-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI EUROPEAN OPEN: Risk Rally Mostly Confined To Equities

EXECUTIVE SUMMARY

- REPUBLICAN CANDIDATES VOW TO REVERSE BIDENOMICS IN DEBATE - BBG

- NVIDIA SOARS AS INSATIABLE AI DEMAND FUELS BLOWOUT FORECAST - BBG

- LNG STRIKE THREAT EASES AS WOODSIDE UNIONS CONSIDER OFFER - BBG

- BANK OF KOREA KEEPS POLICY RATE AT 3.50% - MNI BRIEF

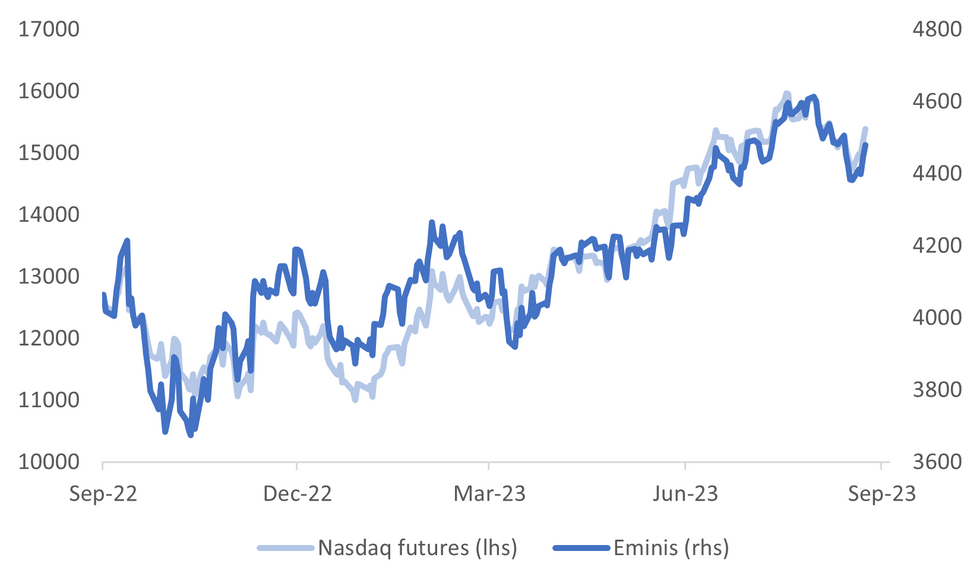

Fig. 1: US Equity Futures

Source: MNI - Market News/Bloomberg

EUROPE

RUSSIA: Russia's most powerful mercenary Yevgeny Prigozhin was on board a plane which crashed on Wednesday evening north of Moscow with no survivors, the Russian authorities said, two months to the day after he led an abortive mutiny against the army top brass. (RTRS)

U.S.

TECH: Nvidia Corp., the chipmaker at the heart of an industrywide race toward artificial intelligence computing, delivered a third-straight sales forecast that surpassed Wall Street estimates, fueled by surging demand for its AI processors. (BBG)

POLITICS: Six of the eight Republican presidential hopefuls at their party's first 2024 debate on Wednesday indicated they would support former President Donald Trump as the 2024 White House nominee even if he is convicted of a crime. (RTRS)

POLITICS: Republican candidates attacked Joe Biden’s stewardship of the US economy at the first presidential debate of the 2024 race, with vows to dismantle an economic program the president has made a centerpiece of his reelection campaign. (BBG)

OTHER

SOUTH KOREA: The Bank of Korea on Thursday kept its policy interest rate unchanged at 3.50% for the fifth consecutive meeting amid growing concern over the weaker economy and the steadily falling headline inflation rate, Wowkorea reported. The decision was widely expected as the country suffers from weak exports. The next meeting is scheduled for October 19. (MNI Brief)

COMMODITIES: Liquefied natural gas workers in Australia will meet Thursday to consider a “strong offer” from Woodside Energy Group Ltd. following new talks, easing a strike threat in one of three disputes underway in the key exporting nation. (BBG)

AUSTRALIA: Australia faces decades of slower economic growth as its population gets older which will pressure the budget and lift national debt, a government report rojected on Thursday, while taxation was notably absent from the reforms suggested. Releasing the latest Intergenerational Report, Treasurer Jim Chalmers said digital technology, climate change, renewable energy, ageing and the need for more aged care would shape the economy over the next 40 years. (RTRS)

NEW ZEALAND: New Zealand’s heavy traffic index fell 3% m/m in July, according to ANZ Bank. Says watching the index closely to see whether the July fall is start of a recessionary pattern. It is potentially a meaningful signal because heavy traffic is threatening to break out of the ‘normal’ range into recessionary territory: (ANZ)

JAPAN: Japan is scheduled to begin releasing treated wastewater from the Fukushima nuclear site into the Pacific Ocean later on Thursday, the first discharge in a process that could last about 30 years and has drawn threats of retaliation from China. (BBG)

NORTH KOREA: North Korea's second attempt to place a spy satellite in orbit failed on Thursday after the rocket booster experienced a problem during its third stage, state media reported, as space authorities vowed to try again in October. (RTRS)

TAIWAN: Taiwan opposition Kuomintang’s presidential candidate Hou Yu-ih is scheduled to visit New York, New Jersey, Washington D.C., and San Francisco from Sept. 14 to 21, Taipei-based United Daily News reports, without saying where it got the information from. (BBG)

PHILIPPINES: THE International Monetary Fund (IMF) will be revising its growth outlook for the Philippines following the second quarter's steeper-than-expected slowdown. "In light of the second-quarter gross domestic product (GDP) estimates and considering the challenging outlook for the global economy, it may prove difficult to reach the 6.0- to 7.0-percent growth target for 2023," IMF Resident Representative Ragnar Gudmundsson told The Manila Times on Wednesday. (Manila Times)

CZECH: The Czech central bank’s sales of some returns on its foreign reserves will be done in a way that they affect the currency market “as little as possible,“ board member Jan Kubicek said in an interview with Hospodarske Noviny newspaper. (BBG)

ARGENTINA: The International Monetary Fund will allow Argentina to carry out foreign exchange intervention within a range that won’t be made public, the country’s economy minister Sergio Massa said at a press conference in Washington DC Wednesday. (BBG)

CHINA

INFRASTRUCTURE: China’s investment in new infrastructure projects, such as electric vehicle charging stations, 5G network and data centers, is likely to reach 2.6-3 trillion yuan this year as local governments accelerate special bond issuance to fund construction, according to a Shanghai Securities News report Thursday, citing analysts. (BBG)

LGFV: China is attempting to diffuse risks from its $9 trillion pile of off balance-sheet local government debt, without resorting to major bailouts. That path forward is a treacherous one for President Xi Jinping’s government. To thread the needle, the provinces and cities whose borrowing drove the world’s largest infrastructure boom will need to roll back their spending and restructure debt — all without drastically dragging down economic growth. If they fail, it could thrust the world’s second-biggest economy into a prolonged malaise. (BBG)

FINANCE: China’s $2.9 trillion trust industry is emerging as yet another threat to the world’s second largest economy. After being restructured at least six times since its inception in 1979, the sector is facing another round of losses that Goldman Sachs Group Inc. analysts say may swell to the equivalent of $38 billion. Private wealth giant Zhongzhi Enterprise Group Co. and its affiliate Zhongrong International Trust Co. have halted payments on scores of high-yield investment products since last month, even sparking rare protests in Beijing. (BBG)

Liquidity: The People’s Bank of China will likely inject liquidity via large-scale reverse repo operations, as the issuance of government bonds will remain high for the rest of the month and banks continue to increase credit supply, said Feng Lin, analyst at Golden Credit Rating. Since Aug 15, the PBOC has injected a net of CNY691 billion via reverse repo, maintaining a large amount of injection even after the tax payment peak. (Securities Daily)

BRICS: BRICS nations should oppose decoupling and economic coercion as the group works towards deeper economic, trade and financial cooperation, according to President Xi Jingping. Speaking at the BRICS summit in South Africa, Xi said the group should promote deeper economic exchanges as the global economy's recovery was not stable and may grow less than 3% this year. (Yicai)

CHINA MARKETS

MNI: PBOC Net Drains CNY107 Bln Thursday via OMO

The People's Bank of China (PBOC) conducted CNY61 billion via 7-day reverse repos on Thursday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY107 billion after offsetting the maturity of CNY168 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:50 am local time from the close of 1.8025% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Wednesday, compared with 44 on Tuesday.

PBOC Yuan Parity Lower At 7.1886 Thursday Vs 7.1988 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1886 on Thursday, compared with 7.1988 set on Wednesday. The fixing was estimated at 7.2812 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA JULY PPI Y/Y-0.2%; PRIOR 0.3%

CHINA JULY SWIFT GLOBAL PAYMENTS CNY 3.06%; PRIOR 2.77%

MARKETS

US TSYS: Narrow Ranges In Asia

TYU3 deals at 109-25, -0-04, a 0-05+ range has been observed on volume of ~105k.

- Cash tsys sit 1bp cheaper to flat across the major benchmarks, light bear flattening is apparent.

- Tsys trimmed some of yesterday's gains in early dealing, there was no obvious headline driver for the move which came alongside the USD firming from session lows. Perhaps participants are looking ahead to Fed Chair Powell's speech on Friday, using yesterday's richening as an opportunity to enter fresh short positions.

- The early move lower didn't follow through and tsys observed narrow ranges for the remainder of the session. There was little meaningful macro news flow.

- There is a thin docket in Europe today, further out we have US initial jobless claims and durable goods. Kansas City Fed’s annual economic policy symposium in Jackson Hole begins. Fedspeak from Philadelphia Fed President Harker and Boston Fed President Collins will cross. The latest 30-Year TIPS Supply is also due.

JGBS: Futures Holding Richer, Near Session Highs, Tokyo CPI Tomorrow

JGB futures are stronger, +30 compared to settlement levels, having consolidated the overnight strengthening sparked by weaker-than-expected EU & US PMIs.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined weekly investment flow data that showed offshore purchases of Japanese bonds surged last week, while local investors continued to sell offshore bonds.

- Accordingly, local participants have likely been on headlines and US tsys watch.

- US tsys sit 1bp cheaper to flat across the major benchmarks, light bear flattening is apparent. US tsys trimmed some of yesterday's gains in early dealing, but there was no obvious headline driver for the move which came alongside the USD firming from session lows. Perhaps participants are looking ahead to Fed Chair Powell's speech on Friday, using yesterday's richening as an opportunity to enter fresh short positions.

- The cash JGB curve has twist-flattened, with yields 0.1bp higher to 3.8bp lower (20-year). The benchmark 10-year yield is 1.4bp lower at 0.660% versus the post-BoJ YCC tweak high of 0.68% set yesterday.

- The swaps curve has bull flattened, with swap spreads broadly wider.

- Tomorrow the local calendar sees Tokyo CPI for August and PPI for July. Department Store Sales for July are also on tap.

AUSSIE BONDS: Richer But Have Pared Early Gains, Tracking US Tsys

ACGBs (YM +5.0 & XM +7.0) are stronger but have pared early gains sparked by weaker-than-expected EU & US PMIs. With the domestic data docket empty today, local participants have likely eyed headlines and US tsys.

- US tsys have been pressured in recent dealing, the move comes alongside a move off session lows in the USD. US tsys sit flat to 2bp cheaper across the major benchmarks, with the curve flatter.

- Cash ACGBs are 5-7bp richer with the AU-US 10-year yield differential +2bp at -8bp.

- Swap rates are 4-5bp lower, with the 3s10s curve flatter and EFPs wider.

- The bills strip has bull flattened, with pricing flat to +5.

- RBA-dated OIS pricing is 2-5bp softer for meetings beyond December, with May'24 leading.

- Tomorrow the local calendar is empty.

- July retail sales print on Monday, August 28. They fell 0.8% m/m in June to be up 2.3% y/y. Since that release, CBA has published its revamped household spending series. See MNI CBA Spending Insights Shows Continued Soft Consumption for more details. In July the HSI was flat on the month to be up 1.3% y/y. A flat reading for July retail sales would result in annual growth easing further to 1.6%.

NZGBS: Sharply Richer But Pared Gains Into The Close

NZGBs closed 7-10bp richer, but 3-4bp off session bests. The away from session bests coincided with a cheapening in US tsys in Asia-Pac trade.

- US tsys have been pressured in recent dealing, the move comes alongside a move off session lows in the USD. US tsys sit flat to 2bp cheaper across the major benchmarks, with the curve flatter.

- Today’s weekly supply also likely weighed, particularly at the short end. The NZGB auctions showed mixed results, with the cover ratio for the Apr-27 bond collapsing to 1.38x from 2.79x. Meanwhile, the cover ratios for the May-32 and May-51 bonds held around 3.00x. In post-auction trade, the lines were flat to 0.5bp cheaper, led by the Apr-27 bond.

- RBNZ publishes new residential mortgage lending data for July. Lending to all borrowers fell 12% m/m to NZ$5.0bn, the lowest for July since 2017. (See link)

- Swap rates are 4-9bp lower, with the 2s10s curve 4bp flatter and implied swap spreads wider.

- RBNZ dated OIS pricing is 3-6bp softer for meetings beyond October, with Jul’24 leading. Terminal OCR expectations soften 3bp to 5.64%.

- Tomorrow the local calendar is empty.

FOREX: Narrow Ranges In Asia

There have been narrow ranges across G-10 FX with little follow through on moves in Asia.

- Kiwi is marginally pressured, NZD/USD trimmed some of yesterday's gains before unwinding a ~0.3% loss to sit ~0.1% lower last printing at $0.5970/75.

- AUD/USD is little changed, the pair briefly dealt above Wednesday's high however there was little follow through and gains were pared. Despite the recent rally the trend outlook is bearish, support comes in at $0.6365 (low from Aug 17) and resistance is at $0.6522 (20-Day EMA).

- Yen is marginally softer, however USD/JPY remains well within recent ranges. Support comes in at ¥144.17, the 20-Day EMA, and ¥143.00, low from Aug 9. Resistance is at ¥146.56 (Aug 17 high) and ¥146.93 (8 Nov 22 high).

- Elsewhere in G-10; SEK is pressured however liquidity is poor in Asia and GBP is ~0.1% firmer.

- Cross asset wise; US Equity futures are firmer after Nvidia's bullish revenue outlook spills over into a wider bid. E-minis are up ~0.7% and NASDAQ futures are up ~1.3%. BBDXY is down ~0.1% and US Tsy Yields are ~1bp firmer across the curve.

- There is a thin docket in Europe today, further out we have US Durable Goods and Initial Jobless Claims.

EQUITIES: Surging US Tech Futures Aid Asia Pac Sentiment

Regional equities are firmer in Asia Pac trade on Thursday, which follows a positive lead from US/EU markets in Wednesday trade. US futures have also maintained a strong positive tone during the session, with the Nasdaq leading the charge, +1.24%, while Eminis are +0.68%, last near 4477 and the simple 50-day MA on the topside. Shares in chip/AI bellwether Nvidia surged in extended trading as the company delivered stronger than expected sales for the 3rd straight quarter.

- Hong Kong markets have been amongst the strongest performers, the HSI up 1.91% to the break. The tech sub index up over 3% at this stage, its 3rd straight session of gains.

- China stocks were slow to post gains in the first part of trading, but the CSI 300 is up nearly 1% to the break. The Shanghai Composite is near +0.50% firmer.

- Tech sensitive plays like the Kospi, have also rallied, the bourse up 1%, while the Taiex +0.80% at this stage. Offshore investors have added $246.1mn to local Korean shares.

- Japan stocks have lagged, the Topix up 0.25%, the Nikkei 225 +0.45%. The head of the Japan Exchange Group stated that the benefits of a weaker yen were diminishing for Japan stocks.

- In SEA, market gains have been more limited, with bourses rising less that 1% for the most part. The Philippines is the exception, up 1.2% at this stage. The JCI is lagging in Indonesia, close to flat.

OIL: Crude Off Lows But Possible Supply Increase Weighs On Prices

Oil is off its intraday low but still down during the APAC session. Prices fell almost 1.5% on Wednesday and are down another 0.3% today, as a possible easing of sanctions against Venezuelan oil would increase supply. The USD index is 0.1% lower.

- WTI is down 0.3% to $78.62/bbl but off the low of $78.27 earlier in the session. Brent is 0.3% lower at $82.99 but has struggled to hold breaks above $83 today. It is off the low of $82.64.

- The possible temporary lifting of sanctions against Venezuela comes at a time of soaring Iranian crude shipments, but also Saudi/Russia output cuts and low US stockpiles. The market also remains concerned re demand given the disappointing recovery in China and possibly further rate hikes in the US.

- Woodside employees vote today on the “in-principle” agreement between the company and unions. If supported, industrial action will be called off. The Chevron ballot deadline is today. European LNG prices fell on Wednesday on optimism that there would be a deal.

- Later the Fed’s Harker and Collins speak. On the data front there are US jobless claims, July durable goods orders and Chicago & Kansas City Fed Indices.

GOLD: Strong Rally On Back Of Declines In USD & Bond Yields

Gold is slightly stronger in the Asia-Pac session, after closing +1.0% at $1915.48 on Wednesday. Bullion benefited from the sharp reversal of recent USD strength and a large rally in US tsys.

- US tsys strengthened in the European session as European bonds reacted to weaker-than-expected Euro Area PMIs. US tsys then extended gains after flash US PMIs printed softer than forecast, with technical flows and position squaring adding a level of support through the session. US tsys finished 8-13bps richer across the major benchmarks.

- The pivotal economic event of this week centres on the speech by Fed Chair Powell at the Jackson Hole gathering on Friday. The prevailing concern is that Powell might undermine investors' optimistic expectations, specifically the notion that the Federal Reserve has concluded its interest rate hikes and is poised to initiate rate cuts in the early months of the upcoming year.

- According to MNI's technicals team, Wednesday’s high of $1920.40 cleared resistance at $1916.3 (20-day EMA) to open $1932.7 (50-day EMA).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/08/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/08/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/08/2023 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/08/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/08/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 24/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/08/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.