-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: RBA Comes Down On The Dovish Side As It Delivers Latest 25bp Hike

EXECUTIVE SUMMARY

- CHINA WARNS US RISKS CATASTROPHE WITH MOVES TO ‘CONTAIN’ BEIJING (BBG)

- RBA HIKES 25BP, CUTS "MONTHS AHEAD" FROM GUIDANCE (MNI)

- GREECE MONTHS AWAY FROM INVESTMENT-GRADE RATING, SAYS CENTRAL BANK CHIEF (FT)

- ANALYSTS SEE POSSIBLE CHINA RRR CUT COMING (SECURITIES DAILY)

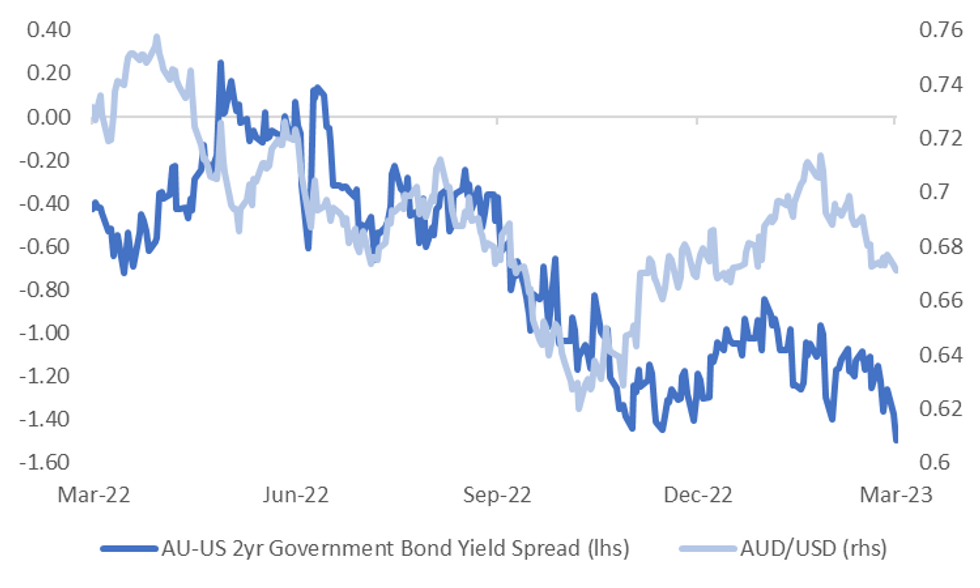

Fig. 1: AUD/USD Vs. AU/U.S. 2-Year Yield Spread

Source: MNI - Market News/Bloomberg

UK

BREXIT: Northern Ireland’s Democratic Unionist Party is setting up a consultation group to consider the UK and European Union’s new post-Brexit agreement. (BBG)

ECONOMY: Separate data from Barclays showed consumer spending on payment cards rose by 5.9% year-on-year in February. Barclays said annual growth rates were impacted by the lifting of Omicron Plan B restrictions last year, which caused a spike in spending due to pent-up demand. (RTRS)

EUROPE

FRANCE: French unions are betting on a massive turnout on Tuesday to bring the country to a standstill in a sixth day of protests against President Emmanuel Macron’s plan to raise the minimum retirement age. (BBG)

ITALY: Italy seems to have avoided an economic recession despite being hit by costly energy prices and record high inflation, Economy Minister Giancarlo Giorgetti said on Monday, offering a less grim outlook for the right-wing government. (RTRS)

GREECE/RATINGS: Greece is on the cusp of regaining its investment-grade credit rating after 12 years in the junk-bond wilderness, its central bank governor Yannis Stournaras has said as he urged the country’s next government to maintain fiscal prudence. (FT)

ESTONIA/RATINGS: Outcome of general election is credit positive, economy and public finances pose key challenges though. (Moody’s)

BONDS: European bond sales have topped €500 billion ($532 billion) since the start of the year — the fastest pace on record as uncertainty over inflation and geopolitics prompt companies, banks and governments to overlook rising yields and push ahead with their debt plans. (BBG)

U.S.

FED: The White House said it would have news soon on President Joe Biden's nominee to serve as vice chair of the Federal Reserve Board of Governors. (RTRS)

ECONOMY: Bank of America Chief Executive Officer Brian Moynihan said on Tuesday the U.S economy would reach a technical recession starting in the third quarter of 2023. (RTRS)

EQUITIES: Meta Platforms Inc., the owner of Facebook and Instagram, is planning a fresh round of layoffs and will cut thousands of employees as soon as this week, according to people familiar with the matter. (BBG)

OTHER

U.S./CHINA: Senate Intelligence Committee Chairman Mark Warner is set to unveil a bill Tuesday that would allow the US to ban the popular video-sharing app TikTok and other Chinese technology, according to a person familiar with the matter. (BBG)

U.S./CHINA: House Foreign Affairs Committee Chairman Michael McCaul and Democratic Representative Gregory Meeks call for a determination and sanction authorization on Hangzhou Hikvision Digital Technology Co., Ltd, in a letter to President Biden. (BBG)

U.S./CHINA: China’s new foreign minister warned that soaring US-China tensions risk blowing past any guardrails in the relationship, showing that divisions between the world’s biggest economies are becoming more entrenched. (BBG)

U.S./CHINA/TAIWAN: Taiwan will not allow "repeated provocations" from China, the island's defence minister said on Tuesday, as China's foreign minister said Taiwan was the "first red line" that must not be crossed in Sino-U.S. relations. (RTRS)

U.S./CHINA/TAIWAN: U.S. House Speaker Kevin McCarthy plans to meet Taiwan's President Tsai Ing-wen in the U.S. in coming weeks, two sources told Reuters on Monday, a move that could replace the Republican Speaker's anticipated but sensitive trip to the democratically governed island claimed by China. (RTRS)

JAPAN/SOUTH KOREA: Japan and South Korea have not decided whether to resume a bilateral currency swap arrangement as their relations improve, Japanese Finance Minister Sunichi Suzuki said. (RTRS)

RBA: The Reserve Bank of Australia warned further tightening may be needed as it hiked rates 25bp to 3.6% on Tuesday, but tempered its warning by cutting February's reference to "over the months ahead", a hint policymakers may be getting close to a pause in their tightening campaign. (MNI)

AUSTRALIA/CHINA: Australian Prime Minister Anthony Albanese said on Tuesday he would accept an invitation to visit China. "I think it is a good thing that the relationship has got more stable. We want a more stable, secure region," Albanese said at the Australian Financial Review summit on Tuesday. (RTRS)

AUSTRALIA/CHINA: Australian beef, lobster and dairy exporters are starting to reap the benefits of better relations with China, Agriculture Minister Murray Watt said. (BBG)

NEW ZEALAND: The Governments’s accounts will change “significantly” in the coming months and years as the North Island rebuilds and recovers after Cyclone Gabrielle, the Finance Minister says. But Grant Robertson has promised the Government is well-placed to respond to the cyclone and the ongoing cost of living pressures, which will be a major focus of the Government’s May budget. (Stuff NZ)

BOK: Bank of Korea Governor Rhee Chang-yong on Tuesday said interest rate difference with the United States is only one of many factors affecting the foreign exchange rate, and that recent won weakness was due to dollar strength rather than a rate hold by the central bank. (RTRS)

NORTH KOREA: North Korea said any move to shoot down one of its test missiles would be considered a declaration of war and blamed joint military exercise between the United States and South Korea for growing tensions, state media KCNA said on Tuesday. (RTRS)

CANADA/CHINA: Canadian Prime Minister Justin Trudeau said on Monday he will appoint an independent special investigator to probe alleged election interference by China and also announced separate new probes into the suspected foreign meddling. (RTRS)

TURKEY: Turkish President Recep Tayyip Erdoğan now knows who he will face this May, in the most hotly contested elections in his 20-year rule: Kemal Kılıçdaroğlu. (POLITICO)

MEXICO: Mexico said on Monday that it will demonstrate with data and evidence that there has been no trade harm, after receiving a request from the U.S. Trade Representative's office to start technical consultations on its plans to restrict genetically modified corn. (RTRS)

MEXICO: The US has asked Mexico to review whether workers at a Unique Fabricating Inc. facility in Santiago de Querétaro have been denied labor rights. (BBG)

BRAZIL: Brazilian Finance Minister Fernando Haddad said on Monday that his ministry has finalized its contribution to the design of the country's new fiscal framework, but highlighted that other ministries will still evaluate it before the president. (RTRS)

BRAZIL: Brazil’s economic team intends to unveil a plan to shore up the country’s fiscal credibility before the central bank’s upcoming interest rate decision in a bid to pressure the monetary authority into lowering borrowing costs, according to two people with knowledge of the matter. (BBG)

BRAZIL: The President of the Brazilian central bank Roberto Campos Neto has been involved in the discussions about the new names for the institution’s board, Finance minister Fernando Haddad told journalists. (BBG)

BRAZIL: A meeting between Americanas and creditor banks this Monday had no progress, reports newspaper O Globo without citing how it obtained the information. (BBG)

RUSSIA: US State Department and European Commission officials met with diamond industry representatives to discuss next steps on Russian diamond trade and the most effective ways to disrupt that revenue, State Department spokesperson said in statement dated March 6. (BBG)

RUSSIA/CHINA: China must advance its relations with Russia as the world becomes more turbulent, Foreign Minister Qin Gang said on Tuesday. (RTRS)

RUSSIA/INDIA: Both sides agreed to work together to unlock the full potential of India-Russia bilateral trade and economic relations including through addressing the trade deficit and market access issues, said the government in a statement. (Times of India)

SOUTH AFRICA: South African President Cyril Ramaphosa appointed a new deputy and electricity czar and replaced several ministers, injecting new blood into a cabinet that’s failed to get to grips with crippling energy shortages and revive a flagging economy. (BBG)

SOUTH AFRICA: The power utility announced on Monday evening that stage-4 and stage-5 load shedding would continue throughout the week. (Independent Online)

CHILE: Chile estimates dollar sales of up to $1b a month for March to June with a maximum daily amount of $100m, according to the Finance Ministry. (BBG)

METALS: The government of Peru, the second-biggest producer of copper and zinc, expects that shipments of the commodities will begin to normalize within days as the nation’s worst street protests in decades ease. (BBG)

METALS: High iron ore prices are being underpinned by strong demand for the steelmaking ingredient, according to the head of Rio Tinto Group, the world’s largest producer. (BBG)

METALS: The chief executive of global miner BHP Group BHP.AX said the company was positive about the growth of the Chinese economy this year, with green shoots already appearing. (mining.com)

ENERGY: U.S. regulators sent another list of questions seeking information to Freeport LNG on Monday, as they evaluate its request to restart full commercial operations of its export facility in Texas. (RTRS)

ENERGY: Cheniere Energy Inc. says China will no longer act as “relief valve” by supplying liquefied natural gas to Europe like it did during last year’s energy crisis, and may instead take flows away from Europe to serve its own growing economy. (BBG)

OIL: The price caps imposed by the G7 and allies to force Russia to sell its crude and fuel at a discount are working well, U.S. Energy Envoy Amos Hochstein said on Monday. (RTRS)

OIL: The United Arab Emirates has been taking more cargoes of Russian crude oil, according to ship tracking data and trading sources, in another example of how Western sanctions on Russia have adjusted traditional energy trade flows. (RTRS)

OIL: Production of oil in the Permian Basin will peak in five to six years as the best acreage for drilling and fracking is used up, according to the head of Pioneer Natural Resources Co., one of the biggest operators in the region. (BBG)

CHINA

PBOC: China’s central bank could cut the required reserve ratio for banks to adjust liquidity after the PBOC drained funds through its open market operations, Securities Daily reports, citing analysts. (BBG)

PROPERTY: The government work report released last weekend signalled more support for the real estate sector, as Beijing seeks to tackle “hidden risks” in the housing industry, according to Yicai.com. (MNI)

FDI: Foreign enterprises in China can operate at ease, with generous rewards on offer for those who develop in the country, according to the nationalist paper Global Times. (MNI)

DEBT: China’s National Development and Reform Commission held a meeting with its local bureaus in Guangdong province and Shenzhen city on March 1 and discussed Chinese overseas debt cross-border supervision. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY478 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY3 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY478 billion after offsetting the maturity of CNY481 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9970% at 10:00 am local time from the close of 1.8253% on Monday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday, compared with the close of 42 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9156 TUES VS 6.8951 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9156 on Tuesday, compared with 6.8956 set on Monday.

OVERNIGHT DATA

CHINA JAN-FEB TRADE BALANCE +US$116.88BN; +US$82.50BN

CHINA JAN-FEB EXPORTS USD -6.8% YTD Y/Y; MEDIAN -9.0%

CHINA JAN-FEB IMPORTS USD -10.2% YTD Y/Y; MEDIAN -5.5%

CHINA JAN-FEB TRADE BALANCE +CNY810.32BN

CHINA JAN-FEB EXPORTS CNY +0.9% YTD Y/Y

CHINA JAN-FEB IMPORTS CNY -2.9% YTD Y/Y

JAPAN JAN LABOUR CASH EARNINGS +0.8% Y/Y; MEDIAN +1.8%; DEC +4.1%

JAPAN JAN REAL CASH EARNINGS -4.1% Y/Y; MEDIAN -3.2%; DEC -0.6%

AUSTRALIA JAN TRADE BALANCE +A$11.688BN; MEDIAN +A$12.250BN; DEC +A$12.985BN

AUSTRALIA JAN EXPORTS +1% M/M; DEC 0%

AUSTRALIA JAN IMPORTS +5% M/M; DEC +1%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE 79.9; PREV 80.0

Consumer confidence remained virtually unchanged - and very low - in the week to 5 March. It was the fourth consecutive week with confidence among the worst 12 results since the COVID outbreak in Australia. (ANZ)

AUSTRALIA FEB FOREIGN RESERVES A$85.0BN; JAN A$84.5BN

SOUTH KOREA Q4, P GDP -0.4% Q/Q; INITIAL -0.4%; Q3 +0.3%

SOUTH KOREA Q4, P GDP +1.3% Y/Y; INITIAL +1.4%; Q3 +3.1%

UK FEB BRC LIKE-FOR-LIKE SALES +4.9% Y/Y; JAN +3.9%

MARKETS

US TSYS: Narrow Ranges In Asia, Powell In Focus

TYM3 deals at 111-05+, +0-06, a touch off the top of the 0-06 range on volume of ~70K.

- Cash Tsys sit 0.5-1bp richer across the major benchmarks.

- Moderate pressure was seen in early trade as Asia-Pac participants focused on the core FI pressure seen on Monday in the wake of particularly hawkish ECB speak from ECB's Holzmann.

- Amid light headline flow Tsys then ticked away from session cheaps, before a bid in ACGBs spilled over seeing Tsys firm to session highs. The RBA hiked the cash rate 25bps, however there was a dovish feel to the post-meeting statement.

- There was little follow through to the move, with notable underperformance noted vs. ACGBs. Tsys then respected narrow ranges for the remainder of the session.

- Fed Chair Powell's semi-annual Monetary Policy report to the Senate Banking Committee provides the highlight of the broader macro Tuesday. Also on the wires we have Wholesale Inventories and Consumer Credit. There is also the latest 3-Year Tsy supply.

JGBS: Curve Twist Steepens, 30-Year Auction Only Generates Tepid Demand

JGB futures ticked higher during the Tokyo session, more than unwinding overnight weakness, leaving the contract +4 ahead of the close, just shy of best levels. A bid in wider core global FI markets provided further support in the Tokyo afternoon after a morning uptick.

- Wider cash JGBs run 1.5bp richer to 2bp cheaper, pivoting around 10s as the curve twist steepens. 10s continue to operate effectively on the upper boundary of the range allowed under the BoJ’s YCC parameters (0.50%).

- Weakness in the longer end seemed to be related to the weakness seen in core global FI markets on Monday, while the twist steepening felt a bit like a further unwind of hawkish flattener plays given a growing feel that there will not be a tweak deployed at this week’s BoJ monetary policy decision (Governor Kuroda’s final meeting atop the central bank).

- Elsewhere, 30-Year JGB supply saw a tepid reception, although there wasn’t much in the way of post-auction follow through in price action.

- Current account data and BoJ Rinban operations headline the domestic docket tomorrow.

JGBS AUCTION: 30-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y732.6bn 30-Year JGBs:

- Average Yield: 1.416% (prev. 1.543%)

- Average Price: 103.84(prev. 101.15)

- High Yield: 1.425% (prev. 1.551%)

- Low Price: 103.65(prev. 101.00)

- % Allotted At High Yield: 78.3018% (prev. 96.9964%)

- Bid/Cover: 2.997x (prev. 3.323x)

AUSSIE BONDS: RBA's Dovish Shift Sparks A Rally

The RBA increased the cash rate by 25bp, as widely expected, but watered down the hawkish message contained in the February statement by dropping the reference to “increases” in interest rates over coming months and replacing it with “further tightening of monetary policy will be needed”. The bid tone was also supported by the assertion from the RBA that recent data suggested a lower risk of a wage-price spiral and the rather bold claim that “inflation had peaked”, referencing the monthly CPI.

- ACGBs futures richen as much as 12bp and 18bp respectively after the decision with YM +14.0 and XM +8.0 at the close, a few bp back from their respective post-decision highs. Cash ACGB yields close 8-14bp lower with the 3/10 curve 6bp steeper.

- A similar move in swaps with little movement in EFP. Earlier today a 1y Vs. 1y1y flattener was deemed to have offered a good risk-return play on the RBA pivoting towards a less hawkish stance. At the close, the 1y1y rate was 13bp lower with the 1y Vs. 1y1y 5bp flatter than morning levels.

- Bill strip closed 6-17bp richer led by the late whites and front reds.

- RBA-dated OIS pricing softened by 4-13bp led by meetings beyond June. Terminal rate expectations drop to around 4.00% versus 4.13% prior to the RBA decision.

- RBA Governor Lowe is to deliver a speech at the AFR Business Summit tomorrow.

Fig 1: RBA-Dated OIS Pre- & Post-RBA

Source: Bloomberg / MNI - Market News

NZGBS: Richen After New Supply Syndication

NZGBs reverse morning underperformance versus $-Bloc peers after pressure surrounding the issue of the new NZGB May-30 via syndication passed (NZ$4bn vs. the range of NZ$3-5bn, likely limited by a want to avoid the cheap extreme of the initial pricing range).

- After cheapening as much as 6-7bp pre-issuance, NZGBs closed flat to 2bp cheaper with the NZ/US and NZ/AU 10-year differentials 3bp and 1bp tighter, respectively (pre-RBA decision).

- Swaps closed 4-5bp cheaper with the 2s10s curve unchanged.

- RBNZ dated OIS were +2-6bp firmer across meetings with Nov-23 and Feb-24 leading. April meeting pricing remained around 40bp of tightening with terminal OCR pricing back at the RBNZ’s projected peak of 5.50%.

- YtD NZ deficit readings were marginally deeper than expected, while Finance Minister Robertson noted the impending headwinds on the fiscal front re: the cyclone rebuild, but stressed that government finances are well placed to deal with both that and the cost of living pressures households are facing.

- With the local data calendar light until February’s card spending data (Thu), the market will be fixed on the raft of central bank events over the coming days, starting with this evening's speech on monetary policy by RBNZ Governor Orr at a private event in London and Fed Chair Powell’s semi-annual testimony to Congress.

- A reminder that the delayed impulse from the RBA decision will be felt tomorrow morning, hwen NZGBs re-open.

EQUITIES: Most Regional Markets Higher, But HK & China Diverge

Most regional markets are tracking higher, led by the HSI and China Enterprise index, although mainland shares are struggling. US futures are firmer, while SEA markets in terms of the Thailand and Philippines bourses have benefited from downside inflation outcomes today.

- The HSI opened flat but quickly rose to +1%, with gains fairly broad based. On the sidelines of the NPC, the general manager of the Shanghai Stock Exchange reportedly called for better funding access from the market, particularly for SoEs. The HS China Enterprise Index is also up over 1%.

- Mainland shares are still struggling though, with the CSI 300 off by 0.2% at this stage.

- Elsewhere the Nikkei 225 is +0.30%, while the Kospi (+0.40%) and Taiex (+0.70%) are also in positive territory.

- The SET in Thailand is +0.90%, heading for its first gain since the 21st of Feb. Lower inflation aided sentiment. A similar dynamic was in play for Philippines stock, up by the same amount, although inflation rates remain much higher compared to Thailand.

GOLD: Bullion Waiting For Fed’s Powell To Appear Later

Gold has been trading in a narrow range during the APAC session after falling 0.5% on Monday due to higher US yields. It is currently in a holding pattern ahead of Fed Chairman Powell’s appearance later and is around $1848.15/oz having reached a high of $1850.52 following a low of $1844.15. The USD index is 0.1% lower.

- Gold is trading below its 50-day moving average. Initial resistance sits at $1858.26, while support is at $1804.90, the February 28 low, which is also the bear trigger.

- Later Fed Chairman Powell appears before the Senate banking panel. His comments will be watched closely for clarification on the monetary policy outlook but he is expected to say that the terminal rate will be higher than expected at the last meeting. This would be negative for bullion. He appears before the House on Wednesday. The data calendar is light with only US wholesale inventories and consumer credit scheduled.

OIL: Crude Continues Trending Higher, Focus On Fed’s Powell

Oil prices are higher for the sixth consecutive day in line with better equity sentiment. WTI rose 1% on Monday and is now up a further 0.3% during APAC trading to around $80.66/bbl, while Brent is also up 0.3% at $86.41. Hawkish comments from Fed Chairman Powell later could weigh on crude though. The USD index is currently down 0.1%.

- WTI reached a peak of $80.94 earlier following a low of $80.40. It broke resistance at $80.78 but couldn’t hold it. Key resistance is at $82.89, the January 23 high. It is above its 100-day moving average.

- Brent hit a high of $86.75 following a low of $86.19, while off the highs it is still approaching its 200-day moving average. It broke resistance of $86 but couldn’t sustain a break of $86.55, the February 13 high.

- Reports are indicating that Russia’s announcement to cut output by 500kbd in March has not yet impacted shipments.

- Later Fed Chairman Powell appears before the Senate banking panel. His comments will be watched closely for clarification on the monetary policy outlook but he is expected to say that the terminal rate will be higher than expected at the last meeting. This would be negative for crude. He appears before the House on Wednesday. The data calendar is light with only API inventory data, US wholesale inventories and consumer credit scheduled.

FOREX: AUD Pressured After RBA Dovish Shift

AUD is the weakest performer in the G-10 space at the margins as there was a dovish tone to the RBA's post-meeting statement as they raised the cash rate 25bps.

- The RBA removed language about the need for hikes in the months ahead, as well as noting that inflation pressures may have peaked. AUD/USD fell ~0.8% from peak to trough, support was seen below $0.67 as the pair pared losses to sit at $0.6710/15. Earlier in the session the trade balance for January was a touch narrower than expected, a surplus of $11.7bn was recorded vs $12.25bn exp however there was little reaction in the AUD.

- NZD/USD is a touch firmer, up ~0.1% from yesterday's closing price. Kiwi has observed narrow ranges for the most part, with little follow through on moves. AUD/NZD is softer, down ~0.4%, last printing at $1.0820/30.

- Yen is little changed today, USD/JPY has observed a ¥135.85/136.15 range for the most part with little in meaningful moves. January's Labor Cash Earnings printed at 0.8% below the expected 1.8%, Real Cash Earnings fell 4.1% vs -3.2% exp.

- EUR and GBP are marginally firmer, however ranges have been tight in Asia.

- BBDXY is down ~0.1%. 10 Year US Treasury Yields are little changed, e-minis are up ~0.2%.

- Fed Chair Powell's semi-annual Monetary Policy report to the Senate Banking Committee provides Tuesday's highlight.

FX OPTIONS: Expiries for Mar07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0570-85(E1.3bln), $1.0620-30(E1.0bln), $1.0675-85(E922mln), $1.0710-30(E938mln), $1.0740-45(E1.0bln), $1.1000(E1.4bln)

- USD/JPY: Y136.00-10($783mln), Y136.50-65($774mln)

- GBP/USD: $1.1950(Gbp572mln), $1.1975(Gbp721mln), $1.1994-00(Gbp1.0bln)

- USD/CAD: C$1.3600-15($1.3bln)

- USD/CNY: Cny6.9500($1.4bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/03/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/03/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 07/03/2023 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/03/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/03/2023 | - | *** |  | CN | Trade |

| 07/03/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/03/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 07/03/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 07/03/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/03/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.