-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Tokyo Upside CPI Surprise Keeps BoJ Outlook In Focus

EXECUTIVE SUMMARY

- REPUBLICANS TOY WITH EXTENDING DEBT LIMIT TO END OF SEPTEMBER (BBG)

- ECB SEEN DELIVERING TWO HALF-POINT HIKES ON WAY TO MAY PEAK (BBG)

- CONSUMER INFLATION IN JAPAN’S CAPITAL HITS NEAR 42-YR HIGH, KEEPS BOJ UNDER PRESSURE (RTRS)

- JAPAN PM SAYS CAN’T RULE OUT RETURN OF DEFLATION DESPITE PRICE SPIKE (RTRS)

- JAPAN, NETHERLANDS TO JOIN US IN CHIP EXPORT CONTROLS ON CHINA (BBG)

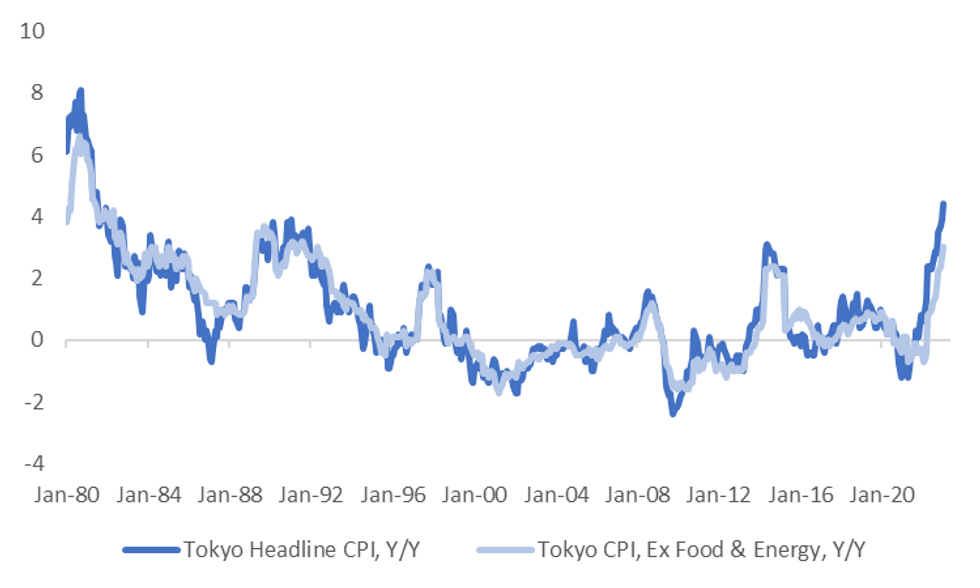

Fig. 1: Tokyo Headline & Core CPI, Y/Y

Source: MNI - Market News/Bloomberg

EUROPE

ECB: Back-to-back interest-rate increases of 50 basis points are approaching from the European Central Bank, whose battle with persistent inflation will see it hike borrowing costs until May, according to a survey of economists. (BBG)

U.S.

EQUITIES: Intel Corp. gave one of the gloomiest quarterly forecasts in its history after a personal-computer slump ravaged the chipmaker’s business, sending shares tumbling and further setting back turnaround efforts. The company predicted a surprise loss in the current period and a sales range that missed analysts’ estimates by billions of dollars. At the low end of Intel’s projections, revenue would be the smallest quarterly total since 2010. (BBG)

DEBT: House Republican leaders are considering proposing a short-term extension of the federal debt ceiling to delay the risk of a default until Sept. 30, according a person familiar with their deliberations, a step that would allow more time to resolve an impasse with Democrats.The strategy is merely an option under consideration, and it isn’t clear whether the Democratic-controlled Senate or White House would agree to briefly putting off a reckoning on the debt ceiling, said the person, who asked not to be identified. (BBG)

OTHER

JAPAN: Japanese PM Fumio Kishida said on Friday that a return to deflation in the world’s third largest economy cannot be ruled out, because domestic data remains weak. (RTRS)

JAPAN: The Japanese government plans to leave the decision of whether to wear masks indoors up to the individual as it finalizes plans to lower the disease classification of Covid-19 in May, public broadcaster NHK reported. (BBG)

JAPAN: Core consumer prices in Japan's capital, a leading indicator of nationwide trends, rose 4.3% in January from a year earlier, marking the fastest annual gain in nearly 42 years and keeping the central bank under pressure to phase out economic stimulus. (RTRS)

JAPAN: Japan and the Netherlands are poised to join the US in limiting China’s access to advanced semiconductor machinery, forging a powerful alliance that will undercut Beijing’s ambitions to build its own domestic chip capabilities, according to people familiar with the negotiations. (BBG)

JAPAN: China is “100% sure” to retaliate over Japanese backing for Biden administration restrictions on semiconductor exports, and firms facing the fallout should look for markets elsewhere, a ruling Liberal Democratic Party lawmaker said. (BBG)

JAPAN: Goldman Sachs Group Inc. raised its forecasts for Japan’s upcoming spring wage negotiations, expecting the highest base pay hike in three decades as inflation continues to surprise on the upside. The brokerage now sees a base wage increase of 1.2% in the annual negotiations between labor unions and companies, up from its previous forecast of 0.9%. When combined with scheduled, seniority-based raises, Goldman expects an increase of 2.8% as a result of the wage negotiations, up from its former view of 2.5%. (BBG)

JAPAN: The Bank of Japan will conduct funds-supplying operations against pooled collateral on Jan. 31 with the duration of loans being 5 years. Interest to be determined by variable-rate method and amount to be determined on the day of the operation. (BBG)

AUSTRALIA: ACCC’s latest gas inquiry report forecasts a supply shortfall of 30 petajoules in Australia’s east coast gas market this year if the LNG producers were to export all their uncontracted gas. However, the LNG producers have enough uncontracted gas to prevent a domestic shortfall, Australian Competition & Consumer Commission says in a statement (BBG)

AUSTRALIA: The A$14.7 billion shortfall compares with the 2022-23 October Budget profile deficit of A$26.2 billion. Receipts were A$8.8 billion higher than the 2022-23 October Budget profile; payments were A$2.8 billion lower (BBG)

IRON ORE: Iron ore is expected to moderate after a ~30% surge driven by China’s reopening, according to Citigroup Inc., which pared its price target. “It’s time to step off the China reopening trade in iron ore,” the bank said in a Jan. 27 note by analyst Ephrem Ravi. The three-month forecast was downgraded to $120/t given an uncertain short-term outlook for the steelmaking ingredient. (BBG)

SOUTH KOREA: South Korean manufacturers' business sentiment for February weakened to the worst level in over two years, a central bank survey showed on Friday, hurt by heightened uncertainty over the economic outlook. (RTRS)

SOUTH KOREA: South Korea will extend restriction on short-term visa issuance for China to Feb. 28, health ministry says in statement. To resume visa issuance before end of Feb. if coronavirus situation in China improves (BBG)

OVERNIGHT DATA

SOUTH KOREA FEB MANUFACTURING CONFIDENCE 65; JAN 68

SOUTH KOREA FEB NON-MANUFACTURING CONFIDENCE 70; JAN 68

JAPAN TOKYO JAN CPI 4.4% Y/Y; MEDIAN 4.0%; Dec 3.9%

JAPAN TOKYO JAN CPI EX FRESH FOOD 4.3% Y/Y; MEDIAN 4.2%; DEC 3.9%

JAPAN TOKYO JAN CPI EX FRESH FOOD, ENERGY 3.0%; MEDIAN 2.9%; DEC 2.7%

NZ JAN ANZ BUSINESS CONFIDENCE -52.0; DEC -70.2

NZ JAN ANZ BUSINESS ACTIVITY OUTLOOK -15.8; Dec 25.6

AUSTRALIA Q4 PPI 0.7% Q/Q; Q3 1.9%

AUSTRALIA Q4 PPI 5.8% Y/T; Q3 6.4%

AUSTRALIA Q4 EXPORT PRICE INDEX -0.9%; MEDIAN -1.3%; Q3 -3.6%

AUSTRALIA Q4 IMPORT PRICE INDEX 1.8%; MEDIAN 1.3%; Q3 3.0%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYH3 deals at 114-20+, -0-07, just off the base of its 0-08+ range on volume of ~70k.

- Cash tsys sit 1-3 bps cheaper across the major benchmarks.

- After a muted start, spillover pressure from JGBs, post Tokyo CPI release, weighed on tsys at the margins resulting in mild cheapening.

- The move marginally extended as Japan and Netherlands agreed to join US curbs on Chinese Chips. There was a bid in the greenback, however with liquidity impaired due to the Chinese holidays there was little follow through in Tsys.

- There is a thin docket in Europe today. Further out we have a slew of US data including personal income/spending, PCE Deflator, U of Mich Consumer Sentiment and Pending Home Sales.

EQUITIES: Tech Headwinds Limit Gains

Regional equity markets are mostly in the green, although headwinds in the tech space have taken the shine off what would have been a fairly positive end to the week for Asia Pac bourses. Intel's disappointing earnings update has kept US futures in the red for the whole session. We were last around -0.55% for Nasdaq futures, while Eminis are down -0.25% at this stage.

- Reports that Japan and the Netherlands will join the US in curbing technology related exports to China has also weighed on sentiment in the tech space.

- The HSI is back to flat for the session, after opening up higher. Semiconductor related names have fallen, although the HSI Tech sub index is still up 0.33% at this stage (yesterday we rose 4.26%, while the Golden Dragon index was up strongly in US trade for Thursday.

- Optimism around China re-opening, with strong anecdotes of travel and related expenditure through the LNY period is providing an offset.

- The Nikkei 225 is around flat at this stage as well, while the Kospi is +0.70%, but is off earlier highs. The Kospi is comfortably through the simple 200-day MA.

- Indian shares are down with the main indices off by around 1% at this stage. Adani shares continue to fall, after the recent short-seller report, while bank names are also down today.

OIL: Close To 100-Day EMA Resistance Point

Brent crude prices are marginally higher at this stage, last near 87.80, around +0.40% for the session. This puts us on track for a modest 0.23% gain for the week, with Brent consolidating somewhat after strong gains in the previous two weeks. Bulls will also be looking for a concerted break through $88/bbl before turning more bullish. Also note the 100-day EMA, which comes in at $88.28/bbl sit just above this level.

- Brent has been unable to sustain breaks above this resistance point since early July last year, see the chart below.

- Elsewhere EU officials are reportedly considering a $100/bbl cap for Russian diesel exports, while the cap would be lower for other products like fuel oil. Goldman Sachs warned that the next round of oil sanctions on Russia could be more disruptive than the first round, citing global diesel inventory levels as being tight.

- Looking ahead, China markets return from the LNY break next week, with PMI prints for January out on Tuesday. OPEC+ meetings will also take place over Tuesday/Wednesday, although no change is expected from an output standpoint at this stage.

Fig 1: Brent Crude Close To 100-Day EMA Resistance Point

Source: MNI - Market News/Bloomberg

GOLD: Tracking Lower For The Week

Gold tried to go higher at the start of the session, but couldn't sustain gains near $1935. We last close to $1922, with lows for the session coming around $1920. This is -0.4% and comes after Thursday's -0.87% dip. If sustained this would leave gold tracking at a loss for the week of 0.22%, which is modest but would be the first weekly lost since the first half of December.

- While USD indices remain close to recent lows, the gold trend appears to be consolidating somewhat, as we are now some distance below earlier highs in the week near $1950.

- Dips sub $1920 have been supported, while below that is the $1900 little.

- Next week's Fed meeting may also be bringing some cautiousness into the market.

- ETF gold holdings have actually started to track higher in recent sessions, but the move up is modest so far.

FOREX: Greenback Bid In Asia

The USD is trading on the front foot late in the Asian session, BBDXY is up ~0.2%, as Netherlands and Japan agreed to join US curbs on Chinese chips.

- USD/JPY also gave up its early CPI inspired gains having met support below ¥129.60 and is dealing a touch above ¥130.

- AUD/USD saw resistance above $0.7120, however is currently holding above $0.71.

- There have been narrow ranges in NZD/USD, kiwi is the strongest performer in the G-10 space at the margins as business conditions improved off record lows. The pair is dealing just above session lows at $0.6485/90.

- EUR and GBP are both ~0.2% softer vs the USD.

- Lunar NY Holiday impacted liquidity in Asia-Pac hours, with China still out.

- There is a thin docket in Europe today. Further out we have a slew of US data including personal income/spending, PCE Deflator, UofMich Consumer Sentiment and Pending Home Sales.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/01/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 27/01/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 27/01/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/01/2023 | 0800/0900 | *** |  | ES | GDP (p) |

| 27/01/2023 | 0900/1000 | ** |  | EU | M3 |

| 27/01/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 27/01/2023 | 1500/1000 | ** |  | US | NAR pending home sales |

| 27/01/2023 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/01/2023 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.