-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Headline Watching Into New Year

- Markets generally stuck to tight ranges in Asia hours, outside of Chinese equities which benefitted from hope re: further easing.

- U.S. weekly jobless claims data and the latest MNI Chicago PMI print headline Thursday’s docket.

BONDS: Core FI Coils In Asia

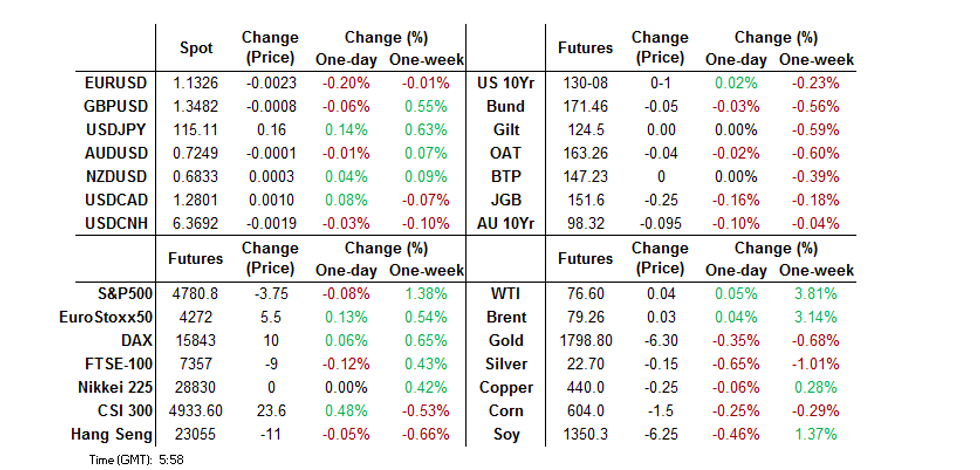

A block lift of TYH2 futures (+2.1K) followed some light screen buying in Asia, allowing the contract to extend to fresh session highs, before backing off. Still, the contract remains in a particularly narrow 0-03+ range, well within the boundaries observed in recent weeks, last +0-01 at 130-08. Cash Tsys sit ~0.5-1.0bp richer across the curve, with the belly leading the bid. There hasn’t been anything in the way of notable macro headline flow observed overnight. Weekly jobless claims data & the latest MNI Chicago PMI print headline the NY docket on Thursday.

- The overnight weakness witnessed in JGB futures extended in Tokyo trade, with the contract hitting the bell -26 vs. Wednesday’s settlement levels. A technical break below the Nov 30 low has added to bearish momentum after the formation of a double top pattern earlier this month. Cash JGB trade saw 7s lead the way lower, cheapening by ~2bp, while super long swap spreads widened, pointing to a futures driven move which was aided by payside flows in the long end of the swap curve. Local headline flow remained light ahead of the 4-day weekend that will be observed in Japan. A Nikkei poll pointed to a mere 18% of firms looking to raise wages by a degree that would satisfy the wishes of Japanese PM Kishida (+3%).

- Aussie debt markets coiled during Sydney dealing, with little to drive the space out of tight ranges during the final full session of the calendar year. That left YM -5.5 and XM -9.5 at the bell. EFPs were narrower on the day. Meanwhile, the Bill strip closed 1-5 ticks cheaper through the reds. Local headline flow was light, with PM Morrison confirming the previously touted loosening of COVID restrictions re: isolation protocols.

FOREX: Antipodeans Lodge Modest Outperformance In Limited Asia Trade

The Antipodeans outperformed in the G10 FX space during Asia hours, although the moves are very modest, with the major USD pairs generally operating within ~10 pips of Wednesday’s closing levels at typing. There has been nothing in the way of notable headline flow for market participants to latch onto.

- The NZD sits atop the G10 FX pile. Perhaps some spill over from the uptick in U.S. equities during the NY session has provided some support for the NZD. NZD/USD has traded as high as $0.6849 and last deals at ~$0.6840. With the Dec 23 high now breached, bulls turn their attention to the Dec 1 high ($0.6868). To the downside, the 21-DMA has acted as support since it was breached from below on Dec 22. Key support is some way lower, at the YtD low ($0.6702).

- USD/JPY traded as high as Y115.07, adding ~10 pips in the process. As mentioned, there hasn’t been much in the way of notable headline flow to drive broader macro sentiment, while JPY markets have thinned out ahead of the elongated Tokyo weekend. Technically, bulls look to initial resistance in the form of the Nov 26 high (Y115.37), with any sustained break there exposing the Nov 24 high/bull trigger (Y115.52). Bulls remain in control from a technical perspective, with bears needing to force a breach of the 20-day EMA to start reasserting some control.

- U.S. weekly jobless claims data and the latest MNI Chicago PMI print headline Thursday’s docket, with a call between U.S. President Biden & his Russian counterpart Putin also set to garner attention. Until then, headline watching will be at the fore.

FX OPTIONS: Expiries for Dec30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1284-90(E589mln), $1.1330-40(E771mln)

- EUR/GBP: Gbp0.8375(E541mln), Gbp0.8635(E583mln)

EQUITIES: China Outperforms On Easing Hopes

Most of the major regional equity indices were little changed on the day during Thursday’s Asia-Pac session. Mainland Chinese indices were the exception to the broader rule, benefitting from increased speculation re: deeper monetary and fiscal easing in ’22, with continued year-end related OMO liquidity injections from the PBoC also supporting sentiment. U.S. e-mini futures are little changed after the S&P 500 & DJIA lodged record closing levels on Wednesday as the Santa rally extended.

GOLD: Consolidating Around $1,800/oz

The pullback from Wednesday’s highs in U.S. real yields allowed bullion to reclaim the $1,800/oz mark, with that move consolidating during Asia-Pac dealing. That leaves spot little changed, just above $1,800/oz. Bulls need to force a break of the 61.8% retracement of the Nov 16-Dec 15 downleg ($1,830.0/oz) to open the way higher, while support comes in at the Dec 21 low, followed by the channel base drawn off the Aug 9 low.

OIL: Marginal Gains In Asia, WTI & Brent Operate Within Wednesday’s Ranges

WTI & Brent crude futures sit ~$0.25 above their respective settlement levels, well within the ranges observed on Wednesday. A reminder that Wednesday’s weekly U.S. DoE inventory release resulted in some intraday volatility. There hasn’t been much in the way of market moving news since the New York bell.

- Wednesday saw RTRS sources suggest that “Kuwait's candidate to lead OPEC has widespread support from the group, with current secretary general Mohammad Barkindo not expected to seek re-election.” Elsewhere, the Saudi King stressed that market stability and balance are a pillar of Saudi energy policy.

- Focus remains pinned on next week’s OPEC+ gathering.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.