-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Supported, As Stronger CNY Fixing Sees Little Follow Through

EXECUTIVE SUMMARY

- FED’S COOK SAY ACHIEVING PRICE STABILITY TO TAKE CAUTION - MNI

- ISRAEL CANCELS DC TRIP AFTER US ALLOWS UN CEASE-FIRE RESOLUTION - BBG

- JAPAN FEB SERVICES PPI RISES 2.1% VS. JAN 2.1%

- TRADES IN CHINA’S LONG BONDS ARE GETTING CROWDED - SECURITIES DAILY

- RBA TO LOOK PAST VOLATILE LABOUR DATA - MNI POLICY

- AUSTRALIA’S CONSUMER SENTIMENT DROPS AS RATE-CUT PROSPECTS DIM - BBG

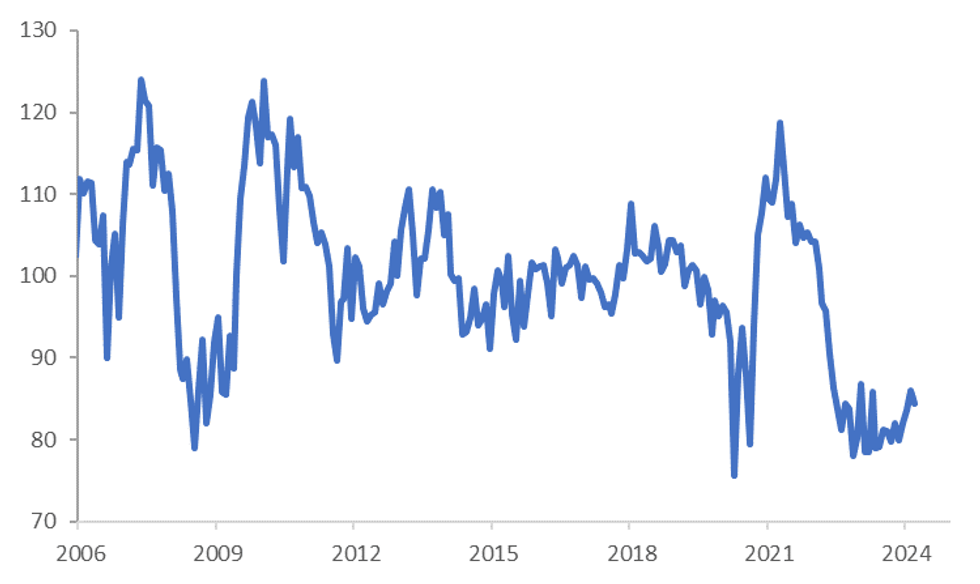

Fig. 1: Australian Westpac Consumer Sentiment Index Softens

Source: MNI - Market News/Bloomberg

U.K.

GEOPOLITICS (BBC): The UK government has formally accused China of being behind what it called "malicious" cyber campaigns against MPs and the Electoral Commission. Two people and a company have been sanctioned over cyber-attacks.

EUROPE

GERMANY (BBG): Chancellor Olaf Scholz signaled his willingness to discuss reforming Germany’s budget rules that limit borrowing to a fraction of the country’s economic output.

FRANCE (ECONOMIST): Insee, the official statistics body, will publish figures expected to show that the country’s budget deficit reached well over 5% of GDP in 2023. The government’s official target was 4.9%. This makes France one of the countries with the largest deficit, relative to its income, in the euro zone. Pierre Moscovici, head of the Cour des Comptes, the French national auditor, calls the problem “very preoccupying”.

UKRAINE (POLITICO): Lithuanian President Gitanas Nausėda is inside the room when fellow EU leaders meet and he's sensing a growing agreement among them on the view that Russia must be defeated in Ukraine.

U.S.

FED (MNI): Federal Reserve Governor Lisa Cook said Monday officials must cautiously balance the risk of easing monetary policy too much or too soon, allowing inflation to linger above target, and taking too long to ease, which could harm the economy needlessly and deprive people of economic opportunities.

FED (MNI INTERVIEW): Federal Reserve officials are making steady progress in the effort to bring inflation back to their 2% target, but must not ignore the risk that price pressures will stall at higher levels, former Richmond Fed research director John Weinberg told MNI.

JOBS (MNI): Two million older Americans have opted for early retirement since Covid, a trend that appears to be accelerating even as the job market bounced back and meaning employers are turning to younger workers to fill the gap, San Francisco Fed economists said in a paper Monday.

POLITICS (RTRS): A New York judge's decision on Monday to set an April 15 trial date for Donald Trump's criminal hush-money case ups the odds the former president will face at least one verdict that could complicate his bid to retake the White House on Nov. 5.

OTHER

ISRAEL (BBG): The Israeli government called off a US trip by senior officials after the Biden administration decided not to veto a United Nations Security Council resolution demanding an immediate cease-fire in Gaza, a decision reflecting a shift of approach by Washington.

JAPAN (MNI BRIEF): Japan's services producer price index rose 2.1% y/y in February, marking the 36th straight rise and unchanged from January's 2.1%, showing continued pass-through of cost increases, preliminary data released by the Bank of Japan on Tuesday showed.

AUSTRALIA (MNI): Strong jobs data last week have injected further doubt into Reserve Bank of Australia productivity growth assumptions, though its initial reaction will be to look through volatile figures it believes to be largely driven by seasonal factors, MNI understands.

AUSTRALIA (BBG): Australia’s consumer confidence fell in March as households remain concerned about their finances and the near-term prospects for the economy, with little sign interest rates are about to begin coming down.

TAIWAN/CHINA (BBG): Taiwan’s former President Ma Ying-jeou will meet with Chinese President Xi Jinping in Beijing on April 8, according to a report by Storm Media, without saying where it got the information from.

BRAZIL (MNI INTERVIEW): The hawkish shift in the Central Bank of Brazil’s guidance doesn't necessarily mean it will decelerate the pace of rate cuts in June, the former head of the BCB’s open market operations department Sergio Goldenstein told MNI, adding that the board wants to give itself more room to respond to data while its official forecasts point to inflation only slightly above the 3% target for 2025.

CHINA

(POLICY): The People’s Bank of China will strengthen countercyclical adjustments and take maintaining price stability and promoting a moderate price rebound as important considerations, said PBOC Governor Pan Gongsheng at the China Development Forum. Ample policy space and a rich reserve of tools exists, he said.

BONDS (SECURITIES DAILY): China’s bond investors are opting for long- and super-long-term sovereign bonds amid a lack of more profitable investment and ample market liquidity, Securities Daily and Shanghai Securities News reported Tuesday.

PROPERTY (RTRS): Chinese regulators are pushing banks to use a “whitelist” mechanism to speed up loan approvals to private property developers, Reuters reports, citing people with knowledge of the matter.

ECONOMY (CCTV): China’s economic recovery has been improving since the beginning of 2024, laying a solid foundation for achieving the nation’s full-year development goals, Premier Li Qiang said in meetings in Beijing with the IMF’s Kristalina Georgieva and World Bank’s Ajay Banga, according to state broadcaster CCTV.

INVESTMENT (XINHUA): Chinese Vice Premier He Lifeng on Monday met with visiting business leaders around the world including Blackstone’s Stephen Schwarzman, welcoming them to increase investments in the country, Xinhua News Agency reported.

INVESTMENT (21st Century Business Herald): Policymakers will support international firms to establish R&D centres in China and encourage partnerships with domestic companies, according to Jin Zhuanglong, minister of Industry and Information Technology. Speaking at the China Development Forum, Jin said foreign companies have an important role in stabilising China's industrial growth and promoting high-quality development.

FINANCE (ECONOMIC DAILY): Authorities should improve market and legal mechanisms to eliminate financial fraud, newspaper Economic Daily says in a commentary on Tuesday.

CHINA MARKETS

MNI: PBOC injects net CNY145 bln via Omo Tues; rates unchanged

The People's Bank of China (PBOC) conducted CNY150 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY145 billion after offsetting CNY5 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8500% at 09:24 am local time from the close of 1.9027% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 48 on Monday, compared with the close of 46 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0943 on Tuesday, compared with 7.0996 set on Monday. The fixing was estimated at 7.2019 by Bloomberg survey today.

MARKET DATA

AUSTRALIA MARCH WESTPAC CONSUMER CONFIDENCE FALLS TO 84.4; PRIOR 86.0

AUSTRALIA MARCH WESTPAC CONSUMER CONFIDENCE FALLS 1.8% M/M; PRIOR +6.2%

JAPAN FEB. SERVICES PRODUCER PRICES RISE 2.1% Y/Y; EST. +2.1%; PRIOR +2.1%

SOUTH KOREA MARCH CONSUMER CONFIDENCE FALLS TO 100.7; PRIOR 101.9

SOUTH KOREA FEB. RETAIL SALES RISE 13.7% Y/Y; PRIOR +8.2%

SOUTH KOREA FEB. DISCOUNT STORE SALES RISE 21% Y/Y; PRIOR -9.2%

SOUTH KOREA FEB. DEPARTMENT STORE SALES RISE 7.2% Y/Y; +0.7%

MARKETS

US TSYS: Treasury Futures Erased Most Of Earlier Gains After Volumes Spiked

- Jun'24 10Y futures gapped higher earlier, and volumes spiked with about 21,000 contracts trading inside a minute, there was little in the way of market catalyst, the 10y contract hit a high of 110-23+ and has now settled back at 110-19+ up + 03 for the day, while the 5Y contract moved higher in unison, however volume remained in line with prior days, the 5Y contract trades up + 01¼ at 106-31¼, from a high of 107-02

- Looking at technical levels: Initial support lays at 109-24+ (Mar 18 low/ the bear trigger), further down 109-14+ (Nov 28 low), to the upside resistance holds at 110-30+ (Mar 21 & 22 high), above here 111-00+ (50-day EMA), while a break above here would open a retest of 111-24 (Mar 12 high).

- Cash treasuries are slightly flatter today with yields flat to 1.5bps lower, the 2yr is unchanged at 0 4.627% while the 10yr is -0.8bp to 4.238%, while the 2y10y is +2.871 at -35.342

- Pimco reported earlier that they are holding smaller than usual position in US Treasuries

- Looking ahead: Later today Durable & Capital Goods Orders

JGBS: Futures Holding A Downtick, BoJ Tamura Speech & 40Y Supply Tomorrow

JGB futures are holding a downtick, -2 compared to the settlement levels, having traded within a relatively constrained range.

- According to MNI’s technicals team, a stronger reversal higher is required to signal the end of the recent corrective phase. The bull trigger has been defined at 147.74, the mid-January high. A break would resume the uptrend. Moving average studies remain in a bull-mode set-up, highlighting an uptrend. For bears, a resumption of weakness would potentially open the 144.60 support.

- There haven't been significant domestic catalysts to note, aside from the previously highlighted PPI Services. Final February machine tool orders are due.

- Cash US tsys are dealing flat to 1bp richer in today's Asia-Pac session after yesterday's 4-5bps cheapening across benchmarks.

- Cash JGBs are mostly richer, with yields +0.2bp to -1.0bp. The benchmark 10-year yield is 0.2bp higher at 0.736% versus the YTD high of 0.801% set on March 15.

- The swaps curve has twist-steepened, pivoting at the 20s, with rates 4bps lower to 1bp higher. Swap spreads are tighter out to the 10-year and wider beyond.

- Tomorrow, the local calendar sees a speech from BoJ Board Member Tamura in Aomori, along with 40-year supply.

AUSSIE BONDS: Cheaper, Narrow Ranges, CPI Monthly Tomorrow

ACGBs (YM -2.0 & XM -4.0) are holding cheaper after dealing in relatively narrow ranges in today’s Sydney session. The domestic calendar has been light.

- Cash ACGBs are 2-4bps cheaper, with the AU-US 10-year yield differential unchanged at -19bps.

- Swap rates are 1bps higher.

- The bills strip is slightly cheaper, with pricing flat to -2.

- RBA-dated OIS pricing is slightly mixed. A cumulative 41bps of easing is priced by year-end.

- (AFR) Unions’ push for a 5 per cent increase in minimum rates for 2.9 million workers will ensure interest rates remain higher for longer and restrict hiring, businesses warned. (See link)

- (AFR Ed Shann) I doubt the current optimism that falling inflation will allow interest rate cuts anytime soon. In fact, it is possible rates will need to rise again to tame domestic inflation. (See link)

- Tomorrow, the local calendar will see the CPI Monthly for February. Consensus is at 3.5% y/y from 3.4% in January.

- The Commonwealth Bank is predicting a rise to 3.8% y/y, with expectations that Q1 Trimmed Mean CPI will rise 0.8% q/q when the quarterly data is released on April 24.

- Tomorrow, the AOFM plans to sell A$800mn of the 4.5% Apr-33 bond.

NZGBS: Closed Cheaper But Off Worst Levels, May-35 Bond Syndication Launch

NZGBs closed 5-6bps cheaper but well off the session’s worst levels. In the absence of domestic drivers, the local market has moved away from cheaps in line with US tsys in today’s Asia-Pac session. Cash US tsys are dealing 1-2bps richer across benchmarks.

- RBNZ raised its foreign currency intervention capacity to NZ$20b at the end of February.

- Swap rates closed 2-4bps cheaper, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is flat to 3bps firmer across meetings, with Feb-25 leading. A cumulative 68bps of easing is priced by year-end.

- Tomorrow, the local calendar sees the NZ Government Budget Policy Statement at 13:00 NZT.

- NZ Treasury has appointed ANZ Bank, Bank of New Zealand, UBS, and Westpac as joint lead managers for the formation of the panel responsible for syndicating the May 2035 nominal bond. The Treasury anticipates launching this transaction before the conclusion of April, pending favourable market conditions. Consistent with standard procedure, should the syndication proceed, the scheduled bond tender for the corresponding week will be cancelled.

FOREX: USD Supported On Dips, As Stronger CNY Fixing Sees Little Follow Through

The BBDXY index has been supported on dips so far today, although we aren't in positive territory for the session, the index sitting at 1243.3 currently (earlier lows were at 1242.28). Overall moves have remained modest.

- The USD has found some support amid a less positive regional equity market backdrop, with HK and China slightly lower. US yields remain lower though, although losses (-1bps) are only modest compared to gains seen in Monday trade.

- The CNY fix was again set stronger the expected but follow through USD/CNY downside was limited and the pair has rebounded back towards 7.2200, limiting USD weakness elsewhere.

- AUD/USD couldn't sustain gains above 0.6550, we last tracked near 0.6535/40. The above mentioned equity weakness a headwind, while iron ore is also weaker. The active Singapore contract back under $106/ton, off a little over 2.6%. Copper is also weaker.

- On the data front we had Westpac Australian consumer sentiment drop, while the Japan PPI services came is as expected at 2.1% y/y.

- USD/JPY has traded tight ranges overall, the pair last near 151.35/40. Earlier comments from FinMin Suzuki were in focus in relation to FX. They largely echoed comments made by FX Chief Kanda yesterday.

- NZD/USD is modestly outperforming AUD, but hasn't drifted too far away from the 0.6000 level. The AUD/NZD cross saw selling interest emerge above the 1.0900 level (last near 1.0885).

- Later US February durable orders, January CoreLogic house prices, March consumer confidence and Richmond Fed indices print. ECB’s Lane speaks.

ASIA EQUITIES: HK & China Equities Mixed, As Investors Await Corporate Earnings

Hong Kong and China equity markets have been mixed and well off highs from earlier this morning, as investors await earnings from some major companies including EV maker BYD. Regulators urge banks to adopt a "whitelist" system to speed up loan approvals for private property developers, with a directive last week to complete approvals and issue loans by June-end, covering projects requiring 1.5 trillion yuan in fresh financing, Reuters sources say. Hong Kong has Trade Balance data due later today.

- Hong Kong equities are mostly higher, the Mainland Property Index was up as much as 3.71% in early morning trade and has given up most of those gains are we come back from the break, trading just 0.80% higher, the HSTech Index trades up 0.30% after breifly trading down for the day, while the wider HSI is up 0.30%. In China, equity markets are mixed, with the CSI300 unchanged for the day, while the smaller cap focused CSI1000 down 1.00% and ChiNext up 0.17%

- China Northbound flows were 5.6billion yuan on Friday, with the 5-day average at -1.0billion, while the 20-day average sits at 2.61 billion yuan.

- (Reuters) - China pushes banks to speed approvals of new loans to private developers. (See link)

- China's central bank governor Pan Gongsheng affirms the nation's property market has a solid foundation for long-term health and stability, noting limited financial system impact from market fluctuations. Speaking at the China Development Forum, Pan highlights progress in resolving local debt risks and vows to continue financial sector opening-up efforts. He expresses confidence in meeting the 2024 GDP growth target of approximately 5% and pledges to enhance counter-cyclical policy adjustments, emphasizing the importance of a mild price rebound in monetary policy considerations.

- Top executives of foreign industrial and technology conglomerates highlight China's focus on advancing high-end manufacturing and fostering new quality productive forces, which they believe will create fresh growth points for multinational corporations, especially in green and strategic emerging industries. They note China's rapid adoption of new technologies, making it a highly dynamic market, while emphasizing their continuous investment in the country's green transition and innovation. China's actions to remove restrictions on foreign participation in manufacturing and increase openness in various sectors further attract foreign investment, particularly in high-tech manufacturing, which saw a 10.1% increase in foreign direct investment in the first two months of the year.

- Looking ahead, it's a quiet week for China econ data, while Hong Kong has Trade Balance data later today

ASIA PAC EQUITIES: Regional Asian Equities Mixed, Japan FinMin Warns FX Markets

Regional Asian equities are mixed today, with little in the way of major regional news or eco data out today, investors have turned their focus to US data due out later in the week, while some investors remain cautious and are preparing for the upcoming corporate earnings season, amidst cautionary notes from some analysts who suggest that overly optimistic profit expectations, instrumental in driving various markets to all-time highs, might lead to a market correction if actual reports fall short. Earlier Japanese Finance Minister spoke about the moves in the FX markets, which followed the countries Chief currency official delivering his strongest warning in months around the weakening currency.

- Japan's equities have turned slightly higher in the second half of trading today, earlier equities prices were weighed down by comments from the Japanese FinMin's where he warned the FX market, mentioning they wouldn't rule out any options against excessive FX moves. Exporters are the worst performing sector, on the back of expected higher yen. Earlier PPI services was released coming in line with expectations at 2.1%. The Topix is up 0.12%, while the Nikkei 225 is unchanged.

- South Korean equities surged higher this morning on stronger tech prices on the back of Micron Technology surge on Monday, we now trade off those earlier highs as investors look to take profits. Earlier SK released consumer confidence data showing a fall from 101.9 in Feb to 100.7 in March, while department store sales rose 7.2% y/y and discount store sales rose 21% y/y, overal Retails sales rose 13.7% y/y vs 8.2% y/y in Jan. The Kospi is 0.76% higher.

- Taiwanese equities opened the day higher,, although have seen selling as the day has progressed and now trade down 0.12%. Taiwan's industrial production index fell by 1.10% compared to the previous year, attributed to declines in mining and quarrying by 9.80% and manufacturing by 1.20%. However, there were increases in water supply by 2.52% and electricity and gas supply by 0.78%.

- Australian equities face the greatest risk of a pullback according to Chris Montagu, Citigroup’s quantitative market strategist, who notes the market's one-sided positioning and extended levels, particularly due to its leverage to China through resources. The ASX 200 closed lower today down 0.41%

- Elsewhere in SEA, NZ equities closed down 0.29%, Indonesian equities are lower by 0.44% Tuesday they broke a 6-day streak of foreign investor equity inflows, Singapore equities are up 0.90% after Mondays CPI data showed a slight beat coming in at 3.4% vs 3.2% and Industrial Productions beat coming in at 3.8% y/y vs 0.5% expected, Malaysian equities are unchanged, while Philippines equities are down 0.50%

OIL: Crude Steady As Geopolitics Create Significant Uncertainty

Oil prices are off their intraday highs to be little changed during the APAC session as OPEC+ members don’t believe it is necessary to change quotas. WTI rose to $82.30/bbl but is now back below $82 at $81.92. Brent is around $86.69 after rising to $87.06 earlier. The USD index is off its lows to also be flat on the day.

- The US waiver of sanctions on Venezuelan oil & gas expires on April 18 and there are growing concerns that it won’t be renewed as Venezuela has failed to meet the condition of free & fair elections. President Maduro has disqualified his main rival from running in July’s vote. India has stopped buying Venezuelan oil because of this scenario, while refusing to take oil on Russian state-owned tankers also because of sanctions.

- With the IEA revising its forecasts to show a small deficit in the oil market and conflicts impacting energy security, US inventory data out later today is being monitored closely. Recent weeks have seen drawdowns in crude stocks.

- Bullish technicals are supportive of oil prices with Brent’s 50-day moving average above the 200-day.

- Attention is on Russia with Ukrainian drone attacks continuing and a tragic terrorist attack in Moscow. Rosneft’s Kuibyshev refinery in Samara, southern Russia, was attacked on Saturday and now half its capacity is offline.

- Later US February durable orders, January CoreLogic house prices, March consumer confidence and Richmond Fed indices print. ECB’s Lane speaks.

GOLD: Holding Near Highs

Gold is slightly lower in the Asia-Pac session, after closing 0.3% higher at $2171.83 on Monday.

- US Treasuries saw losses of 4-5bps across benchmarks to start a holiday-shortened week. US bonds were heavy amid anxiety over the FOMC's policy path with risk the Fed does not cut rates the 3 times projected by the dots this year.

- Comments from Fed Bostic supported that chance too, as he revised his outlook for only 1 easing, versus 2 previously. While Fed Cook said officials must cautiously balance the risk of easing monetary policy too much or too soon, allowing inflation to linger above target, and taking too long to ease, which could harm the economy needlessly and deprive people of economic opportunities.

- The market’s focus is on Friday’s release of US PCE deflators. That said, the scope for any major surprises should be limited in Good Friday trading, with the CPI and PPI figures feeding into that release.

- According to MNI’s technicals team, the trend condition in gold remains bullish and sights are on $2230.1, a Fibonacci projection. Key short-term support has been defined at $2146.2, the Mar 18 low.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/03/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 26/03/2024 | 0700/0800 | ** |  | SE | PPI |

| 26/03/2024 | 0800/0900 | *** |  | ES | GDP (f) |

| 26/03/2024 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/03/2024 | 1200/0800 |  | CA | BOC Sr Deputy Rogers speaks in Halifax NS | |

| 26/03/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/03/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/03/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/03/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/03/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/03/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/03/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/03/2024 | 1900/2000 |  | EU | ECB Lane Lecture At Trinity College Dublin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.