-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Yen Continues To Outperform On Crosses

EXECUTIVE SUMMARY

- HARRIS SECURES DELEGATES NEEDED TO BECOME DEMOCRATIC NOMINEE FOR PRESIDENT - RTRS

- FED QT LIKELY TO LINGER AFTER RATE CUTS START - MNI INTERVIEW

- BOJ QT IMPACT WILL INCREASE AS HOLDINGS REDUCE - MNI BRIEF

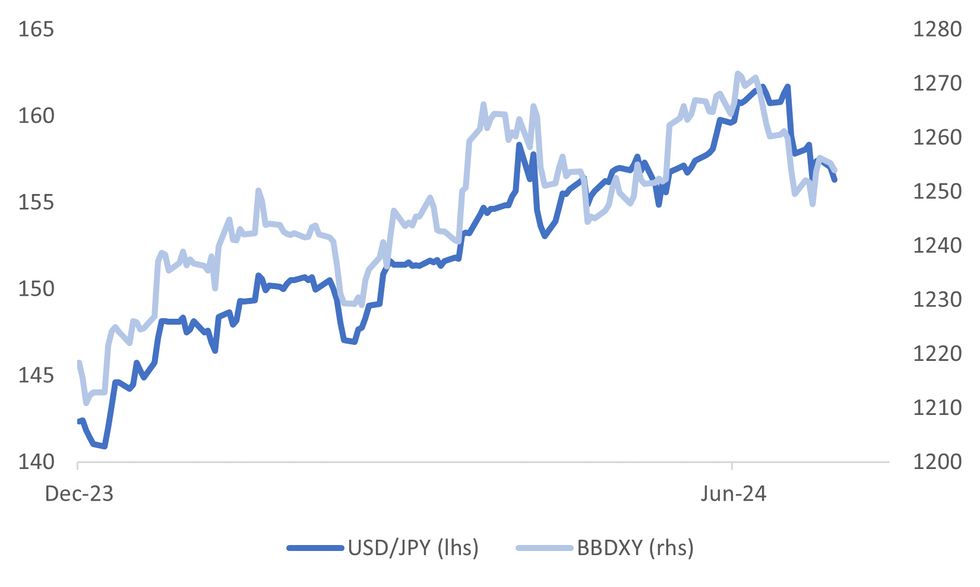

Fig. 1: USD/JPY & USD BBDXY Index

Source: MNI - Market News/Bloomberg

UK

POLITICS (BBC): “The Conservatives are to start a three-month leadership contest to replace Rishi Sunak this week, due to end with the announcement of a new Tory leader on 2 November.”

EUROPE

FRANCE (BBG): “French President Emmanuel Macron called for a “political truce” during the summer Olympics in Paris, which begin Friday, potentially delaying the appointment of a prime minister and the formation of a new government.”

EU (BBC): “The European Union has stripped Hungary of the right to host the next meeting of foreign and defence ministers over its stance on the war in Ukraine.”

HUNGARY (POLITICO): “Hungary on Monday said it had asked the European Union to take action against Ukraine for imposing a partial ban on Russian oil exports, arguing the move was jeopardizing Budapest’s energy security.”

BUSINESS (EURONEWS): “A 2009 agreement insisted on by the European Commission meant that Microsoft could not make security changes that would have blocked the update from cybersecurity firm Crowdstrike that caused an estimated 8.5 million computers to fail, the Big Tech giant said in comments to the Wall Street Journal newspaper.”

US

POLITICS (RTRS): “U.S. Vice President Kamala Harris secured support Monday from a majority of delegates to the Democratic National Convention, likely ensuring she will become the party's nominee for president next month, according to multiple sources.”

POLITICS (BBG): “Vice President Kamala Harris quickly consolidated support from powerful Democrats for her nascent presidential bid, with an effort to end the turmoil that has consumed her party and alter an election that has become Donald Trump’s to lose.”

POLITICS (BBG): “Republican Vice Presidential nominee JD Vance called President Joe Biden’s departure from the 2024 race a “threat to democracy,” using the same rhetoric he decried just days ago, following the assassination attempt against Donald Trump.”

FED (MNI INTERVIEW): Fed QT Likely To Linger After Rate Cuts Start

US ECONOMY (MNI INTERVIEW): The integrity of the data used by Americans and policymakers including the Federal Reserve is in increasing jeopardy and in some instances is already suffering from the impacts of underinvestment, according to the authors of a new report from the American Statistical Association and George Mason University.

CORPORATE (BBG): “Boeing Co. dominated the first day of dealmaking at the Farnborough International Airshow, sealing an estimated $12.6 billion in aircraft sales at the aviation industry’s biggest event of the year.”

OTHER

JAPAN (MNI POLICY): BOJ QT Impact Will Increase As Holdings Reduce

JAPAN (NIKKEI/BBG): “Japan’s ruling Liberal Democratic Party Secretary-General Toshimitsu Motegi says that the Bank of Japan should articulate its normalization policy more clearly, including its consideration of raising rates gradually, Nikkei reports citing a speech in Tokyo on Mon.”

SOUTH KOREA (BBG): “South Korea’s prices are likely to rebound temporarily in July due to unusual weather and base effect, Finance Minister Choi Sang-mok says in a meeting.”

MIDEAST (RTRS): “Israel sent tanks back into the greater Khan Younis area after ordering evacuations of some districts it said had been used for renewed attacks by militants and at least 70 Palestinians were killed by Israeli fire, Gaza medics said on Monday.”

YEMEN (THE ECONOMIST): “The UN Security Council meets on Tuesday to debate the ever-messier situation in Yemen.”

CHINA

RATES (CSJ): “China’s interest rate cut on Monday has strengthened the role of its seven-day reverse repo rate as the policy benchmark and will help lower funding costs and spur the country’s economic recovery, China Securities Journal reports Tuesday, citing analysts.”

BONDS (SECURITIES TIMES): “PBOC’s Monday decision to allow institutions participating in MLF operations to apply for reduction or exemption of collateral should help ease the lack of supply in the bond market and increase pool of tradable bonds, Securities Times reports Tuesday citing unidentified sources.”

BOND ISSUANCE (ECONOMIC INFORMATION DAILY): “The issuance of government bonds is expected to significantly speed up in the third quarter, helping to accelerate infrastructure investment and stabilize economic growth, Economic Information Daily reports Tuesday, citing analysts.”

CHINA MARKETS

MNI: PBOC Net Drains CNY408.7 Bln Via OMO Tues

The People's Bank of China (PBOC) conducted CNY267.3 billion via 7-day reverse repo on Tuesday, with rate kept at 1.70%. The operation has led to a net drain of CNY408.7 billion after offsetting the CNY676 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7426% at 09:40 am local time from the close of 1.7184% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 58 on Monday, compared with the close of 45 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1334 on Tuesday, compared with 7.1335 set on Monday. The fixing was estimated at 7.2742 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA JUNE PRODUCER PRICES +2.5% Y/Y; PRIOR +2.3%

MARKETS

US TSYS: Tsys Futures Edge Higher On Low Volumes, Curve Flattens

- Treasury futures have edged higher throughout the session, with the long-end slightly out-performing after lagging the recovery heading into NY close overnight. Volumes are well down on averages while TU is + 00⅜ at 102-14⅜ and TY is + 03+ at 110-26+.

- Tsys flows: Buyer block 6,061 UXY at 114-11 & Block Steepener DV01 318k TU/UXY

- The treasury curve has bull-flattened throughout the session with the 2yr -0.7bps at 4.510% and the 10yr -1.4bps at 4.239%. The past week has seen the treasury curve move about 9bps wider with the 2s10s little changed at -27bps over the week after rallying from -43bps in July.

- The 1yr USD Inflation Swap is trading near yearly lows at 1.9175, falling 51bps since July 1, futures markets are pricing in just under 2.5 cuts into year-end.

- Projected rate cut pricing into year end has receded vs. early Monday levels (*): July'24 at -2.5% w/ cumulative at -0.6bp at 5.323%, Sep'24 cumulative -24.3bp (-25bp), Nov'24 cumulative -38.5bp (-39.5bp), Dec'24 -60.7bp (-62bp)

- Looking ahead today we have Regional Fed and Existing Home Sales data and $69B 2Y Note auction.

JGBS: Cash Bonds Slightly Mixed With A Flattening Bias, 40Y Supply Tomorrow

JGB futures are weaker but well off session cheaps, -9 compared to the settlement levels.

- Machine Tool Orders data is due later today, otherwise the local calendar has been light.

- (Bloomberg) The Bank of Japan should more clearly show its intention to normalize monetary policy, according to ruling party heavyweight Toshimitsu Motegi in remarks a week before the central bank meets to decide whether to raise interest rates. (See link)

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session, ahead of Regional Fed and Existing Home Sales data and a $69bn 2Y Note auction.

- Cash JGBs are 1bp cheaper to 1bp richer across benchmarks. The benchmark 10-year yield is 0.8bp higher at 1.063% versus the cycle high of 1.108%.

- The 40-year yield is 0.2bp lower higher at 2.421%, ahead of tomorrow’s supply and a week ahead of the upcoming BoJ’s policy decision. Although this 40-year sale is set for a higher outright yield than at the May auction (high yield of 2.27%), secondary pricing hasn’t yet reached the 2.5% area which is said to be a target zone for institutional investors.

- Swap rates are flat to 2bps lower, with the curve flatter. Swap spreads are tighter.

- Tomorrow, the local calendar will see Preliminary Jibun Bank PMIs alongside 40-year supply.

AUSSIE BONDS: Light Local Calendar, Subdued Trading, US Tsys Providing Support

ACGBs (YM -4.0 & XM -2.5) are holding weaker after dealing in narrow ranges in today’s Sydney session. With the domestic calendar light today, cash US tsys have been the key influence on the local market. Cash US tsys are 1-2bps richer in today’s Asia-Pac session, ahead of Regional Fed and Existing Home Sales data and a $69bn 2Y Note auction.

- The AOFM sold A$100mn of 2.50% 20 Sep 2030 inflation-linked bond at a weighted average yield of 1.7172%, with a cover ratio of 3.4500x.

- Cash ACGBs are 3bps cheaper, with the AU-US 10-year yield differential at +10bps.

- Swap rates are 2bps higher.

- The bills strip has bear-steepened, with pricing flat to -3.

- RBA-dated OIS pricing is little changed out to May-25 and 1-2bps firmer beyond. Terminal rate expectations sit at 4.43%.

- Tomorrow, the local calendar will see Preliminary Judo Bank PMIs. This will be the data highlight for the week.

- ICYMI, the AOFM announced on Friday that a new Dec-35 bond is planned to be issued via syndication this week (subject to market conditions). The issue size is expected to be around $10bn.

NZGBS: Closed Slightly Richer, Subdued Session, Light Local Calendar Along Week

NZGBs closed near the session’s best levels, with yields down 1bp. Benchmark yields had been 1-2bps higher in early trade following the modest negative lead-in from US tsys overnight.

- Nevertheless, dealings were subdued with the local calendar empty today. Indeed, Friday’s release of ANZ Consumer Confidence data represents the sole release for the week.

- The 1-2bps richening by cash US tsys in today’s Asia-Pac session likely assisted the local market’s move away from session cheaps. Today, the US calendar will see Regional Fed and Existing Home Sales data and a $69bn 2Y Note auction.

- Swap rates closed 1-3bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is 1-3bps softer for 2025 meetings. The market has a 39% chance of a 25bp cut in August priced. There is an 85% chance of a cut priced by October, with a cumulative 68bps of easing by year-end.

- On Thursday, the NZ Treasury plans to sell NZ$300mn of the 3.0% Apr-29 bond and NZ$200mn of the 4.50% May-35 bond.

FOREX: Dollar Index Down As Yen Rallies On Supportive Cross Asset Backdrop

The USD BBDXY sits lower, largely thanks to a firmer yen backdrop so far in Tuesday trade. The index last under 1254, off 0.10%. Yen gains have been prominent, particularly commodity related FX like NZD and AUD.

- USD/JPY has steadily pushed down through Asia Pac trade, the pair last near 156.25/30, up around 0.50%, and just under intra-session lows from Monday. 155.38, the July 18 low is the next potential downside target.

- Cross asset trends are supporting the yen, with US equity futures lower, while some regional equity markets are struggling as well, most notably China (CSI 300 off 1%), which is likely weighing on higher beta FX against the yen.

- AUD/JPY is back to 103.65, while NZD/JPY is around 93.25/30, with both pairs around session lows. For NZD/JPY we were last near these levels in the first half of May. NZD/USD is back under 0.5970, AUD.USD at 0.6635.

- In the yield space, US Tsy yields have ticked down, 0.7-1.9bps, another support point for the yen. Combined with a slightly firmer JGB yield backdrop has helped push yields differential with the US down a touch.

- Commodity markets are mostly weaker, with focus on the metals space. Cooper (CMX basis) is down modestly while Iron ore is over 2%. China growth concerns/supply are driving sentiment in this space.

- Looking ahead we have another light session data wise, with just the US Richmond Fed index, and existing home sales. The ECB's Lane also speaks.

ASIA STOCKS: China & HK Stocks Struggle As Market Looks For Further Policy Support

Hong Kong and China equity markets are mostly lower today. The subdued performance in these markets contrasts with the broader positive trend in Asian equities, which were bolstered by a tech-led surge in Wall Street. The market still seems a bit concerned around the US election after Biden dropped out with odds showing Trump is well in front, leading to concerns of tougher trade restrictions and tariffs if he does win the Presidential Election. Additionally, the markets are still hoping for more policy announcements to support the struggling Chinese economy following last week's Third Plenum.

- Hong Kong equities are mostly lower today with the Property Indices have given back earlier gains with (Mainland -0.25%, HS Property -0.40%), tech stocks are drifted lower through the day with the HSTech Index now down 1% while the broader HSI is 0.20% lower.

- China onshore markets are underperforming HK stocks, growth/mid cap stocks looks to be the worst performing today with the CSI 500 down 1.70% & ChiNext down 1.55% while small-caps indices are down slightly less with the CSI 1000 1.40% lower & CSI 2000 0.70%, the large-cap CSI 300 is down 0.95%.

- China's government spending fell almost 3% in the first half of the year, with local government expenditures down 4.2%, contributing to a larger deficit of 3.63 trillion yuan and potentially hindering economic growth. Despite central government spending rising 10%, overall economic growth slowed to 5%, prompting fiscal support measures and interest rate cuts to boost the economy, as per BBG.

- The recent Third Plenum and announcements that came from it together with the PBoC cutting LPRs on Monday have done little to spur the market higher, while it is suspected the the China National Team has been involved in supporting the market over the past month, the CSI 300 is up just 0.64% over the same period which suggests there may be further weakness to come without further supportive policies measures.

ASIA PAC STOCKS: Asian Equities Rebound Although Off Earlier Highs

Regional Asian equities have tracked US markets higher today, with the MSCI Asia Pacific Index ending a three-day decline. Taiwanese stocks are the top performers after heavy selling recently by foreign investors looks to have at least temporarily stopped as TSMC surges 3.40%. The market is enjoying a decrease in political uncertainty, with it now widely expected Kamala Harris will lead the Democrat party, while we now just wait for the announcement of her running mate. There is little in the way of economic data today, with focus now turning to US Inflation data and Major Tech earnings later this week.

- Japanese equities are higher today although we are well off the morning highs. The Yen has strengthened and now trades back below 157.00 after LDP Secretary-General Motegi spoke about how the BoJ should articulate its normalization policy more clearly and said “It is clear that an excessively weak yen is negative for the Japanese economy." Japanese banks are the top performing today with the Topix Banks Index up 1.40%, Tech stocks are well off earlier highs with the Nikkei 225 now flat after opening up about 0.80%, while the wider Topix Index is 0.20% higher.

- South Korean equities have rebounded following a four-day sell-off, the Kospi still trades 2% lower over the past week. Foreign investors have continued to sell local tech stocks today, although overall flows are positive with investors buying transport and financial stocks. The Kospi is up 0.60%, while the Kosdaq is 0.50% higher.

- Taiwan equities are the top performers today, tracking gains made overnight in the Philadelphia SE Semiconductor Index which closed 4% higher, TSMC has contributed the most to index gains, up 3.40% while the Taiex is 2.13% higher.

- Australian equities are higher today, although have underperformed global markets. Financials have been the largest contributor to the index gains, while energy stocks are the only sector in the red with Woodside leading the decline after reporting a revenue miss. The ASX 200 is 0.60% higher, while in New Zealand the NZX 50 is trading 0.90% higher.

- In EM Asia, markets are mixed with Singapore's Straits Times up 0.50%, Malaysia's KLCI up 0.50%, while Indonesia's JCI is unchanged, Philippines PSEi is down 0.10%, Thailand's SET is down 1% while India's Nifty 50 is down 0.20%

OIL: Crude Holds Onto Losses, US Inventory Data Out Later

Oil prices are little changed today after falling over the last two trading days. Brent is around $82.46/bbl off the intraday high of $82.63, and WTI is $78.40/bbl after rising to $78.59.

- Concerns over the US political situation and demand strength from China in the face of disappointing data and yesterday’s rate cuts have weighed on oil prices. This triggered algorithmic selling, according to Bloomberg. But prompt spreads continue to point to a tight market.

- The last few weeks have seen a sharp crude inventory drawdown in the US and today’s industry data will be monitored to see if that continued last week, especially as there was a rise in both gasoline and distillate stocks.

- Another quiet day with only the ECB’s Lane speaking and US July Philly & Richmond Fed indices, and June existing home sales released.

GOLD: Pullback From Record High Continues

Gold is slightly higher in today’s Asia-Pac session, after closing slightly lower at $2396.59 yesterday. The yellow metal hit an intra-day low of $2384.

- Bullion has now pulled back around 3.5% from its record high set last week.

- US yields ended Monday ~1bp higher after being ~2bps lower during the Asian session on the back of news that President Biden was pulling out of the election race.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- It seems very likely that Kamala Harris will be the Presidential Nominee for the Democrats with the focus now turning to her running mate, betting markets have Josh Shapiro as the favourite with a 32% chance followed by Andy Beshaer at 26% and Roy Cooper at 20%.

- The market is now waiting for Friday’s update on the Fed’s preferred underlying inflation measure, which is expected to show the PCE deflator retreated to an annual pace of 2.5% from 2.6% in the year to May.

- According to MNI’s technicals team, the trend condition in gold remains bullish, despite the fade off last-week highs, with initial resistance at $2,483.8, the July 17 high. Initial support is at $2,390.1, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/07/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/07/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 23/07/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/07/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/07/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/07/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 23/07/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/07/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/07/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.