-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Focus on EZ IP

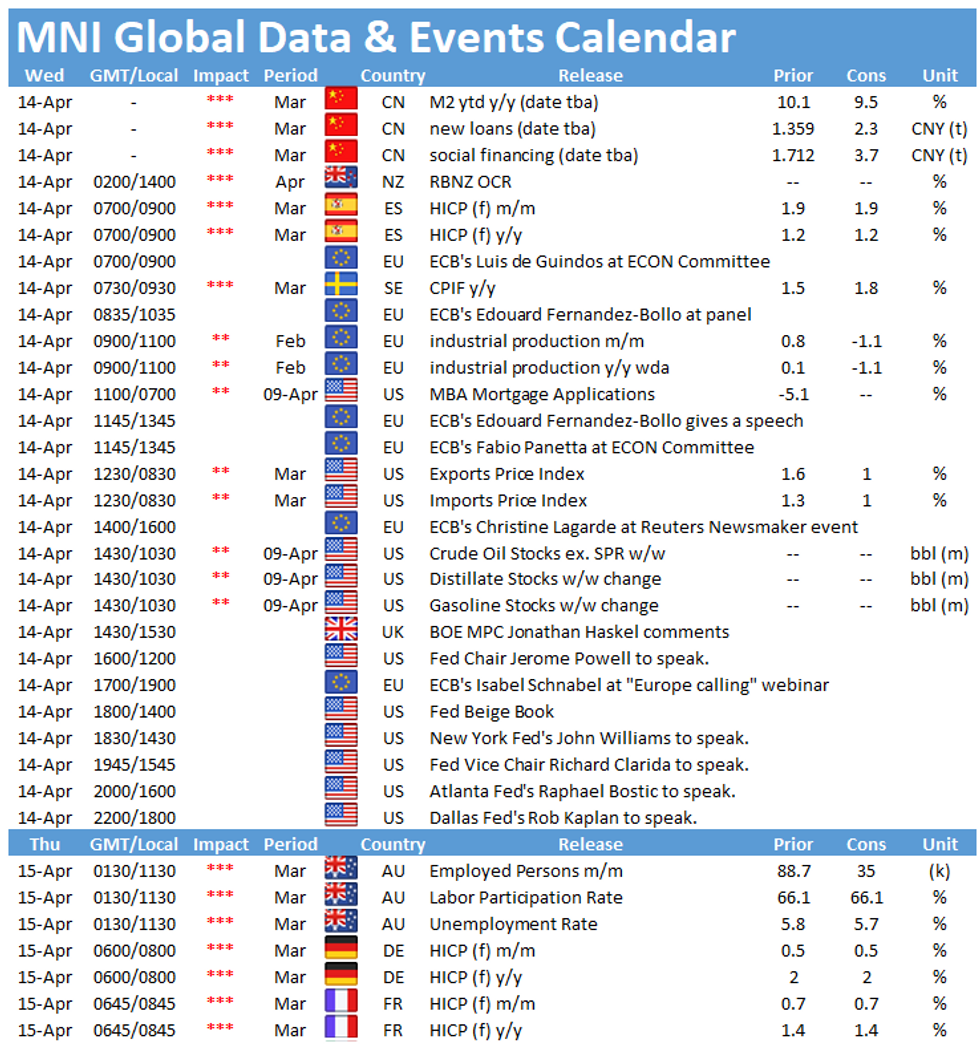

The main data events Wednesday include the publication of Swedish inflation figures at 0830BST, followed by EZ industrial production at 1000BST. In the US the release of the import and export price index at 1330BST is notable.

Swedish inflation seen higher

Annual Swedish inflation is forecast to accelerate to 1.6% in March, following February's downtick to 1.4%. The CPI recovered in January when it rose to 1.6% after recording levels below 1% since March 2020. Meanwhile, the CPIF is expected to increase to 1.8% in March, up from 1.5% recorded in February. The main contributions to price growth in February came from rising prices for clothing and fuel and electricity, while food inflation declined. In its February forecast the Riksbank noted that inflation is expected to vary significantly this year due to energy prices and changed patterns of consumption during the pandemic. While they expect inflation to remain stable in 2022, the Riksbank sees price growth sustainably at target (2.0%) only in 2023.

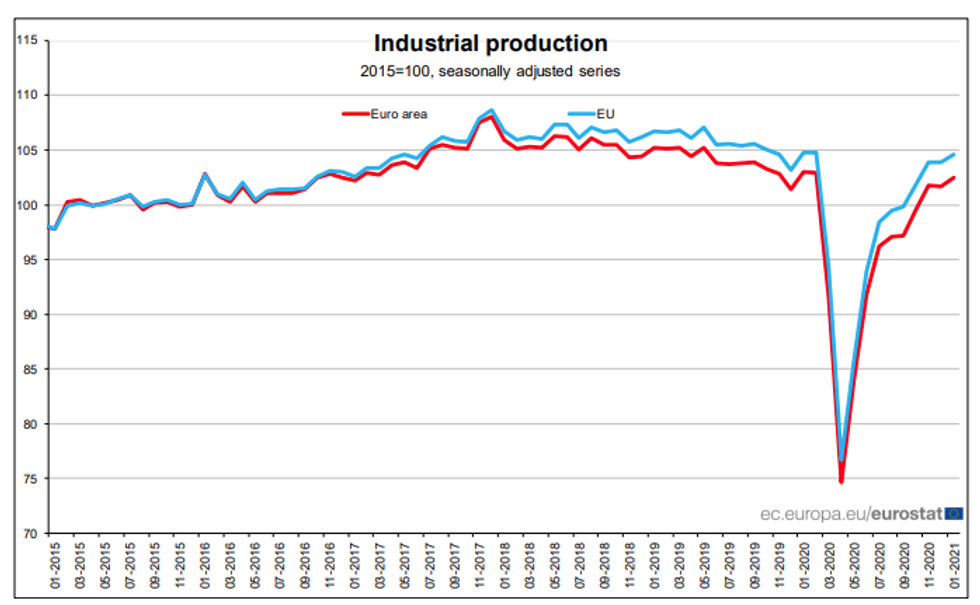

EZ industrial output expected to drop

Monthly industrial production is forecast to decline by 1.1% in February after rising by 0.8% in January. Industrial output in Europe was hampered by supply chain issues and cold weather, which is likely to take its toll in February as well. Survey evidence continues to indicate strong business activity growth in the manufacturing sector. The manufacturing PMI rose sharply in March and reported the largest improvement in operating conditions in 24 year.

On the other hand, available state level data for industrial production provides a different picture for February. Germany and France posted declines of industrial output in contrast to markets predicting an uptick and Spanish output was flat, also coming in below expectations. The Italian IP index rose slightly in February, but by less than anticipated.

Source: Eurostat

US import price index seen lower

The import price index is forecast to tick down to 1.0% in March after rising by 1.3% in the previous month and by 1.4% in January. January's increase was the largest uptick since March 2012. Annual import prices increased markedly as well, edging up to 3.0% in February. Both fuel and nonfuel prices contributed to the rise in the import price index with prices for fuel imports growing by 11.1%, while nonfuel import prices increased 0.4%. The export price index is seen decelerating to 1.0% in March, down from 1.6% recorded in February and 2.5% seen in January. January's increase was the largest since records began in 1988.

Wednesday's event calendar throws up a busy schedule. The main speakers to follow include ECB's Luis de Guindos, Edouard Fernandez-Bollo, Fabio Panetta, Christine Lagarde and Isabel Schnabel as well as Dallas Fed's Rob Kaplan, BOE's Jonathan Haskel, New York Fed's John Williams and Atlanta Fed's Raphael Bostic.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.