-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: US Retail Sales Seen Slowing

Europe's data calendar is again quiet on Friday with the only release scheduled being final inflation figures from Spain at 0800BST. The main data publications to follow in the US include the release of retail sales at 1330BST and industrial production figures at 1415BST.

Final Spanish inflation seen at flash result

Inflation accelerated significantly in April, mainly on the back of electricity prices and energy price base effects as fuel and oil prices fell sharply at the same time a year ago. The annual HICP rose to 1.9%, while the CPI increased to 2.2%. Core inflation on the other hand, eased 0.3pp to 0.0% in April, according to the flash result. Markets are looking for an unchanged reading for the final print.

Survey evidence indicates rising prices as well with the Spanish services PMI noting that higher operating costs led to an increase in output charges. However, inflation remains modest as competitive pressures remain and weigh on pricing power.

US retail sales forecast to rise at slower pace

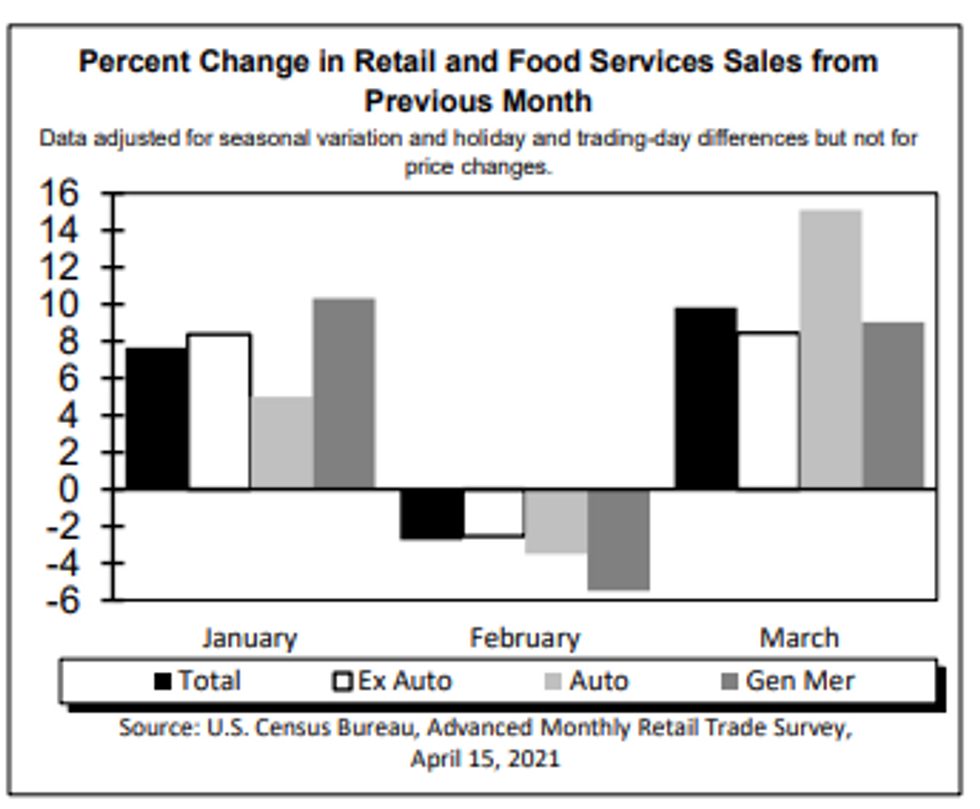

Sales are expected to have slowed through April after a stronger-than-expected March reading of 9.8%, as highlighted in the latest MNI Reality Check, with Bloomberg forecasting a gain of 1.1%. Momentum from government stimulus and business re-openings that fuelled spending through March extended into April. Excluding motor vehicle sales, retail sales should have increased 0.8%, and excluding sales from both vehicles and gas stations, retail sales should rise 0.7%.

The conference board consumer confidence index noted that households are more optimistic about their income prospects, likely due to the improving job market and the recent stimulus checks. Moreover, the Michigan sentiment index is also forecast to rise in May, following an uptick in April. Both developments bode well with future gains of retail sales.

US industrial production expected to slow slightly

Monthly industrial production rebounded in March to 1.4% after dropping by 2.6% in the previous month. In March, manufacturing and mining output increased by 2.7% and 5.7%, respectively. On the other hand, utilities output dropped by 11.4% due to a change in demand for heating caused by temperature swings between February and March. In April, markets are looking for another gain of industrial production, although at a slower pace of 1.3%. Meanwhile, capacity utilisation is forecast to edge higher to 75.3% in April, up from 74.4% seen in the previous month. March's rate was still 5.2% below the long-run average.

Survey evidence is in line with market forecasts. The ISM manufacturing PMI eased slightly in April, however, the index remains well above the 50-mark, signalling expansion of business activity. The IHS manufacturing also suggests an expansion of output in April with the index ticking up slightly.

The only event scheduled on Friday is Dallas Fed's Rob Kaplan participating in a webinar.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.