-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Awaiting Jackson Hole Schedule

Highlights:

- NASDAQ posts sharp outperformance among futures on solid Nvidia earnings

- Treasuries sit mildly cheaper ahead of data, Fedspeak and TIPS supply

- Markets await publication of Jackson Hole schedule after the US close

US TSYS: Mildly Cheaper Ahead Of Data, Fedspeak and TIPS Supply

- Cash Tsys are mildly cheaper on the day ahead of the US session, broadly consolidating the late partial paring of yesterday’s sizeable gains in the case of the front-end, or simply consolidating the large gains seen further out the curve.

- 2YY +0.9bp at 4.976%, 5YY +0.4bp at 4.373%, 10YY +0.8bp at 4.200%, 30YY +0.2bp at 4.272%.

- TYU3 trades 4 ticks lower at the low end of a narrow range,. Earlier highs of 109-31+ tallied with yesterday’s high after which lies resistance at the 20-day EMA of 110-11, although the bounce is deemed corrective with ultimately focus on support at 108-28 (Aug 22 low). Volumes are elevated at 390k as the roll should more earnestly get underway ahead of Aug 31 first notice.

- Data: Durable goods Jul prelim (0830ET), Weekly jobless claims (0830ET), Chicago Fed National Activity Index Jul (0830ET), Kansas City Fed Mfg Activity Aug (1100ET)

- Fedspeak: Harker with CNBC (1000ET), Collins with Yahoo! Finance (1115ET). The full JH Symposium agenda is released at 2000ET today but Powell is already known to speak tomorrow 1005ET.

- Note/bond issuance: US Tsy $8B 30Y TIPS Reopen (912810TP3) (1300ET)

- Bill issuance: US Tsy $80B 4W, $70B 8W Bill auctions

MNI 2023 Jackson Hole Preview

EXECUTIVE SUMMARY:

- Chair Powell’s task in his Jackson Hole keynote speech is to reaffirm the recent turn to a meeting-by-meeting, data-dependent approach to policy while emphasizing that the Fed intends to keep rates in restrictive territory for a lengthy period of time.

- In this regard it is likely to sound like a bookend to his brief 2022 speech in which he invoked the lessons of the 1970s and 80s to say “we must keep at it until the job is done”, with Powell laying out the “higher for longer” rate landscape for the year ahead.

- Most analysts expect Powell to deliver a hawkish-on-balance message, and combined with the recent jump in market rates, the bar is set reasonably high for a hawkish reaction.

- MNI's Preview of Jackson Hole includes what we know so far is scheduled for the event, sell-side analysis, and a run-down of recent Fed communications.

FOR FULL PDF ANALYSIS:

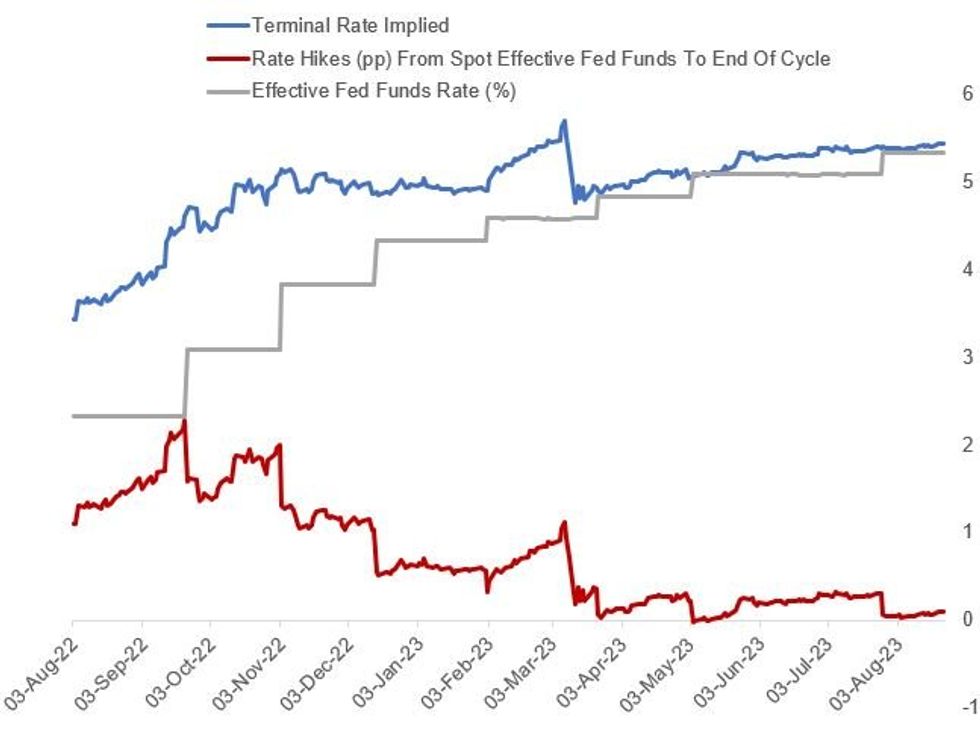

STIR FUTURES: Fed Implied Rates Near Unchanged Ahead Of Data, Fedspeak

- Fed Funds implied rates are only fractionally higher overnight ahead of data including preliminary durable goods and weekly jobless claims, and Fedspeak before Jackson Hole gets underway.

- Cumulative hikes from 5.33% effective: +3.5bp Sep (+0.5bp), +11bp Nov (+0.5bp)

- Cuts from Nov terminal: 1.5bp to Dec’23, 47bp to Jun’24 and 114bp to Dec’24. They are all unchanged, with the latter off Tuesday’s recent low close of 104bps.

- Harker (’23 voter) speaks on CNBC at 1000ET after offering a dovish take on Aug 8 by arguing for rates on hold. Collins (non-voter) is also of interest in a Yahoo! Finance interview at 1115ET having not heard from her since the July FOMC.

Source: Bloomberg

Source: Bloomberg

Familiar Band Remains In Play For USD/CNH, Difficulty Of Defending CNY7.30 Noted

MNI (London) - The uptick from lows in the USD biases USD/CNH back to near unchanged levels, above CNH7.2800.

- Our policy team’s latest exclusive (click for full story) noted that traders and policy advisers are acutely aware of the difficulties that the PBoC faces when it comes to defending the CNY7.30 mark in the onshore yuan, flagging continued use of the yuan’s mid-point fixing and offshore liquidity restrictions as the current preferred tools for the Bank.

- Beyond the immediate term, the same people suggest that the yuan could still strengthen towards the end of the year, which is in line with the thought process flagged by numerous state-run media outlets in recent weeks.

- A quick reminder that the reported PBoC efforts to remove excess offshore liquidity provided support to the redback earlier this week, although the impact of the move in forward points has faded from extremes in the time since, with suggestions that state-owned banks were quick to return to the market with liquidity.

- The PBoC’s mid-point fixing lean (towards CNY strength) has been well-documented in recent weeks.

- As we flagged elsewhere, Thursday saw the record run (based on data back to ’16) of outflows from mainland Chinese equities came to an end, which would have provided incremental support for the yuan.

- Beyond the immediate term, the same people suggest that the yuan could still strengthen towards the end of the year, which is in line with the thought process flagged by numerous state-run media outlets in recent weeks.

- USD/CNH remains comfortably within the range stablished in recent weeks, with well defined technical parameters in play and moving averages remaining in bull mode.

Fig. 1: USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: Scandi Currencies Remain Within Range of Multi-Month Lows

- Most major pairs are respecting their recent ranges through the Thursday European morning, with EUR/USD, GBP/USD and USD/JPY all well within the Wednesday range.

- US equity futures are diverging, with the NASDAQ-100 future outperforming notably on the back of the better-than-expected Nvidia earnings release. Their shares trade with gains of over 8% in pre-market trade, signaling a solid open for tech-oriented and high beta names at the Thursday opening bell.

- With risk appetite and the trajectory of equities so key for currency market sentiment this week, markets will be watching stocks closely ahead of the speech from Fed's Powell tomorrow.

- Scandi currencies sit weaker against all others in G10, keeping USD/SEK within range of yesterday's multi-month high posted at 11.0341. Similarly, USD/NOK remains within the multi-week uptrend off the July lows, with 10.7324 marking first resistance ahead of 10.7738.

- Looking ahead, US weekly jobless claims and the prelim July durable goods data are the calendar highlights on top of speeches from Fed's Harker and Collins. The full Jackson Hole summit agenda is set to be released after the US market close, at 2000ET.

FX OPTIONS: Expiries for Aug24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E962mln), $1.0814-20(E1.4bln), $1.0840-50(E521mln), $1.0890-00(E1.6bln), $1.0930-50(E1.5bln), $1.1000(E1.1bln)

- USD/JPY: Y144.00($819mln), Y144.50($674mln), Y145.00-05($2.1bln), Y146.00($1.9bln)

- GBP/USD: $1.2675-00(Gbp690mln), $1.2725-35(Gbp602mln)

- EUR/GBP: Gbp0.8595-05(E570mln)

- AUD/USD: $0.6330-50(A$560mln)

- USD/CAD: C$1.3465($745mln)

- USD/CNY: Cny7.2300($1.5bln), Cny7.2400($1bln), Cny7.2500($1.3bln), Cny7.2700($1.1bln), Cny7.3000($3.7bln), Cny7.3300($1.9bln), Cny7.3500($3.2bln)

EQUITIES: Recent Recovery in E-Mini S&P Results in Break of 20- and 50-Day EMAs

- A bearish theme in Eurostoxx 50 futures remains present, however, for now a corrective cycle remains in play and the contract is trading higher. Resistance to watch is 4338.70, the 50-day EMA. A break of this average would highlight a stronger bullish theme and signal scope for a climb, potentially towards 4420.00, the Aug 10 high. Key support and the bear trigger has been defined at 4187.00, the Aug 8 low.

- The latest recovery in the E-mini S&P contract has resulted in a break of both the 20- and 50-day EMA values. This signals potential for a stronger short-term recovery. Attention is on resistance at 4493.98, the base of a bull channel that was breached last week. The channel is drawn from the Mar 13 low. Clearance of this level would open 4517.75, the Aug 15 high. Support to watch lies at 4399.50, yesterday’s low. A break would be bearish.

COMMODITIES: WTI Futures Breach Support at $78.33, the Aug 3 Low

- The uptrend in WTI futures remains intact, however, a corrective cycle is in play for now. Yesterday’s move lower resulted in a print below support at $78.33, the Aug 3 low. A clear break of this support would highlight a stronger bear cycle and pave the way for a deeper retracement. Note that a key support lies at the 50-day EMA, which intersects at $77.42. Initial resistance to watch is $81.75, a break would be a bullish development.

- The outlook in Gold remains bearish, however, a short-term correction has resulted in a recovery this week. The yellow metal is through resistance at the 20-day EMA and attention turns to the 50-day EMA, at $1932.0. A clear break of this average would strengthen the current bull cycle. For bears, moving average studies continue to highlight a dominant downtrend. Key support and the bear trigger has been defined at $1884.9, the Aug 21 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/08/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/08/2023 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/08/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/08/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 24/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/08/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 25/08/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 25/08/2023 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/08/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 25/08/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/08/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/08/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index Direction |

| 25/08/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/08/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 25/08/2023 | 1405/1005 |  | US | Fed Chair Powell on economic outlook | |

| 25/08/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/08/2023 | 1900/2100 |  | EU | ECB's Lagarde speaks at Jackson Hole |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.