-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. CPI In View

EXECUTIVE SUMMARY

- HAWKISH FOMC MINUTES SHOW NO SIGN OF PIVOT (MNI)

- MNI: FED’S BOWMAN SEES SIZABLE HIKES IF INFLATION DOESN’T EBB (MNI)

- ECB CLOSING IN ON RULE CHANGE TO SHAVE BANKING PROFITS (RTRS SOURCES)

- ECB’S DE COS: SOME SHOCKS IN ECB DOWNSIDE SCENARIO HAVE MATERIALIZED (BBG)

- ECB NEUTRAL RATE NEAR 2% CAN BE REACHED IN 2022, HOLZMANN SAYS (BBG)

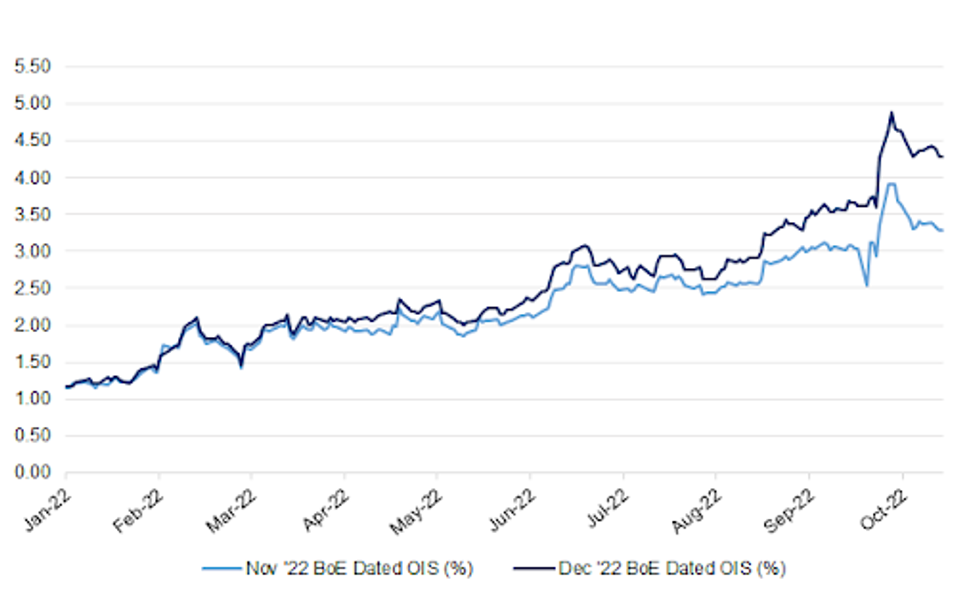

- BOE'S MANN HIGHLIGHTS CASE FOR FRONT-LOADING RATE RISES (MNI)

Fig. 1: Nov ‘22 & Dec ‘22 BoE Dated OIS

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Monetary Policy Committee member Catherine Mann, who has been one of THE most hawkish MPC members, has again made the case for front-loading rate hikes. (MNI)

BOE: Chancellor of the Exchequer Kwasi Kwarteng said the Bank of England will be responsible if UK markets suffer renewed volatility after its bond-buying program ends on Friday. Speaking on the sidelines of the International Monetary Fund’s annual meetings in Washington, Kwarteng told Sky News that any turmoil after the central bank withdraws support “is a matter for the governor.” (BBG)

FISCAL: Liz Truss has been told by her most senior advisers that she needs to rip up last month’s mini-budget and raise corporation tax as the price of restoring market confidence in her government. (The Times)

FISCAL: Liz Truss is under growing Tory pressure to raise corporation tax to reassure the markets over her debt reduction plan as she ruled out major spending cuts. (Telegraph)

FISCAL: Jacob Rees-Mogg has taken aim at the independent fiscal watchdog that analyses government budgets despite the huge market unrest. (Huffington Post)

PENSIONS: A number of UK companies are facing calls to provide emergency loans to their employee pension schemes in the latest bid for those funds to raise cash. (BBG)

PENSIONS: UK pension funds are dumping assets to meet margin calls as the BOE confirmed it will end emergency bond buying, and the reverberations are being felt everywhere from Sydney to Frankfurt and New York. (BBG)

ECONOMY: PageGroup, the global recruitment company, reported a “slight softening” in employers’ confidence across the majority of its regions as uncertainty creeps into the labour market. (The Times)

EUROPE

ECB: European Central Bank policymakers are closing in on a deal to change rules governing trillions of euros worth of loans to banks in a move that will shave tens of billions of euros off in potential banking profits, sources close to the discussion said. (RTRS)

ECB: Bank of Spain Governor Pablo Hernandez de Cos said that some of the shocks in the European Central Bank’s downside scenario “may have materialized.” The ECB published two different scenarios at its last meeting in October -- a baseline and a downside version that foresaw stronger inflation and a contraction in economic output in 2023. Still, de Cos noted that energy prices are lower than in the central scenario. (BBG)

ECB: The European Central Bank can get close to its neutral level of interest rate by the end the year if it hikes by a total of 125 basis points at its next two meetings, according to Governing Council member Robert Holzmann. (BBG)

FRANCE: France on Wednesday ordered some staff at an Exxon Mobil fuel depot back to work and warned a TotalEnergies depot could be next, risking a wider conflict with trade unions as it battles to secure petrol supplies after weeks of strikes. (RTRS)

U.S.

FED: Federal Reserve officials agreed inflation remains far too high and interest rates must keep rising to more restrictive levels and stay there for a while, showing little hint of a near-term shift in the course of policy, according to minutes from the FOMC’s September meeting released on Wednesday. (MNI)

FED: The Federal Reserve should keep hiking interest rates aggressively unless unacceptably quick inflation shows signs of receding, and policy must remain tight for a while after that, Governor Michelle Bowman said Wednesday. (MNI)

FISCAL/ECONOMY: U.S. Treasury Secretary Janet Yellen sought Wednesday to project confidence in the U.S. financial outlook while pledging vigilance in responding to “risks on the horizon.” (AP)

US TSYS: Treasury Secretary Janet Yellen cited concerns about the potential for a breakdown in trading of US Treasuries, as her department leads an effort to shore up that crucial market. (BBG)

ENERGY: U.S. consumers can expect to pay up to 28% more to heat their homes this winter than last year due to surging fuel costs and slightly colder weather, the U.S. Energy Information Administration (EIA) projected in its winter fuels outlook on Wednesday. (RTRS)

OTHER

GLOBAL TRADE: Taiwan Semiconductor Manufacturing Co. has secured a one-year license to continue ordering American chipmaking equipment for its expansion in China after the U.S. rolled out tough export controls to block Beijing's tech ambitions, sources briefed on the matter told Nikkei Asia. (Nikkei)

U.S./CHINA: The China Semiconductor Industry Association opposes the U.S. Commerce Department's export control regulations and hopes the U.S. government can "correct wrong practices in a timely manner," the trade group said in a statement on Thursday. (RTRS)

GEOPOLITICS: The White House rolled out a long-delayed national security strategy on Wednesday that seeks to contain China's rise while reemphasizing the importance of working with allies to tackle challenges confronting democratic nations. (RTRS)

G7: The Group of Seven aims to enhance policy cooperation in an effort to address a further slowdown in the global economic recovery as risks continue to mount, according to a draft communique. (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Wednesday the government will take decisive action in the currency market if speculative moves were seen in the yen. (RTRS)

JAPAN: Japanese firms overwhelmingly support increasing defence spending amid heightened sabre-rattling in Asia, according to a Reuters monthly poll on Thursday, which also showed half of companies expect the yen's decline to hurt profits. (RTRS)

BOJ: The International Monetary Fund said that the Bank of Japan shouldn’t even consider policy adjustments to improve the sustainability of its yield curve control right now, as they are likely to be interpreted as a step toward tightening. (BBG)

HONG KONG: Hong Kong will not give up on frequent Covid-19 tests for arrivals even if the city’s border restrictions are further relaxed, a move insiders do not expect to happen soon, the Post has learned. (SCMP)

HONG KONG: Hong Kong is considering easing property taxes and visa restrictions as authorities seek to curb a pandemic brain drain that’s threatened the city’s status as an international financial hub. (BBG)

NORTH KOREA: North Korean leader Kim Jong Un oversaw the launch of two long-range strategic cruise missiles, state media reported on Thursday, calling it a test to confirm the reliability and operation of nuclear-capable weapons deployed to military units. (RTRS)

NORTH KOREA: President Yoon Suk-yeol said Thursday he is looking carefully at "various possibilities" on how to further strengthen U.S. extended deterrence against North Korea's growing nuclear threat. (Yonhap)

RUSSIA: Weekly consumer prices in Russia rose for the third week running, data published on Wednesday showed, after almost three months of weekly deflation and a little over two weeks before the central bank next meets to decide on interest rates. (RTRS)

SAUDI ARABIA: The U.S. isn’t currently planning any significant changes to the number of U.S. forces stationed in Saudi Arabia but some aspects of the two nations’ extensive defense cooperation could be affected following President Biden’s decision to reassess relations after OPEC+ unveiled an oil production cut, U.S. officials said. (WSJ)

CHILE: Chile’s central bank raised its interest rate by 50 basis points, saying borrowing costs have reached the highest level of its tightening cycle and that they will remain steady to ensure inflation eases to target. (BBG)

METALS: The Biden administration is considering a complete ban on Russian aluminum -- long shielded from sanctions due to its importance in everything from automobiles and skyscrapers to iPhones -- in response to Russia’s military escalation in Ukraine. (BBG)

ENERGY: Russia is considering building more subsea natural gas pipelines to Turkey to redirect the idled flows on the Nord Stream link to Europe, President Vladimir Putin said ahead of a meeting with Turkish leader Recep Tayyip Erdogan. (BBG)

ENERGY: At least eight Katyusha rockets were fired at the Khor Mor gas field in Iraq's Kurdistan region on Wednesday, but the attack did not result in casualties or affect the operations, sources said. (RTRS)

ENERGY: The European Union will unveil proposals next week to launch joint gas buying within months and develop an alternative gas price benchmark, but a meeting of EU countries on Wednesday left it unresolved whether the package would include a gas price cap. (RTRS)

OIL: Saudi Minister of State for Foreign Affairs Adel al-Jubeir said his country partnered with Russia to slash oil production in order to stabilize markets and denied that there were political motives behind the decision, which has enraged US leaders and sparked calls to rethink ties with Riyadh. (CNN)

OIL: Some Biden administration officials are growing concerned that their plan to cap the price of oil purchased from Russia may backfire after the OPEC+ alliance’s surprise production cut last week, according to people familiar with the matter. (BBG)

OIL: U.S. Treasury Secretary Janet Yellen said on Wednesday that a price cap on Russian oil exports in the $60-a-barrel range would likely be sufficient to reduce Moscow's energy revenues while allowing profitable production. (RTRS)

OIL: The United States is starting to see success with discussions of a Russian oil price cap by the Group of Seven (G7), as Washington has heard countries are negotiating deals with Russia to buy oil far below the benchmark Brent crude price, a top U.S. Treasury official said Wednesday. (RTRS)

OIL: Senate Energy Committee chair Joe Manchin (D-W.Va.) is urging President Biden to marshal executive powers to help boost U.S. oil production following the OPEC+ move to cut output. (Axios)

OIL: U.S. Deputy Energy Secretary David Turk said on Wednesday that the United States has millions of barrels in the Strategic Petroleum Reserve, and Washington will try to use those barrels responsibly where it makes sense to stabilize markets. (RTRS)

OIL: Russia plans to expand its port capacity by 40m tons/year for oil exports as an alternative to crude shipments to Europe via the Druzhba pipeline, Interfax reports, citing Russian Deputy Prime Minister Alexander Novak. (BBG)

OIL: Germany said on Wednesday it was receiving less oil but still had adequate supplies, after Poland found a leak in the Druzhba pipeline that delivers crude from Russia to Europe that Warsaw said showed no sign of being caused by sabotage. (RTRS)

OIL: U.S. oil demand and production is expected to grow more slowly than previously forecast for the remainder of this year and in 2023, the U.S. Energy Department said on Wednesday. (RTRS)

CHINA

ECONOMY: Many local governments plan to boost Q4 economic growth by focusing on stabilising investment and promoting consumption, Securities Daily reported. Sichuan, Shandong, (MNI)

POLICY: China will conduct a sample survey of the nation’s population changes in 2022 in Nov., the National Bureau of Statistics says in a statement. (BBG)

PROPERTY: Some local governments in China are buying apartments previously intended for sale in the private market, or encouraging state-owned enterprises to purchase units, and then turning them into public housing in a bid to shore up the sluggish property market, Caixin reported. (MNI)

PROPERTY/CREDIT: A Chinese developer with state backing for domestic funding support has defaulted on a Hong Kong dollar convertible bond, raising concerns about Beijing’s ability to contain the severe liquidity crisis among the nation’s property firms. (BBG)

DIGITAL YUAN: The People’s Bank of China will explore the establishment of a multilateral cooperation mechanism for the cross-border payment of digital yuan, and participate in the Multiple Central Bank Digital Currency (m-CBDC) Bridge Project advocated by the Bank for International Settlements, according to a statement on its social media account. (MNI)

CHINA MARKETS

CHINA NET DRAINS CNY75BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY75 billion after offsetting the maturity of CNY77 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7808% at 09:39 am local time from the close of 1.5226% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Wednesday vs 47 on Tuesday.

CHINA SETS YUAN CENTRAL PARITY AT 7.1101 THURS VS 7.1103 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1101 on Thursday, compared with 7.1103 set on Wednesday.

OVERNIGHT DATA

JAPAN SEP PPI +9.7% Y/Y; MEDIAN +8.9%; AUG +9.0%

JAPAN SEP PPI +0.7% M/M; MEDIAN +0.3%; AUG +0.2%

JAPAN SEP BANK LENDING INCLUDING TRUSTS +2.3% Y/Y; AUG +1.9%

JAPAN SEP BANK LENDING EXCLUDING TRUSTS +2.6% Y/Y; AUG +2.2%

AUSTRALIA OCT MELBOURNE INSTITUTE CONSUMER INFLATION EXPECTATIONS +5.4%; SEP +5.4%

NEW ZEALAND SEP FOOD PRICES +0.4% M/M; AUG +1.1%

SOUTH KOREA SEP HOUSEHOLD LENDING KRW1,059.5TN; AUG KRW1,060.7TN

UK SEP RICS HOUSE PRICE BALANCE +32%; MEDIAN +45%; AUG +51%

MARKETS

SNAPSHOT: U.S. CPI In View

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 122.17 points at 26274.53

- ASX 200 down 4.94 points at 6642.6

- Shanghai Comp. down 1.814 points at 3023.692

- JGB 10-Yr future down 2 ticks at 148.39, yield down 0.5bp at 0.251%

- Aussie 10-Yr future down 5.0 ticks at 95.98, yield up 5.3bp at 4%

- U.S. 10-Yr future -0-06 at 111-09+, yield up 2.27bp at 3.9189%

- WTI crude up $0.04 at $87.31, Gold down $2.87 at $1670.32

- USD/JPY down 5 pips at Y146.86

- HAWKISH FOMC MINUTES SHOW NO SIGN OF PIVOT (MNI)

- FED’S BOWMAN SEES SIZABLE HIKES IF INFLATION DOESN’T EBB (MNI)

- ECB CLOSING IN ON RULE CHANGE TO SHAVE BANKING PROFITS (RTRS SOURCES)

- ECB’S DE COS: SOME SHOCKS IN ECB DOWNSIDE SCENARIO HAVE MATERIALIZED (BBG)

- ECB NEUTRAL RATE NEAR 2% CAN BE REACHED IN 2022, HOLZMANN SAYS (BBG)

- BOE'S MANN HIGHLIGHTS CASE FOR FRONT-LOADING RATE RISES (MNI)

US TSYS: Modest Cheapening Overnight, CPI Eyed

Spill over from weakness in ACGBs coupled with block sales in FV & TY futures applied some light pressure in pre-CPI Asia-Pac trade, leaving the major cash Tsy benchmarks 1.0-2.5bp cheaper as we moved towards London hours, with modest bear steepening of the curve in play.

- TYZ2 deals 0-06+ cheaper on the session, printing 111-09, 0-00+ off the base of its 0-08+ session range, on limited volume of ~59K.

- There hasn’t been much in the way of meaningful headline flow cross, outside of Fed Governor Bowman flagging uncertainty re: the required terminal rate of the current hiking cycle, as she reaffirmed the prospect of sizable hikes until inflation falls, alongside the need for restrictive policy settings for some time.

- FOMC dated OIS currently prices a terminal rate of ~4.65%, with ~74bp of tightening priced for next month’s FOMC.

- The previously flagged block sales in FV (-2K) & TY (-2.5K, -1.5K & -1.6K) futures were also accompanied by a block buyer of TYX2 110.00 puts (+5K)

- Gilt market gyrations and the impending U.S. CPI report provide the two focal points on Thursday, (see our full preview of the CPI release here). Elsewhere, weekly jobless claims data, 30-Year Tsy supply and Fedpseak from Waller, Cook & George will hit during NY hours.

JGBS: Twist Flattens, Possibly Aided By Lifers Being Active In Long End

The JGB curve twist flattened during the Tokyo morning, with domestic life insurers and pension funds perhaps eying the multi-year high ~120bp pickup for 30-Year yields over 10s as an entry point.

- Although it is hard to be certain of that dynamic given the lack of demand at Wednesday’s soft 30-Year auction.

- Spill over from Wednesday’s late UK Gilt/U.S. Tsy bid may also be supporting longer dated paper.

- Still, a modest downtick in U.S. Tsys during the Tokyo session has seemingly applied pressure to paper out to 7s, as well as JGB futures, with the major cash benchmarks in that zone running ~1bp cheaper on the day, while futures stick to a narrow range, last -3.

- Firmer than expected domestic PPI data likely played into the weakness in the sub-10-Year zone.

- BBG recently flagged that cash 10s have traded, breaking a run of 4 consecutive untraded sessions.

- Friday’s local docket is headlined by 5-Year JGB supply, with the latest round of weekly international security flow data from the MoF also set to provide the usual interest.

AUSSIE BONDS: Curve Steeper, U.S. CPI Eyed

Aussie bonds came under some steepening pressure on Thursday, leaving YM +0.5 & XM -4.5 ahead of the close, as wider cash ACGB trade sees 0.5bp of richening to 5.0bp of cheapening, with a pivot around 5s and a parallel shift in the 10+-Year zone.

- There wasn’t an overt driver for the move, leaving us to suggest that the lack of willingness to force a meaningful move below the 0bp level in the AU/U.S. 10-Year yield spread may be at the fore, with the latest bounce away from that level observed in Sydney trade, alongside the early weakness in ACGBs, before a correction off of worst levels.

- Bills run +2 to 1 through the reds, with RBA dated OIS pricing a terminal rate of ~3.95%, little changed on the day.

- Melbourne Institute inflation expectations data was unchanged at 5.4% in October, with the reading operating a little over 1.0ppt off its cycle peak.

- Looking ahead, Friday will see a A$700mn of ACGB Apr-27 supply, the release of the weekly AOFM issuance slate and local reaction to Thursday’s U.S. CPI print.

NZGBS: NZGBs A Little Flatter, Off Best Levels

NZGBs moved away from best levels as ACGBs and U.S. Tsys traded a little softer during Thursday’s Asia-Pac session, leaving the major benchmarks 1-3bp richer on the day come the bell, with some light bull flattening in play.

- NZGBs did regain some poise, moving away from worst levels, even with payside flow evident in swaps, which resulted in swap spread widening on the session.

- The latest round of NZGB supply (consisting of Apr-25, May-32 & May-41) saw firmer demand for the longer-dated paper on offer (cover ratios of 1.68x, 2.11x and 2.78x), which aided the flattening dynamic. Lower cover for the shorter-dated paper on offer was perhaps a function of uncertainty re: monetary policy and ongoing market vol.

- RBNZ dated OIS continues to price a terminal OCR of ~4.90%, little changed on the day.

- Friday’s domestic docket will be headlined by m’fing PMI data, although catch up to core FI market gyrations in lieu of the impending the U.S. CPI print will probably provide more market impact during the early rounds of Friday dealing.

EQUITIES: Major Indices Mostly Lower In Asia

The MSCI Asia-Pacific Index is on track to record a fifth consecutive day of losses, with the negative lead from Wall St., worry re: the impending U.S. CPI print and continued woes for Chinese tech names, stemming from Sino-U.S. tensions, applying pressure to the space during Thursday dealing.

- The Hang Seng leads the way lower, last dealing 1.0% softer on the day.

- The latest, albeit well telegraphed, property developer debt default out of China got plenty of airtime.

- The ASX 200 has bucked the regional trend, adding a mere 0.1%, with guidance from Qantas supporting names linked to tourism, while financials benefited from Bank of Queensland’s earnings report. Still, a heavy day for real estate-linked names limited gains.

- The 3 major U.S. e-mini contracts are essentially unchanged on the day.

OIL: Global Growth Fears Driving Market, Watch US CPI

Oil prices are little changed from overnight trading and have been range trading ahead of the US September CPI data later. WTI has been in the tight range of $87.00-87.50/bbl, now at $87.11, and Brent $92.45-$92.90 and is currently $92.43/bbl.

- WTI has broken through both its 5- and 50-day moving averages and is now headed towards the 20-day MA.

- Global growth concerns have been weighing on commodities generally, as markets are expecting demand to fall. Confirming these fears OPEC cut its oil demand forecasts for 2022 and 2023. US and Japanese crude inventories rose in the latest data. These concerns have been driving the unwinding of last week’s output-driven rally.

- There was further talk regarding US plans to impose a price cap on oil from Russia. Bloomberg reported that some US officials are concerned that the strategy will actually cause a jump in oil prices, as Russian President Putin has said he won’t supply anyone who participates in the cap. It remains a very sensitive issue.

GOLD: Coiling Into U.S. CPI

Asia-Pac trade has seen spot gold stick within the confines of the narrow range established over the last couple of sessions, last dealing little changed, just below $1,670/oz.

- The broader USD remains within touching distance of cycle highs, with our weighted U.S. real yield monitor exhibiting a similar dynamic.

- The impending U.S. CPI print presents the next major macro risk event and will cross early in the NY morning.

- Market participants are assessing the potential terminal rate of the current Fed hiking cycle (last priced at ~4.65%, per dated OIS) , with the swift monetary tightening deployed YtD more than offsetting well-documented geopolitical worries, leaving gold ~19% off its YtD high, or the best part of 9% lower YtD.

- The initial technical support and resistance lines are well defined. The 3 Oct low ($1,659.7/oz) protects key support at the YtD base ($1,615.0/oz). Meanwhile, initial resistance is seen at the Oct 4 high ($1,729.5/oz)

FOREX: Yen Takes Focus, Tight Ranges Observed Ahead Of U.S. CPI

The yen was in the spotlight after USD/JPY breached prior intervention levels on Wednesday and kept climbing as BoJ Gov Kuroda reaffirmed the central bank's dovish credentials. The rate got some reprieve in early Asia trade, but clawed back losses into the Tokyo fix and still operates within touching distance from the Y147.00 mark.

- Japanese FinMin Suzuki reiterated that officials are focusing on volatility rather than specific levels of the exchange rate and stand ready to take bold action if they see excessive moves. USD/JPY overnight implied volatility extended yesterday's upswing to 22.4%.

- Sterling traded on a heavier footing, with uncertainty surrounding the UK's fiscal outlook still causing reverberations in the FX market.

- The U.S. CPI report provides the highlight of today's session, with headline inflation expected to have slowed to +8.1% Y/Y in September, per a Bloomberg survey. The data will inform the debate on Fed tightening outlook. As things stand, another 75b rate hike is virtually fully priced for the November FOMC meeting.

- Other notable data releases include U.S. jobless claims, as well as German and Swedish CPI figures. Speeches are due from ECB's Nagel & Riksbank's Breman.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/10/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/10/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 13/10/2022 | 0730/0930 |  | EU | ECB de Guindos Speech at (M&A) España y Europa Event | |

| 13/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 13/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/10/2022 | 1230/0830 | *** |  | US | CPI |

| 13/10/2022 | 1300/1400 |  | UK | BOE Mann Speech at Peterson Institute for Internat. Economics | |

| 13/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/10/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 13/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/10/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/10/2022 | 1700/1300 |  | US | Atlanta Fed Raphael Bostic | |

| 13/10/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.