-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Yen Vol Surges Amid Intervention Risks/BoJ Proximity

EXECUTIVE SUMMARY

- META SHARES SINK ON HIGHER AI SPENDING, LIGHT REVENUE FORECAST - RTRS

- BHP APPROACHES RIVAL MINER ANGLO AMERICAN ABOUT TAKEOVER - BBG

- BLINKEN TELLS CHINA TO MANAGE TIES ’RESPONSIBLY’ AS TALKS BEGIN - BBG

- CHINA BOND MARKET MAY SEE CORRECTION IN NEAR TERM - CHINA BUSINESS NEWS

- JAPAN KEEPS TRADERS ON INTERVENTION ALERT AFTER YEN PIERCES 155 - BBG

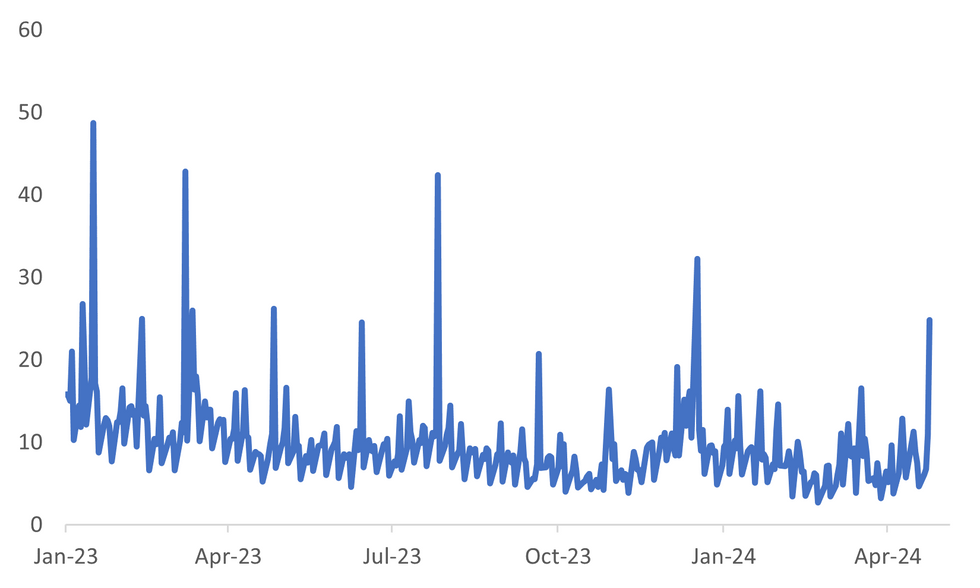

Fig. 1: USD/JPY Overnight Vol Surges

Source: MNI - Market News/Bloomberg

U.K.

ELECTION (BBC): Labour says it expects to renationalise most passenger rail services within five years, if it is elected. The party says it will meet the pledge by bringing passenger services into public control as the contracts expire - but there will still be a role for the private sector.

POLITICS (BBC): Jeremy Hunt has defended plans to slash civil service jobs to increase defence spending and Ukraine aid, during a surprise trip to Kyiv. The government has pledged to increase UK military spending to 2.5% of national income by 2030. Mr Hunt confirmed the increase will cost an extra £20bn, which unions claim will be funded by cutting 70,000 jobs.

EUROPE

SPAIN (BBG): Prime Minister Pedro Sanchez announced that he may resign after a court in Spain opened an investigation into his wife, pushing the country into uncharted political territory and raising the possibility of a new general election.

FRANCE (FRANCE24): French President Emmanuel Macron will outline Thursday his vision for a stronger Europe, pushing EU members to be less dependent on the United States but also hoping to boost his party's flagging campaign in EU elections

GERMANY (POLITICO): The German judiciary launched two preliminary investigations on Wednesday against MEP Maximilian Krah from the far-right Alternative for Germany (AfD) party over alleged payments from Russia and China for his work in the Parliament.

GERMANY (BBG): The Alternative for Germany has submitted a proposal to parliament that would task the government to examine the legitimacy of the European Central Bank’s bond purchases.

UKRAINE (POLITICO): Ukrainian drones destroyed two fuel storages in Russia’s Smolensk region in the early hours of Wednesday, a Ukrainian law enforcement official familiar with the matter told POLITICO. The attacks came despite public warnings from US officials that Kyiv's attacks on Russian oil refineries risk destabilizing global markets, with Defense Secretary Lloyd Austin urging the country to focus on military targets.

CORPORATE (RTRS): Meta Platforms disappointed investors on Wednesday with forecasts of higher expenses and lighter-than-expected revenue, knocking nearly $200 billion off its stock market value and raising fears the surging cost of AI is outpacing its benefits.

CORP (BBG): International Business Machines Corp. dropped about 9% in extended trading after the company’s weak consulting unit sales disappointed investors, overshadowing its acquisition of software firm HashiCorp Inc.

POLITICS (RTRS): A grand jury has charged 18 people with allegedly taking part in an Arizona fake elector scheme to re-elect then-U.S. President Donald Trump in 2020, the state's attorney general said on Wednesday. The court papers list a "former U.S. president," Trump, as an unindicted co-conspirator.

US/CHINA (BBG): Secretary of State Antony Blinken said the world’s largest economies must “lay out our differences,” as he began two days of talks in China, with the threat of US sanctions targeting Beijing over its support of Russia’s war in Ukraine looming over his visit.

US/CHINA (BBG): Secretary of State Antony Blinken raised concerns over unfair trade practices in the world’s No. 2 economy as he began talks in China, with the threat of US sanctions on Beijing for its support of Russia looming over his visit.

UKRAINE (BBC): Ukraine has begun using long-range ballistic missiles secretly provided by the US against invading Russian forces, American officials have confirmed. The weapons were part of a $300m (£240m) aid package approved by US President Joe Biden in March and they arrived this month.

CHINA (POLITICO): China is helping Russia meet its war goals in Ukraine by continuing to sell supplies such as drone technology and gunpowder ingredients to Moscow, the U.S. Ambassador to NATO said in an interview.

OTHER

JAPAN (BBG): Japanese officials rolled out further warnings on the yen after the currency slumped through the 155 mark against the dollar, leaving market players on edge ahead of a central bank meeting and US economic data that may trigger further moves.

AUSTRALIA (BBG): BHP Group Ltd. has approached Anglo American Plc about buying the 107-year-old company in a move that offers to spark the biggest shakeup of the global mining industry in over a decade.

CANADA (MNI): Bank of Canada officials agree that when they begin lowering interest rates the pace of cuts will be gradual, according to minutes from the last decision published Wednesday that also showed more confidence inflation pressures are normalizing.

CHINA

BONDS (CHINA BUSINESS NEWS): China’s bond market may see a correction in the short term, but there is still solid support in the longer run, China Business News reports, citing investment managers and analysts.

BONDS (FINANCIAL NEWS): China’s local governments are expected to speed up issuance of special bonds in the second and third quarter to help drive economic recovery, PBOC-backed newspaper Financial News reports, citing experts.

ECONOMY (PEOPLE’S DAILY): Authorities’ financial work must adhere to the principle of stability, emphasizing macroeconomic control, financial development, reform, and supervision, as well as risk management, according to an article from the Central Financial Work Commission published in the People's Daily, a party-run publication.

ECONOMY (YICAI): Authorities should implement proactive policy support to manage China's structural transformation and avoid “Japanification”, Ouyang Hui, distinguished dean of finance at the Cheung Kong Graduate School of Business said. Ouyang noted Japan entered stagnation due to the government's insufficient response to a cyclical recession, and Chinese authorities needed to take stronger action to handle non-performing assets and resolve real estate and local debt risks.

CHINA MARKETS

MNI: PBOC Conducts CNY2 Bln Via OMO Thurs; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Thursday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the maturity of CNY2 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8808% at 09:49 am local time from the close of 1.8716% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Wednesday, compared with the close of 46 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1058 on Thursday, compared with 7.1048 set on Wednesday. The fixing was estimated at 7.2442 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA 1Q GDP EXPANDS 1.3% Q/Q; EST. +0.6%; PRIOR +0.6%

SOUTH KOREA 1Q GDP EXPANDS 3.4% Y/Y; EST. +2.5%; PRIOR +2.2%

SOUTH KOREA MAY MANUFACTURING CONFIDENCE RISES TO 74; PRIOR 73

SOUTH KOREA MAY NON-MANUFACTURING CONFIDENCE RISES TO 71; PRIOR 69

MARKETS

US TSYS: Futures Steady As Markets Await PCE

It has been a very muted session for US Tsys. TYM4 sits at 107-25, +01+ in recent dealings, having stuck to ranges from late NY trade on Wednesday in Asia Pac today. Highs were at 107-27, lows 107-23+.

- We haven't seen much spill over from the sharp fall in US equity futures, apart from a modest rise at the open. Volumes in Tsy futures have been less than 50k so far today. AU and NZ markets are out, which has likely lightened volumes/interest to a degree.

- In the cash Tsy yield space, we are firmer, but gains are under 1bps at this stage. The 10yr last near 4.645%. The 2/10s curve is near -29bps, the steepest levels since early Fed/late Jan.

- Looking ahead, we have Wkly Claims, GDP, Core PCE Index in focus.

JGBS: Futures Unwind Most Of Wednesday's Losses Ahead Of BoJ Tomorrow

JGB futures have drifted higher today, last 144.19, -.02 for JBM4. Intra-session lows from Wednesday, post Tokyo trade, came in close to 144.00. Today we have unwound a good proportion of yesterday's sell off.

- Focus clearly rests on tomorrow's BoJ meeting outcome, although no major changes are expected at this stage.

- News flow has been light today, although FX markets remain a focus point, given fresh multi decade lows in the yen against the USD. We had familiar FX jaw boning from FinMin Suzuki before parliament today. Equity markets are also weaker, amid a negative lead from US tech futures.

- JGB yields are drifting lower, the 10yr last under 0.89%, after making highs back to Nov last year yesterday. The 30 and 40yr tenors are also down by 1-2bps.

- Swaps are all lower in yield terms for 2 to 10yr tenors. The 10yr last at 0.975%.

FOREX: USD/JPY Drifts Higher, Vols Spike Amid Intervention Risks/BoJ Coming Into View

With Australia and New Zealand markets out for the ANZAC day holiday, focus has largely rested on USD/JPY. The pair has firmed a little in the first part of Thursday trade, last in the 155.45/50 region. This is through Wednesday highs and fresh highs back to 1990 for the pair. The BBDXY USD index is unchanged though near 1261.

- Familiar FX rhetoric from FinMin Suzuki crossed the wires around watching FX markets closely. Chief Cabinet Secretary also noted that is it important for FX markets to reflect fundamentals (BBG). However, yen didn't strengthen on the comments.

- Overnight vols surged to 28% at one stage, as tomorrow's BoJ meeting comes into view. This is highs back to mid Dec last year. The skew around risk reversals has also been to the downside in USD/JPY.

- Elsewhere, the main cross asset feature of note has been a sharp fall in US equity futures at the open, led by the Nasdaq (-1.20%), as Meta's earnings update from late Wednesday US time, weighed heavily on sentiment.

- The impact on higher beta plays has been minimal though, with AUD/USD up a touch to 0.6505, while NZD/USD is around 0.5940. Liquidity is no doubt lighter though in both markets.

- US yields sit a touch higher, but gains are under 1bps at this stage.

- Looking ahead, we have Wkly Claims, GDP, Core PCE Index in US. In Europe we have German consumer confidence and some ECB speak.

ASIA EQUITIES: US Tech Future Down On Meta Disappointment, HK/China Outperform

Asia equity markets are mixed, despite a strong negative lead from US equity futures. US futures sit down sharply, led by the Nasdaq (-1.15%) as Meta's late earnings update from Wednesday US time left investors disappointed around the revenue outlook. HK/China have outperformed but sit away from best levels.

- Major markets in the region all tracked lower at the open, although Hong Kong markets have recovered. The HSI is back up 0.55%, albeit away from best levels at the break. The tech sub index was up in earlier trade, but is now back to fat. Optimism around online gaming in China is aiding sentiment in the space this week, with strong gains seen through Tues/Wed trade.

- China mainland markets are also higher, albeit to the tune of 0.24% for the CSI 300 index.

- Japan markets are off more than 1% at this stage for the Topix, nearly 2% for the NKY. Weakness in the US tech space has seen a negative spillover effect. Focus remains on USD/JPY which continues to make fresh cyclical highs back to 1990.

- Tech weakness is also weighing on the Kospi (-1.15%) and Taiex as well (-1.30%). Earlier chip maker SK Hynix posted better than expected profit results in South Korea, while the authorities also announced details of the short-sale monitoring program (see this BBG link).

- Note onshore markets in Australia and New Zealand are close today for the ANZAC day holiday.

- In SEA, trends are relatively steady with most major indices posting either modest losses or gains.

OIL: Crude Little Changed Ahead Of Key US Data

Oil prices are little changed during APAC trading and close to intraday highs, as markets wait for Q1 GDP and the Fed’s preferred inflation measure core PCE prices. WTI is 0.1% higher at around $82.93/bbl, near today’s high of $82.95. Brent is up 0.2% to $88.16 after a high of $88.18 but has spent some of the session below $88. The USD index is unchanged.

- EIA reported that crude stocks fell sharply by 6.37mn, but there was little market reaction including in the APAC session. Gasoline inventories fell 634k but distillate rose 1.61mn barrels last week. Refinery utilisation rose 0.4pp to 88.5%.

- Geopolitical tensions have eased and oil’s associated premium has unwound this week but issues remain with Ukraine striking two Russian oil depots in western Russia and Houthis claiming they had targeted shipping off the Yemeni coast both on Wednesday.

- Bloomberg is reporting some negative market developments with options showing a bearish skew and the US Oil Fund, biggest oil ETF, recording its largest recorded daily outflow. In addition, refining margins for diesel in Asia are at their lowest in almost a year.

- Later US Q1 GDP and core PCE prices, March trade, inventories and weekly jobless claims print. Bloomberg consensus is at 2.5% q/q saar for GDP and an elevated 3.4% for core PCE prices. A stronger print would likely weigh on crude as markets worry about the demand outlook.

GOLD: Bullion Range Trading, Key PCE Price Data Coming Up

Gold prices have been range trading during the APAC session with them falling to a low of $2305.20/oz after rising to $2322.14. They are currently down only 0.1% to $2313.00 after falling 0.3% on Wednesday and are still 3.8% higher in April. There is little direction from the greenback with the USD index unchanged.

- Bullion has traded below the 20-day EMA signalling the start of a possible corrective cycle. Initial support is at $2291.60, April 23 low. It has been significantly overbought and a correction would allow that to unwind. The bull trigger is at $2431.50, April 12 high.

- Gold prices are down 3.3% this week due to the easing of geopolitical tensions in the Middle East and subsequent reduction in safe-haven purchases. It remains elevated though possibly due to increased demand from Asia, inflation hedging and central bank buying.

- Later US Q1 GDP and core PCE price index, March trade, inventories and weekly jobless claims print. Gold will watch GDP and the consumer price component closely as price moves are highly dependent on Fed expectations. Bloomberg consensus is at 2.5% q/q saar for GDP and an elevated 3.4% for core PCE prices. A print above this would likely weigh on non-yield bearing bullion as Fed easing expectations get pushed back further.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/04/2024 | 0600/0800 | ** |  | SE | PPI |

| 25/04/2024 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/04/2024 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2024 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 25/04/2024 | 0700/0900 |  | EU | ECB's Schnabel Speech for 'ChaMP' | |

| 25/04/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/04/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 25/04/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 25/04/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/04/2024 | 1230/0830 | *** |  | US | GDP |

| 25/04/2024 | 1230/0830 | * |  | CA | Payroll employment |

| 25/04/2024 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 25/04/2024 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 25/04/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/04/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/04/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/04/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/04/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.