-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN OPEN: NZD Outperforms Post RBNZ, Fitch Downgrades China Outlook

EXECUTIVE SUMMARY

- FED’S BOSTIC SEES ONE RATE CUT, FLEXIBLE ON PATH - MNI BRIEF

- HIGHER IMPORT PRICES TO DRIVE POLICY - BOJ’s UEDA - MNI BRIEF

- JAPAN MAR CGPI RISES 0.8% Y/Y, HIGHER IMPORT PRICES - MNI BRIEF

- FITCH CUTS CHINA OUTLOOK TO NEGATIVE ON STEADY RISE IN DEBT - BBG

- RBNZ LEAVES OCR AT 5.5% - MNI BRIEF

- MNI BoK WATCH: BOARD TO CONSIDER HOLD AT 3.5%, INFLATION IN FOCUS

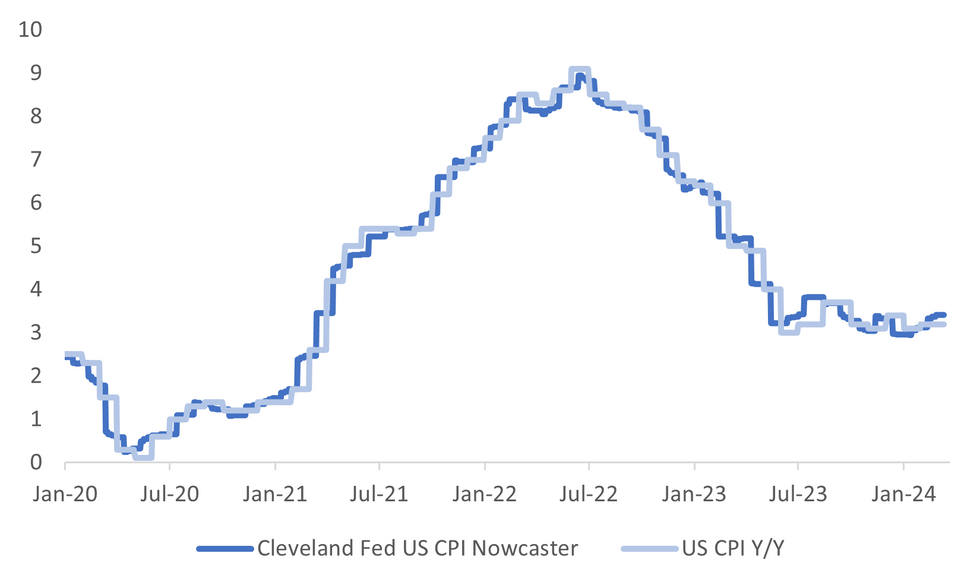

Fig. 1: US CPI Y/Y Versus Cleveland Fed Nowcaster

Source: MNI - Market News/Bloomberg

EUROPE

EU (MNI BRIEF): The European Union may eventually need to take another route to secure a strong and well-funded backstop for the Single Resolution Fund, if Italy continues to fail to ratify changes to the treaty governing the European Stability Mechanism, a senior EU official said on Tuesday.

SNB (BBG): The Swiss National Bank must prioritize rebuilding its capital over making payouts to the government, according to Vice President Martin Schlegel, the frontrunner to become the country’s next central bank chief.

U.S.

FED (MNI BRIEF): Atlanta Federal Reserve President Raphael Bostic reiterated Tuesday his view for one interest rate cut in 2024, but he remains open to adjusting his view should the economic picture change.

INFLATION (BBG): US inflation for food consumed at home has started to level off, but prices are still going up at American restaurants, according to US Agriculture Secretary Tom Vilsack.

POLITICS (RTRS): U.S. President Joe Biden has marginally widened his lead over Donald Trump ahead of the November presidential election as the Republican candidate prepares for the start of the first of four upcoming criminal trials, a new Reuters/Ipsos poll found.

POLITICS (BBG): Rep. Tom Cole (R-Okla.) will be the next chairman of the House Appropriations Committee following the endorsement of a key group of the chamber’s Republicans today, elevating a long-time deal maker to a top negotiating position on government funding bills for at least the rest of the year.

CORPORATE (BBG): Microsoft Corp. will invest $2.9 billion over the next two years to boost its hyperscale cloud computing and artificial intelligence infrastructure in Japan, marking its biggest investment in the country.

OTHER

ASIA PAC (RTRS): More joint patrols can be expected in the South China Sea after drills by the United States, Australia, the Philippines and Japan last weekend, U.S. national security adviser Jake Sullivan said on Tuesday, ahead of U.S. summits this week with the Japanese and Philippine leaders.

JAPAN (MNI BRIEF): Japan's corporate goods price index rose 0.8% y/y in March vs. February’s 0.7%, the second straight acceleration, while imports posted their second straight rise, up 1.4% following the prior month's 0.2% gain, data released by the Bank of Japan showed on Wednesday.

JAPAN (MNI BRIEF): Bank of Japan Governor Kazuo Ueda said on Wednesday the BOJ would consider monetary policy change should the risk of the underlying inflation rate rising above 2% increase due to higher import prices driven by the weak yen.

NEW ZEALAND (MNI BRIEF): The Reserve Bank of New Zealand’s monetary policy committee left its official cash rate at 5.5% Wednesday, noting the economy continued to evolve as anticipated.

NEW ZEALAND (BBG): Immigration Minister Erica Stanford comments at a parliamentary select committee hearing Wednesday in Wellington. “We have unsustainably high net immigration”. Immigration needs a “proper rebalance” to deal with a number of issues. Says former government’s reliance on the median wage as a proxy for skill didn’t work, and resulted in a flood of low-skilled workers

SOUTH KOREA (MNI BOK WATCH): The Bank of Korea monetary policy board will strongly consider holding its policy rate at 3.50% following Friday’s meeting as the bank continues to pay close attention to still stubborn inflation. Focus will shift to whether BOK Governor Rhee Chang-yong will maintain his vigilance over the inflation outlook, while carefully weighing the risk of a slower economy and rising household debt, according to a person familiar with South Korea's economy and monetary policy.

INDIA (BBG): Apple Inc. assembled $14 billion of iPhones in India last fiscal year, doubling production in a sign it’s accelerating a push to diversify beyond China. The US tech giant now makes as much as 14% or about 1 in 7 of its marquee devices from India, people familiar with the matter said, declining to be named as the information isn’t public.

CHINA

RATING (FITCH): Fitch Ratings revised the outlook on China’s long-term foreign debt to negative from stable, citing increasing risks to the country’s public finance prospects. Rising economic uncertainties and China’s efforts to shift its growth model away from one driven by the property market “have eroded fiscal buffers from a ratings perspective,” according to a Wednesday statement by the rating agency.

RATING (MNI BRIEF): Fitch's sovereign credit rating methodology fails to reflect the impact of recent fiscal policy in promoting growth and stabilising macroeconomic leverage, according to an official from the Ministry of Finance.

STOCKS (SHANGHAI SECURITIES NEWS): Chinese equities are becoming more attractive due to the prospects of an economic recovery and low valuations, Shanghai Securities News reports, citing securities firms.

STOCKS (SHANGHAI SECURITIES NEWS): Some Chinese brokerages have lowered the annualized deposit rate on clients’ margin deposits to 0.2% from 0.25%, Shanghai Securities News reported, citing announcements by securities firms.

GROWTH (SECURITIES TIMES): China should maintain macro policy intensity in Q2 following Q1's likely strong performance, Securities Times said in a commentary. Residents’ willingness to increase leverage for home purchases remains weak and infrastructure construction requires further fiscal support to consolidate, which makes maintaining relatively low interest rates necessary, the newspaper said.

SMES (SECURITIES DAILY): The China SME development index reached 89.3 in Q1, up 0.2 points from the previous quarter, but below the prosperity threshold of 100, according to the China Association of SMEs. The sub-index for the industrial sector rose 0.4 points, while construction fell by 0.2. The data showed companies still needed policy support to optimise development and enhance momentum, according to Liu Xiangdong, deputy director of the Center for International Economic Exchanges.

CHINA MARKETS

MNI: PBOC injects CNY2 bln via Omo weds; liquidity unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:39 am local time from the close of 1.8382% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 43 on Tuesday, compared with the close of 44 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0959 on Wednesday, compared with 7.0956 set on Monday. The fixing was estimated at 7.2262 by Bloomberg survey today.

MARKET DATA

JAPAN MAR PPI Y/Y 0.8%; MEDIAN 0.8%; PRIOR 0.7%

JAPAN MAR BANK LENDING INCL TRUSTS Y/Y 3.2%; PRIOR 3.0%

JAPAN MAR BANK LENDING EX-TRUSTS Y/Y 3.6%; PRIOR 3.4%

MARKETS

US TSYS: Treasury Futures Test Tuesday's Highs Ahead Of CPI

- Jun'24 10Y futures has seen low volumes and remained in tight ranges, lows of 109-19+ were made during the morning session, before edging higher were we have been testing the highs from Tuesday of 109-23, currently the contract is up + 02 from NY closing levels at 109-22+.

- Looking at technical levels: Initial support lays at 109-00 (round number support), a break here would open up a move to 108-25+ (2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing). While to the upside resistance holds at 110-06 (Apr 4 high), above here 110-24+/31+ (50-day EMA / Mar 27 high and key resistance)

- Cash Treasury curve has is a touch flatter today with the 2Y yield -0.6bp at 4.737%, 10Y -0.6bp to 4.356%, while the 2y10y +0.180 at -38.486.

- Cross markets, NZGBs yields are 1-3bps lower post the RBNZ decision to be 5-9bps lower on the day, while ACGBs yields are 3-8bps lower

- Looking Ahead: MBA Mortgage Applications, CPI and March FOMC minutes later today.

JGBS: Cheaper Apart From the 10Y, US CPI & FOMC Minutes Due, 20Y Supply Tomorrow

JGB futures are holding weaker, -8 compared to the settlement levels.

- There haven't been domestic data releases to highlight, apart from the previously mentioned PPI and Bank Lending data.

- The domestic market seems to have been influenced by remarks made by BoJ Governor Ueda in his Semi-Annual Report on Currency and Monetary Control. In addition to previously outlined comments, Ueda also said it’s undesirable for a central bank to hold a large volume of government bonds on the scale of the BOJ’s holdings over the long term. (See link)

- (Reuters) - BoJ Governor Ueda also said the central bank would not directly respond to currency moves in setting monetary policy, brushing aside market speculation that the yen's sharp falls could force it to raise interest rates. (See link)

- Cash US tsys are dealing ~1bp richer in today’s Asia-Pac session ahead of today’s US CPI data and the release of the FOMC Minutes.

- Cash JGBs are flat to 2bps cheaper, apart from the 10-year. The benchmark 10-year yield is 0.7bp lower at 0.793% versus the YTD high of 0.802%, set earlier in the week.

- The swaps curve has bear-steepened, with rates 1-3bps higher.

- Tomorrow, the local calendar will see International Investment Flow, Money Stock and Tokyo Avg Office Vacancies data alongside 20-year supply.

AUSSIE BONDS: Richer, Awaiting US CPI Data & The FOMC Minutes

ACGBs (YM +3.0 & XM +8.0) are richer and near session highs. In the absence of domestic data, the local market has extended overnight moves in line with US tsys in today’s Asia-Pac session ahead of US CPI & the release of the FOMC Minutes. Cash US tsys are currently dealing 1bp richer. (See MNI U.S. CPI Preview: Apr 2024 - Key Framing Of Trends With June Cut Seen As A Coin Toss here)

- The latest round of ACGB Apr-27 supply went well, with pricing comfortably through mids and the cover ratio at a robust 3.8375x.

- There has also likely been a positive spillover from a 1-3bps richening in NZGBs following the RBNZ Policy Decision. The RBNZ's April monetary policy decision delivered few surprises.

- Cash ACGBs are 4-8bps richer, with the AU-US 10-year yield differential 3bps lower at -26bps, just above the bottom of the range it has traded in since late 2022.

- Swap rates are 5-7bps lower, with the 3s10s curve flatter.

- The bills strip has bull flattened, with pricing flat to +4.

- RBA-dated OIS pricing is flat to 5bps softer across meetings, with early-25 leading. A cumulative 32bps of easing is priced by year-end.

- Tomorrow, the local calendar sees CBA Household Spending and Consumer Inflation Expectations data.

NZGBS: Closed Richer & At Session Highs, Few Surprises From The RBNZ

NZGBs closed at the session’s best levels, 6-8bps richer, after the RBNZ's April monetary policy decision delivered few surprises. As expected, the decision was to hold rates steady at 5.50%.

- RBNZ board members acknowledged that most major central banks are “cautious” about easing policy given the risk of inflation remains sticky.

- The RBNZ noted that growth in unit labour costs remains elevated. Inflation will continue to be persistent in regions where higher labour costs have not been accompanied by improved productivity or reduced profit margins.

- The central bank also noted: "Overall, members agreed that the balance of risks was little changed since the February Statement."

- Cash US tsys have slightly extended yesterday’s richening in today’s Asia-Pac session ahead of US CPI data and the release of the FOMC Minutes.

- Swap rates are 4-8bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing is flat to 2bps firmer after the decision, with 60bps of cumulative easing priced for year-end.

- Tomorrow, the local calendar sees Finance Minister Willis in front of a Select Committee on Budget Policy.

- Tomorrow, the NZ Treasury plans to sell NZ$275mn of the 3.0% Apr-29 bond, NZ$175mn of the 2.0% May-32 bond and NZ$50mn of the 2.75% May-51 bond.

FOREX: NZD Outperforms Post RBNZ Decision

Outside of NZD gains, the general G10 FX tone has been a quiet one ahead of key event risks in the US later. The BBDXY was last near 1240.65, slightly down on end Tuesday levels.

- NZD/USD is up around 0.25% in latest dealings, which puts the pair at 0.6075. The RBNZ left rates on hold as expected, but didn't give off any dovish rhetoric. The central bank reiterated that restrictive policy has to be maintained for a sustained period to ensure a return to the inflation target.

- For NZD/USD we are right on Tuesday highs and testing resistance at the 50-day EMA. A break above would likely see 0.6100 targeted, while initial support is at 0.6040 (20-day EMA), then 0.6000 (round number support).

- AUD/USD sits slightly weaker, last near 0.6620. This has helped nudge the AUD/NZD cross back to 1.0900, with recent highs at 1.0950/60.

- USD/JPY has been steady, last in the 151.75/80 region. BoJ Governor Ueda was again before parliament. He noted the BOJ would consider monetary policy change should the risk of the underlying inflation rate rising above 2% increase due to higher import prices driven by the weak yen. His appearance didn't impact yen though.

- Looking ahead, the main focus in the US session will be the CPI print, followed by the FOMC Mins.

ASIA EQUITIES: HK Equities Surge Higher Lead By Tech, China Equities Underperform

Hong Kong and China equities are mixed today with Hong Kong equities again out-performing China mainland indices. The HSI is close to 2%, while the HS China Enterprise Index is now in bull market territory up 20% from lows mad Jan 22, while China Mainland Indices are lower with small-cap and growth stocks the worst performers. Tech stocks are the top performing sector lead higher by Tencent and Alibaba which have been supported by share buybacks and news of more approvals of online games. EV stocks have also rallied higher after EV penetration recovered in April.

- Hong Kong equities are higher today, led by the HSTech Index which is up 2.49%, the Mainland Property Index is up 1.42%, HS China Enterprise Index up 2.15% while the HSI is up 1.88%. China equity markets are lower today, with the CSI1000 erasing all of Tuesday gains, down 1.52%, while the CSI300 is faring a bit better down just 0.43%.

- China Northbound flows were 1billion yuan on Tuesday, with the 5-day average at -0.71billion, while the 20-day average sits at 1.42billion yuan.

- Over the past week in the property space, China Jinmao Holdings Group has told some investors it’s in talks with banks to refinance a HK$4 billion ($511 million) syndicated loan due in July. Country Garden’s President Mo Bin pledged to ensure delivery of the company’s housing projects during a monthly management meeting on Sunday. Sunac China will sell the remaining 51% stake in Chongqing College Town project and related debts to Chongqing Xiangyu Real Estate and Xiamen Xianghe Investment for 540 million yuan ($74.7 million) and Shimao Group shares fell as much as 12% in Hong Kong after China Construction Bank filed a winding-up petition against the company.

- (Bloomberg) Chinese Brokerages Lower Rate on Margin Deposits, Newspaper Says (See link)

- (Bloomberg) CHINA PREVIEW: CPI to Pull Back to 0.3% as Holiday Demand Fades (see link)

- (Bloomberg) Chinese EV Stocks Rise as EV Penetration Recovers in April (see link)

- Looking ahead, Focus is on China CPI Thursday

ASIA PAC EQUITIES: Asian Equities Mixed As Japanese Equities Head Lower Ahead Of US CPI

Regional Asian equities are mixed on Wednesday, US equity futures are unchanged as we await inflation data due out later today. In local markets the MSCI APAC Index is on track for the third day of gains as HK equities offset losses in Japanese equities. Apart from The RBNZ decision, where they kept rates on hold, the calendar has been very quiet. Markets are closed in South Korea, Singapore, Indonesia, Malaysia and the Philippines.

- Japan equities opened lower on Wednesday with investors expected to take a wait-and-see stance ahead of the release of US inflation data. BoJ Governor Kazuo Ueda made comments Tuesday that suggested he is keeping his options open for a further paring back of monetary easing, he also spoke earlier this morning where he mentioned the BoJ owns about 7% of the entire Japanese stock market and that deciding the fate of ETF holdings will be a difficult task while also noting a potential increase in bond buying if yields rise sharply and is cautious about directly responding to FX movements but suggests a potential policy shift if FX movements risk pushing inflation above expectations. While Microsoft will invest $2.9 billion over the next two years to boost its hyperscale cloud computing and artificial intelligence infrastructure in Japan, marking its biggest investment in the country. The Nikkei 225 index dropped 0.38% to 39,924 while the broader Topix Index slipped 0.27%, to 2,747.

- Taiwanese equities saw a $500m inflow from foreign investors on Tuesday, while equities surged. Equities are unchanged on Wednesday, as investors await US inflation data later today, while late on Tuesday CPI released which missed estimates, the March print came in at 2.14% vs 2.50% show a decent drop from the Feb where CPI was 3.08%.

- Australian equities have opened higher with the ASX 200 up 0.27% marking the third day of gains. Miners, Health care and Real Estate names are the top performing sectors with Financials and Tech stocks the worst sectors.

- Elsewhere in SEA, New Zealand equities are up 0.15% with little reaction to the RBNZ decision to keep rates on hold. Thailand equities are up 0.44%, Indian equities are up 0.25%

OIL: Holding Tuesday Losses Ahead Of Key US Event Risks

Brent crude sits close to unchanged in the first part of Wednesday dealing. We were last close to $89.45/bbl, just up from end Tuesday levels in NY. It's a similar backdrop for WTI, with the front month contract near $85.30/bbl. This follows falls in Tuesday trade of a little over 1% for both benchmarks.

- BBG noted that industry sources are pointing to a rise in US oil inventories, with official data due for release during Wednesday US trade. This has taken some of the gloss of the recent rally in crude, albeit at the margins.

- Elsewhere, Iran’s Islamic Revolutionary Guard Corps naval forces said that Iran is choosing not to disrupt flows through the Strait of Hormuz in the Persian Gulf.

- Also, world oil demand growth for 2024 has been revised down by 480k b/d to 0.95m b/d in the EIA’s Short-Term Energy Outlook.

- These developments may have also seen some tempering of bullish sentiment, particularly ahead of the US CPI and FOMC Mins due later.

- Not much has changed from a technical standpoint though, for WTI the next objective is $89.08, a Fibonacci projection. On the downside, initial firm support to watch lies at $82.80, the 20-day.

GOLD: Winning Run Continues Ahead Of US CPI & FOMC Minutes

Spot gold reached a new high ($2365.35) on Tuesday, before closing 0.6% higher at $2352.78, as demand remained strong ahead of tomorrow’s US data. Bullion is little changed so far in the Asia-Pac session.

- Tuesday’s move was supported by lower US Treasury yields ahead of today’s US CPI & FOMC Minutes. (See MNI U.S. CPI Preview: Apr 2024 - Key Framing Of Trends With June Cut Seen As A Coin Toss here)

- According to MNI’s technicals team, the next objective is $2376.5, a Fibonacci projection. Initial firm support is at $2222.4, the 20-day EMA.

- (AFR) One of the reasons for their price strength is that investors are increasingly using gold and oil to hedge against economic uncertainty and geopolitical tensions. So far, the rally in the precious metal has been mainly driven by central bank buying, particularly by the People’s Bank of China. (See link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/04/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 10/04/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 10/04/2024 | 0800/1000 | * |  | IT | Retail Sales |

| 10/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/04/2024 | - | *** |  | CN | Money Supply |

| 10/04/2024 | - | *** |  | CN | New Loans |

| 10/04/2024 | - | *** |  | CN | Social Financing |

| 10/04/2024 | 1230/0830 | *** |  | US | CPI |

| 10/04/2024 | 1230/0830 | * |  | CA | Building Permits |

| 10/04/2024 | 1345/0945 |  | CA | BOC Monetary Policy Report | |

| 10/04/2024 | 1345/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 10/04/2024 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 10/04/2024 | 1430/1030 |  | CA | BOC Governor Press Conference | |

| 10/04/2024 | 1645/1245 |  | US | Chicago Fed's Austan Goolsbee | |

| 10/04/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/04/2024 | 1800/1400 | ** |  | US | Treasury Budget |

| 10/04/2024 | 1800/1400 | *** |  | US | FOMC Minutes from March meet |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.