-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Re-elected

EXECUTIVE SUMMARY

- MACRON BEATS LE PEN TO WIN RE-ELECTION

- LAGARDE SAYS EUROPE, U.S. FACE “DIFFERENT BEAST” WITH INFLATION (BBG)

- ECB POLICYMAKERS KEEN FOR QUICK END TO BOND BUYS, EARLY RATE HIKE (RTRS)

- GERMANY TO BORROW EXTRA EUR40BN TO CUSHION WAR BLOW (BBG)

- PUTIN ABANDONS HOPES OF UKRAINE DEAL, SHIFTS TO LAND-GRAB STRATEGY (FT)

- JAPAN FINMIN OFFICIAL DENIES REPORT JAPAN, U.S. DISCUSSED JOINT FX INTERVENTION (RTRS)

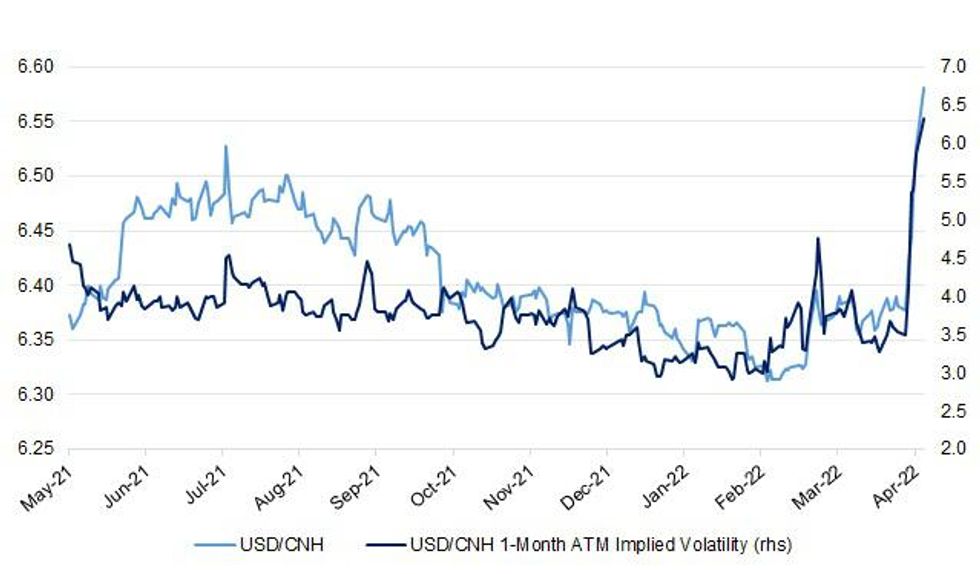

Fig. 1: USD/CNH & USD/CNH 1-Month ATM Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: A Whitehall report into lockdown-breaking parties in Downing Street is so damning that senior officials believe it could leave Boris Johnson with no choice but to resign as prime minister, The Times has been told. The report by Sue Gray, a senior civil servant, is understood to be highly critical of Johnson both for attending some of the events and the culture in No 10 under his leadership. (Times)

ECONOMY: Against a backdrop of soaring inflation in Britain's food retail sector, supermarket group Morrisons said on Monday it was reducing prices on over 500 products. Britain's fourth largest grocer after Tesco, Sainsbury's and Asda said the lower prices cover 6% of its total volume sales. It said the price cuts were in essential items such as eggs, baked beans, rice, coffee, cereals, chicken, sausages and nappies. It said the average saving was 13%. (RTRS)

ECONOMY: Asking prices for U.K. homes hit a record high for a third-straight month, driven by a shortage of properties on the market. Online property portal Rightmove Plc said that the price sellers sought in April was 9.9% higher than a year ago at 360,101 pounds ($463,598). All regions and all segments of the market hit record highs for the first time since 2007. “It can’t and won’t continue like this, but with the demand and supply imbalance being so out of kilter, it looks like any substantial slowdown will be gradual in coming and be a soft rather than hard landing,” said Tim Bannister, director of property data at Rightmove. (BBG)

EQUITIES: Britain unveiled a new taskforce on Monday to write rules forcing financial firms and listed companies to publish plans from next year for transitioning to a net zero economy by 2050. The taskforce will develop "rigorous and robust" measures to tackle greenwashing - inflated green credentials - and support companies to establish "investable and accountable" transition plans, the finance ministry said in a statement on Monday. It has a two-year mandate to set up good practices for transition plans, along with a 'sandbox' to test the new plans. (RTRS)

EUROPE

ECB: European Central Bank President Christine Lagarde said Sunday that while both the U.S. and Europe are struggling to contain soaring inflation, they are also “facing a different beast.” Lagarde, appearing on CBS’s “Face the Nation,” said the ECB will use “the tools and sequence” most appropriate for taming inflation, which currently includes a wind-down of bond-buying in the third quarter and possible, gradual, interest rate increases. Spiking inflation in Europe has been exacerbated by Russia’s invasion of Ukraine, which sent the price of fossil fuels soaring for European countries dependent on Moscow for natural gas and oil. Lagarde said 50% of Europe’s current record inflation stems from surging energy costs. “If I raise interest rates today, it is not going to bring the price of energy down,” Lagarde said. (BBG)

ECB: European Central Bank policymakers are keen to end their bond purchase scheme at the earliest possible moment and raise interest rates as soon as July but certainly no later than September, nine sources familiar with ECB thinking told Reuters. The ECB has been removing stimulus at the slowest possible pace this year but a surge in inflation is now putting pressure on policymakers to end their nearly decade-long experiment with unconventional support. The big obstacle so far has been that longer-term forecasts still showed inflation falling back below the ECB's 2% target but fresh estimates shared with policymakers at their April 14 meeting showed even 2024 inflation over target, several of the sources said. (RTRS)

GERMANY: Germany will increase borrowing plans by nearly 40 billion euros ($43 billion) this year to cushion the effect of the war in Ukraine, taking the total for net new debt to almost 140 billion euros, according to three people familiar with the matter. The adjustment is needed to help finance a range of government measures designed to offset the economic impact of the war and surging energy prices on companies and consumers, said the people, speaking on condition of anonymity before the fiscal plan is presented to the cabinet on Wednesday. The proposal by Finance Minister Christian Lindner will then be sent to parliament for approval. (BBG)

GERMANY: Germany’s opposition leader threatened to block plans to borrow 100 billion euros ($108 billion) to modernize the Bundeswehr. For the CDU to agree, Germany would have to permanently spend more than 2% of gross domestic product on defense and present repayment plan for the new debt, party leader Friedrich Merz told Bild am Sonntag. According to the newspaper, the Chancellery in Berlin is considering asking parliament to approve the special fund for the army without an attached economic plan and a concrete list of planned arms purchases. (BBG)

GERMANY: CDU leader Friedrich Merz wants to call on the government together with the traffic light coalition parties in the Bundestag to deliver heavy weapons to Ukraine. The draft appeal states that the Scholz government should "immediately and noticeably" intensify arms deliveries to Ukraine. Armaments should be made available "to the greatest possible extent" from the stocks of the Bundeswehr. (Spiegel)

FRANCE: Emmanuel Macron comfortably defeated far-right rival Marine Le Pen on Sunday, heading off a political earthquake for Europe but acknowledging dissatisfaction with his first term and saying he would seek to make amends. Leaders in Berlin, Brussels, London and beyond welcomed his defeat of the nationalist, eurosceptic Le Pen. With 97% of votes counted, Macron was on course for a solid 57.4% of the vote, interior ministry figures showed. But in his victory speech he acknowledged that many had only voted for him only to keep Le Pen out and he promised to address the sense of many French that their living standards are slipping. "Many in this country voted for me not because they support my ideas but to keep out those of the far-right. I want to thank them and know I owe them a debt in the years to come," he said. (RTRS)

FRANCE: French far-right leader Marine Le Pen said on Sunday that she would keep up the political fight against President Emmanuel Macron in the run-up to June parliamentary elections, as she conceded defeat to the incumbent in France's presidential election. "The French showed this evening a desire for a strong counterweight against Emmanuel Macron, for an opposition that will continue to defend and protect them," she told supporters after early projections indicated she had lost the election. (RTRS)

SLOVENIA: Political newcomer liberal Robert Golob has defeated Slovenia’s three-time prime minister, populist conservative Janez Janša, in elections in a country split by bitter political divisions over the rule of law. With almost all the votes counted on Sunday in the country of around two million people, GS stood at 34.5% of the vote compared with 23.6% for Janša’s Slovenian Democratic party. “Our objective has been reached: a victory that will enable us to take the country back to freedom,” Golob told jubilant supporters late Sunday. “People want changes and have expressed their confidence in us as the only ones who can bring those changes,” he said earlier via a livestream from his home where he was in isolation after contracting Covid-19. The 55-year-old former power company manager has promised to restore “normality”, having billed the elections as a “referendum on democracy”. (The Guardian)

SWITZERLAND: Neutral Switzerland has held up German arms deliveries to Ukraine by blocking the re-export of Swiss-made ammunition used in Marder infantry fighting vehicles that Kyiv would like to get, Swiss paper SonntagsZeitung reported. (RTRS)

UKRAINE: The United States announced new military assistance for Ukraine and a renewed diplomatic push in the war-ravaged nation as President Joe Biden’s secretary of state and Pentagon chief completed a secrecy-shrouded trip to Kyiv. In the highest-level American visit to the capital since Russia invaded in late February, top envoy Antony Blinken and Defense Secretary Lloyd Austin told Ukraine’s president, Volodomyr Zelenskyy, and his advisers that the U.S. would provide more than $300 million in foreign military financing and had approved a $165 million sale of ammunition. They also said Biden would soon announce his nominee to be ambassador to Ukraine and that American diplomats who left Ukraine before the war would start returning to the country this coming week. The U.S. Embassy in Kyiv will remain closed for the moment. (AP)

UKRAINE: Turkish President Recep Tayyip Erdogan, during a telephone conversation with his Ukrainian counterpart Volodymyr Zelensky on Sunday, said that Turkey is set "fundamentally positive" to act as one of the countries guarantors of Ukraine's security. (TASS)

UKRAINE: Officials in Kyiv are concerned Putin may go further than Russia’s stated goal of capturing the eastern Donbas border region and instead try to seize the whole of the south-east, cutting Ukraine off from the sea, according to people involved in trying to end the war. Ukraine is confident it can push Russian troops back further after defeating Putin’s initial plan to rapidly seize the country, but officials are increasingly worried that Moscow could resort to tactical nuclear weapons if it suffers further setbacks, two of the people said. In a meeting with Michel in Kyiv on Wednesday, Zelensky said Ukrainian public opinion did not support continuing the peace talks, adding that he was conscious that fighting Putin was more popular than making concessions, according to a person briefed on their conversation. (FT)

UKRAINE: Ukraine has repelled numerous Russian assaults along the line of contact in Donbas this week, a British military update said on Sunday. Despite Russia making some territorial gains, Ukrainian resistance has been strong across all axes and inflicted a significant cost on Russian forces, the UK Ministry of Defence tweeted in a regular bulletin. "Poor Russian morale and limited time to reconstitute, re-equip and reorganise forces from prior offensives are likely hindering Russian combat effectiveness," the update added. (RTRS)

UKRAINE: Russian forces attempted to storm the Ukrainian-held Azovstal steel plant in the besieged southeastern city of Mariupol on Sunday, Ukrainian officials said, despite Russian President Vladimir Putin's comments last week that the complex did not need to be taken. (RTRS)

UKRAINE: Russians prepare to attack Kryvyi Rih, Zelensky's home town. Oleksandr Vilkul, the head of the Kryvyi Rih’s military administration, said that the offensive is expected in the coming days, but the city is “fully prepared.” (Kyiv Independent)

UKRAINE: Ukraine has asked the International Atomic Energy Agency for "a comprehensive list of equipment" it needs to operate nuclear power plants during the war with Russia, IAEA Director General Rafael Grossi said on Saturday. This includes radiation measurement devices, protective material, computer-related assistance, power supply systems and diesel generators, he said in a statement. "We will coordinate the implementation of the assistance that the IAEA and its member states will provide, including by delivering required equipment directly to Ukraine's nuclear sites," he said. "The needs are great and I'm very grateful for the considerable support that our Member States have already indicated they will make available." (RTRS)

U.S.

ECONOMY: Alvaro Bedoya will be confirmed to the U.S. Federal Trade Commission this week, Senate Majority Leader Chuck Schumer said on Sunday, giving the agency enough votes to investigate oil companies Democrats say are "gouging" consumers with high gasoline prices. Vice President Kamala Harris will be on hand to break an expected 50-50 Senate tie over Bedoya's nomination, giving Democrats a 3-2 majority among FTC commissioners. Currently, there are two Democrats and two Republicans, resulting in deadlocks. "He (Bedoya) will give Lina Khan and the FTC the majority to go after the oil companies and go after gouging," Schumer said during a press conference in New York City. Khan, a Democrat, chairs the FTC. (RTRS)

POLITICS: Congressman Kevin McCarthy, the top Republican in the U.S. House of Representatives, came under fire from some of his fellow party members, after an audio recording showed him saying that then-President Donald Trump should resign over the Jan. 6, 2021, U.S. Capitol riot. The comments, which McCarthy had denied hours before the recording emerged, could undermine his widely known ambition to become House speaker next year if Republicans take control of the chamber in November's midterm elections, as expected. (RTRS)

EQUITIES: Twitter Inc. is in discussions to sell itself to Elon Musk and could finalize a deal as soon as this week, people familiar with the matter said, a dramatic turn of events just 10 days after the billionaire unveiled his $43 billion bid for the social-media company. The two sides met Sunday to discuss Mr. Musk's proposal and were making progress, though still had issues to hash out, the people said. There is no guarantee they will reach a deal. Twitter is slated to report first-quarter earnings Thursday and had been expected to weigh in on the bid then, if not sooner. (DJ)

OTHER

GLOBAL TRADE: The head of the world’s largest ship manager has urged Nato to provide naval escorts for commercial vessels passing through the Black Sea, which lies off Ukraine’s southern coast, as dozens remain stuck in the conflict zone. René Kofod-Olsen, chief executive of V.Group, said the western military alliance should intervene to ensure trade can flow from a region of vital importance for global food supplies. (FT)

EU/INDIA: The European Union's chief executive will seek to increase sales of European military equipment to India and relaunch talks on a free trade deal when she meets India's prime minister in New Delhi on Monday, a senior EU official said. European Commission President Ursula von der Leyen's visit is part of Western efforts to encourage India to reduce its ties to Russia after Moscow's invasion of Ukraine, and follows a trip last week by British Prime Minister Boris Johnson. Von der Leyen arrived in India on Sunday for a two-day official visit, her first as president of European Commission. (RTRS)

UK/INDIA: Britain and India agreed on Friday to step up defence and business cooperation during a visit to New Delhi by Boris Johnson, who said a bilateral free-trade deal could be wrapped up by October. (RTRS)

JAPAN: A senior Japanese finance ministry official on Saturday denied a media report that Japan and the United States discussed coordinated currency intervention to stem further yen falls at a bilateral finance leaders' meeting. Broadcaster TBS on Friday said Finance Minister Shunichi Suzuki and U.S. Treasury Secretary Janet Yellen discussed the idea of joint currency intervention to arrest yen falls during their meeting on Friday, held on the sidelines of the International Monetary Fund gatherings. The report was not true, the official told Reuters on condition of anonymity because of the sensitivity of the matter. (RTRS)

JAPAN: Japan's foreign minister promised his country would bolster its military to help the United States maintain regional security during a visit on Saturday to a U.S. aircraft carrier patrolling Asian waters. "Today I was able to experience first hand the frontline of national security," Yoshimasa Hayashi told reporters in the hangar deck of the USS Abraham Lincoln sailing in waters south of Tokyo. Japan will "significantly strengthen" its defence capabilities and work closely with the United States, he added. (RTRS)

AUSTRALIA/CHINA: Australia Prime Minister Scott Morrison said a Chinese military base in the Solomon Islands would be a “red line” for his government, as he attempts to deflect criticism he did not move quickly enough to avoid a security agreement between Honiara and Beijing. Speaking at a press conference on Sunday in Darwin, Morrison said his determination to avoid a naval base in the Solomon Islands was shared not just by the U.S. but by the Pacific nation’s Prime Minister, Manasseh Sogavare. (BBG)

NORTH KOREA: North Korea has yet to hold a military parade after showing signs of preparing for one to mark the Monday anniversary of the founding of its army, Yonhap News Agency said, delaying an event where it could showcase weapons to threaten the U.S. and its allies. Satellite imagery indicated that thousands of soldiers and major weapons systems were poised to parade through central Pyongyang on Sunday night but the event did not take place, perhaps due to poor weather, Yonhap reported an unnamed informed source as saying. North Korea’s official media made no mention of a parade on Monday morning. That opens up the possibility for the parade to be held Monday night to culminate celebrations for the 90th anniversary of the North Korean People’s Revolutionary Army. (BBG)

TAIWAN: Taiwan will not go into a Shanghai-like lockdown to control a rise in domestic COVID-19 cases as the vast majority of those infected have no symptoms or show only minor symptoms, Premier Su Tseng-chang said on Saturday, pledging to keep opening up. Speaking to reporters, Su said the government was confident in the steps being taken and it was "fortunate" more than 99% of cases were either asymptomatic or had mild illness. The government expects daily cases to reach 10,000 by the end of the month and has warned the peak is likely several weeks off. (RTRS)

PERU: Peruvian President Pedro Castillo said on Friday that he will seek to ask citizens in October whether they want to rewrite the country's market-friendly constitution, renewing a campaign promise that he had all but abandoned in office. "We will present a bill to Congress ... so that the people are consulted whether they want a new constitution," Castillo said in remarks from the city of Cuzco, where he traveled to quell protests against rising prices. (RTRS)

RUSSIA: Vladimir Putin has lost interest in diplomatic efforts to end his war with Ukraine and instead appears set on seizing as much Ukrainian territory as possible, according to three people briefed on conversations with the Russian president. Putin, who was seriously considering a peace deal with Ukraine after Russia suffered battlefield setbacks last month, has told people involved in trying to end the conflict that he sees no prospects for a settlement. “Putin sincerely believes in the nonsense he hears on [Russian] television and he wants to win big,” said a person briefed on the talks. (FT)

RUSSIA: The Putin administration’s domestic policy bloc has come to a conclusion: there are currently no “good PR scenarios” for ending Russia’s war against Ukraine that would also preserve the authorities’ ratings. This is what three sources close to Putin’s administration told Meduza. Putin’s domestic policy team began developing these “exit strategies” several weeks ago. “They looked, fiddled around, [but] there’s no clear scenario in sight. As such, they decided not to prepare [public] opinion for possible negotiations [and reaching a peace agreement]. They’re letting everything take its course,” explained one of Meduza’s sources. (Meduza)

RUSSIA: The European Union is preparing “smart sanctions” against Russian oil imports designed to minimise economic damage to the continent’s economy, a senior Brussels official has said. Valdis Dombrovskis, the European Commission’s executive vice-president, told The Times that Brussels would soon present a sixth package of sanctions measures against President Putin that would include “some form” of an oil embargo amid pressure for the bloc to deprive Moscow of lucrative energy revenues. “We are working on a sixth sanctions package and one of the issues we are considering is some form of an oil embargo. When we are imposing sanctions, we need to do so in a way that maximises pressure on Russia while minimising collateral damage on ourselves,” Dombrovskis said. (The Times)

RUSSIA: There is insufficient support from European Union member states for a complete embargo or punitive tariff on Russian oil and gas imports, the EU's top diplomat Josep Borrell was quoted as saying by German newspaper Die Welt on Monday. "At the moment, we in the EU do not have a unified position on this question," Borrell told the newspaper. (RTRS)

RUSSIA: Several weeks have passed since the U.S. and its allies first imposed sanctions on Russia’s biggest companies and its business and political leaders, all the way up to President Vladimir Putin. Yet one person has been spared, in a last-minute decision: Alina Kabaeva, the woman the U.S. government believes to be Mr. Putin’s girlfriend and the mother of at least three of his children. The belief among U.S. officials debating the move is that sanctioning Ms. Kabaeva would be deemed so personal a blow to Mr. Putin that it could further escalate tensions between Russia and the U.S. The 69-year-old Mr. Putin has never acknowledged a relationship with Ms. Kabaeva, a 39-year-old former cover model for Russian Vogue. The U.S. Treasury Department, which according to U.S. officials prepared the sanctions package against Ms. Kabaeva, now on hold, declined to comment. U.S. officials said that the action against Ms. Kabaeva isn’t off the table. (WSJ)

RUSSIA: NASDAQ exchanges in the United States and the Nordic countries (the company operates sites in Sweden, Denmark, Finland, Iceland) “will stop working in Russia” from April 29, 2022, “which will lead to the termination of access to exchanges for residents of Russia,” the letter says, sent by the Danish Saxo Bank to its customers. The document was published in profile chats for investors in Telegram, two clients of Saxo Bank confirmed to RBC that they had received the letter. (RBC)

RUSSIA/TURKEY: Turkey and Russia have “agreed to suspend the use of the airspace for Russian military aircraft and even civilian aircraft carrying soldiers to Syria,” Çavuşoğlu told reporters aboard his flight to Uruguay. Turkey had been giving permissions in three-month intervals, and the last note was until April, he said, adding that President Recep Tayyip Erdoğan had informed his Russian counterpart, Vladimir Putin, and then the flights were suspended. (Hurriyet)

MIDDLE EAST: The U.S. and Israel will hold a new round of strategic talks this week focusing on the Iranian nuclear program and countering Iran’s activity in the region, Israeli and U.S. officials said. Why it matters: The talks will take place amid a deep stalemate in indirect negotiations between the U.S. and Iran over reviving the 2015 nuclear agreement. (Axios)

ISRAEL: U.S. President Joe Biden announced his plans to visit Israel in the coming months in a call with Prime Minister Naftali Bennett on Sunday, a statement from the Premier Minister's Office and the White House said. The phone call also touched on Iran and steps Israel is taking to quell Jerusalem violence, the premier's office statement said. (Haaretz)

AFGHANISTAN: Afghanistan's acting defence minister said on Sunday that the Taliban administration would not tolerate "invasions" from its neighours after protesting against airstrikes it says were conducted by neighbouring Pakistan. (RTRS)

METALS: A Chilean environmental regulator has recommended that global miner Anglo American's Los Bronces copper project not be granted an extension permit involving a planned $3.3 billion investment, the company said on Saturday. Anglo American said Chile's Environmental Assessment Service had issued the recommendation although a firm decision on the mine's life extension would only come next week. The company is seeking to extend the life of the mine through 2036. Chile is the world's top copper producer and Los Bronces is a large mine with a capacity to produce over 300,000 tonnes of the red metal each year. (RTRS)

METALS: Peru said on Friday a group of indigenous communities had lifted a protest against Southern Copper Corp's Cuajone copper mine that had forced a suspension of production for more than 50 days. The government had declared a state of emergency in the region earlier in the week, sending soldiers to lift a protest organized by a group of indigenous communities. In a statement later on Friday, Southern Copper Corps said it has discovered damages to the mine's installations, including to a concrete spillway, water valves as well as the firm's rail line. The company added that it expects to restart Cuajone's operations as soon as the rail line is fixed, but did provide any timeline.The 52-day mine stoppage caused a loss of more than $260 million in exports as well as $400 million in lost tax revenue, the company added. (RTRS)

OIL: Libya said that output from closed oil fields will be resumed in the coming days, the country’s oil ministry said in a Facebook post. The ministry said it held a meeting with tribal leaders in the areas where oil fields were closed and was about to reach an agreement with them. (BBG)

CHINA

ECONOMY: China should take more vigorous macro policies to hedge the impact of the Covid-19 epidemic and keep economic growth in Q2 above 5% to ensure the 5.5% growth target for this year can be achieved, Cls.cn reported citing Wang Yiming, member of the People’s Bank of China’s Monetary Policy Committee. Authorities should quickly control the epidemic by early May, Wang said. The priorities are to actively expand domestic demand, boost consumption, as well as safeguard the supply chain to stabilize market expectations, Wang was cited as saying. (MNI)

CORONAVIRUS: Shanghai authorities battling an outbreak of COVID-19 have erected fences outside residential buildings, sparking fresh public outcry over a lockdown that has forced much of the city's 25 million people indoors. (RTRS)

CORONAVIRUS: Beijing's Chaoyang district will require people who live and work in the district to undergo three coronavirus tests this coming week, the city government of Beijing said on Sunday. Chaoyang is the biggest district in Beijing and is home to 3.45 million people. The city government's requirement comes after Beijing reported 22 new coronavirus cases on Saturday. (RTRS)

CORONAVIRUS: Beijing is on high alert for a new Covid-19 outbreak after recording 41 new cases in the past three days with cases detected in five districts, the China News Service reported on Sunday citing Pang Xinghua, deputy director of Beijing Center for Disease Control and Prevention. Health officials said on the weekend that the epidemic may have been spreading unnoticed for a week, with those infected found among a school, a tour group, and multiple families, while more cases are expected to be detected as mass testing gets underway, according to the newspaper. (MNI)

CORONAVIRUS: Alibaba's supermarket chain Freshippo said on Sunday it was adding more couriers to meet high demand in Shanghai but this was not yet catching up with the rising needs of locked-down residents as the city battles a surge in COVID-19 cases. Shen Li, a vice president at Alibaba Group's Freshippo, told reporters on Sunday that while the company's delivery capacity had recovered to about 60-70% of pre-outbreak levels as more couriers were allowed back on the roads, many difficulties remained. "The biggest challenge we are facing now is that the demand and numbers of orders from consumers has increased by about two to three times compared with pre-outbreak levels," she said. (RTRS)

FOREX: The yuan will regain support with foreign capital returning should China successfully contain the epidemic and implement more precise and effective ways to manage the outbreak and introduces pro-growth policies soon to restore market confidence, wrote Guan Tao, former forex official and chief economist at BOC Securities in an article published on Yicai.com. The recent depreciation of the yuan was due to a correction amid the spillover risk of Russia-Ukraine conflicts, greater regulatory oversight of China's U.S.-listed overseas companies and a sharp rebound of local Covid-19 cases, said Guan. Guan dismissed the speculation that the central bank has intervened by setting the central parity weaker. The recent weakening of the yuan will help release some pressure to depreciate as the U.S. Federal Reserve tightens its policies, Guan said. (MNI)

EQUITIES: As China’s markets gyrate following Covid outbreaks and Russia’s invasion of Ukraine, one of the nation’s best-performing macro hedge funds is bracing for more pain. Shanghai Banxia Investment Management Center, which topped local rankings in 2020, has cut its stock exposure to zero in anticipation of a worsening economy and further declines in equities, founder Li Bei said. The fund, which manages more than 5 billion yuan ($785 million), has also closed almost all short positions in commodities after rising prices led to losses. “This year could be even worse for fund managers than 2008” when, even during the global financial crisis, holding government bonds could still be a winning strategy, Li said in an interview this month. “It’s now very difficult to find a place where they can make money.” (BBG)

RATES: China’s biggest state-owned banks lowered rates on some deposits of consumers in response to the government’s call for help in backstopping the world’s second-largest economy. (BBG)

OVERNIGHT DATA

JAPAN MAR SERVICES PPI +1.3% Y/Y; MEDIAN +1.2%; FEB +1.1%

JAPAN FEB, F LEADING INDEX CI 100.0; FLASH 100.9

JAPAN FEB, F COINCIDENT INDEX 96.8; FLASH 95.5

UK APR RIGHTMOVE HOUSE PRICES +9.9% Y/Y; MAR +10.4%

UK APR RIGHTMOVE HOUSE PRICES +1.6% M/M; MAR +1.7%

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The 25 bps cut to banks' reserve requirement ratio announced on April 15 takes effect today, releasing about CNY530 billion of long-term funds, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9364% at 09:34 am local time from the close of 1.7518% on Sunday.

- The CFETS-NEX money-market sentiment index closed at 45 on Sunday vs 49 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4909 MON VS 6.4596

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4909 on Monday, compared with 6.4596 set on Friday, marking the lowest parity since Aug 23, 2021.

MARKETS

SNAPSHOT: Re-elected

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 503.9 points at 26595.46

- ASX200 is closed

- Shanghai Comp. down 74.735 points at 3012.184

- JGB 10-Yr future up 16 ticks at 149.25, yield down 0.2bp at 0.248%

- Aussie Bonds are closed

- US 10-Yr future up 40.625 ticks at 119.328125, yield down 3.87bp at 2.8581%

- WTI crude down $3.22 at $98.86, Gold down $14.89 at $1916.7

- USD/JPY up 2 pips at Y128.52

- MACRON BEATS LE PEN TO WIN RE-ELECTION

- LAGARDE SAYS EUROPE, U.S. FACE “DIFFERENT BEAST” WITH INFLATION (BBG)

- ECB POLICYMAKERS KEEN FOR QUICK END TO BOND BUYS, EARLY RATE HIKE (RTRS)

- GERMANY TO BORROW EXTRA EUR40BN TO CUSHION WAR BLOW (BBG)

- PUTIN ABANDONS HOPES OF UKRAINE DEAL, SHIFTS TO LAND-GRAB STRATEGY (FT)

- JAPAN FINMIN OFFICIAL DENIES REPORT JAPAN, U.S. DISCUSSED JOINT FX INTERVENTION (RTRS)

BOND SUMMARY: Risk Aversion Is Boon For Core FI, Antipodean Markets Closed

Broader aversion to risk lent support to core FI space, as looming global policy tightening, China's difficult Covid-19 situation, and Russia's ongoing invasion of Ukraine continued to undermine market sentiment. Emmanuel Macron's victory in the French presidential runoff failed to alter the otherwise gloomy risk backdrop, despite removing a key risk to political stability in Europe.

- T-Notes were in demand overnight, with TYM2 last seen +0-16 at 119-14, after topping out at 119-16. Eurodollar futures trade 5.5-11.5 ticks higher through the reds. U.S. Tsy yields sit 4.0-5.9bp lower across the curve, with its belly outperforming. The local economic docket lacks notable risk events.

- JGB futures pushed higher, extending gains after the Tokyo lunch break. JBM2 last changes hands at 149.29, up 20 ticks from the previous settlement. Cash JGB yield curve has flattened a tad. The BoJ conducted the pre-announced round of fixed-rate 10-Year JGB purchases in defence of the official cap on 10-Year yields.

- Antipodean financial markets were closed in observance of the ANZAC Day.

EQUITIES: Mostly Lower In Asia On Risk-Off Mood; US Mega-Cap Earnings Loom

Major Asia-Pac equity indices are between 1.5% to 2.7% worse off at typing, tracking a negative lead from Wall St.

- The CSI300 sold off, sitting 2.2% worse off at typing, trading at levels last witnessed in June ‘20. Losses were observed in virtually all sub-indices, with high-beta healthcare and consumer staples again leading losses. A note that some state-owned banks have announced the lowering of rates on certificates of deposit by 10bp earlier in the session, allowing banks to charge less for loans.

- The Hang Seng struggled, dealing 2.7% weaker at typing on underperformance in the financials sub-index and weakness in China-based tech stocks, with the Hang Seng Tech Index trading 2.9% softer at writing.

- Looking outside of Asia, several U.S. tech megacaps report earnings this week (noting that ~180 companies from the S&P500 making up approx. half of the index’s value will report earnings this week). Alphabet and Microsoft kick things off on Tuesday after the closing bell. Meta is up next on Wednesday after hours, while Amazon and Apple will report after the market closes as well. A note that weakness in mega-cap Netflix last week following dismal subscriber growth numbers inspired notably softer sentiment in tech stocks globally (particularly “stay-at-home”/pandemic winners) throughout the week.

- U.S. e-mini equity index futures are off worst levels, dealing 0.4% to 0.6% softer, led by losses in DJIA contracts.

- A note that Australian markets are closed for the ANZAC holiday today.

OIL: WTI Dips Below $100 As Events In China Eyed

WTI is ~-$2.90 and Brent is ~-$3.00 to print $99.20 and $103.70 respectively at typing, with focus centering around China’s ongoing COVID outbreak and its resulting impact on Chinese energy demand.

- To elaborate on certain developments, pandemic control measures have been enacted on the district of Chaoyang (pop. ~3.5mn) in Beijing, following the detection of at least ten cases over the weekend. Worry re: the possibility of a lockdown is evident (taking reference to limited reports of observed stockpiling activity amongst residents), although such a measure has not been announced yet. Looking to Shanghai, the city continues to record ~20k fresh cases daily, with deaths rising to a record of 51 for Sunday.

- Looking ahead, authorities have doubled-down on China’s “dynamic zero-COVID” strategy, with the head of the country’s COVID taskforce saying on Friday that the policy is necessary due to medical resource constraints and the low vaccination rate amongst the elderly population. BBG source reports on Friday estimated that Chinese crude consumption for April would decline by ~20%, representing a ~1.2mn bpd decrease.

- Elsewhere, a rising chorus of growth forecast downgrades continues to weigh on the outlook for energy demand worldwide, with RTRS source reports on Friday pointing to the German government trimming its GDP growth projections for ‘22 from +3.6% to +2.2%.

- Major oil benchmarks saw little reaction to a Times report that crossed early in the Asian session, citing the European Commission’s (EC) Dombrovskis as confirming the EC’s work on “some form” of embargo on Russian crude. A note that this comes after EC President von der Leyen had in the previous week touted work on “clever mechanisms” to ban Russian oil for the upcoming sixth round of EU sanctions on Russia.

GOLD: Lower As Fed’s Focus On Neutral Rates In View

Gold is $7/oz weaker, operating around session lows to print $1,924/oz at typing. The precious metal has hit its lowest levels in over two-weeks in Asia-Pac dealing, on track to close lower for a fourth session in five after coming to within a whisker of $2,000/oz on Apr 18 (at $1,998.4/oz).

- The move lower comes despite a broad downtick in nominal U.S. Tsy yields, with pressure from increasingly hawkish Fed expectations evident. On that front, May FOMC dated OIS point to ~55bp of tightening priced in for that meeting, suggesting a ~20% chance of a 75bp hike despite Cleveland Fed President Mester (‘24 voter) last Friday voicing opposition to such a move throughout calendar ‘22, emphasising the need for a “methodical approach” to hiking rates.

- To recap, Fed messaging leading up to the pre-FOMC blackout period has coalesced around a series of 50bp rate hikes to “neutral” levels (seen as around 2.5% by some Fed officials), led by remarks from Fed Chair Powell on Thursday indicating support for a 50bp hike in the May FOMC.

- From a technical perspective, gold has broken below its 50-Day EMA, exposing key support at $1,890.2/oz (Mar 29 low).

FOREX: G10 FX Space Sees No Desire To Take Risk, Yuan Tumbles After PBOC Fix

The spectre of an aggressive global tightening cycle mixed with China's worrying Covid-19 situation and Russia's ongoing invasion of Ukraine unleashed risk-off flows across G10 FX space at the start to the week. Activity was limited by market closures in Australia and New Zealand, with the countries observing the ANZAC Day holiday.

- Antipodean currencies led commodity-tied FX lower, with softer crude oil prices amplifying the impact of broader risk-off flows. Oil came under pressure as Libya said it would soon resume output in several shuttered fields.

- Risk aversion threw a lifeline to the embattled yen, making it the best G10 performer, even as Reuters cited a Japanese Finance Ministry official, who denied Friday's TBS report suggesting that Japan and the U.S. discussed the possibility of a coordinated currency intervention.

- Offshore yuan went offered as the PBOC set the the mid-point of permitted USD/CNY trading range virtually in line with expectations, reverting to a neutral stance after signalling appreciation bias (~50 pip deviation) on Friday. Spot USD/CNH pierced the CNH6.55 figure on its way to fresh one-year highs, while its implied volatilities soared to fresh cycle highs across the curve.

- The EUR caught a bid in early trade, but pared gains as the session progressed. The initial impulse was generated by the news that French President Macron defeated his right-wing rival Marine Le Pen and secured re-election.

- German Ifo Survey as well as comments from BoC's Macklem & ECB's Panetta take focus from here.

FOREX OPTIONS: Expiries for Apr25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E712mln), $1.0800-03(E521mln), $1.0825(E502mln), $1.0925(E503mln)

- AUD/USD: $0.7350(A$804mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/04/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 25/04/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/04/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/04/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/04/2022 | 1500/1100 |  | CA | BOC Gov Macklem testifies at parliamentary committee | |

| 25/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/04/2022 | 1700/1900 |  | EU | ECB Panetta Speech at Columbia University |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.