-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Mood Positive In Asia Pac Post Fed

EXECUTIVE SUMMARY

- MNI FED WATCH: POWELL WITHHOLDS GUIDANCE, KEEPS SEPTEMBER LIVE

- UKRAINE COUNTEROFFENSIVE IS MOVING, US SAYS WHILE PLEDGING SUPPORT - RTRS

- HONG KONG’s HANG SENG TECH INDEX RISES 20% FROM MAY LOW - BBG

- CHINA DEVELOPERS GAIN AS ANALYSTS EXPECT MORE EASING POLICIES - SECURITIES TIMES

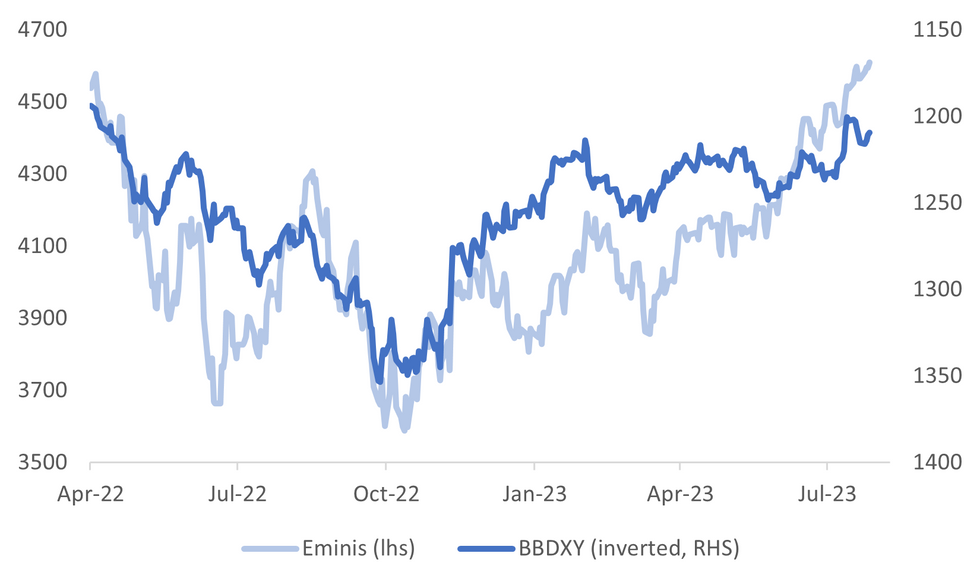

Fig. 1: US Eminis & BBDXY (Inverted)

Source: MNI - Market News/Bloomberg

U.K.

BOE: Advisers to Chancellor of the Exchequer Jeremy Hunt are increasingly concerned that the Bank of England risks raising interest rates too much in the coming months, potentially pushing the UK into an unnecessary recession. A majority of Hunt’s seven-member Economic Advisory Council believes that the bank should slow its fastest cycle of rate increases in three decades, according to people familiar with the discussions. That view is being taken by seriously by top Treasury officials in the wake of better-than-expected inflation figures and other data that suggest a broader slowdown, said the people, who asked not to be named discussing internal deliberations. (BBG)

PROPERTY: Two thirds of property surveyors think Britain's commercial real estate market is in a downturn, as higher Bank of England interest rates have brought the toughest credit conditions since at least 2014, a survey showed on Thursday. The Royal Institution of Chartered Surveyors (RICS) said 68% of members judged the overall market was in a downturn, even though some sectors such as industrial property, student housing and prime office space were robust. (RTRS)

EUROPE.

UKRAINE: Ukraine's counteroffensive is "not a stalemate" even if it is not progressing fast enough, White House national security spokesman John Kirby told reporters on Wednesday. Kirby made the remarks when asked about the pace of Ukraine's counteroffensive in a press briefing. "President Zelenskiy himself has said that he that it's not progressing as fast as he would like and they're not moving as far every day as they would like. The United States is not going to take a position on that," Kirby said. (RTRS)

UKRAINE: Ukraine has begun a major push in its south as its counteroffensive against Russia picks up pace, according to a U.S. official who asked not to be identified discussing the details of military operations. (BBG)

ITALY: Italian Prime Minister Giorgia Meloni is looking to build up a relationship with Joe Biden by pledging to break with China and plans to brief the US president in person Thursday on the delicate choreography of that split. (BBG)

U.S.

FED: Federal Reserve Chair Jerome Powell Wednesday maintained a hawkish tone without providing much additional guidance on the path of interest rates, emphasizing decisions will be made on a meeting-by-meeting basis and leaving open the possibility of consecutive rate hikes. "We haven't made a decision to go to every other meeting. We're going to be going meeting by meeting," Powell told reporters. "We haven't made any decisions about any future meetings including the pace at which we consider hiking." (MNI)

FISCAL: The Republican-controlled U.S. House of Representatives began debating the first of 12 fiscal 2024 spending bills on Wednesday, as lawmakers edged toward a looming showdown with the Democratic-led Senate that could trigger a government shutdown this autumn. (RTRS)

US/CHINA: Blinken, asked about New Zealand’s relationship with China: “I think what is most striking to me, both here in New Zealand, in the region more broadly, as well as in Europe, in northeast Asia, is an extraordinary convergence of approaches to dealing with the incredibly complex and consequential relationship that we all have with China”. (BBG)

OTHER

AUSTRALIA: BHP Group Ltd. is warning Australia will fail to fully reap the rewards of the green-energy transition that’s spurring demand for metals such as copper and nickel unless it addresses high taxes and wages, along with a looming skills shortage. (BBG)

NEW ZEALAND: US Secretary of State Antony Blinken holds joint press conference with New Zealand Foreign Minister Nanaia Mahuta after talks in Wellington on Thursday. Blinken: “On Aukus, as we continue to develop it, as we continue to work particularly now on the second pillar, the door is very much open for New Zealand and other partners to engage as they see appropriate” (BBG)

HONG KONG: The Hong Kong Monetary Authority raises its base rate to 5.75% from 5.5%, according to the de facto central bank’s page on Bloomberg. It is tracking the U.S. Federal Reserve’s move as the Hong Kong dollar is pegged to the greenback. (BBG)

HONG KONG: A gauge of China tech shares traded in Hong Kong extended gains from a May low to 20% on expectations of further stimulus for the nation’s flagging economy. Hong Kong’s Hang Seng Tech Index jumped as much as 3.3% on Thursday, led by XPeng Inc. after plans by Volkswagen AG to invest in the Chinese electric vehicle maker. Its peers including Nio Inc. and Li Auto Inc. also gained. (BBG)

SOUTH KOREA: South Korean government, together with the central bank, will strengthen monitoring over financial markets and swiftly take stabilization steps when needed, Finance Minister Choo Kyung-ho says in a meeting.South Korea’s financial markets have been generally stable recently. (BBG)

SOUTH KOREA: South Korea's central bank said on Thursday its monetary policy board decided to reform its standing lending facility, a monetary policy tool for supplying liquidity to banks, strengthening its role as a liquidity backstop. The board decided to lower lending rates for the loans taken out from the facility to 50 basis points above the base rate, from the current 100 basis points, and accept additional kinds of bonds as collateral with an option to extend maturities by a longer period for loans, the Bank of Korea (BOK) said in a statement. (RTRS)

SOUTH KOREA: Samsung Electronics (005930.KS) on Thursday struck a cautious note on the global semiconductor outlook, announcing plans to extend production cuts because a demand recovery is largely constrained to high-end chips used in artificial intelligence. (RTRS)

NORTH KOREA: Kim Jong Un met Russia’s defense minister in the first high-level talks for North Korea since the start of the Covid pandemic, using the 70th anniversary of the end of Korean War fighting to signal fresh engagement with key partners. (BBG)

CHINA

PROPERTY: Chinese developer shares including Country Garden and R&F Properties extend their recent gains, with a Securities Times report saying analysts are expecting the government to continuously ease property policies in 2H. (BBG)

PROPERTY: China Securities Regulatory Commission may introduce more abundant financial tools to meet the financing needs of real-estate companies and help resolve debt risks of local-government financing vehicles, said Zhang Jun, chief economist at Galaxy Securities. (21st Century Business Herald)

CAR SALES: Retail buyers purchased 1,122,000 passenger cars over July 1-23, a 2% increase y/y but 7% fall m/m, according to data released from the Car Passenger Association. Buyers of new energy vehicles (NEVs) purchased 442,000 units, up 23% y/y but declined 2% m/m. (Yicai)

CHINA/US: Chinese Vice President Han Zheng told Visa Inc. Chairman Alfred Kelly Wednesday in Beijing that China welcomes US and other foreign companies’ investment and businesses, the official Xinhua News Agency reports. China hopes American companies play a more important role in economic and trade cooperation, Han says. (BBG)

YUAN: China’s top diplomat Wang Yi told his Turkish counterpart Hakan Fidan Wednesday in Ankara that the Asian nation supports companies of the two countries using local currencies in trade settlement. (BBG)

DEBT: China’s debt-to-GDP ratio rose to a record in the second quarter, although consumers and businesses are borrowing at a slow pace, reflecting low confidence that’s hitting economic growth. (BBG)

PROFITS: China’s industrial profits dropped at a slower pace in June, though worsening factory-gate deflation and slowing consumer spending continued to squeeze business’s margins. (BBG)

CHINA MARKETS

PBOC Net Injects CNY88 Bln Via OMOs Thursday

The People's Bank of China (PBOC) conducted CNY114 billion via 7-day reverse repos on Thursday with the rate unchanged at 1.90%. The operation has led to a net injection of CNY88 billion after offsetting the maturity of CNY26 billion reverse repo today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8070% at 09:44 am local time from the close of 1.8435% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday, compared with the close of 45 on Tuesday.

PBOC Yuan Parity At 7.1265 Thursday Vs 7.1295 Wednesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1265 on Thursday, compared with 7.1295 set on Wednesday. The fixing was estimated at 7.1441 by BBG survey today.

OVERNIGHT DATA

SOUTH KOREA AUGUST BUSINESS SURVEY MANUFACTURING 69; PRIOR 72

SOUTH KOREA AUGUST BUSINESS SURVEY NON-MANUFACTURING 76; PRIOR 78

AUSTRALIA 2Q EXPORT PRICE INDEX Q/Q -8.5%; MEDIAN -6.7%; PRIOR 1.6%

AUSTRALIA 2Q IMPORT PRICE INDEX Q/Q -0.8%; MEDIAN -0.8%; PRIOR -4.2%

CHINA JUNE INDUSTRIAL PROFITS Y/Y -8.3%; PRIOR -12.6%

MARKETS

US TSYS: Marginally Richer In Asia

TYU3 deals at 112-02, -0-02+, a 0-09 range has been observed on volume of ~80k.

- Cash tsys sit 0.5-3bps richer across the major benchmarks, the curve has bull steepened.

- Tsys firmed off session lows as risk sentiment improved in Asia as participants digested yesterday FOMC rate decision and Fed Chair Powell's press conference.

- The move in Tsys was seen alongside pressure on the USD, BBDXY is down ~0.2%, and US Equity Futures and Regional Equities moving higher.

- Tsys dealt in narrow ranges with little follow through for the remainder of the session.

- FOMC dated OIS remains stable, a ~5.4% terminal rate is seen in November with ~60 bps of cuts to June 2024.

- The latest monetary policy decision from the ECB headlines in Europe today. Further out we have US GDP, durable goods orders, initial jobless claims and wholesale inventories. The latest 7-Year Supply is also due.

JGBS: Futures Holding Weaker, Tokyo CPI & BoJ Policy Decision Tomorrow

In the Tokyo afternoon, JGB futures are holding slightly weaker, -6 compared to the settlement levels, after paring overnight losses.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined international investment flow data.

- The move away from session lows has been assisted by an extension of the post-FOMC rally in US tsys in Asia-Pac trade.

- The cash JGB curve has twist flattened, pivoting at the 4-year zone, with yields +0.2bp to -2.2bp. The benchmark 10-year yield is 0.4bp lower at 0.451%, below BoJ's YCC limit of 0.50%.

- The 2-year is underperforming on the curve at -0.039% despite today’s 2-year auction showing solid demand.

- The swaps curve has bull flattened with rates 0.2bp to 2.0bp lower. Swap spreads are mixed.

- Tomorrow the local calendar sees July Tokyo CPI data along with the BoJ Policy Meeting Decision. Our analysis aligns with the prevailing consensus, which anticipates that the current easing policies will be maintained during this week's meeting. Market expectations also appear fairly low, with the 10yr JGB yield below the upper bound of the -/+0.50% permissible range, while the 10-yr Swap/JGB spread (which can be thought of as a proxy for BoJ YCC tweak speculation) sits around +15bps currently, not too far off multi-month lows going back to last August 2022. (See MNI BoJ Preview here)

AUSSIE BONDS: Richer, Near Session Highs, Retail Sales Tomorrow

ACGBs (YM +6.0 & XM +5.0) are dealing near session highs, adding to yesterday’s post-CPI rally. At current levels, ACGB futures are 10-13bp higher than pre-CPI levels. Other than the previously flagged weaker-than-expected Q2 terms of trade data, there haven’t been any domestic drivers of note.

- Today’s local session strength has been assisted by an extension of the post-FOMC rally in US tsys in Asia-Pac trade. US tsys sit 0.5-3bps richer across the major benchmarks.

- Cash ACGBs are 6-7bp richer with the AU-US 10-year yield differential -3bp at +10bp.

- Swap rates are 6-7bp lower with EFPs little changed.

- The bills strip bull flattens with pricing +1 to +7.

- RBA-dated OIS pricing is 2-6bp softer for meetings beyond October. A 27% chance of a 25bp hike in August is priced. The expected terminal rate sits at 4.31% versus 4.45% ahead of the CPI data.

- Tomorrow the local calendar sees Q2 PPI data along with June Retail Sales.

- The latest monetary policy decision from the ECB headlines in Europe today.

- With Fed Chair Powell emphasising data dependency, today's US calendar sees Q2 GDP, durable goods orders, initial jobless claims and wholesale inventories, ahead of Friday's Q2 ECI and monthly PCE reports.

- Tomorrow the AOFM plans to sell A$700mn of 4.50% 21 April 2033 bond.

NZGBS: Richer But Underperforms $-Bloc, Consumer Sentiment Data Tomorrow

Short to mid-curve NZGBs closed richer, but off session bests, with benchmark yields 1-3bp lower and the curve steeper. The 10-year benchmark closed 1bp cheaper.

- Although there were no significant domestic factors at play, the local market experienced strength during the session, likely due to an extension of the post-FOMC rally in US tsys and ACGBs in the Asia-Pac trade. The local market's gains were further supported by robust demand witnessed at the weekly auction, evident from cover ratios ranging from 3.35x to 4.00x.

- Despite the overall positive performance, NZGBs underperformed their counterparts in the $-Bloc. The NZ-US and NZ-AU 10-year yield differentials respectively 4bp and 5bp wider at +79bp and +64bp.

- Swap rates closed 3-4bp lower.

- RBNZ dated OIS closed with pricing flat to 3bp softer across meetings with Jul’24 leading.

- Tomorrow the local calendar sees ANZ Consumer Confidence.

- With Powell emphasising data dependency, later today sees an important US docket with the 1st release for Q2 GDP, preliminary durable goods for July, jobless claims and other second-tier releases (along of course with the ECB decision) before Friday's Q2 ECI and monthly PCE reports.

EQUITIES: Eminis Threatening Break Higher, March 2022 Levels Within Sight

Regional equities have mostly tracked higher today. Spillover has been evident from higher US equity futures, which has aided broader risk appetite in the region. At this stage, Eminis are around +0.30% higher, last in the 4609/10 region. This is right on fresh highs going back to March last year. Nasdaq futures are outperforming amid a softer US yield backdrop post the FOMC. The Sep contract is up 0.65% at the time of writing.

- China related markets have also performed well. The HSI is up 1.36% at the break, with the tech sub index now 20% above May's trough point. Today the HSTECH is up nearly 3%.

- On the mainland the CSI 300 is up 0.54%, with the real estate sub index +0.77%. Onshore analysts expect housing restrictions to be relaxed in H2, with renewed confidence in this outlook post the Politburo meeting at the start of the week.

- Japan stocks are firmer, with the Topix near +0.50%, the Nikkei 225 +0.75%. The yen was firmer in early trade, but is away from best levels. No policy changes are expected at tomorrow's BoJ meeting.

- The Kospi is +0.70%, but the Kosdaq has continued to retrace, down a further -0.80%, after yesterday's ~4% fall on valuation concerns for EV battery related companies. The BoK has boosted liquidity support for the banking sector.

- In SEA, gains are more modest, while Philippines and Thai equities are tracking weaker.

FOREX: USD Pressured In Asia

The greenback has been pressured in Asia today after yesterday's FOMC rate decision and press conference as Fed Chair Powell noted that any further hikes are data dependent. The Antipodeans are leading the bid, BBDXY is down ~0.2%.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD last prints at $0.6255/60 and is up ~0.8%. The pair has cleared its 200-Day EMA ($0.6229) in Asia and sits at its highest level since 20 July.

- AUD/USD is up ~0.7%, the pair last prints at $0.6805/10. Resistance comes in at $0.6847 (high from Jul 20) and $0.69 (high from June 16).

- Yen is ~0.3% firmer, USD/JPY has breached the ¥140 handle and last prints at ¥139.75/85. The pair found support below ¥139.75, the low from July 21, and losses have been marginally pared.

- Elsewhere in G-10, EUR and GBP are ~0.1% firmer. NOK and SEK are both up ~0.4% however liquidity is generally poor in the Asian session.

- Cross asset wise; E-minis are up ~0.3% and the Hang Seng is up 1.3%. US Tsy Yields have ticked lower, the 2 Year Yield is down ~3bps.

- The highlight of today's docket is the ECB monetary policy decision. We also have a slew of US data due including GDP, durable goods orders, initial jobless claims and wholesale inventories.

OIL: Rebounds, Offsetting Wednesday's Fall

Brent crude has tracked higher through Asia Pac trade, last near $83.70/bbl. We are threatening to push to fresh highs, with July 25 highs very close by. At this stage Brent is ~1% higher, more than offsetting Wednesday's -0.86% fall. We are tracking comfortably higher over the past week. WTI was last close to $79.70/bbl, up by a similar amount for the session.

- Broader risk appetite has been supported today post Wednesday's Fed outcome. US yields are lower, the dollar offered, while regional equities are tracking higher. This has spilled over to oil, with other commodities also pushing higher.

- This comes after Wednesday data showed weekly EIA petroleum data pointing to a smaller than expected crude draw with an unexpected drop in refinery utilisation.

- Saudi Arabia is also expected to extend the 1mbpd oil supply cut again into September according to a Bloomberg survey. 15 of 22 traders, analysts and refiners surveyed by Bloomberg predict it will continue into September.

- For Brent, mid April levels around $85.50/bbl could be targeted on a further upside push. Beyond that lies April highs close to $87.50/bbl. On the downside, the 200-day EMA comes in at $82.30/bbl.

GOLD: Stronger As Fears Of Further Fed Hikes Fade

Gold is +0.3% in the Asia-Pac session, after closing stronger (+0.4%) on Wednesday as traders priced in lower odds of further US monetary tightening in September after the Federal Reserve raised rates to a 5.25-5.50% range, the highest level in 22 years.

- Front-end US tsys finished 6bp richer than just before the FOMC statement to be 2bp lower in yield on the day. The presser leaned slightly dovish with reiteration of signs of progress for instance in labour market balance and noted the potential impact of tighter credit conditions. Higher rates are typically negative for bullion, which doesn’t yield any interest.

- The USD dropped alongside lower 2-year US tsy yield.

- According to MNI’s technicals team, resistance remains at the bull trigger of $1987.5 (Jul 20 high).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/07/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/07/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/07/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/07/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/07/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/07/2023 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 27/07/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 27/07/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 27/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/07/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/07/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 27/07/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 27/07/2023 | 1230/0830 | *** |  | US | GDP |

| 27/07/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/07/2023 | 1245/1445 |  | EU | ECB President Lagarde post-rate meet press conference | |

| 27/07/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 27/07/2023 | 1400/1000 | ** |  | US | Kansas City Fed Manufacturing Index |

| 27/07/2023 | 1415/1615 |  | EU | ECB Lagarde speaks on the ECB Podcast | |

| 27/07/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/07/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/07/2023 | 1700/1300 |  | US | Fed proposal on capital |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.