-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

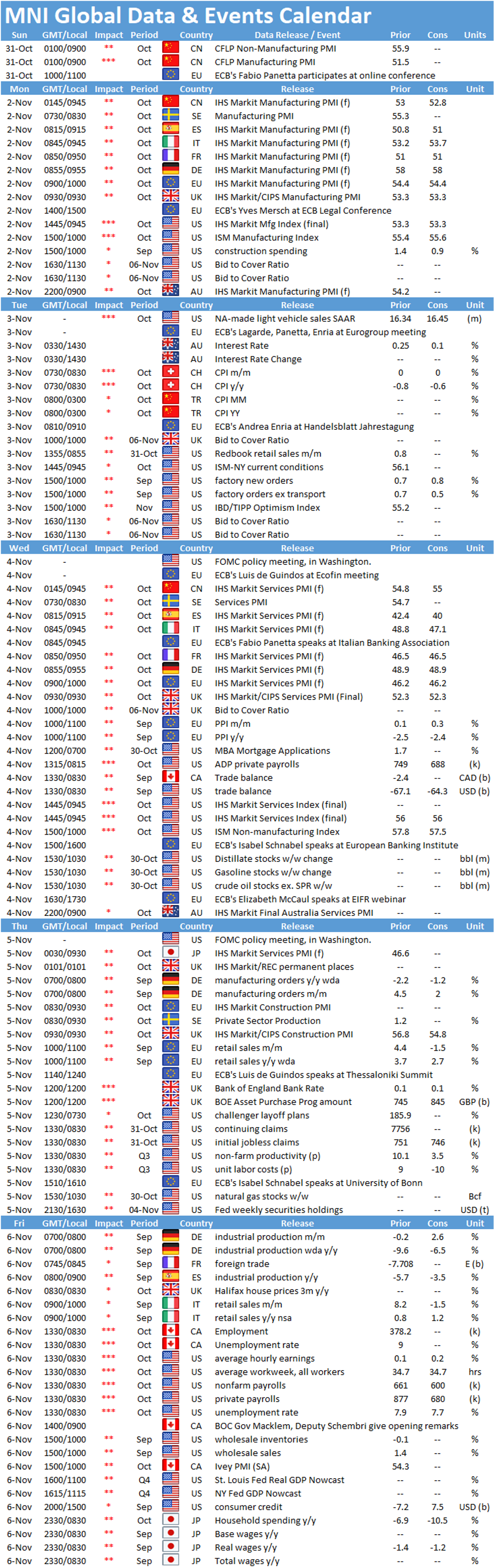

Free AccessMNI Global Week Ahead November 2 - 6

Key Things to Watch For:

- Thursday, November 5 – Bank of England Policy Decision

- The BOE meets amid a sharp increase in Covid-19 infections and a service-driven slowdown, boosting expectations that Threadneedle Street's policymakers will ease policy further.

- While too early for the Bank to move towards negative rates -- the consultation period doesn't end until mid-November -- the BOE will likely further increase levels of QE.

- With no firm guidance on the MPC's rule of thumb, estimates range from GBP55 billion to GBP100 billion of additional firepower.

- Thursday, November 5 – FOMC Policy Decision

- No change in policy is anticipated at the meeting two days after the presidential election, and will not include an SEP update. Rates are on hold near zero and asset purchases are expected to continue at the current pace.

- Sources expect a detailed discussion of future balance sheet policy options that include ramping up QE, shifting purchases toward longer maturities, yield curve control and expanding the purchases of non-Treasury assets. The release of the meeting minutes after a three-week delay should shed more light on that.

- Friday, November 6 – U.S. Nonfarm Payrolls

- Employment continued to grow through October, though the labor market recovery is still slowing after unprecedented improvement in the spring and summertime. Nonfarm payrolls should grow by 600,000 in figures due Friday, according to Bloomberg.

- Weekly unemployment claims levels have softened in recent weeks, suggesting that employers increased staff through the month. But analysts note that claims being made under special provisions of the CARES Act are still surging, and roughly 23 million unemployed Americans are still receiving government support.

- Hiring is thought to have slowed in mid-to-late October as Covid-19 case counts and hospitalization rates across the country skyrocketed and the many businesses were constrained by social distancing guidelines.

- Private payrolls are set to grow 680,000 in October, according to Bloomberg.

- The unemployment rate in October likely fell to 7.7% from 7.9% in September.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.