-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

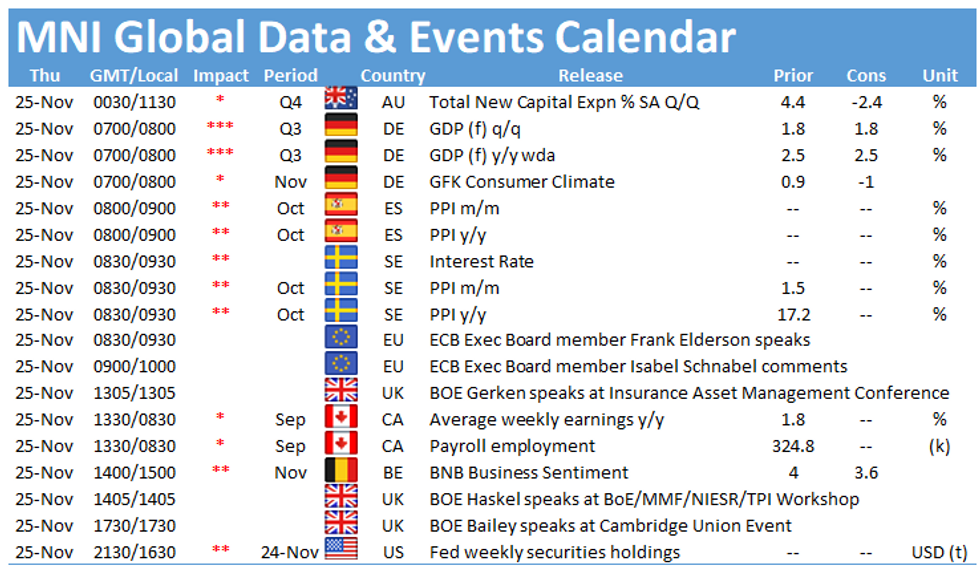

MNI GLOBAL MORNING BRIEFING: November 25

With U.S. markets closed for the Thanksgiving holiday, Europe picks up the slack on data releases.

German Gfk consumer climate (0700 GMT)

German consumer confidence is forecast to drop to -1.0 in December, down almost two points from 0.9 in November. The index popped above zero last month, following all readings being below zero since the beginning of the pandemic.

Consumer optimism continues to diminish as inflated prices squeeze disposable incomes and citizens find themselves in a state of uncertainty with the imminent threat of lockdowns following neighbouring Austria.

German final Q3 GDP seen unrevised (0700 GMT)

German GDP growth is seen unrevised, with quarterly GDP predicted to remain at 1.8% q/q and annual GDP to stay steady at 2.5%.

Germany's growth over Q3 is largely attributable to boosted household consumption over the period, however, this was dampened by persistently high energy prices and supply bottlenecks hampering the manufacturing sector.

Spanish PPI seen higher again (0800 GMT)

Analysts are looking for the y/y PPI rate to jump above 24% in October, following last month's reading of 23.6%. The Spanish PPI showed negative readings from mid-2019 until this year, where prices have been hiking since March as inflated electricity and fuel costs coupled with supply chain disturbances continue to push prices upwards. Despite strong inflation, the ECB remains geared towards note hiking in 2022.

Swedish PPI to reach all-time high (0830 GMT)

Energy prices continue to wreak havoc across Europe, with Sweden's PPI is forecasted to continue to increase to 17.9% for October, compared to 17.2% in September and surpassing record highs in Swedish data. For the Riksbank this could imply either a separation from their three-year-long zero-rate policy or monetary tightening in the foreseeable future.

Speakers Thursday include ECB Executive Board members Isabel Schnabel and Frank Elderson, with BOE Governor Andrew Bailey and MPC member Johnathan Haskel also on the schedule.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.