-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR/USD Prints Sixth Session of Lower Lows

HIGHLIGHTS:

- Single currency hits fresh 2021 low, EUR/CHF tested

- Biden announcement on Fed Chair could slip into next week

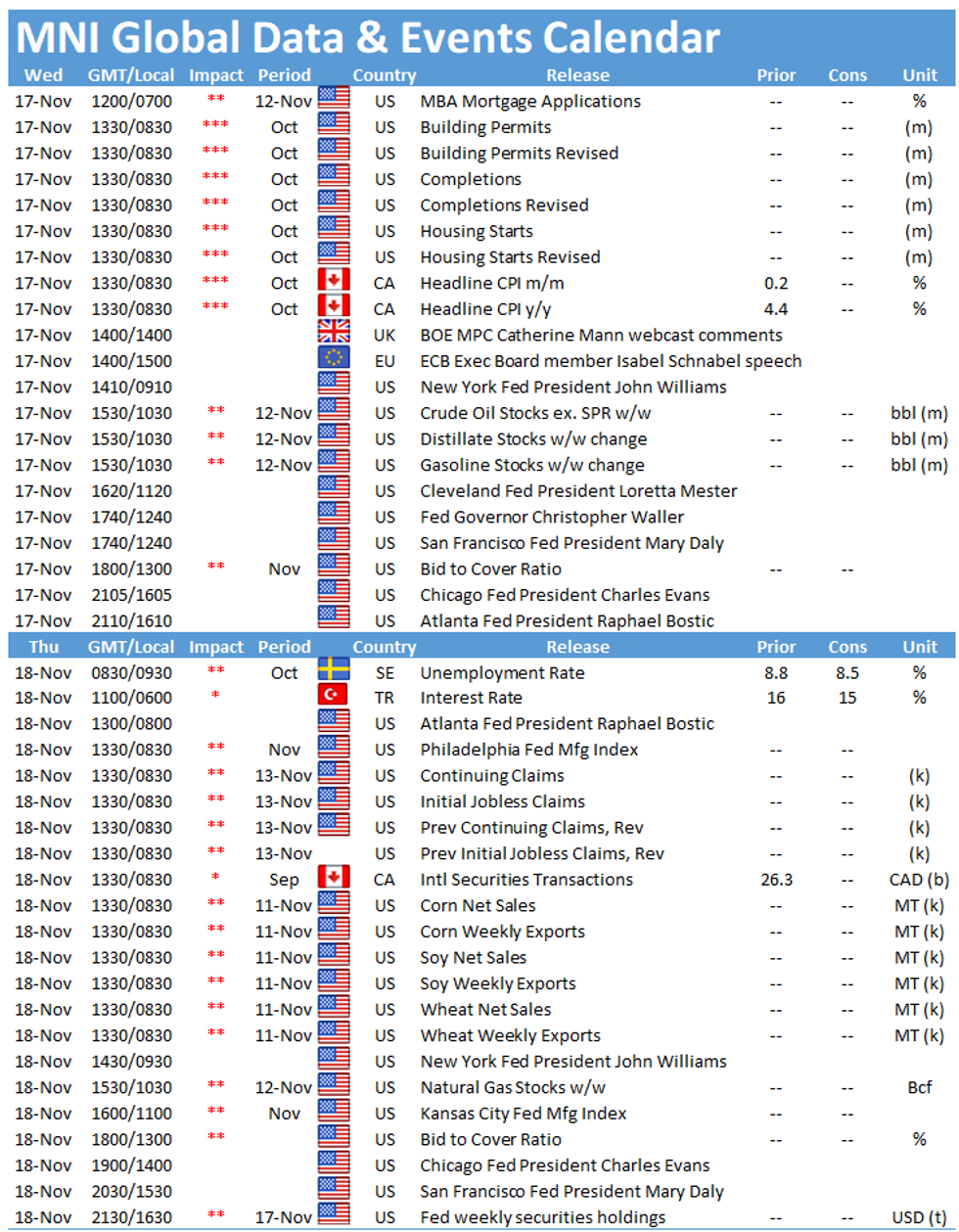

- Canadian CPI, US housing data on the docket

US TSYS SUMMARY: Quiet Start For Treasuries After Two Days of Bear Steepening

Tsys see minor bull flattening this morning (Ylds -0.4-1.0bp) in limited retracement from bear steepening of past two days. Limited data today but plenty of Fed speak and greater focus on Fed chair pick in the "next four days". Equities steady, -0.3% off recent highs yesterday (ESZ1 4694.5).

- Biden says to expect Fed chair decision in "the next four days", although a BBG source later suggested it may slip into next week. The source pointed to a 2-horse race between Powell & Brainard (in line with broader expectations), further eroding Powell's early frontrunner status.

- Multiple Fed speakers today: Williams (0910ET), Bowman (1100ET), Mester & Waller (1120ET), Daly & Waller (1240ET), Evans (1605ET) and Bostic (1610ET).

- Quieter data day after yesterday's heavy schedule: building permits/housing starts for October expecting partial bounce back.

- TYZ1 at 130-06 having briefly dipped below yesterday's low of 130-03 to 130-01+ (lowest since 22 Oct) before retracing, on low volumes.

- 2-Yr yield down -0.4bps at 0.514%, 5-Yr flat at 1.265%, 10-Yr down -0.5bps at 1.628%, and 30-Yr is down -1.0bps at 2.019%. 2s/10s down fractionally today at 111bps, but up 6bps for the week.

- Next scheduled NY Fed purchases: Tsy 22.5Y-30Y (appr $1.600B) on Thu 1010-1030ET, TIPS 1Y-7.5Y (appr $1.775B) on Fri 1010-1030ET.

EGB/GILT SUMMARY: BoE Again In The Spotlight Following Oct CPI Print

European FI has traded mixed this morning alongside a similarly uneven showing for equities and FX.

- The gilt curve has steepened on the back of the short end firming and longer end yields inching higher. The 2s30s spread is 2bp wider.

- UK CPI surprised higher in October, reading 4.2% Y/Y vs 3.9% expected and elevating pressure on the BoE which left policy unchanged at the last MPC meeting despite turning notably hawkish in the run up to the meeting.

- Bunds traded mixed across the curve and near yesterday's closing levels.

- The OAT cuve has bear steepened with the 2s30s spread trading up 2bp.

- It is a similar story for BTPs where the shorter end trades close to flat on the day and longer end yields are up 1-2bp.

- Supply this morning came from Germany (Bund, EUR693mn allotted) and the EU (Bills, EUR1.992bn). In addition, Italy is tapping the USD 3.875% May-51 bond via syndication.

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXZ1 168.5/168ps 1x2, bought for 8 in 1k

RXG2 170/168.5ps, bought for 47 in 1k

OEG2 132.5/133cs, sold at 38 in 1k

2RM2 99.87/99.75ps vs 100.25/100.37cs, bought the ps for 0.75 in 5k

UK:

2LZ1 98.62p, sold at 18 in 6k,SFIH2 99.35/99.20/99.05p fly, bought for 2 in 5k

EUROPE ISSUANCE UPDATE: Weak Bund Auction, Italy Syndication

Germany sells:

E693mln 0% Aug-52 Bund, Avg yield 0.08% (Prev. 0.35%), Bid-to-cover 0.77x (Prev. 1.67x), Buba cover 1.12x (Prev. 2.05x)

Italy Syndication:

- ITALY USD 3.875% May-51 tap

- Settlement 24-Nov-2021 (T+5)

- Guidance Libor MS +185bps area (currently equates to ~ CT30+165bp, 3.66%yield)

FOREX: EUR/USD Losses Accelerate, Shows Below 1.13

- Single currency weakness played out further overnight, with EUR/CHF slipping sharply amid thin Asia-Pac trade. Stop-loss selling and option related flow was cited behind the move that drove the cross to 1.0508 - a fresh YTD low, narrowing the gap with major support at May 2020's 1.0505.

- EUR/USD breaking through the 1.13 handle added to the downside pressure. CHF has slipped off the overnight highs since, with the currency among the weakest in G10 headed into the US crossover. The price action will raise focus on the SNB's FX policy, with markets looking to gauge the bank's tolerance levels for the CHF rate.

- Elsewhere, AUD trades poorly, with AUD/USD showing through last week's lows as markets responded to wage index data overnight, which showed pay growth well shy of the RBA's cited 3% requirement for rate hikes. Wages grew at a pace of 2.2% - alongside expectations.

- Canadian CPI and US housing data take focus going forward. Canada's inflation report is seen showing core metrics inching higher still, although trimmed core CPI is seen holding at 3.4%. On the speaker slate, BoE's Mann, ECB's Schnabel and Fed's Williams, Bowman, Daly and Evans are all on the docket.

FX OPTIONS: Expiries for Nov17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1390(E914mln), $1.1450-70(E735mln), $1.1490-05(E1.9bln)

- USD/JPY: Y115.00($558mln)

- EUR/GBP: Gbp0.8445(E839mln)

- AUD/USD: $0.7300(A$722mln)

- USD/CAD: C$1.2500($551mln), C$1.2540-50($905mln)

Price Signal Summary - USD Bull Cycle Remains Intact

- In the equity space, S&P E-minis are holding above recent lows and a bullish theme remains intact. Attention is on 4717.00 next, 1.50 projection of the Jul 19 - Aug 16 - Aug 19 price swing. Initial support to watch is 4615.28, the 20-day EMA. EUROSTOXX 50 futures uptrend remains intact and the contract continues to climb. The psychological 4000.00 has been tested. This signals scope for an extension towards 4420.80, 1.382 projection of the Jul 19 - Sep 6 - Oct 6 price swing.

- In FX,EURUSD traded lower today and has breached key support at 1.1300, the base of a bear channel drawn from the Jun 1 high. A clear break and continued bearish follow through would open 1.1222, 1.618 projection of the Jan 6 - Mar 31 - May 25 price swing. GBPUSD remains vulnerable. The break of 1.3412, Sep 29 low, opens 1.3334 next, 1.00 projection of the Sep 14 - 29 - Oct 20 price swing. EURGBP remains offered and has traded through support at 0.8403, Oct 26 low. This opens 0.8356, Feb 26 low. USDJPY has breached resistance at 114.70, the Oct 20 high. The break higher confirms a resumption of the underlying uptrend and paves the way for an extension. This opens 115.51 next, the Mar 10, 2017 high. EURCHF is trading just ahead of a major support at 1.0505, the May 14, 2020 low. A break would expose the cross to a deeper sell-off below 1.0500.

- On the commodity front, Gold remains bullish. Attention is on $1877.7, Jun 14 high and $1903.8, Jun 8 high. WTI key resistance at $85.41, Oct 25 high, remains intact. Attention however is on key short-term support at $78.25, Nov 4 low. A break would suggest scope for a deeper corrective pullback.

- In the FI space, Bund futures maintain a bullish short-term tone. The focus is on 171.95, 61.8% of the Aug - Nov sell-off. Support to watch is 170.06, Nov 5 low. Gilts also maintain a firmer tone and the recent pullback is considered corrective. A resumption of strength would suggest potential for a climb towards 127.69 next, Sep 21 high. The recent corrective pullback does not appear to be over yet though. Next support is at 124.79, Nov 4 low.

EQUITIES: Wall Street Eyes Flat Open, On Watch for Fed Announcement

- US futures are mixed-to-lower, but point to a generally flat open for the major three indices. The outlook for the e-mini S&P remains bullish and futures remain above recent lows. Another all-time high print on Nov 5 confirmed a resumption of the uptrend and the focus is on 4717.00 next, a Fibonacci projection. Trend signals such as moving average studies are in a bull mode set-up, reinforcing current conditions and market sentiment.

- European markets are more mixed, with UK firms lagging to drag the FTSE-100 lower by 0.4% or so. The EuroStoxx50 is making minor gains of 0.1% - with similar price action across French and German stocks.

- UK indices are underperforming somewhat on the lagging energy sector - with oil prices rolling off recent highs as markets eye speculation that the US and China could co-ordinate possible action against high energy and fuel prices.

- Markets remain on watch for a possible statement from the White House on the next chair of the Federal Reserve. Reports late yesterday suggested Biden would make a decision within the next four days on Fed leadership beyond February next year.

COMMODITIES: Europe-Bound Gas Prices Extend Further

- Europe-bound gas prices remain well bid, and are revisiting levels not seen since the supply crunch in October as traders eye possible delays to Russia's Nordstream 2 pipeline. Yesterday, Germany's energy regulator paused the certification process for the fuel line, waiting for the completion of certain legal contracts before progress can resume. The halt came despite Russia's insistence that the pipeline is ready to meet all criteria and gas is ready flow "as soon as possible".

- The WTI futures curve trades slightly flatter, with front-month contracts edging off recent highs. Markets eye speculation that the US and China could coordinate on a reserves release should fuel prices continue to surge, with the Xi-Biden call earlier in the week highlighting the need to work together on energy markets.

- WTI futures remain below recent highs and above support. Key resistance and the bull trigger is $85.41, Oct 25 high. A break of this hurdle is required to confirm a resumption of the uptrend and resume the bullish price sequence of higher highs and higher lows.

- Gold rallied sharply higher last week resulting in a clear break of resistance at $1834.0, Sep 3 high. The breach of this hurdle reinforces current bullish conditions and paves the way for further strength near-term.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.