-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI EUROPEAN OPEN: RBNZ Dated OIS Softer After Policy Rate Held Steady

EXECUTIVE SUMMARY

- RBNZ HOLDS STEADY AT 5.5% AS HIGH OCR BITES - MNI BRIEF

- RBA LOWE LAYS OUT BOARD MEETING REFORM - MNI BRIEF

- CHINA SEEN TO RAMP UP FISCAL STIMULUS TO BOOST ECONOMY - CSJ

- NORTH KOREA FIRES LONG-RANGE MISSILE AHEAD OF S.KOREA, JAPAN MEETING - RTRS

- JAPAN JUNE CGPI RISE SLOWS TO 4.1% Vs. MAY 5.2% - MNI BRIEF

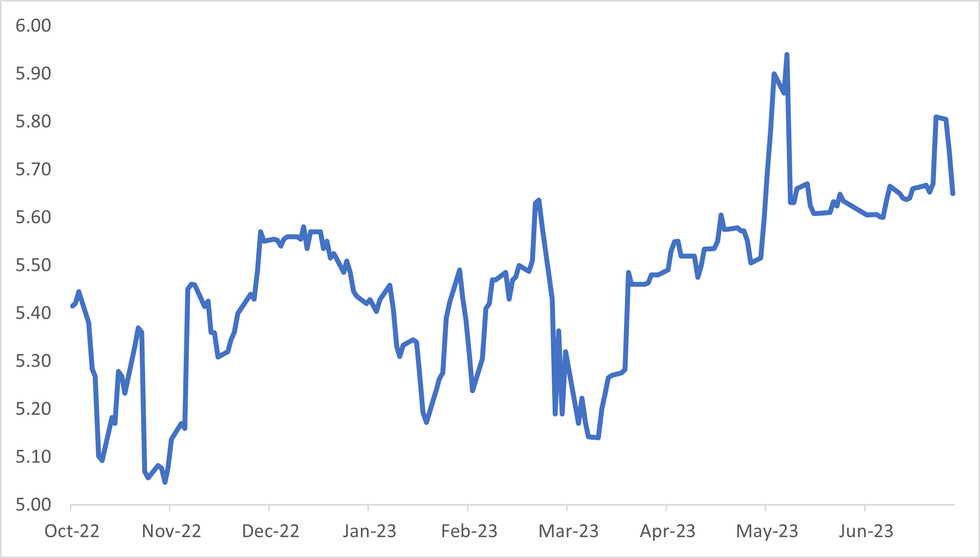

Fig. 1: RBNZ Dated OIS Terminal Rate Pricing (%)

Source: MNI - Market News/Bloomberg

U.K.

INFLATION: Britain’s cost-of-living crisis still has nearly a year to run, with calculations showing that the average household will be £2,300 ($2,974) worse off by the time inflation eases. A report from Grant Thornton UK LLP and Retail Economics said the UK was only three-quarters of the way through a financial squeeze that will last until May next year. It said £65 billion would be wiped off total household spending power. (BBG)

EUROPE

UKRAINE: Ukrainian President Volodymyr Zelenskiy meets NATO leaders on Wednesday after they declared his country's future lay inside the alliance but rebuffed his call for a timeline to membership. Zelenskiy will join the NATO leaders on the second day of their summit in Vilnius for an inaugural session of the NATO-Ukraine Council, a body established to upgrade relations between Kyiv and the 31-member transatlantic military alliance. (RTRS)

U.S.

MONEY-MARKETS: Money-market funds are set for a reprieve on “swing pricing” as Wall Street’s top regulator wraps up rules aimed at stemming rapid outflows during times of financial stress. The Securities and Exchange Commission still intends to impose other fees that will affect parts of the $5.5 trillion industry, according to a person familiar with the matter who asked not to be identified discussing the plans ahead of the meeting. (BBG)

US/CHINA: John Kerry, the U.S. special envoy on climate issues, will visit China from July 16-19, China's Ministry of Ecology and Environment said on Wednesday, the latest senior U.S. official to travel to Beijing in recent weeks. (RTRS)

OTHER

NEW ZEALAND: The Reserve Bank of New Zealand’s Monetary Policy Committee left its official cash rate unchanged today at 5.5%, holding steady for the first time since August 2021 as inflation declines from its peak and the country’s economy slows. In a statement, the committee said rates would need to remain restrictive for the foreseeable future, "to ensure consumer price inflation returns to the 1-3% target range, while supporting maximum sustainable employment." (MNI Brief)

NEW ZEALAND: New Zealand’s governing Labour Party has ruled out implementing a wealth or capital gains tax after the October election while leaving the door open for other, less-radical tax adjustments. “I’m confirming today that under a government I lead there will be no wealth or capital gains tax after the election,” Prime Minister Chris Hipkins said in a statement Wednesday in Wellington. “With many Kiwi households struggling, now is simply not the time for a big shake-up of our tax system.” (BBG)

AUSTRALIA: (MNI) Sydney - The Reserve Bank of Australia board from 2024 onwards will meet eight times a year, a reduction from its current 11 meeting schedule, following recommendations made by the RBA review in April. Speaking at an industry lunch Wednesday, RBA Governor Philip Lowe said four meetings will occur on the first Tuesday of February, May, August and November while the remainder will be held midway between these meetings. “The exact dates for 2024 will be published soon and the dates for future years will be published well in advance,” Lowe said. (MNI BRIEF)

AUSTRALIA: The Reserve Bank of Australia will update its MoU with the members of the Council of Financial Regulators (CFR) and the Australian Prudential Regulation Authority to set out clearer commitments on cooperation. The move follows recommendations made by the RBA review earlier in April that related to the Reserve’s financial stability goals. (MNI)

AUSTRALIA: Australia Treasurer Jim Chalmers said on Wednesday the cabinet would meet soon to decide the next governor of the country's central bank, after local media reported that a government decision could be reached as early as this week. Markets are still in the dark whether Chalmers will extend Reserve Bank of Australia (RBA) Governor Philip Lowe's seven-year term when it ends on Sept. 17, or select a replacement following perceived past missteps by the central bank head. (RTRS)

JAPAN: North Korea fired a long-range missile off its east coast on Wednesday, as leaders of South Korea and Japan were set to meet on the sidelines of the NATO summit in Lithuania to discuss rising threats including the nuclear-armed North. (RTRS)

JAPAN: The y/y rise in Japan's corporate goods price index slowed to 4.1% in June from May's revised 5.2% – the sixth straight deceleration – showing that upstream cost increases have peaked, Bank of Japan data released Wednesday showed. (MNI BRIEF)

TAIWAN: China sent the most warplanes into sensitive areas around Taiwan since large-scale military exercises in April, a move that follows visits to the democratically run island by US and Canadian lawmakers. (BBG)

CHINA

FISCAL: China is expected to boost fiscal support to the economy with more policy tools, China Securities Journal says in a front-page report, citing analysts. China is likely to ease local governments’ fiscal pressure by issuing special sovereign bonds, report cites Zhixin Investment economist Lian Ping as saying. (CSJ)

CREDIT: China’s new loan and aggregate financing will grow at a steady pace in the second half of the year after a rebound in June, Shanghai Securities News says in a front-page report, citing analysts. (SSN)

PROPERTY: China should make further efforts to curb “excessive risk aversion” among financial institutions in terms of real estate financing and guide them to provide “normal” support to cash-strapped developers, according to a commentary published in the front page of the Economic Daily. (BBG)

CHINA MARKETS

PBOC Conducts CNY2 Bln Via OMOs Weds; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Wednesday, with the rates at 1.90%. The operation has led no change to the liquidity after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7865% at 09:40 am local time from the close of 1.7270% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday, compared with the close of 45 on Monday.

PBOC Yuan Parity Lower At 7.1765 Wednesday Vs 7.1886 Tuesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1765 on Wednesday, compared with 7.1886 set on Tuesday. The fixing was estimated at 7.1912 by BBG survey today.

OVERNIGHT DATA

NZ MAY NET MIGRATION SA 4939; PRIOR 7633

SOUTH KOREA JUNE UNEMPLOYMENT RATES SA 2.6%; MEDIAN 2.6%; PRIOR 2.5%

SOUTH KOREA JUNE BANK LENDING TO HOUSEHOLD TOTAL KR1062.3t; PRIOR 1056.4t

JAPAN JUNE PPI M/M -0.2%; MEDIAN 0.2%; PRIOR -0.7%

JAPAN JUNE PPI Y/Y 4.1%; MEDIAN 4.4%; PRIOR 5.1%

JAPAN MAY CORE MACHINE ORDERS M/M -7.6%; MEDIAN 1.0%; PRIOR 5.5%

JAPAN MAY CORE MACHINE ORDERS Y/Y -8.7%; MEDIAN 0.1%; PRIOR -5.9%

MARKETS

US TSYS: Marginally Richer In Asia, CPI On Tap

TYU3 deals at 111-11+, +0-03, a 0-05 range has been observed on volume of ~59k.

- Cash tsys sit 1bp richer across the major benchmarks.

- Tsys have been range bound in a muted Asian session on Wednesday, local participants are perhaps sidelined due to the proximity of today's June CPI print.

- Support was seen on spillover from NZGBs, as the RBNZ held the OCR steady at 5.50%, however the move didn't follow through and tsys ticked away from session highs.

- The highlight of today's docket is the latest US CPI print, the MNI preview is here.

- There are a number of Fed speakers scheduled to cross including Richmond Fed President Barkin, Minneapolis Fed President Kashkari and Atlanta Fed President Bostic. The latest 10-Year Supply is also due.

JGBS: Futures At Session Lows, Through Key Support, 20-Year Supply Tomorrow

In the Tokyo afternoon session, JGB futures are sitting just off the Tokyo session’s worst levels at 147.27, -47 compared to the settlement levels. The session low so far has been 147.23. This comes despite PPI and Core Machine Orders data undershooting expectations.

- According to the MNI technicals team, a breach of 147.34 signals a deeper reversal and opens 146.11, the Feb 22 low.

- As reported by Bloomberg (ICYMI), the decline in JGB futures, coupled with the absence of any official statements from Japanese authorities, is intensifying speculation about a potential policy adjustment from the BoJ this month. Although the BoJ has not provided any hints, some traders are preparing for a larger JGB short position that could gain momentum and continue to grow once policy-tightening measures are eventually implemented. (See link)

- The cash JGB curve, beyond the 1-year zone, has bear steepened in the Tokyo afternoon session with the futures linked 7-year zone underperforming (3.8bp cheaper). The benchmark 10-year yield is 1.3bp higher at 0.472%, below the BoJ's YCC limit of 0.50%.

- The 20-year benchmark is 1.9bp cheaper at 1.093%, ahead of tomorrow’s supply.

- Swap rates are higher beyond the 1-year with the curve steeper. Swap spreads are wider beyond the 2-year.

- Tomorrow the local calendar sees International Investment Flow (Jul 7) along with 20-year supply.

AUSSIE BONDS: Richer, RBA Gov. Lowe Announces Changes To RBA

ACGBs richened to Sydney session highs as RBA Governor Lowe’s commenced his speech to the Economic Society of Australia, but reversed part of the gains (YM +4.0 & XM +4.0) after the Q&A session revealed little that was new with respect to the policy outlook.

- Lowe did, however, announce changes in response to the recent review of the central bank, according to the ABC. Amongst other initiatives, from 2024, the RBA board will only meet eight times a year, rather than 11. He said the RBA governor will hold a press conference after every board meeting to explain the board's interest rate decision. (See link)

- Cash ACGBs are 4-5bp richer with the AU-US 10-year yield differential -4bp at +18bp.

- Swap rates are 4-6bp lower.

- Bills pricing is +2 to +6 with late whites leading.

- RBA dated OIS 7-8bp softer for meetings beyond December.

- Tomorrow the local calendar sees June MI Inflation Expectations.

- Attention now turns to the release of June US CPI data later. Consensus puts core CPI at 0.3% m/m. A higher-than-expected reading, particularly with robust details in ex-shelter services, would further solidify the "higher for longer" narrative. Conversely, if there is a miss, it would have the most significant impact on pricing expectations for September.

NZGBS: Sharply Richer After RBNZ Leaves OCR At 5.50%

NZGBs closed sharply richer with yields 10-14bp lower on the day after the RBNZ decided to leave the OCR at 5.50%. The 2/10 cash curve is steeper.

- According to the RBNZ, the level of interest rates is constraining spending and inflation pressure as anticipated and required. The Committee agreed that the OCR will need to remain at a restrictive level for the foreseeable future, to ensure that consumer price inflation returns to the 1 to 3% annual target range, while supporting maximum sustainable employment. Note we get Q2 inflation data next Tuesday.

- Swap rates are 6-8bp lower after the decision, and 11-13bp lower on the day.

- RBNZ dated OIS is 2-12bp softer across meetings, Apr’24 leading. The market had given a 25bp hike today a 10% chance. Terminal OCR expectations have softened to 5.64% (Nov'23) versus 5.81% at the start of the week and 5.67% on Friday.

- Tomorrow the local calendar releases REINZ House Prices, Manufacturing PMI, Food prices and Retail Card Spending data.

- Attention now turns to the release of US CPI data later. Consensus puts core CPI inflation at 0.3% m/m in June versus 0.44% in May.

FOREX: Greenback Pressured In Asia

The Greenback has been pressured through the Asian session, a continuation of the recent move lower in USD/JPY which printed its lowest level since mid-June has spilled over into broader USD weakness ahead of today's CPI print.

- USD/JPY prints at ¥139.50/60, the pair is ~0.6% lower. There was no obvious headline driver with pre-US CPI positioning and technical flows weighing on the pair. The next support level is ¥139.18, 38.2% retracement of Mar-Jun bull leg.

- AUD is the strongest performer in the G-10 space at the margins. AUD/USD is up ~0.6% last printing at $0.6720/25. The next upside target is $0.6806 the high from June 22. Firmer commodities have aided the bid in AUD with Iron Ore futures up ~2.4% and Copper up ~0.7%.

- Kiwi is ~0.5% firmer despite the RBNZ's decision to hold the OCR steady at 5.50%. NZD/USD sits a touch above the 200-Day EMA, a level which bulls have not been able to sustain a break of.

- Elsewhere in G-10 EUR and GBP are both ~0.2% firmer. The Scandies are up, NOK and SEK are both ~0.4% higher, however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is down ~0.3% and US Tsy Yields are a touch lower. E-minis are ~0.1% higher and Hang Seng is up ~1%.

- The highlight of today's docket is the latest US CPI print, the MNI preview is here.

EQUITIES: Mixed Trends Ahead Of US CPI Print

Regional equity sentiment has been mixed today. China and Japan markets have struggled for positive traction, but we have mostly seen positive gains elsewhere. US futures are ticking higher, but only modestly. Eminis were last near 4476, +0.05% firmer for the session.

- China mainland stocks are a touch lower at the break. The CSI 300 close to flat at this stage, while the Shanghai Composite is down 0.13%. Onshore media has highlighted local analysts calling for fresh fiscal stimulus in H2.

- The HSI is faring better, up 1.15% at this stage. The Golden Dragon Index continued to recover in US Trade on Tuesday, up a further 1.61%, so we may be seeing some positive carry over from this.

- Japan stocks are softer, with a firmer yen likely weighing at the margins (up 3.43% month to date). The Topix is off by around 0.50% at this stage, Nikkei 225 -0.60%.

- Other markets are doing better, albeit modestly. The Taiex and Kospi up by around 0.25%.

- In SEA gains are slightly higher, with the Philippine index up nearly 0.70% at this stage.

- Thai stocks may be impacted by PM candidate Pita's case being referred to the Thai constitutional court. Tomorrow the Thai parliament is scheduled to vote on a new PM.

OIL: Holding Near Recent Highs, Brent Eyeing $80/bbl Handle

Brent crude sits close to unchanged for the session, last tracking around $79.50/bbl. Earlier highs came in at $79.75/bbl, while a low of $79.31/bbl was seen. We did see a +2.2% gain for Brent on Tuesday, so by and large we are holding onto those gains for far in Wednesday trade. WTI was last near $74.95/bbl, a touch above NY closing levels from Tuesday.

- Broader macro themes have unfolded in a similar fashion to yesterday, with USD sentiment under pressure, the BBDXY off a further 0.30%. On-going China stimulus hopes has been another focus point, with onshore media in China highlighting local analysts calling for more fiscal stimulus in H2.

- Bloomberg also notes reduced Russian supply (based of vessel tracking) to July 9, which suggests OPEC+ supply cuts may be biting further.

- For oil bulls the $80/bbl handle is not too far away, while the 200-day EMA is higher at $82.32/bbl.

- Coming up later is the EIA release of its weekly report on US crude stockpiles.

GOLD: Hits Highest Level In Three Weeks

Gold is 0.4% higher in the Asia-Pac session, after touching the highest level in almost three weeks on Tuesday, supported by falling US tsy yields and a weaker dollar ahead of US CPI data today.

- During a generally quiet New York session, the 10-year tsy yield continued its recent downward trend, while the value of the US dollar dropped to its lowest point since mid-June. These developments typically favour non-interest-bearing metals, such as gold.

- Consensus puts core CPI inflation at 0.3% m/m in June as it slowed from a modest beat of 0.44% in May. There is no evidence that the downside miss in nonfarm payroll gains last Friday has deterred FOMC participants from signalling their preference to raise rates twice more this year. An above-expected print and/or a report with strong details in ex-shelter services would reinforce the "higher for longer" theme; a miss most impactful for September pricing. See the MNI CPI preview here.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/07/2023 | 0600/0700 |  | UK | BOE FPC Summary and Record | |

| 12/07/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/07/2023 | 0800/0900 |  | UK | Financial Stability Report press conference | |

| 12/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/07/2023 | 1230/0830 | *** |  | US | CPI |

| 12/07/2023 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 12/07/2023 | 1345/0945 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/07/2023 | 1345/1545 |  | EU | ECB Lane panels at NBER conference. | |

| 12/07/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 12/07/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 12/07/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/07/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 12/07/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/07/2023 | 1700/1300 |  | US | Atlanta Fed's Raphael Bostic | |

| 12/07/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/07/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 12/07/2023 | 2000/1600 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.