-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD/JPY Back Above 150.00 On Dovish BoJ YCC Tweak

EXECUTIVE SUMMARY

- BOJ KEEPS YCC, 1% 10-YEAR JGB YIELD AS REFERENCE - MNI BRIEF

- FY25 CORE-CORE CPI 1.9%, 2% In Sight - BOJ OUTLOOK - MNI BRIEF

- JAPAN FACTORY OUTPUT RISES FIRST IN THREE MONTHS - MNI BRIEF

- CHINA’S OCT PMI FALLS BACK TO CONTRACTION AT 49.5 - MNI BRIEF

- INTEREST RATE VOL TO IMPACT MARKETS - RBA’S JONES - MNI BRIEF

- INFLATION IN UK SHOPS DROPS TO LOWEST IN MORE THAN A YEAR - BGB

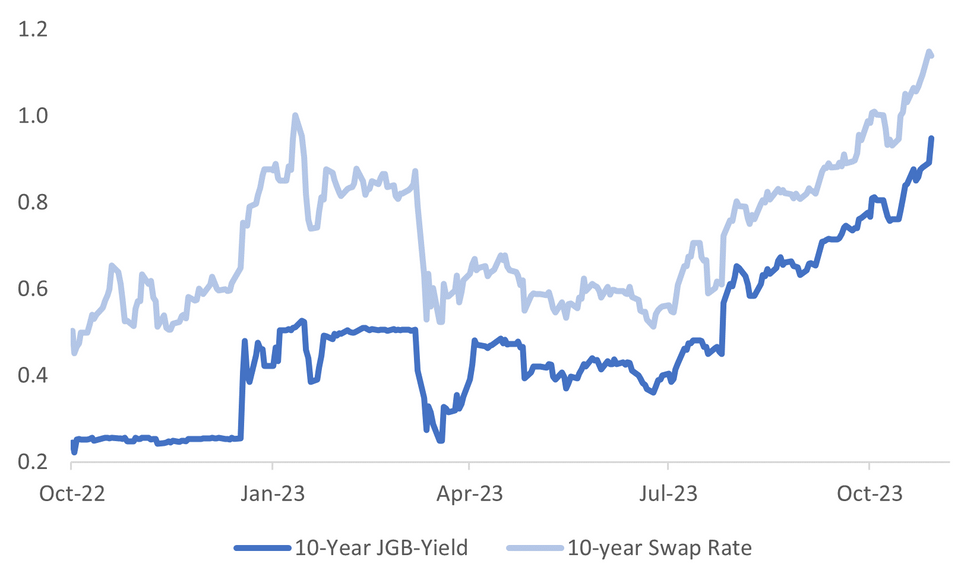

Fig. 1: Japan 10yr JGB Yield & 10yr Swap Rate

Source: MNI - Market News/Bloomberg

U.K.

PRICES (BBG): Inflation in UK stores fell to the lowest level in more than a year in another sign that the cost-of-living crisis is starting to ease.

EUROPE

GROWTH (ECONOMIST): “Europe on the verge of recession” The EU’s and euro zone’s preliminary GDP figures for the third quarter,

released on Tuesday, will probably indicate the start of a recession.

EU/ISRAEL(POLITICO): “Israeli President Herzog endorses Macron’s plan for a coalition to fight Hamas”

NORWAY (POLITCO): Norway's government risks crisis over a contentious package of EU energy bills.

U.S.

POLITICS (RTRS): U.S. House of Representatives Republicans on Monday introduced a plan to provide $14.3 billion in aid to Israel by cutting funding for the Internal Revenue Service, setting up a showdown with Democrats who control the Senate.

POLITICS (RTRS): Donald Trump should be disqualified from Colorado's ballot in next year's election because he "incited a violent mob" in Washington on Jan. 6, 2021, an advocacy group lawyer argued at the opening of a trial on Monday.

CORPORATE (BBG): Apple Inc. announced a new iMac, MacBook Pros and the third generation of its in-house Mac processor line, rolling out a first-of-its-kind M3 chip that boosts performance and graphics horsepower.

US/CHINA (WSJ): New U.S. export controls may compel artificial-intelligence giant Nvidia to cancel billions of dollars in next-year orders for its advanced chips to China, a move that could deprive Chinese tech companies of crucial AI resources.

OTHER

ISRAEL (RTRS): Hamas said its militants in Gaza fired anti-tank missiles at Israel's invading forces early on Tuesday and Prime Minister Benjamin Netanyahu dismissed calls for a halt to fighting that has deepened the Palestinian enclave's humanitarian crisis.

JAPAN (MNI BRIEF): The Bank of Japan board on Tuesday maintained yield curve control, but shifted to a more flexible stance toward the 10-year interest rate, changing its language on the 1% upper bound to refer to it as a reference point in its market operations.

JAPAN (MNI BRIEF): While the Bank of Japan board does not believe Japan's economy will achieve the 2% price target over its March 2026 projection period, its latest forecasts show the target may become apparent in April, the BOJ's Outlook Report showed on Tuesday.

JAPAN (MNI BRIEF): The Bank of Japan said on Tuesday it would leave the frequency of Japanese government bond buying operations and the scale per operation of each zone unchanged in Q4 from the previous quarter.

JAPAN (MNI BRIEF): Japan's industrial output rose 0.2% m/m in September, its first rise in three months, following a 0.7% fall in August, due to higher production of motor vehicles and general-purpose, and business oriented machinery, data released by the Ministry of Trade and Industry showed on Tuesday.

AUSTRALIA (MNI BRIEF): Structurally higher interest rate volatility could threaten the financial system in future, according to Brad Jones, assistant governor (financial system), at the Reserve Bank of Australia.

SOUTH KOREA (BBG): Samsung Electronics Co. beat profit expectations in the third quarter and predicted a recovery in the semiconductor market next year.

CHINA

ECONOMY (MNI BRIEF): China's manufacturing Purchasing Managers' Index fell by 0.7 points to 49.5 in October, falling back to the contractionary zone below the breakeven 50 mark, indicating that the foundation for continued recovery requires further consolidation, data from the National Bureau of Statistics showed Tuesday.

HOUSING (MNI CHINA PRESS BRIEF): Guangzhou, one of the four first-tier cities, will offer housing vouchers for resettlement amid urban village transformation. This will allow villagers to deduct a certain amount of payment if they choose to buy commercial housing elsewhere, which will help lower housing stock and help alleviate financing pressure in the initial stage, said Li Yujia, chief research fellow at Guangdong Urban & Rural Planning and Design Institute.

LIQUIDITY (MNI CHINA PRESS BRIEF): China must carefully coordinate monetary and fiscal policy to avoid liquidity tightening in Q4 following the government’s decision to issue an additional CNY1 trillion in treasury bonds, according to Guan Tao, former director at China's State Administration of Foreign Exchange.

CHINA/US (PEOPLE’S DAILY/BBG): China and the US should push for bilateral relations to return to a healthy path after recent signs of improvement, People’s Daily says in a commentary Tuesday. Progress in the relationship is in the whole world’s interests, according to the commentary written under the pen name Zhong Sheng, which can be read as “Voice of China”

EQUITIES (YICAI/BBG): Ministry of Finance’s new method of evaluating the financial performance of state-owned commercial insurance companies can drive more long-term funds into the stock market, Yicai reports, citing analysts.

EQUITIES (XINHUA/BBG): The chairwoman of E Fund Management Co., Liu Xiaoyan, says in an article she wrote in Xinhua on Monday that there’s limited downside risks to China stocks, making now a good time to buy for the long term.

CHINA MARKETS

MNI: PBOC Injects Net CNY19 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY612 billion via 7-day reverse repo on Tuesday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY19 billion after offsetting the maturity of CNY593 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8853% at 09:47 am local time from the close of 2.1526% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 43 on Monday, compared with the close of 41 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1779 Tuesday vs 7.1781 Monday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1779 on Tuesday, compared with 7.1781 set on Monday. The fixing was estimated at 7.3019 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND SEP BUILDING PERMITS -4.7%; PRIOR -6.7%

NEW ZEALAND OCT ANZ ACTIVITY OUTLOOK 23.1; PRIOR 10.9

NEW ZEALAND OCT ANZ BUSINESS CONFIDENCE 23.4; PRIOR 1.5

SOUTH KOREA SEP IP M/M 1.8%; MEDIAN -1.0%; PRIOR 5.5%

SOUTH KOREA SEP IP Y/Y 3.0%; MEDIAN -0.8%; PRIOR -0.5%

JAPAN SEP JOBLESS RATE 2.6%; MEDIAN 2.6%; PRIOR 2.7%

JAPAN SEP JOB-TO-APPLICANT RATIO 1.29; MEDIAN 1.29; PRIOR 1.29

JAPAN SEP RETAIL SALES M/M -0.1%; MEDIAN 0.2%; PRIOR 0.2%

JAPAN SEP RETAIL SALES Y/Y 5.8%; MEDIAN 5.9%; PRIOR 7.0%

JAPAN SEP P IP M/M 0.2%; MEDIAN 2.5%; PRIOR -0.7%

JAPAN SEP P IP Y/Y -4.6%; MEDIAN -2.3%; PRIOR 4.4%

AUSTRALIA SEP PRIVATE SECTOR CREDIT M/M 0.5%; MEDIAN 0.3%; PRIOR 0.4%

AUSTRALIA SEP PRIVATE SECTOR CREDIT Y/Y 4.9%; PRIOR 5.1%

CHINA OCT MANUFACTURING PMI 49.5; MEDIAN 50.2; PRIOR 50.2

CHINA OCT NON-MANUFACTURING PMI 50.6; MEDIAN 52.0; PRIOR 51.7

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 106-08, +0-01, a 0-11 range has been observed on volume of ~140k.

- Cash tsys sit ~2bps richer across the major benchmarks.

- Tyss firmed off session lows as mild risk off tone took hold in Asia. The USD firmed and US Equity futures ticked lower. A mixed Chinese PMI print added a layer of support.

- Gains extended in volatile trade as a bid in JGBs as the BOJ decision spilled over into the wider space. Tsys held onto some of the gain dealing in a narrow range for the remainder of the session.

- Eurozone CPI and GDP data headlines in Europe today. Further out we have the US Conference Board consumer confidence and employment cost index.

JGBS: BOJ Decision Largely As Expected, Futures Pare Losses

JGB futures spiked sharply higher early in the Tokyo afternoon session after the BOJ left policy unchanged at -0.1% in a unanimous vote. However, it has subsequently unwound that move.

- JGB futures re-opened, spiking to 144.24 from the lunchtime level of 143.88, -36 compared to settlement levels. Earlier, JBZ3 hit 143.57. It is currently 143.86, -39 compared to settlement levels.

- The BOJ has also maintained the upper limit of the Yield Curve Control (YCC) at 1%. This decision drew significant market attention, especially in light of overnight Nikkei headlines that suggested the BOJ might consider adjusting the YCC framework. However, it's noteworthy that the BOJ now labels the upper limit as a "reference." The concept of a 1% upper boundary being regarded as a "reference" implies the possibility of allowing it to slightly exceed 1%, though the extent of flexibility the BOJ has introduced remains subject to debate. We'll need to monitor the BOJ's interventions to determine how far they are willing to let it rise.

- In summary, the decision aligns with general expectations. It involves a minor adjustment in the wording to provide room for flexibility regarding the upper limit for long-term yields while maintaining its accommodative monetary policy stance.

- The cash JGB curve has retained its bearish steepening in post-BOJ trading, but the yield rises have been pared. Yields are 1.9 to 4.7bps higher across benchmarks. Notably, the benchmark 10-year yield is at 0.932% after reaching 0.963% earlier, a new cycle high. At lunch, it was4.2bps higher at 0.936%.

- The swaps curve has maintained its bull-flattening, with rates 0.6bp to 4.4bps lower. Swap spreads sharply tighter across maturities.

AUSSIE BONDS: Cheaper But Off Session Lows After The BOJ’s Dovish Tweak

ACGBs (YM -4.0 & XM -6.0) sit cheaper but have pared earlier losses after the BOJ delivered a dovish Yield Curve Control (YCC) tweak. Overall, the BOJ decision aligned with general market expectations. It involved a minor adjustment in the wording to provide room for flexibility regarding the upper limit for long-term yields while maintaining its accommodative policy stance.

- There have been few domestic drivers other than the previously outlined private sector credit data.

- US tsys initially reacted positively to the BOJ decision, although like JGBs, there has been a paring of the initial gains. Cash US tsys are 2-3bps richer in Asia-Pac trade.

- Cash ACGBs are 3-6bps cheaper, with the AU-US 10-year yield differential 6bps wider at +6bps.

- Swap rates are 3-6bps higher, with the 3s10s curve steeper.

- The bills strip has bear-steepened, with pricing flat to -3.

- RBA-dated OIS pricing is flat to 2bps firmer across meetings. Terminal rate expectations jump to 4.54%.

- Tomorrow, the local calendar sees CoreLogic House Prices, Building Approvals and Judo Bank PMIs.

- Tomorrow, the AOFM plans to sell A$800mn of the Apr-33 bond.

- SAFA priced an A$1bn increase of the 4.75% 24 May 2038 Line. It priced at 116.5bps over the 10-year futures contract at a yield of 6.15%.

NZGBS: Closed With A Twist-Steepening, Q3 Employment Data Tomorrow

NZGBs closed with a twist-steepening of the curve. Interestingly, the 2-year benchmark concluded at its highest level of the session, while the 10-year benchmark ended the day at its lowest point. It's worth noting that the BOJ's decision was released just three minutes before the local market's closing, so there is potential for some market adjustments to become evident in early trade tomorrow.

- Overall, the BOJ decision aligned with general market expectations. It involved a minor adjustment in the wording to provide room for flexibility regarding the upper limit for long-term yields while maintaining its accommodative policy stance.

- US tsys initially reacted positively to the BOJ decision, although like JGBs, there has been a paring of the initial gains. Cash US tsys are 1-3bps richer in Asia-Pac trade.

- Swap rates closed flat to 6bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed little changed.

- Business confidence rose to 23.4 in October from 1.5. Inflation expectations were little changed at 4.94%. “Inflation pressures are gradually waning but there hasn’t been a great deal of progress in the last couple of months. It’s still a very long way back to the inflation target”: ANZ

- Tomorrow, the local calendar sees CoreLogic House Prices and Q3 Employment data. The RBNZ will also publish its Financial Stability Report.

FOREX: Yen Pressured After BOJ Delivers YCC Tweak

The Yen has been after the latest monetary policy decision from the BOJ. Policy was left unchanged however the focus was on the language tweak around YCC, with the 1% upper bound referred to as a reference point.

- USD/JPY is ~0.5% firmer, however the pair is below the ¥150 handle for now after briefly breaching the handle in the aftermath of the BOJ decision. Technically the uptrend remains intact. Resistance comes in at ¥150.78, high from Oct 26, and ¥151.95, high from Oct 21.

- AUD is pressured, extending falls seen after a mixed Chinese PMI report as the bid in USD/JPY spills over into wider USD strength. AUD/USD is down ~0.4% at $0.6345/50. Technically the trend outlook is bearish, support comes in at $0.6270 low from Oct 26 and key support.

- Kiwi is down ~0.3% last print at $0.5825/30, NZD/USD sits a touch off session lows however ranges do remain relatively narrow.

- Elsewhere in G-10; EUR and GBP are down ~0.2% reflecting the broader move in the USD. BBDXY is up ~0.2%.

- Eurozone GDP data provides the highlight in Europe today.

EQUITIES: Japan Stocks Higher Post BoJ, Weaker China PMIs Hurt Sentiment Elsewhere

Regional equities are mostly down in Tuesday trade to date. Japan shares have been volatile around the BoJ decision but are in positive territory as the dust has settled on the central bank's dovish YCC tweak. The Topix was last ~1.0% higher. Weakness is evident elsewhere in NEA as China PMIs disappointed. US futures are weaker, although away from session lows. Eminis last near 4173, off ~0.30%, Nasdaq futures are down -0.50%.

- Headlines crossed from the WSJ that US tech curbs on China may see tech bellwether Nvidia cancel $5bn worth of orders (see this link). This has likely weighed on US tech sentiment and tech sensitive plays in NEA.

- Japan markets have been volatile, but are ultimately tracking higher at this stage. The BoJ dovish hold has weighed on yen (lats 150.00) which will boost exporters, but bank stocks are unwinding earlier gains, given only modest YCC tweaks and no end in sight to easier policy settings.

- The official China PMI prints for October were much weaker than expected, casting doubts on the recovery. At the break the CSI 300 is down 0.66%, while the HSI is off by 1.77%.

- In SEA, the Thailand SET is the worst performer, down around 1% at this stage. Indonesia's JCI is off by 0.70%. Australia's market is just a touch higher (0.1%).

CRUDE: Crude Flat After Losing Today’s Gains On Demand Worries & Stronger USD

Oil prices are flat today after falling sharply on Monday as the market focussed on demand again. They were already off intraday peaks when the disappointing China PMI data was released but then took another leg down and the stronger dollar has seen them now little changed on the day. China is the largest oil importer. The USD index is about 0.2% higher.

- Brent is around $86.38/bbl, close to the low of $86.30. It reached a peak of $86.98 early in the session. WTI is also unchanged at $82.38 following a low of $82.29. Its high before the China data was $82.93.

- Markets are now looking at the demand outlook again with the Fed and US payrolls this week and the conflict in Israel/Gaza seemingly contained in that region for now. The main concern for oil is if the confrontation spreads to Iran.

- Demand fundamentals are looking soft and without the war premium, oil prices may fall further. Gasoline demand in the US is looking weak, China is reducing refining and the IEA expects a sharp drop in German demand, according to Bloomberg.

- Baltic shipping data is showing that the cost of oil transport from the Middle East to China has risen to its highest since June 22 and that most other routes have also seen costs rise, according to Bloomberg.

- Later the US Q3 employment cost index, August house prices, October MNI Chicago PMI and conference board survey are released. There is also euro area Q3 GDP and preliminary October CPI and ECB’s de Guindos speaks. Oil markets will now be looking to Wednesday’s Fed meeting (see MNI Fed Preview).

GOLD: Steady After Being Pressured By Yields & Improving Risk Appetite On Monday

Gold is little changed in the Asia-Pac session, after closing 0.5% lower at $1996.10 on Monday. Bullion was pressured by higher US yields and improving risk appetite.

- US Treasuries were pressured through the NY session, with yields finishing 3-6bps higher on supply concerns and an improvement in risk appetite.

- The US Treasury expects to borrow $776bn in Q4 and an additional $816bn in Q1 2024. Both estimates would represent records for each respective quarter. However, the Q4 estimate was $76bn less than previously announced in July, due to projections of higher receipts.

- Nikkei headlines that posited the BOJ will consider tweaking the yield curve control framework at today’s policy meeting extended the selloff in US Treasuries on beliefs higher JGB rates could pull demand from US Treasuries.

- Risk appetite began the week on a positive note, with the market taking a sanguine view of indications that Israel was taking a less expansive approach to the invasion of Gaza. Wall Street finished up greater than 1%, while oil dropped ~4%.

- From a technical standpoint, gold remains far above support at $1937.6 (20-day EMA) after last week’s strength. MNI’s technicals team believes the precious metal is biased to further gains.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/10/2023 | 0630/0730 | *** |  | FR | GDP (p) |

| 31/10/2023 | 0630/0730 | ** |  | FR | Consumer Spending |

| 31/10/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/10/2023 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 31/10/2023 | 0730/0830 | ** |  | CH | Retail Sales |

| 31/10/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 31/10/2023 | 0745/0845 | ** |  | FR | PPI |

| 31/10/2023 | 0900/1000 | *** |  | IT | GDP (p) |

| 31/10/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 31/10/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 31/10/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 31/10/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 31/10/2023 | 1100/1200 | ** |  | IT | PPI |

| 31/10/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/10/2023 | 1230/0830 | ** |  | US | Employment Cost Index |

| 31/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/10/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 31/10/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 31/10/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 31/10/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 31/10/2023 | 1400/1000 | ** |  | US | housing vacancies |

| 31/10/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 31/10/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 31/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 01/11/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.