-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI EUROPEAN OPEN: Powell Notes Fed Will Do More Than Envisaged If Needed

EXECUTIVE SUMMARY

- POWELL: FOMC PREPARED TO HIKE MORE IF DATA STRONG (MNI)

- ECB’S SCHNABEL SAYS TIGHTER POLICY HAVING LITTLE IMPACT SO FAR (BBG)

- ECB TWEAKS GOV'T DEPOSIT RULES TO SMOOTH MARKETS (MNI)

- CHINA DECLINED U.S. REQUEST FOR CALL BETWEEN DEFENSE CHIEFS AFTER BALLOON SHOOTDOWN (RTRS)

- BIDEN VOWS "TO PROTECT" COUNTRY IN STATE OF THE UNION SPEECH, REFERS TO CHINA BALLOON (RTRS)

- CHINESE BALLOON PART OF VAST AERIAL SURVEILLANCE PROGRAM, U.S. SAYS (WASHINGTON POST)

- KISHIDA: NEW BOJ GOV MUST BE SKILLED COMMUNICATOR (MNI)

- AUSTRALIA CENTRAL BANK’S PEAK RATE NOW SEEN AT 3.85%, POLL SHOWS (BBG)

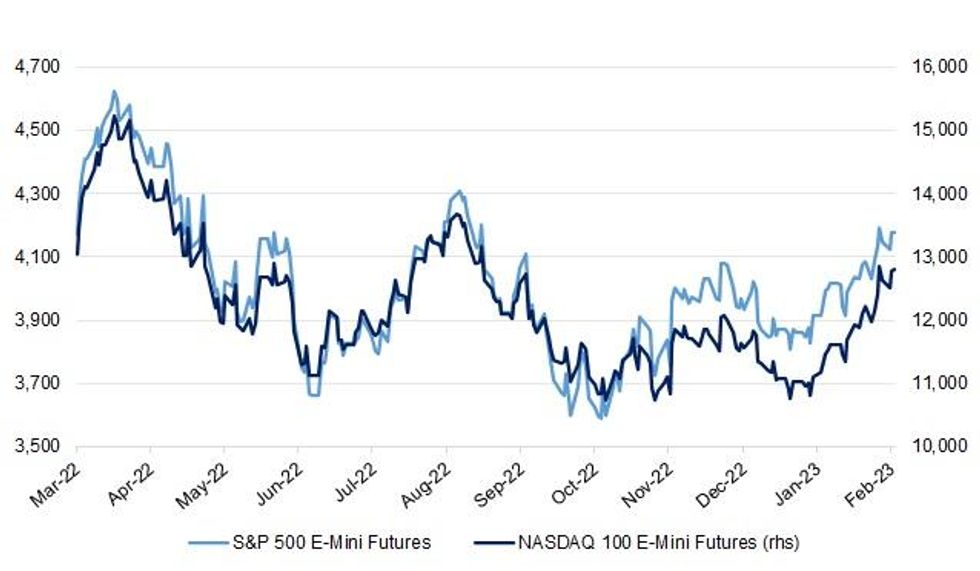

Fig. 1: S&P 500 & NASDAQ 100 E-Mini Futures

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The Bank of England's assumption that the UK will undergo a shallow, five quarter recession through 2023 is too pessimistic and it will instead show minimal growth, of 0.2% this calendar year, new National Institute of Economic and Social Research forecasts show. (MNI)

ECONOMY: Demand for workers accelerated for the first time in nine months in January, piling pressure on the Bank of England as it tries to tame inflation. (BBG)

FISCAL/POLITICS: Firefighters threatened to join the wave of industrial action sweeping Britain if they’re not offered a significant pay rise in a crucial meeting with bosses Wednesday. (BBG)

POLITICS: The new chairman of the Conservative Party hinted that the next UK general election will happen in the second-half of 2024, suggesting Prime Minister Rishi Sunak intends to maximize his time in office before calling a vote. (BBG)

EUROPE

ECB: European Central Bank Executive Board member Isabel Schnabel said there’s been little effect to date from an unprecedented bout of monetary-policy tightening aimed at taming inflation. The growth in consumer prices still has momentum, with the level of underlying inflation extraordinarily high, Schnabel told a webcast on Tuesday. The recent slowdown in the headline number isn’t down to ECB policy, she said. (BBG)

ECB: Euro area government deposits held at the central bank will be remunerated at the short-term rate (€STR) minus 20 basis points from 1 May 2023, the European Central Bank announced Tuesday, citing repo market fragility, persistent collateral scarcity and excess liquidity concerns as the reason to amend the current arrangement, due to expire on 30 April 2023, with an updated scheme. (MNI)

ECB: Bundesbank Vice President Claudia Buch is considering running for the post of chairman of the European Central Bank Supervisory Board, Platow reported, without saying where it got the information. (BBG)

FRANCE: French labor unions pledged to keep up the pressure on President Emmanuel Macron to drop an unpopular plan to raise the retirement age after Tuesday saw a marked drop in the number of people turning out to protest the reform. (BBG)

SWEDEN: Sweden’s housing market continued to seek a bottom at the start of the year, beset by falling activity after ten months of consecutive price declines. (BBG)

U.S.

FED: The FOMC would be prepared to raise interest rates more than investors expect if data come in stronger than anticipated, Federal Reserve Chair Jerome Powell said Tuesday after a surprisingly resilient January jobs report. (MNI)

FED: U.S. inflation looks set to moderate steadily in coming months, allowing the Federal Reserve to soon pause monetary tightening before holding rates at cycle peaks at least through 2023, St. Louis Fed economist Mark Wright told MNI. (MNI)

FISCAL: President Joe Biden challenged Republicans to lift the U.S. debt ceiling and support tax policies that were friendlier to middle class Americans on Tuesday in a State of the Union speech that served as a blueprint for his 2024 re-election campaign. (RTRS)

FISCAL: President Joe Biden in his State of the Union speech on Tuesday pledged to cut the deficit by $2 trillion, without touching Social Security or Medicare. (MarketWatch)

POLITICS: U.S. President Joe Biden's public approval rating sat at 41% - close to the lowest level of his presidency - as he prepared for a major speech on Tuesday that is expected to serve as a blueprint for a 2024 re-election bid, a new Reuters/Ipsos poll showed. (RTRS)

EQUITIES: Biden used a large segment of his ostensibly bipartisan pitch attacking corporations, from what he called "Big Pharma" to "Big Oil" and "Big Tech." Biden accused the pharmaceutical companies of charging too much for insulin but made no mention of their role in tamping down the COVID-19 pandemic. (RTRS)

EQUITIES: Several federal agencies are looking to tighten their ethics rules, while others have directed their internal watchdogs to investigate suspicious investing by officials, as lawmakers continue to press for tougher trading restrictions across the federal government. (WSJ)

OTHER

GLOBAL TRADE: Germany and France’s economy chiefs said they made progress in talks in Washington to improve cooperation with the US on green subsidies and defuse tensions over accusations of unfair competition. (BBG)

GLOBAL TRADE: Chip suppliers have warned that a European effort to impose a ban on “forever chemicals” will cause widespread disruption to already tight semiconductor supply chains. (FT)

GLOBAL TRADE: Europe should consider stockpiling key minerals as part of its plan to reduce its strategic dependency on critical raw materials from outside the bloc, a top Swedish official said. (BBG)

U.S./CHINA: U.S. President Joe Biden said in his State of the Union address on Tuesday that he would cooperate with great power rival China, but vowed "to protect our country," a reference to a Chinese spy balloon that traveled across America last week. (RTRS)

U.S./CHINA: China has declined a U.S. request for a phone call between U.S. Defense Secretary Lloyd Austin and Chinese Defense Minister Wei Fenghe, a Pentagon spokesman said on Tuesday. The Pentagon submitted the request for a secure call on Saturday, immediately after shooting down a suspected Chinese surveillance balloon off the coast of South Carolina, Brigadier General Patrick Ryder said in a statement. "Unfortunately, the PRC (China) has declined our request. Our commitment to open lines of communication will continue," Ryder said. (RTRS)

U.S./CHINA: The U.S. intelligence community has linked the Chinese spy balloon shot down on Saturday to a vast surveillance program run by the People's Liberation Army, and U.S. officials have begun to brief allies and partners who have been similarly targeted. (Washington Post)

U.S./CHINA/TAIWAN: House Foreign Affairs Chairman Michael McCaul said he plans to lead a bipartisan delegation to Taiwan this spring, despite renewed tensions with Beijing over China’s alleged spy balloon incursion over the US. (BBG)

CHINA/TAIWAN: Chinese leader Xi Jinping appears to be recalibrating his hardline approach to Taiwan in the year before the island holds a presidential election that his government’s preferred negotiating partner has a shot at winning. Kuomintang Vice Chairman Andrew Hsia is expected to visit China on Wednesday, the latest in a series of friendly gestures between the one-time foes in the Chinese Civil War. Hsia is expected to visit several Chinese cities over nine days including the capital, where he’s likely to meet Song Tao, a former top Communist Party diplomat who now oversees affairs across the Taiwan Strait. (BBG)

CHINA/TAIWAN: China's Taiwan affairs office on Wednesday urged Taiwan not to use COVID-19 as an excuse to hinder the resumption of direct flights, Chinese state media CCTV cited the office's spokesperson as saying. (RTRS)

JAPAN/CHINA: Japan is arranging to relax border control measures for visitors from China as early as this month, Japanese broadcaster FNN reported on Wednesday. (RTRS)

BOJ: Prime Minister Fumio Kishida said on Wednesday the new Bank of Japan governor must have a high ability to communicate with the heads of major central banks and market players. (MNI)

JAPAN: Japanese Prime Minister Fumio Kishida is set to increase pressure for pay increases by reviving three-way talks among the government, business leaders and labor unions that have been dormant for almost eight years. (BBG)

RBA: Australia’s central bank will raise its benchmark interest rate to a peak of 3.85% from May, economists said in an upgrade of their forecasts following Governor Philip Lowe’s hawkish policy statement. (BBG)

RBA: Australian Treasurer Jim Chalmers said “all options are on the table” when it comes to a decision on whether to reappoint Reserve Bank Governor Philip Lowe, as pressure builds over rapidly rising interest rates. (BBG)

NEW ZEALAND: New Zealand Prime Minister Chris Hipkins has stepped back from some of his predecessor Jacinda Ardern’s more unpopular policies as he refocuses on combating soaring prices and seizing the political middle ground ahead of October’s election. (BBG)

NEW ZEALAND: NZ Treasury Dept comments in fortnightly economic update published Wednesday in Wellington. Flooding in Auckland and elsewhere in North Island is likely to affect the supply of certain foods and other products, pushing up prices temporarily. “Consequently, inflation may remain higher for longer than previously expected, with consumer price inflation around 0.4 percentage points higher than it would otherwise have been over the first half of 2023. (BBG)

BOC: Bank of Canada Governor Tiff Macklem said Tuesday he remains concerned about upside risks to inflation even though he’s likely finished hiking interest rates, making no reference to a potential cut that many investors predict late this year. (MNI)

BOC: Bank of Canada Governor Tiff Macklem conceded that rate hikes have hit the country’s homeowners hard, saying the impact of higher borrowing costs on consumers is a major reason why he chose to hit pause before the US Federal Reserve. (BBG)

CANADA: Canada will boost healthcare spending by an extra CAD46.2 billion over 10 years on top of currently legislated increases that take the total package to CAD196 billion, Prime Minister Justin Trudeau said, just days after pledging to avoid new outlays that make the Bank of Canada's inflation fight more difficult. (MNI)

TURKEY: Two U.S. Agency for International Development teams will arrive Wednesday morning in Turkey and will head to the southeastern province of Adiyaman to focus on urban search and rescue following earthquakes that killed more than 6,300 people and left a trail of destruction in Turkey and neighboring Syria. (RTRS)

TURKEY: German Chancellor Olaf Scholz promised Turkish President Tayyip Erdogan further comprehensive support in dealing with the earthquake disaster, a spokesman for the German government said after the two leaders spoke on the phone on Tuesday. (RTRS)

MEXICO: The Bank of Mexico is expected to hike its benchmark interest rate to a record 10.75% on Thursday, amid a forecast increase in January inflation and following in the footsteps of the U.S. Federal Reserve, a Reuters poll showed on Tuesday. Banxico, as the Mexican central bank is known, is expected to increase the key rate by 25 basis points from a current 10.50%, according to 24 of the 25 analysts and economists surveyed. One participant expects rates to be increased to 11.00%. (RTRS)

BRAZIL: Brazil's central bank chief Roberto Campos Neto on Tuesday stepped up his defense of the institution's independence amid mounting criticism from leftist President Luiz Inacio Lula da Silva and his allies about overly high interest rates. (RTRS)

RUSSIA: Ukraine's national security chief said on Tuesday Kyiv expects Russia to include the northeastern Kharkiv or southern Zaporizhzhia regions as targets of an anticipated offensive aimed at reclaiming the initiative in its year-old invasion. (RTRS)

RUSSIA: Ukrainian Foreign Minister Dmytro Kuleba said on Twitter he spoke on Tuesday with U.S. Secretary of State Antony Blinken about new military aid, sanctions on Russia and "the preparations of important events." (RTRS)

RUSSIA: Denmark, Germany and the Netherlands will pool funds to restore at least 100 old Leopard 1 tanks from industry stocks and supply them to Ukraine, according to a joint statement published on Tuesday. (RTRS)

RUSSIA: The US plans to sell Poland about $10 billion in weapons including 18 Himars rocket launchers and ammunition for the highly accurate mobile platform, the Pentagon announced Tuesday, shoring up a crucial NATO ally as Russia presses its war in neighboring Ukraine. (BBG)

METALS: Glencore’s Antapaccay copper mine in Peru has resumed operations after halting work last month when protesters entered and damaged a worker camp. (BBG)

OIL: Iraq resumed crude oil flows on its export pipeline to the Turkish port of Ceyhan on Tuesday evening, an Iraqi oil source familiar with the matter told Reuters, after a massive earthquake that hit Turkey and Syria halted pumping on Monday. (RTRS)

OIL: Two U.S. Agency for International Development teams will arrive Wednesday morning in Turkey and will head to the southeastern province of Adiyaman to focus on urban search and rescue following earthquakes that killed more than 6,300 people and left a trail of destruction in Turkey and neighboring Syria. (RTRS)

OIL: U.S. crude production will rise in 2023, while demand will stay flat, the U.S. Energy Information Administration (EIA) said in its Short Term Energy Outlook (STEO) on Tuesday. The EIA projected that crude production will rise to 12.49 million barrels per day (bpd) in 2023 and 12.65 million bpd in 2024. The agency also projected petroleum and other liquid fuels consumption would stay flat at 20.3 million bpd in 2023 and rise to 20.6 million bpd in 2024. (RTRS)

CHINA

INFLATION: Pork prices will continue trending downwards in the near term as inventories remain high and Spring Festival consumption demand has passed, according to the Securities Daily. (MNI)

PROPERTY: The rate of decline in total non-bank financing for real estate companies slowed down in January, pointing to an improvement in financing conditions for the property sector following policy stimulus in Q4 2022, according to Shanghai Securities News. (MNI)

CREDIT: New yuan loans issued in January are forecast to have increased by CNY1 billion year-on-year, according to a survey of 13 financial institutions by Caixin. (MNI)

MONEY MARKETS: Funding costs are climbing in China’s interbank market, making it harder for lenders to get their hands on cash just as Beijing works to restore economic growth. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY486 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY641 billion via 7-day reverse repos with the rates unchanged at 2.00% on Wednesday. The operation has led to a net injection of CNY486 billion after offsetting the maturity of CNY155 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1208% at 9:24 am local time from the close of 2.1394% on Monday.

- The CFETS-NEX money-market sentiment index closed at 55 on Tuesday, compared with the close of 54 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7752 WEDS VS 6.7967 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7752 on Wednesday, compared with 6.7967 set on Tuesday.

OVERNIGHT DATA

JAPAN JAN ECONOMY WATCHERS SURVEY CURRENT 48.5; MEDIAN 48.2; DEC 48.7

JAPAN JAN ECONOMY WATCHERS SURVEY OUTLOOK 49.3; MEDIAN 47.6; DEC 46.8

JAPAN DEC BOP CURRENT ACCOUNT BALANCE +Y33.4BN; MEDIAN +Y112.0BN; NOV +Y1.8036TN

JAPAN DEC BOP CURRENT ACCOUNT BALANCE ADJUSTED +Y1.1821TN; MEDIAN +Y1.2363TN; NOV + Y1.9185TN

JAPAN DEC BOP TRADE BALANCE -Y1.2256TN; MEDIAN -Y1.1157TN; NOV -Y1.5378TN

JAPAN JAN BANK LENDING INCLUDING TRUSTS +3.1% Y/Y; DEC +2.7%

JAPAN JAN BANK LENDING EXCLUDING TRUSTS +3.5% Y/Y; DEC +3.0%

SOUTH KOREA DEC BOP CURRENT ACCOUNT BALANCE +US$2.6772BN; NOV -US$222.8MN

SOUTH KOREA DEC BOP GOODS BALANCE -US$475.0MN; NOV -US$998.5MN

MARKETS

US TSYS: Richer In Asia

TYH3 deals at 113-15, +0-07+, a touch off the top of its 0-08+ range on volume of ~89K.

- Cash Tsys sit 2-5bps richer across the major benchmarks, with the curve flattening.

- Local participants focused on the lack of firm pushback to the dovish market reaction to last week’s FOMC in Fed Chair Powell’s Tuesday address with the late NY corporate and Tsy supply-induced cheapening aiding entry.

- The richening held through the session with block trades in TU (+4.5K) TY futures (+1.5k) aiding the bid, although there was some interest in downside exposure via the TYH3 115.00/114.50 put spread (+2.5K).

- There was nothing in the way of meaningful macro headlines, and the space looked through U.S. President Biden’s State of the Union address.

- In Europe today there is a thin data slate, ECB speak from Elderson and Lagarde provide the highlight. Further out we have a number of Fed speakers including NY Fed President Williams, Gov Cook, VC Barr, Atlanta Fed President Bostic, Minneapolis Fed President Kashkari ('23 voter) and Gov Waller. We also have the latest 10-Year Tsy Supply.

JGBS: Flat To Firmer, Kishida Cognisant Of Market Impact When It Comes To New BoJ Governor

JGB futures are +3 into the bell, after sticking within the confines of their overnight range in what has been a limited Tokyo session. Cash JGBs are flat to 3bp richer, with a flattening impulse developing, while swap rates are little changed to 1bp lower, leaving swap spreads little changed through 5s, then wider beyond that point.

- JGBs initially looked through comments made by PM Kishida during the Tokyo lunch break, as he noted that he is considering the impact on the markets re: his choice of BoJ Governor, while flagging communication as a key trait for the successful candidate (given the normalisation task that faces them). The recognition that he is cognisant of the market impact re: the Governor choice may have supported the longer end of the curve in the afternoon.

- Elsewhere, there would have been little spill over from the results of the BoJ Rinban operations, which saw offer/cover ratios of 1.6-2.2x, remaining subdued, although the presence of the operations, coupled with a bid in U.S. Tsys, seemingly aided the bid in JGBs.

- There was also some focus on reports that pointed to Kishida teeing up a meting between the government, labour unions and businesses as his administration looks to generate meaningful wage growth.

- 10-Year JGBi supply is due tomorrow, with the latest preliminary machine tool orders, money supply and international security flow data also slated.

AUSSIE BONDS: Off Lows, RBA Terminal Reassessed

ACGBs moved off early Sydney cheaps as U.S. Tsys firmed (likely on the back of Asia-Pac participants looking to the lack of fresh hawkish rhetoric from Fed Chair Powell on Tuesday), leaving both YM & XM -2.0 at the close. Both contracts respected their overnight session lows on a test during early Sydney dealing. Cash ACGBs were 1.5-2.5bp cheaper, with a light flattening bias seen.

- Bills finished flat to -3 through the reds, while RBA dated OIS continued to show ~20bp of tightening for next month’s meeting, as terminal pricing held just above 3.95%. Meanwhile, the latest BBG survey saw the median RBA terminal rate view shift up to 3.85% from 3.60% (range 3.60-4.10%), in lieu of the tweaks to yesterday’s post-meeting statement.

- Local issuance matters provided the only real domestic points of note, with ACGB Nov-33 supply passing smoothly (see our post-auction bullet for more on that), while the semi side saw SAFA launch a new May-38 line (as much as A$1bn issued this time around), which is set to price on Thursday.

- Comments from Treasurer Chalmers went over old ground, pointing to notable economic headwinds, albeit with no expectations for a recession in Australia.

- Tomorrow’s domestic docket is empty, save weekly AOFM Note supply.

AUSSIE BONDS: ACGB Nov-33 Auction Results

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 3.00% 21 November 2033 Bond, issue #TB166:

- Average Yield: 3.6854% (prev. 3.3903%)

- High Yield: 3.6875% (prev. 3.3925%)

- Bid/Cover: 3.5250x (prev. 2.7778x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 66.1% (prev. 51.2%)

- Bidders 50 (prev. 44), successful 17 (prev. 18), allocated in full 10 (prev. 10)

NZGBS: Uptick In Tsys Allows Move Off Lows

NZGBs finished 4.5-6.5bp cheaper on Wednesday, with a light bear flattening impulse developing as the day wore on. Swap rates were 5-8bp higher, also flattening, leaving swap spreads little changed to a touch wider across the curve.

- The initial cheapening impulse, derived from the trans-Tasman feedthrough from yesterday’s RBA decision, moderated on the back of a bit of a bid in U.S. Tsys during Asia-Pac dealing, as regional participants looked to the lack of firm pushback from Fed Chair Powell vs. the dovish reaction to last week’s FOMC.

- RBNZ dated OIS nudged higher on the day, showing 58bp of tightening for later this month, alongside a terminal OCR of just over 5.25%.

- Local headline flow was dominated by Prime Minister Hipkins unwinding some of ex-PM Ardern’s policies, including the income insurance scheme, while he increased the minimum wage in line with CPI. Hipkins stressed that “the government is refocusing its priorities to put the cost of living front and centre of our new direction,” while underscoring the need for “increased support for business, increased support for those on low incomes and a reprioritization of our work program to shift it to the bread-and-butter issues New Zealanders want us focused on.”

- The latest ANZ Truckometer reading provides the only economic data point on tomorrow’s local docket, although that won’t be a market mover.

EQUITIES: China/HK Struggle, South Korea & Taiwan Higher On Better Tech Sentiment

It has been a mixed bag for regional equities today. Heavyweights China/HK have struggled for upside traction, likewise for Japan shares. US futures are close to flat currently, but this follows a positive session through Tuesday. Sentiment, elsewhere in the region, has been more positive though.

- The HSI is down slightly currently, with the tech sub index off -1.60% at this stage. China mainland stocks are a touch weaker compared to HSI, down around 0.25% at this stage.

- Headline flow has been light, with China looking for closer ties with Taiwan, while Biden's State of The Union stressed the US doesn't want conflict with China. Fitch revised its 2023 GDP forecast for China to 5%, but this is in line with other estimates.

- The Nikkei 225 sits -0.45% lower at this stage, with Japan looking at revising travel rules for China visitors this month.

- The Kospi and Taiex have performed better. The Kospi up 1.23%, the Taiex +1.44%, which is line with the rebound in major tech indices through Tuesday's session.

- Indian shares are holding up, +0.50% for the Nifty at this stage, despite a hawkish +25bps hike from the RBI earlier.

GOLD: Prices Range Trading Post-Payrolls

Gold prices are 0.2% higher rising to $1877.15/oz after rising 0.3% on Tuesday. Bullion has been trading in a narrow range after falling sharply following the very strong payrolls report on Friday. It didn’t react strongly to Fed Powell’s comments as he talked about disinflation but also that rates needed to rise further. The USD is down slightly today.

- Gold is in a corrective cycle and trend conditions remain bearish. Support is at $1861.40, the February 3 low, and resistance remains at $1899.90, the 20-day EMA. Prices are holding above the 50-day simple MA.

- Later today the highlight of the calendar is a number of Fed speakers, as the only data is wholesale inventories. Any dovish comments would be supportive of bullion.

OIL: Crude Tracking Sideways After Strong Rally

Oil prices are range trading today after rising strongly on Tuesday due to positive demand developments and some supply outages. WTI is up 0.2% to $77.30/bbl and Brent is +0.1% to 83.75/bbl. The US is slightly weaker today.

- WTI oil prices are approaching their 50-day simple MA while Brent is above. Resistance for WTI is at $78.39, the 50-day EMA, and support is at $72.25. Brent is close to resistance at $84.08, while support lies at $79.10.

- The oil market wasn’t rattled by Fed Powell’s comments as he talked about disinflation but also that rates needed to rise further. It was more interested in the EIA cutting its US crude output forecast for 2024.

- Later today the highlight of the calendar is a number of Fed speakers, as the only data is wholesale inventories. EIA US fuel stock data is also released. The API data showed a 2.2mn bbl drawdown after several weeks of build.

FOREX: Muted Asian Session

The greenback has dealt in narrow ranges in today's Asian session. There has been little meaningful moves across G-10 FX.

- USD/JPY is little changed, last dealing at ¥131.15/25. Dec Trade Balance printed marginally higher than expectations this morning. There was little reaction in the pair to comments from PM Kishida as he noted that he is considering the impact on the markets re: his choice of BoJ Governor, while flagging communication as a key trait for the successful candidate.

- AUD/USD has dealt in narrow ranges today, currently a touch off best levels at $0.6960/65. The pair has been pressured at the margins as Iron Ore futures in Singapore continue to weaken, down ~0.2% today.

- AUD/NZD is a touch above $1.10 having broken through the key level in early trading. A close above this level opens further upside in the cross.

- Kiwi is also little changed having firmed off session lows, resistance was seen ahead of the 50-day EMA. NZD/USD prints at $0.6325/30. ANZ lowered their Fonterra 2022-23 milk price forecast this morning to $8.50/kg, adding pressure at the margins in early trade. PM Hipkins announced the minimum wage will rise in line with CPI in April.

- EUR and GBP are little changed today having respected tight ranges.

- In Europe today there is a thin data slate. Further out we have a number of Fed speakers on the wires.

FX OPTIONS: Expiries for Feb08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-15(E759mln), $1.0735-50(E1.3bln), $1.0800-15(E621mln)

- USD/JPY: Y130.00($595mln), Y132.85-00($801mln)

- EUR/JPY: Y140.25-26(E1.3bln)

- EUR/GBP: Gbp0.8850-70(E825mln), Gbp0.8900(E673mln), Gbp0.8950(E501mln)

- AUD/USD: $0.7190(A$1.4bln)

- USD/CNY: Cny6.6500($650mln), Cny6.7390-00($869mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2023 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 08/02/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 08/02/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 08/02/2023 | 0900/1000 |  | EU | ECB Elderson Hosts Banking Supervision Press Conf on SREP | |

| 08/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/02/2023 | - |  | EU | ECB Lagarde at European Council meeting | |

| 08/02/2023 | 1420/0920 |  | US | New York Fed's John Williams | |

| 08/02/2023 | 1430/0930 |  | US | Fed Governor Lisa Cook | |

| 08/02/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 08/02/2023 | 1500/1000 |  | US | Atlanta Fed's Raphael Bostic | |

| 08/02/2023 | 1500/1000 |  | US | Fed Vice Chair Michael Barr | |

| 08/02/2023 | 1500/1000 |  | NL | DNB President Klaas Knot speaks at MNI event | |

| 08/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/02/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/02/2023 | 1730/1230 |  | US | Minneapolis Fed's Neel Kashkari | |

| 08/02/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/02/2023 | 1830/1330 |  | CA | BOC minutes from last rate meeting | |

| 08/02/2023 | 1845/1345 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.