-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CLOSING FI ANALYSIS: Stimulus Still Interruptus

US TSY SUMMARY: Strong Risk-Off

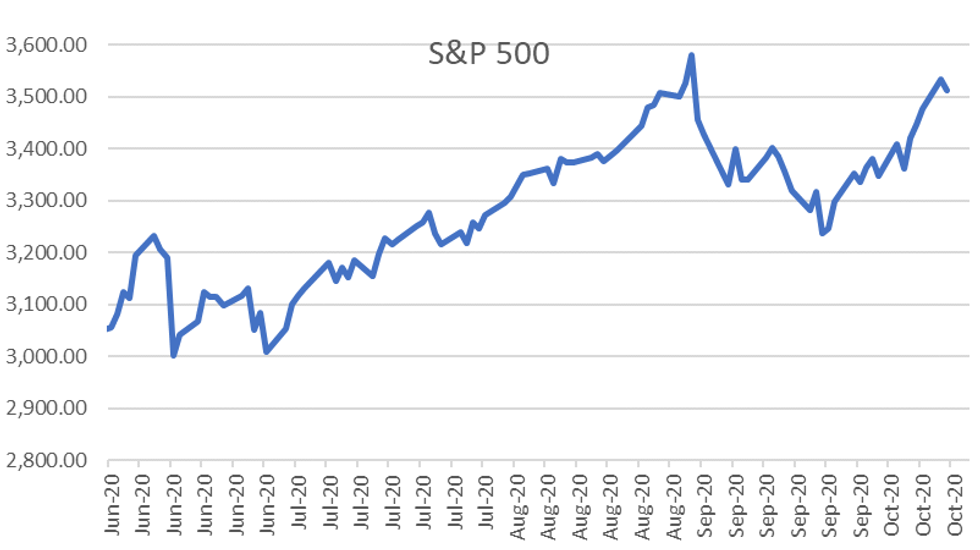

Stimulus, pharma and tech company related headlines remain key driver for risk-of bid in rates, weaker equities (US$/Yen bounce contributing factor (105.55H).

- Mkt on edge after House Majority Leader Hoyer on MSNBC said Speaker Pelosi and Tsy Sec Mnuchin "want to make a deal" but added Pres Trump is "erratic, impulsive on talks". Sen Majority Leader McConnell said wanted vote on $500B targeted relief package sometime next week. Latest counter offer rejected by House Speaker Pelosi and Democrats.

- Pharmaceutical co. Eli Lilly following J&J, halting antibody trial on potential safety concerns, equities falling to new session lows.

- Equities extended session lows on back of earlier Apple headline: "CHINESE PLATFORMS CANCELED APPLE LIVESTREAM, NO REASON GIVEN," Bbg, platforms: Bilibili, Iqiyi, Tencent and Weibo.

- The 2-Yr yield is down 1.4bps at 0.139%, 5-Yr is down 3.5bps at 0.3024%, 10-Yr is down 4.8bps at 0.7256%, and 30-Yr is down 6.2bps at 1.5094%.

US 10Y FUTURES TECHS: (Z0) Strong Recovery

- RES 4: 139-25 High Oct 2

- RES 3: 139-17 76.4% retracement of the Sep 29 - Oct 7 sell-off

- RES 2: 139-11+ 61.8% retracement of the Sep 29 - Oct 7 sell-off

- RES 1: 139-07+/09 20- and 50-day EMA

- PRICE: 139-05+ @ 18:18 BST Oct 13

- SUP 1: 138-28 Low Oct 13

- SUP 2: 138-20+ Low Oct 7 and the bull trigger

- SUP 3: 138-18+ Low Aug 28 and the bear trigger

- SUP 4: 138-04+ 1.000 proj of Aug 4 - 28 sell-off from Sep 3 high

Treasuries rallied Tuesday signalling a possible reversal of the recent bearish theme. A strong daily close today would reinforce this possibility and signal scope for stronger S/T gains. Futures are testing a band of resistance between 139-07+ and 139-09, the 20- and 50-day EMAs. Clearance of this hurdle would strengthen a S/T bullish argument and together with today's gains, open 139-11+, a retracement level. Initial support is at 138-28+.

AUSSIE 3Y TECHS: (Z0) Broader Bullish Theme Intact

- RES 3: 100.00 - Psychological round number

- RES 2: 99.882 - 3.0% Upper Bollinger Band

- RES 1: 99.840 - Alltime High Oct 6 and the bull trigger

- PRICE: 99.8205 @ 18:27 BST Oct 13

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

The Aussie 3yr bond price surge at the tail-end of September and early October confirmed bullish trend conditions. The recent period of consolidation is viewed as a pause in the uptrend and in pattern terms has taken on the appearance of a bull flag. This is a continuation pattern and reinforces the current trend condition. A break of 99.840, Oct 7 high would open 99.882, a Bollinger band objective. 99.760 marks support, Oct 1 and 2 low.

AUSSIE 10Y TECHS: (Z0) Approaching Key Resistance

- RES 3: 99.223 - 3.0% Upper Bollinger Band

- RES 2: 99.185 - High Aug 5 (cont)

- RES 1: 99.180 - High Sep 23, 28, 29 and Oct 2 congestion

- PRICE: 99.165 @ 18:42 BST Oct 13

- SUP 1: 99.075 Low Oct and the key support

- SUP 2: 99.055 - Low Sep 18 and 21

- SUP 3: 98.970 - Low Sep 8

Aussie 10y futures maintain a bullish tone. Recent gains off 99.075, Oct 6 refocuses attention on the congestion area at 99.180 and the bull trigger. A break of this hurdle would confirm a resumption of the underlying uptrend and open 99.223, a Bollinger band projection. Key support has been defined at

99.075, Oct 6 where a break would threaten the bullish outlook and signal a near-term reversal.

JGB TECHS: (Z0) Eyeing Resistance

- RES 3: 152.53 - 1.50 proj of Aug 28 - Sep 4 rally from Sep 7 low

- RES 2: 152.34 - 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 152.05 @ 18:50 BST Oct 13

- SUP 1: 151.75 - Low Oct 08 and key near-term support

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

JGBs continue their recovery and futures have climbed back above 152.00. The short-term outlook has improved for bulls and attention turns to resistance at 152.20, Sep 30 high where a break would expose the key resistance at 152.29, Sep 24 high and the bull trigger. A break of this level would confirm a resumption of the uptrend and open 152.34, a Bollinger band objective and 152.53, a Fibonacci projection. Support is at 151.75, Oct 8 low.

US TSY FUTURES CLOSE: Near Highs

Broadly higher, near top end session range, yld curves flatter on moderate volumes, TYZ>920k), update:

- 3M10Y -3.887, 63.087 (L: 62.414 / H: 65.734)

- 2Y10Y -2.857, 58.625 (L: 58.26 / H: 61.45)

- 2Y30Y -3.846, 137.439 (L: 137.106 / H: 141.002)

- 5Y30Y -2.14, 121.137 (L: 120.937 / H: 123.081)

- Current futures levels:

- Dec 2Y up 0.87/32 at 110-14 (L: 110-13.12 / H: 110-14.12)

- Dec 5Y up 4.75/32 at 125-28 (L: 125-23.5 / H: 125-28.75)

- Dec 10Y up 9.5/32 at 139-6.5 (L: 138-28.5 / H: 139-08)

- Dec 30Y up 24/32 at 175-4 (L: 174-08 / H: 175-07)

- Dec Ultra 30Y up 1-22/32 at 219-17 (L: 217-15 / H: 219-22)

US TSY SUPPLY: Review Week's Tsy Auctions

| DATE | TIME | AMOUNT | SECURITY | CUSIP, YIELD |

| 13-Oct | 1130ET | $54B | 13W-Bill | (9127963U1), 0.105% |

| 13-Oct | 1130ET | $51B | 26W-Bill | (9127964Y2), 0.11% |

| 13-Oct | 1300ET | $30B | 43D-Bill CMB | (9127963B3), 0.095% |

| 13-Oct | 1300ET | $30B | 119D-Bill CMB | (9127964C0), 0.110% |

| 14-Oct | 1130ET | $25B | 105D-Bill CMB | (912796B65) |

| 14-Oct | 1130ET | $30B | 154D-Bill CMB | (912796C98) |

| 15-Oct | 1130ET | $30B | 4W-Bill | (9127964S5) |

| 15-Oct | 1130ET | $30B | 8W-Bill | (9127965C9) |

US EURODLR FUTURES CLOSE: Bid Out The Strip

Steady in the short end to moderately bid out the strip. Lead quarterly holds steady since 3M LIBOR set' +0.00800 to 0.23688% (+0.01275/wk). Latest lvls:

- Dec 20 steady at 99.760

- Mar 21 steady at 99.790

- Jun 21 +0.010 at 99.805

- Sep 21 +0.015 at 99.805

- Red Pack (Dec 21-Sep 22) +0.010 to +0.020

- Green Pack (Dec 22-Sep 23) +0.025 to +0.035

- Blue Pack (Dec 23-Sep 24) +0.040 to +0.045

- Gold Pack (Dec 24-Sep 25) +0.045 to +0.050

USD LIBOR FIX

O/N 0.08000 (-0.00175)

1W 0.09650 (-0.00038)

1M 0.14838 (0.00413)

2M 0.18088 (-0.00425)

3M 0.23688 (0.008)

6M 0.25450 (0.01162)

12M 0.34550 (-0.00213)

FED: NY Fed Operational Purchase:

- TSY 20Y-30Y, $1.733B accepted of $3.992B submission

- Next scheduled purchase:

- Wed 10/14 1010-1030ET: TIPS 7.5-30Y, appr $1.225B

- Wed 10/14 Next forward schedule release at 1500ET

PIPELINE: Toyota Motor Cr Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/13 $2.75B #Toyota Motor, $1.15B 2Y +25, $600M 2Y FRN SOFR+34, $1B 5Y +53; adds to $3B issued on May 20: $1.25B 2Y +100, $1B 3Y +115, $750M 5Y +125.

- 10/13 $1.4B Gaz Finance, inaugural US$ issuance, perp NC5.25, 4.6%a

- 10/13 $1B #Petrobras Global Finance 5.6% 2031 Tap, 4.4% yld

- 10/13 $600M #Athene Global Funding 3Y +103

- 10/12 No new issuance Monday

- Expected to issue Wednesday:

- 10/14 $1B EIB WNG 7Y +15a

- 10/14 $Benchmark Council of Europe 3Y +6a

- 10/14 $Benchmark CADES 10Y Social bond +30a

OUTLOOK: US Data/Speaker Calendar (prior, estimate)

- 14-Oct 0700 9-Oct MBA Mortgage Applications (4.6%, --)

- 14-Oct 0830 Sep Final Demand PPI (0.3%, 0.2%)

- 14-Oct 0830 Sep PPI ex. food and energy (0.4%, 0.2%)

- 14-Oct 0830 Sep PPI ex. food, energy, trade (0.3%, 0.2%)

- 14-Oct 0835 Richmond Fed Barkin eco-outlook conf

- 14-Oct 0900 Fed VC Clarida annual IIF meeting

- 14-Oct 1030 Fed VC Quarles financial stability panel

- 14-Oct 1400 Richmond Fed Barkin, eco-outlook, NY econ club

- 14-Oct 1420 NY Fed Logan, SEC webinar

- 14-Oct 1500 Dallas Fed Pres Kaplan, Fed Quarles on financial supervision

- 14-Oct 1800 Dallas Fed Pres Kaplan, eco/mon-pol virtual town hall

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.