-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Norges Bank Review - COVID Risks Keep Lid on Rates

MNI Norges Bank Review - COVID Risks Keep Lid on Rates

Full article here:

MNINBRevNov20.pdfExecutive Summary:

- The Norges Bank kept rates unchanged, alongside expectations, at 0%.

- The Bank noted that economic developments have been largely in line with their September projections, suggesting the Bank felt little need to tweak policy in November.

- House price growth was explicitly mentioned, showing the Bank's focus on the build-up of financial imbalances.

Key Takeaways:

Near-term COVID risks still counter longer-term financial imbalances

With policy rates unchanged and no new macroeconomic forecasts or rate path projections, the November Norges Bank meeting failed to stir a market response. The Bank did, however, provide an update on the domestic economy's performance against the September MPR forecasts.

Broadly, their assessment is that the economy is developing alongside expectations, prompting the Committee to stick with their language that rates will "most likely remain at today's level for some time ahead".

Interestingly, in the latest example of the Bank favouring realtime and high frequency economic indicators over regular releases, the Bank started by highlighting the rise in COVID cases in Norway and abroad, stressing that the "significant increase" in infection rates throughout Autumn will likely weigh on any global recovery. They also noted that while inflation has moderated and is a "little lower than projected", house prices have continued to rise, and unemployment has declined.

This suggests that once the economy enters any post-COVID recovery phase, the financial imbalances element of their mandate could become a priority, despite the view that underlying inflation will moderate in the coming years.

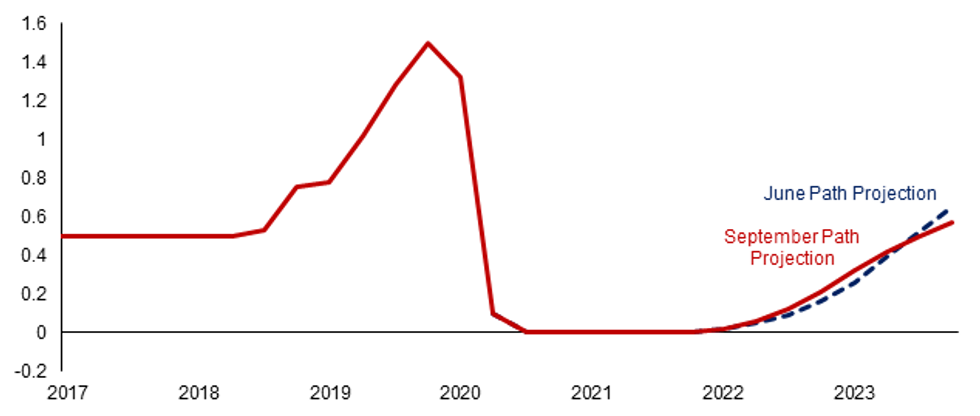

Figure 1: September's rate path projections

Source: MNI/Norges Bank

For the December Monetary Policy Report, the Bank are likely to make only minor revisions to their rate path projections. While the Bank will continue to point to the financial imbalance risks from rising house prices and growing household credit, economic developments have been largely alongside expectations. Additionally, the swelling downside risks from national lockdowns across Europe and rising COVID cases counters any pressure that the Committee may feel from bubbly housing.

Assuming there are no considerable macroeconomic shocks in the meantime, this will likely manifest itself in a slightly higher terminal rate at the very end of the forecast horizon, with rates rising gradually from Q1 2023.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.