-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Aug 18

by Tom Lake

Today's Major COVID-19 Headlines And Latest Data

- The World Health Organisation (WHO)'s Western Pacific regional director Takeshi Kasai stated on August 18 that "the epidemic is changing" insofar as "people in their 20s, 30s and 40s are increasingly driving its spread", compared to the initial outbreaks that tended to centre around older people. Kasai went onto say that younger people increasingly socialising risks those who are asymptomatic unknowingly passing the virus onto older people.

- Mass protests occurred in the Argentinean capital Buenos Aires on August 17 in opposition to the government's handling of the COVID-19 crisis, as well as to planned reforms to the judiciary. Protesters are opposed to President Alberto Fernandez's plans to extend confinement areas around the capital to contain the virus. The city has 90% of the entire country's recorded cases. As of August 18, Argentina has 299,126 confirmed cases causing 5,814 fatalities.

- Several large European nations continue to record spikes in COVID-19 cases. Nineteen countries in total have recorded cumulative two-week infections totals in excess of 20/100k inhabitants according to the European Centre for Disease Prevention and Control. Any score higher than 20/100k is usually considered a sign of a burgeoning outbreak according to health experts. In Spain the rate is currently 115.7/100k, 63.1/100k in Belgium, and 41.2/100k in France.

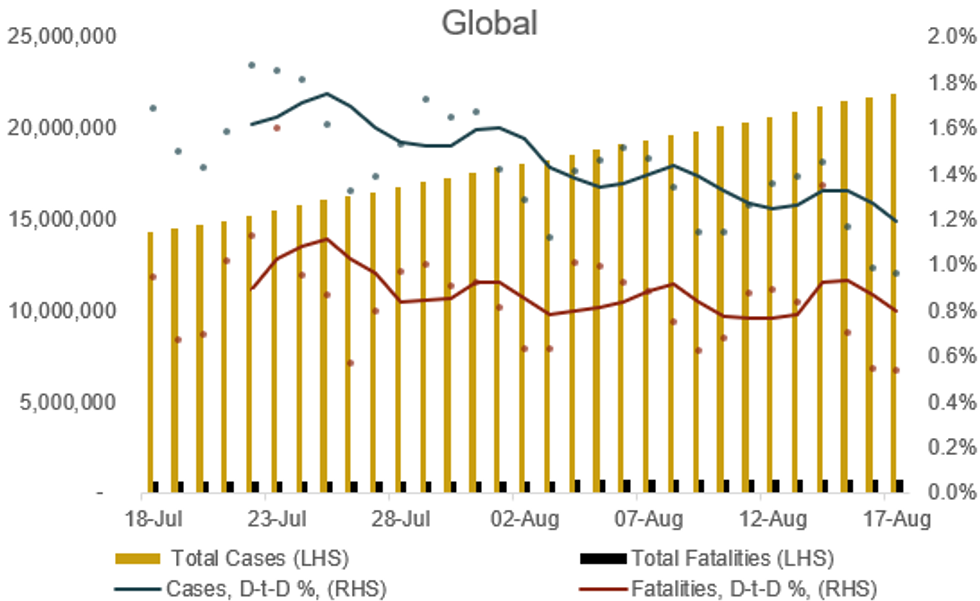

- Global increase in cases (daily) – Yesterday: 1.0%. Seven-day average: 1.2%

- Global increase in fatalities (daily) – Yesterday: 0.5%. Seven-day average: 0.8%

MNI EXCLUSIVE: Fed Sees Stimulus Bump From Weaker Dollar – The Fed likely welcomes the U.S. dollar's slide for giving a small boost to flagging inflation and exports to Europe, where growth is pulling ahead on more effective government relief spending and pandemic containment, former officials told MNI. On MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com

Chart 1. COVID-19 Cases and Fatalities, Nominal and % Chg Day-to-Day (5dma)

Source: JHU, MNI. As of 0600BST August 18. N.b. Each dot represents a single day's figures, data for past month

Source: JHU, MNI. As of 0600BST August 18. N.b. Each dot represents a single day's figures, data for past month

Full article PDF attached below:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.