-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI GLOBAL MORNING BRIEFING: Ukraine Crisis Deepens

Swiss and Swedish data dominates the calendar Monday, although the main release will likely be the Spanish flash February inflation data. However, all economic releases will take a back seat as the headlines from and surrounding the Ukraine conflict dominate the newswires.

Early releases see the Swedish Q4 GDP and retail sales due at 0700GMT. GDP is expected to have grown 1.4% in the three months to December, slowing modestly from 2.0% in Q3. Annually, Q4 growth is expected to pick up tp 6.1% from 4.7% previously.

Swedish retail sales are seen rising 3.2% y/y, recovering from the 4.4% decline in December, although January year-on-year growth is expected to slow to 2.0% from 3.3% in December.

Swiss January retail sales are also expected to recover from the weakness seen in December, with m//m sales at 1.4% vs -2.0%, rising 1.2% y/y vs a 0.4% decline.

Swiss Q4 GDP is expected to rise 0.4% q/q in Q3, slowing from 1.7%, with y/y growth slowing to 3.7% from 4.1%. The KOF February sentiment survey is seen rising to 108.5 from 107.8 in January.

Spain February inflation is seen higher again, with the harmonized index rising to 6.8% y/y, up from 6.2% in January. CPI is also seen at 6.8% y/y.

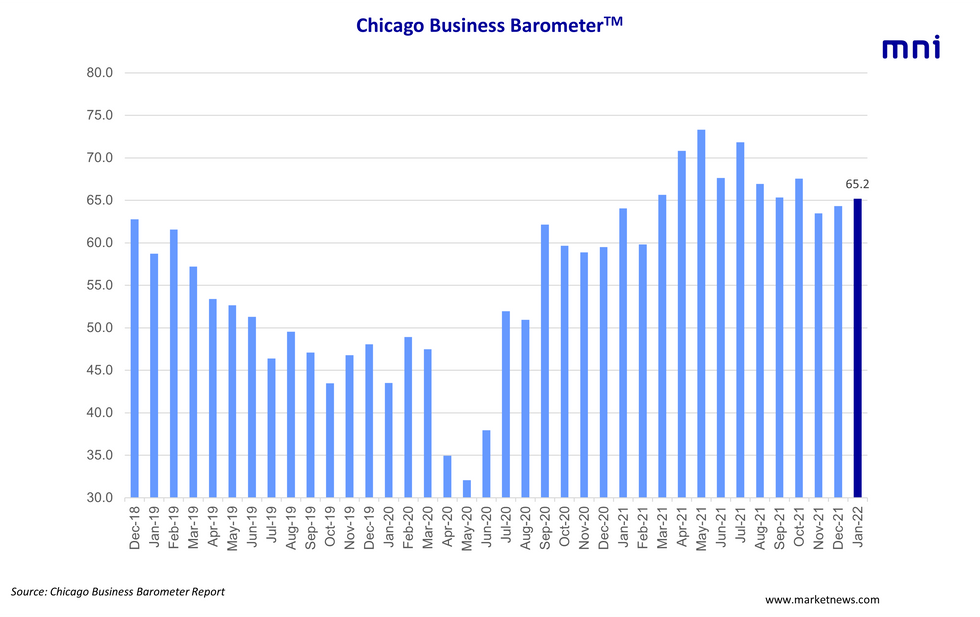

Across the Atlantic, data is largely 2nd tier, although the MNI Chicago Business Barometer will be closely watched.

The US advanced goods trade and Canadian PPI data are expected at 1330GMT. At 1445, the Chicago BB is expected to slow from the 65.2 seen in January.

Chicago Business Barometer to January 2022

Policymaker speeches Monday will include ECB President Christine Lagarde and Executive Board member Fabio Panetta, along with Atlanta Fed President Raphael Bostic. Focus will be on any signs that the current crisis will amend their thinking over policy normalization in coming months.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2022 | 0700/0800 | *** |  | SE | GDP |

| 28/02/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 28/02/2022 | 0700/0800 | ** |  | SE | Trade Data |

| 28/02/2022 | 0730/0830 | ** |  | CH | retail sales |

| 28/02/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 28/02/2022 | 0800/0900 | *** |  | CH | GDP |

| 28/02/2022 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 28/02/2022 | 1130/1230 |  | EU | ECB Panetta speech at EUI monetary policy debate | |

| 28/02/2022 | 1330/0830 | ** |  | US | advance trade, advance business inventories |

| 28/02/2022 | 1330/0830 | * |  | CA | Current account |

| 28/02/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 28/02/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/02/2022 | 1530/1030 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/02/2022 | 1550/1650 |  | EU | ECB Lagarde speech on Women in Econ & Finance | |

| 28/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/03/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.