-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: RISK ON FEEL

MNI US MARKETS ANALYSIS: RISK ON FEEL

HIGHLIGHTS

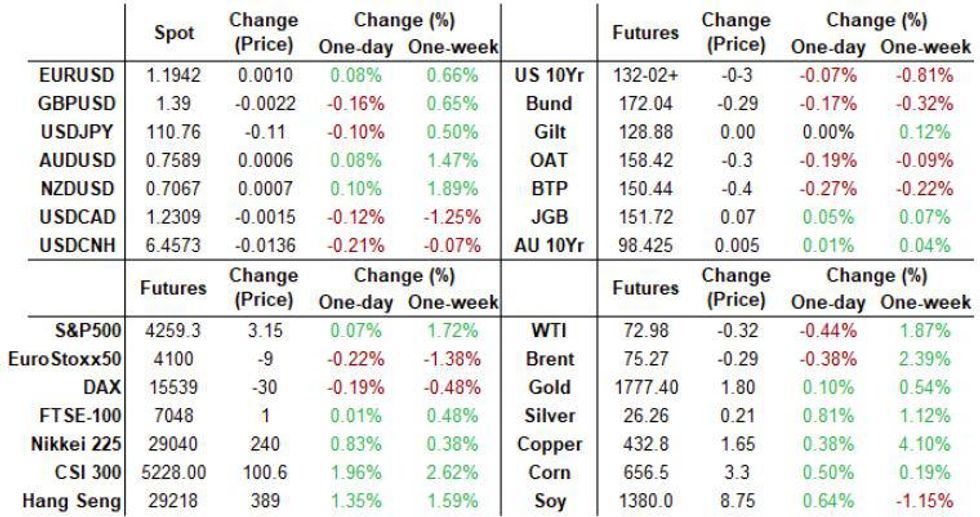

- Risk sentiment boosted by tentative US bipartisan infrastructure agreement

- Equities have pushed higher and sovereign curves have bear steepened

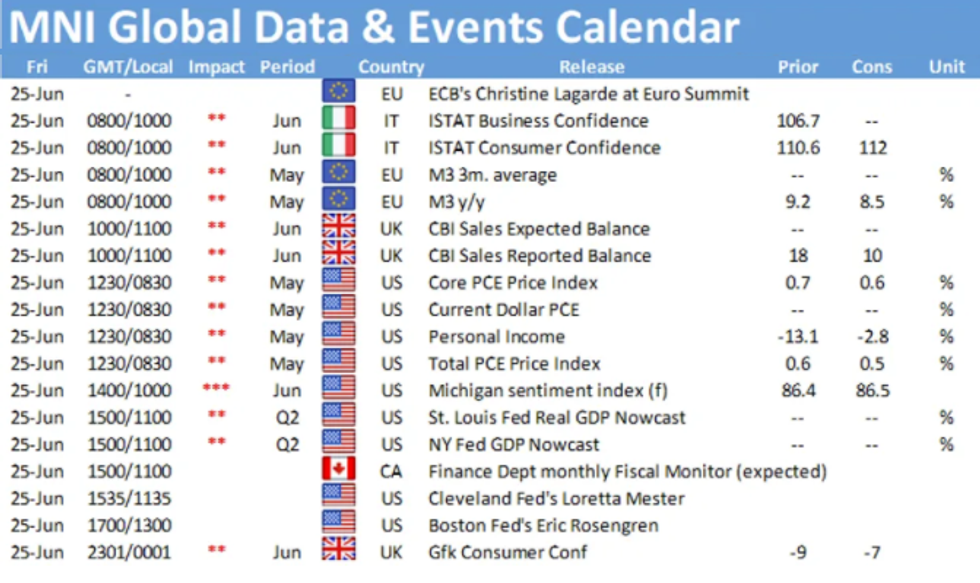

- US PCE data, Uni Michigan Survey Data, and Fed speakers come into focus later today

US TSYS SUMMARY: Slightly Upbeat Mood Ahead Of PCE

Tsys have pulled back from overnight highs Friday to sit largely flat, with PCE data the session's focus.

- Sep 10-Yr futures (TY) down 2/32 at 132-03.5, but well within prior session's ranges (L: 132-02 / H: 132-06.5) and on weak volume (~170k as of 0600ET).

- 30Yr outperforming: 2-Yr yield is up 0.2bps at 0.27%, 5-Yr is up 0.2bps at 0.9151%, 10-Yr is down 0.2bps at 1.4901%, and 30-Yr is down 1bps at 2.0878%.

- Sentiment's been largely positive overnight, with a tentative bipartisan infrastructure agreement in place (though many questions remain). Stock futures briefly touched all-time highs before retracing; the dollar has softened slightly.

- 0830ET sees the May personal income/spending report. The Fed's preferred inflation indicator, the PCE deflator, will be a focus (0.6% M/M prior, 0.5% estimate; core 0.7% prior, 0.6% estimate). Final Jun UMich sentiment at 1000ET.

- In Fed speakers, we get Minn's Kashkari at 1000ET, Cleveland's Mester at 1130ET, Boston's Rosengren at 1300ET, and NY's Williams at 1500ET.

- No supply; NY Fed buys ~$8.425B of 2.25-4.5Y Tsys.

EGB/GILT SUMMARY: Risk-Driven Bear Steepening

The combined impact of the US bipartisan infrastructure agreement and generally strong preliminary PMI data yesterday has fuelled the risk-on theme which has underpinned this morning's equity gains and bear steepening of European sovereign curves.

- Gilts traded softer from the open with cash yields broadly 1bp higher on the day.

- The long-end of the bund curve steepened with the 2s30s spread 2bp wider.

- OATs have underperformed bunds with yields pushing up 1-3bp

- BTPs are also under performing core EGBs with yields 1-4bp higher.

- Supply this morning came from Italy (BTP Short Term: EUR2.75bn & BTPei: EUR1bn) and the UK (T-bills, GBP2.5bn).

- Public Health England has reported the Covid cases involving the Delta variant have increased by 46% over the last week as UK infections continue to rise.

EUROPE ISSUANCE UPDATE

ITALY AUCTION RESULTS: 0% Nov-22 BTP Short Term / 0.15% May-51 BTPei

| 0% Nov-22 BTP Short Term | 0.15% May-51 BTPei | |

| Amount | E2.75bln | E1bln |

| Previous | E3.5bln | E750mln |

| Avg yield | -0.37% | 0.47% |

| Previous | -0.33% | 0.39% |

| Bid-to-cover | 1.58x | 1.30x |

| Previous | 1.45x | 1.35x |

| Price | 100.52 | 91.15 |

| Previous | 100.50 | 93.28 |

| Pre-auction mid | 100.495 | 91.050 |

| Previous | 100.495 | 93.328 |

| Previous date | 26-May-21 | 27-Apr-21 |

UK T-BILL AUCTION RESULTS: GBP2.5bln of 1/3/6-month UKTBs

| Tenor | 1-month | 3-month | 6-month |

| Maturity | Jul 26, 2021 | Sep 27, 2021 | Dec 29, 2021 |

| Amount | GBP0.5bln | GBP0.5bln | GBP1.5bln |

| Previous | GBP0.5bln | GBP1bln | GBP1.5bln |

| Avg yield | 0.0176% | 0.0219% | 0.0553% |

| Previous | 0.0216% | 0.0317% | 0.0594% |

| Bid-to-cover | 3.06x | 5.38x | 2.49x |

| Previous | 4.79x | 3.36x | 2.65x |

| Next week | GBP0.5bln | GBP0.5bln | GBP0.5bln |

FOREX: USD better offered

A more subdued session in FX and across assets as we close out the week.

- The Dollar trades in the red against all G10s on "risk on" as most Fed speakers suggest that Inflation will be temporary, and some move forward on US infrastructure plan.

- The Pound is the only currency down since the BoE yesterday.

- The Kiwi leads gains, up 0.21% versus the USD, while the GBP trades at -0.09%.

- EUR is also mixed and widely range bound, and also leading against the GBP, up 0.19%.

- EURGBP has again tested trendline circa 0.8592, traded 0.85944 high.

- Some market participants will look at 0.8602 June 21st high next.

- But initial upside target is still at 0.8624, the 100d MA, not broken since 11th January.

- USD tested session low versus JPY, EUR, CNY, CAD, AUD, SEK, NOK, PHP, SGD, but well within past ranges.

- Looking ahead, focus will turn the US PCE deflator, US Personal spending/income, and final Michigan.

- Speakers, include ECB de Cos, US Fed Kashkari, Mester, Rosengren and Williams.

FX OPTIONS:

FX OPTION EXPIRY (updated, closest ones).

- EURUSD: 1.1895 (450mln), 1.1920 (330mln), 1.1950 (860mln), 1.1960 (301mln), 1.1975 (225mln)

- USDJPY: 110 (593mln)

- GBPUSD: 1.3900 (232mln)

- AUDUSD: 0.7600 (237mln)

Price Signal Summary - S&P E-Minis Fresh All-Time Highs

- In the equity space, S&P E-minis have traded to fresh all-time highs once again. The contract this week tested the 50-day EMA at 4145.50 and the average provided support, reinforcing bullish conditions. Attention turns to 4300.00. EUROSTOXX 50 futures found support Jun 21 at 4015.00. Attention is on the Jun 18 sell-off that in pattern terms is a bearish engulfing candle and signals a potential S/T top. The key directional triggers are; 4015.00, Jun 21 low and 4153.00, Jun 17 and the bull trigger

- In FX, the EURUSD outlook is unchanged and remains bearish following last week's sharp sell-off. The focus is on 1.1837 next, 76.4% of the Mar 31 - May 25 rally. GBPUSD remains vulnerable following last week's bearish pressure and recent gains are considered corrective. Attention is on 1.3717 next, Apr 16 low. The bear trigger is 1.3787, Jun 21 low. USDJPY edged higher Thursday and delivered a fresh 2021 high, following this week's print above Y110.97, Mar 31 high and the previous bull trigger. This cements the uptrend and maintains a bullish price sequence of higher highs and higher lows. Attention is on 111.30/47, the Mar 26, 2020 high and 1.0% 10-dma envelope.

- On the commodity front, Gold continues to consolidate. The outlook remains weak and the current consolidation appears to be a bear flag. This reinforces a bear theme and the focus is on $1756.2, low Apr 29. The Oil market trend conditions are bullish. Brent (Q1) focus is $76.97, 1.23 projection of Mar 23 - May 18 - May 21 price swing. WTI (Q1) sights are set on $75.01, 1.382 projection of Mar 23 - May 18 - May 21 price swing.

- Within FI, Bund futures have this week probed support at 171.80, Jun 17 low. A stronger sell-off would expose 171.37, Jun 3 low and 170.99, Mar 31 low and a key short-term support. Key support to watch in Gilt futures is unchanged at 126.70, Jun 3 low.

EQUITIES: US Futures higher, European stocks mixed

- Japan's NIKKEI up 190.95 pts or +0.66% at 29066.18 and the TOPIX up 15.55 pts or +0.8% at 1962.65

- China's SHANGHAI closed up 40.908 pts or +1.15% at 3607.562 and the HANG SENG ended 405.76 pts higher or +1.4% at 29288.22

- German Dax down 31.76 pts or -0.2% at 15556.06, FTSE 100 up 3.73 pts or +0.05% at 7113.34, CAC 40 down 11.91 pts or -0.18% at 6619.32 and Euro Stoxx 50 down 9.06 pts or -0.22% at 4113.59.

- Dow Jones mini up 90 pts or +0.26% at 34169, S&P 500 mini up 3.25 pts or +0.08% at 4259.25, NASDAQ mini up 19 pts or +0.13% at 14373.25.

COMMODITIES: Oil down but metals higher

- WTI Crude down $0.3 or -0.41% at $72.98

- Natural Gas up $0.01 or +0.38% at $3.426

- Gold spot up $6.89 or +0.39% at $1782.24

- Copper up $1.65 or +0.38% at $432.15

- Silver up $0.23 or +0.9% at $26.1797

- Platinum up $5.36 or +0.49% at $1101.54

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.