-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

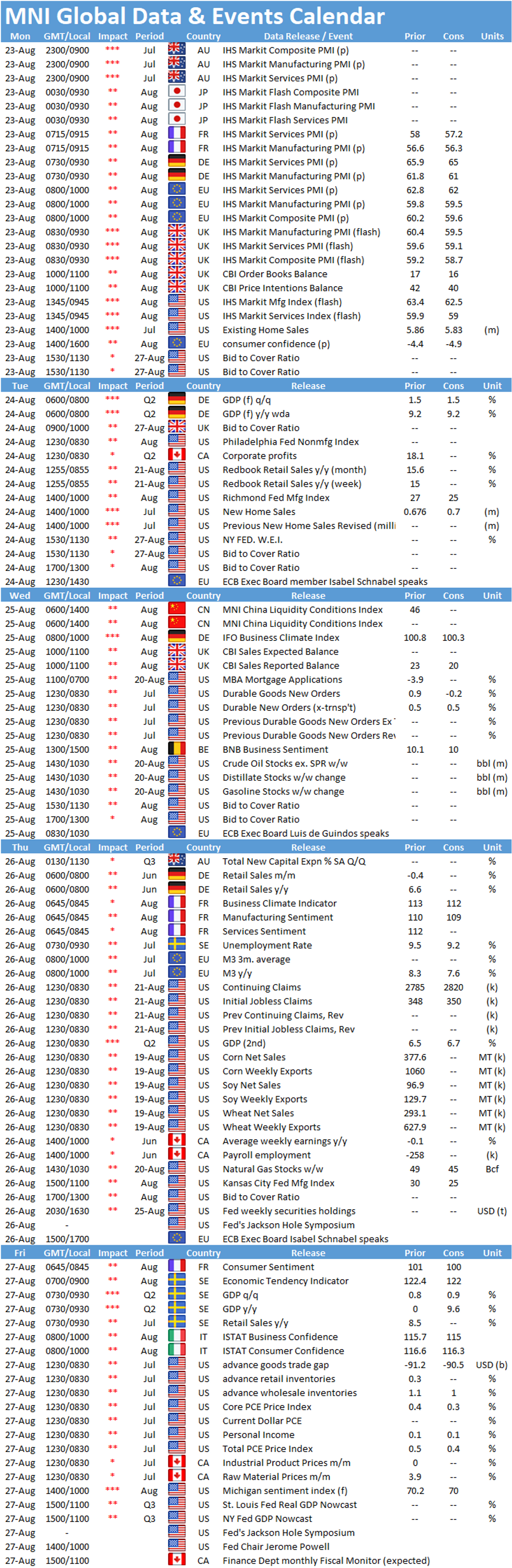

Free AccessMNI Global Week Ahead August 23 – 27

Key Things to Watch:

- Wednesday, August 25 – Germany IFO Survey

- Germany's IFO survey is expected to confirm businesses see a modest slowing into late Q3, certainly in the manufacturing sector. The Current Climate index is expected to decline to 100.3 in August from 100.8 last month, with the Expectations index likely to decline to 100 from 101.2.

- Expectations fell in July after hitting a post-Covid peak in June at 103.7 and are likely to drift again as the Delta variant remains a concern, supply chains pressures intensify, costs rise, and Asian export markets look set to slow.

- Thursday, August 26 – Saturday, August 28 – Federal Reserve's Jackson Hole Symposium

- Fed Chair Jay Powell is set to deliver a speech via webcast on the economic outlook Friday at 10 ET. His remarks will be closely watched for any hints on QE taper timing and how the surge in delta variant cases is shaping the Fed's forecasts.

- Minutes of the July FOMC meeting said most officials supported starting the taper this year if the economy performs as expected.

- The topic of the annual academic conference is ""Macroeconomic Policy in an Uneven Economy" and a detailed schedule is typically released the evening before.

- Friday, August 27 – U.S. Personal Income

- Incomes in July likely dropped off as many states ended federal pandemic unemployment insurance programs in late June, though that should be partially offset by wage increases through the month as labor remained in short supply. Personal income is set to increase 0.1%, according to Bloomberg, the same as June.

- Higher wages and price pressures on goods like gasoline and services in high demand kept PCE inflation elevated through July, with Bloomberg forecasting an increase of 0.4% m/m and 4.1% y/y. Core PCE inflation is set to grow 0.3% m/m and 3.6% y/y.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.