-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS: Divergence in UK / European Rates

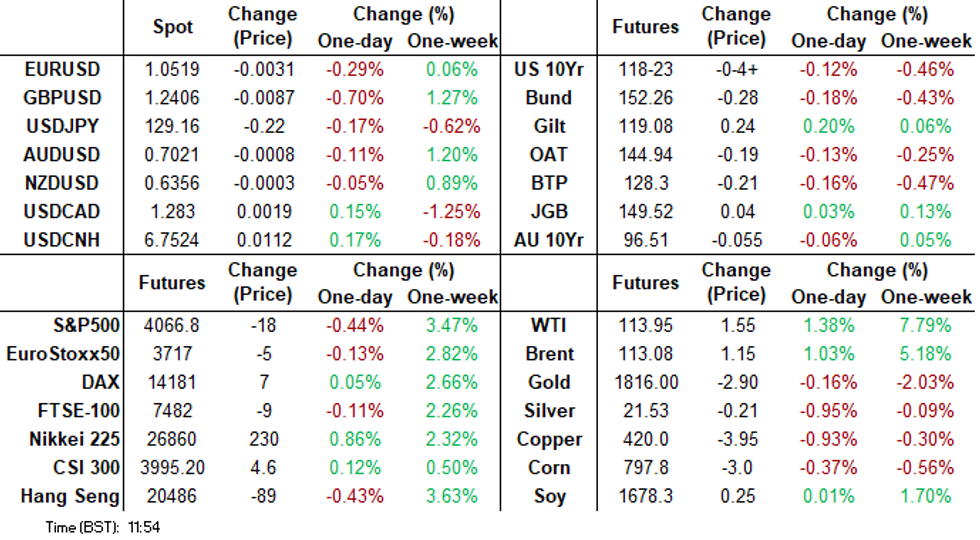

Resending this email that was originally transmitted at 0657ET/1157 London time.

Highlights:

- UK CPI a tenth lower than expected leading to retracement of some of yesterday's GBP strength and gilt sell-off.

- ECB hikes expectations increase after ECB's Rehn said recent data is closer to the adverse scenario in the ECB's March staff projections.

US TSYS: Starting To Build On Yesterday's Sell-Off, 20Y Auction Later

- Cash Tsys unwind an overnight move firmer to leave levels broadly consolidating yesterday’s sizeable sell-off, with the more recent move lower in the front-end in particular being supported by further support for ECB hikes in July.

- 2YY +0.4bps at 2.705%, 5YY +0.4bps at 2.967%, 10YY -0.4bps at 2.982% and 30YY -0.2bps at 3.176%.

- TYM2 sits 4+ ticks lower on the day at 118-23 on modestly below average volumes. Treasuries remain below the recent high of 120-00+ on May 12. The trend direction remains down and recent short-term gains are considered corrective -a pause in the downtrend. Any resumption of gains would open 120-18+, the Apr 27 high. Support eyed at 118-03+ (May 11 low).

- Data/Fedspeak: MBA mortgage apps/contract rate and housing starts/building permits before Harker (’23 voter) at 1600ET.

- Bond issuance: $17B 20Y auction (912810TH1) at 1300ET

- Bill issuance: US Tsy $34B 52W Bill auction carried over from Tuesday at 1130ET

STIR FUTURES: Fed Hikes Dip But Still Near Post-FOMC Highs

- Fed Funds implied hikes have eased since Powell’s interview, which included seeking a convincing inflation drop, neutral rates not a stopping or looking-around point and no hesitation to raising above neutral if needed.

- Evans (’23 voter) was more measured late on, expecting by July or Sep meetings to be talking about transitioning to 25bp hikes and that will have put in place “at least a few” 25bp hikes by Dec whilst expecting to go beyond neutral.

- Pricing 53bp for Jun, 104bp for Jul, 145bp for Sep and 199bp for Dec.

- Ahead: Housing-related data before lone Fedspeak from Harker (’23 voter) at 1600ET.

Cumulative hikes at specific meetings implied by FOMC-dated Fed Funds futuresSource: Bloomberg

Cumulative hikes at specific meetings implied by FOMC-dated Fed Funds futuresSource: Bloomberg

US: Target's Miss Adds To Stagflation Concerns

US retail giant Target's miss on EPS and weaker guidance is dragging stock futures lower. Target is now down 17% premarket; it had been an outperformer this year, down 7% this year as of Tuesday vs -26% for the S&P consumer discretionary index.

- Along with Walmart's huge miss Tuesday, retail giants have not been coping well with the high inflation environment. One never wants to make too many macro conclusions from something like this but the share price reaction suggests, as did Walmart's yesterday, that equities haven't yet fully priced in stagflationary risks. Quotes from the Bloomberg writeup of Target's results:

- On rising costs: "Target said fuel and freight were $1 billion more than expected during the first quarter, while additional hits came from higher pay for warehouse employees and markdowns driven by bloated inventories."

- On consumer activity: Despite higher-than-expected revenue, "strong demand for food and beverages, beauty products and household essentials went along with 'lower-than-expected sales in discretionary categories,' Target said. That’s a sign that shoppers are pulling back as they struggle to buy basic goods."

- On passing along prices to consumers: The CFO "said the company has been raising some prices, although it’s also trying to avoid turning off customers with big increases."

EGB/Gilt: UK Inflation Hits Fresh High

European government bonds have traded mixed this morning with gilts posting gains and euro area bonds trading lower. Equities are broadly higher, but gains have been modest.

- Gilts have stabilised following yesterday's sharp sell off. Cash yields are 2-3bp lower on the day.

- UK headline CPI may have come in slightly below expectations (9.0% Y/Y vs 9.1% expected) but has nonetheless hit a 40-year high, while BoE Governor Andrew Bailey's stark comments earlier in the week on food price risks and controlling inflation continuing to ring loudly.

- ECB commentary has hit the wires again this morning following yesterday's comments from Knot.

- Olli Rehn stated that it was important to quickly move away from negative rates and suggested that the first hike could occur in the summer.

- Meanwhile, Pablo Hernandez de Cos stated that while rate hikes should be gradual given the uncertainty, hikes could nonetheless be made in the coming quarters.

- Bunds have traded lower across much of the curve, although the very long has firmed slightly.

- The OAT curve has similarly twist flattened with the 2s30s spread narrowing 8bp.

- BTPs have sold off with cash yields up 1-6bp and the curve bear flattening.

Issuance Update

Germany

- Sells E1.50bln of the 0% Aug-52 Bund (E1.342bln allotted) with bid-to-cover of 2.76x (Buba cover of 3.08x).

- E1.25bln 7-year May-29 spread set at MS-19bp with books above E3.75bln.

- E1.25bln 20-year May-42 spread set at MS+5bp with books above E2.35bln.

EUROPEAN OPTION HIGHLIGHTS

- RXN2 149.50p, bought for 76/78 in 15k

- OEN2 124.00/123.00/122.50 broken put fly, bought for 12 in 2.5k

FOREX: Most of the action has been in the Pound this morning

- Mostly a steady start for FX, with the USD in the green across G10s, besides versus the Yen, down a small 0.13%.

- Crosses trades well with past ranges, but the notable move so far today, has been in the Pound, following the small CPI miss, by 1 tenth for the MoM and YoY reading.

- The British Pound collapsed and Cable trades in a 129 pips range, but 10 pips off the low at the time of typing.

- EURGBP broke through initial 0.8475 resistance, but failed to break above 0.8500, printed 0.84943 high.

- The EUR also got a small boost after ECB Rehn (leaning Dove): "First rate hike likely to be in the Summer, necessary to move quickly from negative rates".

- But the moves are still limited, given the underpinned USD.

- Looking ahead, nothing in terms of market moving data for the afternoon.

- Fed Harker is the only speaker scheduled for the session.

FX OPTION EXPIRY

Nothing for today or the rest of the week of real note.

AUDNZD 1.8bn at 1.0965 (Monday expiry).- USDJPY; 129.25 (325mln)

Price Signal Summary - S&P E-Minis Gains Considered Corrective

- In the equity space, recent gains in S&P E-Minis are considered corrective and the primary trend direction remains down. Last week’s continuation lower and fresh cycle lows, reinforce the downtrend and signal scope for a continuation lower. The next objective is 3843.25, the Mar 25 2021 low (cont). The key short-term resistance is 4303.50, the Apr 26/28 high. Initial firm resistance is at 4099.00, May 9 high. The primary trend direction in EUROSTOXX 50 futures remains down. However, the contract is currently in a corrective cycle following the recovery from 3466.00, May 10 low. Price is trading at its recent highs and has probed resistance at 3739.60, the 50-day EMA. A clear break of this EMA would improve a short-term bullish theme. On the downside, key support and the bear trigger is 3466.00.

- In FX, EURUSD remains in a downtrend and short-term gains are considered corrective. A resumption of weakness would open 1.0341, the Jan 3 2017 low and a key support. Resistance is at 1.0580, the 20-day EMA. GBPUSD traded higher Tuesday and the pair cleared 1.2406, the May 9 high. This improves short-term conditions for bulls. Attention is on the next resistance at 1.2510, the 20-day EMA, where a break would open 1.2638, the May 4 high and a key resistance. On the downside, key support has been defined at 1.2156, May 13 low. This is also the bear trigger. USDJPY is consolidating. The primary uptrend remains intact. Initial firm support has been defined at 127.52, May 12 low. A resumption of gains would refocus attention on the bull trigger at 131.35, May 9 high. A break would open 131.96, the 1.00 projection of the Feb 24 - Mar 28 - 31 price swing.

- On the commodity front, Gold remains vulnerable following last week’s resumption of the downtrend and recent short-term gains are considered corrective. The yellow metal traded through $1800.0 on Monday. The focus is on $1780.4, the Jan 28 low. In the Oil space, WTI futures maintain a firm note, following recent gains. The contract has breached resistance at $111.37, May 5 high and $113.51, the Mar 24 high. A continuation higher would open $118.13, the Mar 9 high and the $120.00 handle.

- In the FI, Bund futures remain in a downtrend and the contract has pulled away from recent highs. Resistance has been defined at $155.33 May 12 high. An extension lower would open 150.49, the May 9 and the bear trigger. The broader trend condition in Gilts remains down. The contract has found resistance at 121.07, May 12 high. The bear trigger is at 116.87, May 9 low.

COMMODITIES

- WTI Crude up $1.49 or +1.33% at $113.89

- Natural Gas (NYM) down $0.04 or -0.48% at $8.264

- Natural Gas (ICE Dutch TTF) up $2.88 or +3.05% at $97.05

- Gold spot up $1.36 or +0.07% at $1816.53

- Copper down $1.65 or -0.39% at $422.35

- Silver up $0.02 or +0.11% at $21.658

- Platinum up $11.69 or +1.22% at $967.55

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 18/05/2022 | 1230/0830 | *** |  | CA | CPI |

| 18/05/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 18/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 18/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/05/2022 | 2000/1600 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.