-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI GLOBAL WEEK AHEAD: Eyes on Euro Inflation & US Payrolls

All eyes will be on flash eurozone inflation data and US nonfarm payrolls this week, two key influences on the Fed and ECB December monetary policy decisions.

MONDAY No key economic data due.

TUESDAY

Switzerland GDP: The Swiss economy is expected to have maintained pace at +0.3% q/q in Q3, in line with Q2 growth. Looking forward, weak demand from the eurozone alongside high energy prices will weigh heavily on Swiss growth. Energy shortages into winter remain a substantial risk to the resilience of the Swiss economy.

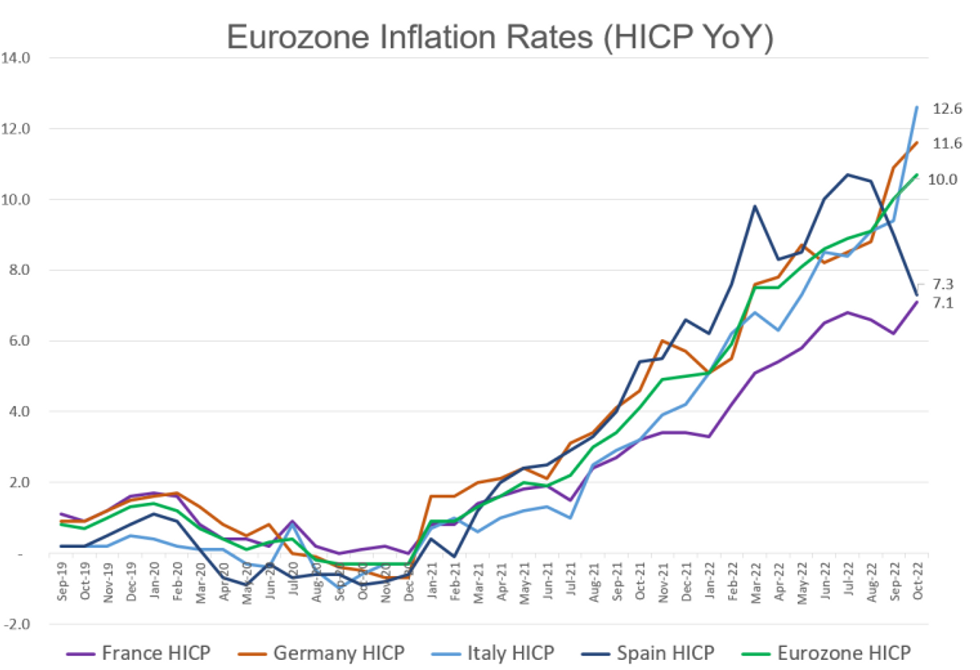

Spain CPI: Spanish headline inflation is anticipated to tick down by 0.2pp to +7.1% y/y in the November flash harmonised print. Contrasting to other major eurozone economies, Spanish inflation has managed to continue a downward trend since August, appearing firmly beyond peak inflation of +10.7% y/y in July.

Germany CPI: German inflation is forecasted to ease off the October peak in November, cooling by 0.3pp to +11.3% y/y in the harmonised print. Prices should come close to stalling on the month. This follows the marked upside surprise in October, which saw energy support packages fail to cool headline inflation.

Eurozone Economic Sentiment: Euro area economic sentiment is expected to see a minor 0.5-point improvement to 93.0 in November, inching off October lows.

Canada GDP: Canadian GDP growth is projected to slow to +0.4% q/q into Q3, after having expanded by a robust +0.8% q/q in Q1 and Q2. Annualised Q3 GDP should ease to around +1.6% (vs +3.3% in Q2) according to StatsCan prelim data. The Canadian economy is seen teetering on the edge of a recession in 2023 as the Bank of Canada looks to raise rates at least another quarter point in December.

US Consumer Confidence: Despite upticks in consumer confidence across Europe, US confidence is forecasted to moderate by 2.5 points to a four-month low around the 100-mark. US consumers have remained relatively optimistic this year, yet inflationary concerns picked up alongside weakening economic expectations in October. A substantial fall in US consumer sentiment could imply weak holiday-season sales.

WEDNESDAY

MNI China Liquidity Survey: The November China Liquidity Index is due on Wednesday, after conditions across China’s interbank market eased and economic outlooks improved in October.

France CPI: French headline harmonised inflation is seen softening by 0.1pp to +7.0% y/y in the prelim November data, ticking up by a more moderate +0.3% m/m. Consumer spending data is also due, which will likely signal an October contraction as high inflation dampens demand headed into the holiday season.

Germany Labour Report: German unemployment should hold steady at around 5.5% in the November data.

Italy CPI: Italian harmonised inflation is expected to also cool in the November flash, slowing by 0.6pp to +12.0% y/y. Prices are seen expanding by +0.2% m/m, a substantial decline from the hefty upside surprise of +4.0% m/m record in October.

Eurozone HICP: Should the slew of national CPI data reflect current forecasts, eurozone HICP is anticipated to edge down by 0.1pp to +10.6% y/y, whilst core inflation holds steady at +5.0% y/y. Following the recent trend in upwards surprises, another euro area uptick is the more likely tail risk. MNI’s interview with Ex ECB’s Gerlach noted that “given what has happened to energy prices, there is the potential for a big drop in inflation going forward”. He highlighted the possibility of hawkish policymakers hiking a less-aggressive 50 basis points in Dec in return for an earlier-than-anticipated start to running off bonds balance sheet.

This, in conjunction with Thursday’s unemployment data will largely influence the December rate decision. Markets are currently pricing around 62bp.

MNI Chicago PMI: The Chicago PMI (produced by MNI and ISM Chicago) for November follows two consecutive months of contractionary activity. The data is due one day in advance of the strongly correlated ISM manufacturing index. Shortly before the Chicago PMI release, US second estimates for Q3 GDP are due, alongside October prelim wholesale inventories, which are anticipated to expand by around 0.5% m/m again as the decline in new orders continues to leave firms accumulating stock.

THURSDAY

Germany Retail Sales: October retail sales will likely be in the red in October. Consensus is looking for a -0.6% m/m and -3.7% y/y contraction. This is substantially worse than +0.9% m/m recorded in September, which reflected the boost to Q3 GDP provided by robust consumer spending.

Switzerland CPI: Following Tuesday’s GDP release, Swiss CPI is likely to hold steady at around +3.0% y/y in November. The SNB is likely to hike its policy rate by 50bps to 1% next month, and signal that it will continue to allow currency appreciation to curb imported inflation. Next month’s SNB forecasts should show a downward trend for both GDP and inflation. While a deep recession is less likely for Switzerland than for the eurozone, headline inflation may take longer to fall due to the high proportion of government-controlled price inputs.

Final Manufacturing PMIs: The final S&P Global PMI prints follow prelim estimates which saw manufacturing remain contractionary across the eurozone and UK, albeit edging up slightly. The US provided the downside surprise in the flash, which signalled a contraction in activity for the first time since June 2020.

Eurozone Unemployment: Euro area unemployment is forecast to hold steady at September’s euro-era low of 6.6% in October, underscoring confidence in the ECB’s rate hikes as they tighten into a recession.

US Personal Income & Sending: October US personal income and spending are anticipated to advance by +0.4% m/m and +0.8% m/m, largely in line with September growth.

US ISM Manufacturing: The November ISM Manufacturing PMI is expected to weaken by 0.4pp, dipping into contractive territory at around 49.8. This would be the first contraction since May 2020. Sharp and continual falls in New Orders have been flagged by regional PMI data and weakening demand prospects are of concern to Q4 growth, leaving the holiday season boost to likely be muted. Of note will also be signs of price pressures diminishing due to weaker demand and employment growth showing any weakness.

FRIDAY

Eurozone PPI: Following downside surprises in German and Spanish data, October PPI should ease substantially from 41.9% y/y recorded in September as energy prices slow across the bloc.

US Nonfarm Payrolls / Unemployment: A softer 200k uptick in nonfarm payrolls is expected by the consensus for November (down from +261k in October). This would be the weakest NFP growth since December 2020, signalling the initial onset of a gradually slowing US labour market. Tech-sector job severances have made headlines in recent months and will be a likely drag. The unemployment rate should remain unchanged at 3.7%.

Source: MNI / Bloomberg

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/11/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 28/11/2022 | 0900/1000 | ** |  | EU | M3 |

| 28/11/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 28/11/2022 | 1330/0830 | * |  | CA | Current account |

| 28/11/2022 | 1400/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 28/11/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/11/2022 | 1530/1530 |  | UK | DMO Q1 Consultation Meetings | |

| 28/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 28/11/2022 | 1700/1200 |  | US | New York Fed's John Williams | |

| 29/11/2022 | 0530/0630 | *** |  | DE | North Rhine Westphalia CPI |

| 29/11/2022 | 0700/0800 | *** |  | SE | GDP |

| 29/11/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/11/2022 | 0800/0900 | *** |  | CH | GDP |

| 29/11/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 29/11/2022 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/11/2022 | 0810/0910 |  | EU | ECB de Guindos Opens Encuentro Financiero Event | |

| 29/11/2022 | 0900/1000 | *** |  | DE | Hesse CPI |

| 29/11/2022 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 29/11/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/11/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 29/11/2022 | 1000/1100 | *** |  | DE | Saxony CPI |

| 29/11/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/11/2022 | 1000/1100 | ** |  | IT | PPI |

| 29/11/2022 | 1235/1235 |  | UK | BOE Mann Panels The Conference Board Conference | |

| 29/11/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/11/2022 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 29/11/2022 | 1330/1430 |  | EU | ECB Schnabel Speech at Frankfurter Konjunkturgespraech | |

| 29/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/11/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 29/11/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/11/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 30/11/2022 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/11/2022 | 0030/1130 | *** |  | AU | Quarterly construction work done |

| 30/11/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 30/11/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 30/11/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 30/11/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 30/11/2022 | 0730/0730 |  | UK | DMO Publishes Q3 Issuance Calendar | |

| 30/11/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 30/11/2022 | 0745/0845 | ** |  | FR | PPI |

| 30/11/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 30/11/2022 | 0745/0845 | *** |  | FR | GDP (f) |

| 30/11/2022 | 0800/0900 |  | ES | Retail Sales | |

| 30/11/2022 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/11/2022 | 0830/0830 |  | UK | BOE Pill Speech at ICAEW Summit | |

| 30/11/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 30/11/2022 | 0900/1000 | *** |  | IT | GDP (f) |

| 30/11/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 30/11/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 30/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/11/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 30/11/2022 | 1330/0830 | *** |  | US | GDP (2nd) |

| 30/11/2022 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 30/11/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 30/11/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 30/11/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 30/11/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 30/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 30/11/2022 | 1830/1330 |  | US | Fed Chair Jerome Powell | |

| 30/11/2022 | 1900/1400 |  | US | Fed Beige Book | |

| 01/12/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/12/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/12/2022 | 0700/0800 | ** |  | DE | Retail Sales |

| 01/12/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 01/12/2022 | 0730/0830 | *** |  | CH | CPI |

| 01/12/2022 | 0730/0830 | ** |  | CH | retail sales |

| 01/12/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/12/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 01/12/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 01/12/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 01/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/12/2022 | 1425/0925 |  | US | Dallas Fed's Lorie Logan | |

| 01/12/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/12/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/12/2022 | 1500/1000 | * |  | US | Construction Spending |

| 01/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 01/12/2022 | 1645/1745 |  | EU | ECB Lane at Banque de France / EUI conference | |

| 01/12/2022 | 1730/1830 |  | EU | ECB Elderson Speech at Lustrum Symposium | |

| 02/12/2022 | 0240/0340 |  | EU | ECB Lagarde Panels Bank of Thailand Conference | |

| 02/12/2022 | 0700/0800 | ** |  | DE | Trade Balance |

| 02/12/2022 | 1000/1100 | ** |  | EU | PPI |

| 02/12/2022 | 1200/1300 |  | EU | ECB de Guindos Speech at OK Diario Event | |

| 02/12/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 02/12/2022 | 1330/0830 | * |  | CA | Production Estimate of Principal Field Crops |

| 02/12/2022 | 1330/0830 | *** |  | US | Employment Report |

| 03/12/2022 | 0230/0330 |  | EU | ECB Lagarde at Bank of Thailand Roundtable |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.