-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY0.5 Bln via OMO Monday

MNI US MARKETS ANALYSIS: A Big Week For Central Banks Keeps Ranges Tight

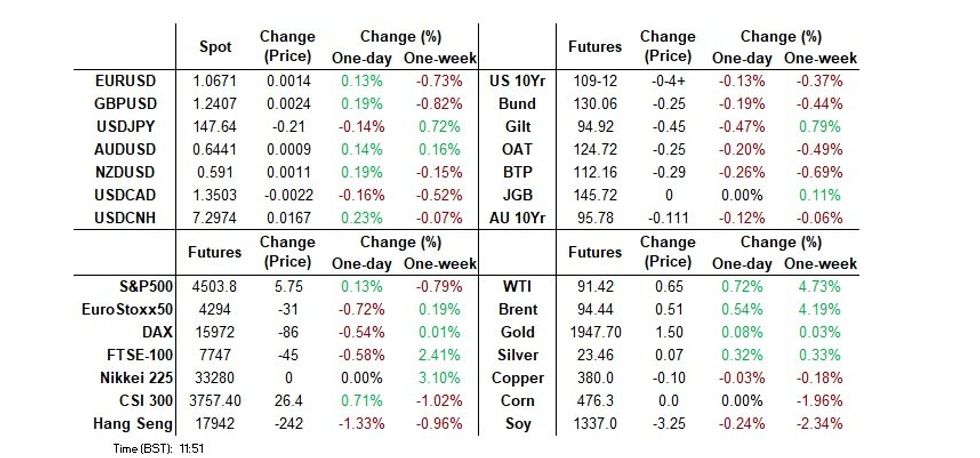

- Ranges were generally tight ahead of this week's raft of global central bank decisions.

- Crude oil futures made fresh '23 highs before backing off from bests, while core global FI yields ticked higher and the USD & NOK nudged lower in G10 FX trade.

- Monday's DM docket is thin, with nothing in the way of meaningful event risk slated.

MNI ECB Review - September 2023: Shifting Focus To Persistence of Policy Rate Setting

- In the end, the ECB hiked by 25bp and indicated that rates have likely peaked.

- This could suggest that the ECB thinks otherwise, and has higher conviction that it has tailored monetary policy effectively for the current economic situation.

- Perhaps more likely given that the decision was made by a ‘solid majority’, this was a compromise decision

- Click for the full publication:ECB Review September 2023.pdf

US TSYS: Marginally Cheaper Ahead Of NY Hours

Cash Tsys are 0.5-2.0bp cheaper on the day, flattening, with some fresh, modest weakness in European & UK peers seeing no real feed through ahead of the NY session.

- Some light pressure for Bunds helped push TY futures through Asia-Pac lows as Europeans filtered in earlier, although initial support at 109-03 remains untested.

- That came after a break of Friday’s low saw selling extend a touch in Asia.

- Contract last -0-04, volume curtailed by a Japanese holiday which kept cash markets closed until London hours.

- Consumer dynamics surrounding the restart of student loan repayments and economic feedthrough from the UAW strike continue to generate interest.

- Lower-tier data and Bill supply is due in NY hours on Monday.

- Wednesday’s FOMC decision, SEP & post-meeting press conference (no change expected by an overwhelming majority in the BBG survey, while markets indicate the same) presents the domestic focal point for participants this week.

- A weekend survey of academic economists, sponsored by the FT, saw most suggest that the Fed will deploy at least one further rate hike in the current cycle, while over 40% pointed to two or more further rate hikes.

US TSY FUTURES: Short Setting Seemed To Dominate On Friday

The combination of outright cheapening and an uptick in open interest across the Tsy futures curve points to an increase in net short setting driving positioning swings for a second straight session on Friday.

| 15-Sep-23 | 14-Sep-23 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,707,353 | 3,688,316 | +19,037 | +729,129 |

| FV | 5,516,839 | 5,497,287 | +19,552 | +830,672 |

| TY | 4,715,643 | 4,708,815 | +6,828 | +444,664 |

| UXY | 1,829,961 | 1,808,581 | +21,380 | +1,957,139 |

| US | 1,361,610 | 1,360,277 | +1,333 | +177,918 |

| WN | 1,538,414 | 1,538,046 | +368 | +75,101 |

| Total | +68,498 | +4,214,623 |

STIR: Less Than 90bps of Fed Cuts Priced For 2024

- The Fed Funds implied terminal rate has unwound Friday’s hit from softer than expected U.Mich consumer inflation expectations and sentiment, lifting back to 5.45% for December. Continued increases further out mean that the market may not be sure on the additional hike for 2023 that the June dot plot pencilled in but it has come around to the 4.5-4.75% 2024 dot.

- Cumulative hikes: 0bp priced for Wednesday’s decision (unch from Fri close), 8bp for Nov (unch), 12bp for Dec terminal (+1.5bp) and closely followed by 11bp for Jan.

- Cuts from terminal: 27bp to Jun’24 and 88bp to 4.57% in Dec’24 – both at fresh recent lows – and with the first cut from the current effective of 5.33% seen in July. On a similar basis, the -87bps for SFRU3/Z4 continues to set fresh lows (in terms of cuts priced) since the initial fallout of regional banking woes in March and before that Oct’22.

STIR: OI Points To Mixed SOFR Positioning Swings On Friday, Short Cover In SFRU3 The Most Notable

The combination of Friday’s price action and preliminary open interest data point to the following positioning swings:

- The whites seemingly saw mixed moves. The unchanged status of SFRM3 and SFRZ3 reveals little in the way of clues re: positioning swings. SFRU3 ticked higher on the day, while open interest in the contract saw a notable fall, which points to short cover being at work. SFRH4 ticked lower, with OI also lower, pointing to a reduction in longs in net terms.

- Apparent reduction in longs across the reds.

- Net short setting in both the green and the blue packs.

| 15-Sep-23 | 14-Sep-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM3 | 1,106,697 | 1,107,348 | -651 | Whites | -101,318 |

| SFRU3 | 1,108,643 | 1,192,480 | -83,837 | Reds | -18,407 |

| SFRZ3 | 1,306,969 | 1,314,001 | -7,032 | Greens | +5,402 |

| SFRH4 | 992,830 | 1,002,628 | -9,798 | Blues | +4,302 |

| SFRM4 | 921,376 | 922,044 | -668 | ||

| SFRU4 | 832,331 | 845,257 | -12,926 | ||

| SFRZ4 | 895,060 | 898,903 | -3,843 | ||

| SFRH5 | 525,745 | 526,715 | -970 | ||

| SFRM5 | 595,503 | 595,243 | +260 | ||

| SFRU5 | 484,458 | 481,721 | +2,737 | ||

| SFRZ5 | 437,486 | 434,894 | +2,592 | ||

| SFRH6 | 296,616 | 296,803 | -187 | ||

| SFRM6 | 253,139 | 248,722 | +4,417 | ||

| SFRU6 | 168,193 | 172,850 | -4,657 | ||

| SFRZ6 | 173,709 | 171,132 | +2,577 | ||

| SFRH7 | 127,682 | 125,717 | +1,965 |

CANADA: Politics Week: Parliament Returns Amid Housing Pinch, Trudeau Poll Dip

- Parliament returns after summer break; fiscal update expected before Christmas with continued deficit spending

- Liberal PM Justin Trudeau has fallen behind in polls to Conservatives led by Pierre Poilievre, though polling over summer between elections is often misleading

- Housing/cost of living remains dominant issue. Trudeau shuffled cabinet with a new housing minister this summer and hinted at more direct federal involvement in the file

- Opposition parties with majority of seats in Parliament forced a judicial inquiry into foreign election interference focused on China

- Program spending rising by double digits amid BOC rate hikes, Finance Minister Freeland says doesn't want to add to inflation fires

- Liberals have deal with NDP to prop up government into 2025, a regular 4-year mandate

- Sample of recent headlines: "Can Trudeau Survive?"; "Trudeau’s tumbleweed of tumult"; "The Liberals are letting themselves become Pierre Poilievre’s punching bag"; "Justin Trudeau’s luck appears to be running out"

EGBS/GILTS: Outrights Cheapen, GGBs Widen

Early weakness in benchmark European & UK bond futures failed to provide meaningful breaks below round number support (130.00 for Bunds & 95.00 for gilts), although a second round of weakness in gilts saw fresh lows registered in recent trade,

- Weekend comments from various ECB Governing Council members pushed back against the idea of near-dated rate cuts, while some more hawkish comments (Holzmann & Kazimir) stressed that we may not have reached terminal rate levels.

- Impetus from the back end of last week and another ’23 high for crude oil futures (although they are off best levels) were eyed initially.

- German cash benchmarks run 1.0-2.5bp cheaper, Bund futures -25.

- GGB widening noted in 10s. Moody’s two-notch rating upgrade of Greece to one step below IG (in line with Fitch & S&P) was probably the best that the country could have hoped for in one step. Still, the ‘stable’ outlook will have disappointed participants and is aiding the widening.

- 10-Year BTPs find support around 4.50%.

- Gilt benchmarks are 2.5-4.5bp cheaper across the curve, futures -45.

- UK headline flow has focused on familiar areas, with participants eying this week’s domestic CPI data and BoE monetary policy decision (~21bp of tightening priced, ~39bp of cumulative tightening priced for current cycle).

- Gilts widen vs. Bunds across the curve.

BONDS: European Issuance Update

Belgium auction results

- E1.311bln of the 3.00% Jun-33 OLO. Avg yield 3.29% (bid-to-cover 1.43x).

- E989mln of the 3.30% Jun-54 OLO. Avg yield 3.745% (bid-to-cover 1.6x).

Slovakia auction results

- E202mln of the 0.125% Jun-27 SlovGB. Avg yield 3.6177% (bid-to-cover 1.16x).

- E295mln of the 3.625% Jun-33 SlovGB. Avg yield 3.8704% (bid-to-cover 1.79x).

- E202mln of the 3.75% Feb-35 SlovGB. Avg yield 4.0813% (bid-to-cover 1.93x).

- E61mln of the 2.00% Oct-47 SlovGB. Avg yield 4.2185% (bid-to-cover 1.48x).

FOREX: USD Leans In The Red

- The USD has pared some of its overnight losses, but still trades lower vs. most G10 peers.

- NZD & GBP are the best performers.

- This morning saw some notable moves in the NOK, but local desks have reported very little in terms of overt drivers. Benchmark crude oil futures hit fresh '23 highs before backing off.

- USD/NOK has now cleared the 10.8299/10.8418 area, the July high and 28th June high. There isn't much in terms of nearby resistance, with the next target now at 10.9133, the 23rd June spike high.

- EUR/NOK bulls look to 11.6301, the August high.

- Most G10 crosses trade in tight ranges ahead of a busy week, which will be headlined by central bank meetings.

- There isn't much to flag in terms of slated tier 1 risk events on Monday.

FX OPTIONS: Expiries for Sep18 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0600 (366mln), 1.0625 (500mln), 1.0700 (351mln), 1.0740 (355mln)

- USDJPY: 147.00 (1.16bn), 148.00 (896mln), 148.35 (1.18bn), 148.50 (1.44bn)

- AUDUSD: 0.6500 (366mln)

- USDCNY: 7.25 (1.08bn), 7.30 (1.74bn)

EQUITIES: S&P E-Minis Bear Threat Remains Present

- A bear cycle in the E-mini S&P contract remains in play. Friday’s strong sell-off reinforces this theme and suggests the recent shallow correction higher is over. Key short-term support has been defined at 4,483.25, the Sep 7 low. Clearance of this level would be a bearish development and open 4,397.75, the Aug 18 low and a bear trigger. For bulls, a resumption of gains would instead open 4,597.50, the Sep 1 high.

- EUROSTOXX 50 futures traded higher last Thursday but are pulling away from the recent peak. Last week’s gains threaten the recent bearish theme and signal a possible short-term reversal with a key support defined at 4,210.00, the Sep 8 low. A resumption of gains would expose resistance at 4,388.00, the Aug 30 high where a break would strengthen a bullish case. For bears, a break of 4,210.00, resumes the recent downtrend.

COMMODITIES: Uptrend In Oil Remains Intact

- Gold has recovered from last week’s $1,901.1 low on Sep 14. A break of this level would strengthen a bearish theme and highlight the fact that the recovery between Aug 21 - Sep 1 has been a correction. This would expose $1,884.9, Aug 21 low. On the upside, initial firm resistance is seen at $1,927.9, the 50-day EMA. The average has been pierced, a cleared break would be a bullish development and open key resistance at $1,953.0, the Sep 1 high.

- In the oil space, the uptrend in WTI futures remains intact and the contract is trading higher today. Last week’s gains confirm a resumption of the uptrend and maintain the bullish price sequence of higher highs and higher lows. Note too that moving average studies are in a bull-mode position, highlighting a rising trend. The $90.00 handle has been cleared, this opens $92.17 next, the Nov 8 2022 high (cont). Initial firm support to watch is $85.46, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/09/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/09/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/09/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/09/2023 | 2000/1600 | ** |  | US | TICS |

| 19/09/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 19/09/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/09/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/09/2023 | 1230/0830 | *** |  | CA | CPI |

| 19/09/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 19/09/2023 | 1230/1430 |  | EU | ECB's Elderson Speaks at Banking Union Conference | |

| 19/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/09/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/09/2023 | 1745/1345 |  | CA | BOC Deputy Kozicki speech in Regina SK. |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.