bank of New Zealand's mandate and lift a ban on the sale of cigarettes to future generations within its first 100 days, Prime Minister Christopher Luxon said in a statement on Wednesday.

AUSTRALIA (MNI BRIEF): The monthly Consumer Price Index rose 4.9% y/y in October from 5.6% the prior month, while trimmed CPI increased 5.1%, down from September’s 5.5%, data from the Australian Bureau of Statistics (ABS) showed Wednesday.

HONG KONG (YICAI): The Hong Kong Stock Exchange has signed an MoU with the Beijing Green Exchange (CBGEX) to promote green finance and sustainable development, according to a notice on its website. Both sides will cooperate to meet China’s growing investment needs for green infrastructure and low-carbon transformation.

CHINA

FDI (MNI): Warmer China-U.S. relations will not reverse the decline of foreign direct investment anytime soon, particularly in technology, and mainland authorities should pursue pro-growth policies to attract hesitant offshore capital especially as interest-rate spreads between the yuan and dollar remain wide, advisors told MNI.

POLICY (SECURITIES DAILY): The People's Bank of China still has room for lowering the policy interest rate to stabilise the economic recovery and reduce government debt pressure, said Zhang Jun, chief economist at Galaxy Securities. Money supply will likely maintain steady growth to solidify the recovery especially when real estate is still adjusting, said Wang Qing, analyst at Golden Credit Rating.

SUPPLY CHAINS (YICAI): China’s Premier Li Qiang has proposed a four-point plan to increase cooperation on international supply chains, as the current world economic recovery remains difficult. Li, speaking at the China International Supply Chain Promotion Expo in Beijing said authorities want to strengthen the coordination of resources in key industrial chains and will refrain from making market interventions.

MONEY MARKETS (BBG): China’s money markets are showing some isolated signs of stress as month-end demand for the yuan picks up, but there’s still little concern about a replay of the cash squeeze that rattled traders in October.

CHINA MARKETS

PBOC Drains Net CNY22 Bln Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY438 billion via 7-day reverse repo on Wednesday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY22 billion after offsetting the maturity of CNY460 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9678% at 09:31 am local time from the close of 2.1105% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Tuesday, compared with the close of 44 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1031 Wednesday vs 7.1132 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1031 on Wednesday, compared with 7.1132 set on Tuesday. The fixing was estimated at 7.1334 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA DEC BUSINESS SURVEY MANUFACTURING 68; PRIOR 69

SOUTH KOREA DEC BUSINESS SURVEY NON-MANUFACTURING 71; PRIOR 69

AUSTRALIA OCT CPI Y/Y 4.9%; MEDIAN 5.2% PRIOR 5.6%

AUSTRALIA Q3 CONSTRUCTION WORK DONE Q/Q 1.3%; MEDIAN 0.3%; PRIOR 2.0%

MARKETS

US TSYS: Yesterday’s Strength Extends Into Asia, Q3 GDP (2nd Est) Due Today

TYZ3 is currently trading at 109-25, +0-08 from NY closing levels.

- Yesterday's US tsy strength has extended into today's Asia-Pac session after generally dovish remarks by Fed Goolsbee aftermarket added to bullish sentiment fueled by Fed Waller yesterday.

- Cash US tsys are 3-4bps richer across benchmarks.

- Today sees the second Q3 US GDP release including core PCE before Fedspeak from Cleveland Fed’s Mester (’24 voter) on financial stability and the Fed’s Beige Book.

JGBS: Futures Sharply Higher As US Tsy Rally Extends Into Asia, Heavy Data Calendar Tomorrow

JGB futures are sharply higher at 146.48, +62 compared to the settlement levels, after hitting a multi-month high of 146.54.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined speech from BOJ Board Member Adachi. To recap, the tone of the speech seemed similar to Governor Ueda’s recent remarks, namely the country's economy had yet to reach a stage where the central bank could debate an exit from ultra-easy monetary policy.

- Today's bid appears linked to an extension of yesterday's US tsy strength in today's Asia-Pac session. Dovish remarks by Fed Goolsbee aftermarket have added to bullish sentiment fueled by Fed Waller yesterday. Cash US tsys are 2-4bps richer across benchmarks.

- The cash JGB curve has richened beyond the 1-year. Yields are 0.9bp higher (2-year) to 8.4bps lower (10-year). The benchmark 10-year yield is at 0.693%. The 40-year has continued to underperform on the curve, 1.8bps lower at 1.940%, after yesterday's poor auction result.

- The swaps curve has bull-flattened, with swap spreads mixed across maturities.

- Tomorrow, the local calendar sees Retail Sales, Industrial Production, Weekly International Investment flows, Housing Starts and Consumer Confidence data.

- The MOF plans to sell Y2.9tn of 2-year JGBs.

AUSSIE BONDS: Sharply Richer After CPI Monthly Miss

ACGBs (YM +14.0 & XM +12.0) add 7-8bps to morning strength after October’s CPI monthly printed on the low side of expectations at 4.9% y/y versus 5.2% estimate and 5.6% prior.

- Subsidies for electricity and rent have helped to bring inflation down as well as lower fuel prices. The moderation in the trimmed mean was a lot less sanguine with it moving to 5.3% from 5.4%. It is worth noting that the first month of the quarter doesn’t include updated prices for most services and given this sector is showing sticky inflation, the October data is likely underestimating current inflation.

- Given the role of subsidies and lack of updated services prices, it is difficult to gauge the extent of demand-driven inflation from the October CPI release that RBA Governor Bullock spoke about in HK yesterday.

- Cash ACGBs are 12-13bps richer on the day, with the AU-US 10-year yield differential 2bps tighter at +8bps.

- Swap rates are 11-13bps lower on the day, 7-8bps lower post-data. The 3s10s curve is steeper.

- The bills strip has extended the overnight bull-flattening, with pricing +1 to +18bp.

- RBA-dated OIS pricing is 2-14bps softer on the day across meetings.

- Tomorrow, the local calendar sees Private Sector Credit, Private Capital Expenditure and Building Approvals data.

NZGBS: Cheaper After The RBNZ’s Hawkish Hold

NZGBs closed 1-2bps richer, flat to 6bps cheaper than the session's best levels, after the RBNZ decision and statement. The RBNZ left rates at 5.5% as was widely expected but given the statement and forecast revisions, it was a hawkish hold. The impact of strong population growth has become “apparent” and it is “increasing the risk of inflation remaining above target”.

- The MPC noted that it “would likely need to increase” rates again if inflation is higher than expected. Given it said inflation remains too high and price and demand indicators will be key to the NZ rate outlook.

- Elsewhere, NZ PM Luxon will introduce legislation to narrow the RBNZ’s mandate in the first 100 days.

- The swap curve has twist-flattened, with rates 6bps higher to 4bps lower. Rates are 2-10bps higher since the RBNZ decision, with the 2s10s curve 8bps flatter.

- RBNZ dated OIS pricing closed 1-7bps firmer across meetings.

- Tomorrow the local calendar sees Building Permits and ANZ Business Confidence.

- Tomorrow, the NZ Treasury plans to sell NZ$200mn of the 4.5% May-30 bond, NZ$250mn of the 2.0% May-32 bond and NZ$50mn of the 2.75% May-51 bond.

- Later today sees the second Q3 US GDP release before Fedspeak from Fed Mester and the Fed’s Beige Book.

FOREX: USD Hits Fresh Lows On Dovish Fed, NZD Outperforms Post Hawkish RBNZ Hold

The BBDXY got to fresh lows of 1228.7 in early dealings before stabilizing, the index last near 1230.25, still off around 0.15-0.20%. Dovish Fed rhetoric weighed in early Asia Pac trade, sending US Tsy futures to session highs, before gains were pared. This has helped USD sentiment stabilize somewhat, the 10yr yield was last 4.29% (earlier lows were just under 4.28%.

- Weighing on the USD was demand for yen into the Tokyo fix. USD/JPY hit of low of 146.67, not too far from trendline support - 146.48, drawn from the Mar 24 low. However, we now sit back at 147.10, close to Nov 21 lows.

- NZD/USD is the clear outperformer, following the hawkish RBNZ hold. The pair is back near 0.6200 (+1%), just off session highs. The RBNZ revised higher the OCR track, and warned policy may need to be tightened further.

- AUD/NZD is down sharply, last near 1.0725/30. bears will eye a break back sub 1.0700. AUD has underperformed after the Oct CPI miss, although there are caveats on this data. AUD/USD was last near 0.6650 little changed versus NY closing levels on Tuesday.

- Looking ahead, the November euro area EC economic sentiment survey is out. The Fed publishes its Beige Book and Mester speaks. In terms of data, there are US October trade numbers, inventories and updated Q3 GDP.

EQUITIES: Hong Kong/China Weighed By Earnings Concerns, Some Strength Elsewhere

Some of the major indices are weaker, with Hong Kong and China markets the main drags. Earnings concerns at China's top food delivery operator have weighed on broader sentiment in these markets. In terms of US futures we sit around 0.16% higher at the stage for both Eminis and Nasdaq futures. Eminis last near 4571, Nasdaq futures around 16075.

- The early impetus in US Tsy futures was higher, amid further dovish Fedspeak, although we are now off session highs. This coupled with weakness in HK/China stocks has weighed on broader sentiment, although there are some pockets of strength.

- At the break, the HSI sits 2% weaker. Food delivery business Meituan stating a slowdown for its services was likely in Q4 (see SCMP here), which has seen shares in the company back to early 2020 levels. The CSI 300 is off 0.67% at the break, with the index back sub the 3500 level.

- Headlines crossed (BBG) that the US congress may drop China investment curbs from its defense bill, but this hasn't impacted sentiment positively at this stage.

- Elsewhere, Japan markets are mixed, with the Topix down 0.30%, but the Nikkei 225 is flat. Weaker banks have been a drag for Japan stocks.

- South Korea and Taiwan markets are around flat. The ASX 200 is doing better, up nearly 0.40%, with health care stocks firmer.

- In SEA, markets are mixed, with fairly muted trading overall.

OIL: Crude Holds Onto Gains, Moving With USD Ahead Of OPEC Meeting

Oil prices have moved with the greenback today holding onto Tuesday’s gains. They are off their early session highs to be little changed on the day as the market waits for Thursday’s OPEC+ meeting. There remains a lot of uncertainty re the outcome as a deal on quotas still seems to be elusive. Some countries have said they want an agreement in place before the meeting, so it could be delayed again.

- Brent is flat at $81.44/bbl after reaching a low of $81.35. WTI is up 0.2% to $76.55 after a low of $76.41. It approached $77 earlier, while the USD was falling, making a high of $76.98. The USD index is down 0.1% but off its intraday low.

- Later the official EIA US inventory data is released. Bloomberg reported that API data showed a 817k barrel stock drawdown in the latest week with gasoline down 898k but distillate up 2.8mn, according to people familiar with the data.

- Later the Fed publishes its Beige Book and Mester speaks. In terms of data, there are US October trade numbers, inventories and updated Q3 GDP. The November euro area EC economic sentiment survey is also out. The OECD also publishes it updated outlook.

GOLD: Tuesday’s Large Gains Extend Into Today’s Asia-Pac Dealings

Gold is 0.3% higher in the Asia-Pac session, after some dovish leaning Fed comments and the associated weaker greenback prompted a strong 1.4% rally in the yellow metal on Tuesday.

- US tsys bull-steepened, with yields 3-12bps lower across benchmarks. The driving force was Governor Waller leaning dovish by touting potential cut timings. In the Q&A, Waller suggested that if inflation continues to cool for maybe three to five months, the Fed could lower the policy rate.

- The push to $2040.97 extended bullion’s impressive run to trade at the highest level since May and significantly narrowed the gap with the year’s highs at $2,063.

- Analysts appear to remain bullish on the yellow metal with strategists at BofA, stating they believe gold could finish 2024 at $2,400 per ounce, if earlier Fed rate cuts were to manifest.

- Mining weekly reported that in their recently published Metals and Mining Outlook for 2024, the BofA analysts said that while the war in the Middle East has boosted gold in the near term, “the yellow metal ultimately remains a trade on rates, so once the Fed announces a decisive end to the hiking cycle in 2Q, new buyers should come into the market.”

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/11/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 29/11/2023 | 0700/0800 | *** |  | SE | GDP |

| 29/11/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/11/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Survey |

| 29/11/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 29/11/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/11/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 29/11/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 29/11/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 29/11/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 29/11/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/11/2023 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 29/11/2023 | 1000/1100 | ** |  | IT | PPI |

| 29/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 29/11/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 29/11/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/11/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/11/2023 | 1330/0830 | * |  | CA | Current account |

| 29/11/2023 | 1330/0830 | *** |  | US | GDP |

| 29/11/2023 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 29/11/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 29/11/2023 | 1845/1345 |  | US | Cleveland Fed's Loretta Mester | |

| 29/11/2023 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.