-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Fed Says Big Banks Ready To Weather Potential Recession

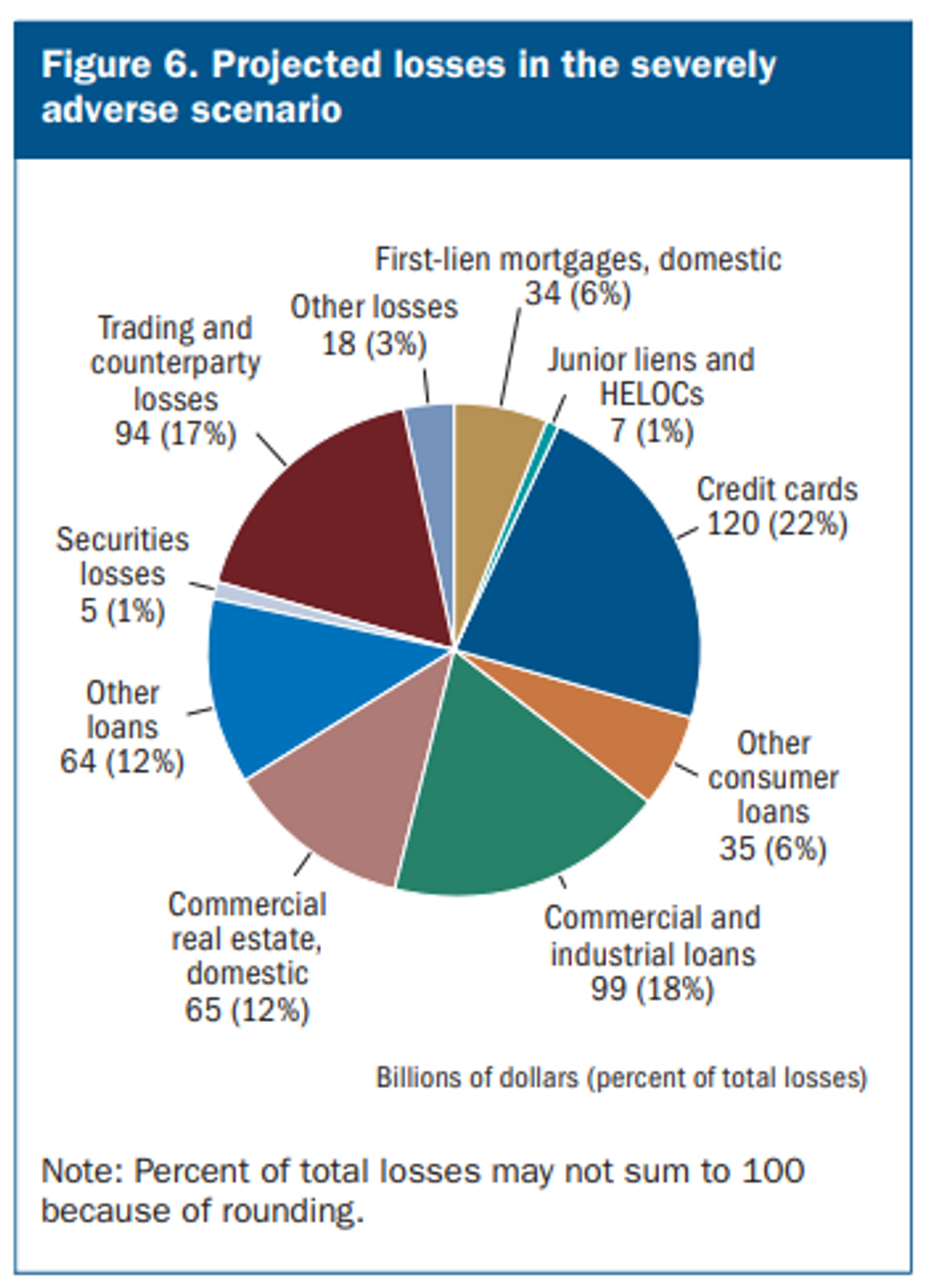

The Federal Reserve gave the biggest U.S. banks a clean bill of health in its annual stress test, saying they would be able to continue lending to households and businesses even in a severe recession, despite seeing total projected losses over half a trillion dollars.

All 23 banks tested remained above their minimum capital requirements during the hypothetical recession that includes a severe global recession with a 40% decline in commercial real estate prices and the unemployment rate rising to a peak of 10%, the central bank said in a report Wednesday.

“Today’s results confirm that the banking system remains strong and resilient,” Vice Chair for Supervision Michael Barr said in a statement, adding that policymakers should remain humble about how risks can arise and continue work to ensure that banks are resilient to a range of economic scenarios, market shocks, and other stresses.

Banks were preparing for the release of the Fed's stress test results, the first in a trio of regulatory actions that could result in higher capital requirements. The results are expected to be followed by announcements of Basel III Endgame requirements and new regulations in the wake of the collapse of four regional banks earlier this year.

The Fed changes the scenarios each year. The 2023 tests were devised before this year's banking crisis in which Silicon Valley Bank and two other lenders failed.

The test’s focus this year on commercial real estate shows that while large banks would experience heavy losses in the hypothetical scenario, they would still be able to continue lending, the Fed said, noting total projected losses amounting to USD541 billion. That is higher than the losses projected in last year’s test but the Fed said the 2.3% aggregate decline in capital is comparable to projections from stress tests in recent years.

In the severely adverse scenario, banks are projected to lose USD64.9 billion on CRE exposures, or 8.8% of average balances. Overall projected CRE loss rates have fallen since 2020 as the hospitality sector recovered from the acute pandemic-related stress, but they remain elevated.

Source: Federal Reserve

Source: Federal Reserve

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.