-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

MNI US MARKETS ANALYSIS

Highlights:

- Sovereign bonds are stuck in a holding pattern, waiting for further cues on the potential roll out of Covid vaccines.

- The EU has again warned that the UK has not adjusted its Brexit negotiating position sufficiently

- The Fed's Evans, Kaplan, Barkin, Bostic and George will be speaking later today.

US TSYS SUMMARY: Attention On Fed-Treasury Fissures

Tsys are well off overnight highs, with attention firmly on the Fed following last night's ructions with the US Treasury over the fate of emergency lending programs.

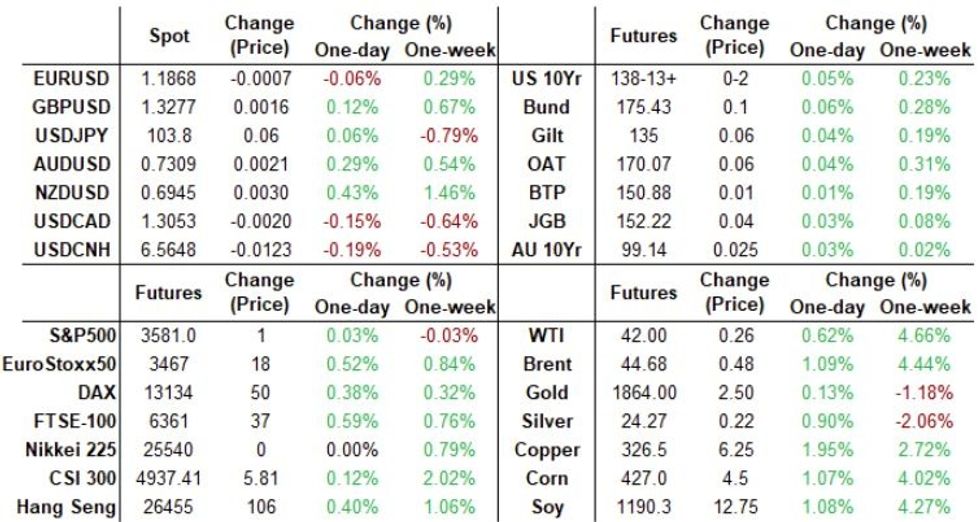

- Dec 10-Yr futures (TY) up 2.5/32 at 138-14 (L: 138-12.5 / H: 138-20). Curve's mixed: 2-Yr yield is up 0.2bps at 0.1634%, 5-Yr is up 0.7bps at 0.3795%, 10-Yr is up 1.1bps at 0.8406%, and 30-Yr is up 0.6bps at 1.5511%.

- Thursday's post-NY close news that Treas Sec Mnuchin Thursday told Fed it would let COVID emergency lending facilities expire at year-end rather than be extended saw Tsys rally into Asia-Pac trading, but that move has been largely reversed.

- Relief was provided as it was noted the Treasury would target the freed-up funds for PPP grants, and would agree to extend other facilities (such as Commercial Paper).

- Still, with the Fed pushing for an extension of programs into 2021, expect to hear more about this fissure in coming days and how it may impact the December FOMC decision.

- On that note, today's Fed speakers include Chicago's Evans (0830ET on CNBC), Dallas' Kaplan (also 0830ET), Richmond's Barkin and Atlanta's Bostic (0900ET), and KC's George (1330ET).

- Dearth of data today and no supply, but we get a fairly sizeable $12.8bn in NY Fed operational purchases at the short-end (0-2.25Y).

BOND SUMMARY: EGB/Gilt

European sovereign bonds have traded a touch firmer this morning with overall price action relatively contained alongside incremental equity gains.

- Gilts trade close to unch on the day. The Dec-20 gilt future trades at 134.99, 5 ticks off yesterday's close.

- The bund curve has marginally steepened with the 2s30s spread 1bp wider.

- OATs trade broadly in line with bunds and little changed on the day.

- The EU has indicated that the UK government has not adjusted its position sufficiently to help overcome the remaining negotiating issues that stand in the way of a Brexit trade deal. This follows the temporary hiatus in face-to-face meetings after an EU negotiator tested positive for coronavirus.

- The UK DMO earlier sold GBP1.75bn of 1-/3-/6-month T-Bills.

- UK retail sales (ex auto) for October came in above expectations (7.8% Y/Y vs 5.9% survey). Public sector finance data confirm that the UK government is on course to borrow a record amount this year.

DEBT SUPPLY

DMO sold GBP1.75bln in 1-/3-/6-month T-bills

- GBP500mln Dec 21 T-bill, avg yield -0.0511% (-0.0468%), cover 3.20x (5.72x)

- GBP500mln Feb 22 T-bill, avg yield -0.1020% (-0.0933%), cover 6.32x (8.76x)

- GBP750mln May 24 T-bill, avg yield -0.0825% (-0.0690%), cover 5.88x (4.75x)

Next week's bill auctions, 3mo and 6mo upsized:

- GBP0.50bln 1-month

- GBP1.00bln 3-month (was 0.50bn)

- GBP1.50bln 6-month (was 0.75bn)

OPTIONS

EUROZONE

Schatz p fly trading for more

DUG1 112.30/20/00 broken put fly, bought for 1.5 in close to 40k total

Large Schatz fly

DUG1 112.30/20/00 broken put fly, bought for 1.5 in 15k total (so far)

Schatz downside fly

DUH1 112.30/112.20/112.00 broken p fly, bought for 1 in 5k- Same fly in Feb was bought for 1.25 in 5k yesterday

FOREX SUMMARY

EUR has seen broader base selling during our early European session.

- The currency touched low of the session against USD, GBP, CNH, CAD, JPY, AUD and is underperforming against all majors besides the SEK

- GBP came under early pressure following report that EU envoys briefed that the UK hasn't moved on 3 main hurdles.

- Cable moved from 1.3269 down to 1.3251, but since recovered after a round of Equity buying hit our screens, with the move higher related to index option expiry.

- Cable is back at 1.3272 at the time of typing

- AUDNZD resumed its downside momentum through lowest levels seen since April 2018, but failed to break the psychological 1.0500 area.

- Looking ahead, we have no data of note, although we still have few more speakers scheduled, including ECB Weidmann, and Fed Kaplan, Barkin and George.

- ALL EYES remains squarely on Brexit, Covid, and US Election certification count going into next week

TECHS: Key Price Signal Summary

- E-Mini S&P futures still trade below resistance at 3668.00, Nov 9 high. A break would resume the uptrend to open 3699.03, a Fibonacci projection. Price action on Nov 9 is a shooting star candle and still reversal warning to bulls. Watch 3506.50, Oct 11 low and key support.

- EURUSD directional triggers at 1.1920, Nov 9 high and 1.1746, Nov 11 low remain intact. A break of 1.1920 resumes the uptrend. On the downside, 1.1603, Nov 4 low is exposed if 1.1746 gives way.

- USDJPY key support lies at 103.18, Nov 11 low and in EURJPY, support lies at 122.69, the Nov 9 low.

- EURGBP trendline resistance is 0.9027, drawn off the Sep 11 high. The trend direction remains down.

- FI resistance levels to watch:

- Bund fut: 175.62 61.8% of the Nov 4 - 11 sell-off

- Gilts: Have stalled ahead of 135.14, Nov 18 high.

- Trendline resistance in Treasuries drawn off the Oct 2 has been cleared. 138-21+ is next resistance, 50-day EMA.

- Key support in Gold remains $1848.8, Sep 28 low and in Brent (F1) at $42.63 and WTI (F1) at $40.33, the Nov 13 lows.

EQUITIES: On The Front Foot

U.S. futures have regained the ground lost late in Thursday's session (after Treas Sec Mnuchin announced the intention to end key COVID lending programs at year-end).

- Asian stocks closed mixed, with Japan's NIKKEI down 106.97 pts or -0.42% at 25527.37 and the TOPIX up 0.98 pts or +0.06% at 1727.39. China's SHANGHAI closed up 14.639 pts or +0.44% at 3377.727 and the HANG SENG ended 94.57 pts higher or +0.36% at 26451.54.

- European equities are higher, with the German Dax up 42.81 pts or +0.33% at 13141.86, FTSE 100 up 41.62 pts or +0.66% at 6369.18, CAC 40 up 29.31 pts or +0.54% at 5498.62 and Euro Stoxx 50 up 14.62 pts or +0.42% at 3471.92.

- U.S. futures are down slightly, with the Dow Jones mini down 65 pts or -0.22% at 29378, S&P 500 mini down 6.5 pts or -0.18% at 3573.5, NASDAQ mini down 4.5 pts or -0.04% at 11982.75.

COMMODITIES: Copper Leads Broad Gains

Commodities are up across the board today with a risk-on cross-market tone prevailing and the USD trading mixed.

- WTI Crude up $0.02 or +0.05% at $41.76

- Natural Gas up $0.03 or +1.16% at $2.623

- Gold spot up $0.85 or +0.05% at $1867.54

- Copper up $3.6 or +1.12% at $325.6

- Silver up $0.14 or +0.59% at $24.1983

- Platinum up $2.36 or +0.25% at $955.39

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.