-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Tsy Yields Tick Higher As Shutdown Averted

EXECUTIVE SUMMARY

- US GOVT SHUTDOWN AVERTED - WSJ

- BOJ BELIEVES 2% PRICE TARGET CAN BE ACHIEVED - MNI

- RBNZ LIKELY TO KEEP OCRr STEADY AT 5.5% - MNI

- CHINA'S FACTORY ACTIVITY EXPANDS FOR FIRST TIME IN 6 MONTHS - AFR

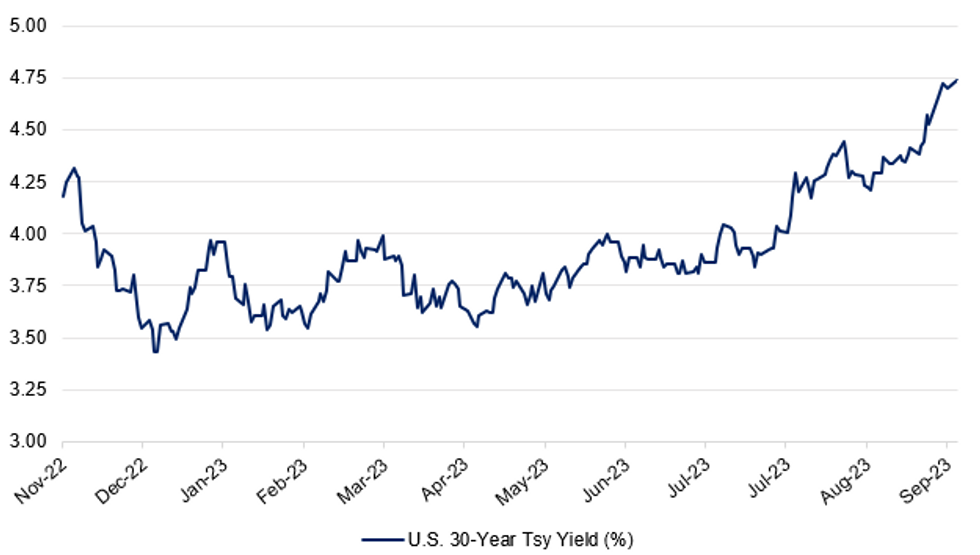

Fig. 1: US 30-Year Treasury Yield

Source: MNI - Market News/Bloomberg

U.K

POLITICS: "Prime Minister Rishi Sunak’s efforts to use the Conservative Party conference to unite his party ahead of a general election next year suffered an early setback when senior Tories called for immediate tax cuts." (BBG)

EQUITIES: "Britain’s stock market is getting back on its feet. Less than a year after losing the crown of Europe’s biggest equity market, London looks set to recapture it from Paris, as the rally in French luxury shares falters." (BBG)

INFLATION: "Water bills are set to rise by 35% on average for households in England by the end of the decade as UK suppliers ramp up investment to expand and fix leaky networks." (BBG)

HEALTH: "People in England are being urged to get a flu jab, with officials estimating that 25,200 hospitalizations were prevented by vaccines last winter." (BBG)

INVESTMENT: "The UK government is considering copying the Canada Growth Fund to help channel investment into green technology and fast-growing businesses in a bid to boost the economy." (BBG)

EUROPE

ECB: "Luis de Guindos has dismissed talk of rate cuts by the European Central Bank as “premature”, warning that hurdles over “the last mile” of bringing inflation back to rate-setters’ 2 per cent target" (FT)

BANKING: "UBS Group AG reached a settlement with Mozambique over Credit Suisse’s role in a ship-financing scandal, resolving the case between the two on the eve of a London trial." (BBG)

SLOVAKIA: "A former prime minister who’s derided the European Union’s sanctions against Russia and pledged to end military aid to Ukraine won Slovakia’s election, delivering a fresh blow to Western unity." (BBG)

UKRAINE: "Ukraine said five ships are heading to its Black Sea ports for loading, while three others have sailed with cargoes, as Kyiv seeks to overcome Russia’s blockade of its commodity exports that started two months ago when Moscow pulled out of a key grain deal." (BBG)

U.S.

POLITICS: "California Governor Gavin Newsom will appoint Laphonza Butler to fill the seat of late Senator Dianne Feinstein, Politico reports, citing an unidentified person familiar with the decision." (POLITICO)

POLITICS: "Republicans and Democrats set aside sharp policy differences to avoid a government shutdown. Now, they have just weeks to resolve fights over aid to Ukraine, heading off a surge in border crossings and the overall size of the federal government." (WSJ)

POLITICS: "Speaker Kevin McCarthy’s decisive moment came Friday night, after a tumultuous closed-door meeting of House Republicans showed once again he couldn’t budge hardliners from a series of contentious demands to prevent a government shutdown." (BBG)

OTHER

BOJ: "The Japanese economy can achieve the Bank of Japan's 2% price target if wage hikes continue in 2H one BOJ board member believes, while a separate member notes positive wage-setting behaviour has started to spread among firms, the September 21-22 meeting summary of opinions showed Monday." (MNI)

JAPAN: "Japanese benchmark business sentiment rose over Q3 for the second straight quarter due to eased supply-side restrictions and slowing cost, and pass-through of cost increases despite growing uncertainty over global demand, the Bank of Japan's September Tankan business sentiment survey showed Monday." (MNI)

JAPAN: "Japan's move to bar most used-car sales to Russia slammed the brakes on a trade nearing $2 billion annually that had boomed in the shadow of sanctions over Ukraine elsewhere, according to trade data and market participants." (RTRS)

NEW ZEALAND: "The Reserve Bank of New Zealand is likely to keep its Official Cash Rate on hold at 5.5% for a third consecutive meeting on Oct 4, despite signs that stronger-than-expected inflation over the short term could warrant future increases." (MNI)

OIL: "Oil opened the new quarter on the front foot, edging higher on widespread bets that global demand is running ahead of supply." (BBG)

CHINA

ECONOMY: "China’s factory activity expanded for the first time in six months in September, an official survey showed on Saturday, adding to a run of indicators suggesting the world’s second-largest economy has begun to bottom out." (AFR)

ECONOMY: "China's Caixin manufacturing PMI edged down 0.4 points to register 50.6 in September from August, staying in the expansionary zone above the breakeven 50 mark for the fourth time in the past five months, the financial publisher said Sunday." (MNI)

MARKET DATA

NEW ZEALAND AUG BUILDING PERMITS -6.7% M/M, PRIOR -5.4%

AUSTRALIA JUDO BANK MFG PMI 48.7, PRIOR 48.2

AUSTRALIA SEP MELB INSTITUTE INFLATION M/M 0.0%, PRIOR 0.2%

JAPAN Q3 LARGE TANKAN MFG INDEX 9, PRIOR 5

JAPAN Q3 LARGE TANKAN NON- MFG INDEX 27, PRIOR 23

JAPAN Q3 SMALL TANKAN MFG INDEX -5, PRIOR -5

JAPAN Q3 SMALL TANKAN NON- MFG INDEX 12, PRIOR 11

JAPAN Q3 TANKAN ALL INDUSTRY CAPEX 13.6%, PRIOR 13.4%

MARKETS

US TSYS: Cheaper In Asia

TYZ3 deals at 107-25, -0-09, a 0-08 range has observed on volume of ~93k.

- Cash tsys sit ~4bps cheaper across the major benchmarks.

- Tsys were pressured in early trade after an agreement in US Congress to avert a government shutdown passed over the weekend.

- Narrow ranges were observed for the remainder of the session with little follow through on moves. There was no meaningful macro news flow.

- On the wires today we have the final read of S&P Global Mfg PMI for September as well as the latest ISM Mfg Survey. There are a number of Fed speakers today including Fed Chair Powell and NY Fed President Williams.

JGBs: Losses Pared On BOJ Bond Buying

JGB Futures pared losses in recent trade after an announcement from the BOJ that they will conduct additional bond buying for 5-10 Year JGBs on October 4.

- This leaves JB1 at 144.83, -0.13, the contract has recovered off its session low at 144.76 after ticking lower from opening levels through the session as spillover from US Tsys weighed.

- The 10 Year Yield is unchanged at 0.76%, with other major benchmarks 1-3bps cheaper.

- Looking ahead, the data docket is relatively light this week. Labor Cash earnings on Friday are the highlight.

- On the supply side tomorrow we have a Y2.7tn 10 Year Bond Auction and on Thursday Y900bn of 30-Year JGBs will come to market.

AUSSIE BONDS: Cash Closed Today, Muted Session For Futures

XM and YM observed narrow ranges today with little follow through on moves. Cash was closed today due to the holiday in NSW.

- XM sits at 95.475, -0.025, and YM at 95.88, -0.03, both contracts have observed narrow ranges in a muted Asian session on Monday.

- RBA dated futures price no change in the cash rate ahead of tomorrow's monetary policy decision. A terminal rate of 4.35% is seen in June 2024.

- Looking at the data docket the aforementioned RBA decision provides the highlight. We also have Trade Balance crossing on Thursday.

NZGBs: Cheaper, RBNZ In View

NZGBs have finished dealing 5-7bps cheaper across the major benchmarks, the curve has bear steepened.

- A cheapening in US Tsys, after a deal to avert a govt shutdown pass Congress over the weekend, spilled over into the wider space.

- August Building Permits fell 6.7% M/M, the prior read was revised lower to -5.4%. A reminder that early this morning the NZIER Shadow Board recommended that the OCR be held unchanged this week, 2 of the board said that the OCR should be hiked 25 bps with 6 members voting for unchanged.

- RBNZ OIS price no change at this week's meeting, a terminal rate of 5.75% is seen in February 2024.

- The aforementioned RBNZ meeting on Wednesday headlines an otherwise thin docket this week.

GOLD: Bullion Continues To Weaken As Rate Cut Expectations Postponed

Gold prices fell 0.9% on Friday driven by a stronger greenback during the NY session. It is down another 0.3% to $1843.84/oz during the APAC session today although trading is thin with a number of holidays across the region. It is off its intraday low of $1842.94 but is still at its lowest since before US banking troubles erupted in early March. The USD index is 0.1% higher.

- The fall in bullion to below $1900/oz triggered ETF outflows, and exacerbated the sell-off, according to Bloomberg.

- S&P e-minis are up 0.6% today as risk appetite improved following the avoidance of a US government shutdown on the weekend.

- Expectations that interest rates will be higher for longer thus postponing the start of monetary easing has pushed bond yields higher across the OECD and weighed on gold prices. They are approaching support at $1839.

- Later Fed Chairman Powell and Fed’s Harker and Williams speak. US manufacturing ISM/PMIs for September and August construction spending print. European manufacturing PMIs are also released and the euro area unemployment rate. BoE’s Mann is scheduled to speak.

OIL: Thin Asian Trading, Crude Supported By Supply Fundamentals

Oil prices are up around 0.3% during APAC trading today and are off their intraday lows. WTI is trading around $91.08/bbl after falling to $90.80 earlier. Brent is $92.44 after falling to $92.17. Trading is thin with a number of markets closed. The USD index is slightly higher.

- The Adipec energy summit being held from October 2 to 5 in Abu Dhabi is expected to provide some insight into how oil producers are viewing the market currently. UAE energy minister Al Mazrouei and OPEC secretary general Al-Ghais are scheduled to speak, according to Bloomberg.

- Crude continues to be supported by tight supply, falling inventories and Russia’s ban on diesel exports. There are also signs of increasing demand and this week’s week-long holiday in China will be watched closely for traveller numbers. Prompt spreads remain in backwardation implying a tight market.

- Later Fed Chairman Powell and Fed’s Harker and Williams speak. US manufacturing ISM/PMIs for September and August construction spending print. European manufacturing PMIs are also released and the euro area unemployment rate. BoE’s Mann is scheduled to speak.

FOREX: USD, Tsy Yields Marginally Firmer As Shutdown Avoided

The USD has ticked marginally higher alongside US Tsy Yields after a US Government shutdown was avoided. .Yesterday Congress passed a stopgap funding bill Saturday evening. The Senate voted to pass the bill on a 88 to 9 margin after the House had voted 335-91. The deal funds govt to the 17 November 2023.

- AUD/USD is pressured and sits at $0.6415/20, the pair is down ~0.3%. For now short term gains are considered corrective, and the trend condition remains bearish. Support comes in at $0.6331, low from Sep 27 and bear trigger. Resistance is at $0.6487 the 50-Day EMA.

- Kiwi is little changed, NZD/USD has see-sawed around the $0.60 handle in thin trade this morning. It is likely that pre-RBNZ positioning will dominate flows this week.

- The Yen is pressured, USD/JPY is up ~0.4% and sits at ¥149.75/80. The trend outlook for USD/JPY is unchanged and remains bullish. Resistance comes in at ¥149.71, high from October 24 2022, then 150 which is round number resistance. Support is seen at ¥147.82 the 20-Day EMA.

- Cross asset wise; US Tsy Yields are ~4bps firmer across the curve. E-minis are up ~0.6%. BBDXY is ~0.1% firmer.

- Looking ahead, the docket is mostly thin in Europe today, the September ISM MFG Survey is due further out.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/10/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 02/10/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 02/10/2023 | 0700/0900 |  | EU | ECB's de Guindos speaks at Foro Empresarial El Diario Vasco | |

| 02/10/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/10/2023 | 0730/0930 |  | SE | Riksbank monetary policy minutes | |

| 02/10/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 02/10/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/10/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/10/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/10/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 02/10/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 02/10/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 02/10/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 02/10/2023 | 1400/1000 | * |  | US | Construction Spending |

| 02/10/2023 | 1500/1600 |  | UK | BOE's Mann speaks at Redburn/Rothschild event | |

| 02/10/2023 | 1500/1100 |  | US | Fed Chair Jerome Powell | |

| 02/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 02/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 02/10/2023 | 1700/1300 |  | US | Fed Vice Chair Michael Barr | |

| 02/10/2023 | 1730/1330 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.