-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Sino-U.S. Verbal Jousting Continues

EXECUTIVE SUMMARY

- CHINA BLASTS MEETING BETWEEN TAIWAN LEADER AND US HOUSE SPEAKER (RTRS)

- CHINA CLEARS PATH FOR FOREIGN INVESTORS TO $5TN SWAPS MARKET (FT)

- CHINA TO REDUCE TAX, FEE BURDEN FOR BUSINESS ENTITIES BY $262 BILLION THIS YEAR (RTRS)

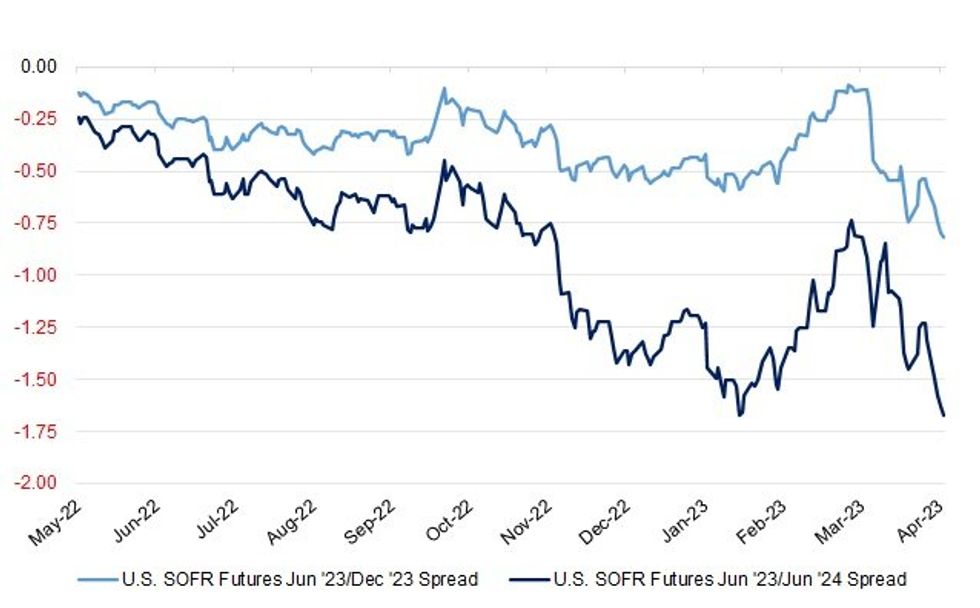

Fig. 1: U.S. SOFR Futures Jun '23/Dec '23 & Jun '23/Jun '24 Spreads

Source: MNI - Market News/Bloomberg

UK

EQUITIES: UK investors looked past the banking crisis last month and put more cash into equity funds than they have done since 2021. According to the latest fund flow index from Calastone, flows were predominantly into global funds, which gained £1.69 billion of new capital, their best month since November 2021 and the third best on record. (The times)

EUROPE

FISCAL: The European Commission has briefed senior member state finance officials about suggested amendments to its November 2022 proposals for reform of the bloc’s fiscal rules, which would take a stricter approach to deviations from limits on public debt and borrowing than initially planned, European officials told MNI. (MNI)

FISCAL: Poland has asked the European Union for additional €23 billion in loans available to the country from the EU’s post- pandemic recovery fund, Dziennik Gazeta Prawna reports. (BBG)

SWEDEN: A rebound in Swedish home prices unexpectedly gathered pace last month, casting doubt on most forecasters’ gloomy outlook for one of the world’s worst-hit housing markets. (BBG)

BANKS: Switzerland has instructed Credit Suisse to cancel or reduce by 50 or 25% all outstanding variable renumeration for the top three levels of management, the Swiss Federal Council said in a statement on Wednesday. (RTRS)

U.S.

ECONOMY: U.S. services growth slowed in March and prices paid remained elevated but the economy should be able to skirt recession, particularly if the Federal Reserve changes its mind and starts cutting interest rates later this year, Institute for Supply Management services chair Anthony Nieves told MNI Wednesday. (MNI)

BANKS: The Federal Deposit Insurance Corporation (FDIC) has retained BlackRock Inc unit Financial Market Advisory to sell the securities portfolios it kept in receivership after the collapse of Signature Bank and Silicon Valley Bank. (RTRS)

OTHER

GLOBAL TRADE: China is considering prohibiting exports of certain rare-earth magnet technology in a move that would counter the U.S.'s advantage in the high-tech arena. Officials are planning amendments to a technology export restriction list, which was last updated in 2020. (Nikkei)

GLOBAL TRADE: China is urging the World Trade Organization to probe practices and heighten oversight of the US, Japan and the Netherlands over their export curbs on semiconductor-making equipment against the country, Yomiuri reports, citing a person familiar with the matter. (BBG)

GLOBAL TRADE: Polish Prime Minister Mateusz Morawiecki says he discussed with Ukraine’s Wolodymyr Zelenskiy solutions to mitigate problems stemming from Ukrainian grain entering European markets. (RTRS)

U.S./CHINA/TAIWAN: The United States has been consistent on its message of urging China to show restraint regarding Taiwanese President Tsai Ing-wen's visit with House Speaker Kevin McCarthy, White House spokesperson Karine Jean-Pierre said on Wednesday. (RTRS)

U.S./CHINA/TAIWAN: U.S. House of Representatives Speaker Kevin McCarthy said he and a bipartisan group of lawmakers had a very productive discussion with Taiwanese President Tsai Ing-wen on Wednesday. McCarthy said the U.S. must continue its arms sales to Taiwan and strengthen economic cooperation with trade and technology. Washington's support for Taiwan will remain resolute and unwavering, he added. (RTRS)

U.S./CHINA/TAIWAN: Mike Gallagher, the Republican head of the new House China committee who was part of the delegation, rejected the idea that the meeting would provoke China, suggesting that capitulating to Beijing would recall Reagan’s warning about “feeding the crocodile hoping that he will eat you last”. Raja Krishnamoorthi, the top Democrat on the committee, said the US bond with Taiwan was “unshakeable” while stressing the US did not want conflict. (FT)

U.S./CHINA/TAIWAN: Taiwan’s president Tsai Ing-wen urged continued support for her country and warned its democracy was “under threat” following a high-profile meeting with US House Speaker Kevin McCarthy in California. (FT)

U.S./CHINA/TAIWAN: China's foreign ministry on Thursday condemned a meeting in California between Taiwan's leader and the U.S. House speaker as "acts of collusion" and said it would take "resolute" measures to defend its sovereignty, according to the Xinhua news agency. (RTRS)

U.S./CHINA/TAIWAN: China's defense ministry said the Chinese army will stand by its responsibility and mission, and always stay on high alert, in remarks early Thursday after Taiwanese President Tsai Ing-wen's meeting with U.S. House Speaker Kevin McCarthy. The ministry urged the United States to honour its solemn political commitment made to China on the Taiwan question, it said in a statement. (RTRS)

U.S./CHINA/TAIWAN: Taiwan was keeping a close watch on a Chinese aircraft carrier and threats to inspect ships in the Taiwan Strait on Thursday after Beijing condemned a meeting between Taiwan President Tsai Ing-wen and U.S. House Speaker Kevin McCarthy. (RTRS)

GEOPOLITICS: The foreign ministers of Iran and Saudi Arabia met in China for the first formal meeting of their most senior diplomats in more than seven years, Saudi state-run Al Ekhbariya television said. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda says that ending deflation doesn’t solve all of Japan’s economic problems. (BBG)

RBA: Australia’s banks can weather global banking volatility and can continue business and private lending, despite elevated risks in the global banking sectors, according to the Reserve Bank of Australia’s semi-annual Financial Stability Review. (MNI)

MEXICO: Mexico’s President Andres Manuel Lopez Obrador invited a group of Latin American and Caribbean presidents, finance and economy ministers and businesspeople to participate in a summit to discuss joint measures against inflation in Cancun, Mexico, from May 6 to May 7. (BBG)

MEXICO: Mexico’s food inflation is still the most worrisome despite prices of processed foods starting to decrease, Banxico’s Deputy Governor Jonathan Heath said on Twitter. (BBG)

BRAZIL: Brazil's central bank governor Roberto Campos Neto said on Wednesday that he is not concerned about whether the new directors of the bank have left-wing, right-wing, or center political beliefs but rather their technical qualifications for the positions. Speaking at an event hosted by the think tank Esfera Brasil, Campos Neto said that policymakers are attempting to smooth the interest rate cycle as much as possible to cause the least amount of damage to the economy, arguing that there are reasons for the current level of rates and that reducing them is a job that also involves the Finance Ministry and Congress. (RTRS)

BRAZIL: Brazil's Petrobras said on Wednesday it has not yet received any government proposal to change its fuel pricing policy, responding to news that President Luiz Inacio Lula da Silva's administration was set to push for such a move. (RTRS)

RUSSIA: Kyiv is willing to discuss the future of Crimea with Moscow if its forces reach the border of the Russian-occupied peninsula, a top adviser to President Volodymyr Zelenskyy has told the Financial Times. (FT)

RUSSIA: The US summoned Russia’s ambassador for a meeting last week, a State Department spokesperson said, as the Biden administration pressures Moscow over the arrest and detention of Wall Street Journal reporter Evan Gershkovich on espionage charges. (BBG)

RUSSIA: The rise in Russia's weekly consumer prices quickened at the end of March, data from state statistics service Rosstat showed on Wednesday, with authorities still fighting to slow inflation. (RTRS)

RUSSIA: India’s central bank unexpectedly left its benchmark interest rate unchanged as global banking woes add uncertainty to the economic outlook, while pledging to hike again if needed. (BBG)

PERU: Peru’s former President Alejandro Toledo lost a last- ditch request to put on hold his extradition to his home country to face corruption charges. (BBG)

ARGENTINA: Argentina is bringing back a temporary exchange rate for soy exports in an elaborate bid to prop up the central bank’s dwindling cash reserves and ease the economic pain of a historic drought. (BBG)

CHINA

ECONOMY: Tourist trips during this year's Tomb Sweeping Festival on April 5 increased 22.7% y/y, according to preliminary statistics from the Data Center of the Ministry of Culture and Tourism. A total of 23.7 million domestic tourists travelled during the holiday, spending a total of CNY6.52 billion, an increase of 29.1% over last year. Of the 14,952 A-level tourist attractions in China, 12,635 were open normally, according to the ministry. (MNI)

FISCAL: China is expected to reduce the tax and fee burden for business entities by 1.8 trillion yuan ($261.62 billion) this year, Wang Daoshu, the country's taxation administration official, said at a news conference on Thursday. (RTRS)

FISCAL: Local government bond issuance could slow in Q2, as stronger y/y economic growth in April and May reduces the need for stimulus, according to the 21st Century Herald. Wind data showed CNY1.67 trillion of bonds were issued in Q1, accounting for 63% of the pre-approved batch announced at the end of last year. Experts said the remaining 37% will be issued before the end of June. The total issuance in Q2 is expected to be above CNY1 trillion, but below CNY1.67 trillion of Q1, according to the Herald. (MNI)

FISCAL: Shanghai vice mayor Li Zheng announces a total of 24 supportive measures at a conference Thursday aimed at attracting investment. (BBG)

SWAPS: China’s delayed Swap Connect scheme has won regulatory approval and is set to launch within months, opening up a $5tn swaps market to foreign investors needing to hedge their exposure to renminbi debt. Final rules for the programme were recently agreed by China and Hong Kong authorities, three people familiar with the matter told the Financial Times. (FT)

CHINA MARKETS

PBOC NET DRAINS CNY431 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY8 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY431 billion after offsetting the maturity of CNY439 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9978% at 09:39 am local time from the close of 1.8605% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Tuesday, compared with the close of 47 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8747 THURS VS. 6.8699 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8747 on Thursday, compared with 6.8699 set on Tuesday.

OVERNIGHT DATA

CHINA MAR CAIXIN SERVICES PMI 57.8; MEDIAN 55.0; FEB 55.0

CHINA MAR CAIXIN SERVICES PMI 54.5; FEB 54.2

There was still a lot of optimism in the services sector in March, as businesses continued to express confidence in an economic recovery following the scrapping of Covid controls. The reading for expectations for future activity remained significantly higher than the long-term average, although it slipped slightly for the second straight month. (Caixin)

AUSTRALIA MAR FEB TRADE BALANCE +A$13.870BN; MEDIAN +A$11.223BN; JAN +A$11.266BN

AUSTRALIA MAR EXPORTS -3% M/M; FEB +1%

AUSTRALIA MAR IMPORTS -9% M/M; FEB +5%

NEW ZEALAND MAR ANZ COMMODITY PRICE INDEX +1.3% M/M; FEB +1.4%

The ANZ World Commodity Price Index increased a further 1.3% m/m in March, but it was a mixed bag amongst the various sectors. Stronger returns for meat largely offset weaker aluminium prices. In local currency terms the index gained 2.7% m/m, supported by a 0.4% m/m easing of the NZD against the Trade Weighted Index. (ANZ)

MARKETS

US TSYS: Richer In Asia

TYM3 deals at 116-18+ unchanged from Wednesday's settlement level, a touch off the top of the observed 0-08 range on volume of ~77k.

- Cash tsys sit 1.5-4bps richer across the major benchmarks, the curve has bull steepened.

- Tsys were marginally firmer in early dealing as Asia-Pac participants reacted to the softer than expected US data on Wednesday.

- Firmer than forecast Caixin services PMI saw the bid moderately extend. Lower WTI futures, down ~0.7%, and US Equity futures, e-minis sit ~0.3% softer, also added a level of support.

- Pockets of screen buyers in FV and TY saw tsys marginally extend gains late in the Asian session. There was no headline catalyst observed on the move.

- In Europe today Swiss unemployment and German Industrial Production headline. Further out we have initial jobless claims and Fedspeak from St Louis Fed President Bullard will cross.

JGBS: Firmer, But Lacking Meaningful Follow Through

JGB futures struggled to detach themselves from late overnight session levels for any meaningful period of time during Thursday’s Tokyo session, with the contract +7 as we move towards the close. Cash JGBs are 0.5-3.0bp richer, with the super-long end outperforming. Swap rates are flat to lower across the curve, lagging the move in JGBs, leaving swap spreads wider.

- A relatively well-received round of 30-Year JGB supply, Sino-U.S. tension re: Taiwan, weakness in crude oil markets & the Nikkei 225/U.S. e-minis, as well as adjustments to Wednesday’s wider moves in core global FI markets, underpinned JGBs for much of the session, although the space has traded away from best levels into the bell.

- Comments from Finance Minister Suzuki & outgoing BoJ Governor Kuroda failed to introduce anything in the way of meaningful, fresh soundbites.

- The weekly international security flow data from the Japanese MoF revealed that international investors were net buyers of Japanese bonds for the second time in 3 weeks, although the record net purchases seen 3 weeks ago continue to dominate when it comes to the assessment of recent dynamics in that metric (as a reminder, the record purchases observed in that week likely represented notable short cover surrounding the most recent BoJ decision and the banking sector tumult).

- Wage and household spending data headline the local docket on Friday.

JGBS AUCTION: 30-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y728.2bn 30-Year JGBs:

- Average Yield: 1.353% (prev. 1.416%)

- Average Price: 101.00 (prev. 103.84)

- High Yield: 1.357% (prev. 1.425%)

- Low Price: 100.90 (prev. 103.65)

- % Allotted At High Yield: 64.4970% (prev. 78.3018%)

- Bid/Cover: 3.186x (prev. 2.997x)

JGBS AUCTION: 6-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y3.25405tn 6-month Bills:

- Average Yield: -0.1574% (prev. -0.1596%)

- Average Price: 100.079 (prev. 100.081)

- High Yield: -0.1454% (prev. -0.1458%)

- Low Price: 100.073 (prev. 100.074)

- % Allotted At High Yield: 1.1546% (prev. 98.4326%)

- Bid/Cover: 4.636x (prev. 3.357x)

AUSSIE BONDS: Stronger, At Bests, Narrow Range

ACGBs sit at or near session highs (YM +7.0 & XM +9.0) after a relatively narrow range. Trade Balance data and the RBA Financial Stability Review (FSR) failed to spark a market reaction with later session strength seemingly tied more to the richening in US Tsys (yields 2-3bp lower) in Asia-Pac trade.

- Cash ACGBs are 7-9bp stronger on the day with the 3/10 curve 2bp flatter and the AU-US 10-year yield differential -2bp at -10bp.

- Swap rates are 6-8bp lower with EFPs 1bp wider.

- Bills pricing is +1 to +7 with reds leading.

- RBA dated OIS pricing is 1-5bp softer across meetings beyond May with a 22% chance of 25bp tightening priced for May. 27bp of easing is priced by year-end.

- On the local data front, February’s trade balance printed a much larger-than-expected surplus of A$13.87bn (versus A$11.22bn expected) as imports dropped 9.1% M/M.

- The FSR stated that households and firms were well-placed to cope with higher interest rates. RBA also noted that about 40% of home loans have less than 3-months buffer.

- With the global calendar light ahead of US Non-Farm Payrolls on Friday, the direction in the local market will likely be guided by risk appetite and US Tsys.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 11 April it plans to sell A$100mn of the 0.25% 21 November 2032 Indexed Bond.

- On Wednesday 12 April it plans to sell A$800mn of the 3.25% 21 April 2029 Bond.

- On Thursday 13 April it plans to sell A$1.0bn of the 9 June 2023 Note, A$1.0bn of the 25 August 2023 Note & A$500mn of the 8 September 2023 Note.

NZGBS: Bull Steepens After Well-Received Supply

NZGBs closed 7-15 richer at session bests after weekly supply received a strong bid (cover 3.08-6.25x), with NZGB May-26 demand the strongest.

- Following the RBNZ’s 50bp hike yesterday, it seems that market participants are now taking the central bank's commitment to bring inflation back to its target range more seriously. However, this move has also raised concerns about over-tightening and a recession. The NZGB cash 2/10 curve steepened 5bp post-supply to be +8bp on the day. NZ/US and NZ/AU 10-year yield differentials were respectively 2bp and 4bp tighter on the day.

- 2s10s swap curve also bull steepened with rates 5-13bp lower, implying wider swap spreads.

- After shunting 20bp higher across meetings yesterday, RBNZ dated OIS pricing today closed 2-9bp softer across meetings with Feb-24 leading. 19bp of tightening was priced for the May meeting. 45bp of easing is priced for Feb-24 off a terminal OCR expectation of 5.45% (July).

- ANZ Commodity Price Index rose 1.3% M/M in March with the Meat, Skins and Wool category the star performer (+5.9%).

- With the global calendar light ahead of US Non-Farm Payrolls on Friday, the direction in the local market will likely remain a tussle between lower global rates and a hawkish RBNZ.

EQUITIES: Still Tracking Lower Amid Recession Fears

Regional equities are mostly on the back foot, following US/EU losses from Wednesday's session. US futures are also tracking lower through the first part of Thursday's session. Eminis are down ~0.30% at this stage, Nasdaq futures off by 0.40%. Lingering US recession fears are still a driver of sentiment, following progressive US data downside surprises this week.

- Hong Kong equities have been in positive territory today but have struggled to maintain gains. Markets were closed yesterday, so this may reflect some catch up, while the better than expected Caixin services PMI aided sentiment earlier. The HSI is currently around flat at the lunch break.

- Onshore China shares aren't faring as well, the CSI 300 down around 0.30% at this stage. US-China tensions potentially weighing, post the Tsai-McCarthy meeting, but don't look to be a key driver.

- Japan markets are once again close to the worst performers in the region. The Topix off by over 1.2% at this stage. Once again, the cyclically sensitive electric appliances sector is driving the weakness.

- The Kospi has shed just over 1% in line with weaker Tech trends from Wednesday's US session. Net outflows from locals are -$450.1mn so far. Taiwan markets have returned after a 3 day break, off by 0.40% at this stage.

- SEA markets are also tracking lower, but losses are less than 0.5% for the most part.

GOLD: Prices Ease But Remain Supported By Weaker US Economic Outlook

Gold prices have eased during APAC trading today after moving higher since Friday. After reacting to Wednesday’s US data, bullion in the end looked through it. Prices are down 0.5% to $2011.50/oz just off the intraday low of $2008.14. They reached a high of $2021.08 earlier. The USD has provided headwinds with the index higher again today.

- The uptrend in gold continues to dominate. Wednesday’s high of $2032.07 broke through resistance of $2031.88 and opened up $2034 as the next level to watch.

- Despite some stabilisation in bullion today, it has been able to hold above the $2000 mark, as this week’s US data has generally disappointed and supported expectations of a less hawkish Fed. The key release is Friday’s March payrolls, which are expected to post a 235k rise with the unemployment rate staying at 3.6%.

- The only US data of note today are the jobless claims and Challenger job cuts for March. The Fed’s Bullard will discuss the economic outlook later.

OIL: Crude Nervous About Demand Again

Oil prices are down today and WTI has broken through yesterday’s low but found support there. Disappointing data from the US over the last few days has reignited demand concerns following the boost to prices from OPEC’s latest output cut decision. The USD index is higher again today.

- Oil prices have been volatile during the APAC session but have been trading in a range of less than a dollar. Crude bounced around the time of the RBI’s announcement that it was on hold after 6 consecutive hikes. Brent is currently down 0.4% to $84.56/bbl after reaching a low of $84.05. WTI is down 0.6% to $80.11 after an intraday low of $79.67. Both are now around their 200-day moving averages.

- The only US data of note today are the jobless claims and Challenger job cuts for March. The Fed’s Bullard will discuss the economic outlook later. There is also German IP and Canadian employment. The key release is Friday’s March US payrolls, which are expected to post a 235k rise with the unemployment rate staying at 3.6%.

FOREX: USD Firms In Asia

The greenback is on the front foot in Asia today, an early offer in the USD/JPY saw the USD briefly pressured however the move retraced and the USD firmed. Softer US and regional equities have weighed on risk sentiment.

- Kiwi is the weakest performer in the G-10 space as falls in equities and commodities weigh. NZD/USD prints at $0.6290/95 down ~0.4% today.

- AUD/USD is also softer, down ~0.3% last printing a touch under $0.67. Iron Ore continues to slide now down ~6.5% through the week.

- Yen is a touch firmer, benefiting from marginally softer US Treasury Yields. USD/JPY printed a low at ¥130.78 in early trade before paring losses. The pair now sits at ¥131.15/25.

- Elsewhere in G-10 weaker oil prices have weighed on NOK, USD/NOK is ~0.3% firmer with the pair breaking its 20-day EMA today. Note though Asia Pac liquidity is likely to be fairly poor for this pair.

- Cross asset wise, WTI futures are down ~1%. E-minis are ~0.3% softer. BBDXY is ~0.2% firmer.

- In Europe today Swiss unemployment and German Industrial Production headline. Further out we have initial jobless claims and Fedspeak from St Louis Fed President Bullard will cross.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/04/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 06/04/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 06/04/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 06/04/2023 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 06/04/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/04/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/04/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/04/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2023 | 1400/1000 |  | US | St. Louis Fed's James Bullard | |

| 06/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 06/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.