-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Assets Buoyed As Recession Fears Ease

EXECUTIVE SUMMARY

- US RETAIL SALES SURPRISINGLY STRONG, CLAIMS LOWER - MNI BRIEF

- FED RATE CUT PACE HINGES STRONGLY ON JOBS - EX-STAFF- MNI

- AUSSIE GOOD PRICES STRONG- RBA’S HAUSER - MNI BRIEF

- PBOC TO ADD POLICY STRENGTH FOR ECON GOALS - PAN - MNI BRIEF

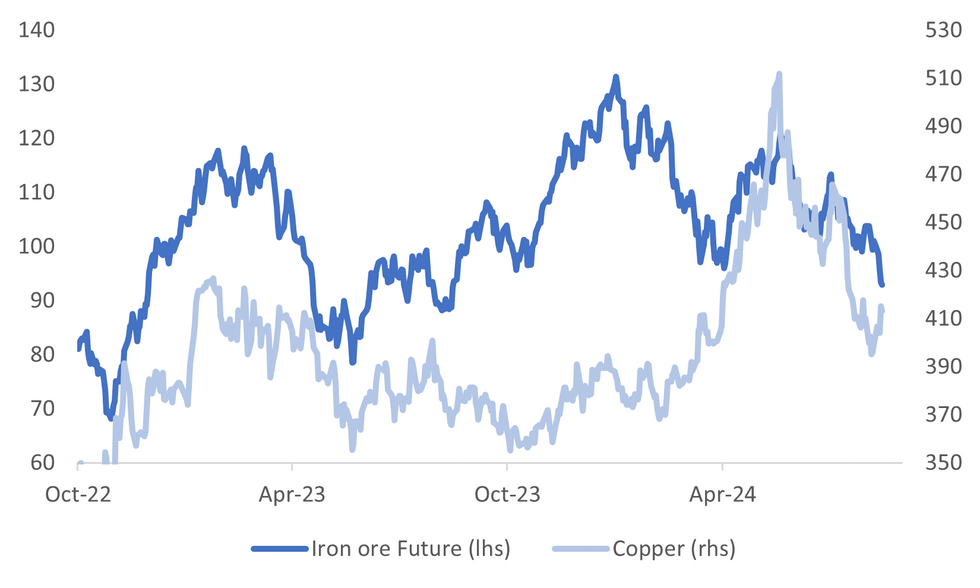

Fig. 1: Iron Ore & Copper Price Trends

Source: MNI - Market News/Bloomberg

EUROPE

CHINA/EU (SHANGHAI SECURITIES NEWS): “Chinese carmarkers are planning to build factories in Europe, according to the Shanghai Securities News. “

GERMANY (BBG): “US State Department approves a possible foreign military sale to Germany of Patriot Advanced Capability-3 Missile Segment Enhancement Missiles and related equipment for an estimated cost of $5 billion, according to a release.”

SWEDEN (BBG): “Sweden has reported a case of the new variant of the mpox virus, the first of its kind to be diagnosed outside the African continent.”

UKRAINE (BBG): “Ukrainian forces said they accepted the surrender of the largest single group of Russian soldiers since the start of the war more than two years ago, as Kyiv’s military claimed to continue expanding its cross-border incursion.”

US

FED (MNI): Fed Rate Cut Pace Hinges Strongly On Jobs - Ex-Staff

FED (MNI BRIEF): St. Louis Fed President Alberto Musalem said Thursday the time could be nearing for the Federal Reserve to reduce interest rates as inflation continues to fall and the job market no longer looks overheated.

ECONOMY (MNI BRIEF): U.S. retail sales in July came in much stronger than markets expected while initial jobless claims fell in the latest week, signs consumer demand and the labor market remain strong.

POLITICS (BBG): “ Vice President Kamala Harris will propose offering as much as $25,000 for first-time homeowners as part of an economic policy rollout Friday, a tacit acknowledgment that voter angst over rising housing costs poses one of the biggest political challenges to her presidential campaign.”

US/CHINA (RTRS): “ Republican Rep. John Moolenaar and Democratic Rep. Raja Krishnamoorthi are urging the Biden administration to probe TP-Link Technology Co and affiliates for possible national security risks, Reuters reported, citing a letter it had seen.”

OTHER

MIDDLE EAST (NYT): “Negotiators met in Qatar for the latest round of negotiations on a deal that would end the fighting and perhaps reduce escalating regional tensions, but Hamas did not send representatives.”

BRAZIL (RTRS): “Brazil's President Luiz Inacio Lula da Silva is looking at submitting all four of his upcoming nominations for the board of the central bank at once, including Gabriel Galipolo for the bank's presidency, people familiar with the matter told Reuters.”

AUSTRALIA (MNI BRIEF): The Reserve Bank of Australia sees Chinese growth as a key risk to the economy and is watching developments closely, Governor Michele Bullock told the House of Representatives Standing Committee on Economics Friday.

AUSTRALIA (MNI BRIEF): Australian goods prices have not deflated as fast as other peer economies, Reserve Bank of Australia Deputy Governor Andrew Hauser told the House of Representatives Standing Committee on Economics Friday.

CHINA

POLICY (MNI EM BRIEF): The People's Bank of China will intensify its policy efforts and maintain ample liquidity to lower funding costs, while preparing incremental measures and coordinating with fiscal polices, Governor Pan Gongsheng has told Xinhua News Agency.

POLICY (BBG): “China’s central bank chief pledged further steps to support his nation’s economic recovery, while cautioning that it won’t be adopting “drastic” measures.”

PROPERTY (MNI BRIEF): Beijing’s real-estate sector sold 5.8 million square meters of property during the first seven months, down 4.1% y/y and accelerating from the 2.5% drop reported for the first six months, Beijing Municipality data showed on Friday.

MUTUAL FUNDS (SECURITIES TIMES): “Some rural commercial banks in China’s Jiangsu and Zhejiang provinces are required to cap their investments in the likes of mutual funds and wealth management products at 2.5% of their total assets, according to a media outlet run by state-run Securities Times.”

RETAIL SALES (CAIXIN): “Retail sales in Beijing, Shanghai and Guangzhou fell 6.3%, 9.4% and 9.6% y/y in June, as the property downturn impacted residents' consumption, Caixin reported. Beijing and Shanghai saw per capita disposable income growth reach 4.2% and 4.4% y/y in H1, the lowest nationwide, Caixin noted.”

CHINA MARKETS

MNI: PBOC Net Injects CNY124.9 Bln via OMO Friday

The People's Bank of China (PBOC) conducted CNY137.8 billion via 7-day reverse repo on Friday, with rate unchanged at 1.70%. The operation has led to a net injection of CNY124.9 billion after offsetting the maturity of CNY12.9 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:54 am local time from the close of 1.8306% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 48 on Thursday, compared with the close of 44 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1464 on Friday, compared with 7.1399 set on Thursday. The fixing was estimated at 7.1742 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND JULY BUSINESSNZ MANUFACTURING PMI 44.0; PRIOR 41.2

NEW ZEALAND Q2 PPI OUTPUT Q/Q 1.1%; PRIOR 0.8%

NEW ZEALAND Q2 PPI INPUT Q/Q 1.4%; PRIOR 0.7%

NEW ZEALAND JULY NON RESIDENT BOND HOLDINGS 59.6%; PRIOR 60.7%

JAPAN JUNE TERTIARY INDUSTRY INDEX M/M -1.3%; MEDIAN 0.3%; PRIOR 0.6%

MARKETS

US TSYS: Tsys Futures Edge Higher, Curve Slightly Steeper

- Treasury futures have ticked higher today, although we now trade slightly off session's best. TUU4 is + 01¼ at 103-04, while TYU4 is + 03+ at 113-02.

- Cash treasury curves are bull-steepening today, yields are 1-3bps lower, short-end outperforming although it did underperform overnight. The 2yr is -2.2bps at 4.071%, while the 10yr is -1.1bp at 3.902%.

- St Louis Fed Pres Musalem is one of the most hawkish members of the FOMC, but his comments overnight suggest he is falling in line with the Fed leadership's view that risks to the inflation vs employment mandates have come into balance - (See link)

- In June, Japanese investors sold a net $30.1 billion in U.S. Treasuries, marking the largest monthly sell-off since September 2022 and the third consecutive month of reductions

- Projected rate cuts through year end have moderated vs. Thursday's pre-data levels (*): Sep'24 cumulative -33.5bp (-35.2bp), Nov'24 cumulative -62.4bp (-69.6bp), Dec'24 -95.3bp (-104.1bp).

- Looking ahead we have Housing Start, Building Permits, U. of Mich. Sentiment and Chicago Fed Pres Goolsbee to speak

JGBS: Belly Of Cash Curve Underperforms, Carry Trade Is Back

JGB futures are weaker, -40 compared to the settlement levels.

- Outside of the previously outlined international investment flow data, there hasn't been much in the way of domestic drivers to flag. The Tertiary Industry Index fell 1.3% m/m in June versus +0.3% estimate.

- (Bloomberg) "Nomura Holdings Inc., Japan’s biggest brokerage, has seen a variety of investors start borrowing the yen again to invest the proceeds elsewhere in higher-yielding assets. It suggests corporate clients and hedge funds, who have been enthusiastic carry traders, are getting back into those deals." (See link)

- Cash US tsys are 1-3bps richer, with a steepening bias, in today’s Asia-Pac session after yesterday’s sharp sell-off following stronger-than-expected data.

- Cash JGBs are 2-5bps cheaper, with the belly of the curve underperforming. The benchmark 10-year yield is 4.1bps at 0.880% versus the cycle high of 1.108%.

- Swaps are mixed, with rates 2bps lower (7-year) to 3bps higher (40-year).

- On Monday, the local calendar will see Core Machine Orders data alongside 1-year supply. 20-year supply is due on Tuesday.

AUSSIE BONDS: Cheaper But Near Session Bests, RBA Minutes On Tuesday

ACGBs (YM -7.0 & XM -5.0) are weaker but near Sydney session highs on a light-data day.

- Outside of the previously outlined RBA Governor Bullock’s testimony, there hasn't been much in the way of domestic drivers to flag.

- The latest round of ACGB May-28 supply saw the weighted average yield print 0.8bps through prevailing mids, extending the recent trend of firm pricing at ACGB auctions. However, the cover ratio fell to 3.8286x from 4.0778x at the July auction. A significantly lower outright yield likely impacted bidding.

- Cash US tsys are 1-3bps richer, with a steepening bias, in today’s Asia-Pac session after yesterday’s sharp sell-off following stronger-than-expected data.

- Cash ACGBs are 5-6bps cheaper after paring earlier losses (was 10-11bps cheaper).

- The AU-US 10-year yield differential is +3bps.

- Swap rates are 5-6bps higher, with EFPs slightly tighter.

- The bills strip has bear-steepened, with pricing -2 to -9.

- RBA-dated OIS pricing has moved 4-8bps firmer across meetings beyond November. A cumulative 19bps of easing is priced by year-end.

- Next week, the local calendar is empty on Monday, ahead of the RBA Minutes of August Policy Meeting on Tuesday.

- The AOFM plans to sell A$800mn of the 3.00% 21 November 2033 bond on Wednesday and A$700mn of the 2.75% 21 November 2028 bond on Friday.

NZGBS: Closed Little Changed But At Session Highs

NZGBs closed little changed but a dramatic improvement from earlier in the session when they were as much as 6-7bps cheaper.

- Apart from the previously mentioned Manufacturing PMI and PPI data, there have been few notable domestic influences.

- Notwithstanding today’s cheapening, NZGBs remain 9-25bps richer than Wednesday’s pre-RBNZ decision levels. The 2/10 curve is 16bps steeper.

- The move away from session cheaps was assisted by cash US tsys, which are 1-3bps richer in today’s Asia-Pac session.

- NZ-US 10-year yield differential is 8bps tighter at +23bps. The differential has traded in a +15 to +85bps range over the past 12 months.

- Swap rates closed 1bp lower to 2bps higher, with the 2s10s curve flatter.

- RBNZ dated OIS pricing is 4-6bps firmer for meetings out to Apr-25. A cumulative 79bps of easing is priced by year-end.

- Next week, the local calendar will see the Performance Services Index on Monday, REINZ House Sales and Trade Balance data on Tuesday and Q2 Retail Sales Ex Inflation on Friday. Also, RBNZ Deputy Hawkesby Speaks on Tuesday.

FOREX: Dollar Pares Recent Gains, NZD/USD Up On Continued Positive Global Equity Tone

Friday G10 FX trends have been skewed against the USD in the first part of trade. NZD/USD has led gains, up nearly 0.40%, although both JPY and CHF have ticked higher as well, even with a positive regional equity backdrop.

- The BBDXY index is less than 0.10% weaker, last under 1244.00. We are comfortably up from earlier lows this week, just under 1239, but we remain in a broader downtrend going back to late July highs.

- NZD/USD is the best performer, up 0.40%, to be back above 0.6010. This has pared NZD underperformance for the week (we are now up slightly), but pre RBNZ levels remain back near 0.6085. Data showed the manufacturing PMI stayed in contraction but up from recent lows.

- AUD/USD is trailing the NZD somewhat, last near 0.6625, up 0.20%, but still the second best performer in the G10 in the past week. Comments from RBA Governor Bullock before Australian parliament today stated the board is not considering an easing in the near term. AUD/NZD sits back at 1.1020, off recent highs near 1.1060. Iron ore is continuing to soften, not following other metals higher, which is a potential AUD headwind.

- USD/JPY has fallen, last under 149.00. It is up 0.30% in yen terms for the session, but this only modestly pares weekly losses in yen. The receding of US recession risks has buoyed the global equity market backdrop.

- Regional equities are all a sea of green, but onshore China equities are only marginally higher.

- US yields are lower today, but holding close to unchanged for the week.

- Looking ahead, we have UK retail sales, while in the US, building permits and UMich sentiment data will close out the week.

ASIA STOCKS: Hong Kong Equities Higher With Tech Outperforming

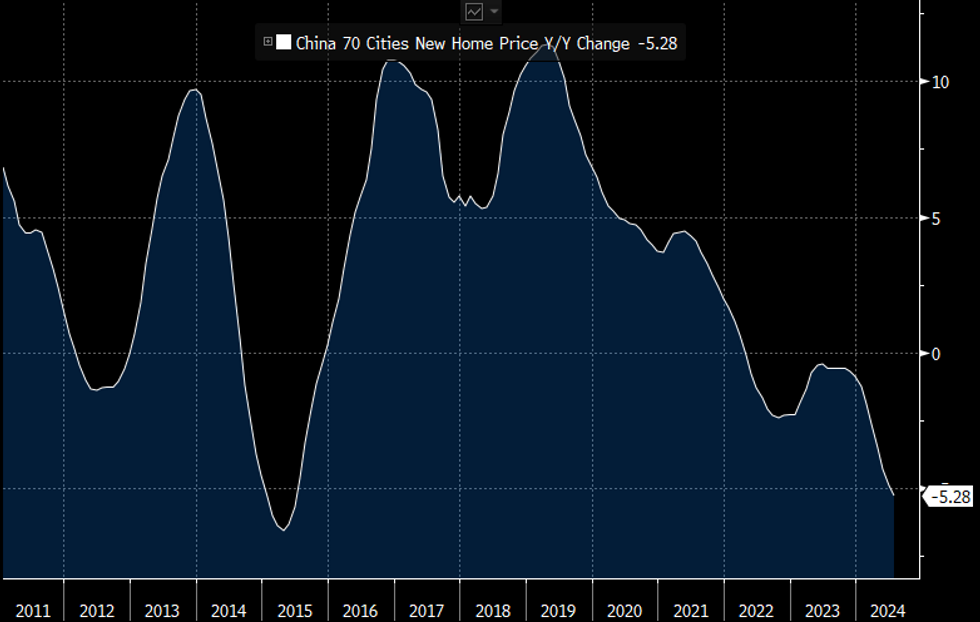

Chinese and Hong Kong markets saw mixed reactions as investors digested weak housing data out of China's after home prices in July plunged the most since 2015, with residential property sale values dropping significantly below their four-year average. Despite these downturns, the PBoC indicated no immediate rush for large-scale economic stimulus, emphasizing a strategy of "policy patience and stability." Hong Kong's HSI started strong on Friday, buoyed by gains in tech stocks like Alibaba, which surged despite reporting a nearly 30% dip in quarterly profits.

- Hong Kong markets are outperforming today with the HSI up 1.70% with tech stocks leading the way (HSTech up 2.15%), property indices have underperformed with (Mainland unch, HS Property -0.37%). China onshore equities are little changed with CSI 300 up 0.04%, small-caps are mixed with the CSI 1000 down 0.30%, while the CSI 2000 is up 0.22%.

- China's central bank chief, Pan Gongsheng, pledged further measures to support the country's economic recovery but emphasized avoiding drastic policy changes. He highlighted the importance of maintaining price stability amid deflationary risks and indicated a gradual shift towards using interest rates over quantitative targets as key monetary tools. Pan also reaffirmed the PBOC's commitment to a supportive monetary policy while acknowledging the relative stability of China's financial system, as per BBG

- China's new home prices in July saw their largest y/y decline since 2015, deepening the bear market for homebuilder stocks.

ASIA PAC EQUITIES: Asian Equities Look To End Week Higher On Tech Rally

Asian markets are rallying today, buoyed by optimism that the US economy will avoid a recession. Almost all major stock benchmarks across the region are up, with a regional gauge poised for its best weekly performance in over a year. Japanese equities are leading the gains, benefiting from a weaker yen which has helped exporters, the currency has fallen significantly against the dollar, easing concerns of a carry trade unwind. The Hong Kong equities saw gains, supported by Alibaba and JD.com posting better-than-expected profits. Meanwhile, China’s central bank pledged more measures to support economic growth, although without drastic interventions. Overall, the Asian markets are extending a recovery from last week’s volatility, driven by positive US economic data and strong performances in tech and export-oriented stocks.

- Japan's benchmark indices are all trading 2-4% higher today, banks again lead the way higher. The rally was fueled by strong U.S. economic data, including better-than-expected retail sales, which eased concerns about a potential recession. The weakening yen also provided a boost, particularly for export-oriented sectors like machinery and electronics. Investor sentiment was further bolstered by signs of stability in the U.S. market and positive reactions to recent domestic corporate earnings. The Nikkei is on track for its best week since April 2020, currently trading 2.90% higher, while the TOPIX is 2.5% higher.

- South Korean stocks are also higher today with the KOSPI up 2%, while the KOSDAQ is lagging although still 1.20% higher, the moves have been driven by eased U.S. recession concerns and strong gains across major sectors. Big-cap stocks led the rally, as Samsung Electronics advanced 2.46%, while SK hynix surged 6.16%, while autos have also jumped between 2-5%. Foreign investors played a key role, injecting $455 million into local equities so far today, particularly in tech stocks.

- Similar to SK, Taiwan's equity market is higher with TSMC contributing the most to the index gains, up 2%.

- Australian equities are higher, although underperforming other region markets. Financials & Materials are the top performers. Earlier, RBA gov Bullock ruled out rate cuts this year, after concerns that inflation is falling very slow. The ASX200 is 1.25% higher today. New Zealand equities are 0.30% today.

- In the Asia EM space, all markets are higher with Indonesia's JCI up 0.40%, Singapore's Strait Times 1.15% higher, Malaysia's KLCI up 0.50%, Philippine's PSEi is up 1.70% higher.

OIL: Higher For The Week as Recession Fears Lowered, Middle East Tensions Continue.

- Oil moved higher over night on simmering tensions in the Middle East as concerns over a potential attack on Israel by Iran intensifies.

- Having traded up towards 81.50 overnight, Oil gave back some early gains in the Asia session trading at $80.86, representing a 1.5% increase on the week.

- West Texas Intermediate briefly traded above $78 a barrel before settling at $77.92 during the Asian market session, representing a 1.3% increase on the week.

- Data throughout Asia this week was mixed with China posting a 8% yoy decline in demand whereas Singapore exports saw a marked increase.

- Overnight data from US offset the data from Asia pointing to a more robust US economy than expected.

GOLD: Rises Despite Stronger Than Expected US Data

Gold is 0.2% lower in today’s Asia-Pac session, after closing 0.4% higher at $2456.79 on Thursday.

- Broad dollar strength in the aftermath of stronger US data yesterday had a very brief negative impact on the yellow metal. Spot gold swiftly recovered to finish moderately higher on the session.

- July's advance retail sales report showed that the recent unexpected pickup in consumer momentum continues. June retail sales came in well above expectations at 1.0% M/M (0.4% expected, -0.2% prior rev from 0.0%).

- Initial jobless claims surprised lower for the second consecutive week with a seasonally adjusted 227k (cons 235k) in the week to Aug 10 after a marginally upward revised 234k (initial 233k).

- 2-year yields spiked 14bps to 4.09% as investors reduced expectations for aggressive easing by the Fed. 10-year yields rose 8bps to 3.91%.

- Higher rates are typically negative for gold, which doesn’t pay interest.

- According to MNI’s technicals team, attention remains on $2483.7, the Jul 17 high and a bull trigger. Clearance of this hurdle would resume the technical uptrend.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/08/2024 | 0600/0700 | *** |  | UK | Retail Sales |

| 16/08/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 16/08/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2024 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/08/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/08/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 16/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.